Author: Nan Zhi, Odaily Star Daily

Both Ethereum and Ethereum-based Layer2 have shown a declining trend in token prices and core projects in the past two years. Among them, ARB has become the worst-performing token in the past year, and STRK has dropped by 90% within just six months of its launch.

The fundamental reason for this is twofold. On one hand, the limited activity and income within the Layer2 ecosystem, and on the other hand, the tokens of various Layer2 only have governance functions and cannot generate income, resulting in weak demand. In response to the latter, the PlutusDAO, a governance aggregation protocol on Arbitrum, initiated a proposal last year to stake ARB for interest, which was passed through off-chain voting. Although it ultimately failed in the on-chain voting process, it did successfully boost the token price for a period of time (with a 30-day increase of about 40%).

On August 16, the Arbitrum community preliminarily passed the proposal to "enable ARB staking to unlock token utility," aiming to empower the ARB token. What are the specific contents of the proposal, and can it reverse the fundamentals of the ARB token? Odaily will interpret this in this article.

Proposal Interpretation

Governance and Token Pain Points

The proposal was put forward by Frisson, the head of Tally Market Operations. Frisson stated that ARB mainly has the following issues:

- Governance power is the sole source of demand for ARB, but the token has a large amount of additional supply, including unlocking and treasury expenditures.

- Re-staking ARB or using it in DeFi is incompatible with governance functions. When ARB is deposited into smart contracts, it loses voting rights, and less than 1% of ARB tokens are actively used in on-chain governance.

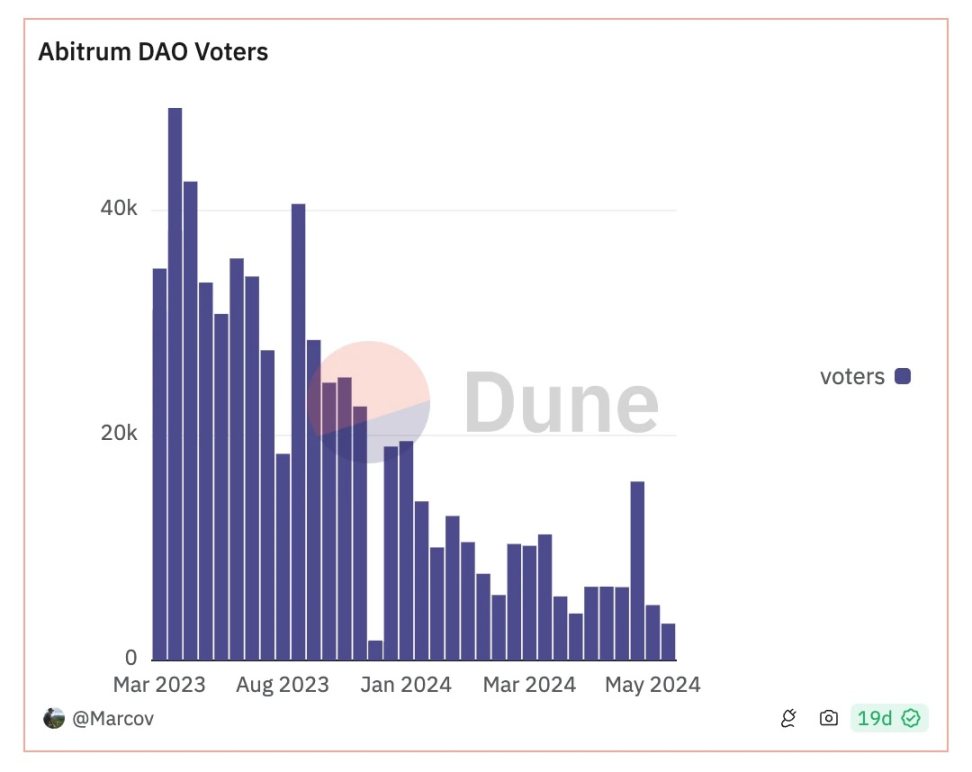

- The number of DAO members participating in governance has been continuously declining since the launch of the Arbitrum token.

Solution

Therefore, the proposal hopes to create a mechanism to distribute income from Arbitrum to token holders, including sequencer fees, MEV fees, validator fees, token inflation, and treasury, among other sources. However, the specific introduction of which income sources will require subsequent governance voting to decide.

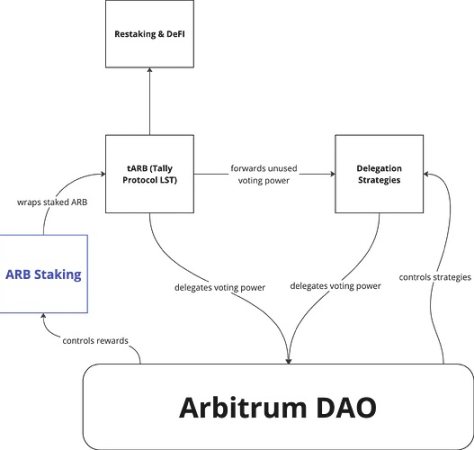

Furthermore, the proposal requires token holders to delegate their tokens to "active governors" before receiving income. At the same time, the proposal introduced stARB, a token for staking ARB liquidity, through Tally, allowing holders to retain the ability to combine with DeFi protocols and compound automatically while staking tokens.

Through the combination of these two modules, ARB holders are expected to earn income through network activities, and the introduction of stARB removes limitations on token governance, allowing for a combination with income to enhance governance activity.

Fundamentally, the approval of this proposal is clearly favorable for ARB. However, in practice, one question needs to be considered: how much income can be generated from network activities? Even if all network income is distributed to token holders, how much benefit can it bring to them?

Network Activity Income

Rising Network Activity

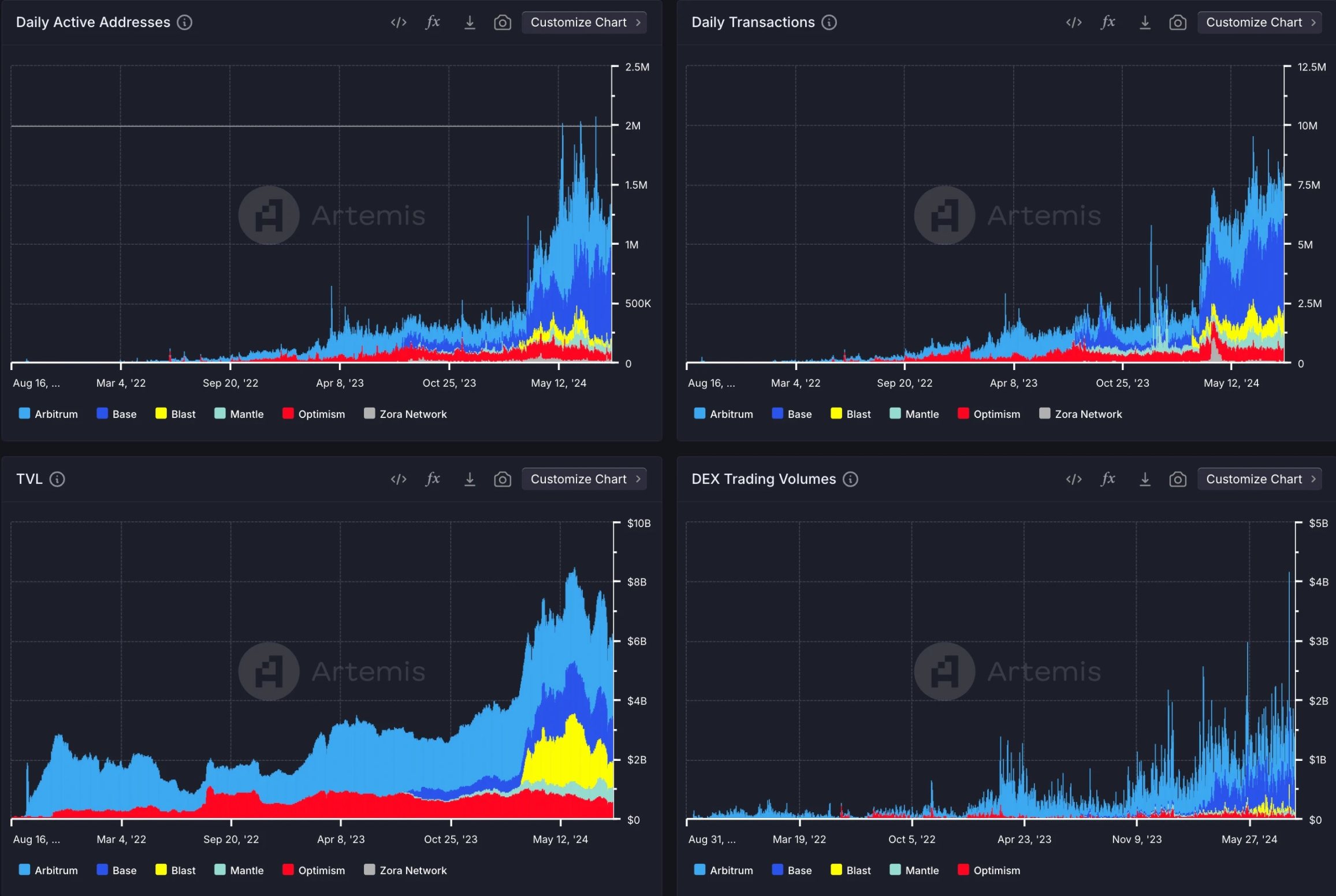

From the perspective of Layer2's conventional indicators, its market share is still at a high level, even showing a slight increase. The following figures show the active addresses, daily transaction volume, TVL, and DEX transaction volume of several major Layer2 networks.

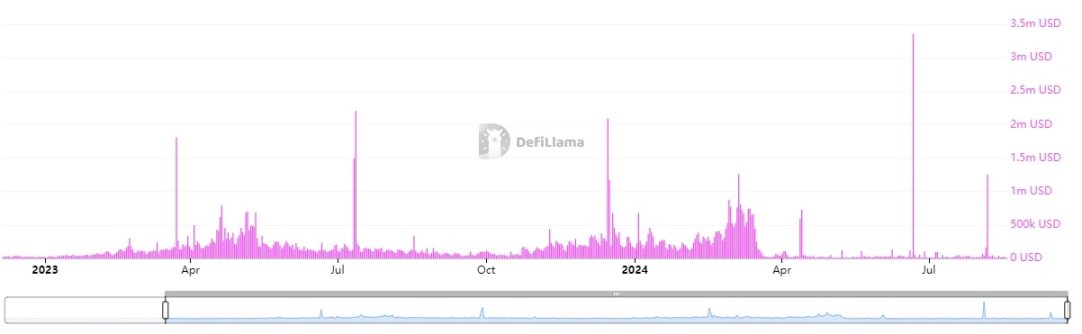

Declining to Negligible Network Income

However, data from DefiLlama shows that the income of the Arbitrum network in the past 24 hours is only $6,000. Since the Cancun upgrade in March, apart from occasional bursts, daily income has fluctuated between approximately $10,000 and $40,000. Based on a daily income of $30,000, the annual network income is only about $10 million, compared to ARB's circulating market value of $1.8 billion and the recent monthly token unlock of $60 million, which is insignificant.

The main reason for the sharp decline in income is that before the Cancun upgrade, the income of Arbitrum and other Layer2 networks mainly came from the difference between "gas fees paid by users on Layer2" and "fees paid by Layer2 to submit transactions to the Ethereum mainnet." For example, Starknet requires at least $1-2 per transaction, but the cost is negligible, with a profit margin of over 99%. After the Cancun upgrade, this core income is unlikely to return to the same level.

Therefore, the only remaining way to provide reasonable income is through "issuance." In November last year, PlutusDAO proposed issuing an additional 100 million ARB as a staking reward. Although it passed the Snapshot off-chain vote, it did not pass the Tally on-chain vote. The reason may be that the inflation rate was too high, with 100 million ARB accounting for 7% of the circulating supply and 1% of the total supply in November last year.

The current circulating supply of ARB is 3.26 billion, and based on an additional issuance of 100 million, the yield would be 3%. It would take at least a year to reach the minimum level of DeFi income, and if the inflation rate is too high, it will become a significant threat to the token price.

Conclusion

In summary, although this staking empowerment proposal logically stands and is clearly favorable for ARB, considering the actual profitability of the network, the degree of favorability currently appears to be limited. The Tally voting plan will take place in October, and it is recommended that relevant ARB token holders pay attention to the specific plan in the next two months.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。