Virtual currency mining is not only a technical issue, but also a complex issue involving global politics, economy, and energy.

Author: Lawyer Liu Honglin, Shanghai Mankun Law Firm

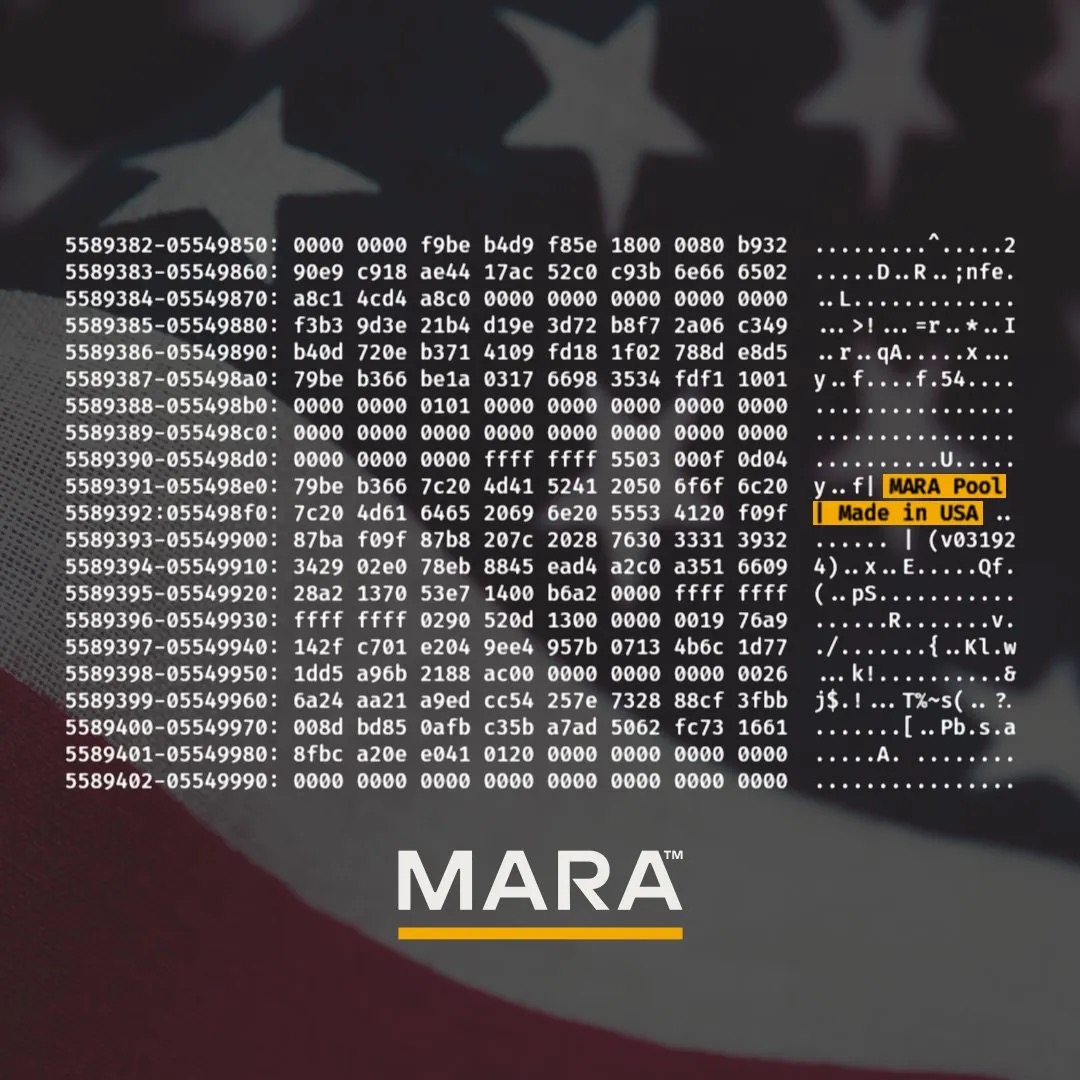

Recently, the Bitcoin mining company Marathon Digital Holdings announced that it will mark "Made in USA" on each Bitcoin block it mines.

Fred Thiel, the chairman of the company, emphasized on social media: MARA Pool proudly marks every block mined in the United States with the "Made in USA" label. We are the only large miner that can do this because we operate our own pool and ensure that all blocks mined by MARA Pool are made in the USA. This statement has not only attracted widespread attention in the industry, but also revealed the complex global political game behind virtual currency.

Marathon Digital Holdings was registered in Nevada on February 23, 2010, and is one of the leading Bitcoin mining companies in the United States. The company has rapidly risen through advanced hardware equipment and low-cost energy resources, and is known for its strict compliance and security. Since 2021, Marathon Digital announced that all of its Bitcoin mining operations comply with the regulations of the U.S. Office of Foreign Assets Control (OFAC), which not only enhances the company's market reputation but also increases its brand value. The announcement to mark each Bitcoin block with "Made in USA" is not only an attempt by Marathon to shape its brand, but also a part of the United States' efforts to strengthen its dominant position in the global virtual currency market.

Great power competition: Why has Bitcoin become a focus?

The issue of Bitcoin in the 2024 U.S. presidential election has become a focus. Several major candidates have expressed varying degrees of support for Bitcoin. Former President Trump explicitly stated that he hopes "all remaining bitcoins are made in the USA" and met with executives from multiple Bitcoin mining companies, indicating that the future U.S. government may further promote policy support for virtual currency mining in order to gain an advantage in global financial technology competition. This indicates that Bitcoin is not only a symbol of technological and financial innovation, but has also become a part of the strategic layout of great powers.

Russia's latest move also demonstrates the great powers' attention to Bitcoin. In 2024, Russia officially passed a Bitcoin mining bill, allowing legal Bitcoin mining activities. This bill shows Russia's attention to virtual currency mining and its efforts to control and utilize this emerging industry through legalization and regulation, especially in the energy-rich Siberian region, where Russia is actively expanding its Bitcoin mining scale using its hydroelectric resources.

More importantly, when facing economic sanctions from Western countries, especially the United States, Russia faces tremendous pressure on the international payment system. The U.S.-led SWIFT system restricts Russia's international financial transaction channels, marginalizing Russia in the global economy. However, through virtual currencies like Bitcoin, Russia can bypass the restrictions of the traditional financial system and achieve fund circulation in the international market. This makes Bitcoin a "digital gold" for the Russian economy under economic sanctions, supporting payments and transactions globally.

The integration of the strategic, social, and economic value of virtual currency mining is particularly important in the context of this great power game. The ability to control virtual currency mining means that a country can have greater influence in the global financial system. This is reflected not only in the competition for financial dominance, but also in the control of energy and technology by great powers. The mining process of Bitcoin consumes massive energy, but this energy consumption is not purely wasteful; it brings significant economic benefits to the country. Through virtual currency mining, great powers can promote the optimization of energy use and technological innovation. For example, mining companies in the United States are actively using renewable energy, not only improving energy efficiency but also supporting grid stability. In contrast, countries like Russia and Canada are using virtual currency mining as an important means to enhance their economic and technological strength through policy guidance, thereby gaining a favorable position in the global market.

China may need to adjust its virtual currency mining policy in a timely manner

While considering the policy on virtual currency mining, China also needs to re-examine the strategic significance of this industry from the perspective of national financial security. In recent years, several countries and regions around the world have begun to view Bitcoin as an important strategic reserve. For example, El Salvador became the first country to adopt Bitcoin as legal tender and started accumulating national Bitcoin reserves. In addition, some countries like Switzerland are gradually incorporating Bitcoin into their national reserve assets. This trend shows that Bitcoin, as a digital asset, has been included in the long-term strategic layout of some countries and regions.

In the future, decentralized virtual assets like Bitcoin will become an important and indispensable part of the global digital economy. These digital assets are not just investment tools, but also a part of national economic security. If the reserve and control of Bitcoin are left in the hands of Western countries, represented by the United States, the global digital economic landscape may further tilt towards these countries in the future. Therefore, China should also consider incorporating Bitcoin and other virtual assets into its national strategic reserve system, just as it values its gold reserves, to ensure that it is not passive in global financial competition.

As suggested by Lawyer Honglin in a previous article "Web3 Lawyer: Suggesting the Government to Adjust the Prohibition Policy on Virtual Currency Mining at the Right Time," in order to promote China's leading position in the next-generation internet with blockchain as the core technology, Chinese regulatory authorities may need to re-examine and adjust the current blanket prohibition policy on virtual currency mining.

First, the shutdown of the mining industry will weaken China's influence in the global blockchain technology and digital currency market, leading to the loss of a large number of talents with rich experience and skills in high-performance computing, algorithm optimization, and hardware development. China was once the world's largest Bitcoin mining market. According to Bloomberg, China's Bitcoin hash rate accounted for 65% of the global total in 2021, but by 2023, this proportion had dropped to less than 10%. This change not only caused China to lose its dominant position in the global digital currency market, but also led to the migration of a large number of outstanding talents and companies to other countries, such as the United States, weakening China's technological innovation capabilities and competitiveness in this field, and putting China at a disadvantage in future digital economic competition. The development of the mining industry is closely related to the development of computer hardware, especially in innovations in high-performance computing chips, heat dissipation technology, and large-scale computing systems, which are not only widely used in virtual currency mining but also have a positive driving effect on other high-tech industries. The government can provide special funds and policy support to promote the research and application of related technologies. For example, establishing a special technology fund to support enterprises and research institutions in developing efficient and low-energy mining equipment and technologies.

Second, the prohibition of mining not only affects technology and the economy, but also represents a significant loss of business profits. According to media statistics, there were 13 A-share listed companies, 7 Hong Kong-listed companies, and 9 Chinese concept stocks involved in virtual currency mining business in China. Companies such as Xinyuan Technology (300472.SZ), Lianluo Interactive (002280.SZ), and Futong Information (000836.SZ) have provided a large number of employment opportunities and tax revenue for the local economy. Inner Mongolia, Yunnan, Sichuan, and other regions, due to their energy advantages, have attracted a large number of mining companies, which have played a positive role in local economic development. For example, Sichuan ranks first in terms of installed hydropower capacity and power generation in China. How to promote the consumption of surplus hydropower is a problem that the local government has been exploring. Using hydropower for virtual currency mining can create a win-win situation where the mining farm operates stably, power generation companies consume excess hydropower, power supply companies increase income from grid fees, and local governments increase funds and tax revenue.

The one-size-fits-all mining ban has brought significant losses to these regions. According to the South China Morning Post, Inner Mongolia lost thousands of jobs and weakened local tax revenue sources due to the withdrawal of mining companies. In contrast, in the United States, well-known virtual currency mining companies such as Riot Blockchain and Marathon Digital Holdings are listed on the Nasdaq, and these companies have earned substantial profits through mining activities. Riot Blockchain reported total revenue of $213 million in 2022, a 65% year-on-year increase, and continued to grow to $275 million in 2023. Marathon Digital Holdings' total revenue reached $250 million in 2022, a 75% year-on-year increase, and grew to $310 million in 2023. According to CoinDesk, the stock prices of Riot Blockchain and Marathon Digital Holdings increased by 45% and 60% respectively in 2023, demonstrating investors' confidence in these companies and their market prospects. If China can guide the legal and compliant development of the mining industry, these profits and economic growth can also be realized in China. According to a report by PricewaterhouseCoopers (PwC), China's potential annual income in the virtual currency mining industry could reach billions of dollars, and with the development of clean energy and technological innovation, the actual economic benefits could be even higher. China can explore a model of state-owned enterprise holding or participating in mining companies to ensure that mining activities are conducted under government regulation. Through the participation of local state-owned enterprises, not only can risks be effectively controlled, but steady growth in tax revenue and economic benefits can also be ensured.

In addition, according to the International Energy Agency (IEA) report, the energy consumption of global Bitcoin mining is gradually transitioning to clean energy. Mining companies in countries such as the United States and Canada are actively using renewable energy sources such as hydroelectric and wind power to reduce carbon footprint and improve energy efficiency. For example, some mining companies in Texas are partnering with power companies to use renewable energy sources such as wind and solar power for mining activities. In addition, the Electric Reliability Council of Texas (ERCOT) allows these companies to reduce power consumption during peak demand periods to support grid stability. Quebec in Canada has strict energy efficiency standards for high-energy mining companies and encourages these companies to use clean energy for mining. Hydro-Québec, the hydroelectric company in Quebec, collaborates with mining companies to reduce carbon emissions by providing renewable energy. This trend indicates that through reasonable policy guidance and regulation, a win-win situation of virtual currency mining and environmental protection can be achieved. The government can establish clear policies to guide the mining industry towards green and energy-efficient development, while strengthening supervision of mining activities to prevent illegal activities. Through a reasonable regulatory framework, industry behavior can be standardized, and the negative impacts of a complete ban can be avoided. For example, the government can stipulate that mining companies must use a certain proportion of renewable energy to promote the development of green energy and improve overall energy efficiency. Strict penalties can also be imposed on companies that violate the regulations.

By referring to successful experiences in other countries, China can explore reasonable policies and regulatory frameworks to promote the healthy development of the virtual currency mining industry, achieving comprehensive benefits of technological progress, economic growth, and environmental protection.

Conclusion

Virtual currency mining is not only a technical issue, but also a complex issue involving global politics, economy, and energy. The strategic layout of great powers in this field not only reflects the competition for financial dominance among countries, but also reveals the important position of virtual currency in the future global economy. For China, timely adjustment of mining policies can not only promote the development of domestic blockchain technology but also enhance China's influence and discourse power in the global virtual currency market. We look forward to more industry professionals and research institutions engaging in in-depth discussions on the regulatory policies of virtual currency mining, and jointly providing scientific and reasonable policy recommendations for the development of China's digital economy.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。