This article will summarize and look ahead to three aspects of the analysis of Sweden's cryptocurrency policy and provide an outlook on its future development trends.

Author: TaxDAO

1. Introduction

The Kingdom of Sweden (Swedish: Konungariket Sverige), commonly known as Sweden (Sverige), is a Nordic country located on the Scandinavian Peninsula. It is one of the largest economies in the Nordic region, with a GDP of 593.12 billion US dollars in 2023 and a per capita GDP as high as 56,291 US dollars, demonstrating its high standard of living and economic potential. In recent years, despite facing challenges of high taxation and government deficits, Sweden has maintained a strong social welfare system, providing comprehensive protection for its citizens from cradle to grave. In addition, Sweden's entrepreneurial environment is very friendly, and the government's emphasis on education and technological innovation has promoted the vigorous development of scientific research and "unicorn" enterprises. Cryptocurrencies in Sweden have also experienced rapid growth due to the relatively relaxed environment, with increasing trading volumes. Sweden's cryptocurrency policy not only affects the stability and development of its domestic financial market but also holds significant importance for international investors and businesses. This article will analyze Sweden's cryptocurrency policy and provide an outlook on its future development trends from three aspects: Sweden's basic tax system, cryptocurrency tax system, and Sweden's cryptocurrency asset tax system.

2. Overview of Sweden's Basic Tax System

2.1 Swedish Tax System

Sweden implements a dual-level taxation system consisting of central and local taxation. The tax authorities are composed of the National Tax Agency and regional tax offices. The National Tax Agency is responsible for issuing tax regulations, administrative interpretations of tax regulations, tax proposals, and managing tax policies of regional tax offices. Regional tax offices are responsible for the specific collection of central and local taxes. There are 10 regional tax agencies under the National Tax Agency, and three of them, Stockholm, Malmo, and Gothenburg, have large enterprise tax collection management offices. All levels of tax authorities enforce tax laws independently and are not subject to interference from the government or parliament. All tax laws in Sweden are enacted by the parliament, which has a tax committee specifically responsible for tax matters. Sweden's tax system is primarily based on income tax, with value-added tax (VAT) also being an important source of tax revenue. Major tax types include personal income tax, corporate income tax, VAT, excise tax, social security tax, property tax, inheritance and gift tax, among others.

2.2 Income Tax

Swedish income tax is divided into corporate income tax and personal income tax.

The tax subject for Swedish corporate income tax is Swedish resident enterprises, which are subject to a fixed tax rate of 21.4%. In Sweden, companies are classified as resident and non-resident enterprises. Sweden adopts the registration standard, which determines whether an enterprise is a resident enterprise based on whether it is registered with the national and local governments. According to this standard, any enterprise registered in the country under national law, regardless of whether its headquarters, management, and control center are located in the country, and regardless of whether its investors are Swedish or foreign, can be considered a resident enterprise. If not registered, a company can still be considered to have resident status if its actual management is located within Sweden, or if the company needs to pay taxes in Sweden due to residence, management, or similar reasons, it is considered to have resident status for the purpose of tax treaties. In regions enjoying special support from the Swedish government, enterprises can deduct 10% of the social security tax paid for employees before corporate income tax. Additionally, companies can set aside a "tax distribution reserve" of up to 25% of pre-tax profits each year. This reserve can be used to offset losses in future years, and if no losses are offset within six years after withdrawal, the amount must be included in the taxable income and tax must be paid on it.

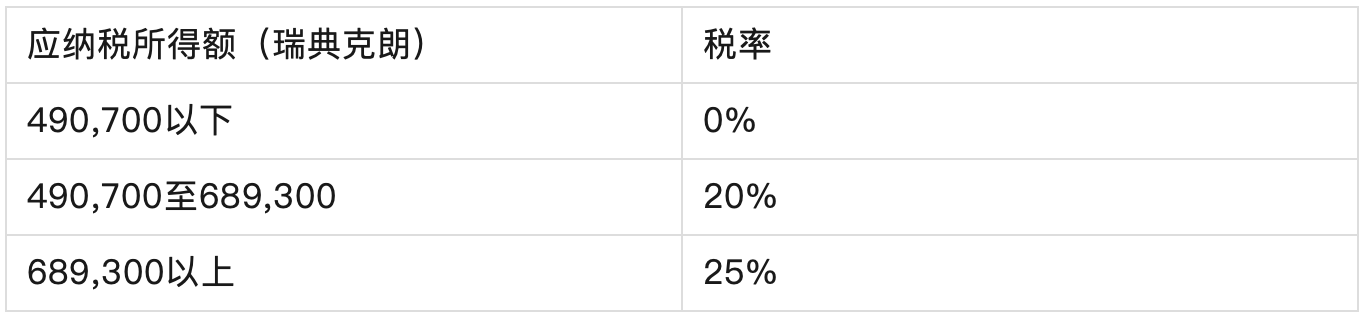

The tax subject for Swedish personal income tax is resident taxpayers, referring to natural persons who have a residence or habitual residence in Sweden, and are subject to personal income tax on their worldwide income in Sweden. Taxable income includes employment income, business income, and investment income. Non-resident taxpayers in Sweden, who have neither residence nor habitual residence in Sweden, are only subject to personal income tax on income derived from Sweden. For employment income and business income, taxpayers can deduct personal allowances before calculating municipal income tax and national income tax. If a taxpayer receives income related to the previous two years or the following two years (including the current year) in the current tax year, and the income is at least 50,000 Swedish kronor, the income needs to be adjusted across years. The specific progressive tax rates are as follows:

Investment income refers to the income obtained by disposing of assets minus the cost of acquiring the assets. This type of tax is called capital gains tax, and the method of calculating income varies depending on the form of capital gains. Except for gifts and inheritance, tax must be paid on asset sales, exchanges, and transfers. The fixed tax rate for investment income is 30%, and local governments do not tax investment income.

2.3 Value-Added Tax (VAT)

The Swedish value-added tax is known as MOMS, and the taxpayer is any entity or individual engaged in any economic activity in Sweden, excluding individuals under employment contracts or other legal forms of employment. Legal entities that have registered for VAT and purchase specific services from outside Sweden are also considered VAT taxpayers. Economic activity refers to activities conducted by producers, traders, or service providers, including mining, agriculture, or similar professions. Since January 1, 2017, small businesses with annual sales not exceeding 30,000 Swedish kronor in the current tax year and the previous two fiscal years are exempt from VAT, but small businesses can also choose to register as VAT taxpayers. Non-profit organizations of a benevolent nature and registered religious groups are considered non-tax residents and are exempt from VAT. This provision also applies to partnerships and trading companies. Taxable events for VAT include all sales of goods and provision of services, except for goods or services explicitly exempt from taxation under Swedish law, as well as import and intra-EU acquisitions. The standard VAT rate in Sweden is 25%, consistent with the EU VAT directive. Certain specific goods and services may be subject to lower preferential tax rates, such as 12% (restaurants and restaurant services; food; sales of artists' or artists' property of their own works; import of art, collectibles, and antiques, etc.) and 6% (books, newspapers, magazines, etc.; passenger transport services; admission fees for circuses, cinemas, or theater performances; zoo admission fees, etc.).

3. Sweden's Cryptocurrency Tax System

In Sweden, investors can directly purchase Bitcoin and other cryptocurrencies through websites such as Safello, btcx, and Trijo, or through online banks such as Avanza and Nordnet. The btcx platform, operated by Goobit, has approximately 200,000 Swedish customers. For emerging technologies like cryptocurrencies, Sweden's tax system demonstrates advanced and friendly attitudes, providing a transparent and predictable tax environment that helps businesses achieve long-term growth, maintain their commercial reputation, and build trust among investors.

The Swedish Tax Agency (Skatteverket), as the leading authority for national taxation, is not only responsible for tax collection and management but also protects society from tax abuse by enforcing tax regulations. In the field of cryptocurrencies, the Swedish Tax Agency has clearly classified income from cryptocurrencies as capital gains, a subcategory of income tax, subject to a 30% tax rate. This clear tax guidance provides a clear path for cryptocurrency enterprises and individual investors to comply with tax laws. For example, when a Swedish resident sells their held cryptocurrencies and realizes a profit, this profit is taxed as capital gains, whether it is from selling on the trading market, mining activities, or receiving goods or services payments in cryptocurrency form. All such income must be detailed in the annual tax return. Taxpayers are required to provide detailed information for each transaction, including purchase and sale dates, realized profits or losses, and must convert them to Swedish kronor (SEK) based on the exchange rate on the transaction date.

To ensure the accuracy of tax reporting, taxpayers need to closely monitor exchange rate fluctuations, as even small transactions may have significant tax implications due to exchange rate fluctuations. In addition, if taxpayers incur losses in cryptocurrency transactions, these losses can be used to offset other capital gains, thereby reducing the taxable base. However, this process must comply with specific rules and limitations, and taxpayers should consult professional tax advisors to ensure compliance.

In special cases, such as income generated from cryptocurrency mining or participation in staking and decentralized finance (DeFi) activities, it may also be considered personal business income and subject to different tax rates based on the individual's total income. Additionally, while most cryptocurrency transactions are taxable, specific cryptocurrency activities may qualify for tax exemptions or exclusions under certain circumstances.

In recent years, the Swedish Tax Agency (Skatteverket) has enhanced tax standards through close cooperation with EU tax authorities and international organizations, ensuring fairness and transparency in tax policies. As a member of the OECD, Sweden actively follows OECD tax rules and has introduced new measures in the cryptocurrency tax field, such as adopting the Crypto Asset Reporting Framework (CARF), which requires cryptocurrency enterprises to automatically report tax-related information and share data internationally. In 2022, the new amendment to the DAC proposed by the European Commission aligns with the objectives of CARF, introducing new rules for all cryptocurrency service providers within the EU, consistent with the MiCA regulation and anti-money laundering directives, enhancing the detection of tax evasion and fraudulent activities. Additionally, in April of this year, the Swedish Tax Agency conducted investigations into 21 cryptocurrency mining companies and found that 18 of them provided misleading information to evade taxes, resulting in a demand for payment of over 990 million Swedish kronor in taxes. This demonstrates Sweden's strict enforcement of cryptocurrency-related tax regulations.

4. Summary and Outlook of Sweden's Cryptocurrency Tax System

Sweden is at the forefront of global financial innovation and is actively shaping an open and regulated market environment for cryptocurrencies. It is expected to continue strengthening supervision in this area. Sweden may enhance cooperation with other EU countries and international organizations to improve global compliance with cryptocurrency taxation through information sharing and best practices. In the future, the Swedish government may explore innovative incentive measures, such as providing tax relief for companies actively reporting cryptocurrency transactions or offering financial subsidies to companies investing in cryptocurrency-related technology research and development, promoting tax compliance and driving the development and application of cryptocurrency technology. Sweden may consider providing tax offsets for businesses adopting blockchain technology to enhance transparency and efficiency, or offering research and development funding for startups developing secure cryptocurrency storage solutions. These policies will help cultivate an innovation-friendly business environment while ensuring that tax regulations are respected and enforced.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。