4Alpha Research Analyst: 17

Recently, Binance Labs announced its investment in Pluto, the parent company behind the Telegram mini-game Catizen, as one of the most popular games in the Telegram ecosystem. Catizen will also launch its token soon. This article will comprehensively introduce the development of Catizen and discuss the future development of the Telegram and TON ecosystem brought about by Catizen.

Introduction to Catizen

1. What is Catizen?

Catizen is a super casual cat-raising game in the Telegram ecosystem, with the slogan "Play for Airdrop." The game was officially launched in March 2024 and had over 1 million players in the first week of public testing. As of July 29th, according to official data, the total number of players exceeded 26.95 million, with 1.47 million daily active users, 1.61 million on-chain users, 20.74 million on-chain transactions, 201k Twitter followers, and 5.25 million channel subscribers.

Catizen has completed three rounds of financing, with the latest investment from Binance Labs.

2. Gameplay

Catizen is a super casual game where players act as the owner of a cat café, managing up to 12 cats of different levels. Every 2 cats of the same level can be combined to create a higher-level cat. Cats can produce tokens, and as the level of the cats increases, they can produce more tokens per second. Tokens can be used to directly purchase higher-level cats in the store to speed up the game progress. In addition to the normal game content, Catizen also incorporates many social factors such as inviting new users to earn diamonds and exchanging diamonds for cash.

Overall, Catizen's gameplay is very similar to the popular 2018 WeChat mini-game "Mengquan Bianbianbian." The goal for players is to continuously combine cats to obtain higher-level cats, achieve a sense of accomplishment, and potentially receive airdrops. However, compared to Mengquan Bianbianbian, Catizen is still relatively monotonous apart from its core gameplay.

3. Economic Model

Currently, Catizen's ecosystem involves four in-game non-tradable tokens: vKITTY, Fish, xZEN, and $wCATI, and the overall token economy has not been fully disclosed.

It is known that CATI will be listed on exchanges as a tradable token. vKITTY and Fish are functional in-game tokens, with vKITTY's production speed being a measure of game progress. According to official data from July, users with higher vKITTY production speeds will receive priority airdrops. Fish is a practical in-game token that can indirectly increase the production speed of vKITTY by consuming Fish. The only way to obtain Fish is through recharging (apart from completing beginner tasks).

The entire token economy of Catizen determines that users who want to receive a higher airdrop ratio must spend money, and cannot achieve it through simple non-spending methods. For non-spending players, there is a limit to the increase in vKITTY production capacity. As a result, players who do not meet the vKITTY production capacity may not receive any or very few airdrops.

4. Data Performance

The following Catizen data is mainly from official disclosures at different times and is for reference only.

As of July 29th, according to official data, the total number of players exceeded 26.95 million, with 1.47 million daily active users, 1.61 million on-chain users, 20.74 million on-chain transactions, 201k Twitter followers, and 5.25 million channel subscribers.

Catizen was officially launched in March 2024. Within 10 weeks of its launch, the total registered users exceeded 10 million, with over 2 million daily active users, 400k paying users, and cumulative on-chain revenue exceeding $11 million, with nearly 80% of the revenue coming from $TON.

As a super casual game, the usual payment rate is low, but Catizen achieved a nearly 4% payment conversion rate solely through in-game purchases. Each paying user provides $25 in revenue, and each user provides $1.1 in revenue. Even in the traditional overseas super casual game field, Catizen's data is still impressive.

5. Future Roadmap

2024 Q1 Launch (completed): Game launch, using the Play-to-earn Airdrop Model (doubtful)

2024 Q2 Token issuance (postponed): Listing on major exchanges, airdrop for early users and supporters

2024 Q3 Platformization: Introduction of token staking lock-up game platform economy, obtaining NFTs and airdrops through token staking; introduction of game revenue sharing mechanism

2024 Q4 Innovation: Introduction of AI and AR versions, attracting traditional game players through cooperation

2025 Q1 Game and platform optimization: Increasing user base, optimizing platform mechanisms

2025 Q2 Innovative feature optimization: Introducing new features for AI and AR versions

2026 Q3 Cat Universe: Start developing the Cat Universe

According to Catizen's plan, it has completed the first phase of the cold start period, gaining a large number of users and is transitioning to a token-based LaunchPool.

6. Development Team

The development team behind the Catizen game, Pluto, has extensive experience in game development and operation and has enough reserves of small games, allowing it to continue to launch new products after Catizen. Currently, their website shows 38 small games awaiting Web3 transformation.

Thoughts on Catizen and the TON Ecosystem

After in-depth research on Catizen, we have the following thoughts and predictions about the TON ecosystem:

Tokens

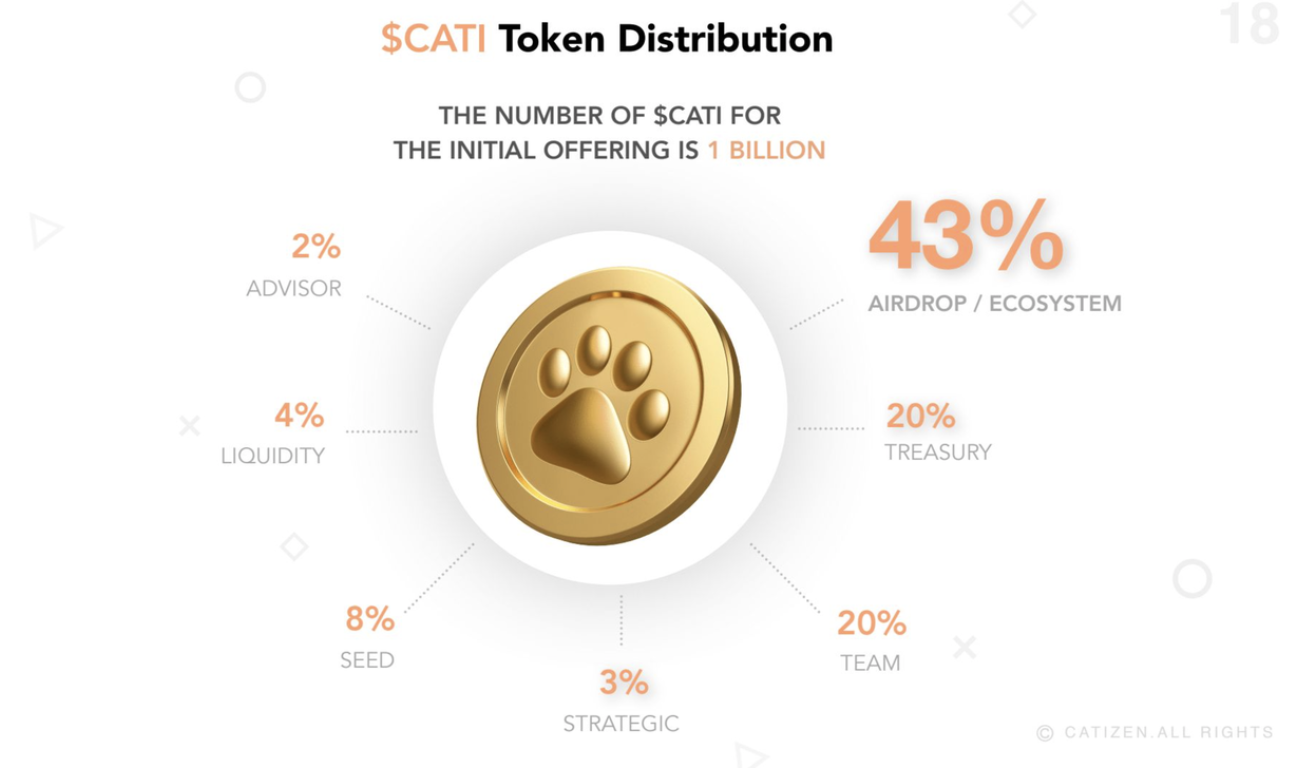

According to the latest official whitepaper, the economic model of Catizen's governance token $CATI is as follows. The portions belonging to the team, seed round investors, and advisors will be linearly unlocked 12 months after TGE, with a total release period of 4 years (30% of the total). $CATI is already tradable on Bybit's Pre-Market. As of August 1st, the latest transaction price is 0.7U, corresponding to a FDV of $700 million. The current fully circulating $NOT is a FDV of $1.35 billion.

It is worth mentioning that Catizen is not the first game launched by the Pluto team in the TON ecosystem. As early as 2023, the Pluto team ported a game called Tap Fantasy, originally operated in the BSC ecosystem, to the TON ecosystem and issued tokens. The token Magic Crystal ($MC) of Tap Fantasy has a FDV of $16.48 million.

Opportunities in the TON Ecosystem: Large Growth Potential, Foundation for Mass Adoption, and Payment Capability

(1) The TON ecosystem has a large user base, and there is still significant room for on-chain activity growth.

Since January 2024, the number of active addresses in the TON ecosystem has continued to grow, reaching a new high of around 450K daily active users, surpassing Ethereum's on-chain daily activity (around 400K). The on-chain daily activity of TON is similar to highly active L2 solutions like Arbitrum and Base.

We can speculate on the potential for TON ecosystem activity based on the development of the WeChat mini-game ecosystem. Currently, WeChat has around 1.3 billion monthly active users, with 750 million active users in WeChat mini-games. The most popular mini-games have over 100 million monthly active users, reaching 8% of WeChat's monthly active users. Telegram currently has around 900 million monthly active users. If we compare the conversion rate of WeChat mini-games, we can expect to see mini-games in the Telegram ecosystem with over 70 million monthly active users. With a conversion rate of 10% similar to Catizen, the on-chain monthly activity in the TON ecosystem still has several times the growth potential. Currently, only Solana has achieved over a million active addresses on-chain, and TON is the next public chain with this potential.

(2) The TON ecosystem provides support for "channels" and can offer high conversion rates.

Before TON, the narrative of reducing intermediary profits through crypto has been around for a long time but has not been realized. This may be due to two reasons. First, there was a lack of good distribution channels. In the Web2 payment landscape, the channel often determines the payment method, and not the other way around. Therefore, the narrative of taking away profits from Web2 intermediaries and giving them to users is reasonable but difficult to promote. These limitations not only restrict the promotion of Web3 payment methods but also limit the development of all Web3 products that rely on large DAUs (such as games and social media). Due to its background, Telegram actively supports crypto and has become the first channel with enough traffic and motivation to promote decentralized payment methods. Second, there was a low conversion rate. In the past, Web3 projects were not only limited by channels but also by the low conversion rates due to poor wallet experiences, making traditional advertising channels less meaningful. Telegram integrates wallets, dApps, and fiat on/off ramps, which can effectively increase conversion rates. Based on these points, the TON ecosystem provides traffic support from the official side (TON Foundation actively promotes Catizen in multiple occasions) and has built the infrastructure to convert traffic into users. It is reasonable to expect a TON ecosystem with a large number of wallet users.

(3) Users in the TON ecosystem have payment capabilities.

For traditional game developers, the narrative of "bypassing platforms, reducing fees, and increasing profits" on Web3 game platforms has finally become possible. By default, recharging in the game directly requires purchasing Telegram's virtual token, Star, through the App Store, and then using Star to purchase in-game items. This process involves various fees. However, by recharging through an independent Top-Up Bot, users can purchase items directly from Catizen with $TON/$USDT at a 10% discount. Of the over $11 million in revenue generated by Catizen in the first two months, 80% was paid through $TON. This level of revenue is enough to make us anticipate the emergence of a Web3 channel with almost no intermediary fees.

(4) The ecosystem is still in its early stages.

As mentioned earlier, Catizen's current gameplay is not significantly innovative compared to "Mengquan Bianbianbian" in 2018. This situation is not unique to Catizen; many mini-games on Telegram are simple ports of early mini-games that have already been verified on WeChat, with no significant innovation and even some features being removed. Therefore, even if the TON ecosystem follows the old path of iterating on Chinese mini-games, there is still a lot of room for development.

In addition to game quality, TON ecosystem mini-games rely solely on in-game purchases for monetization, without a significant amount of ad-based monetization. Therefore, if the TON and Telegram game ecosystem can develop, it is inevitable that an ad monetization platform targeting Telegram and TON on-chain users will emerge.

Risks in the TON Ecosystem: Audience Limitations and Token Concentration

(1) The core spirit of mini-games is different from crypto and still needs to explore financial applications.

For exchanges, acquiring new users through TON mini-games is relatively feasible because users will need a platform for converting tokens after receiving airdrops. Currently, Pixelverse has partnered with the Bybit Web3 wallet, and TapSwap has integrated tasks for new user registrations on Binance.

However, the more important aspect is the conversion rate of these new users to continued participation in trading. From the author's personal perspective, even with the success of the $NOT token, the potential for casual mini-games to bring in new crypto users who continue to engage in trading on exchanges may still not be ideal. The main reason is that the model of casual mini-games is more akin to a "you reap what you sow" PoW model, emphasizing a return on investment with each input. In contrast, the exchange model is more akin to a "win or lose" gambling model, creating a stimulating rollercoaster experience. These two products have different core audiences.

Therefore, in addition to exploring the direction of mini-games, there is still a need to actively explore DeFi products in the TON ecosystem, fully leveraging the advantages of the TON ecosystem in channels and conversion rates.

(2) Telegram users are not concentrated in crypto-friendly and high-paying regions.

According to Statista data, the top five download regions for Telegram are India, Russia, the United States, Indonesia, and Brazil, most of which are not crypto-friendly. In contrast, Japan and South Korea, which are strong in both cryptocurrency trading and game payment capabilities, are not even in the top ten.

(3) Token concentration in $TON.

Many data sources have shown that over 90% of $TON tokens are concentrated in the hands of 100 addresses, posing a sharp blade over the heads of every participant and builder in the ecosystem.

(4) Inescapable PointFi, the token issuance model in the TON ecosystem is easily manipulated.

Since Telegram mini-games support both on-chain and off-chain payment methods, and the game's values and logic are not fully on-chain, there is a great deal of uncertainty when using in-game "points" or "values (such as token production capacity)" as the standard for airdrops. Before the tokens are released, it is extremely difficult to predict the true distribution of chips.

Conclusion

This article primarily explores the potential of the TON ecosystem through Catizen. For mini-games, there is often no fixed methodology for a hit game, and it relies more on "emerging innovation" and "efficient deployment." From a gameplay perspective, Catizen does not belong to a heavy game mode that can lock in high-paying players in the long term. The future development potential of Catizen and $CATI depends on the empowerment of its $CATI token economic model (whether it is one game, one coin, or if $CATI serves as a governance token throughout) and the operational and product selection capabilities of Catizen in the future.

Regardless of how Catizen develops, its current success reflects many potential issues and opportunities in the TON ecosystem. The TON ecosystem is still worth our long-term attention.

References

https://docsend.com/view/h9x78qwy4yz2bfd7

https://www.youxituoluo.com/532105.html

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。