Introduction

Since the fourth quarter of 2023, the cryptocurrency market has shown a clear bullish trend, and along with this macro environment, the Meme token market has experienced significant growth. These tokens have demonstrated huge potential for value growth in the short term, attracting a large number of investors. However, the Meme token market has also shown extremely high volatility and short market cycles, with some tokens having active trading periods of less than 10 minutes. Due to technical factors such as blockchain network congestion and operational speed limitations, transactions often need to be conducted in seconds, increasing the risks faced by investors, especially the possibility of buying at market highs. In response to these challenges, Dex Trading Bot (decentralized exchange trading bots) has emerged to address the need for fast trading and reduce MEV (maximum extractable value) losses and other practical issues.

Mainstream exchanges such as Binance have launched related products (such as Banana), and the Dex Trading Bot field has quickly gained market attention. Analysis shows that these tools not only perform well in terms of usage, but also demonstrate strong profit-making capabilities, and have accumulated a large number of real users.

With its extensive user base, clear application scenarios, and significant profit potential, Dex Trading Bot is becoming an emerging area worth close attention in the cryptocurrency market.

What is Dex Trading Bot

Dex Trading Bot is an automated trading tool designed specifically for DEX traders, primarily to optimize the trading experience for users. These bots can perform various functions, including but not limited to automatic order placement, portfolio management, and setting stop-loss and take-profit orders. Dex Trading Bot can continuously monitor and trade in the cryptocurrency market 24 hours a day, increasing the likelihood of capturing favorable trading opportunities.

Dex Trading Bot can achieve automated trading through smart contracts, allowing users to use it without the need for programming skills. Current Dex Trading Bots also support cross-chain trading and multi-platform operations. Additionally, Dex Trading Bot can provide a variety of strategy choices, such as arbitrage, copy trading, and grid trading, helping users find the best profit opportunities in different markets.

Dex Trading Bot can also implement more complex trading operations through automated APIs, such as limit orders, market orders, and order cancellations. Therefore, Dex Trading Bot is a very powerful automation tool that can significantly improve trading efficiency and profitability, especially suitable for users who want to conduct efficient trading on decentralized exchanges, especially for those trading "meme" coins and chasing after "dog coins" on the chain.

Services Provided by Dex Trading Bot

The reason why Dex Trading Bot is widely accepted by trading users is that it provides more services than DEX. According to several top-ranking Dex Trading Bots in the market, the services provided by Dex Trading Bot can be summarized as follows:

Automated Trading

Automated trading refers to using Dex Trading Bot to automatically execute trades, saving time and effort for trading users. Users do not need to manually monitor the market and execute trades; they only need to set trading strategies and conditions, and the trading bot will automatically execute trades based on these conditions.

Automated trading can help trading users better grasp market changes, seize trading opportunities in a timely manner, and reduce the impact of human factors on trading decisions. By using Dex Trading Bot for automated trading, trading users can more efficiently manage their investment portfolios, improve trading efficiency, and reduce trading losses caused by negligence or emotions. Therefore, the automated trading function of Dex Trading Bot provides users with a more convenient and efficient trading method, helping users optimize their trading experience and improve trading results.

Optimizing Trading Experience

To enhance the trading experience, Dex Trading Bot has functions such as stop-loss, take-profit, and trailing stop-loss, which can help trading users control risks and profits more accurately. Whether it is short-term trading or long-term investment, Dex Trading Bot can provide effective trading decision support for trading users. With intelligent algorithms and real-time market data analysis, Dex Trading Bot can help trading users make more rational trading decisions, avoid emotional behavior, and thereby improve trading success rate and returns.

Sniping Function

The sniping function refers to the purchase function provided by Dex Trading Bot, such as making purchases at the opening or during pre-sales activities.

Dex Trading Bot can quickly buy or sell assets at specific time points to capture the best opportunities in the market. The sniping function in the trading market can help investors seize the best trading opportunities, thereby achieving better investment returns. By using the sniping function, Dex Trading Bot can quickly react to market changes based on preset conditions and strategies, thereby achieving rapid buying and selling of assets to make the most of market volatility and gain more trading opportunities and profits. The sniping function is a very important tool for investors, as it can improve trading efficiency and accuracy, helping investors better seize market opportunities and achieve better investment returns.

One-Click Copy Trading

Dex Trading Bot allows trading users to pre-select one or more trading entities, such as accounts or trading bots, that they believe have a relatively high trading success rate, and then add these trading entities to a watchlist within Dex Trading Bot. The bot will then automatically follow the trading behavior of these entities in real time. If these trading entities make any trading actions, Dex Trading Bot will immediately replicate these trading actions, automatically executing every trading instruction of the trading entities. This allows trading users who do not have enough time and professional knowledge to analyze the market to improve their own trading success rate.

Limit Orders and DCA

Dex Trading Bot's limit orders are set to allow partial fulfillment and obtain tokens for the fulfilled part. When making a trade, the bot can choose the order validity period, exchange price, and exchange quantity based on the best path, thereby maximizing the benefits in the trade. This allows trading users to more conveniently avoid cost increases and slippage issues caused by price impacts during trading, while also avoiding MEV issues.

Dex Trading Bot has introduced DCA (dollar-cost averaging) investment products, allowing users to lower their purchase costs to their expected price range by setting regular and fixed investments in the future. This method can help investors reduce the risk of single price point investments in highly volatile market environments. Dex Trading Bot provides DCA investment products, where users only need to set their purchase frequency, purchase price range, total time period, and the desired cryptocurrency to purchase. Once the DCA takes effect, the purchased tokens will be transferred to the user's account associated with Dex Trading Bot and automatically traded based on the preset price range and trading frequency. After the DCA period ends, the tokens will be automatically transferred back to the user's wallet.

Classification of Dex Trading Bot

According to the profit model of Dex Trading Bot, it can be divided into three types:

Subscription Fee Model

The subscription fee system requires users to pay a certain amount of subscription fee to the project before using Dex Trading Bot. Generally, the fee is around 0.1 ETH per month or 1 ETH per year. The subscription fee model tends to cater to communities or small circles, and the most common user group is KOLs with relatively high success rates on the internet, who provide signals to their followers. Users replicate the operations of KOLs through the copy trading function.

Trading Fees

The Dex Trading Bot that charges trading fees is similar to DEX, and fees are charged based on the number of transactions each time Dex Trading Bot is used for trading operations. The general fee is around 0.5%-1.5% of the transaction amount, and these fees do not include the fees that trading users incur in DEX, resulting in double fees being charged. However, in general, Dex Trading Bot will allocate a portion of its income to its token holders, maintaining a positive cycle relationship.

Projects that have not issued tokens will not distribute project income.

Subscription Fee and Trading Fee Hybrid Model

Some Dex Trading Bots combine subscription fees and trading fees. Generally, these Dex Trading Bots offer some upgraded services, such as Maestro. The main income of the Maestro project comes from charging trading fees to users, with a fee of 1% of the transaction amount. However, since it has not issued tokens, all fees are treated as protocol income and not distributed to users. It also provides a VIP community service system, where users can pay $200 to join the VIP community and enjoy carefully selected Smart Money addresses or wealth passwords, similar to paid groups created by traditional KOLs.

Based on the nature of Dex Trading Bot, it is mainly aimed at high-frequency trading, seeking advantages in quickly trading Meme or "dog" projects. Therefore, users who use Dex Trading Bot for trading are mostly high-frequency traders. Additionally, the project charges per transaction, with fees mostly set at around 1%. Therefore, the project income of Dex Trading Bot is comparable to the income level of top DEX platforms.

Advantages of Bot Compared to Traditional DEX

After using Dex Trading Bot, its usage has increased significantly in a short period of time, and its project income is now comparable to that of top DEX platforms. The reason for this phenomenon is that Dex Trading Bot has several irreplaceable advantages compared to traditional DEX:

Quick Response

By using Dex Trading Bot for trading, users can achieve quick responses. Once the target price is triggered, the trade will be executed immediately, avoiding potential delays from manual operations. This real-time trading method greatly improves trading efficiency and reduces trading risks. Additionally, during periods of increased on-chain trading volume, network congestion often occurs, leading to DEX experiencing lag due to the performance of the underlying chain. However, Dex Trading Bot achieves fast execution through its efficient trading mechanism, avoiding delays caused by network congestion and ensuring users can complete trades quickly. Furthermore, due to the high demand for fast purchases of tokens such as "dog" coins or Meme at market opening, Dex Trading Bot is particularly suitable for users who require fast trading at market open. These users can seize market opportunities at the earliest time and achieve higher returns through fast trading. The instant response capability of Dex Trading Bot allows users to place orders quickly and complete trades.

Automated Trading

In the 24/7 trading mechanism of the crypto market, the market changes rapidly, posing significant challenges for high-frequency traders. Therefore, the demand for automated trading has emerged. Automated trading not only accurately captures various time periods of market fluctuations but also saves time and effort for traders. Traditional manual trading requires investors to spend hours monitoring the market and executing trades manually, while automated trading completely frees investors from the heavy burden of trading operations, allowing them to focus more on market analysis and strategy formulation. This not only improves trading efficiency but also enables investors to better grasp market trends and make wiser investment decisions.

Reducing MEV Losses

The biggest challenge for trading users in traditional DEX trading on the chain is MEV attacks, which can cause significant losses. Preventing MEV attacks is a problem that DEX needs to address. Although many DEX have made improvements to prevent MEV attacks, the effectiveness is not satisfactory, and MEV attacks still occur. If an MEV attack occurs when a trader is trying to quickly purchase tokens at market open, the resulting losses can be much greater than usual. Therefore, traders usually need to set a high slippage to ensure successful trades. However, Dex Trading Bot can effectively prevent MEV attacks through its technology. Traders only need to pay a fee of around 1%, and the saved slippage costs often exceed the fees paid, greatly reducing trading costs.

High Flexibility

Users can customize settings according to their needs, including custom trading strategies and parameters. This flexibility allows each user to optimize their trading based on their investment strategies and risk preferences. Through customized settings, users can better adapt to market changes, improve trading efficiency, and better control risks. Different investors have different needs and preferences, and the high flexibility of Dex Trading Bot can meet these diverse needs, providing users with a more personalized trading experience. In the constantly changing market environment, high flexibility has become an important factor in improving trading competitiveness and adaptability, providing users with more choice and room for maneuver.

Enhancing User Experience

Compared to traditional DEX, Dex Trading Bot offers a higher level of user experience for trading users. Dex Trading Bot provides convenient cryptocurrency trading, monitoring, and analysis tools, greatly improving the convenience of trading for users. By accessing various platforms, trading users can easily conduct cryptocurrency trading, monitor market dynamics in real time, and conduct in-depth data analysis to help users make wise trading decisions. Dex Trading Bot not only simplifies the trading process but also provides comprehensive market information and analysis reports, allowing users to have a clearer understanding of market trends and risks, thereby improving trading success rates. Dex Trading Bot also offers a variety of trading tools and functions, such as automated trading and quantitative analysis, to help users better seize market opportunities and achieve more stable and consistent returns.

Dex Trading Bot Data

Based on the latest data provided by Dune, we have analyzed the data of Dex Trading Bot as follows:

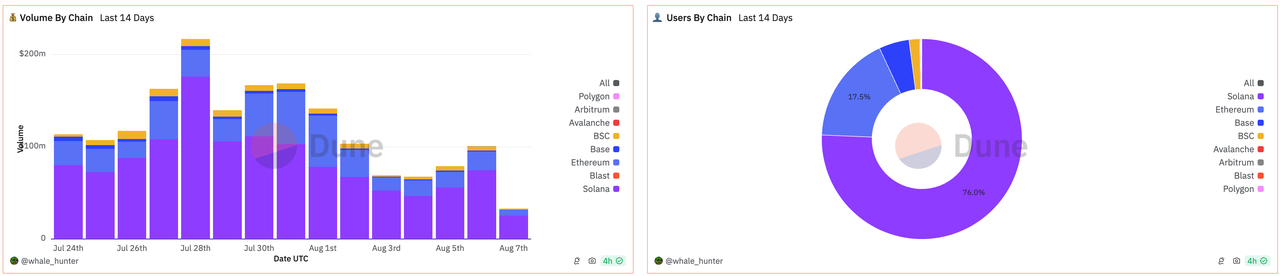

Trading Volume and Users on Different Chains

Trading volume and user count (Data source: https://dune.com/whale_hunter/dex-trading-bot-wars)

In terms of trading volume, the daily trading volume of Dex Trading Bot is $105.54 million. This is mainly due to the sharp drop on Monday, resulting in a decrease in on-chain trading volume. From the chart, we can see that all trades mainly come from three public chains. The trading volume on Solana chain is $74.78 million, on Ethereum chain is $20.15 million, and on BSC chain is $1.57 million. Solana and Ethereum together account for 95% of the total volume.

In terms of user count, the daily user count on Solana is 161,200, on Ethereum is 36,900, and on BSC is 10,200. From the data, it is evident that the average transaction amount per user is relatively small on Solana at $463, on Ethereum at $546, and on BSC at $96.42.

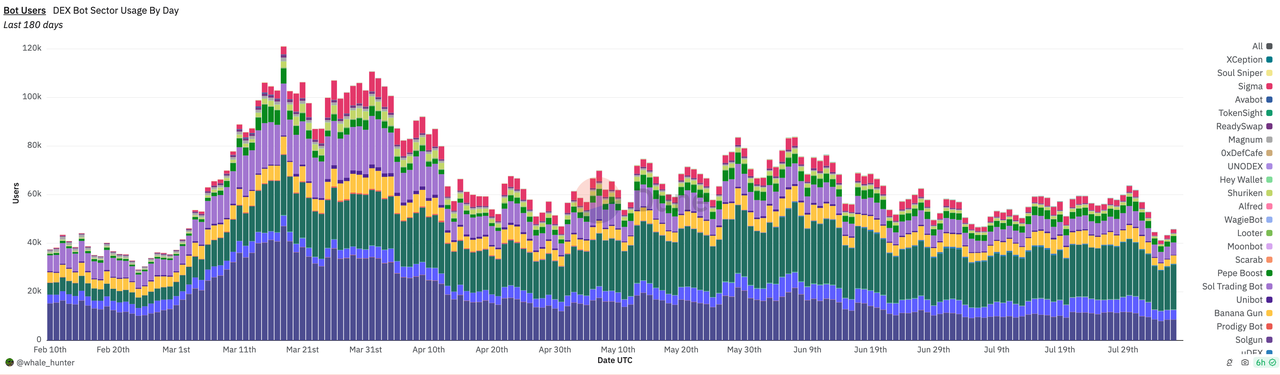

User Count Trend

User Count in 180 Days (Data Source: https://dune.com/whale_hunter/dex-trading-bot-wars)

According to the chart data, the market has been in a wide-ranging trend for the past four months, and there was a sharp drop in the market on Monday. There have been no prominent hotspots in the market in recent months, so the number of on-chain traders has remained between 58,000 and 60,000.

However, during an upward market trend, the user count grows rapidly, reaching 120,000 on March 18. It can be concluded that the usage of Dex Trading Bot is influenced by the market's activity level, as a significant number of hotspots appear when the market is on an upward trend, leading to a continuous increase in the demand for Dex Trading Bot.

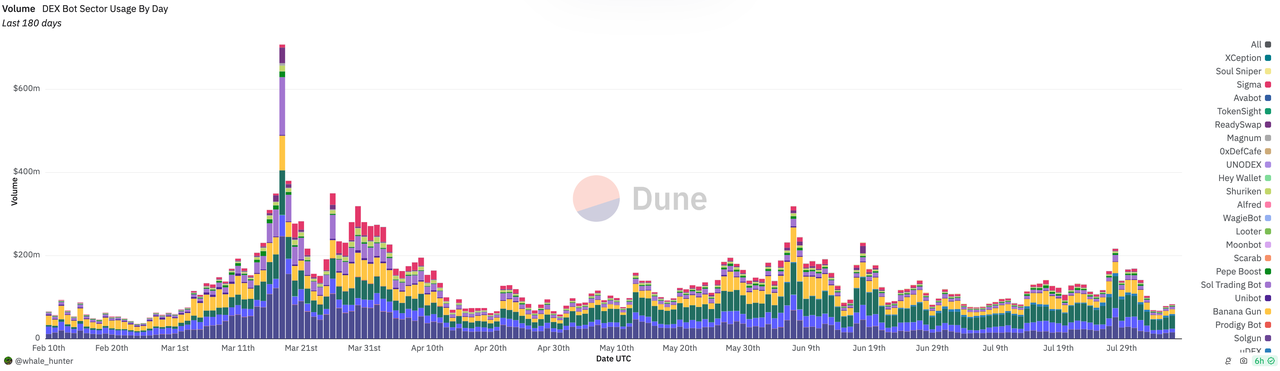

Trading Volume Trend

Trading Volume in 180 Days (Data Source: https://dune.com/whale_hunter/dex-trading-bot-wars)

From the chart, it is evident that there is a certain correlation between the trading volume and user count of Dex Trading Bot. During favorable market conditions, both the trading volume and user count show an increasing trend. Conversely, during unfavorable market conditions, both the trading volume and user count decrease. Comparing the data, the trading volume reached 700 million at its peak, but is currently around 100 million, while the user count was 120,000 at its peak and is now over 50,000. This indicates that during favorable market conditions, existing traders increase their investment amount or trading frequency, thereby driving the growth of trading volume. Therefore, during favorable market conditions, the growth rate of trading volume far exceeds the growth rate of the user count.

Bot Income

The total daily income of Dex Trading Bot has now reached $1.641 million, with the majority of the income attributed to Photon, Trojan, BonkBot, Banana Gun, and Bullx. These five projects' income accounts for 96% of the entire track. This indicates that the income level of Dex Trading Bot track projects is very high. Currently, it is in a low period of market trading, and the peak of trading volume on March 18 also coincided with the peak of income, reaching a daily income of $29.038 million. BonkBot, in particular, was able to achieve a daily income of $22.81 million, surpassing the income of any DEX or other projects in the market. Therefore, the income level of Dex Trading Bot track projects is very high.

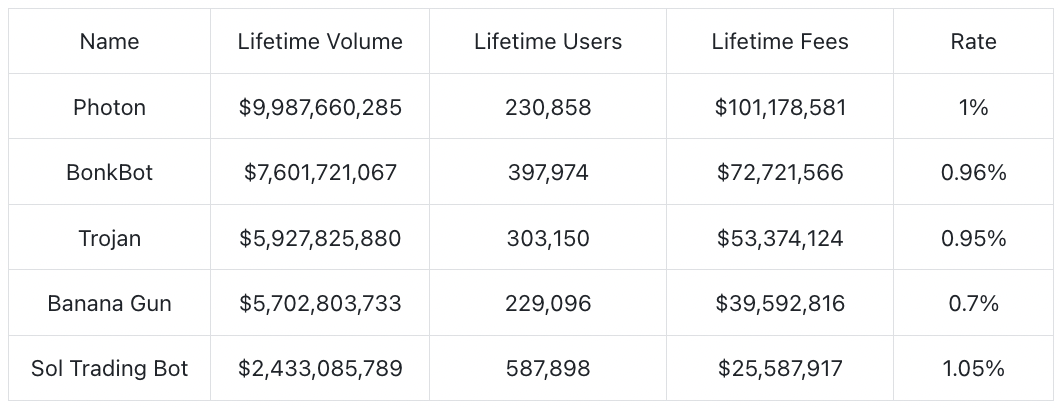

Representative Projects in the Dex Trading Bot Track

From the table, we can see that the top five projects in the Dex Trading Bot track are: Photon, BonkBot, Trojan, Banana Gun, and Sol Trading Bot. Although Banana Gun ranks fourth in total trading volume, it is very close to Trojan, which ranks third, but there is a significant gap between it and Sol Trading Bot, which ranks fifth. Therefore, let's introduce the four projects in the top tier: Photon, BonkBot, Trojan, and Banana Gun.

Photon

Photon is a Solana-based Dex Trading Bot, currently ranking first in trading volume in the Dex Trading Bot track, with a total trading volume of $9.987 billion. Its main features include:

Memescope: Photon collaborates with Pump.fun and Moonshot to provide trading users with information about various tokens of interest before purchasing, allowing users to create all the indicators they care about when deciding which tokens to buy, and annotating the source of each message, providing greater flexibility and convenience for trading users.

DCA Dollar-Cost Averaging: Photon allows users to create DCA dollar-cost averaging orders based on their investment plans and risk preferences, only requiring input of the desired purchase or sale amount, time interval between each order, total amount to be purchased, target range of market value (minimum/maximum), and order expiration time (24/48/72 hours), while also specifying the priority and bribe amount for each DCA order.

Limit Orders: Photon's limit orders are divided into three types: buy on dips, stop loss, and take profit. When using limit orders, users only need to set how much the market cap falls or rises, or use the target line provided by Photon, and then set the time for use.

Smart-MEV Protection: When trading, users have a Smart-MEV option. If users wish to complete their trades as quickly as possible, they need to select this option. After selecting it, there is a choice of using more than or less than 0.0001 SOL for bribing. When choosing more than, it will be used for every operation, and if choosing less than, it will only be used when JITO accepts the trading order.

Photon's main function is to help users quickly purchase tokens in the cryptocurrency market, while also providing other financial services such as limit orders and DCA dollar-cost averaging. Photon also collaborates with Pump.fun and Moonshot to provide users with more extensive token information. Its users can safely purchase tokens listed on Ethereum and Solana. Photon sets a user trading fee of 1%.

BonkBot

BonkBot is a Dex Trading Bot developed by the Bonk community, currently ranking as the robot with the highest trading volume in the Dex Trading Bot track, with a total trading volume of $7.59 billion. BonkBot is known for its simple user interface and its main features include:

Simplified Trading Process: Users only need to paste the token address into a Telegram chat to immediately execute a purchase trade, without the need to connect a wallet or adjust slippage.

High Performance and Efficiency: BonkBot has high speed and superior execution capabilities, allowing buy and sell operations to be completed in a short time, greatly reducing waiting time.

MEV Protection: BonkBot collaborates with Jito Labs to provide advanced MEV protection, defaulting to accelerate trades and defend against front-running attacks.

Referral System: Through the referral mechanism, users can earn a portion of the trading fee as a reward, further incentivizing the use of the platform.

Because BonkBot is built on the Solana chain, and Solana mainly relies on the issuance and prosperity of Meme coins in this bull market, and Dex Trading Bot was mainly born because of Meme coins and "dog" coins, the trading volume and user count of BonkBot have significantly increased with the blessing of the Meme coin culture on the native Solana chain. Its ecosystem is supported by BONK, enhancing its market influence and user stickiness. Additionally, BonkBot's collaboration with Raydium further enhances its market performance and user experience. BonkBot sets a user trading fee of 1%.

Banana Gun

Banana Gun is a Telegram-based Dex Trading Bot, currently ranking third in trading volume in the Dex Trading Bot track, with a total trading volume of $5.69 billion. Its main features include:

Sniping Function: Banana Gun can help trading users quickly buy or sell assets at specific times, especially at the opening of a project, to capture the best opportunities in the market. It can assist investors in seizing the best trading opportunities in the market, thereby achieving better investment returns.

MEV Protection: Banana Gun provides advanced MEV protection, defaulting to accelerate trades and defend against front-running attacks.

Maximum Spending: Banana Gun adds slippage control and limit orders in its trading package, and allows users to set a maximum spending limit to restrict the amount of tokens and gas they are willing to spend. When dealing with tokens with the maximum trading volume, the token contract code limits the maximum quantity that can be purchased in a single trade. If the maximum allowed trading volume is reached, the remaining ETH will be refunded to the user. If the trade cannot meet the maximum allowed purchase quantity, it will be automatically canceled.

The main function of Banana Gun is to help users quickly snatch up tokens in the cryptocurrency market, especially skilled in sniper operations at the opening. Its users can safely purchase tokens listed on Ethereum, Solana, and Base, and be the first to buy during new coin releases.

BananaGun sets a user trading fee of 0.5%.

Trojan

Trojan is a Solana-based Dex Trading Bot, currently ranking fourth in trading volume in the Dex Trading Bot track, with a total trading volume of $5.62 billion. Its main features include:

One-Click Copy Trading: The Trojan robot can simultaneously track up to 40 wallets. In terms of other operations for one-click copy trading, it is similar to other Dex Trading Bots, but it stands out in being able to track a larger number of wallets, helping trading users to obtain more trading references.

DCA Dollar-Cost Averaging: Trojan allows users to regularly purchase cryptocurrencies with a fixed amount or quantity based on their investment plans and risk preferences, regardless of whether the market is rising or falling. This allows users to regularly purchase assets with the same amount or quantity, which not only helps trading users diversify investment costs and reduce the impact of market fluctuations, but also avoids purchasing assets at market peaks, optimizing the user's own investment. Additionally, Trojan's DCA function can automatically execute purchase operations.

Trojan, formerly known as Unibot on Solana, was created by Reethmos, the former operations manager of the Unibot community. It was originally a product under Unibot and was renamed Trojan after its success. The Trojan trading interface is similar in style to Unibot. Trojan sets a user trading fee of 1%, which can be reduced to 0.9% through referrals from other users.

Summary

Dex Trading Bot is a special trading track that emerged from the demand of trading users to hedge "dog" coins and snatch up Meme coin launches in the market. The main user group served by Dex Trading Bot is trading users who are focused on "dog" coins and Meme coin launches. In the past six months, the trading volume and user data of Dex Trading Bot have shown that it is a highly efficient and convenient trading tool, demonstrating tremendous potential and attractiveness in the cryptocurrency market. Some of its unique features have attracted a large amount of attention from users and investors. Although the current data has seen a significant decline compared to the peak, overall it remains quite healthy.

From the project income of the Dex Trading Bot track, we can see that the income-generating ability of Dex Trading Bot projects can be described as a "money-making machine," and even during the hottest market period, it has surpassed the income of top DEXs in the market. From the perspective of project profitability, the Dex Trading Bot project teams will have ample motivation to continuously innovate and optimize the project.

Looking at future development, the Dex Trading Bot project is a specific manifestation of the intent-focused track, and this manifestation can only be expressed to trading users in a form that better aligns with their operational experience. Currently, the AI track in the market will be the future direction of development, so Dex Trading Bot will actively integrate AI technology in the future, making the project more intelligent and better aligned with the interests of trading users.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。