Author: Andrew Throuvalas

Translation: Plain Blockchain

Despite Ethereum's warm welcome from Wall Street, the price of Ether (ETH) in this cycle has failed to keep pace with its cryptocurrency competitors.

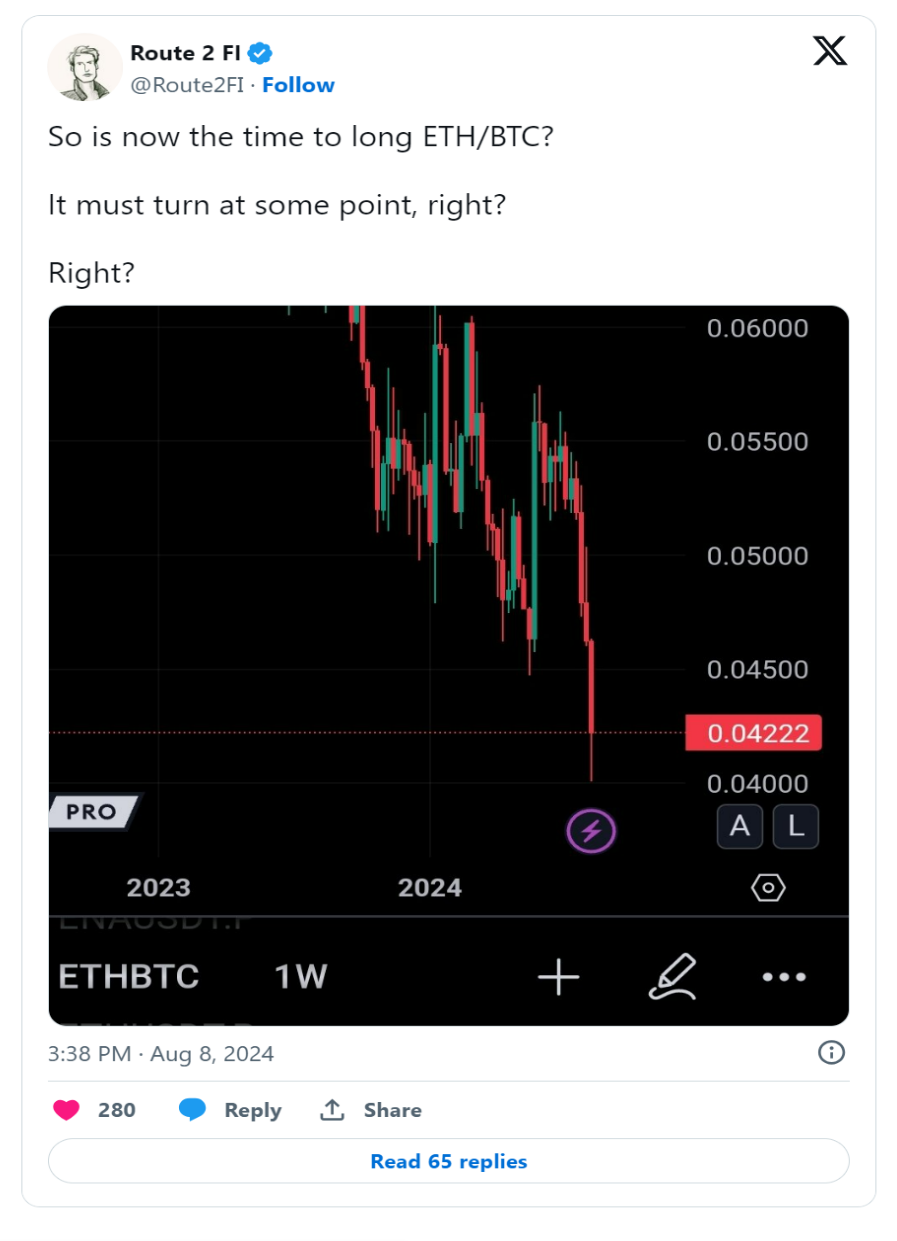

As the cryptocurrency market sharply declined on Sunday, according to TradingView's data, the ETH-to-BTC exchange rate reached its annual low of 0.041. Although digital assets, including ETH, have since experienced a solid recovery, the ratio still stands at 0.043 at the time of writing.

Many find this trend unusually concerning. In bull market years, it was common for dominant digital assets that received a lot of capital inflow to surpass Bitcoin and flow into riskier small-cap assets. In fact, during Bitcoin's first-quarter surge, tokens like Solana and meme coins like PEPE and WIF proved this, but ETH did not.

Financial analyst Wesley Kress wrote on Twitter on Tuesday, "This shift challenges the long-held belief that network effects alone sustain Ethereum's dominant position. Ethereum has performed poorly in this cycle, and I think people are realizing it's not the future."

However, some other analysts believe that this pessimistic view is exaggerated. They argue that time will be Ethereum's best friend, especially with the new Ethereum spot ETF gaining traction.

"There's too much hype about the immediate impact this ETF might have on the price, and right now, there's too much panic," cryptocurrency influencer Crypto Kaleo stated on Thursday. He pointed out that the Ethereum ETF has been live for 12 days, which is the same amount of time it took for Bitcoin to bottom out and rebound after their respective ETFs were launched in January.

"In theory, the launch of the ETF is bullish for the price of Ethereum, as it allows various institutions to buy Ethereum that might otherwise be restricted by regulation," Crypto Kaleo added.

However, according to Jonathan Bier, Chief Investment Officer of FarsideUK, the ETF may not bring the same level of success to Ethereum as it did for Bitcoin.

"A large part of the success will depend on people and entities moving their existing Ethereum Trust holdings into the ETF," Bier told Decrypt. He noted that Grayscale's reduction of Ethereum holdings may be more severe compared to Bitcoin, as investors selling their Ethereum Trust shares need to consider capital gains tax.

"At the same time, Ethereum investors are less loyal than Bitcoin investors," he added. "Ethereum investors are always looking for the latest and greatest with the newest technology."

Throughout the year, Solana has surpassed Ethereum in key on-chain metrics related to network activity. In late July, Solana exceeded Ethereum's total transaction fees for the first time.

Furthermore, several on-chain metrics related to the market also indicate wavering interest in Ethereum compared to Bitcoin. According to CryptoQuant, Bitcoin's "realized market cap" — a measure of the scale of new investors flowing into Bitcoin — has increased by $187 billion year-to-date, while Ethereum's is at $127 billion.

"Bitcoin has outperformed Ethereum in some network fundamental metrics," said Julio Moreno, research director at CryptoQuant, to Decrypt. "For example, the ratio of the number of transactions in the Ethereum network to the number of transactions in the Bitcoin network has also decreased as the ETH/BTC price ratio has declined."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。