撰文:Golem(@web3_golem)

做比特币投资者真难,每天都活在上涨的恐惧中。

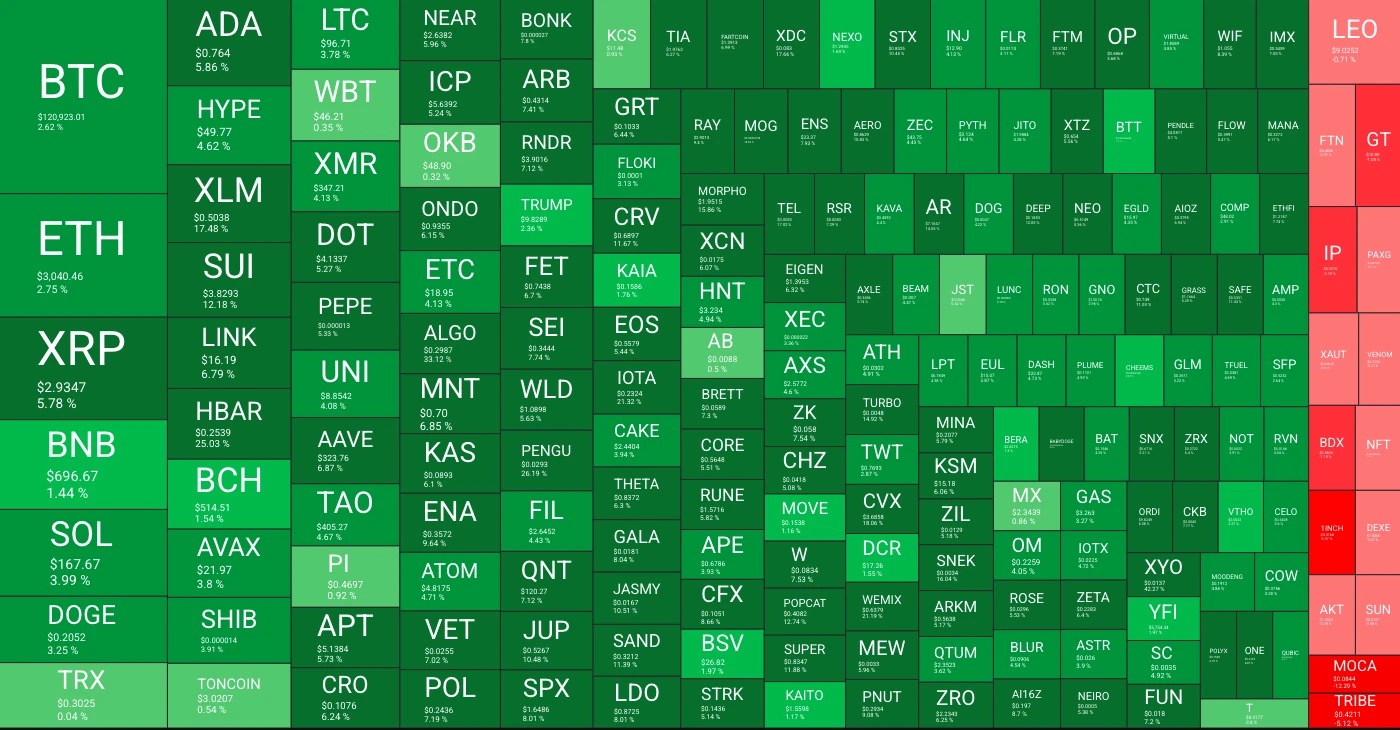

OKX行情显示,比特币今日上涨首次突破12万美元创下了历史新高。山寨币表现也不逊色,根据Quantify Crypto数据,市值前200的山寨中,过去24小时仅有15个代币下跌,其余均处于山寨趋势,其中HBAR过去24小时涨幅超25%、SUI过去24小时涨幅超12.18%,ETH、SOL、BNB和XRP等市值前排的大山寨过去24小时也有1~5%的涨幅。

与此同时,港股加密货币概念股涨幅也持续扩大,欧科云链涨超30%,雄岸科技涨18%,蓝港互动涨超10%。

不看上图都能知道,形势一片大好,然而,与比特币此前突破6.9万美元前高和10万美元大关时不同,市场情绪并未有太大FOMO,虽然社交媒体里充斥着各种喜讯播报新闻,但各个社区群聊却异常安静。行业里的人之前已经止盈下车了?这次为什么没人铺天盖地喊起飞了?

被比特币涨到麻目的投资者

山寨币经历80%回撤后的反弹即使再小,被套的投资者也会兴奋的喊牛回;但持续新高的比特币,即使目前没有套任何投资者,「+%」的相对数值越来越小只会让人越发麻木。况且随着全球加密监管政策利好不断、比特币财库上市公司增多、股票代币化进入合规运营期,自2025年4月份以来,比特币已经连续3个月月线收涨,3个月涨幅超46%。

投资者的兴奋阀值逐渐提高,期待更多落到了山寨币上。Google Trends 数据也显示,公众对比特币的搜索兴趣已经却远低于 2017 年和 2021 年牛市期间的水平。

10x Research 最新报告也指出,比特币近期创历史新高并非由市场炒作驱动,而是源于更深层的宏观经济变化。美国 5 万亿美元债务上限提高、巨额赤字支出以及特朗普工作组即将发布的加密政策报告,正共同重塑宏观格局。报告认为,比特币已转变为对冲无节制财政支出的宏观资产,其叙事逻辑发生根本转变。7 月 22 日和 30 日 FOMC 会议可能成为重新定义比特币在金融体系中角色的关键催化剂。

因此,关于比特币此次突破12万美元,市场上并无直接刺激理由,而是此前一系列利好持续发酵的结果。Cryptoquant 分析师 Axel Adler Jr 也从经验主义的角度为7月的上涨找了理由,「根据 2012-2025 年的历史数据,7 月是比特币增长最可靠的月份之一:在 14 个案例中的 10 个(71%)显示出正回报。此外,10 月份的可靠性最高,其中‘正值’月份的比例达到 77%。」

山寨虽有起色但未达理想效果

影响市场情绪还有一个重大原因或许是,山寨币整体虽在7月11日至今有涨幅,但仍未达到投资者心中预期。OKX 行情数据显示,时隔5个月,ETH 今日上涨突破 3050 USDT(2 月 3 日),但心酸的是,同样是5个月前(2月3日),比特币的最高价为102500美元,相对而言,比特币仍有17%的涨幅,以太坊完全停留原地。

「比特币独美、山寨不跟涨甚至反跌」的行情在2024年就已是投资者持续讨论的话题,彼时比特币具有美国比特币现货ETF和机构购买托底,而山寨币反而经历着VC信任危机、大额解锁砸盘和Meme吸走投机资金等困境,做空山寨成为了当时主要的交易策略。因此甚至直到如今,部分投资者仍对山寨币心存芥蒂,对山寨季不抱希望。

然而,加密市场瞬息万变,作为投资者我们应该审时度势,及时调整。彭博社 ETF 分析师 James Seyffart 7月份发布 2025 年底前加密现货 ETF 的获批概率的预测表示,美SEC或将于2025年下半年批准多支山寨币ETF,其中 LTC、SOL 和 XRP 获批概率达 95%,DOGE、HBAR、Cardano、Polkadot、Avalanche 预计通过概率为 90%。SUI 预计通过概率为 60%,Tron/TRX、Pengu 预计通过概率为 50%。

加之,各种「山寨币」版微策略纷纷建立,CZ 甚至表示至少有超过 30 支团队想要推出 BNB 财库相关的上市公司(Public Co.)项目,山寨币也将引来具有ETF和机构购买托底的时代。

多位KOL也在7月发文看好山寨季即将来临。LD Capital 创始人、「e将军」易理华发文表示,山寨季可能要等到 8 月或 9 月降息确定后,市场才会真正迎来流动性溢出。

加密 KOL Miles Deutscher针对昨日 PUMP 12 分钟公售 5 亿美元一事对山寨发表观点称,「这表明当有合适的机会时,仍然有大量的流动资金愿意参与。山寨币并没有‘死亡’,他们只是需要正确的叙事。」补充阅读:《PUMP公售12分钟售罄,开盘后的两种剧本,你信哪个?》。

BitMEX 联合创始人 Arthur Hayes 也发文表示,「如今情绪已转变,比特币在成交量良好的情况下突破了历史高点;以太坊也紧随其后,而且将会跑赢,山寨币季即将到来,市场认为特朗普会在关税问题上采取意外行动,Arthur Hayes 家族办公室基金 Maelstrom 已加仓看涨。」

当然,还有很多山寨季即将来临的信息,但罗列再多也不如投资者自己心中坚定的信心。希望下次我们能一起喊,山寨起飞!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。