Author: Deep Tide TechFlow

A butterfly flapping its wings in Brazil may lead to a tornado in Texas a month later.

On July 31, the Bank of Japan raised its policy interest rate from around 0% to 0.25%, marking the first rate hike since Japan ended its negative interest rate policy in March this year.

Over the past month, the yen has risen by about 8% against the US dollar. With the expectation of narrowing interest rate differentials between the US and Japan, the trend of arbitrage trading reversal is triggering a large-scale "liquidation" globally.

Some financial markets around the world are experiencing a Black Monday.

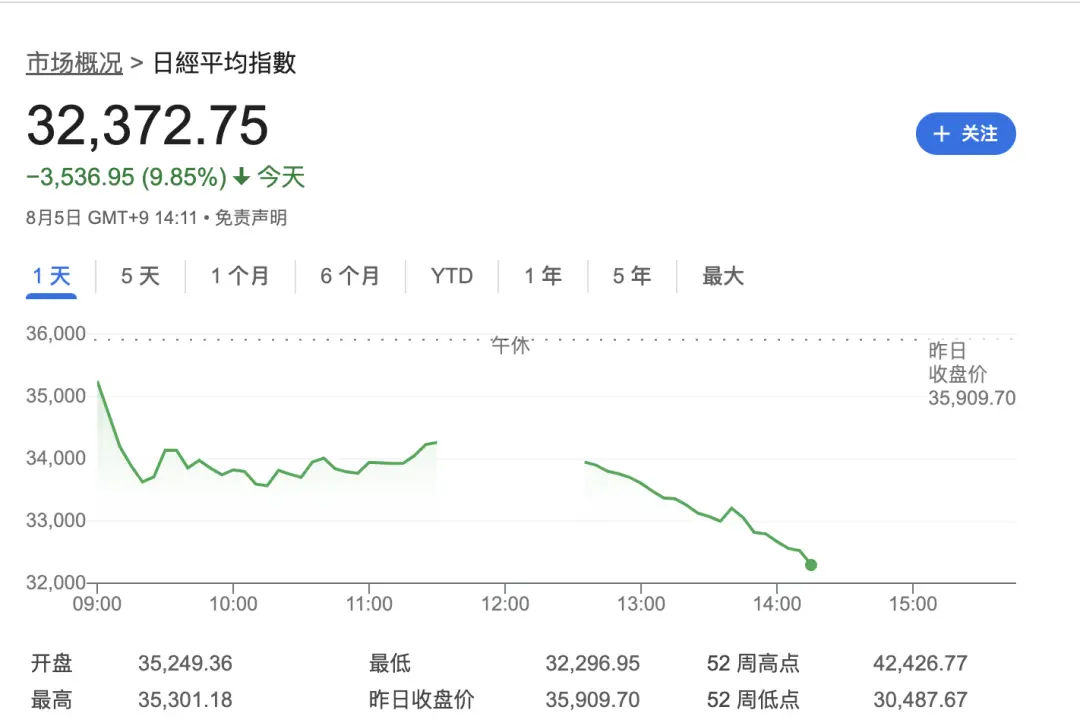

The Japanese stock market saw an epic plunge, with the Nikkei index plummeting by 9%, and the TOPIX index triggering circuit breakers twice, marking the largest single-day drop in eight years.

The stock markets in South Korea and Taiwan were not spared.

The Korean market also opened with a drop of over 4%, and Samsung's stock price fell by 5%, marking its largest drop since 2020. The Korean exchange implemented temporary trading halts.

US stock futures continued to decline, with Nasdaq 100 index futures widening their decline to 2%. The yield on the US 2-year Treasury bonds fell by 9 basis points to its lowest level since May 2023, and the US dollar index fell to around 103. It is foreseeable that tonight's US stock market will be another bloodbath.

However, the most devastating impact is seen in the cryptocurrency market.

Bitcoin fell to around $54,000 at one point, and Ethereum fell to around $2,100, with a nearly 20% decline in a single day, resulting in $800 million in liquidations within 24 hours, causing the entire cryptocurrency market capitalization to drop below $2 trillion.

In retrospect, this global market crash may have been caused by the reversal of the yen arbitrage combined with the turmoil in the Middle East.

What is yen arbitrage trading?

Currency arbitrage trading is a type of carry trade, which involves borrowing in a currency with a low interest rate and investing in financial assets with higher interest rates or expected returns.

Due to Japan's consistently low interest rates, market participants borrow funds at low rates in Japan, exchange them for other currencies such as the US dollar, and invest in assets in countries with higher interest rates.

The peak of yen arbitrage trading began in 2004. To stimulate economic recovery, the Bank of Japan implemented a "zero interest rate" policy from March 2001 to July 2006. During this period, interest rates in Europe and the US were frequently raised, leading to higher interest rate levels. Investors borrowed yen and purchased US dollars, euros, and other high-yield currencies in the foreign exchange market for investment in stocks, real estate, and other markets, or directly purchased high-yield assets denominated in these high-yield currencies, profiting from these activities.

Yen arbitrage trading has historically supported bull markets in global stock markets, allowing cheap currency funds to be invested elsewhere.

A typical example is Warren Buffett borrowing yen to buy shares of Japanese trading companies last year, completely hedging the risk/return of the yen exchange rate, and focusing on the stable cash flow of large Japanese trading companies.

Even under the impact of US dollar interest rate hikes, the US stock market has continued to maintain a "bull market" and reach new highs, benefiting from yen arbitrage trading, which has provided ample liquidity.

Bitcoin is no exception, as it has also benefited from the long-term depreciation of the yen.

In May, BitMEX founder Arthur Hayes wrote an article advocating for Bitcoin, believing that the weakness of the yen could push Bitcoin to $1 million.

Arthur pointed out that the USD/JPY exchange rate is one of the most important global economic variables, and the complex currency policy interactions among the US, China, and Japan, as well as their profound impact on the global economy, affect the trends in the cryptocurrency market.

When referring to the situation where the interest rate differential between the US and Japan widened and the yen continued to depreciate, Arthur mentioned that the Bank of Japan would not be willing to raise interest rates because it is the largest holder of Japanese government bonds. When interest rates rise, bond prices will fall, meaning that the Bank of Japan will incur the greatest losses. However, if the Bank of Japan does not raise interest rates and the Federal Reserve does not lower interest rates, the interest rate differential between the US dollar and the yen will still exist. In the case of higher US dollar yields than the yen, investors will continue to sell the yen, leading to further depreciation of the yen.

"Faced with the depreciation of global fiat currencies, Bitcoin is the best-performing asset, and they know this. When measures are taken against the weakness of the yen, I will mathematically predict how the funds flowing into the Bitcoin complex will push the price to $1 million, or even higher," Arthur predicted.

However, the situation developed contrary to Arthur's prediction, as the yen did not continue to depreciate; instead, the Bank of Japan began to raise interest rates.

According to historical records, each reversal of yen arbitrage trading may trigger a crisis, as a major side effect of yen arbitrage trading is to fuel asset bubbles in relevant countries and markets, especially in emerging market countries.

A massive amount of yen funds is widely distributed in world stock markets, currency markets, and commodity markets, becoming an important force influencing global market trends, and its rapid flow in the global market has cast many shadows over the international financial market. It is for this reason that both the International Monetary Fund and the Bank for International Settlements have repeatedly warned of the dangers of yen arbitrage trading.

The International Monetary Fund (IMF) has published a report studying the relationship between yen arbitrage trading and the subprime crisis. The report points out that the end of yen arbitrage trading often leads to fund withdrawals, triggering a global decline in asset prices, and as financial institutions deleverage, it will lead to credit tightening.

Specifically, the impact of the reversal of yen arbitrage trading is mainly reflected in the following aspects:

Asset price fluctuations: The unwinding of yen arbitrage trading leads to the withdrawal of funds from high-yield risky assets, which usually triggers a decline in asset prices.

Credit market tightening: When financial institutions begin to unwind yen arbitrage trading, they need to reduce leverage by selling assets and repaying debts, leading to reduced liquidity in the credit market and further credit tightening.

Change in risk appetite: The "fear index" VIX is negatively correlated with the scale of yen arbitrage trading. When market participants expect low risk and high returns, the scale of yen arbitrage trading increases, and vice versa.

Exacerbation of the subprime crisis: As financial institutions unwind their arbitrage trading positions, the prices of subprime-related assets further decline, exacerbating credit market tightening and financial institution losses.

Recently, the sharp decline in US stocks led by the technology sector largely indicates a significant unwinding of arbitrage trading.

According to a report released by Citigroup analysts Osamu Takashima AC, Daniel Tobon, and Brian Levine, the threshold for the reversal of the US dollar against the yen from an upward trend to a downward trend is approximately 4.75% in the US-Japan interest rate differential. Currently, this differential is about 5.25%, and it may require the Federal Reserve to cut interest rates three times to reach this level, a process that may take about six months.

Respect the market and risk!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。