Currently, as the Ethereum spot ETF faces significant outflows of funds, the weak downward trend in ETH prices, low trading activity, and other multiple signs of weakness have continuously undermined market confidence in Ethereum.

Author: Nancy, PANews

Currently, as the Ethereum spot ETF faces significant outflows of funds, the weak downward trend in ETH prices, low trading activity, and other multiple signs of weakness have continuously undermined market confidence in Ethereum.

In the first month of listing, "bleeding" exceeded $4.3 billion, and the momentum of fund outflows slowed down

Trading volume directly reflects market sentiment and investment trends. Currently, the purchasing power of nine Ethereum spot ETFs in the United States is insufficient, and the withdrawal of large funds also reflects the market's uncertainty and concerns about the short-term trend of Ethereum to a certain extent.

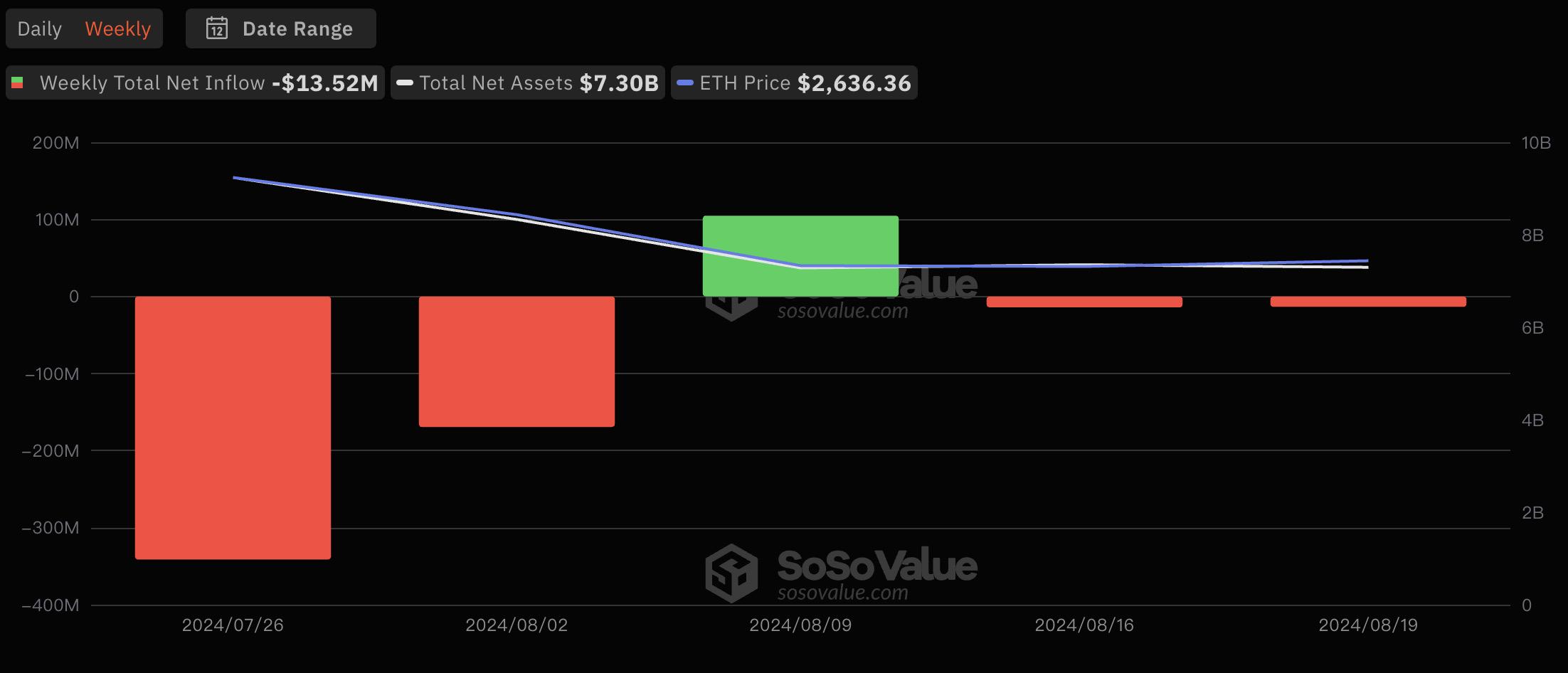

In the first month of listing, according to SoSoValue data, as of August 19, the total net asset value of the Ethereum spot ETF reached $7.3 billion, with a net asset ratio (market value as a percentage of total Ethereum market value) of 2.32%. Among them, the top three ETFs in terms of market size are Grayscale's ETHE ($4.48 billion, accounting for 1.54%), Grayscale Mini ETF ETH ($0.95 billion, accounting for 0.3%), and BlackRock's ETHA ($0.84 billion, accounting for 0.27%).

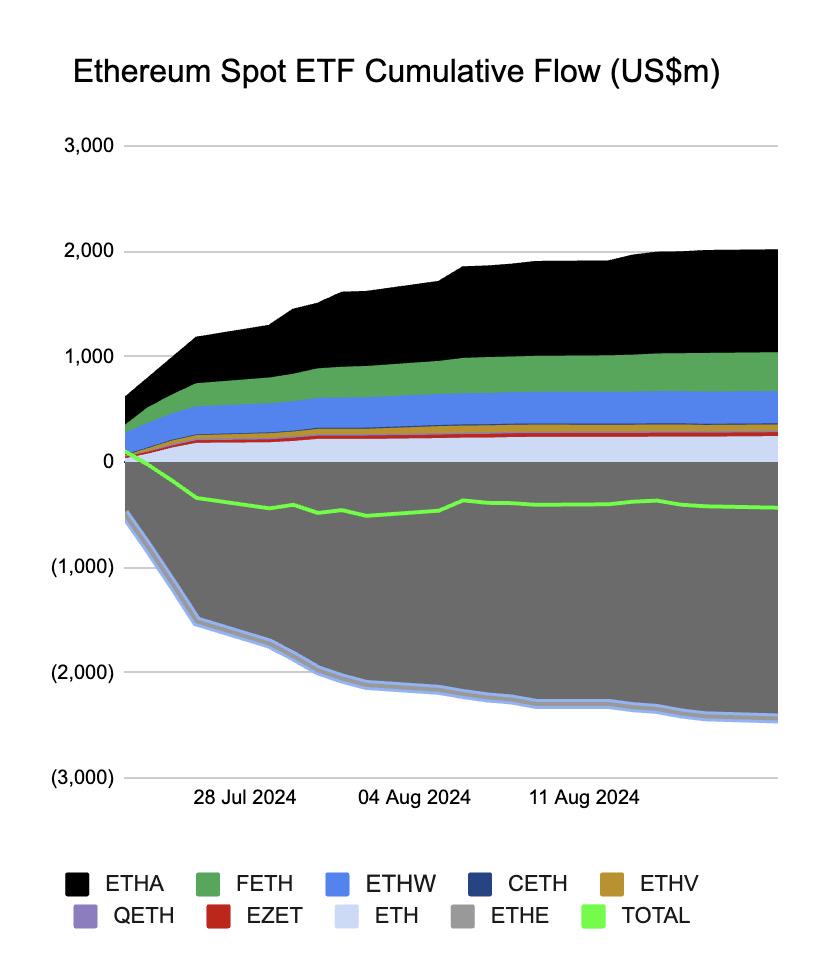

Compared to the slowing pace of fund withdrawals from Bitcoin spot ETFs during the same period, Ethereum spot ETFs have not yet reversed the trend of continuous fund outflows. Farside Investors data shows that as of August 19, these Ethereum spot ETFs have accumulated net outflows of over $430 million. Among them, Grayscale's ETHE is the main camp of "bleeding." Farside Investors data shows that ETHE has experienced a high outflow of funds of up to $2.43 billion in the past month.

On the other hand, BlackRock's ETHA, Fidelity's FETH, and Bitwise's ETHW have become the main force of "attracting funds." Farside Investors' statistical data shows that as of August 19, the net inflows of ETHA, FETH, and ETHW exceeded $970 million, $360 million, and $300 million, accounting for 82.5% of the total net inflows of Ethereum spot ETFs (approximately $2 billion).

Although Ethereum spot ETFs as a whole have shown a significant net outflow trend, looking at the weekly fund flows, the outflows of these ETFs have started to slow down significantly in the four trading weeks after listing and have continued to decline for three consecutive weeks. SoSoValue data shows that except for the first week, which had the most severe "bleeding" at $340 million, the outflow scale of these ETFs has gradually narrowed and showed positive growth for the first time in the third week, with a net inflow of approximately $100 million, mainly driven by ETHA.

With poor performance in fund inflows, the price trend of Ethereum and its spot ETF is also not optimistic. According to CoinGecko data, as of August 20, the price of ETH has dropped by approximately 34.2% from its peak this year, falling to the level of early February. According to PANews statistics, since its launch, the average price of the nine Ethereum spot ETFs has dropped by approximately 21.7%, with ETHE, ETHA, and ETHW slightly exceeding the average.

Pledging or improving the serious overflow of ETF funds, multiple factors suppress price increases

"A large amount of fund outflows has led to Ethereum's underperformance compared to Bitcoin. Even new Ethereum ETFs like BlackRock iShares Ethereum Trust have seen some positive fund inflows, but old products like Grayscale ETHE are facing a large amount of fund outflows, and aggressive selling by major market makers like Jump Trading has exacerbated this trend," Bitfinex Alpha pointed out in its latest report.

The report also believes that as Ethereum ETFs face challenges in performance and fund outflows, whether they can recover and continue to attract investor interest in the coming months will be crucial. More broadly, key factors such as the macroeconomic environment and potential interest rate cuts by the Federal Reserve will significantly affect the future fund flows and market dynamics of Ethereum and Bitcoin ETFs.

However, the introduction of the pledging function for Ethereum spot ETFs may make ETH more attractive and improve the current situation of fund outflows. Cynthia Lo Bessette, head of Fidelity's digital asset management department, recently stated that although the SEC has not approved ETFs that can pledge ETH, this situation may change in the future because pledging is an important part of the Ethereum ecosystem and an important part of Ethereum investment opportunities. She believes it is more a matter of time than whether it will happen, and the Fidelity team has had constructive discussions with SEC staff about the possibility of launching a pledged ETH ETF.

In addition to the continuous outflow of ETF funds, key indicators such as the ETH/BTC exchange rate hitting a new low and gas fees falling to a trough are also undermining market confidence. With the continuous decline in Ethereum prices, the ETH/BTC exchange rate has recently hit a three-year low of 0.042, causing many bulls to start reducing positions or stop-loss. In addition, data from Etherscan shows that Ethereum network gas fees have dropped below 1 gwei for several consecutive days, reaching the lowest level in several years. Cryptocurrency analysis firm Kaiko Research explained in a report that the increase in Layer 2 activity and the Dencun upgrade in March have reduced Layer 2 transaction costs, causing Ethereum gas fees to hit their lowest point in five years.

The report believes that this fee reduction has had a significant impact on Ethereum, as lower fees mean less ETH is burned, leading to an increase in token supply, which may temporarily suppress potential price increases. According to the latest data from Ultrasound.money, the Ethereum supply has increased to approximately 120.28 million ETH, with an increase of 77,091 ETH in the past 30 days. About 19,438 ETH has been burned through the destruction mechanism, resulting in a net increase of approximately 60,712 ETH, with a supply growth rate of 0.61% per year.

Industry insiders are optimistic about future growth prospects

Amid the prevailing pessimism, many industry insiders have also made predictions about the future price trend of Ethereum, and they generally have a positive outlook on Ethereum's future growth prospects.

Michaël van de Poppe, founder of MN Trading, recently posted on social media, stating that the market value of altcoins split from Bitcoin may still significantly surpass. If it rebounds, it will confirm a bullish divergence and indicate that the market is shifting towards the Ethereum ecosystem rather than Bitcoin.

Benjamin Cowen, founder of Into The Cryptoverse, believes that Bitcoin will take the "final step" towards 60% dominance (market share) at the earliest in September or at the latest in December, and Ethereum and many other cryptocurrencies have room for development. During the "major altcoin season," such as in 2021, Bitcoin's dominance tends to decline, but it slowly recovers to previous levels after the market turns bearish.

CryptoQuant analyst Burak Kesmeci stated in a post that two different on-chain indicators may indicate that the current Ethereum retracement is in its later stages. Current data shows that Ethereum buyers are gradually regaining strength. However, it remains to be seen whether this is a temporary rebound or the beginning of a strong rebound dominated by bulls. Time will tell.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。