As long as traders make money, JLP loses money, and if traders lose money, JLP makes money.

Author: WOO

I believe that most cryptocurrency users would agree that the frenzy of this bull market's altcoin season has not yet arrived, and the overall market does not have a clear mainstream narrative, only meme coins have exploded in growth. Although the rise is fierce, without fundamental support, it is easy for investors to lose confidence and panic sell in unstable market conditions, making the downturn more violent. In such a high-volatility situation, how many people can really make money?

As a general retail investor, besides investing in mainstream coins, is there a more profitable and stable way to participate in the market? WOO X Research will take everyone deep into understanding JLP.

JLP has risen by 83% since the beginning of this year, surpassing Bitcoin's 45%, and the trend can be clearly seen in the chart, even if it falls, it does not retrace too much, it keeps going up.

So what is JLP? And how does it maintain price stability and growth? How long can this kind of increase last?

What is JLP?

To understand JLP, you must first know about Jupiter. Jupiter is a Solana-based Dex trading aggregator, which, in addition to spot trading, also provides other products and services: in the product part, it includes decentralized perpetual contracts, LaunchPad, and on the service side, it provides different functions for different types of users, such as Dollar Cost Averaging (DCA), limit orders, etc.

JLP is the liquidity asset of Jupiter Perp, consisting of SOL, ETH, WBTC, USDT, and USDC, and represents the fact that Jupiter Perp currently only supports contract trading for ETH, BTC, and SOL.

As of the deadline, the locked total value of JLP is about 676 million US dollars (with an upper limit of 700 million), with SOL accounting for the highest target weight at 44%, ETH at 10%, WBTC at 11%, USDC at 26%, and USDT at 9%.

Due to the good performance of SOL this year, JLP has also benefited from it, but is JLP really as simple as a blue-chip ETF in the cryptocurrency circle?

Operating Mechanism

JLP is not just an ETF for blue-chip coins, but also the counterparty of Jupiter Perp users, meaning: as long as traders make money, JLP loses money, and if traders lose money, JLP makes money. Its operating principle is similar to GLP of GMX. The key to the sustainable operation of this model lies in the high probability of traders losing money in the long term. Being a liquidity provider (LP) is equivalent to being a house, with a high probability of stable long-term profits.

In addition, the value of JLP also comes from the fees generated when users operate. When traders open leveraged positions, they borrow tokens from the JLP pool, and liquidity providers, i.e., JLP holders, earn fees from these leveraged trading activities, including borrowing fees and trading fees (0.06%). As a JLP holder, you will receive 75% of the fees generated by the contract trading exchange, and this fund is reinvested directly in JLP, increasing its price and promoting continuous compounding. According to platform income, the current APY is 106%.

The value of JLP comes from:

- Index funds of SOL, ETH, WBTC, USDC, USDT.

- Traders' profits and losses

- Fees generated from opening positions, closing positions, price impact, borrowing fees, and trading fees, of which 75% goes to JLP

How does it actually work?

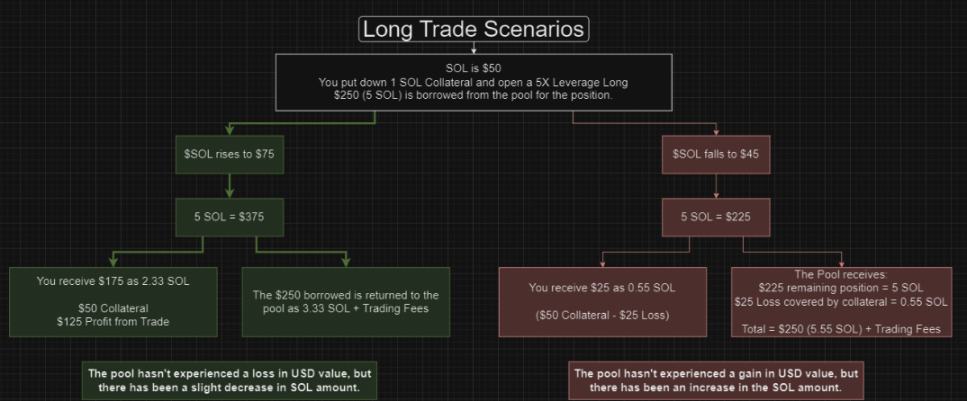

Suppose a user buys 1 SOL as collateral at a price of $50 and leverages 5 times to borrow $250 (i.e., 5 SOL) for a long position.

- Scenario 1: SOL price rises to $75, and the 5 SOL is now worth $375. The user repays the borrowed $250 (about 3.33 SOL) and pays the trading fee (0.06%). The user is left with 2.33 SOL (about $175), of which 1 SOL is your collateral, and the remaining 1.33 SOL is profit.

- Scenario 2: SOL price falls to $45: your 5 SOL is now worth $225, you get 0.55 SOL (about $25), return the remaining 3.33 SOL to the liquidity pool, and pay the trading fee. The user's collateral decreases, and incurs a loss of $25.

In short, JLP earns 75% of the traders' losses and the fees generated by contract trading, so to judge whether JLP can continue to grow, in addition to the trend of the intrinsic asset value, it is necessary to pay attention to the profitability of traders and the trading volume on the platform.

Can the increase be sustained?

As mentioned earlier, the key points to focus on are: the profitability of platform traders and the trading volume.

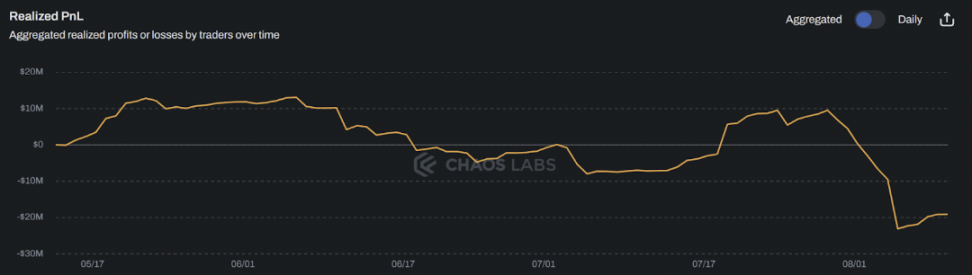

Profitability of platform traders: According to Chaos Labs data, in the past 90 days, traders have cumulatively realized profits and losses, with losses exceeding $20 million. In the early days, most traders were still profitable, but as time went on, the losses became greater, especially when the extreme market conditions came on 8/5, the losses were even more severe.

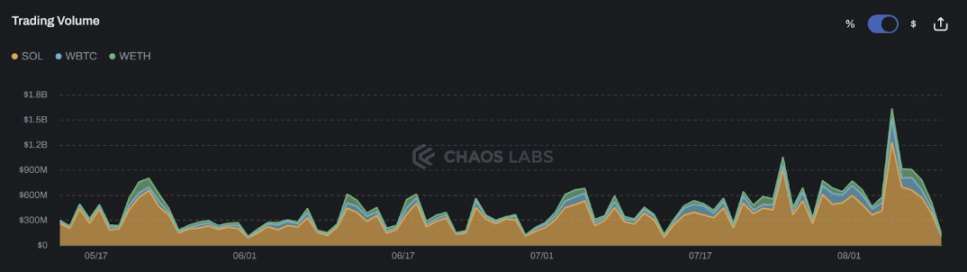

Trading volume on the platform: It remains stable with no significant growth. The daily trading volume is mainly concentrated between 2 to 9 billion US dollars, reaching 16 billion on 8/5. SOL has the highest proportion throughout the period. In comparison, the trading volume of WBTC and WETH is significantly smaller and relatively stable, without significant fluctuations like SOL.

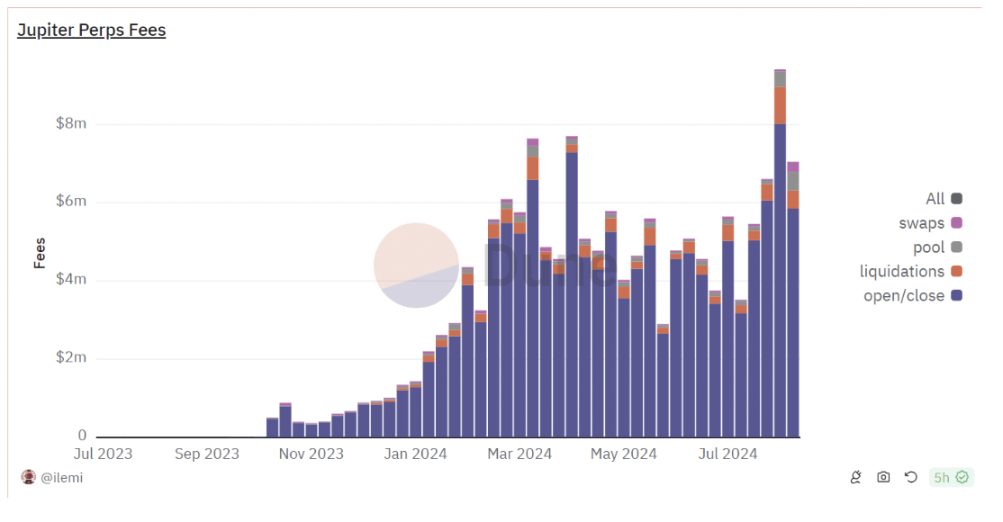

Platform revenue situation: This data is recorded on a weekly basis, showing the revenue situation of Jupiter Perp since its launch. It can be clearly seen that the overall revenue continues to grow, with a single-week revenue of about 6 million US dollars in the past six months, and a historical record of 9.42 million on the week of 7/29 (due to the market crash on 8/5). The fee structure is dominated by opening/closing fees, followed by liquidation fees, and then pool and coin exchange fees.

In summary, considering the loss situation of platform traders, stable trading volume, and continuously growing revenue, the price of JLP is expected to continue to rise.

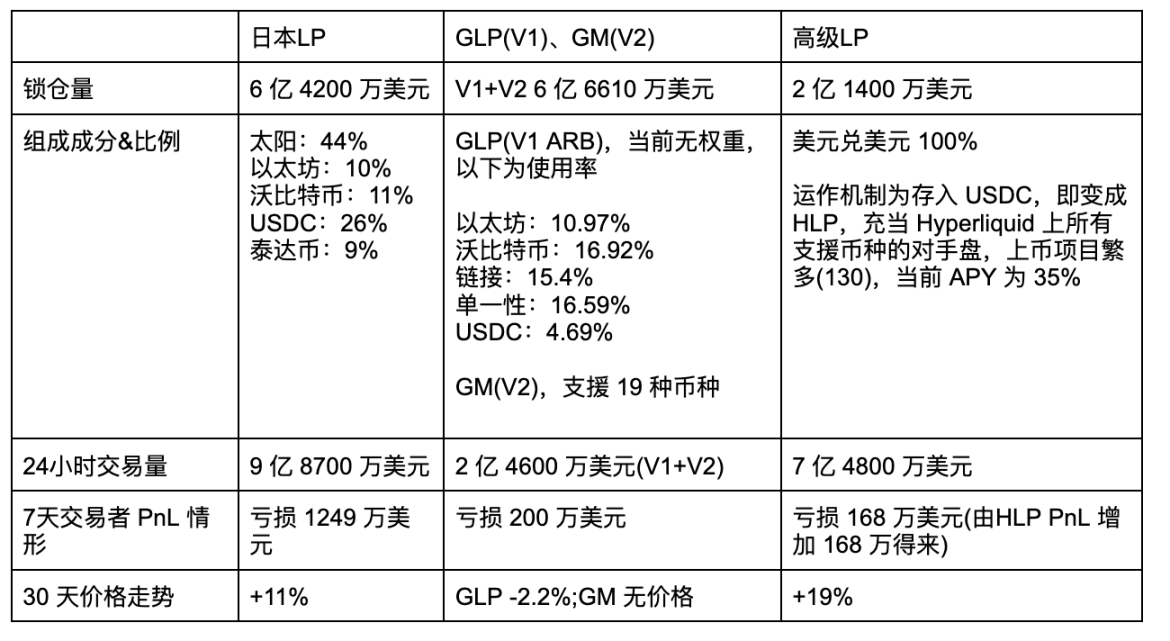

Horizontal comparison with GLP, HLP

JLP is not the first token fund to act as the counterparty of Perp Dex traders. This concept was invented by GMX, and the counterparty token is GLP (V1), abandoning the traditional order book form, allowing users to enjoy a zero-slippage trading experience.

HLP is the token fund of Hyperliquid, which is also a Perp Dex, with TVL ranking third in the entire network (first is Jupiter, second is GMX).

The following is a comparison of JLP, GLP, and HLP:

Currently, Jupiter Perp Dex has the largest trading volume and the highest trader losses among the three, and JLP is also a relatively stable choice among these three.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。