Author: Xiao Sa, lawyer

On the morning of August 19th, the Supreme People's Court and the Supreme People's Procuratorate of China jointly held a press conference to officially release the "Interpretation on Several Issues Concerning the Application of Law in Handling Criminal Cases of Money Laundering" (referred to as the "Interpretation" or "New Regulation" below).

The "Interpretation" consists of thirteen articles, with concise wording and comprehensive measures to combat money laundering crimes. It is worth noting that Article 5 of the "Interpretation" makes specific provisions for the bottom-line clause of the crime of money laundering, explicitly including "virtual asset transactions" in it.

What does this mean for the cryptocurrency industry? Does trading cryptocurrency constitute a crime? Can over-the-counter (OTC) trading still be conducted? Today, the Xiao Sa team will explain this in detail based on actual cases, providing comprehensive insights. We recommend saving this for reading.

After the new regulation takes effect, can cryptocurrency still be traded?

According to Article 13 of the "Interpretation": This interpretation shall come into force on August 20, 2024. It was announced on the same day and implemented the next day, indeed quite fast.

So, for our cryptocurrency partners in China, the most urgent task is to obtain a clear conclusion: Can cryptocurrency still be traded after the new regulation?

To give the conclusion first: Yes.

Firstly, the "Interpretation" was not formulated specifically for the cryptocurrency industry. From its name and the associated criminal penalty provisions, it is evident that its focus is on money laundering crimes and crimes of concealing or disguising proceeds of crime, rather than deliberately targeting the cryptocurrency industry or the blockchain and Web3 sectors.

Secondly, Article 5 of the "Interpretation" has made it clear: Only those who use virtual asset transactions to shield the proceeds of crime specified in the seven specific upstream crimes defined for the crime of money laundering may constitute money laundering. The upstream crimes specified in Article 191 of the Criminal Law include: (1) drug crimes; (2) crimes of organized crime groups; (3) terrorist activities crimes; (4) smuggling crimes; (5) bribery and corruption crimes; (6) crimes of disrupting financial management order; (7) financial fraud crimes.

The Xiao Sa team believes that the main reason for explicitly including "virtual asset transactions" as one of the methods for the crime of money laundering (Article 191, paragraph 1, item 5 of the Criminal Law) is that when cryptocurrency is used as a money laundering tool, it is too convenient.

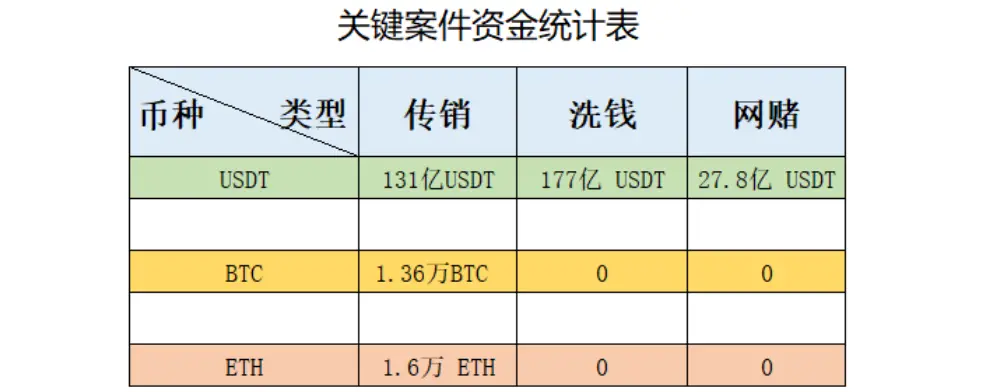

According to the report by the China Chain Security Research Institute, in 2021 alone, the amount involved in cases of money laundering, pyramid schemes, and online gambling using cryptocurrency reached 298.542 billion RMB, with USDT, BTC, and ETH accounting for the majority. To this day, this figure is still rapidly increasing.

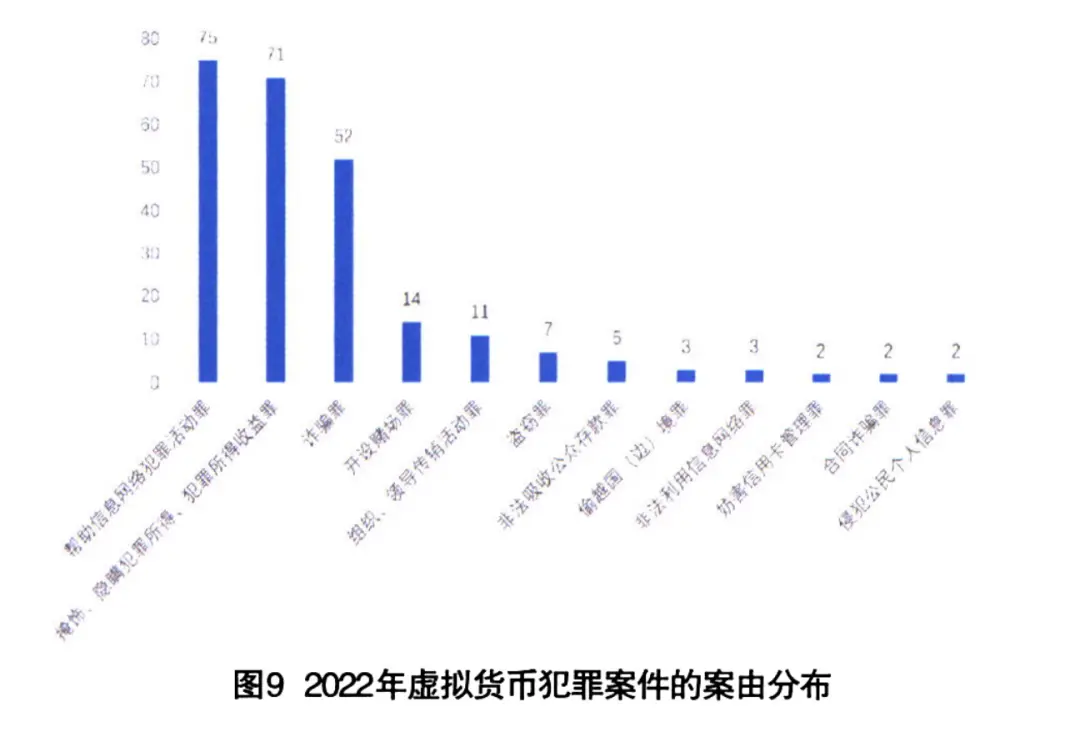

Additionally, according to an article published in the 2nd issue of Police Technology in 2023, in the category of virtual currency crimes, aiding and abetting crimes ranked first, and concealing crimes ranked second, far exceeding other types of crimes.

In addition to money laundering, pyramid schemes, and online gambling, the Xiao Sa team has also handled various cases of illegal and criminal activities using cryptocurrency in practice:

(1) One spouse using cryptocurrency to conceal and transfer joint assets; (2) A high-net-worth individual using cryptocurrency to evade China's foreign exchange controls, transferring assets overseas to purchase real estate, securities, and other assets; (3) A company and its controlling shareholder using cryptocurrency to evade the statutory foreign exchange settlement channels, transferring overseas income into China, evading taxes; (4) A person who has been dishonest in fulfilling obligations, using cryptocurrency to evade the court and creditors' asset inquiries and maliciously refusing to fulfill the debts determined by effective judgments; …

Furthermore, there is a well-known case—the illegal absorption of public deposits by Tianjin Lantian Ge Rui. The ringleader Qian Zhimin, on the eve of the explosion in 2017, easily carried hundreds of millions of embezzled funds converted into Bitcoin on a portable hard drive, fled abroad, and lived a lavish life until being arrested by the British police in 2024.

This clearly shows that once cryptocurrency is used as a money laundering tool, it is indeed too convenient.

After the new regulation is issued, what is the riskiest behavior in the cryptocurrency industry?

Firstly, it is the cryptocurrency exchanges, followed by individuals with high demand for OTC trading and frequent transactions.

According to the provisions of China's Criminal Law, whether it is the crime of money laundering or the crime of concealing or disguising proceeds of crime, it must be based on the criminal's "knowledge or should have known" that the relevant funds are the proceeds of crime or the derived proceeds of crime from upstream money laundering crimes. Concealing or disguising proceeds of crime other than upstream money laundering crimes, such as proceeds from telecommunications fraud, is another crime.

For a long time, the most troublesome issue for cryptocurrency exchanges and individuals with high demand for OTC trading and frequent transactions has been the receipt of funds involved in criminal cases. There is even a saying in the cryptocurrency industry that "if your card has not been frozen, you have not really traded cryptocurrency."

Therefore, since receiving illicit funds has become an unavoidable and objectively possibly unavoidable issue, it is crucial to define the "knowledge or should have known" in the crime of money laundering and the crime of concealing or disguising proceeds of crime stipulated in China's Criminal Law.

Article 3 of the "Interpretation" provides a clear provision for determining "knowledge or should have known": It should be judged comprehensively based on the information the person has been in contact with or received, the situation of handling the proceeds of crime and their benefits on behalf of others, the types and amounts of the proceeds of crime and their benefits, the transfer and conversion methods of the proceeds of crime and their benefits, abnormal transaction behavior, fund accounts, the person's professional experience, the relationship with the upstream criminals, and their statements and defenses, as well as the testimony and evidence provided by co-defendants and witnesses.

To illustrate, the Xiao Sa team handled a real case before the "Interpretation" was issued. In 2023, student A was criminally detained on suspicion of "concealing or disguising proceeds of crime" for selling USDT (referred to as "U") by a judicial authority in a certain place in China. During the meeting with student A, he clearly told us that the USDT he sold was from cryptocurrency trading, and he was completely unaware of the source of the funds from the underground money shop. After the Xiao Sa team intervened, it was found that the main reasons why student A was suspected of "concealing or disguising proceeds of crime" by the judicial authority in China were as follows:

(1) The funds transferred from the underground money shop to student A's account were from telecommunications fraud; (2) Student A had a specific relationship with the underground money shop, and their chat records could prove that student A had some understanding of the source of the funds from the underground money shop; (3) The funds transferred from the underground money shop to student A's account far exceeded the amount he received from selling U (calculated based on the exchange rate at the time of selling U); (4) Student A could not provide a reasonable explanation for the reasons for the excessive funds transferred in and the destination of the funds, and there was no objective evidence left; (5) Student A had the behavior of retaining funds after receiving illicit funds and only transferred them out after a long period of time.

Based on the above objective evidence, the judicial authority in China determined that student A "knew or should have known" that the funds transferred from the underground money shop to his account were from telecommunications fraud and convicted and sentenced him.

Similarly, in a case handled by the People's Court of Dongsheng District, Ordos City in 2023, with a case number of (2023) Ne 0602 Xing Chu 203, the court sentenced a defendant, Mr. Xu, for a case very similar to the one handled by the Xiao Sa team. During the period from February 27, 2022, to March 3, 2022, Mr. Xu provided his three bank cards to others for use, resulting in over 900,000 RMB being defrauded from the cards, which were then frozen. Subsequently, when Mr. Xu sold U online on March 5, 2022, he received another 200,000 RMB from telecommunications fraud, and he withdrew the funds from the bank counter on the same day.

The court's logic for determining the subjective "knowing" intention of Mr. Xu in the crime of concealing or disguising proceeds of crime was as follows:

(1) Because Mr. Xu already "knew in the process of his cryptocurrency transactions that the recipient's account for receiving payments or the payer's account for making payments could be associated with telecommunications fraud, i.e., the funds paid by the buyer for purchasing cryptocurrency could be proceeds of telecommunications fraud."

(2) Therefore, "in the cryptocurrency transaction on March 5, 2022, Mr. Xu should have known that the funds paid by the buyer were proceeds of crime."

I cannot agree with this. While Mr. Xu's behavior of profiting from providing cards is indeed wrong and may be suspected of aiding and abetting a crime, there is no evidence to prove that the person using the card and the cryptocurrency exchange receiving U are accomplices, nor is there evidence to prove that the two funds involved in telecommunications fraud are from the same or related cases of telecommunications fraud. So how can Mr. Xu's improper knowledge of the source of funds in the crime of aiding and abetting be directly "pushed" to the crime of concealing or disguising proceeds of crime?

Simply convicting and punishing him based on the statement in the judgment that "the funds paid by the buyer for purchasing cryptocurrency could be proceeds of telecommunications fraud" violates the principle of legality in criminal law.

How should cryptocurrency traders protect themselves?

In recent years, due to rampant telecommunications fraud, a large amount of illicit funds have flowed into underground money shops, increasing the probability of cryptocurrency traders receiving dirty money. However, in most cases, they are only subject to frozen accounts and occasionally questioned as witnesses by investigative agencies. But the criminal risk is like a black swan around us, and it cannot be ignored.

Therefore, based on practical experience, the Xiao Sa team has some suggestions for cryptocurrency traders to prevent criminal risks.

First, leave a trace of the source of funds for cryptocurrency trading. From what the Xiao Sa team understands, the majority of cryptocurrency traders' funds come from legitimate sources, such as their own salaries, legally earned income from business operations, or idle funds from the disposal of real estate, stocks, and other assets in previous years. Therefore, the most urgent task is to keep evidence of the source of funds used for cryptocurrency trading, so that they can explain it clearly if questioned.

Second, keep a record of the transactions of buying and selling cryptocurrency on platforms. This evidence is very important. Some cryptocurrency platforms only provide a record query function for the past three months, and further queries may not be supported by the platform. Therefore, cryptocurrency traders must develop the habit of taking screenshots, recording videos, and keeping evidence every month to prevent being caught off guard.

Furthermore, the relevant records must be consistent, and the fund chain must be complete. For whatever reason, there should be no situation where a large amount of funds with an unclear source far exceeds the income from cryptocurrency trading and cannot be explained.

Finally, if necessary, reduce the frequency of OTC trading and only choose reliable channels to sell cryptocurrency when necessary. When selling cryptocurrency, both parties can provide evidence and make commitments to each other regarding the clean source of cryptocurrency and fiat currency through signing relevant agreements, leaving a trace for future reference.

Conclusion

The official announcement of the criminalization of "virtual asset transactions" bluntly means an increase in criminal risk for cryptocurrency industry professionals. While cryptocurrency exchanges face the sword of Damocles +1, cryptocurrency traders need to be extremely cautious and cannot simply apply their previous experiences to the present day. Keeping evidence is the best way to protect themselves.

Furthermore, do not hesitate to seek professional legal assistance if necessary. When communicating with a lawyer, it is essential to be honest and comprehensive in preventing the proliferation of criminal risks.

That's all for today's sharing. Thank you, readers!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。