Author: Rainy Sleep

Why did Binance Labs invest in Solayer?

What are the differences between Solayer and Jito Restaking?

Today, let's discuss my thoughts based on the current information.

First, if you want to quickly understand the project, you can easily see Solayer's project introduction and investment background through Rootdata.

Solayer received investment from Binance Labs in the latest round of financing. In the previous Builders Round, Solana co-founder Anatoly, Solana core influencer Ansem, Polygon co-founder Sandeep, Babylon Chief Strategy Officer Dong Xinshu, Tensor co-founder, and Solend founder all participated.

In the current market, the core of creating content is not to provide detailed introductions to protocol architecture or analyze protocol data, but to clarify how the market should perceive this project. Therefore, starting from this content, I hope to change the previous writing style, abandoning the previous lengthy introductions to protocol architecture and data, and directly express my understanding of this project.

Protocol architecture: Introduction to Solayer

Protocol data: Solayer Information

The current market's understanding of Restaking is dominated by Eigenlayer—Eigenlayer aggregates and extends the economic security of Ethereum through $ETH Restaking. In short, public chain teams can use EigenDA as a DA layer. Celestia's DA service is its competitor. However, it is worth mentioning that although the DA service is a simple business, it needs enough customers and application users to thrive.

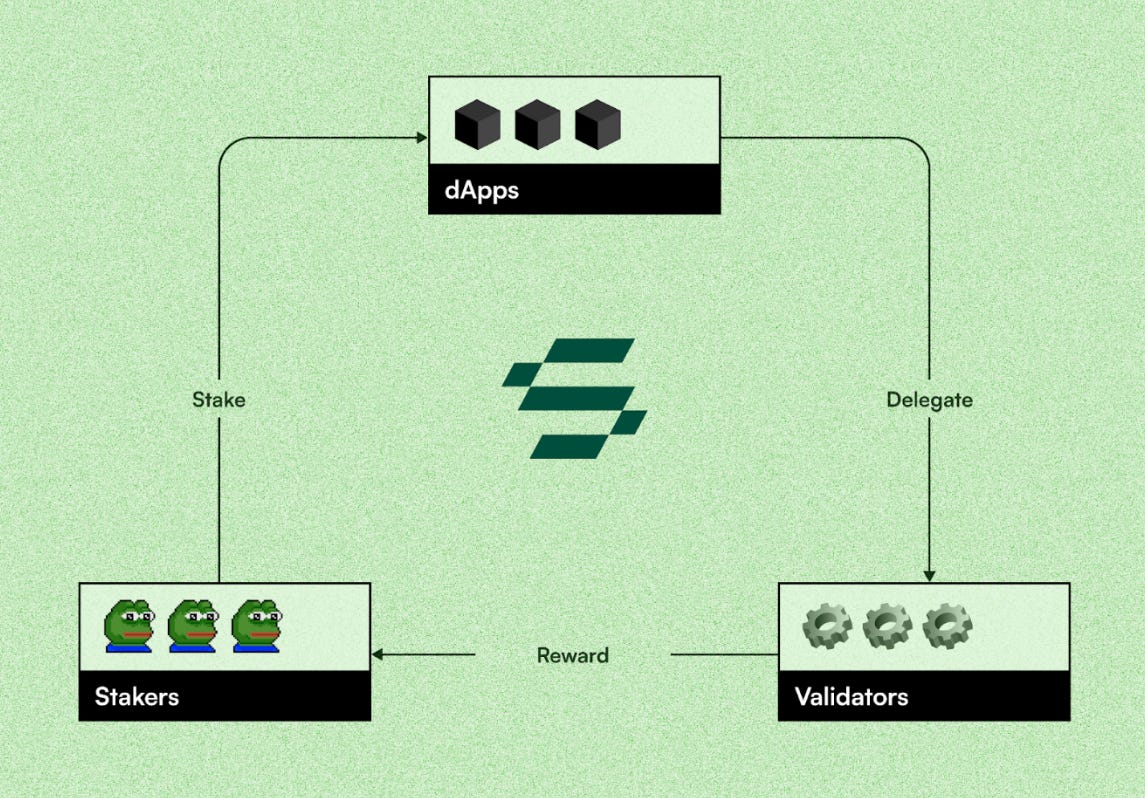

Although Solana Restaking and Ethereum's Restaking have the same name, the focus and target customer groups of the two businesses are completely different. Eigenlayer focuses more on providing services externally (external AVS), while Solayer focuses more on providing services for internal Solana applications (endogenous AVS). Of course, Solayer can also expand externally, but currently, it is only the first phase of Solayer.

I think Solayer's blog explains its business model in the first phase very well (Introducing Solana Restaking Standard: Endogenous AVS):

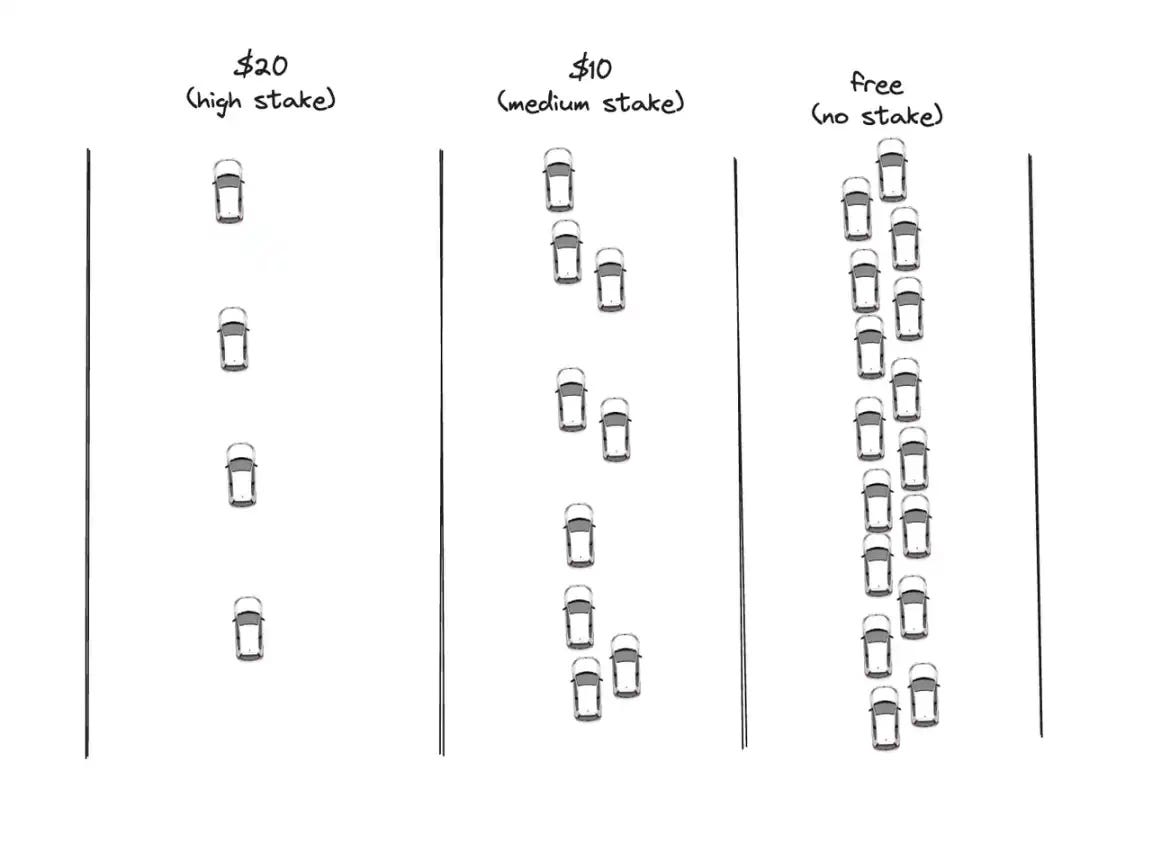

Imagine Solana as a highway with multiple lanes, where different lanes have different tolls and congestion levels, representing different Staking Tiers. Different DApps, as passing cars, have different speed and acceptable tolls. Solayer acts as a coordinator for users' funds, playing the roles of coordinating cars (DApps), the highway's lanes (Validators), and toll booths for each lane (Restakers).

In other words, DApps in the Solana ecosystem can use Solayer's services according to their needs (block space and priority transactions) to ensure whether they are in the fast lane or slow lane, thus providing a better experience for users.

The income of users participating in Solayer Restaking comes from three aspects:

- Solana Staking Rewards;

- MEV income;

- Possible Solayer token airdrops;

Explained in this way, perhaps we can understand why Binance Labs would invest in Solayer—because Solayer will occupy an important ecological position in Solana in the future.

Next, let's briefly discuss Solayer's competitor Jito and the recently popular Sanctum.

In the article "Announcing Jito Restaking" (https://www.jito.network/zh/blog/announcing-jito-restaking/), although Jito did not mention the focus of its future business, it only talked about the advantages of its product. However, in the oracle example it provided, we can see that Jito Restaking's business focus seems to be more like Eigenlayer's, providing services for cross-chain bridges, oracles, or Rollups (economic security). This is also the difference between Jito Restaking and Solayer's current business model. These are just my speculations for now. I will discuss in detail after further content is released.

Sanctum's narrative is not as grand as Jito and Solayer. It aims to be a liquidity layer for LST. In simple terms, when some small LSTs lack liquidity and cannot quickly exit through swaps, Sanctum provides an integrated liquidity layer to support various types of LST in Solana. In short, Sanctum's product aims to solve the liquidity problem of current SOL LST.

Finally, let's answer the first question: Is Solana Restaking a good business?

From Solayer's perspective, I think this is a good business. Unlike external AVS, in the first phase, Solayer's target customer group is the current Solana ecosystem DApps, and Solayer's services have a low threshold—if there is a demand, DApps can easily use the services provided by Solayer. This is also why I think Solayer can quickly establish an ecological moat.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。