In general, Harris's "Opportunity Economy" framework is an extremely left-wing economic plan.

Written by: Web3Mario

Abstract: This week, the market officially entered a period of calm before the Jackson Hole meeting, and everyone is waiting for Powell to provide an official interpretation of the latest employment and inflation data, and to give clear guidance on future monetary policy, which will undoubtedly be a key reference for the September interest rate decision. However, last Friday, an interesting piece of information in the crypto world did not attract much attention, which is the official announcement by Democratic presidential candidate Harris of her first clear economic policy framework - the "Opportunity Economy" architecture. As I was organizing the analysis article about Usual Money last Friday, I didn't notice it, but after studying the relevant details over the weekend, I found it interesting and wanted to share it with you. In general, Harris's "Opportunity Economy" framework is an extremely left-wing economic plan, specifically aimed at reducing the living costs of the American people in four areas through the power of government policies, including housing, healthcare, food and daily necessities, and childcare. If implemented, this plan may once again boost the cryptocurrency market, as seen in the 2021 trend, but it may also reignite inflation in the United States.

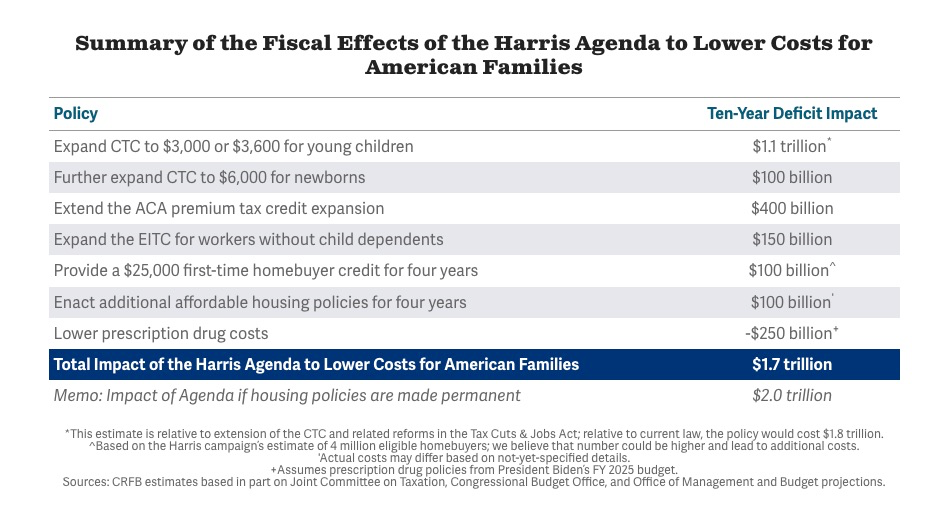

Harris's first economic policy document, "Agenda to Lower Costs for American Families" - a $1.7 trillion subsidy plan

Recently, with Harris officially nominated as the presidential candidate, her momentum has significantly increased due to active promotion by major financial and media outlets. Poll data has even surpassed Trump's, showing a promising trend. Of course, those familiar with the electoral system may be aware that polls are a highly subjective unofficial activity, and organizers can cleverly manipulate the results they want to see through survey methods, questionnaire design, and the selection of survey subjects. Therefore, it is not surprising that the Democratic Party, with control over mainstream media, can easily create such impressive data. Therefore, it is important to take a wait-and-see approach when considering this matter. However, after integrating internal forces, the propaganda machine of Harris's campaign team has been fully activated, and its strength is still not to be underestimated. This is also why Trump is eager to return to Twitter and actively interact with Musk. Therefore, we also need to actively observe and analyze Harris's possible governance direction.

One of the core points that Harris has been questioned about all along is that she has not shown a clear preference for economic policies since entering politics, which is mainly related to her work experience. Of course, considering her past handling of political issues, including immigration and public security, Harris has shown a left-wing populist attitude, and the market has to some extent anticipated that her economic policies after taking office may lean left. However, on August 16, Harris's campaign team officially released her first clear economic policy document - "Agenda to Lower Costs for American Families", which surprised many people and sparked considerable controversy. Here, it is worth explaining why this proposal is called "Opportunity Economy." Harris's team believes that by reducing the costs of American families, many middle-class people will have more job and entrepreneurial opportunities, thereby stimulating overall economic vitality and reviving the American Dream. The main reason for the controversy is that this is an extremely left-wing economic policy, which aims to reduce the living costs of the American people in four areas through government intervention, including housing, healthcare, food and daily necessities, and childcare.

In the housing sector, it mainly includes three specific directions:

Harris calls for the construction of 3 million new homes to end the housing supply shortage in the next four years. This will be achieved through three directions to stimulate the plan, including providing tax incentives for the construction of entry-level homes and affordable rental housing; establishing a $400 billion federal innovation fund to incentivize innovative housing construction schemes; and reducing government review and approval processes to lower related costs.

Lowering housing rents by cracking down on businesses and major landlords, including preventing Wall Street investors from buying and reselling homes in large quantities, and canceling tax incentives for purchasing single-family rental properties; preventing large corporate companies from manipulating rental prices through private equity-supported pricing tools.

Providing a $25,000 down payment subsidy for first-time homebuyers, significantly expanding the 400,000 subsidy quota to 4 million under the Biden administration and relaxing the review standards.

In healthcare, it mainly includes three directions:

Setting a cap of $35 for insulin costs and a cap of $2,000 for out-of-pocket prescription drug costs.

Speeding up Medicare's negotiation process for prescription drugs.

Enhancing competition and requiring the healthcare industry to increase transparency, first by cracking down on abusive practices by pharmaceutical companies that hinder competition and by squeezing the profits of small pharmacies and increasing consumer costs by medical intermediaries.

In the food and daily necessities sector, it mainly includes:

Promoting the first federal ban on food and grocery price fraud.

Establishing clear rules that large companies cannot unfairly exploit consumers and make excessive profits from food and groceries.

Ensuring that the Federal Trade Commission and state attorneys general have new powers to investigate and impose strict new penalties on companies that violate regulations.

In childcare, it mainly includes:

Tax cuts for middle-class families with children, with a maximum child tax credit of $3,600.

Providing a $6,000 tax credit for families with newborns in the first year.

A $1,500 tax cut for dual-income families.

Tax cuts for purchasing health insurance.

Harris's team has promised to start implementing these proposals within the first 100 days of her term to reduce the living costs of ordinary Americans. The biggest controversy mainly focuses on the housing and food and daily necessities policies, as well as the overall budget of the policy. First, most opponents believe that her radical housing subsidy and construction policies will greatly increase government financial pressure, leading to a more serious debt crisis. Secondly, the food and daily necessities policies also go against market principles. She attributes inflation to improper profits by related companies, which clearly indicates a lack of understanding of the market and a misunderstanding of the different characteristics of oligopoly and perfect competition markets. In fact, the retail industry belongs to a perfectly competitive market, and the profit margins of most retailers in the retail business usually remain in single digits. Government intervention will lead to an imbalance in market supply and demand, triggering a new round of inflation and causing bankruptcy of a large number of related companies.

Finally, in terms of the total budget of this plan, the responsible non-profit organization, the Committee for a Responsible Federal Budget, estimates that this plan will increase the government deficit by between $1.7 trillion and $2 trillion over the next 10 years, which may cause three problems. First, it will make the already escalating debt crisis in the United States more serious. Uncontrolled government spending will continue to erode America's credit and potentially trigger a US dollar crisis. Secondly, this stimulus plan will further push up domestic inflation in the United States. Finally, since Harris's team has stated that this budget will be borne by the wealthy through changes in the tax structure, this is undoubtedly contrary to Trump's policy of tax cuts for businesses benefiting the wealthy, which will further exacerbate domestic social conflicts in the United States. It can be seen that after the bill was made public, the US dollar index and gold, as a safe-haven asset against inflation, both experienced significant reactions.

Impact on the Crypto World - Short-term Bullish, Long-term Bearish

Next, let's analyze the impact of this bill on the crypto market. The United States has always been proud of its spindle-shaped social class structure, with the middle class accounting for over 50% of the population, despite a declining trend. The impact of this bill mainly benefits this segment of the population. We know that government policies have diminishing effects on economic intervention because they significantly affect the expectations of all parties in the market. However, in general, the short-term impact of government intervention is still strong and powerful. Therefore, if the above plan can be implemented, there is no doubt about its short-term effects. At that time, the living costs of most American middle-class families will be significantly reduced, leading to an increase in disposable income for residents in the short term. This provides fertile ground for the rise of risk assets, especially high EPS technology assets. The reason is simple: when the common people have more money, big capital can make money, and big capital making money will actively promote new narratives, leading to an active market.

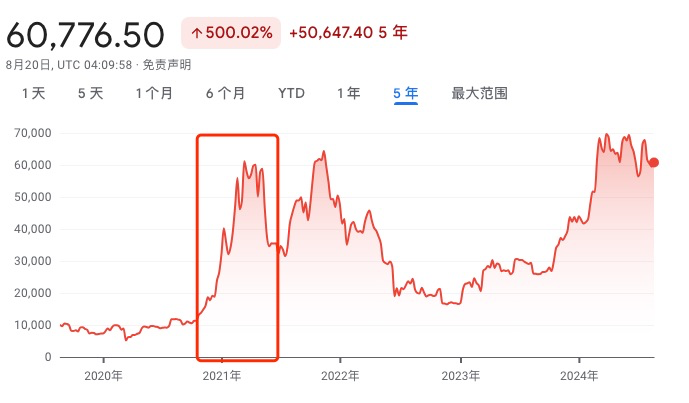

This story already played out once in 2021, with the Biden administration's $1.9 trillion COVID-19 relief bill at the beginning of 2021, which significantly increased the disposable income of most American families in the short term, triggering a frenzy of growth in the crypto market, mainly in Bitcoin. Of course, with the accumulation of wealth effects, inflationary pressures in American society have increased day by day. As we all know, to combat stubborn inflation, the Federal Reserve had to undergo a monetary tightening cycle for more than two years, leading to a significant retreat in risk assets. Therefore, I believe that if an economic policy of a similar scale can be implemented, it will be bullish for crypto assets in the short term, but caution is needed in the medium to long term due to the potential currency policy risks brought about by the return of inflation. Of course, this depends on Harris's successful election and the effective implementation of the policy, and I will continue to monitor it in the future.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。