Token migration or merger does not guarantee immediate and/or long-term positive price trends.

Author: panadol girl

Translation: Deep Tide TechFlow

If you are a project founder and want to upgrade or migrate your old tokens, merge with another token, give it a rebirth, and reshape the token's economics and utility, this article may be helpful to you.

Some may say that a project only has one chance to release tokens correctly (I agree with this view when all conditions are met), but the fact is that the market and narrative can change, the team's strategy and vision can change, and even the community's expectations can change over time.

In this case, the token's brand and market positioning may need to be adjusted to maintain relevance, and the token's utility will also change. Founders and teams should have the right to make this choice, as long as it is reasonable, well-considered, and approved by the community.

@karmen_lee and I spent several hours delving into five token migration and merger cases to gain a more comprehensive understanding of key considerations, conversion mechanisms, timelines, price performance, and community reactions.

We also developed a high-level blueprint that may be helpful for founders and builders (I will post another article introducing this). This article will focus on what we discovered from these five cases and my own thoughts:

MC –> BEAM

RBN -> AEVO

AGIX, FET, OCEAN -> ASI

KLAY, FNSA -> PDT

OGV -> OGN

First, I will summarize some key considerations:

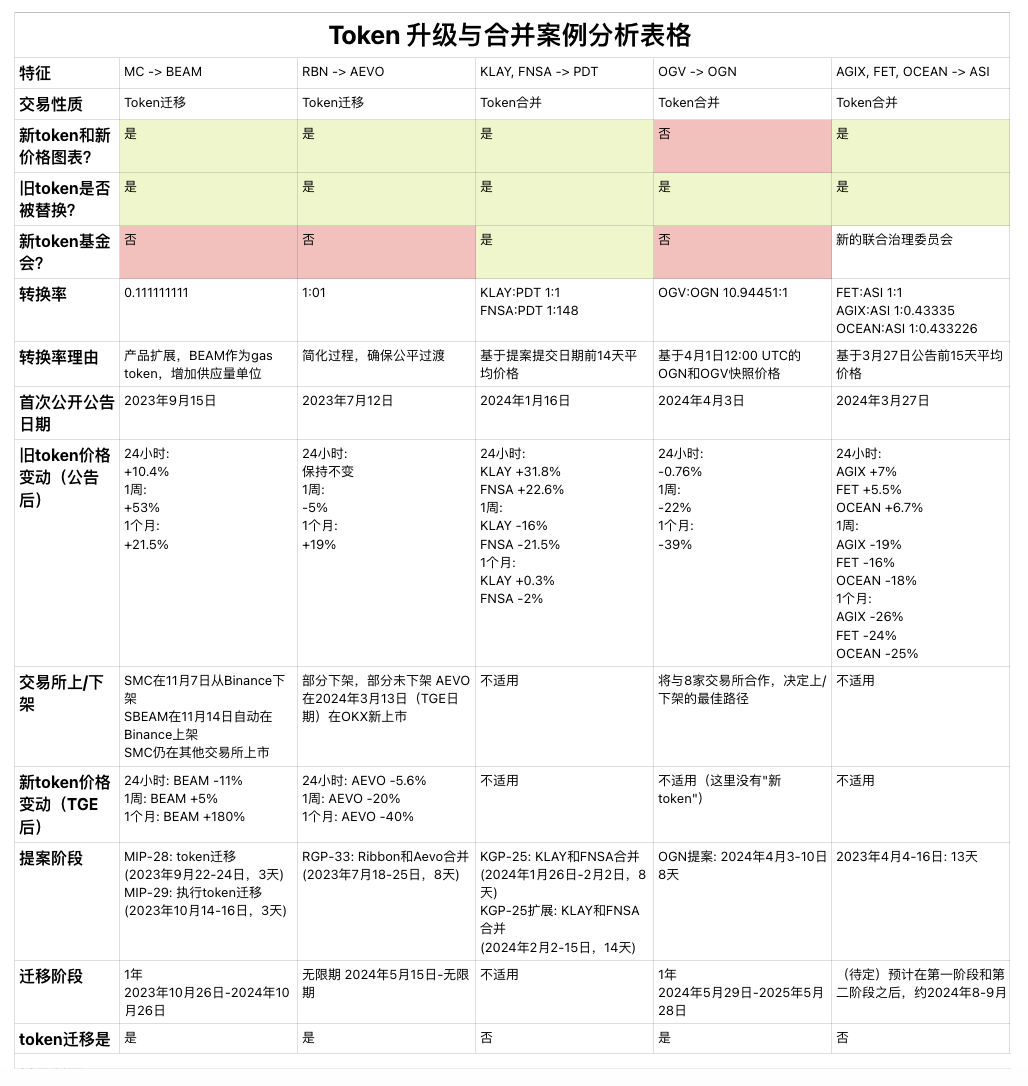

Deep Tide Note: This table summarizes the detailed features and data of five token upgrade/merger cases, including transaction nature, token replacement situation, conversion rate, announcement date, price impact, exchange listing/delisting situation, proposal and migration stages, specific migration steps, and the utility and changes of the new token.

Next, let's delve into it.

- MC -> BEAM ----------

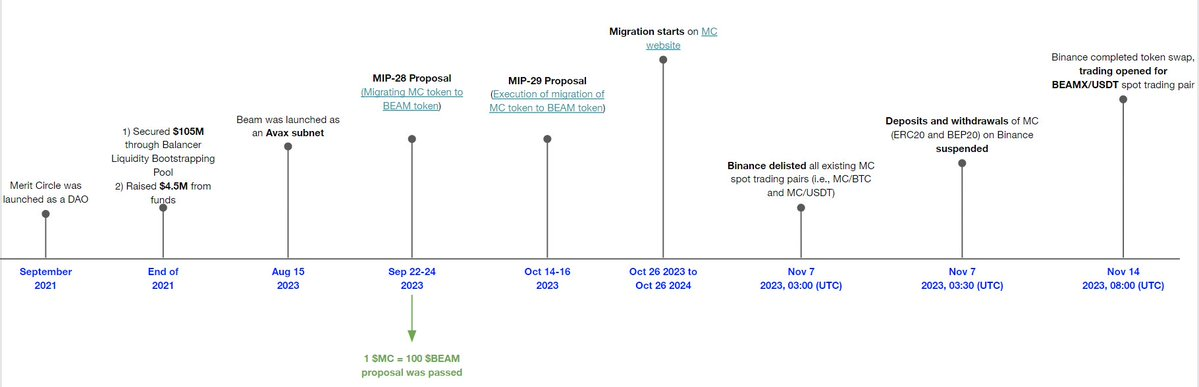

The migration of Merit Circle to Beam may be one of the most successful and validated token migration cases. This is a good example that demonstrates how a project evolves into a blockchain with clear and consistent community communication and proposal processes. Detailed timeline:

Why upgrade?

Better align the token brand and underlying network.

Enhance the token's utility.

Market positioning, brand awareness, and brand strength.

Time efficiency -> a quick way to align internal and external attention and knowledge to the new vision of BEAM.

Why not airdrop the token directly?

BEAM is intended to replace the MC token, not coexist with it.

A fair and accurate airdrop is very difficult due to the constant turnover of MC tokens.

Significant costs (including transaction costs).

Price impact

In the six weeks after migration, the value of BEAM increased by about 200%, indicating strong market support.

The price of MC has also risen by over 3 times since the migration opened on October 26, 2023.

- RBN -> AEVO -----------

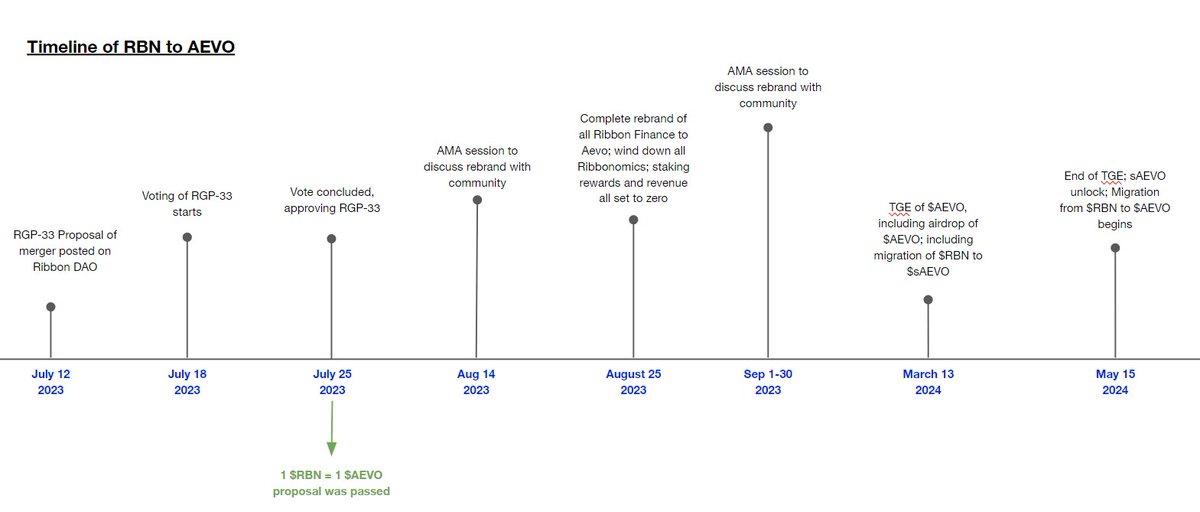

In the DeFi field, the merger of Ribbon Finance with Aevo (a non-custodial exchange based on OP) is an interesting case that integrates automatic staking mechanisms in the process.

Two different products, 1 RBN token -> 1 unified product, 1 new AEVO token. Here is the timeline:

Why merge:

Address scalability issues encountered by Ribbon in DeFi options.

Synergies provided by the products.

Technical advantages of UI/UX: Aevo L2 rollup aims to provide users with a 0 gas fee solution, reduce order delays, increase order processing capacity, and active market making, etc.

Direction and goals of development: The new AEVO token is based on a clear, evolving goal: to become a high-performance derivatives trading platform and offer more products under one brand.

Staking mechanism:

The converted AEVO tokens need to be locked for 2 months. AEVO tokens are converted to sAEVO (staked AEVO), then locked to avoid immediate selling, which could cause price fluctuations.

- AGIX, FET, OCEAN -> ASI ---------------------

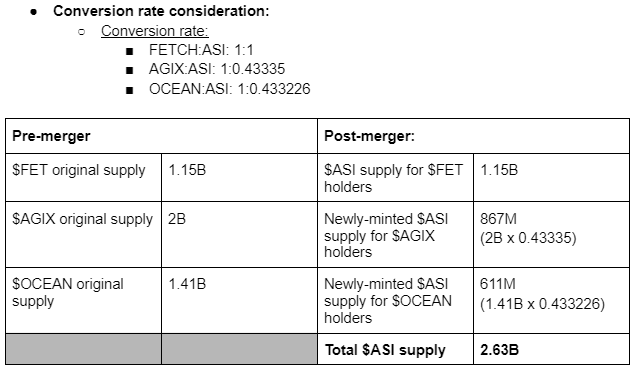

One of the hottest merger cases this year is the merger of three high FDV AI tokens: Fetch.ai (AI agents), SingularityNET (AI development and integration research), and Ocean Protocol (data sharing and monetization). When the news was first announced in March, our team had a conference call with Singularity to understand their motives and mechanisms.

The key learning from this case is their conversion rate considerations and why they did not apply any type of premium or discount to the token valuation.

Why merge:

Integrate liquidity—liquidity costs are high.

Create the largest independent participant in the AI research field.

Conversion rate considerations:

The exchange ratio is based on the average price in the 15 days before the announcement.

To reduce obstacles in valuation negotiations, the team valued the tokens under the same market conditions, without applying a premium or discount based on liquidity or trading volume differences.

FET was chosen as the base token, so the exchange ratio with ASI is 1:1.

- You can view the ongoing two-stage merger process here: https://fetch.ai/blog/navigating-the-asi-token-merger-a-comprehensive-guide.

- KLAY, FNSA -> PDT ----------------

This year, the two oldest Korean tokens also decided to merge - one supported by Kakao and the other supported by LINE - both being the largest instant messaging apps in Korea. Their vision is to become the leading blockchain in Asia, leveraging their combined user base of over 250 million wallets, 240+ DApps, and services.

The key point of this case study is their burning mechanism,

~22.9% of the total supply of the new PDT token will be burned.

100% of the non-circulating supply will be removed.

Purpose: to reduce inflation and control the supply.

They have released a comprehensive document explaining the process and providing clear mathematical guidance. Following their steps is very simple, and it's easy to understand their reasons: https://klaytn.foundation/wp-content/uploads/2024/02/PJD-Supplement-Insights_240208_EN.pdf.

- OGV -> OGN ----------

Purpose: to integrate all of Origin's products and their associated appeal into a single governance and revenue token OGN. Integrating liquidity.

The key learning from this case study is the catalyst: the team realized that OGV's market pricing seemed unreasonable, with its market cap/TVL ratio far lower than that of other competitors.

Closing thoughts:

Token migration or merger does not guarantee immediate and/or long-term positive price trends. Therefore, make sure you have sufficient reasons and solid grounds to support "why migrate or merge". You should do it for the right reasons, for the right community.

Token migration is not a one-time event. This is just the beginning. Communication, transparency, and governance proposals should not stop afterwards, which is also why I believe some case studies are more successful than others.

Most of the migrations in these 5 cases have not yet been completed, so there is still much to monitor, including the progress of their overall products and ecosystems, as well as token performance; to determine "whether this is a successful migration or merger".

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。