We mentioned before that the internet giants are re-entering the encryption field?

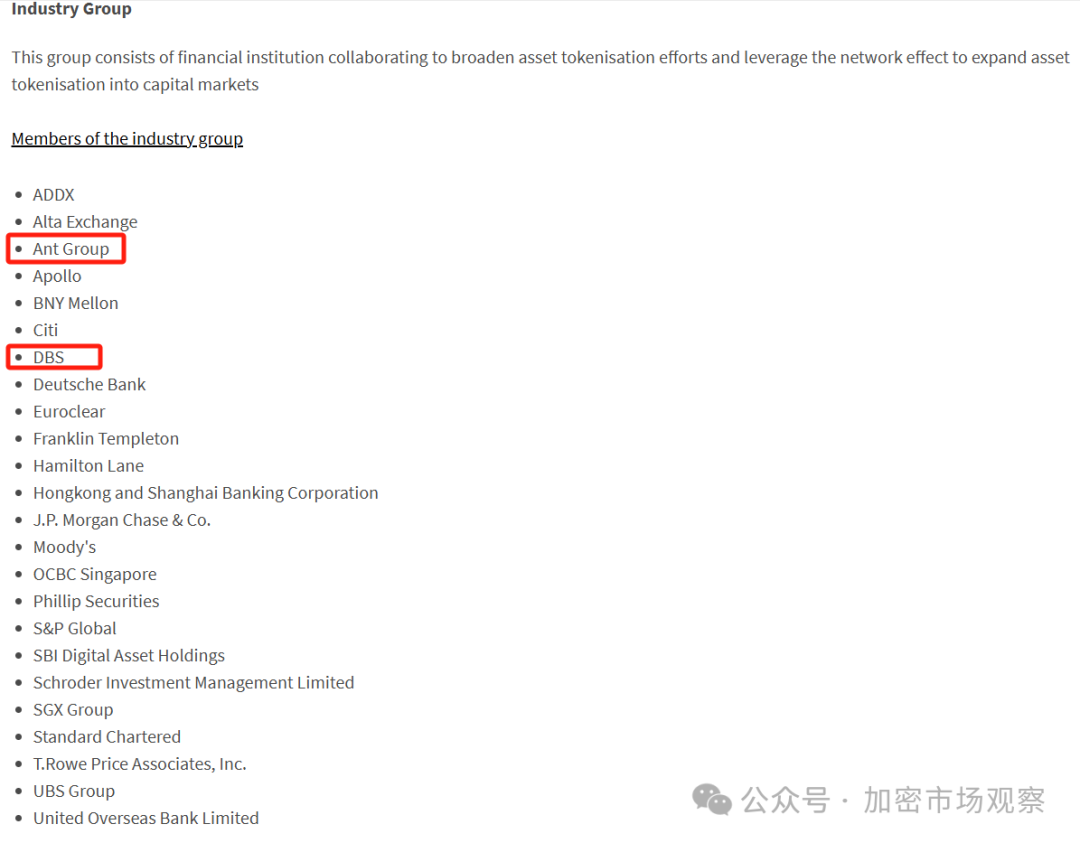

Sure enough, yesterday, Ant Group, which has deep ties with Alibaba, made a big move. Ant Group is collaborating with the largest bank in Singapore, DBS Bank, to launch a pilot program for "DBS Treasury Tokens."

According to the official description from DBS Bank, this project can help Ant Group reduce the settlement time for internal transactions from several days to seconds, thereby optimizing internal liquidity and operational funds.

Ant Group also stated that it sees application cases in instant tax refund services and cross-border payments for small and medium-sized enterprises.

This DBS Bank has quite a background. Its full name is "Development Bank of Singapore," and our banks like Shanghai Pudong Development Bank and Guangdong Development Bank have learned from DBS.

With a large number of cross-border traders in its hands, Ant Group's collaboration with DBS may enable a large amount of cross-border trade to be settled in real time in a tokenized manner, thus bypassing Swift directly?

Providing endorsement for this project is the Guardian project initiated by the Monetary Authority of Singapore.

The purpose of this project is to tokenize assets to enhance the liquidity and efficiency of the financial market. The collaboration between Ant Group and DBS is one of the practical application scenarios of this project.

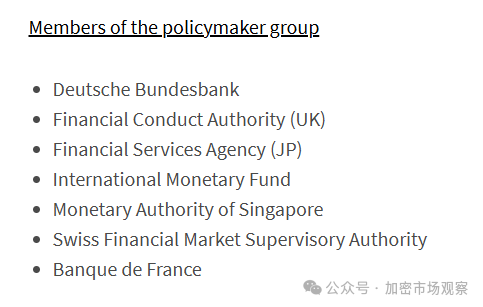

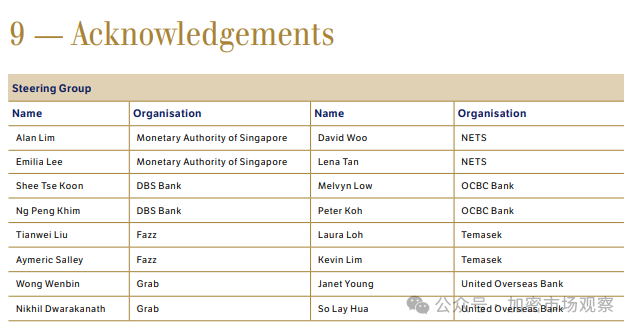

It is estimated that in order to counterbalance the United States, they have brought in partners from Europe and Japan to work together. The members of the policy-making group include:

- Deutsche Bundesbank

- Financial Conduct Authority (UK)

- Financial Services Agency (Japan)

- International Monetary Fund

- Monetary Authority of Singapore

- Swiss Financial Market Supervisory Authority

- Bank of France

Upon confirmation, there are no organizations from the United States in the group of policy-making members, so it is highly likely that they are plotting against the United States.

Only a few American companies are included in the group of enterprise members, including JPMorgan Chase, among others.

The main characters of this article, Ant Group and DBS Bank, are also prominently listed.

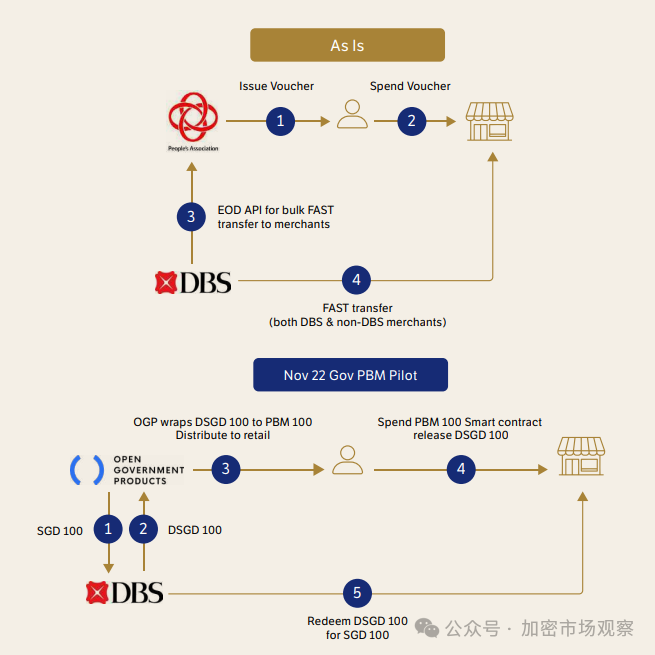

Singapore's ambitions may not stop there; they also have a project called Project Orchid.

This project mainly aims to explore the issuance of central bank digital currency by Singapore, known as the "Digital Singapore Dollar."

The Singapore Dollar is different from the currencies of many other countries. The currencies issued by the central banks of many countries are backed by their own printing, while the Singapore Dollar is supported by Singapore's massive foreign exchange reserves.

So the Singapore Dollar is almost like a stablecoin, except that the central bank occasionally adjusts the exchange rate using foreign exchange to mitigate the impact of inflation.

In the case presented in this Project Orchid, DBS Bank has clearly defined its position alongside the Monetary Authority of Singapore:

The central bank is responsible for issuing stablecoins, and DBS Bank acts as the exchange.

The participating organizations in Project Orchid are almost all local institutions in Singapore.

In this way, Singapore's intentions become quite clear:

The Singapore Dollar can develop into a cryptographic stablecoin in the future, facilitating domestic institutional settlements and profit-making.

International trade will unite countries in Europe and Asia to counter the US dollar.

Ant Group, as a multinational trading institution, is responsible for creating application scenarios~

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。