London's Lloyd's provides digital asset protection insurance through the Ethereum public chain.

By Aiying

Lloyd's of London, with a history of over 300 years, now provides digital asset protection insurance through the Ethereum public chain. These insurances can be paid directly on the chain with cryptocurrency, simplifying the heavy paperwork of intermediaries and improving efficiency. Evertas and smart contract insurance provider Nayms played a key role in this process.

Lloyd's of London is one of the world's most famous insurance markets, founded in 1686. As a global insurance and reinsurance market, Lloyd's is not an insurance company, but a market composed of multiple insurance companies and individual underwriters, known as "Names." Lloyd's provides a platform for underwriting various risks, including shipping, aviation, natural disasters, and other complex and high-risk areas.

The uniqueness of Lloyd's lies in its underwriting method and operating model. Each underwriter (or "member") underwrites risks through Lloyd's syndicates, which are managed by managing agents. Lloyd's structure allows underwriters to spread risks among multiple members, thereby increasing underwriting capacity and stability.

Evertas is an insurance platform focused on the cryptocurrency field, recently obtaining underwriting status from Lloyd's of London, becoming the first underwriter of Lloyd's to provide insurance for digital wallet products. This status enables Evertas to write and manage policies in different regions and specific areas, and to write policies on behalf of Lloyd's member company Arch Insurance. Arch Insurance is also the sponsor of Evertas' underwriting application.

Hank Watkins, President of Lloyd's Americas, stated: "Approving Evertas' underwriting application is the result of Arch Insurance's collaboration with its new distribution partner, aiming to promote growth in an industry hindered by the lack of risk transfer options."

J. Gdanski, CEO of Evertas, stated that their goal is to enable people using public blockchain infrastructure to seamlessly connect with traditional fiat institutions. Whether paying with USDC or local cryptocurrency, or placing policies entirely on the chain, blockchain can help coordinate the work between brokers, insured parties, and insurance companies.

Nayms is a digital marketplace focused on connecting brokers and underwriters with cryptocurrency capital investments, named after the "Names" of Lloyd's, the individuals and companies underwriting risks at Lloyd's. Evertas also provides insurance for custodians, exchanges, and Bitcoin mining. Last year, Evertas acquired mining insurance expert Bitsure and provided policies with limits of up to $200 million for each cryptocurrency mining facility.

Nick Selby, Evertas' head of underwriting in Europe, stated that they have introduced expertise in the cryptocurrency field into the underwriting process, gaining a deep understanding of the risks underwritten, enabling them to clearly define the scope of underwriting and to pay claims more quickly.

Specific Products

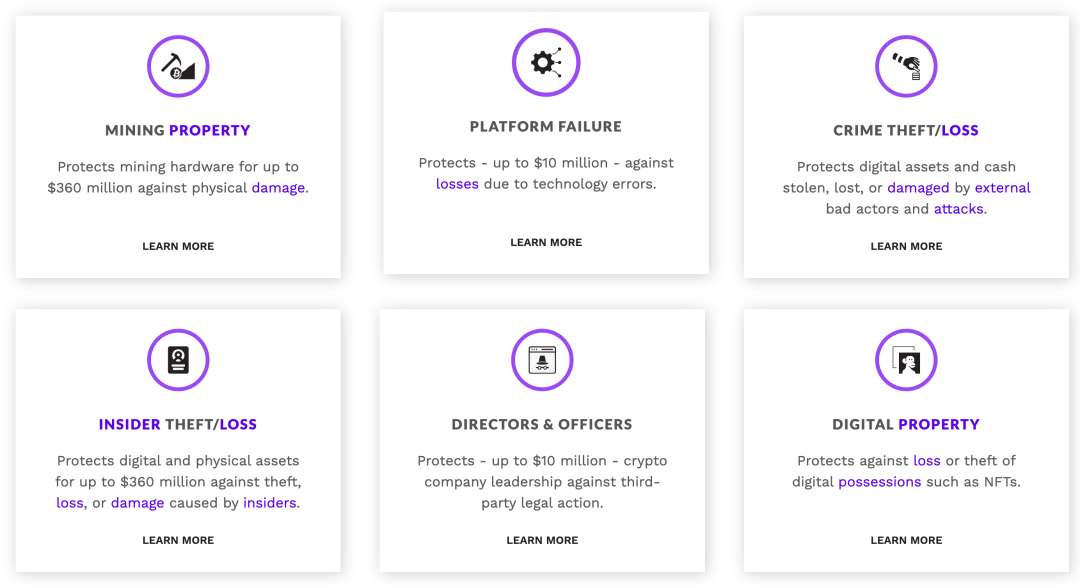

According to Aiying, it is learned that they currently offer six main insurance products, detailed as follows:

1. Mining Property Insurance

Protects mining hardware and facilities from physical damage. This type of insurance is designed specifically for Bitcoin mining farms, covering equipment damage and business interruption caused by natural disasters such as fire, flood, and earthquake. The policy limit can be as high as $360 million.

2. Platform Failure Insurance

Provides protection against losses caused by technical errors (such as software or hardware failures). This insurance helps companies deal with system crashes, server failures, and other technical issues, ensuring financial security in the event of a technical failure, with a maximum coverage of $10 million.

3. Theft / Loss Crime Insurance

Protects digital assets and cash from theft, loss, or damage caused by external malicious acts and attacks. This insurance covers all types of digital asset storage methods, including cold storage, warm storage, and hot storage, ensuring asset security in the event of external attacks.

4. Internal Theft / Loss Insurance

Provides protection against theft, loss, or damage of digital and physical assets caused by internal employees and contractors. This insurance aims to prevent internal threats and ensure compensation for unlawful behavior within the company.

5. Directors and Officers Liability Insurance

Protects company leadership from the impact of third-party legal actions, including directors' and officers' liability, company indemnification, and company liability. This insurance ensures the financial security of directors and officers in legal proceedings and compliance issues, with a maximum coverage of $10 million.

6. Digital Property Insurance

Protects digital assets such as NFTs from loss or theft and addresses valuation challenges. This insurance considers the uniqueness and rarity of each asset, ensuring accurate assessment and compensation for losses in the event of theft or loss.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。