Author: Little Bear Biscuit.eth, Riyue Xiaochu, Cryptocurrency KOL

Editor's Note: Recently, cryptocurrency KOL Little Bear Biscuit.eth posted on the X platform that Solana may be facing major risks, and the price of SOL will have a hard time returning to $200. The article pointed out the quarterly continuous losses revealed in Solana's financial report and the issue of unlimited issuance of SOL. This article has caused many retail investors to have FUD about SOL. Yesterday evening, cryptocurrency KOL Riyue Xiaochu refuted Little Bear Biscuit.eth's views, stating that the inflation of SOL is within a reasonable range and will not hinder the price increase, and that the losses are just a data illusion when priced in USD. This article reprints the articles of the two KOLs as follows:

This article is for readers' reference only and should not be considered as investment advice. Please DYOR.

Little Bear Biscuit.eth

$SOL may be in big trouble, and 90U is not the bottom, so don't buy the dip!!! Did everyone know that Jump liquidated its token position in Solana when it plummeted yesterday? Solana, which was once thriving, has a bright future. Why would Jump, such a powerful high-frequency quantitative institution, choose to liquidate?

The $SOL tokens that were liquidated went into the wallets of us retail investors, and we handed stablecoins to Jump. At such a low price, when else should we buy the dip? Who is the fool after all? Today, I, Little Bear Biscuit, will tell you the astonishing truth: $SOL is unlikely to return to $200. My judgment is based on public data:

· In just the first half of the year, Solana suffered a huge loss of $1.8 billion, and the losses are still accelerating. · Solana has unlimited issuance, with 161 million tokens issued in three years, and institutions are cashing out.

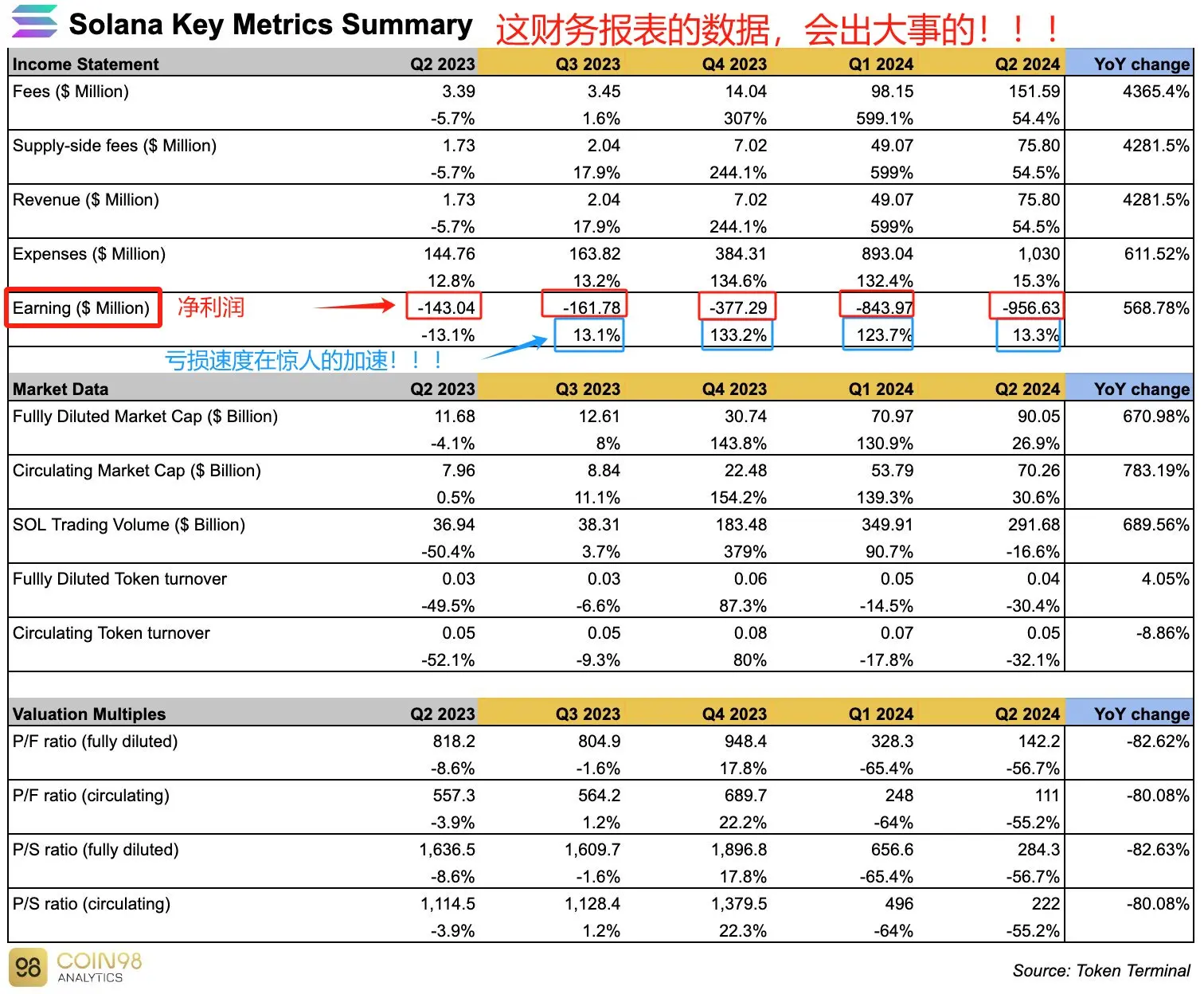

Financial Data

Solana has been losing money every quarter: from a loss of $160 million, $370 million, $840 million, to a loss of $950 million in the second quarter of this year! The magnitude of these losses is still accelerating and cannot be stopped!

Has anyone told you about these astonishing data? Retail investors, wake up and be cautious about buying the dip!

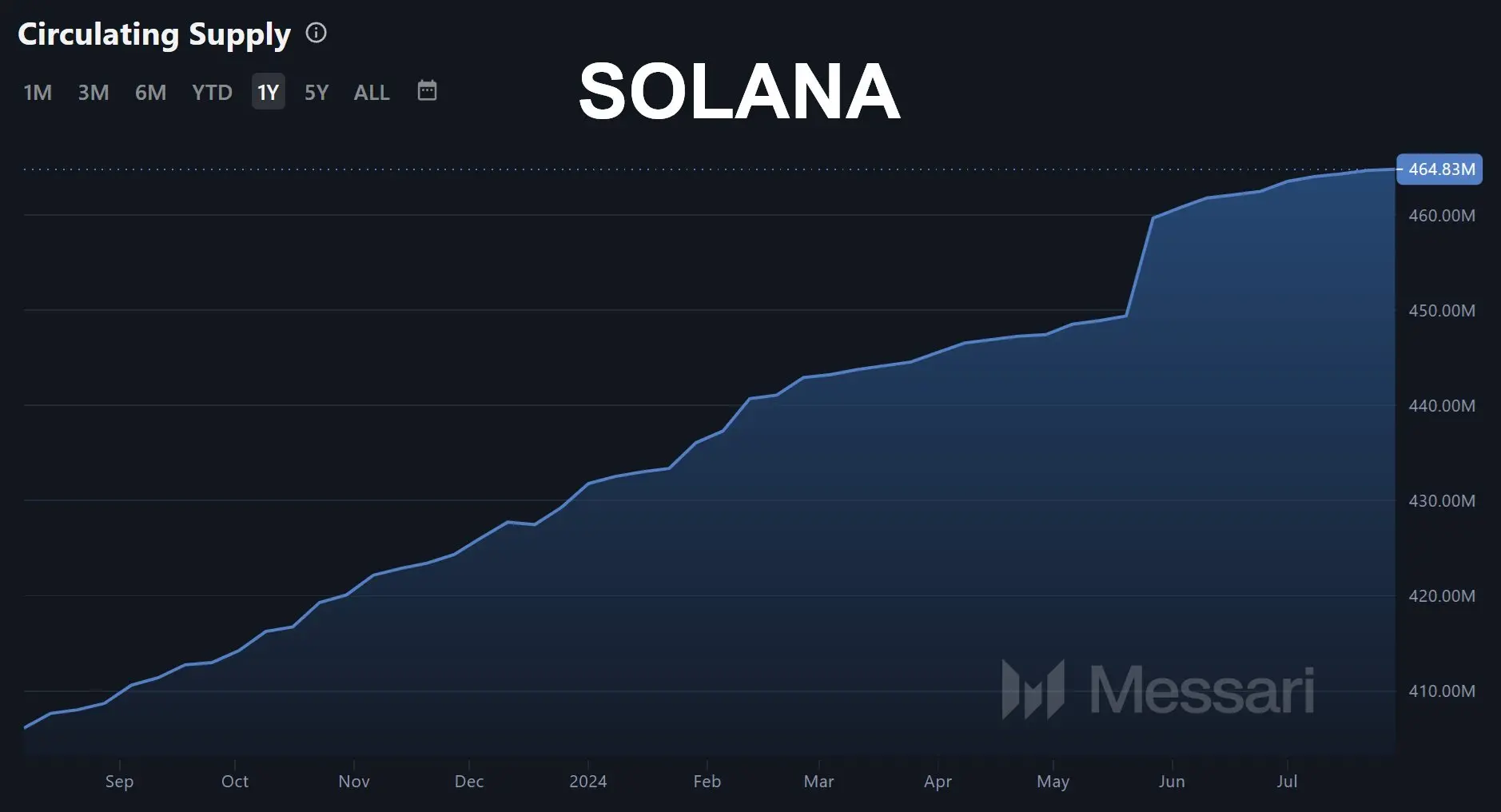

Unlimited Issuance

Since August 2023, 60 million SOL tokens have been issued, equivalent to selling $8.4 billion to the market at the current price of 140U per token. In October 2021, the total supply of SOL was only 301 million tokens, and three years later it is 462 million tokens, representing a 15% annual issuance rate. With such a high inflation rate, are you still daring to buy the dip?

In this bull market in 2024, VCs are happily counting money on vacation. Only retail investors are still fantasizing about SOL returning to $200. I hope this article can help everyone have an independent, objective, calm, and clear understanding. Wishing everyone to avoid pitfalls and make more money!

Data sources:

@ Coin98 Analytics' Solana financial report released in July

@ MessariCrypto's token issuance data

Riyue Xiaochu

Once again, there is a mistaken analysis of the data, leading to incorrect conclusions.

Many people are bullish on SOL, and this article has caused a lot of anxiety. So many people have privately asked about this issue. Therefore, I have written some explanations in the form of an article.

First of all, I do not mean any disrespect to the original author of the article. On the contrary, I am now willing to selflessly share high-quality KOL content, which deserves everyone's praise. The mistake in the data analysis here is because the data dimension itself is very easy to misunderstand.

1 First, let's talk about inflation. The author of the article quoted data from Messari, pointing out that SOL issued an additional 60 million tokens last year, worth $8.4 billion. However, in reality, this additional circulation is not entirely the issuance of the SOL network. First of all, the Messari screenshot clearly states that it is additional circulation. Secondly, in the red screenshot I provided, you can see a step-like increase, and it is impossible for the issuance to increase at the same rate.

Additional circulation includes not only the network's issuance but also the unlocked portion. Since the institutions and teams of SOL have already fully unlocked, what is currently being unlocked should be from the foundation or the ecosystem fund. This part of the tokens often only gets unlocked but does not circulate. Because the foundation cannot freely circulate this portion of SOL.

What we are concerned about is inflation, and in fact, it has already been stated in the official documentation that now in the fifth year of Solana's launch, the annual inflation rate is 3.5%, and it decreases by 15% each year. For comparison, in 2020, ETH's inflation rate was 4.5%, and ETH's market value at that time was between $200-700 billion.

Therefore, SOL's inflation is not a big problem. Historically, issuance during an uptrend does not have a significant impact on the token price because many people will continue to hold the tokens. Reasonable inflation will not hinder the token price from rising, and similarly, deflation cannot trigger a rise in the token price (as with ETH).

2 The second point raised by the original author is the huge losses of SOL and the rapid expansion. From the financial statements, it can be seen that from Q2 of 23, there were losses of $160 million, $370 million, $840 million, to this year's Q2 of $950 million.

In reality, this is not an increasing loss. It is just a data illusion caused by pricing in USD. In fact, nothing has happened.

Because the expenses here include daily operations and the payment of SOL to the nodes (which is the issuance discussed earlier), and the latter accounts for a large portion.

Let's do a simple calculation. The average price of SOL in Q2 of 23 was around $25, and in Q4, the price was larger due to the rally, so let's calculate based on an average price of $50. This year's Q2 was basically calculated at around $160. I roughly calculated that SOL issued 6 million tokens each quarter. So, a simple multiplication, Q2 of 23 was $150 million, in Q4 it was $300 million, and by this year's Q2, it was $960 million.

(Of course, if you feel that the USD valuation of inflation is constantly expanding, you can refer to the earlier discussion on inflation.)

By now, everyone should understand that the financial statements seem to show huge losses rapidly expanding, but it is just a data illusion caused by the rise in SOL's price. In fact, nothing has happened, nothing has happened, nothing has happened.

Alright, let the music and dance continue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。