Editor's note: This article was written on August 5th, when the price of Bitcoin was fluctuating around $50,000. It has since rebounded to $55,000. As for the judgment on the subsequent market trends, let's take a look at how the crypto experts view it.

Author: Chandler, Foresight News

The latest data released last Friday showed an increase in the U.S. unemployment rate in July, triggering close attention to indicators of economic recession, which in turn led to the spread of recession panic globally, resulting in a significant decline in global capital markets on Monday. The Nikkei fell by 4451 points, marking the largest drop in the Japanese stock market, surpassing the record of a 3836-point drop after the U.S. stock market crash on October 20, 1987. The benchmark Kospi index and the small-cap Kosdaq index in South Korea fell by over 8%, triggering a circuit breaker and marking the largest single-day drop since 2008. Nasdaq 100 index futures extended their decline to over 5%, while European stocks opened and traded lower, with the Euro Stoxx 50 index falling by over 3%.

The crypto market is also not immune to synchronous declines. After breaking through $60,000, BTC did not find support and continued to fall, breaching $50,000 and reaching a low of around $49,000, with a daily decline of over 15%. ETH's decline in the past 24 hours exceeded 20%, dropping below $2200 and wiping out all gains from 2024. According to CMC market data, the total market value of cryptocurrencies plummeted to as low as $1.76 trillion, with a nearly 20% decline in 24 hours.

Against the backdrop of global market turmoil, the "3·12" tragedy seems to be reappearing. Frontline institutions and analysts expect that it is more reasonable for the market to anticipate two interest rate cuts by the end of 2024, given the imminent pressure of interest rate cuts and economic recession. The sharp decline in Bitcoin prices often occurs almost simultaneously with the decline of the Nasdaq 100 index, especially in the face of widespread systemic risks in the market, such as the market crash triggered by the COVID-19 pandemic in March 2020 and the market adjustment in 2022. At other times, Bitcoin's fluctuations seem more like independent events, although they may also have a certain impact on market sentiment.

Zhu Haokang, Director of Digital Asset Management at Huaxia Fund (Hong Kong) and Founder of the Asia RWA Working Group, conducted a detailed comparison of Bitcoin prices with the Nasdaq 100 index, concluding that the sharp decline in Bitcoin prices often occurs almost simultaneously with the decline of the Nasdaq 100 index, especially in the face of widespread systemic risks, such as the market crash triggered by the COVID-19 pandemic in March 2020 and the market adjustment in 2022. At other times, Bitcoin's fluctuations seem more like independent events, although they may also have a certain impact on market sentiment.

Figure 1: MVRV (Market Value to Realized Value) compares the market price of BTC with the overall average purchase price of on-chain BTC. In the figure, MVRV excludes BTC that has not moved for over 7 years from the calculation, considering them as long-term dormant or lost. The black line in the figure represents the BTC: MVRV index from [22 to present]; the blue line represents the BTC: MVRV index from [18-21]; the red line represents the BTC: MVRV index from [14-17]. The three lines align the halving of BTC mining output in each respective cycle.

Figure 2: The time relationship between the sharp decline in Bitcoin prices and the decline of the Nasdaq 100 index over the past 16 years, as well as the specific decline magnitude:

Bitcoin Sharp Decline in 2013

Time of Bitcoin price sharp decline: December 2013

Bitcoin decline magnitude: From over $1100 to around $500, a decline of about 55%

Nasdaq 100 index decline time: No significant correlated decline

Time relationship: No apparent relationship

Bitcoin Sharp Decline in 2017-2018

Time of Bitcoin price sharp decline: December 2017 - February 2018

Bitcoin decline magnitude: From nearly $20,000 to around $6,000, a decline of about 70%

Nasdaq 100 index decline time: February 2018

Nasdaq 100 index decline magnitude: A brief 10% pullback

Time relationship: Almost synchronous

Market Crash Triggered by COVID-19 in March 2020

Time of Bitcoin price sharp decline: March 2020

Bitcoin decline magnitude: From around $10,000 to around $4,000, a decline of about 60%

Nasdaq 100 index decline time: March 2020

Nasdaq 100 index decline magnitude: About 30%

Time relationship: Synchronous

Bitcoin Sharp Decline in May 2021

Time of Bitcoin price sharp decline: May 2021

Bitcoin decline magnitude: From around $64,000 to around $30,000, a decline of about 53%

Nasdaq 100 index decline time: May 2021

Nasdaq 100 index decline magnitude: A brief 5% pullback

Time relationship: Almost synchronous

Cryptocurrency Market Crash in 2022

Time of Bitcoin price sharp decline: May 2022 - June 2022

Bitcoin decline magnitude: From around $40,000 to around $20,000, a decline of about 50%

Nasdaq 100 index decline time: Early 2022 - June 2022

Nasdaq 100 index decline magnitude: About 30%

Time relationship: Almost synchronous

Hayden Hughes, Cryptocurrency Investment Director at Evergreen Growth, a family wealth management company: Cryptocurrency assets have become part of the victims of yen carry trade unwinding

As speculators adapt to higher interest rates in Japan, cryptocurrency assets have become part of the victims of yen carry trade unwinding. These investors are also dealing with a significant increase in hedging costs due to fluctuations in the USD/JPY exchange rate.

Daniel Tan, Portfolio Manager at Grasshopper Asset Management: It is more reasonable for the Fed to cut interest rates twice by the end of 2024

We believe that the likelihood of the Fed cutting interest rates five times by the end of 2024 is not high. It is more reasonable to cut interest rates twice, once in September and once in November, with a total reduction of 75 basis points by the end of the year. This indicates potential opportunities to increase bond holdings in the coming months. Overall, we are cautious about chasing the recent global stock market rally at the beginning of August, which has been mainly driven by the surge in global tech stocks. Given the significant rise in tech stocks earlier this year and investors seeking to sell assets to offset losses, there may still be room for continued stock market sell-offs in the near term.

George Bourbouras, Research Director at Melbourne's K2 Asset Management: The market's reaction to employment data seems excessive

The market is clearly concerned about the recent soft economic data. However, inferring from last Friday's employment data seems excessive, as it is only a monthly data point. A better guide would be three consecutive months of data. It is clear that the recent momentum of the U.S. economy has slowed. Recent improvements in U.S. core inflation data, coupled with some comments from the Fed, have led the market to expect a 25-basis-point rate cut in September. The days of ultra-low cash rates in the U.S. are over.

Despite market volatility and concerns that recent soft economic data will persist, overall returns and credit conditions remain strong. Given the Fed's expected start of rate cuts before the U.S. election (November 5), although there are reasons for rate cuts, this may appear problematic on the surface. This could exacerbate market volatility ahead of the election.

Min Jung, Analyst at Presto Research: Disappointing employment data, economic recession concerns, and large transfers by Jump Crypto have led to the decline in the crypto market

The decline in Bitcoin and Ethereum can be attributed to several factors. First, the employment data released last Friday was significantly lower than expected, with only 114,000 jobs added, exacerbating concerns about economic recession. Over the weekend, there were reports that Warren Buffett's Berkshire Hathaway sold nearly half of its Apple holdings in the second quarter, which may further pressure the stock market.

Additionally, over the weekend, Jump Crypto, the crypto division of Jump Trading, seemed to start transferring hundreds of millions of dollars' worth of crypto assets, including Ethereum and USDT. This has led many to speculate that the company may be liquidating its crypto assets amid an investigation by the U.S. CFTC. Jump Trading has been transferring ETH to a CEX, as there are rumors that they may be forced to exit the crypto business due to the CFTC's investigation.

Crypto analyst Lark Davis: Reduced exposure but not exiting the crypto market, better buying opportunities may arise in the future

I am reducing some of the risks in my portfolio. The reasons mainly include: 1. Paranoia about the liquidation risk of BTC and ETH collateral loans; 2. A large portion of net assets is in cryptocurrencies, leaving a small cash position, which needs to change; 3. For the sake of capital preservation.

I know it's best to buy on the dip now, and the current oversold levels are likely the first real buying opportunity in the market. If I had funds available, I could take advantage of this opportunity. Despite many people catching falling knives in the past 72 hours, remember that there is still uncertainty in the Japanese market, the U.S. market, and Iran, which could bring more attractive opportunities. I still hold a large amount of cryptocurrency. I have not completely exited the market.

Justin d'Anethan, Head of Asia Pacific Business Development at Keyrock, a crypto market maker: The current market is not led by BTC

Unlike in the past, this market is driven by sentiment, not by Bitcoin, of course, this is because of Ethereum spot ETF trading and large investors unwinding their ETHE (Grayscale ETH Trust) positions. Looking at a larger time frame, the interest rate environment, the possibility of Trump winning the election, and the Mt.Gox redemption pressure have also put pressure on the cryptocurrency market.

10x Research: Bitcoin may fall to $42,000

The support line at $55,000 is expected to be broken, which could push the price down to $42,000. In this scenario, Ethereum may also fall below $2,000. Although this may seem extreme to some, the continued weak market structure, on-chain data, and our cycle analysis indicate further pressure ahead.

Andrew Kang, Co-founder of Mechanism Capital: Bitcoin below $50,000 has extremely high cost-effectiveness

I won't bet on ETH to further decline. It may decline further, but it's best to focus on finding future buying opportunities. Don't cry because it's over. I'm neither bullish nor bearish on ETH. I think it's not clear where it's going next, and the risk/return of betting on it may not be very good.

Regardless of what happens in the short term, Bitcoin below $50,000 has extremely high cost-effectiveness.

Jeremy Allaire, Co-founder and CEO of Circle: Still bullish, focusing on technology, industry, and adoption

I'm still bullish (on the crypto industry) as I was six weeks ago. Focusing on technology, industry, and adoption. When facing global macro volatility, don't focus on the prices of digital commodities unless you're here to trade.

Bitwise CEO: The current moment is the beginning of an "incredible bull market" for Bitcoin

Although it's hard to imagine, when looking back in the future, the current moment will be seen as the beginning of an "incredible bull market" for Bitcoin. With falling interest rates and imminent concerns about economic recession, a large amount of USD invested in stocks and fixed income will seek to flow into other assets.

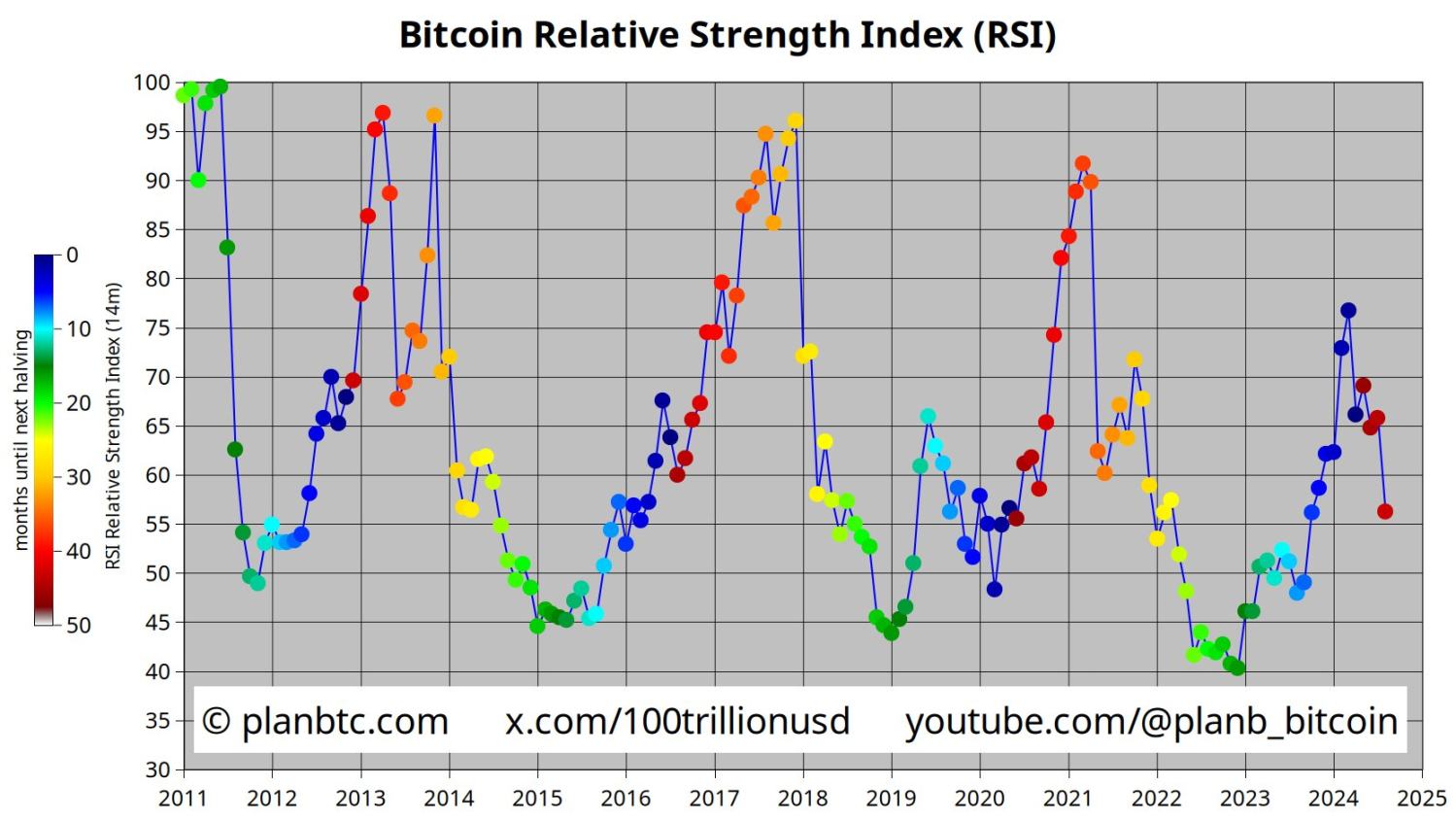

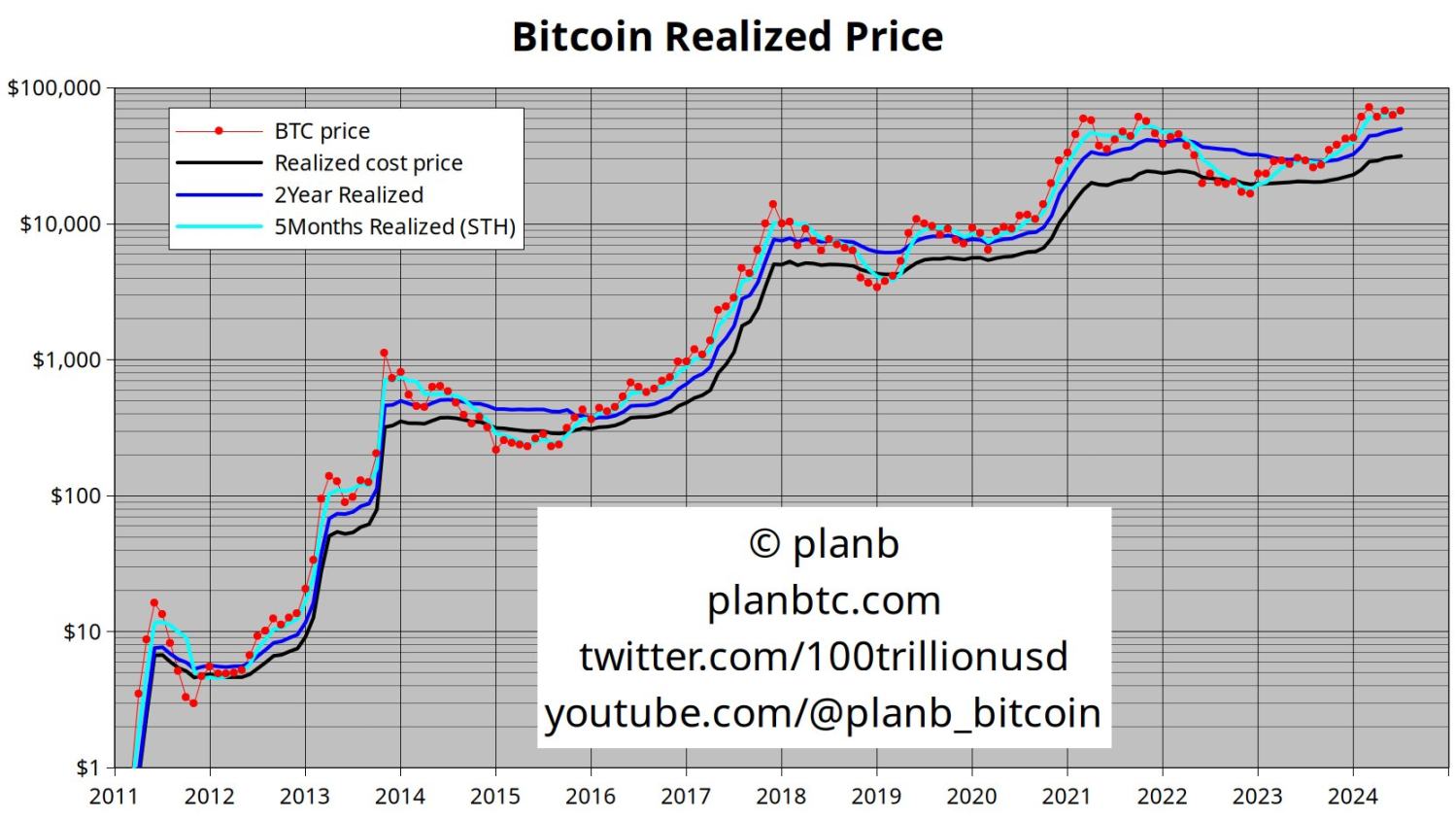

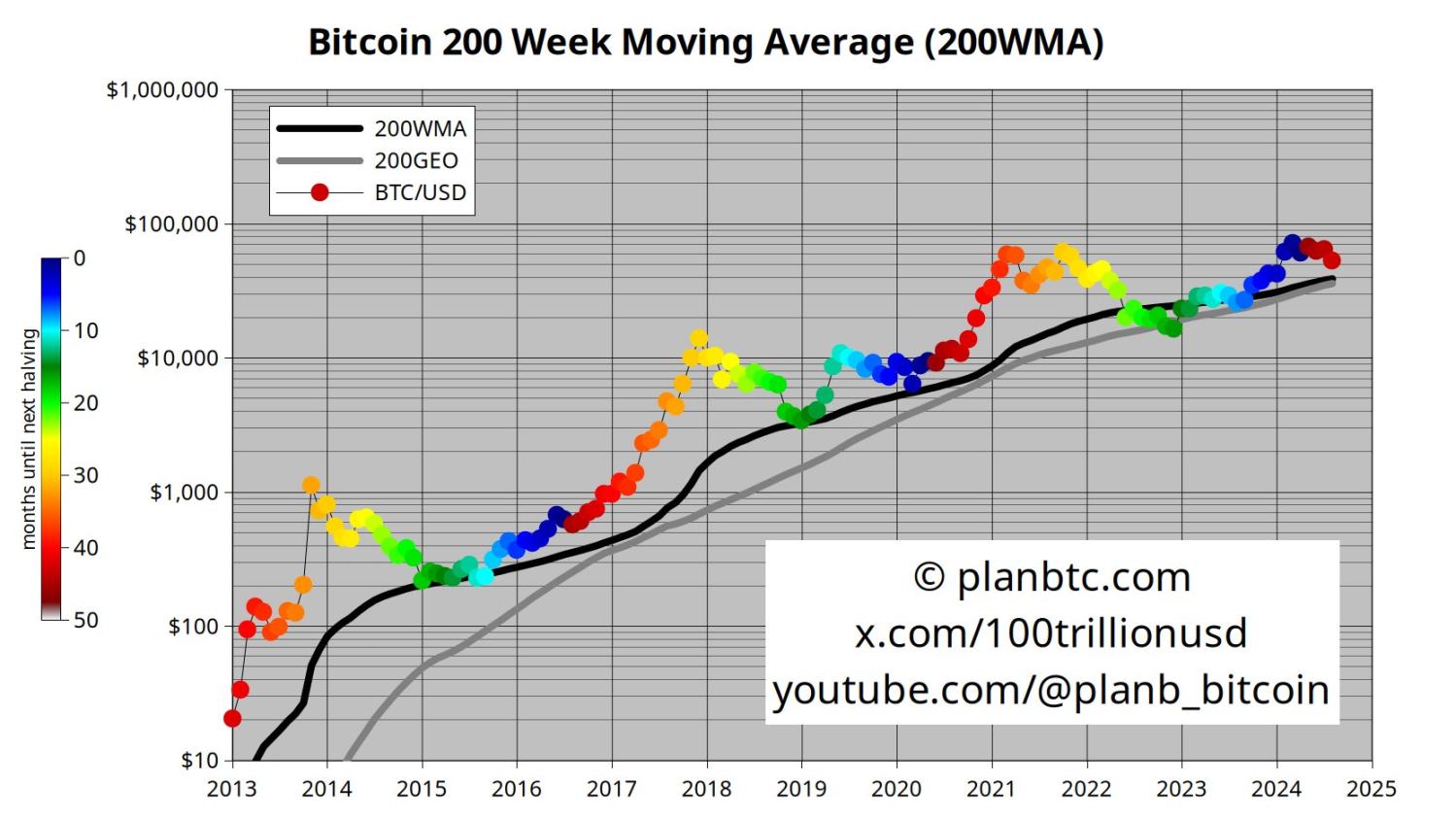

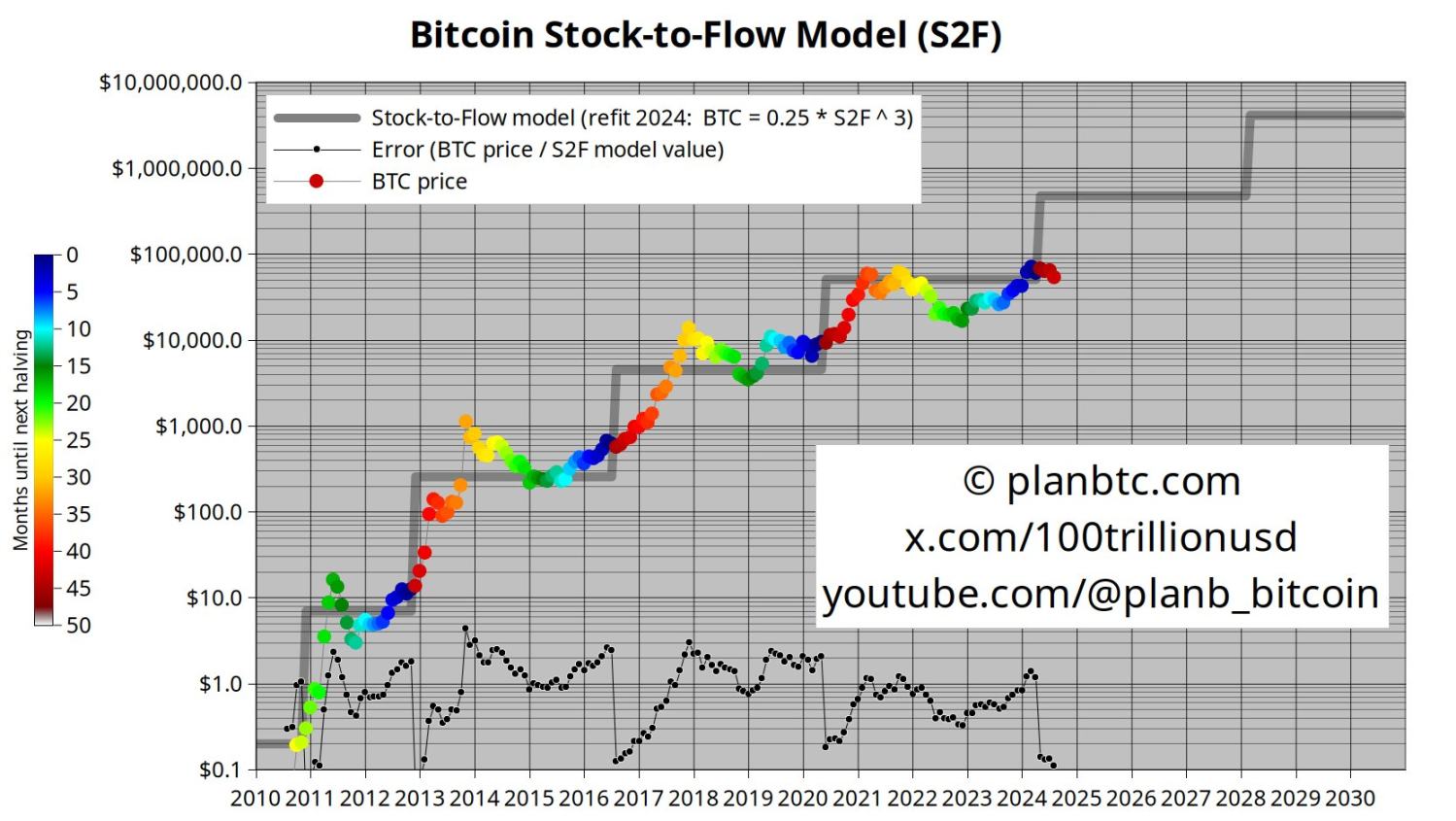

Quantitative analyst PlanB: 20% chance of going to zero, 80% chance of rising to $1 million

Most of you know that my Bitcoin strategy is: let it fall to zero or rise to $1 million. I make models and charts because they help me understand our situation in these scenarios (zero and $1 million). My view is: high volatility, but higher trend, 20% chance of going to zero, 80% chance of rising to $1 million.

Arthur_0x, CEO of DeFiance Capital: The market will enter a period of low liquidity in the coming weeks, but it's the best investment opportunity

This is remarkably similar to the cryptocurrency crash triggered by macro traditional financial weakness in March 2020, albeit on a slightly smaller scale. The market will enter a period of low liquidity in the coming weeks, but generally, if you have cash to buy, you will find the best investment opportunities here. Some major players who have been marginalized and missed entry opportunities this year will take advantage of this opportunity to enter the market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。