An in-depth analysis of the technical details of the Berachain protocol's Proof of Liquidity (POL) mechanism.

Author: Francesco

Translation: Deep Tide TechFlow

After a year of unfulfilled promises in the new bull market, cryptocurrencies have a new spirit animal: Bera.

In the highly challenging environment of cryptocurrencies, there is one project that stands out more than others.

This article will introduce Berachain, going beyond speculation to delve into the technical details of its protocol's Proof of Liquidity (POL) mechanism, in order to better understand its ecosystem.

What is Berachain?

Berachain is a novel Layer 1 (L1) blockchain.

Contrary to the common belief that L1 solutions have reached their peak, Berachain and Monad aim to revitalize and redefine the potential of L1.

This approach contrasts sharply with the current trend, where most projects either focus on building Layer 2 (L2) solutions on Ethereum or develop as independent application chains and Layer 3 (L3) networks.

The decision to innovate at the L1 level is closely related to Berachain's most significant advancement—the novel POL consensus mechanism.

Distinguishing POL from PoL

Readers may still remember the Protocol Owned Liquidity (PoL) concept from the Olympus DAO era, which may evoke complex emotions.

However, the POL introduced by Berachain represents a unique and innovative concept that needs to be clearly distinguished:

POL = Proof of Liquidity

PoL = Protocol Owned Liquidity

Evolution of Consensus

Since the advent of Bitcoin, blockchain networks have been striving to address the blockchain trilemma—balancing security, speed, and decentralization.

Different consensus mechanisms are used to coordinate the incentives of participants in decentralized networks.

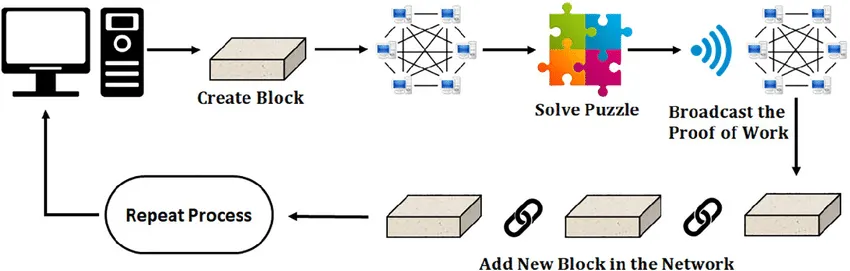

Initially, Bitcoin adopted Proof of Work (POW), requiring miners to invest in hardware and bear the cost of electricity to solve cryptographic puzzles and mine new bitcoins.

POW serves as a form of cryptographic proof, where one party proves to others that a specific amount of computational effort has been invested.

The POW model was initially adopted by Ethereum and others, becoming the most viable method to coordinate incentives in decentralized networks.

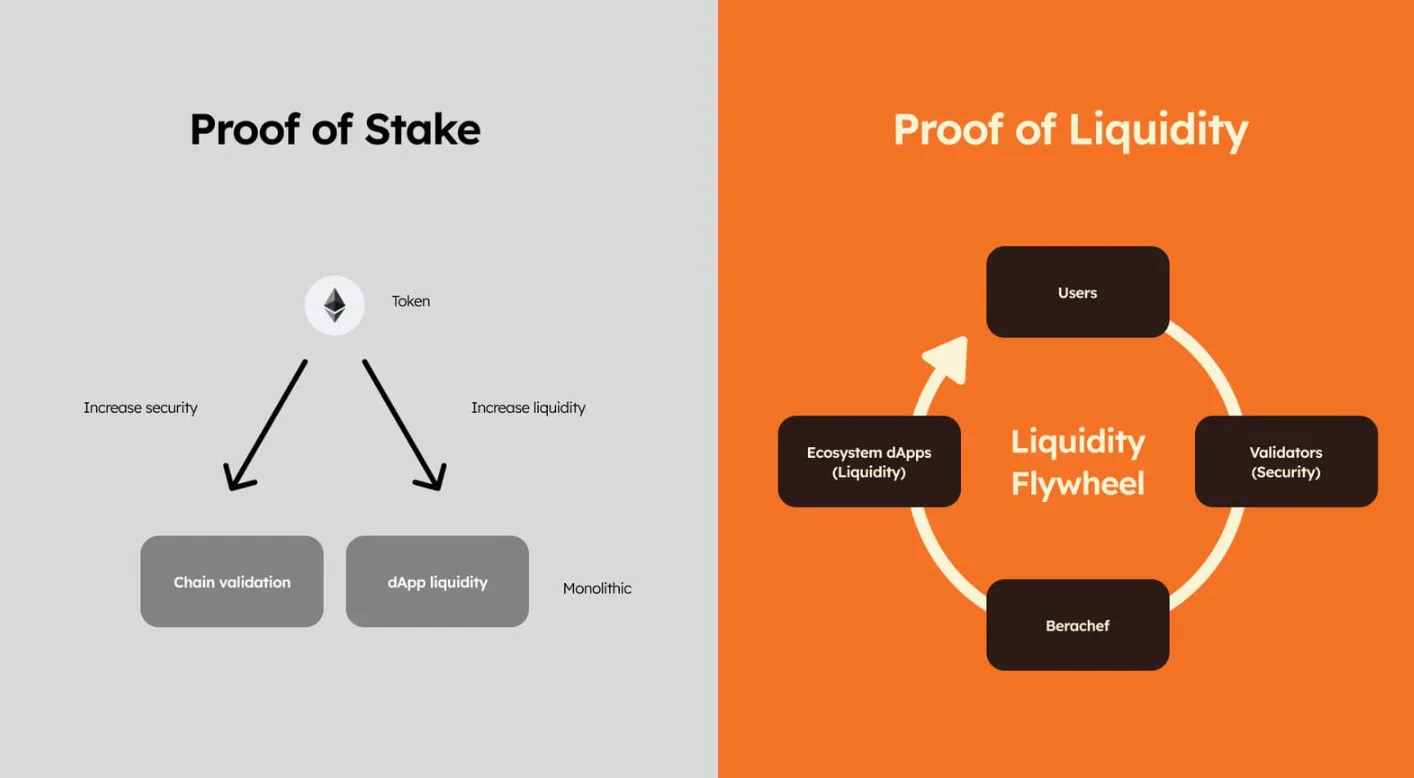

However, with the increasing cost and energy consumption associated with POW, as well as concerns about centralization of mining power and long-term sustainability, the industry began to shift towards Proof of Stake (POS) as the preferred consensus mechanism.

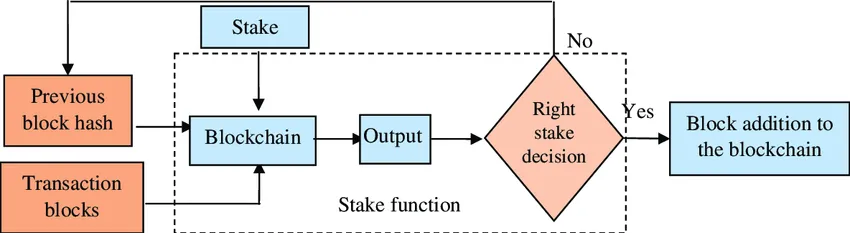

In POW, validators must purchase physical hardware to mine bitcoins. In contrast, a POS network (such as Ethereum) requires validators to participate in block creation and transaction validation by staking a certain amount of the network's native token (e.g., 32 ETH in Ethereum), giving them "skin in the game."

The incentives of validators are aligned with the normal operation of the network: if malicious behavior occurs, validators will lose (be slashed) a portion of their staked ETH.

Transition from POS to POL

While the POS model ensures the interests of validators in the game, it fails to align their interests with the protocol towards a common goal.

At least at the consensus level, there is a clear lack of alignment or deeper participation in the following aspects:

Ensuring the protocol's normal operation

Validators ensuring the protocol drives economic activity in the network

The lack of this cooperation in the consensus mechanism also raises questions about the roles of users.

This is where Berachain's POL consensus comes into play.

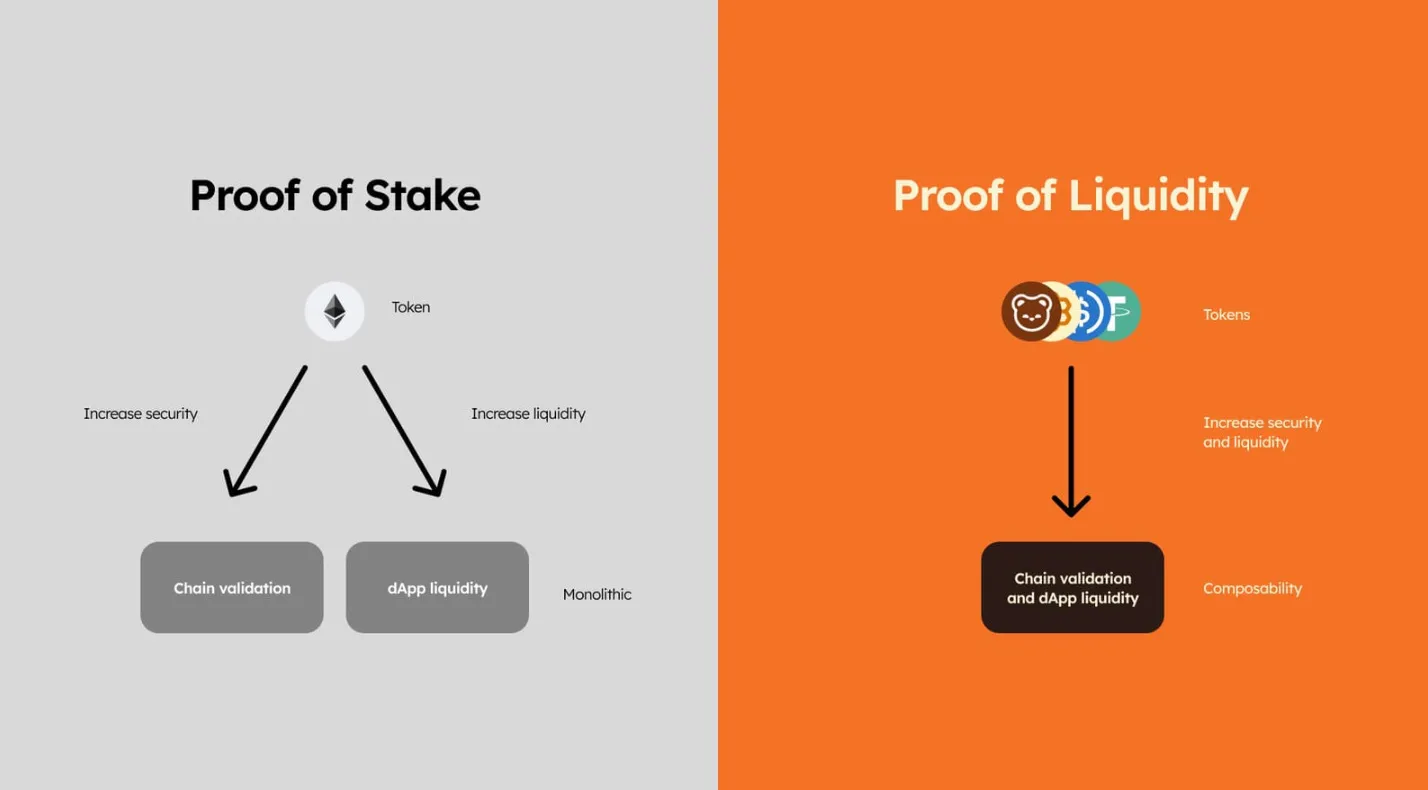

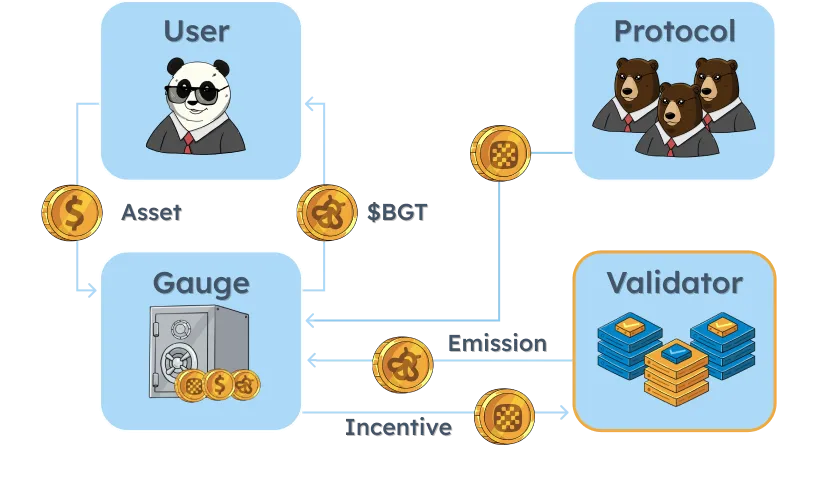

Based on POS, POL consensus integrates an incentive system at the consensus level, strategically aligning the interests of all network participants—validators, applications, and users.

In the cryptocurrency space, the use of incentives has been thoroughly validated, with significant examples like Curve, Convex, and Redacted demonstrating the power of incentives in aligning interests and expanding products.

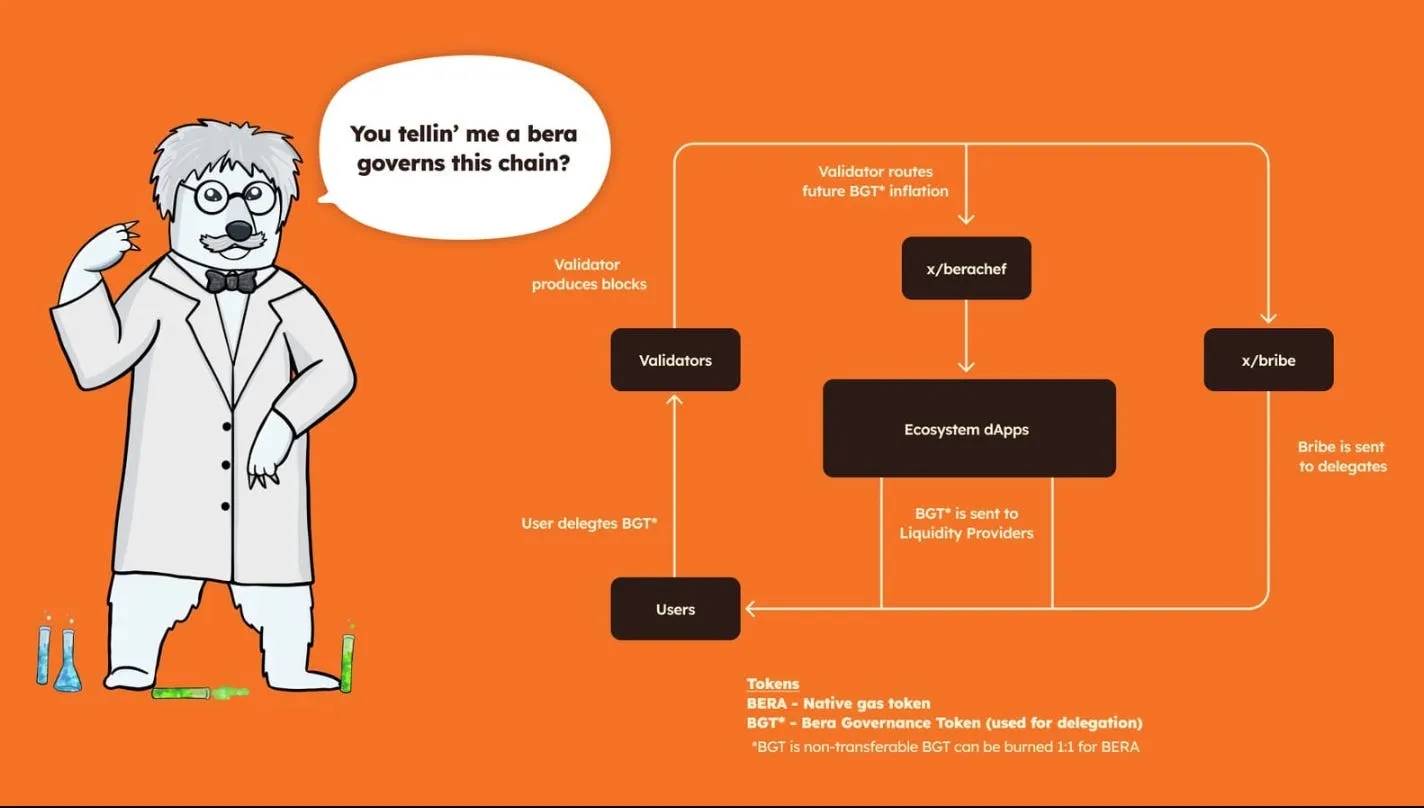

However, Berachain is pioneering the direct integration of a bribery system into the consensus model, ensuring that cooperation among network participants is deeply rooted in the network infrastructure.

Practical Impact of POL

Under this model, Berachain is building a network that scales liquidity and security proportionally with the network's growth, fostering community cohesion from the outset.

The POL system incentivizes all participants, with a particular emphasis on the active participation of validators, which is crucial for the network's success.

Understanding the incentive balance achieved through POL requires an introduction to Berachain's token model:

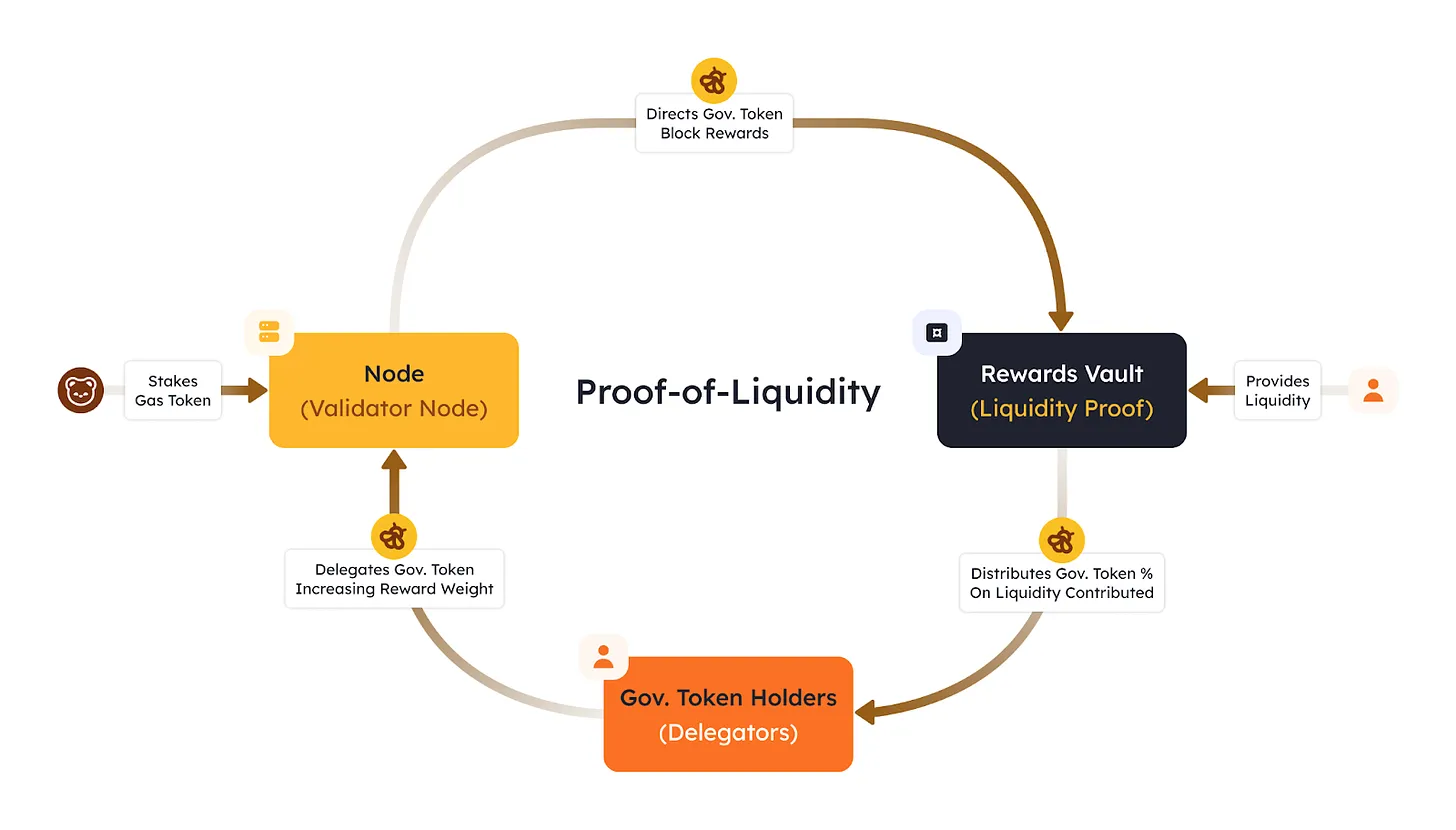

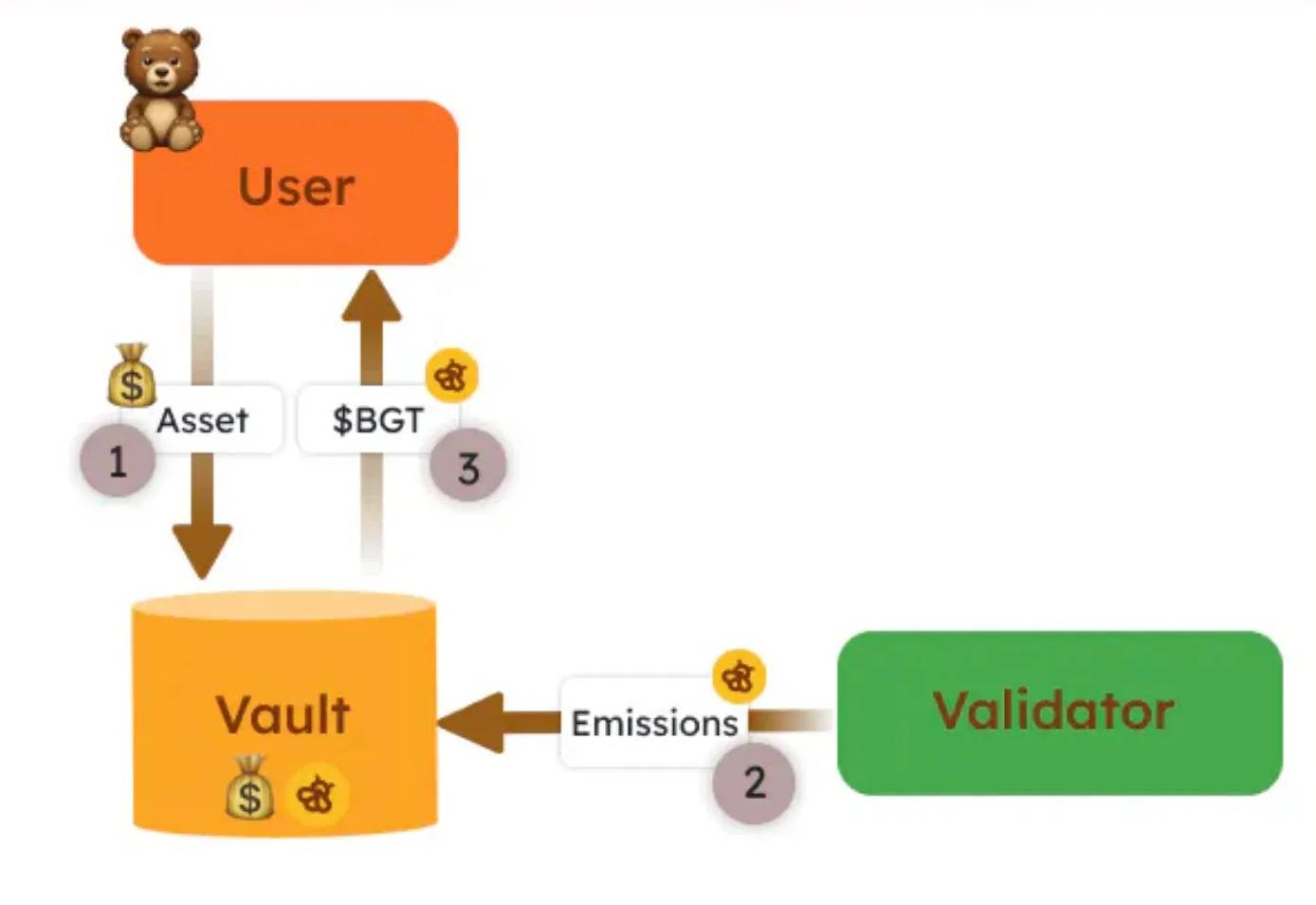

BGT: Bera Governance Token (BGT) is a core component of the POL model. It is non-transferable and can only be obtained through participating in POL. BGT is not just a simple governance token for voting; it also represents the most important part of POL rewards: users delegate BGT to validators, and new BGT is only rewarded when validators propose valid blocks, after which validators distribute the rewards to applications based on the bribes received. Users can only obtain BGT by adding liquidity to a liquidity pool (LP) that distributes BGT—once obtained, they can choose to use or burn it to obtain BERA.

BERA: Berachain's gas token, transferable, and network participants must stake this token to become active validators.

HONEY: Berachain's native USD-pegged collateralized stablecoin, which can be minted by depositing different whitelisted collateral into the reserve.

Berachain Flywheel

Berachain's "modular liquidity" transforms the ecosystem from zero-sum game to a collaborative environment, generating a flywheel effect for the entire ecosystem:

Validators interact directly with users, maximizing the BGT delegated to them. The more BGT users delegate, the more rewards they receive. Validators earn fees from these rewards.

Applications collaborate to receive larger BGT rewards into their liquidity pools, encouraging user liquidity addition rather than competition.

Users have different options after depositing funds into liquidity pools, which change over time. Their rewards depend on the total asset share they stake in the pool and the amount of BGT rewards validators distribute to that gauge.

Ultimately, validators decide the distribution of BGT across various pools and protocols, and their strategies may vary.

Protocols can also attract more BGT rewards by incentivizing validators with native token rewards—bribes. Let's look at a practical example:

- Validators direct their BGT towards the protocol's liquidity pools.

- Suppose you are FrancescoProject, and you have FRAcoin. You want to establish a strong liquidity pool on FRAcoin/Bera.

- To do this, you decide to bribe validators with X amount of FRAcoin, and then validators send their BGT to the liquidity pool for FRAcoin/Bera.

- Users want to earn BGT, so they will add liquidity to that liquidity pool.

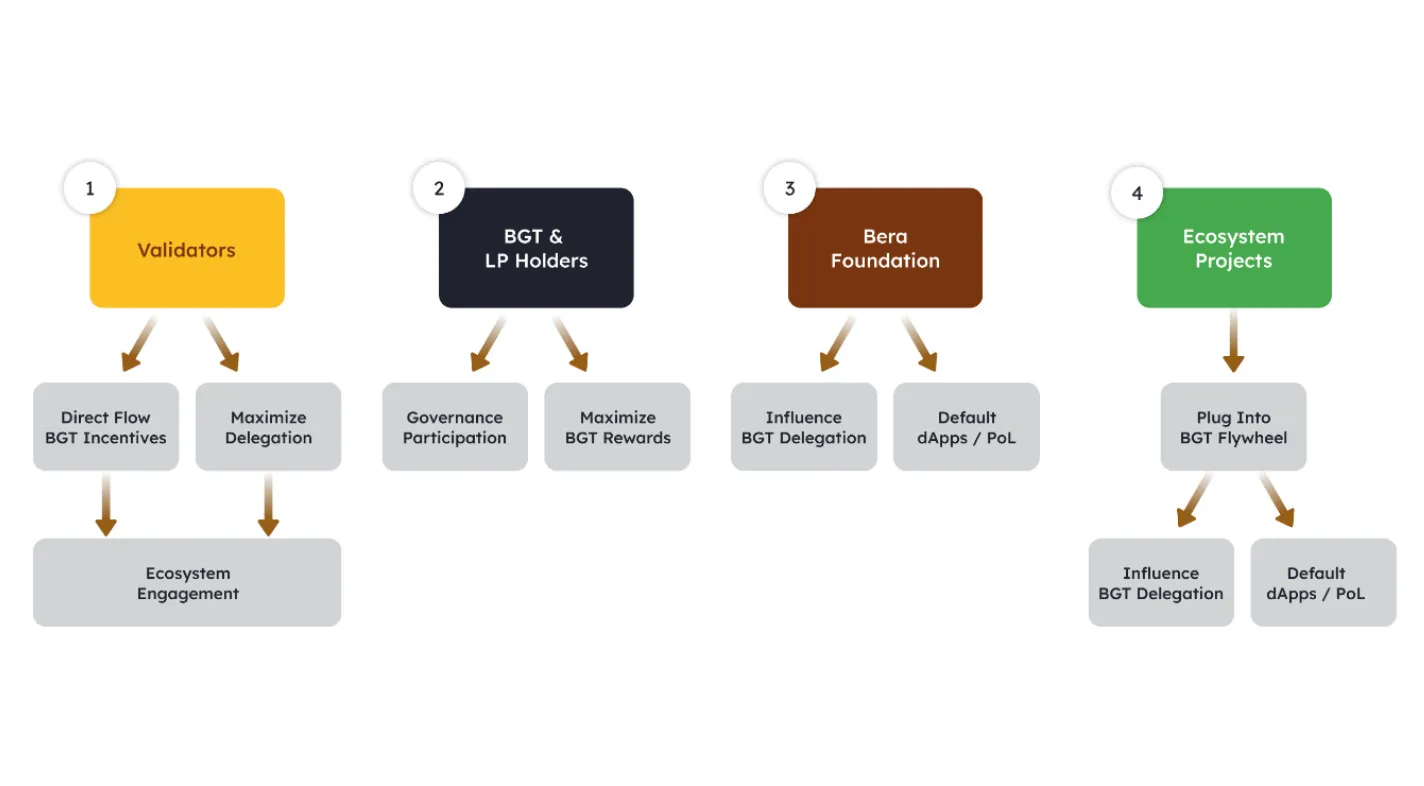

This model requires close coordination between validators, applications, and users to incentivize all participants. Here is how participants in Berachain engage with the flywheel.

1. Validators: Validators distribute BGT rewards based on their reward weight, which is proportional to the amount of BGT delegated to them. Validator rewards also include bribes from ecosystem applications + rewards from block capture value (e.g., BERA from gas, HONEY from transaction fees), in addition to ensuring network security.

In addition to ensuring network security, validators must:

- Maximize their BGT delegation

- Directly incentivize BGT

2. Users: Users vote through their wallets: they provide liquidity to whitelisted pools and receive LP tokens. They can stake these tokens in specific gauges to earn BGT, which they can then delegate to validators.

3. Ecosystem Projects: Anyone can leverage Berachain's native distribution as a source of income. Applications can send bribes to delegators, forming a positive feedback loop to incentivize liquidity in specific gauges and allocate more rewards to these applications (e.g., users will see this and choose to add more liquidity to the gauge, earning more BGT and increased rewards relative to other gauges).

In this POL framework, the role of validators becomes increasingly important.

They can establish direct collaborative relationships with applications on Berachain, diversifying their income sources through bribes. For example, validators may collaborate with protocols to enhance user incentives, increasing LP participation.

Therefore, delegating BGT to validators requires careful consideration: due to their interplay with applications and users, they play a crucial role in the ecosystem.

While the POS model ensures validators' interests in the ecosystem, POL extends this alignment to coordinate the interests of all network participants at the consensus level.

While protocols like Curve use incentives to guide distribution into a single pool, the Berachain ecosystem collectively operates to determine the best flow of value, thus achieving a more comprehensive ecosystem flywheel.

Addressing Challenges Faced by Traditional Liquidity Providers

The POL consensus addresses traditional challenges faced by liquidity providers (LPs) by providing multiple sources of rewards:

- BGT distribution from validators

- LP rewards

- Additional rewards and incentives from bribes

In addition to receiving these rewards, LPs also increase their participation in governance by obtaining BGT, further enhancing their role in the network.

POL also enables Berachain applications to utilize the chain's native distribution as a source of income, rather than paying for LP rental liquidity, empowering Protocol Owned Liquidity (PoL).

This approach simplifies the application process to initiate liquidity and deposits by aligning with validators and offering higher bribes to attract liquidity.

In turn, this can facilitate the development of consumer-facing applications, going beyond decentralized finance (DeFi). These applications will be less reliant on short-term capital and can leverage ecosystem liquidity to kickstart their operations.

The POL model of Berachain believes that as long as there are sufficient incentives to delegate BGT and participate in the network, liquidity will follow.

Broader Implications and Future Considerations

Great technology can only take you so far.

While technological innovation is crucial, Berachain's approach ensures sustained growth and collaboration by focusing on its ecosystem's positive feedback loop, making it stand out.

In cryptocurrency, the scarcest resource is users.

With many vying for the same pool of users, POL consensus ensures that Berachain users will enjoy better rewards and participation in the ecosystem since its inception. Many new L2 launches adopt predatory strategies, forcing users to lock liquidity for months without any rewards or decision-making power.

Berachain rewrites this script, making users not just participants in liquidity but active and significant participants who can determine the flow of liquidity and value in the ecosystem.

While previous incentive programs and closed-loop incentive systems only benefited participants, POL is the first "scalable incentive system at the protocol level," aimed at ensuring the network's long-term success and sustainability.

This aligns with the Fat Bera theory, that "applications built at the forefront with PoL will capture most of the value in the Berachain ecosystem."

Currently, this model heavily relies on the relationship between Berachain validators and BGT delegators. Will this relationship continue once the network goes live?

Many also emphasize the crucial role of validators in the ecosystem. Will they eventually become too powerful?

The dependency of validators on block production could also become a single point of failure: what if the demand for block creation decreases?

Lastly, but equally important, many have raised concerns about decentralization.

While Berachain mentions "Proof of Liquidity is for the people," most validators and liquidity pools require whitelisting. Is the system operating as expected, or is this just another way to centralize power in the hands of a few?

Most of the theoretical assumptions of this model must be validated in practice.

The success of the POL model will depend on its implementation in the real world and ensuring ongoing efforts for decentralization and sustainability.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。