Title: Bitwise Chief Investment Officer Talks about the Market Crash on August 5: The Fed's Printing Press is Ready, This is a Great Buying Opportunity

Author: Matt Hougan, Chief Investment Officer at Bitwise

Translator: Luffy, Foresight News

This weekend, the cryptocurrency market experienced a significant sell-off. From 4 p.m. last Friday to 7 a.m. on Monday, Bitcoin fell by nearly 20%, dropping from $63,356 to $51,026. Ethereum performed even worse, dropping from $3,307 to $2,234, a decrease of over 30% (Note: The author's time zone is 12 hours behind Beijing time). As of now, the cryptocurrency market has seen a certain degree of rebound.

Of course, cryptocurrency is not the only market experiencing a sharp decline.

Global capital markets are in turmoil due to economic recession and heightened geopolitical concerns. In Japan, the Nikkei index just experienced its worst day since 1987, with a drop of over 12%. In the United States, Nasdaq futures fell by over 4%, and the VIX volatility index has risen by 100% since last Friday.

If you are like most cryptocurrency investors, you will experience intense emotional fluctuations, fear, or despair. For many, the most shocking emotion is anger.

"Isn't cryptocurrency supposed to hedge global uncertainty? What's going on?"

I feel the same way. But based on my experience managing cryptocurrency funds full-time for over six years, there is one thing I feel more deeply, and that is opportunity.

Lessons from the Sell-off Triggered by the COVID-19 Pandemic

The last time the market experienced a similar collapse was on March 12, 2020. That day, the world realized the significant impact of the COVID-19 pandemic.

In case you've forgotten, let me remind you: it was chaos.

On March 12, the Dow Jones Industrial Average fell by 2,353 points, marking the largest single-day drop since 1987. Technology stocks and commodities all plummeted. We all thought the global economy was about to end. The next morning, the president declared a state of emergency nationwide.

Among all assets, Bitcoin suffered the most significant decline, dropping from $7,911 to $4,971, a 37% decrease. It was a heart-stopping plunge, wiping out a year's worth of gains within 24 hours.

The feeling at the time was that we might be done for. The media claimed that Bitcoin had failed as a hedge asset.

Then something incredible happened. As global leaders took measures to stabilize the economy (lowering interest rates, printing money), Bitcoin began to rise. A year later, the trading price of Bitcoin reached $57,332, an increase of over 1,000%.

Looking back, March 12, 2020, was not a day to panic. It was the best time in a decade to buy Bitcoin.

In hindsight, the reasons are easy to understand. Bitcoin did not fundamentally change because of the COVID-19 pandemic. On March 11 and March 12, the maximum number of Bitcoins (21 million) remained the same. On March 11, you didn't need to rely on any bank, government, or company to store wealth in Bitcoin, and the same was true on March 12.

At the same time, the COVID-19 pandemic added more reasons for Bitcoin's long-term rise. It indicated that central banks would intervene to rescue the economy when in trouble. It demonstrated the limitations of centralized institutions. It reminded us that the future will be more networked and digitized.

These changes all indicate that the importance of Bitcoin will continue to rise, not diminish. In the long run, this has indeed been the case.

Today, I see the same situation.

Reasons for the Current Market Crash

I don't want to spend too much time reviewing the reasons for the current market pullback. In short: weak economic data released by the United States on Friday triggered concerns about a global economic slowdown. This led to panic in Asia, and the rapid unwinding of yen carry trades (a strategy aimed at exploiting interest rate differentials between currencies) caused a sharp drop in the Japanese stock market. Additionally, concerns about geopolitical risks in the Middle East have intensified, with Iran threatening to attack Israel.

These events coincided with negative developments in the cryptocurrency market, where a large market maker (Jump Trading) ran into trouble, leading to forced liquidation of a large number of positions.

All of this happened over a low-liquidity summer weekend, further exacerbating the decline.

But please note what will happen next: we are about to see a replay of the COVID-19 pandemic script.

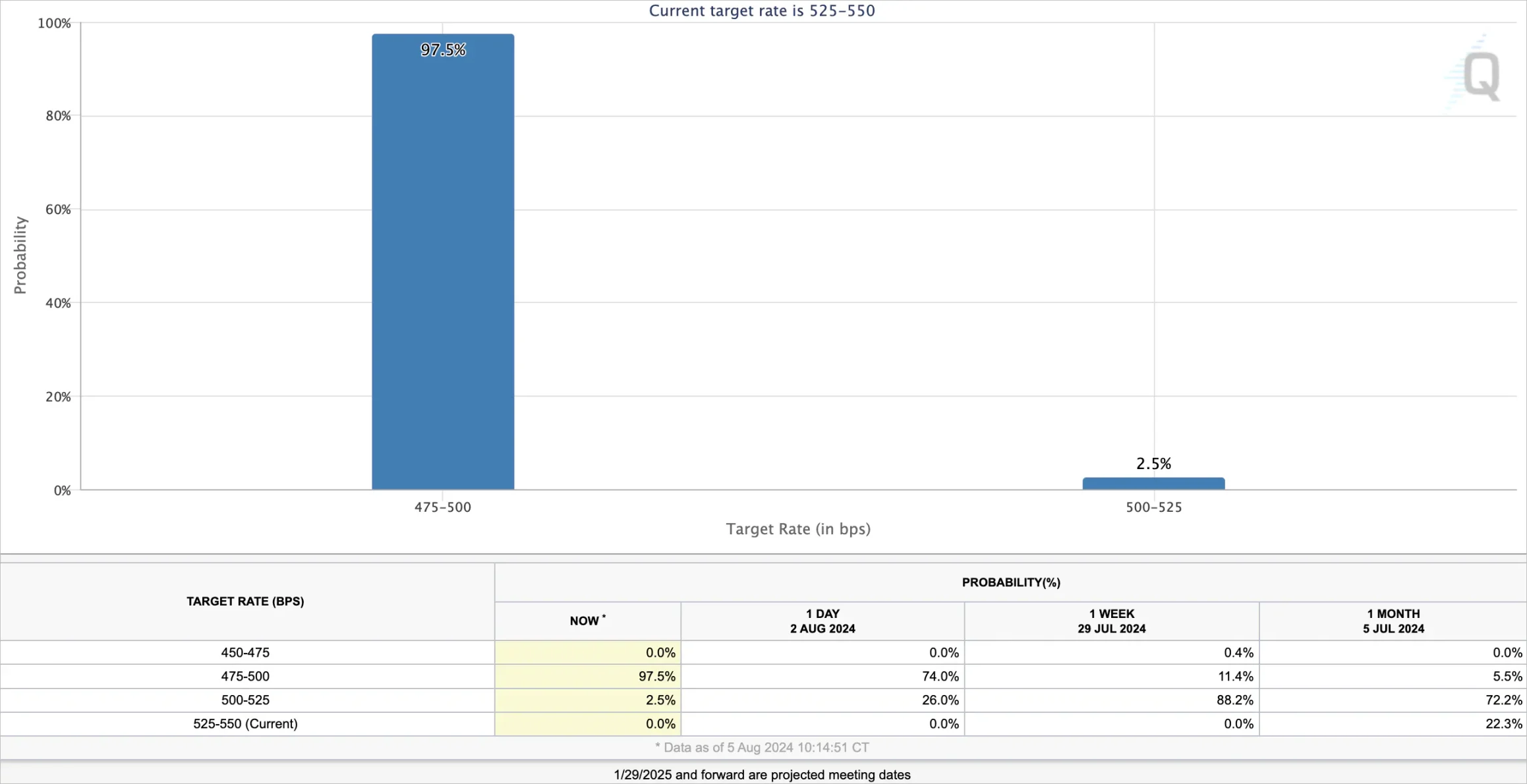

The federal funds futures market has already priced in aggressive measures. A week ago, Federal Reserve Chairman Jerome Powell downplayed the need for a rate cut this year, with the market expecting only an 11% chance of a 50 basis point cut at the September meeting. Now, the market has raised this possibility to 98%. Some are even calling for an "emergency rate cut" before the September meeting.

So, will the printing press really start? If history is any guide, the answer is yes. It happened during the COVID-19 pandemic, after the 2010 Eurozone crisis, and in 2008. If the events of this weekend lead to real economic turmoil, this situation will happen again.

What to Watch for in the Future

In the short term, the key question is whether the cryptocurrency market has already hit bottom. A significant pullback in the cryptocurrency market may create a self-reinforcing downward cycle. This is because, as prices fall, leveraged traders face margin calls and are forced to sell. We have already seen over $1 billion in futures liquidation, and it is not yet clear if we have hit bottom.

In addition, attention needs to be paid to the health of companies in the cryptocurrency ecosystem. As we saw in the 2021 crisis, extremely violent fluctuations may crush companies with excessively high leverage on their balance sheets. There have been rumors that at least one market maker (Jump Trading) is facing challenges, and if this spreads, it could prolong the downward trend.

I will also monitor the flow of funds in ETFs to see if ETF investors will take advantage of this pullback to sell or buy more. These three factors will largely determine our short-term direction.

But my real advice is to ignore short-term factors and focus on the long term. Bitcoin is a volatile asset, with large fluctuations in value. It has always been this way, and it will continue to be so. The current moment once again proves that trying to time the market is foolish.

Bringing a trading mentality into the cryptocurrency space is wrong. You are investing in a once-in-a-lifetime transformation of the global monetary system. Resist the urge to focus on daily prices and instead focus on the levels Bitcoin may reach next year, in five years, and in ten years.

When you land your first job on Wall Street, they will tell you that the four most expensive words in finance are "this time is different."

Historically, whenever we see this kind of global economic panic, cryptocurrency initially falls, but then rises over the next year. Maybe this time really is different, but I wouldn't bet on it. In fact, I bet the script will replay.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。