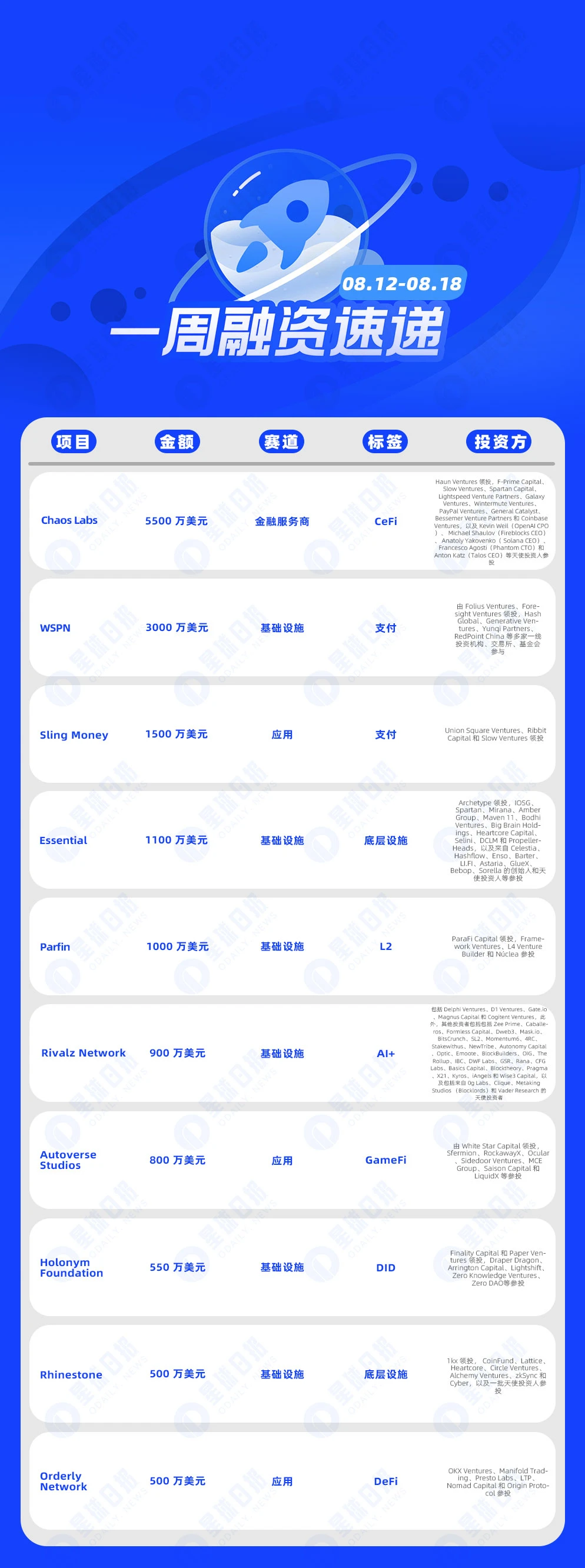

According to incomplete statistics from Odaily Star Daily, there were a total of 19 domestic and foreign blockchain financing events announced from August 12th to August 18th, which is an increase from the previous week's 14 events. The disclosed total financing amount is approximately $170 million, a significant increase from the previous week's $61.9 million.

Last week, the project with the highest investment amount was the financial services provider Chaos Labs ($55 million), followed closely by stablecoin 2.0 infrastructure company WSPN ($30 million).

The specific financing events are as follows (Note: 1. Sorted by disclosed amount; 2. Excluding fund-raising and M&A events; 3. * indicates "traditional" companies with some business involving blockchain):

Chaos Labs completes $55 million Series A financing, led by Haun Ventures

On August 15th, Chaos Labs announced the completion of a $55 million Series A financing, led by Haun Ventures, with participation from prominent new investors including F-Prime Capital, Slow Ventures, and Spartan Capital. They joined existing investors Lightspeed Venture Partners, Galaxy Ventures, Wintermute Ventures, PayPal Ventures, General Catalyst, Bessemer Venture Partners, Coinbase Ventures, as well as angel investors Kevin Weil (OpenAI CPO), Michael Shaulov (Fireblocks CEO), Anatoly Yakovenko (Solana CEO), Francesco Agosti (Phantom CTO), and Anton Katz (Talos CEO). The new funds will accelerate their product development and expand their cutting-edge risk management platform.

On August 16th, stablecoin 2.0 infrastructure company WSPN completed a $30 million seed round financing, led by Folius Ventures and Foresight Ventures, with participation from numerous leading investment institutions, exchanges, and foundations including Hash Global, Generative Ventures, Yunqi Partners, and RedPoint China.

Stablecoin payment application Sling Money completes $15 million Series A financing, led by USV

On August 15th, stablecoin payment application Sling Money completed a $15 million Series A financing, led by Union Square Ventures, Ribbit Capital, and Slow Ventures. Prior to this, Sling Money also completed a $5 million seed round financing, led by Ribbit Capital with participation from Slow Ventures. Transfers on Sling Money support the use of Pax Dollar (USDP), which is a USD-backed stablecoin issued by Paxos Trust Company.

Essential completes $11 million Series A financing led by Archetype, and launches Pre-Alpha Devnet

On August 13th, intent-based blockchain infrastructure project Essential announced the completion of an $11 million Series A financing led by Archetype, with participation from IOSG, Spartan, Mirana, Amber Group, Maven 11, Bodhi Ventures, Big Brain Holdings, Heartcore Capital, Selini, DCLM, PropellerHeads, as well as founders and angel investors from Celestia, Hashflow, Enso, Barter, LI.FI, Astaria, GlueX, Bebop, Sorella, and others.

On August 14th, Ethereum Layer 2 development company Parfin completed a $10 million Series A financing, led by ParaFi Capital, with participation from Framework Ventures, L4 Venture Builder, and Núclea. It is reported that the company will continue with a second round of Series A financing, with the total expected to reach $16 million. The new funds will be used to develop its Rayls network and expand its global business.

On August 14th, decentralized AI infrastructure project Rivalz Network raised $9 million in recent rounds of financing. The main investors include Delphi Ventures, D1 Ventures, Gate.io, Magnus Capital, and Cogitent Ventures. Other investors include Zee Prime, Caballeros, Formless Capital, Dweb3, Mask.io, BitsCrunch, SL2, Momentum6, 4RC, Stakewithus, NewTribe, Autonomy Capital, Optic, Emoote, BlockBuilders, OIG, The Rollup, IBC, DWF Labs, GSR, Rana, CFG Labs, Basics Capital, Blocktheory, Pragma, X21, Kyros, iAngels, and Wise3 Capital, as well as angel investors from 0g Labs, Clique, Metaking Studios (Blocklords), and Vader Research. Rivalz is addressing a key bottleneck in AI development—the demand for AI-ready, validated, and privacy-preserving data. Rivalz's DePIN dual-chain infrastructure is built on Dymension and Arbitrum and will fundamentally change the landscape of AI.

On August 14th, Web3 game development studio Autoverse Studios announced the completion of $8 million in financing, led by White Star Capital, with participation from Sfermion, RockawayX, Ocular, Sidedoor Ventures, MCE Group, Saison Capital, and LiquidX. The new funds will be used to develop their social racing Web3 game, Auto Legends, with the goal of building a game that brings Web3 ownership and trading mechanisms to traditional gamers and attracts more Web2 users.

On August 17th, decentralized network digital identity security development organization Holonym Foundation announced the completion of a $5.5 million seed round financing, led by Finality Capital and Paper Ventures, with participation from Draper Dragon, Arrington Capital, Lightshift, Zero Knowledge Ventures, Zero DAO, and others. Holonym Foundation is building critical middleware and applications to empower Web3 users to own, manage, and selectively share data, providing privacy and security guarantees to enhance the digital identity capabilities of every citizen.

On August 14th, modular smart account infrastructure development company Rhinestone announced the completion of a $5 million seed round financing, led by 1kx, with participation from CoinFund, Lattice, Heartcore, Circle Ventures, Alchemy Ventures, zkSync, Cyber, and a group of angel investors. Rhinestone is building infrastructure for smart accounts, and to date, the company's total financing amount has reached $5.42 million.

- Orderly Network completes $5 million strategic round financing, with participation from OKX Ventures

On August 16th, Orderly Network announced the completion of a $5 million strategic round financing, with participation from OKX Ventures, Manifold Trading, Presto Labs, LTP, Nomad Capital, and Origin Protocol. The new funds will be used to develop new products and enhance its on-chain liquidity.

On August 16th, decentralized underlying protocol KIP Protocol, focusing on AI, announced the completion of a $5 million private placement financing, jointly led by Animoca Ventures and Tribe Capital, with participation from GBV Capital, DWF Ventures, Morningstar Ventures, and others. To date, KIP Protocol has raised a total of $10 million. This round of financing will further drive the decentralized AI development of KIP Protocol by creating secure decentralized AI solutions.

On August 12th, the liquidity protocol Ion Protocol, for staking and restaking assets, completed a $4.8 million financing, with participation from Gumi Capital Cryptos, Robot Ventures, BanklessVC, NGC Ventures, Finality Capital, and SevenX Ventures. To date, its total financing amount has reached $7 million, and the new funds will be used to support and develop its native yield platform called Nucleus.

On August 15th, Crunch Lab announced the completion of a $3.5 million seed round financing, led by cryptocurrency investment company Multicoin Capital, with participation from Factor Capital, Fabric VC, and Elixir Capital. To date, the company's total financing amount has reached $5.3 million.

On August 12th, decentralized proprietary investment platform BasedVC completed a $2 million seed round financing at a post-investment valuation of $15 million, with participation from Neo Tokyo, Kongz Capital, as well as angel investors Mario Nawfal, Crypto Banter, Ashcrypto, and Kmanu.

On August 16th, the Berachain ecosystem Goldilocks DAO announced the completion of a $1.5 million strategic round financing, led by Shima Capital and Hack VC, with participation from Public Works, Iberia Capital, Rana DAO, Atka Incubator, and several angel investors.

On August 13th, the Ethereum Layer2 network Reddio announced the completion of seed round financing, jointly led by Paradigm and Arena Holdings. It is reported that the project has already launched staking and task systems. The project was founded by Neil, a graduate of Stanford Graduate School of Business and the National University of Singapore. He was previously the 003 employee of Twilio in the Asia-Pacific region, the general manager of PingCAP in Eurasia, a lecturer at Nanyang Technological University, and an early advocate of zk scaling technology, providing open-source scaling solutions for projects like Starknet.

On August 14th, the decentralized AI blockchain platform Sahara AI announced the completion of a new round of financing, with Binance Labs, Pantera Capital, and Polychain Capital leading the investment. Samsung, WeVenture, TMB Bank (Thailand), dao5, Alumni Ventures, Geekcartel, Nomad Capital, Mirana Ventures, and others participated in the investment. The new funds will be used to further expand its global team, enhance the performance of its AI blockchain, and accelerate the development of its developer ecosystem. This round marks Sahara AI's Series A financing, with a total financing amount of approximately $43 million.

On August 16th, Web3 game platform and subsidiary of Animoca Brands, GAMEE, announced the completion of a new round of financing, with participation from TON Ventures. The new funds will support GAMEE's WATCoin ecosystem, including the WatBird Mini App project. GAMEE will further integrate TON-based digital assets (such as tokens and NFTs supported by TON) into its Telegram Mini App to enhance user engagement.

On August 16th, Hong Kong-listed company SDM Education Group voluntarily announced that it has signed a Series A strategic investment agreement with the digital asset trading platform BiFinance. The two parties will engage in long-term cooperation in the areas of blockchain technology, real-world assets, digital assets, and more.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。