As of mid-August 2024, despite the volatility in the DeFi market, the overall trend is still upward, with various areas such as liquidity mining, lending, and cross-chain bridges showing different degrees of change and challenges.

Author: insights4vc

Translated by: Blockchain in Plain English

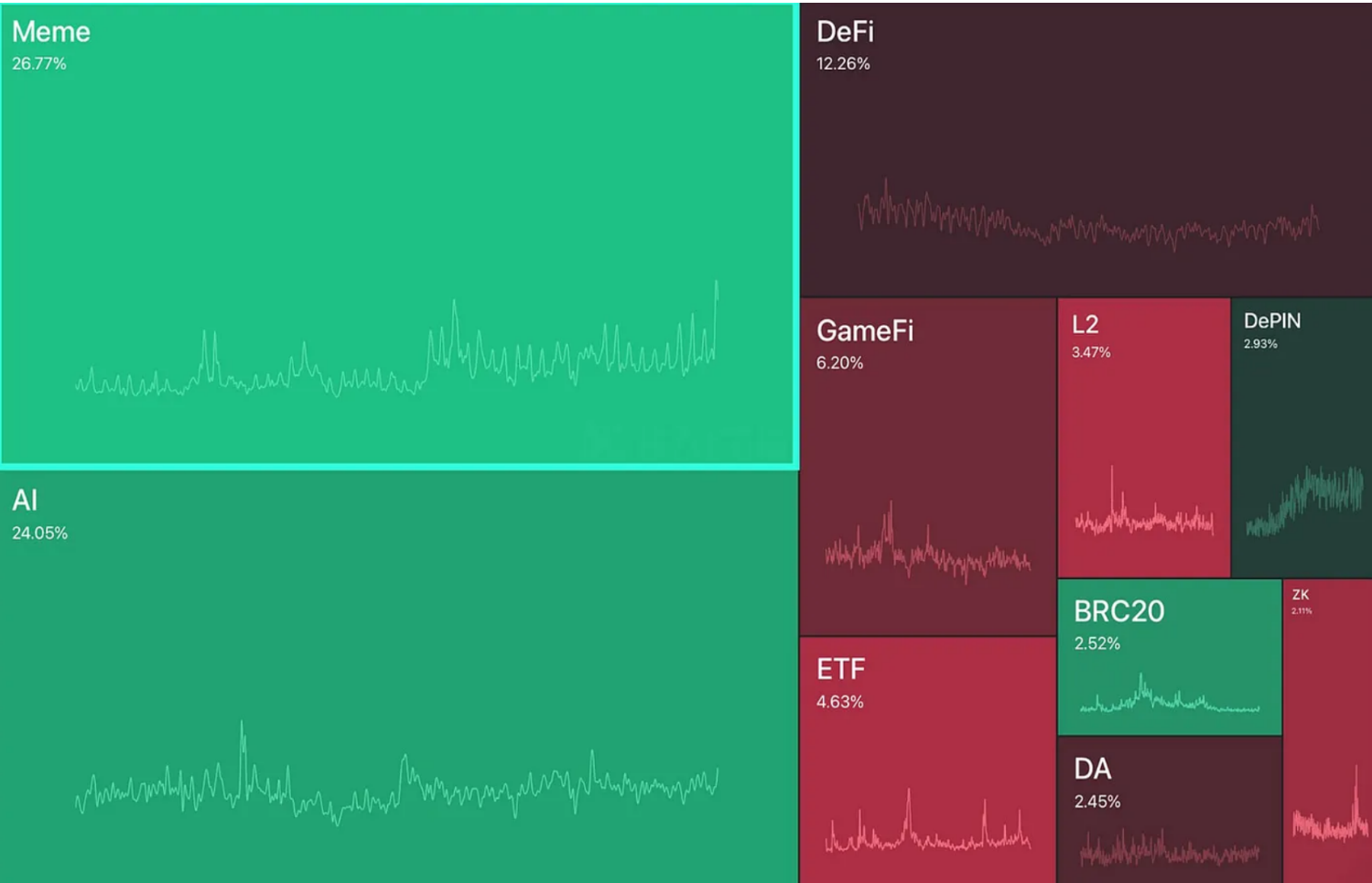

In today's news brief, we will introduce the landscape of decentralized finance (DeFi) as of mid-August 2024, focusing on on-chain data of various DeFi branches. As shown in the Kaito mind map below, the Web3 space is currently dominated by meme coins and AI-related projects, while DeFi is still lagging behind.

Mental market share (Source: www.kaito.ai)

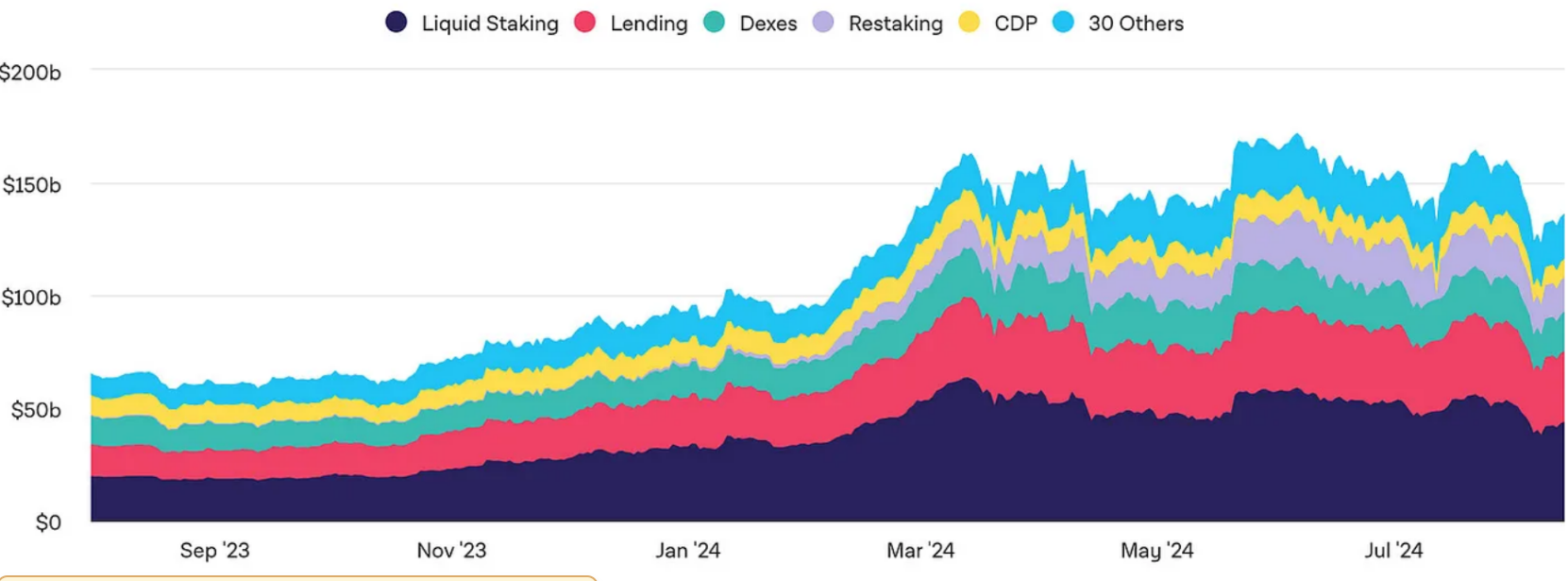

1. Total Value Locked (TVL)

Total Value Locked (TVL) is a metric used to evaluate the scale of DeFi projects by calculating the total value (in USD) of all assets locked in the corresponding smart contracts. As of mid-August, the category with the highest locked value is liquidity mining, reaching 43.7 billion USD, followed by lending at 31.5 billion USD, and decentralized exchange (DEX) at 17.3 billion USD.

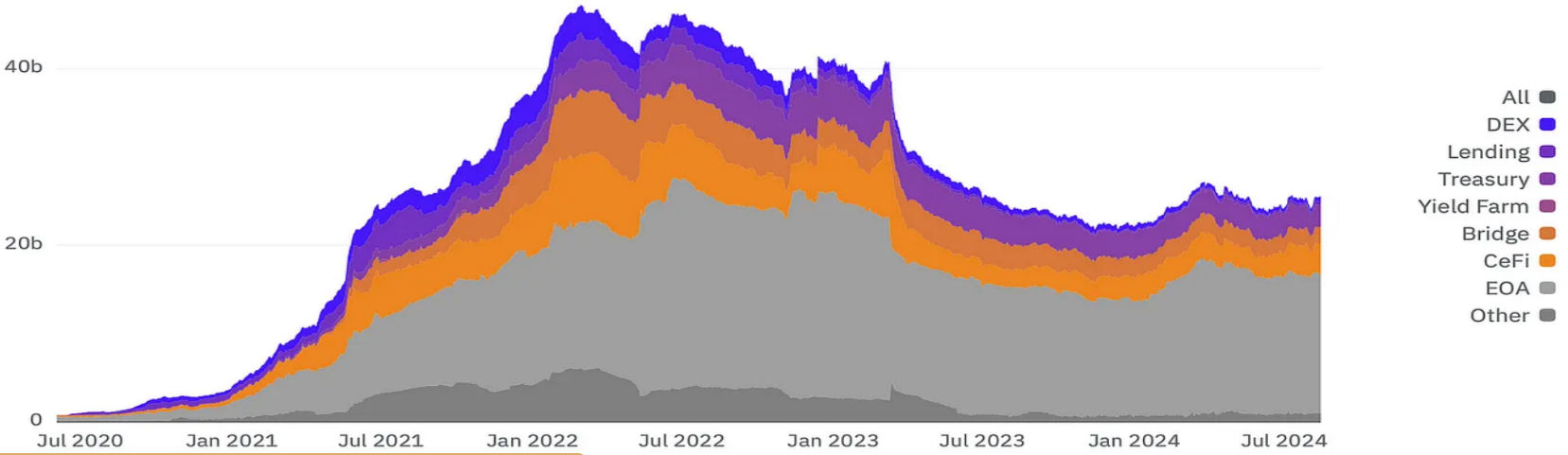

Locked value divided by category

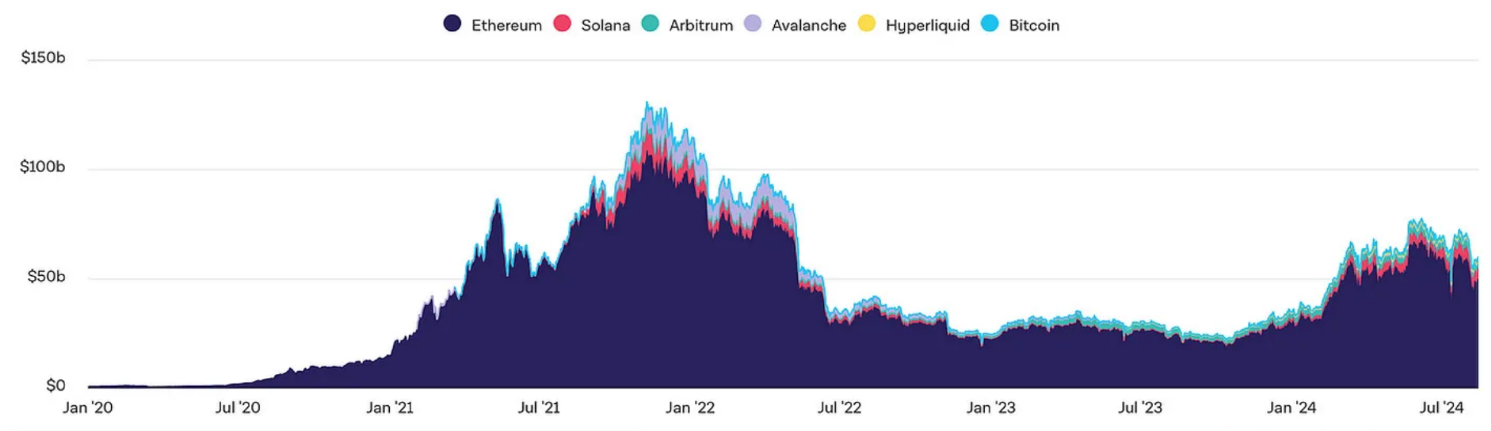

Ethereum still has the highest locked value, exceeding 50 billion USD, while Solana is close to 5 billion USD. Although the overall trend is still upward compared to 2023, the locked value has decreased from over 75 billion USD since early June to around 60 billion USD, a decrease of about 20%. It is worth noting that the current locked value is more than half lower than the level in November 2021.

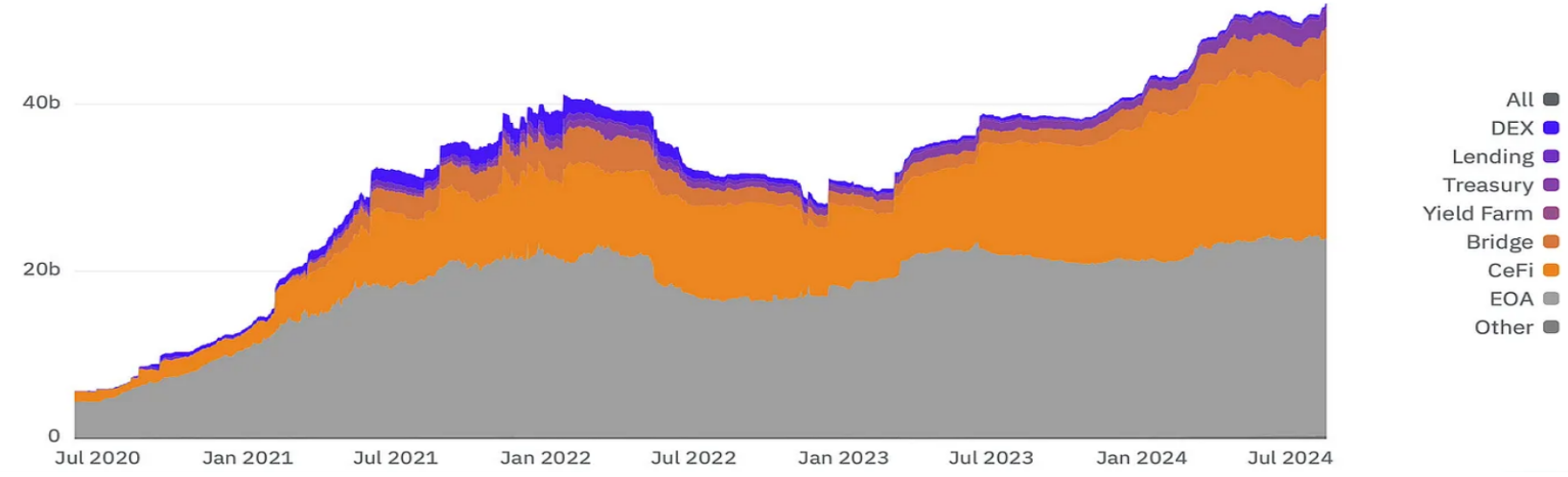

Locked value divided by blockchain

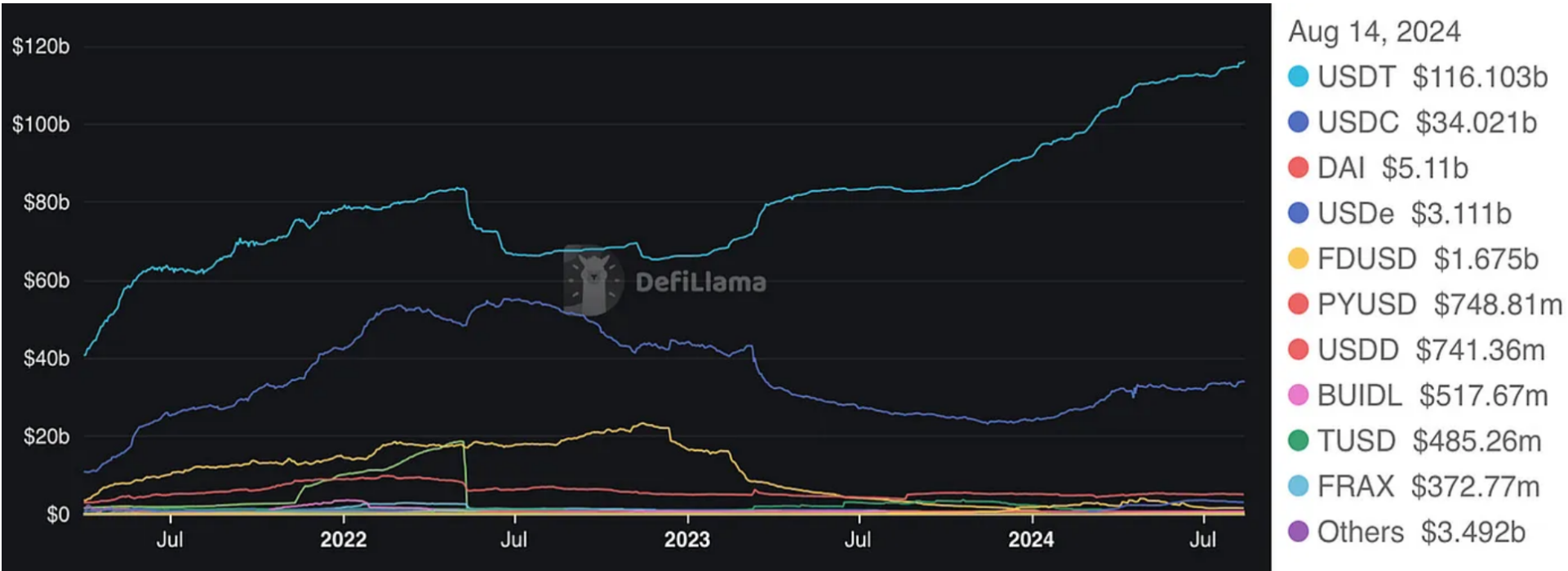

2. Stablecoins

In mid-May, we detailed the mechanism of stablecoins in a previous news brief (available here). Since then, we have not observed any significant market fluctuations. USDT remains the market leader, maintaining stable growth, with a current market cap of approximately 116 billion USD.

Market cap (Source: defillama.com)

USDC distribution by category (EOA — External Account)

USDT distribution by category

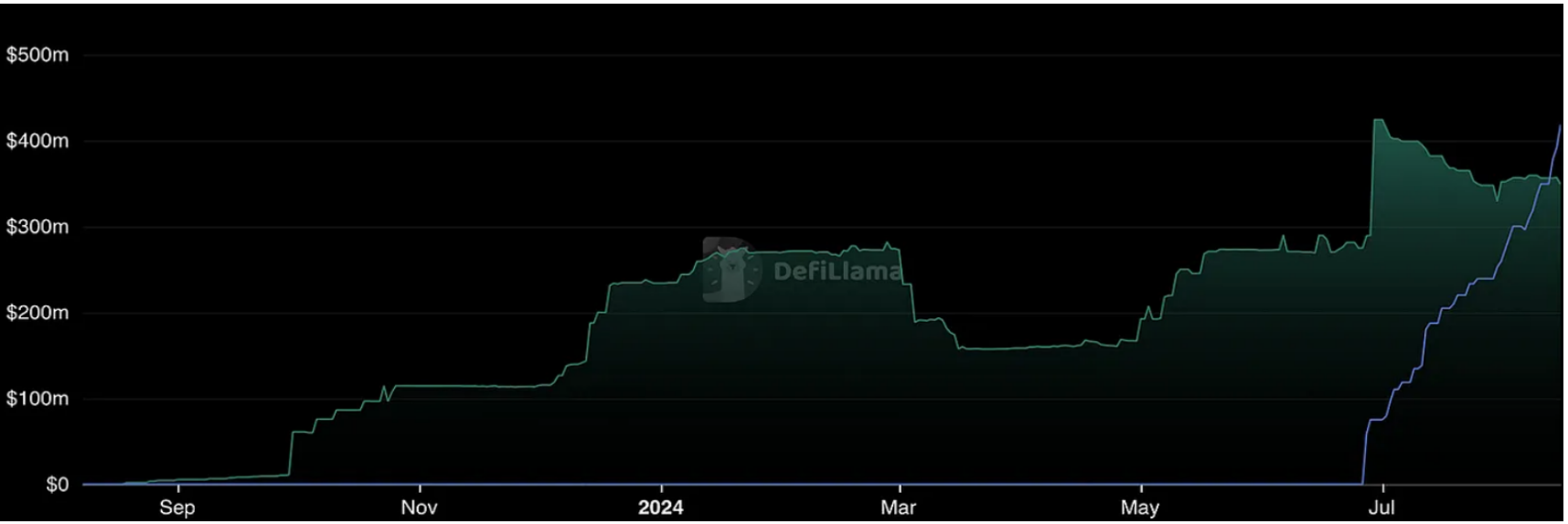

Since May 31, 2024, PayPal USD (PYUSD) has been launched on the Solana network, announced at Consensus 2024. This integration leverages Solana's fast transaction confirmation and low cost, providing the ability for users and developers to complete payments within seconds. Sheraz Shere, Head of Payments at the Solana Foundation, emphasized that Solana's speed and scalability make it an ideal platform for global financial institutions like PayPal to develop accessible, cost-effective, and instant payment solutions. PYUSD can be accessed through PayPal, Venmo, Paxos, Crypto.com, and Phantom, and transfers of PYUSD between Ethereum and Solana are feeless. PYUSD on Solana is issued by Paxos Trust Company.

As of August 15, the total market cap of PayPal USD is 767.47 million USD, with a circulating supply of 418.67 million on Solana (SOL) and 348.94 million on Ethereum (ETH).

PYUSD on Solana vs PYUSD on Ethereum

3. Decentralized Exchange Platforms (DEXs)

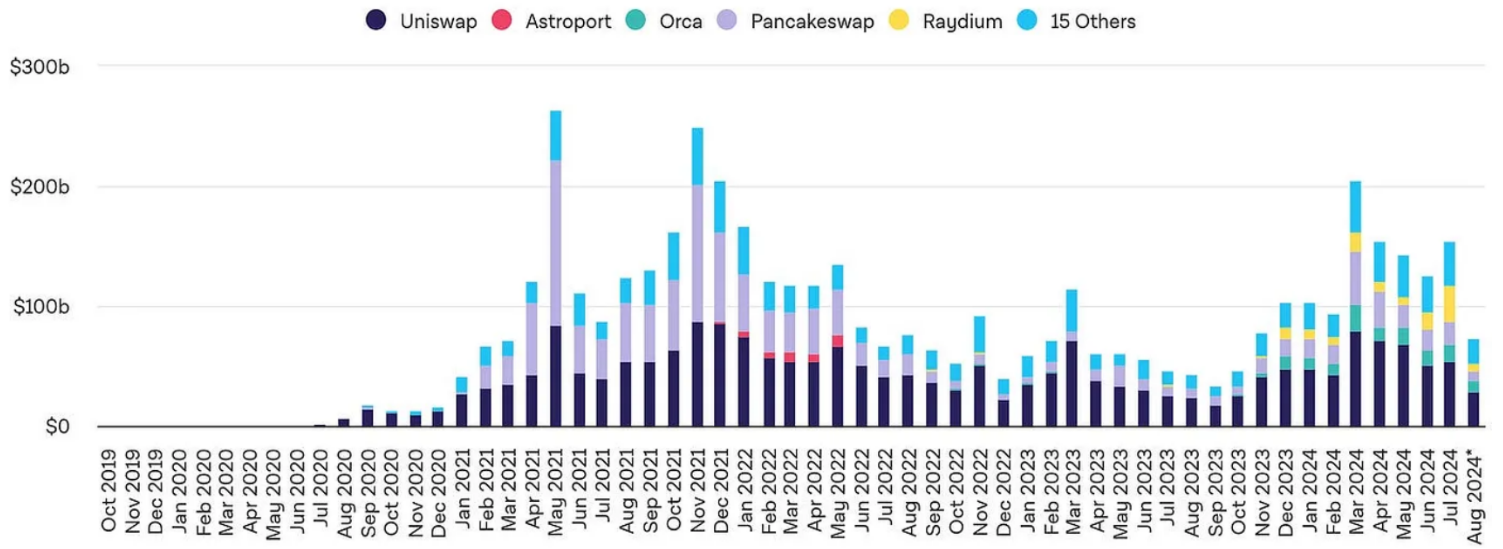

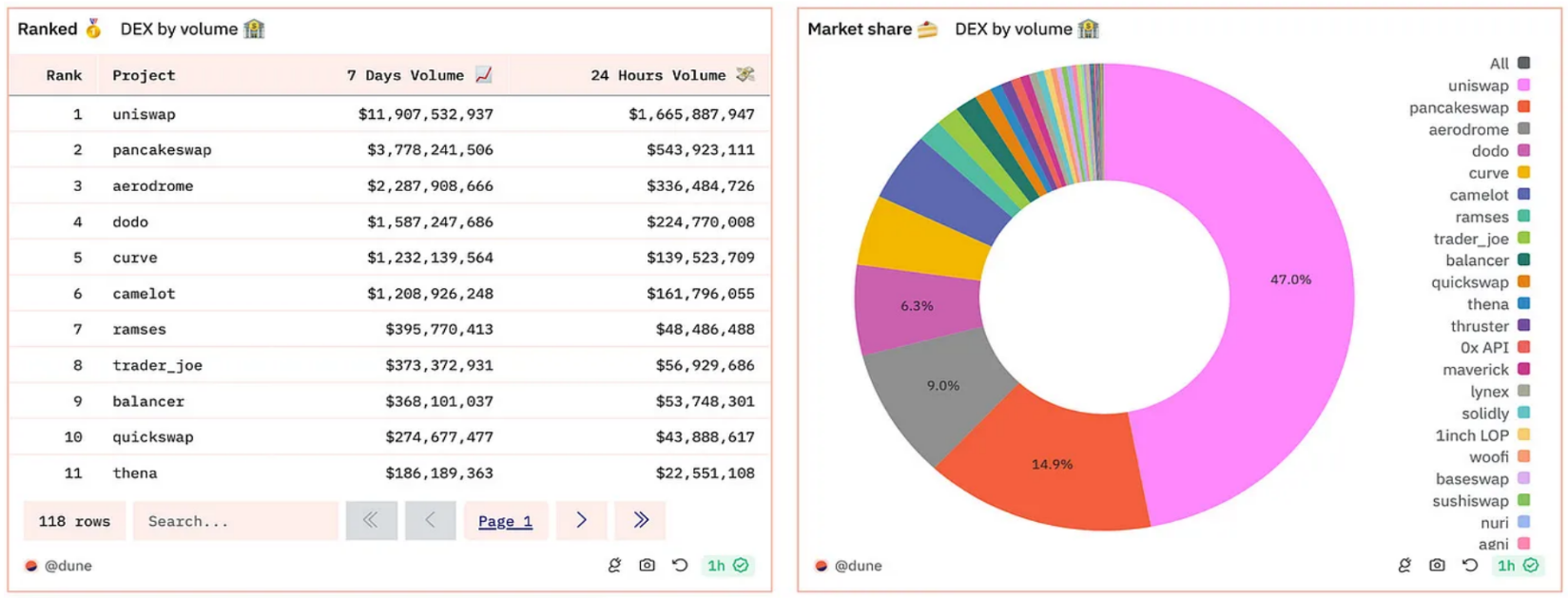

As of August 14, 2024, Uniswap accounted for nearly 40% of the DEX trading volume, but the current trading volume is lower than in 2021.

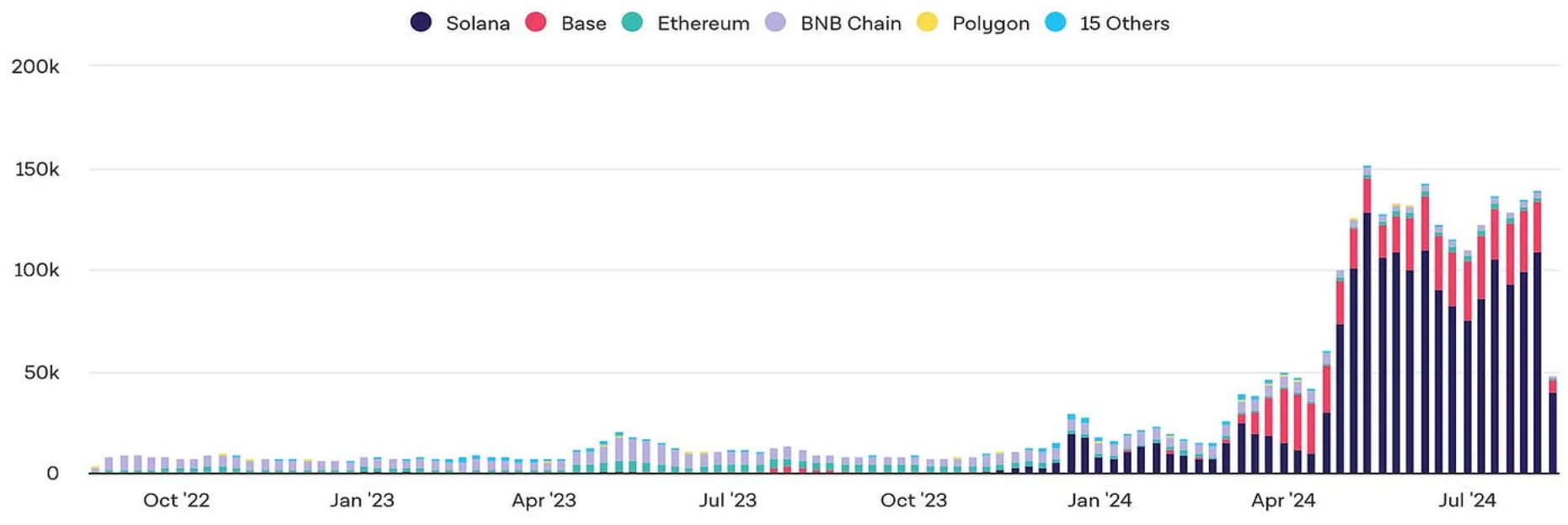

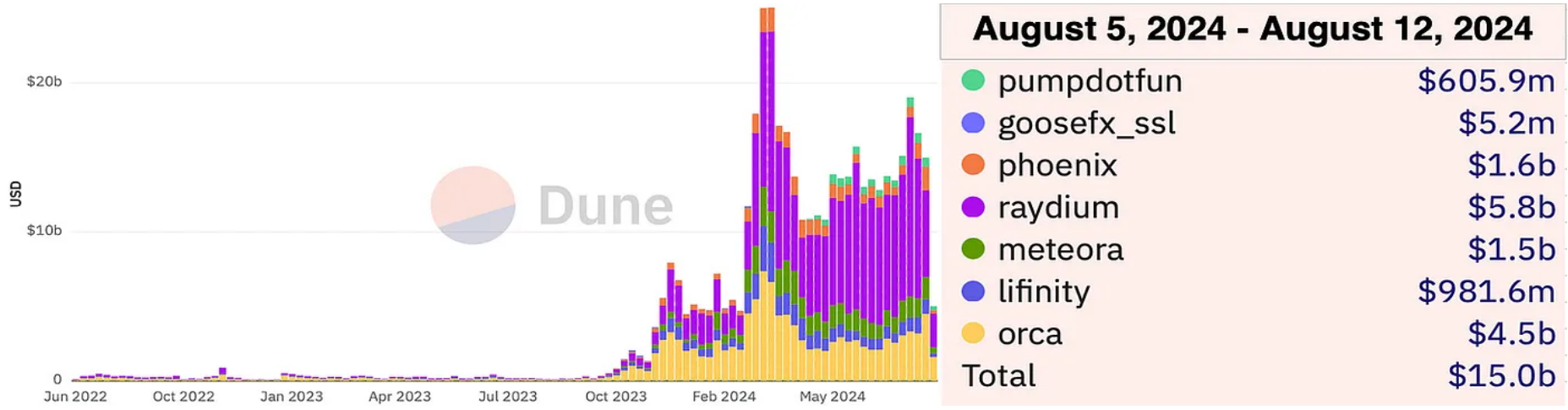

For DEXs on Solana, Raydium and Orca dominate the market, with trading volumes of 58 billion USD and 45 billion USD, respectively. We observed that since the beginning of 2024, most new tokens have been created on Solana, with approximately 100,000 created per week, and the total in recent weeks ranging from 130,000 to 140,000.

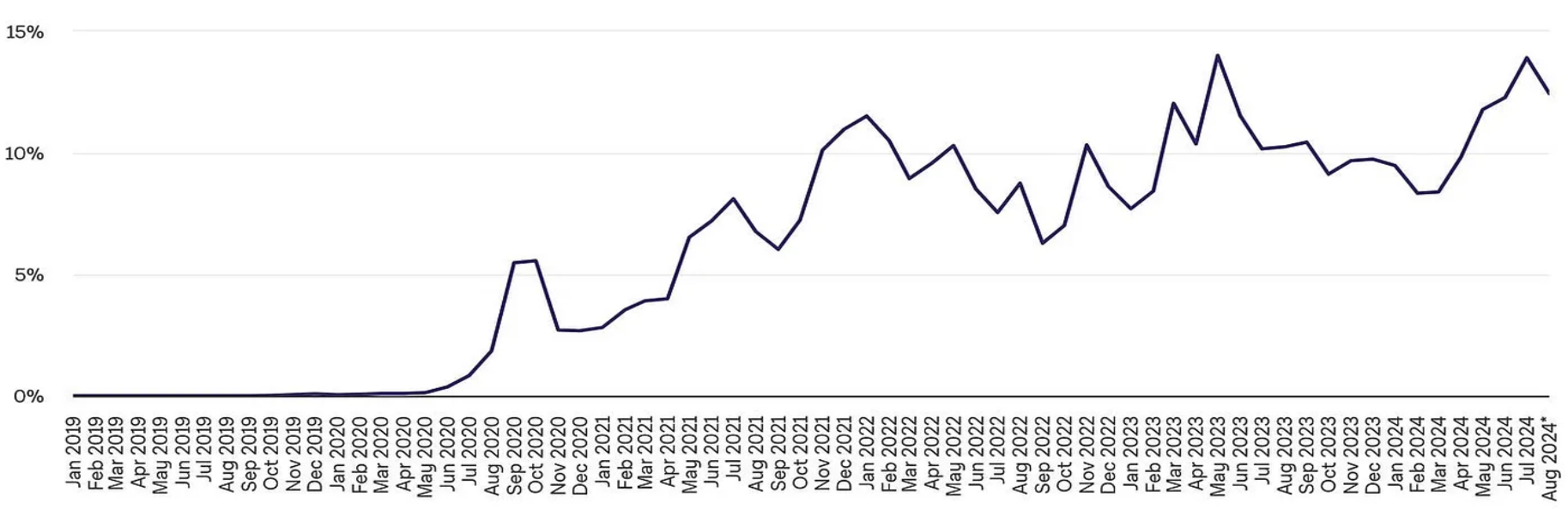

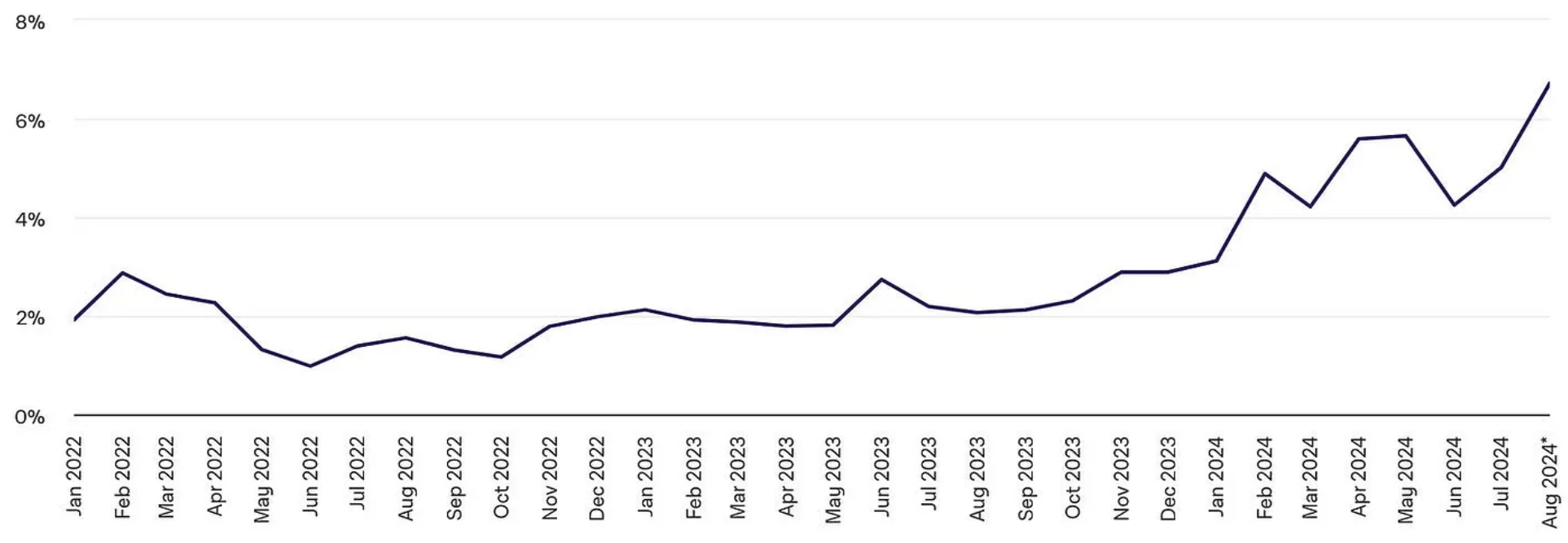

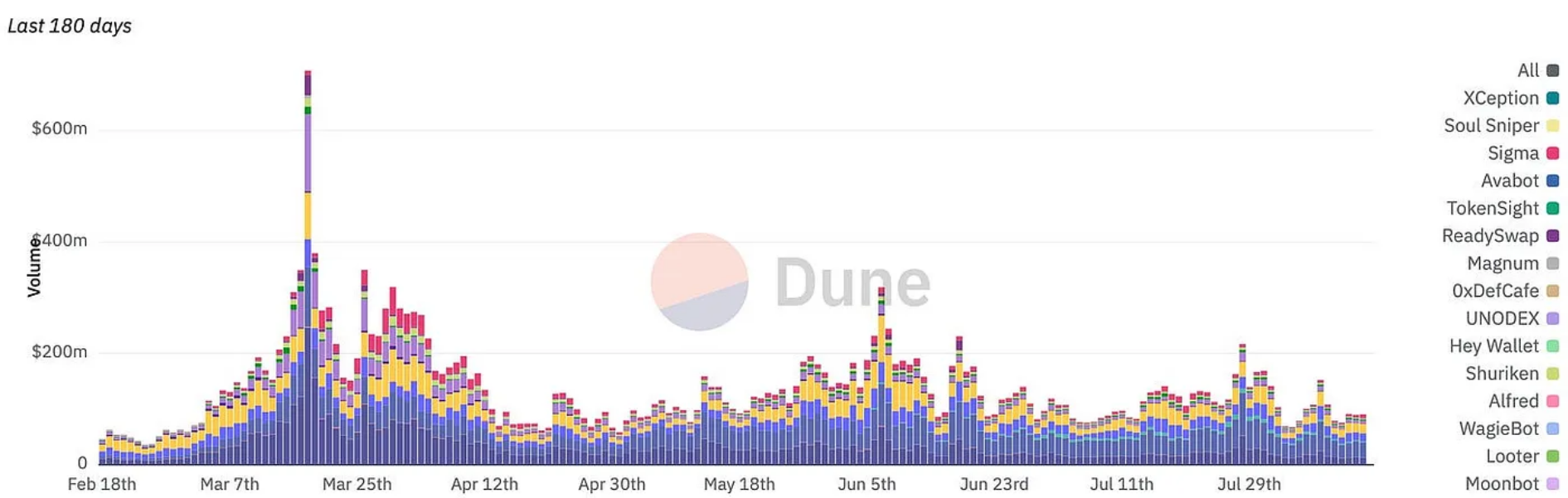

In addition, the proportion of trading volume for DEXs compared to centralized exchanges (CEXs) is steadily increasing, with a proportion of 6.72% for the futures market and 12.44% for the spot market. The Telegram Bot's trading volume has been stagnant in the past few weeks, approximately half of the record values in June and the first quarter of 2024.

DEX trading volume

EVM DEXs divided by trading volume

Proportion of DEX vs CEX spot trading volume (%)—(August 14, 2024: 12.44%)

Proportion of DEX vs CEX futures trading volume (%)—(August 14, 2024: 6.72%)

New Tokens Appearing on DEXs

DEXs on Solana — Trading Volume

Telegram Bot — Trading Volume

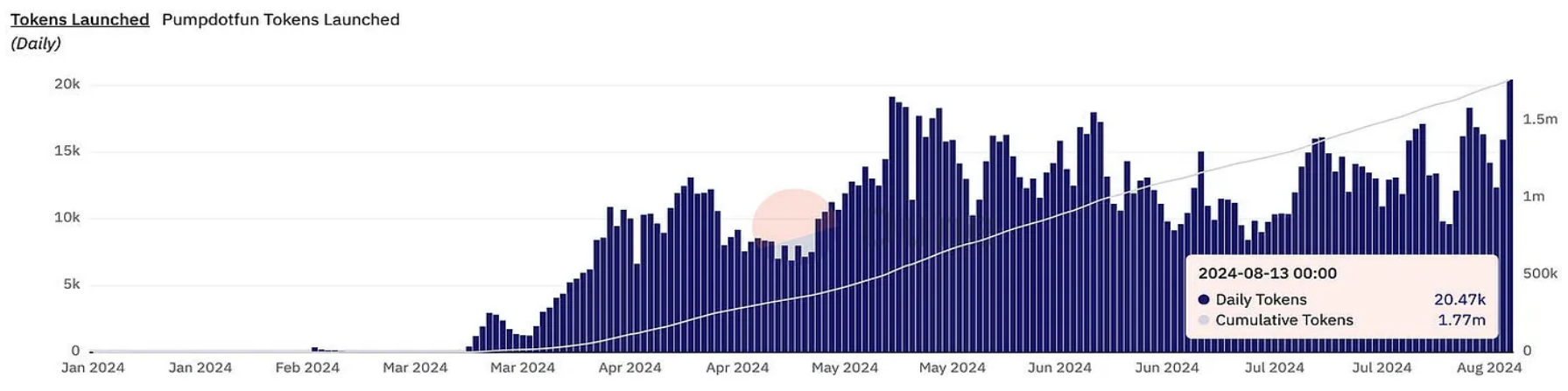

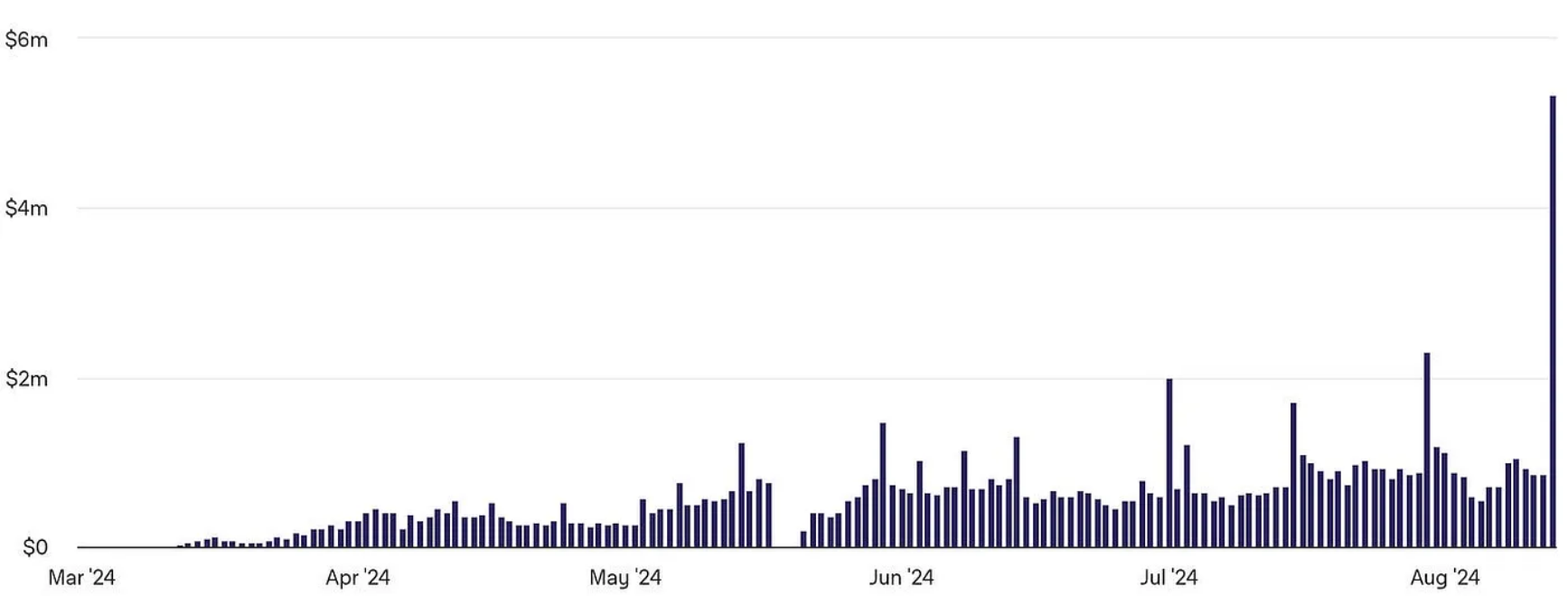

Since its launch in March, Pump.fun has attracted a lot of attention in the early stages of the Memecoin craze. The platform has simplified the token issuance process at a cost of 0.02 SOL, with a cumulative token count exceeding 1.77 million, and the platform's daily revenue reaching a historical high of over 5.5 million USD after the conversation between Elon Musk and Donald Trump. In the past 30 days, tokens generated by Pump.fun had the highest trading volume on Raydium, approaching 6.7 billion USD.

Pump.fun — Launched Tokens

Pump.fun Daily Revenue — (August 13, 2024: 5.33 million USD)

Pump.fun — Revenue

4. Liquidity Mining

Ethereum introduced the staking mechanism through the ETH Staking Deposit Contract in December 2020. However, before the Shanghai upgrade in April 2023, users were unable to access their staked funds, leading to liquidity issues. To address this, Liquidity Staking Derivatives (LSDs) emerged, allowing users to deposit ETH and receive a synthetic asset that can be freely traded or used as collateral in DeFi without sacrificing yield. This innovation eliminated the need for complex infrastructure or locking 32 ETH for Ethereum staking.

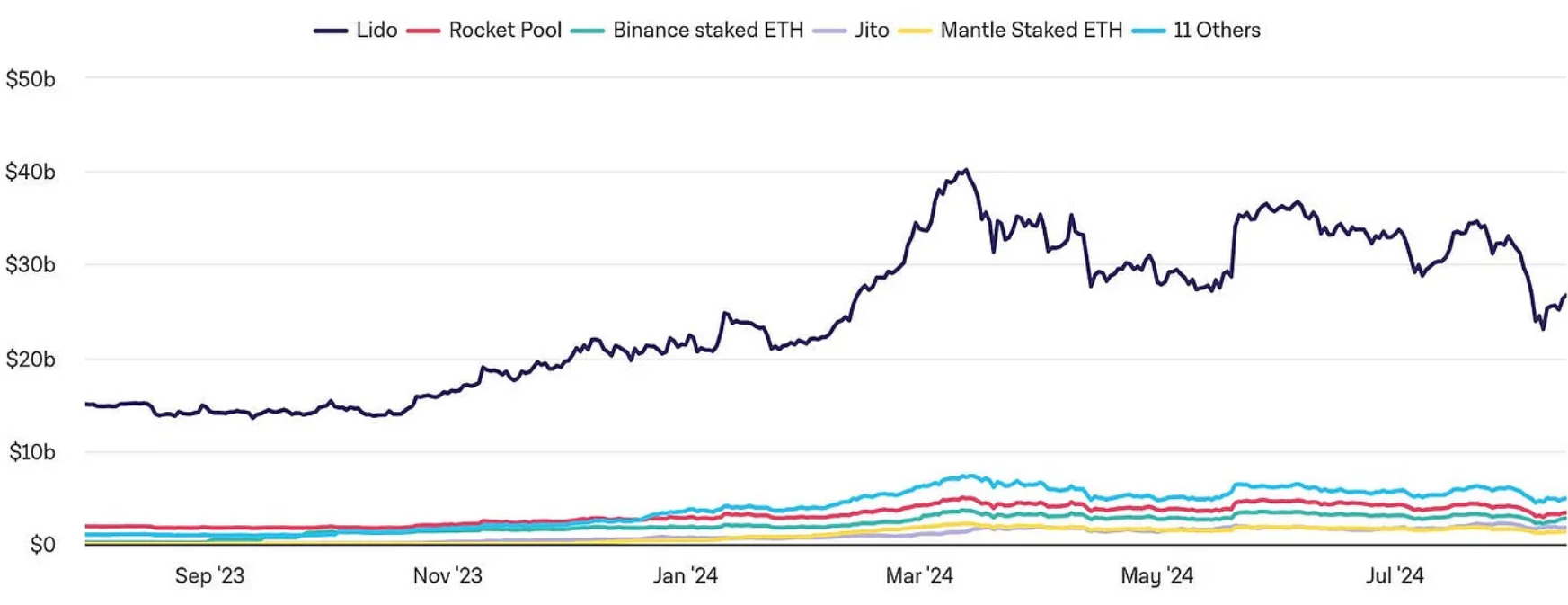

Locked value in liquidity mining

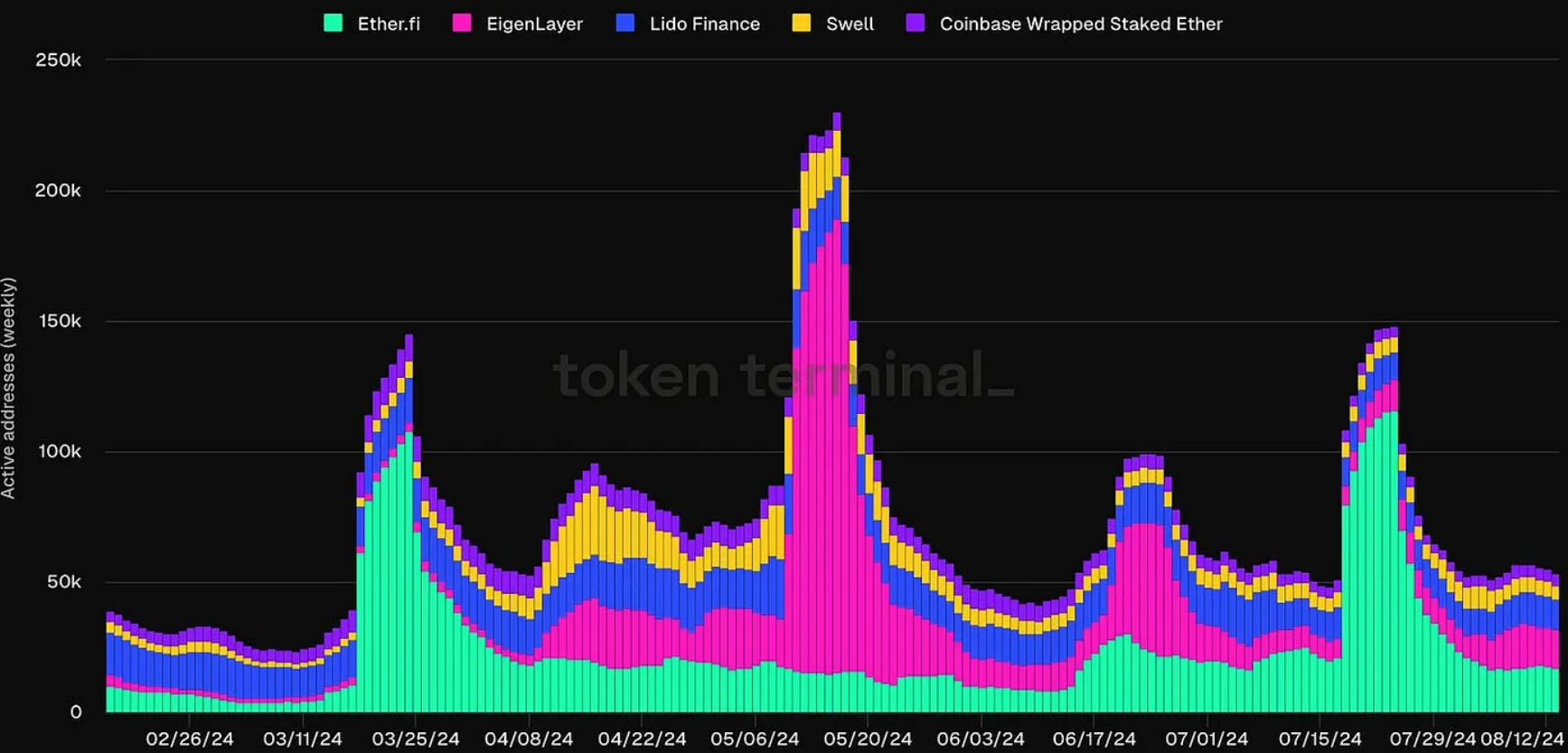

For several months, Lido has consistently been the absolute leader in the liquidity mining field, with a total locked value (TVL) exceeding 25 billion USD. However, in the past month, weekly activity at individual addresses has significantly decreased, especially in Ether.fi-related activities.

Active addresses (weekly)

5. Lending

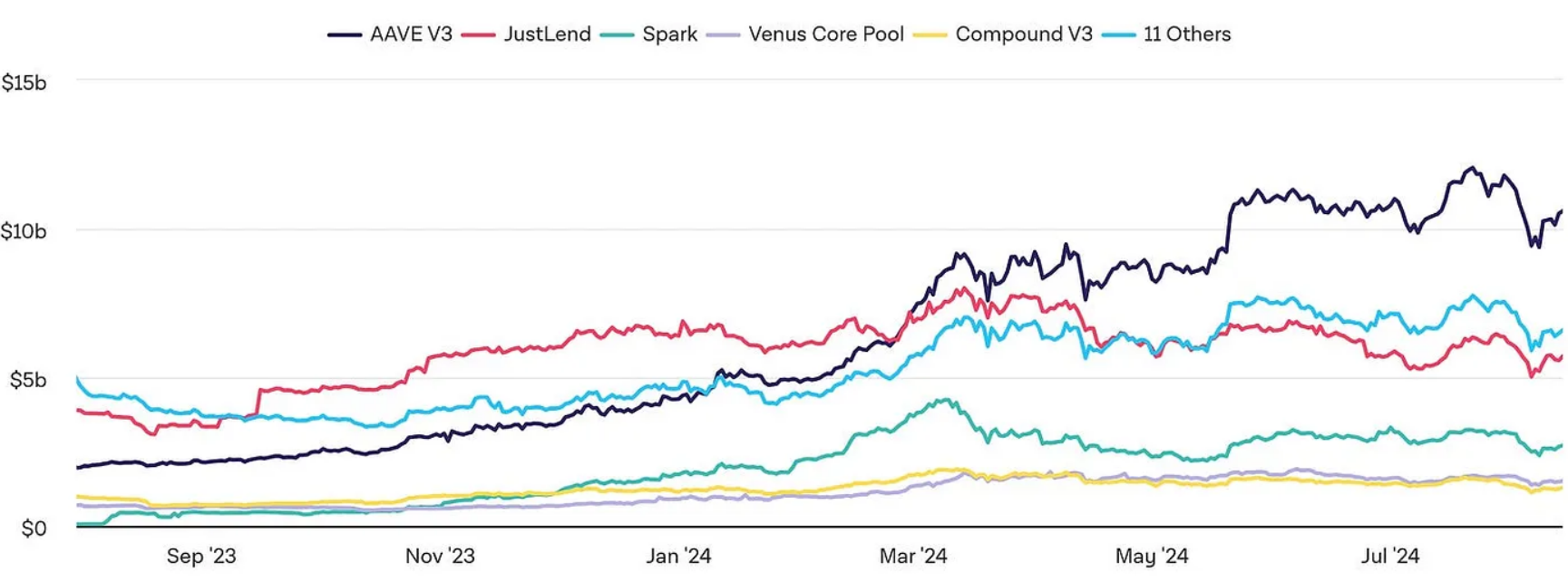

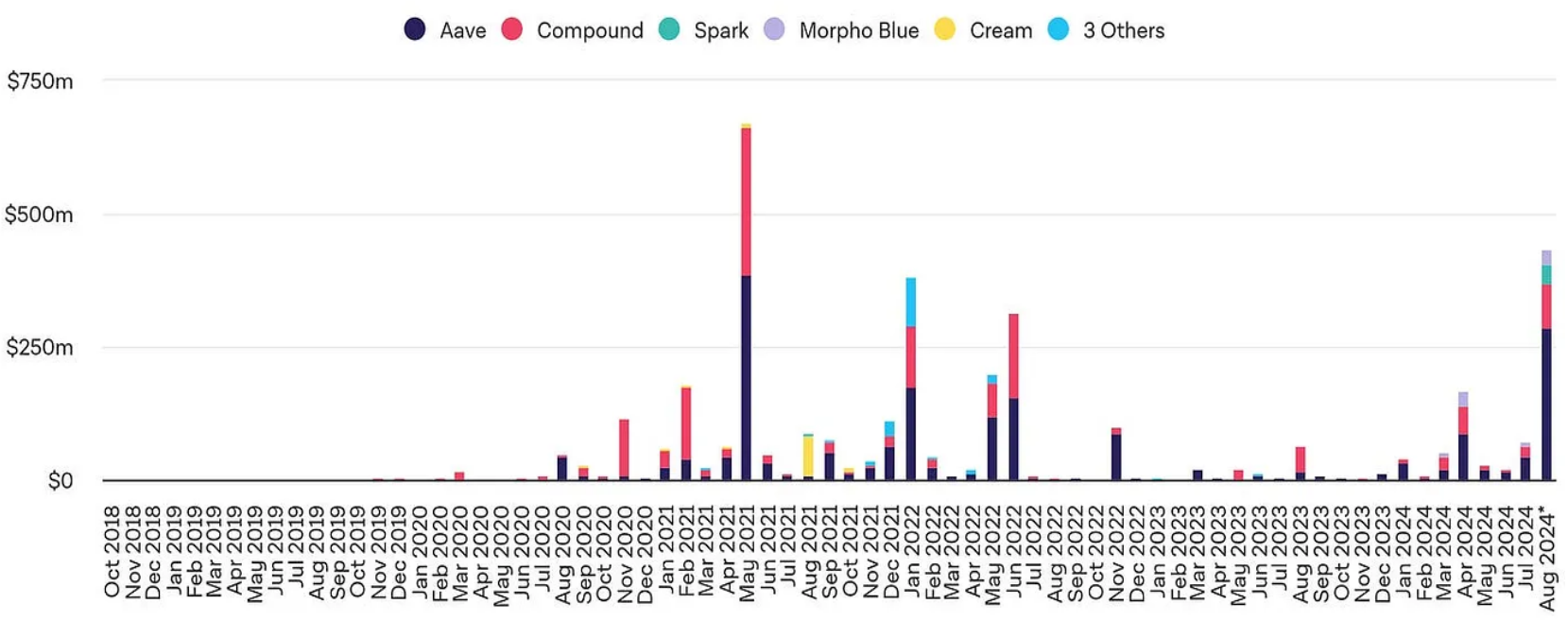

Since March, Aave has maintained a significant lead in total locked value (TVL), exceeding 100 billion USD, establishing its leadership position in the lending field. In August, although the month is not yet over, we have already recorded the second-highest Ethereum lending liquidation.

Locked value in lending

Ethereum lending market liquidation

6. Cross-Chain Bridges

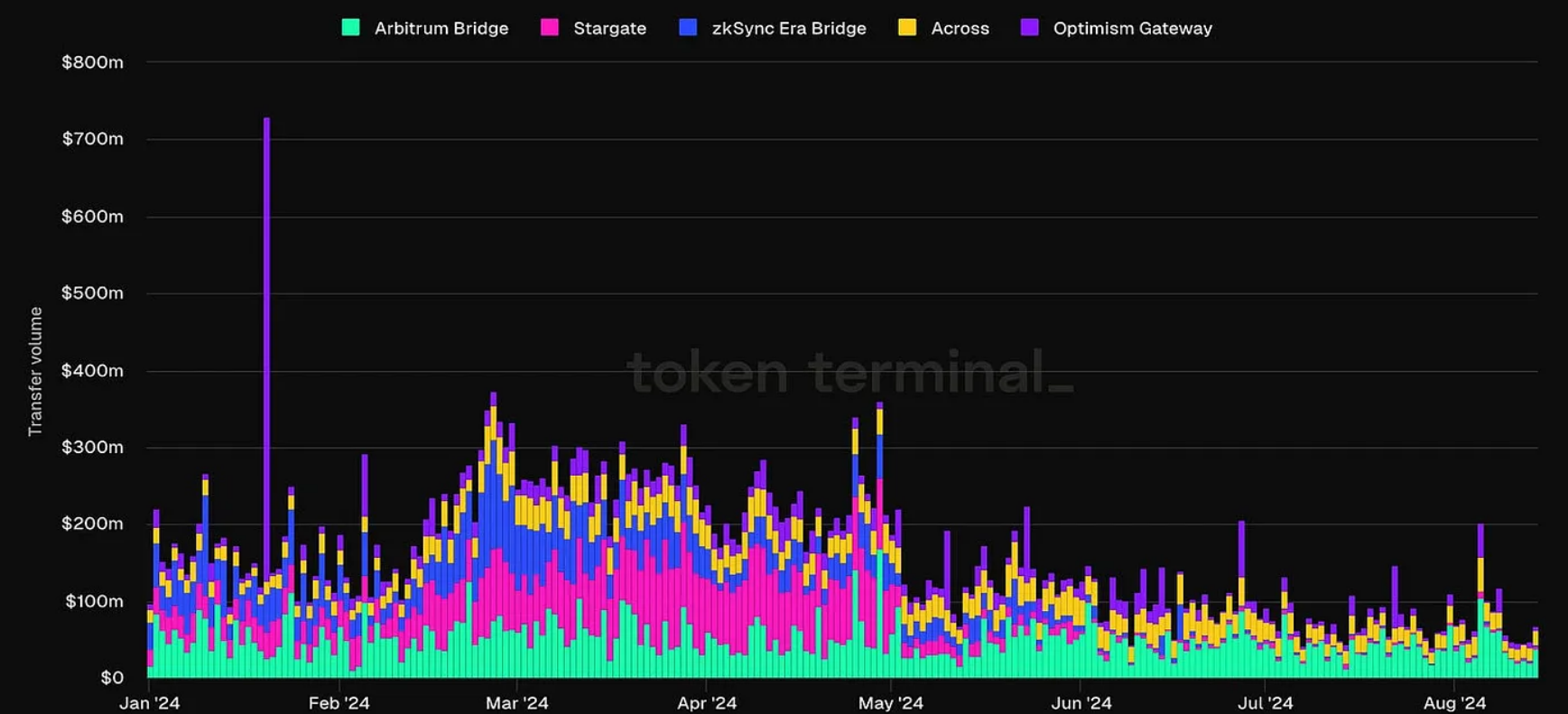

Since mid-May, we have observed a significant decrease in trading volume across the entire cross-chain bridge field. Currently, Arbitrum Bridge ranks first, with a daily trading volume close to 40 million USD. The zkSync Bridge has also experienced significant declines in various metrics over the past few months.

Cross-chain bridges (transfer volume)

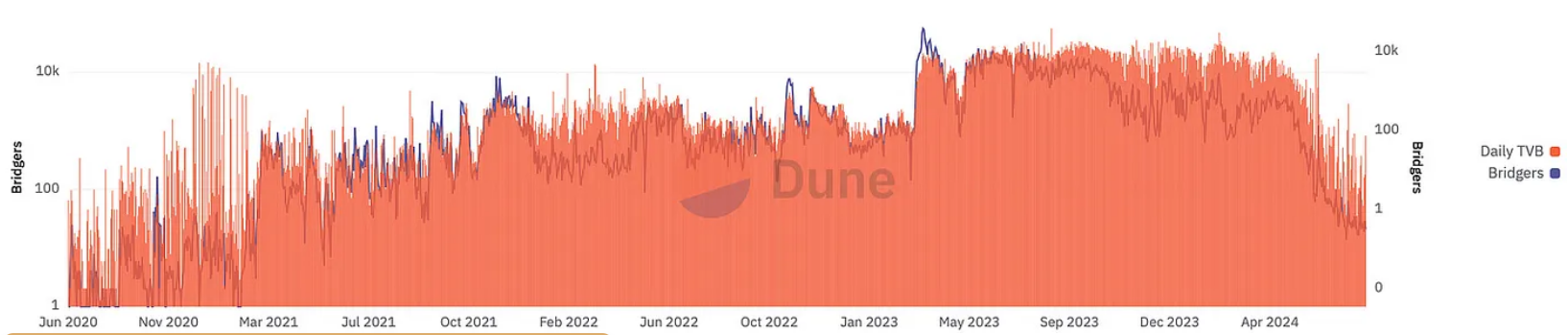

zkSync cross-chain bridge

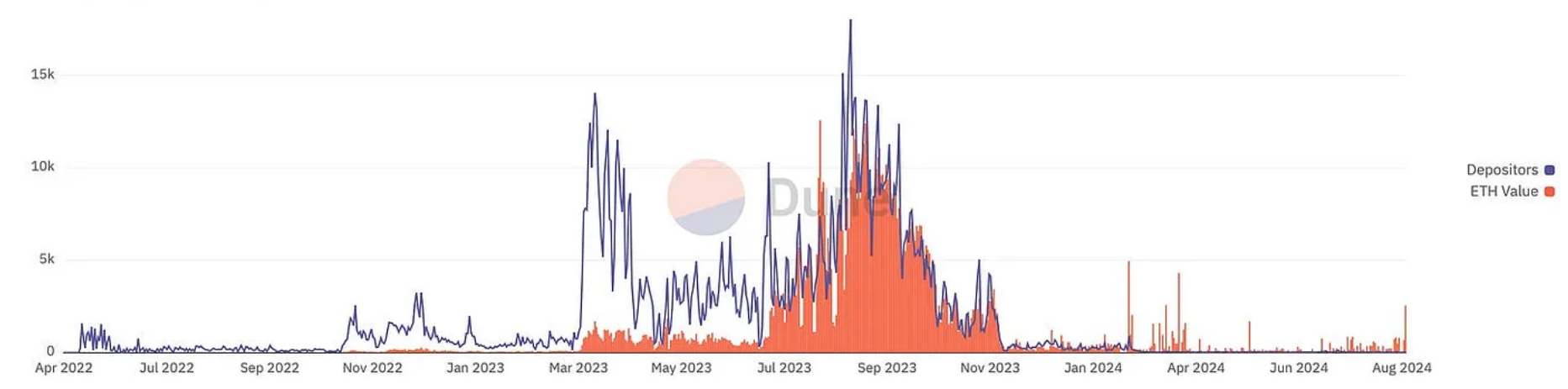

StarkNet cross-chain bridge

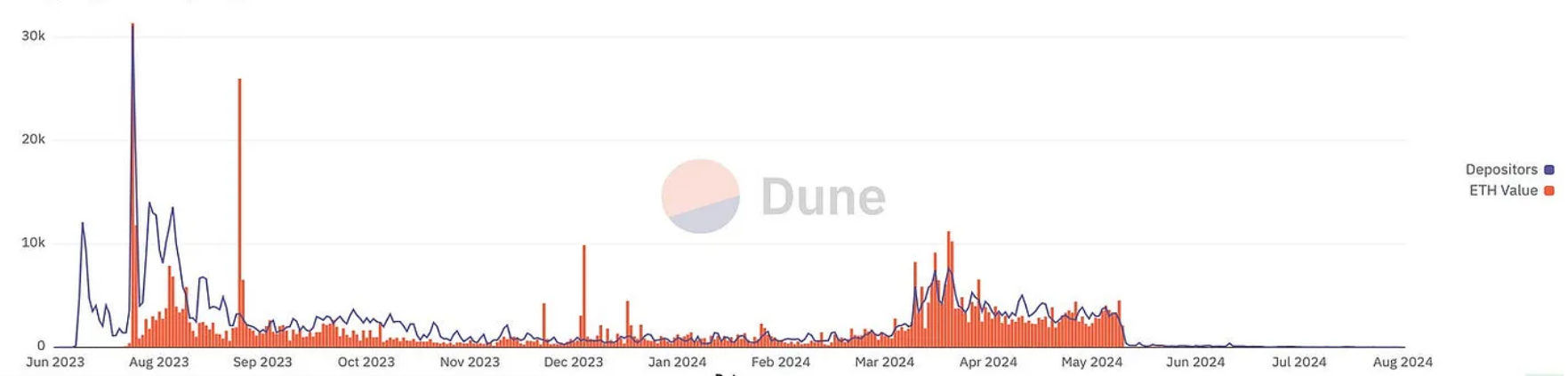

Base cross-chain bridge

7. Restaking

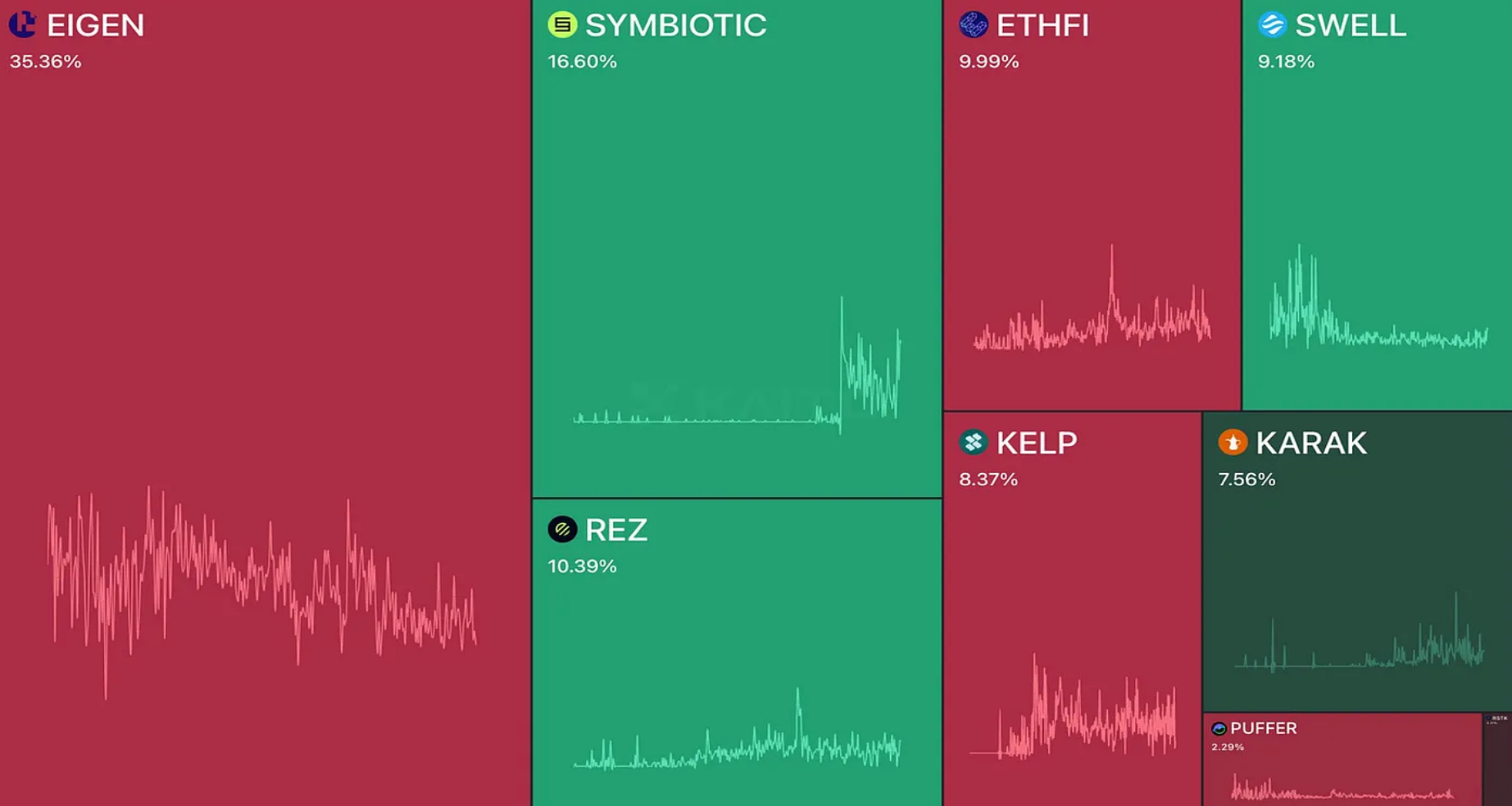

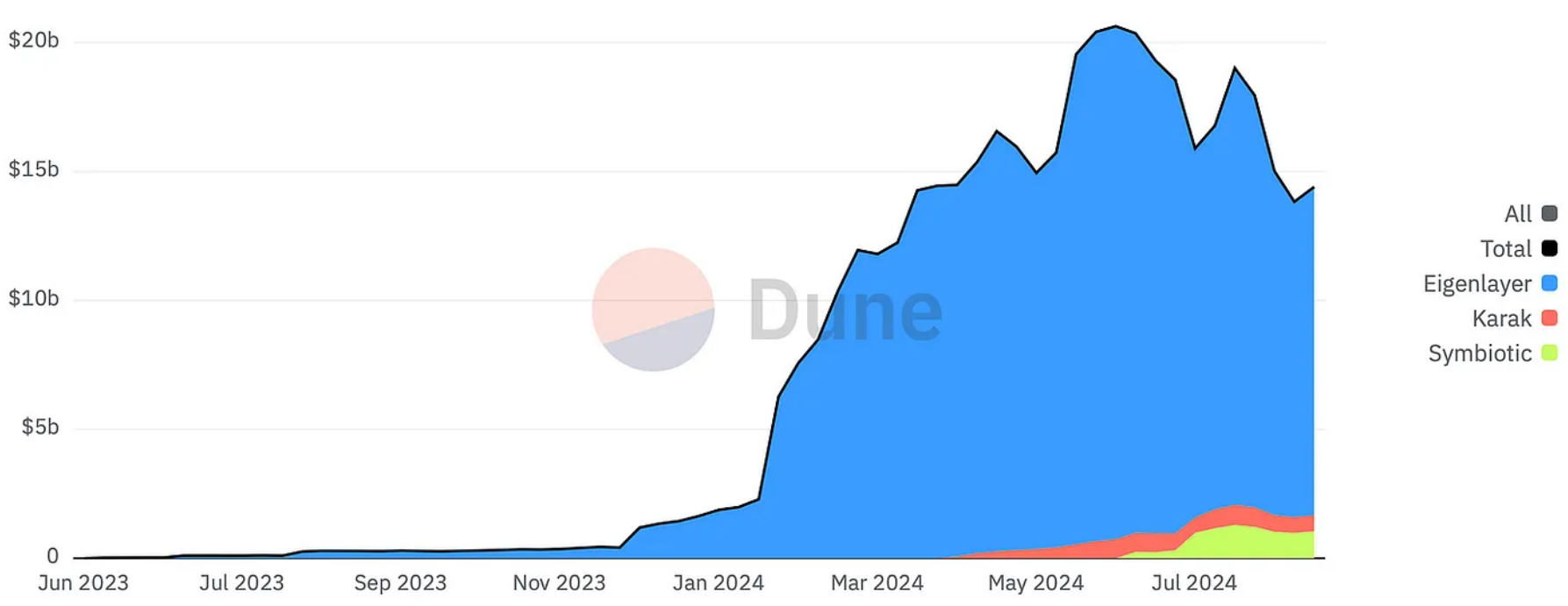

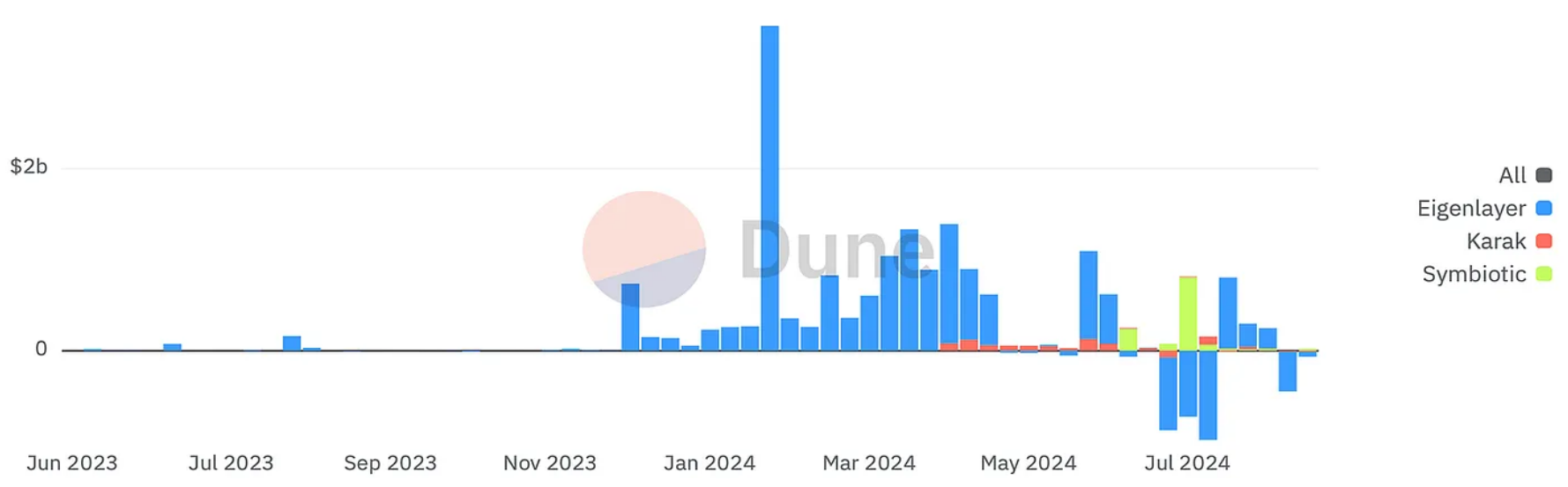

Since the end of last year, Eigenlayer has been leading in the DeFi restaking field, with a total locked value (TVL) close to 15 billion USD. After experiencing several months of positive net inflows, Eigenlayer has seen outflows of funds in recent weeks.

Awareness of restaking (Source: www.kaito.ai)

Total Locked Value (TVL) — Eigenlayer, Symbiotic, and Karak

Total Locked Value (TVL) — Net Inflows

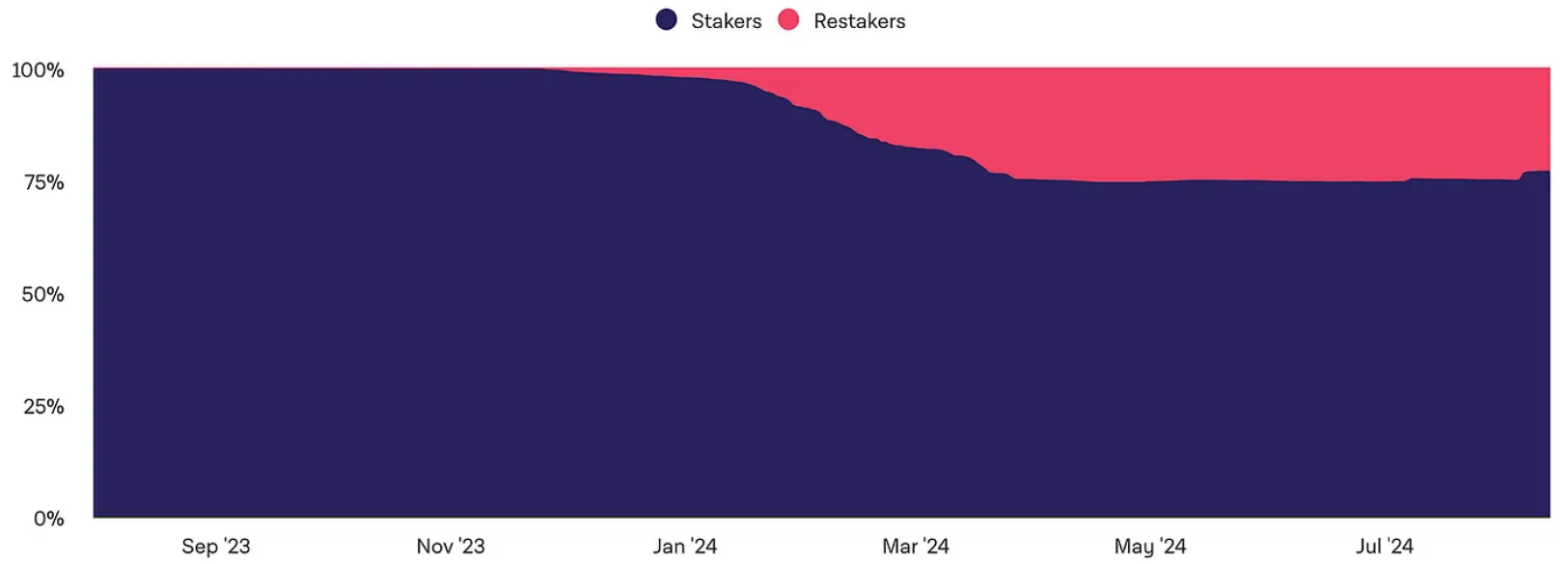

Daily Active Restaking vs Regular Staking Validator Share

8. Conclusion

As shown by the on-chain data in the above communication, we can observe that despite significant market volatility recently, DeFi protocols have not faced major solvency issues. Although there are clear signs of stagnation or even downward trends, the overall trend is still upward compared to last year.

Original article link: https://www.hellobtc.com/kp/du/08/5364.html

Source: https://insights4vc.medium.com/august-2024-defi-landscape-on-chain-data-insights-2d9d4b2086e2

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。