Writing: WOO

Background

In this round, meme coins dominate the market, with little interest in DeFi and related "practical" tokens. The total DeFi lock-up amount in the market is approximately 182 billion US dollars, which is still about 40% away from the new high of 300 billion US dollars at the end of 2021. This indirectly proves that in the current continuous market highs, the DeFi sector has failed to keep up.

However, in the cryptocurrency market, DeFi is one of the few tracks that can generate real income and is the cornerstone of the overall market liquidity. Although the price performance may not be as strong as that of emerging meme coins, the old blue-chip DeFi projects still play an important role in the market, with Aave, MakerDAO, and Uniswap being the top three protocols in terms of total lock-up amount, and also the absolute leaders in this track.

How have they managed to stand firm in the ever-evolving cryptocurrency market? What major updates have they made? Do they still have growth potential in the future? WOO X Research will provide answers in this article.

Aave

Current Situation

Aave, which started as ETHLend in 2017, was renamed Aave in 2018, deployed the initial version of smart contracts on Ethereum and launched Aave V1 in 2019, followed by Aave V2 at the end of 2020, and Aave V3 in March 2022.

Aave V3 supports cross-chain lending, improves capital utilization through an efficient mode, and supports isolated asset lending. This version also allows setting limits for borrowing and depositing, updates the liquidation mechanism, and can provide various reward tokens.

The current Total Value Locked (TVL) is 220 billion, making it the second largest locked project in the overall cryptocurrency market, second only to Lido, and it supports 12 blockchains, providing an unlicensed lending platform for everyone. It is also the preferred place for whales to go long or short using lending.

In addition to the lending function, Aave also launched its stablecoin GHO in July 2023, which is over-collateralized stablecoin. The stability mechanism is as follows:

- When the GHO price is higher than the peg, users can create 1 GHO worth $1 using collateral and then sell it at a higher price, making a profit and bringing the GHO price back down.

- When the GHO price is lower than the peg, users can buy 1 GHO at a price lower than $1 in the market, then use it to repay $1 of debt, reducing the supply of GHO and increasing the price.

Furthermore, GHO uses assets from Aave V3 as collateral to mint on the Ethereum market. In addition, Aave stakers (stkAAVE holders) have several main benefits compared to regular users:

- Lending rate discount: For every 1 stkAAVE staked, users can enjoy a discount on borrowing up to 100 GHO. The discounted borrowing rate will be lower than the standard rate. For example, if the standard borrowing rate is 7.25%, stakers of AAVE can enjoy a rate of 5.08%.

- Reward program: Stakers can receive regular rewards through the Merit program, with the current reward rate at 3.58%.

The current market value of GHO is $102 million, which is comparable to the market value of crvUSD.

However, the good performance of the product does not necessarily translate to good token price performance, as the $Aave token is not closely related to the protocol itself and mainly empowers governance. Its trend has lagged behind Ether for the past year.

Recent Updates

On July 25th, the governance representative ACI of the Aave official team proposed a new economic model for Aave, with a high probability of the proposal passing.

The main contents are:

Launch of the Umbrella Atokens security module:

- AToken defense mechanism: Previously, Aave's security module involved selling off the collateralized assets to repay the debt. Now, a new category of Atokens has been added to protect the assets. In the event of a shortage, these tokens will be confiscated to destroy the debt, and the collateralized assets will be destroyed instead of sold off. This can improve the efficiency of the system.

- Incentivizing user borrowing: About 80% of Aave users only deposit funds in the protocol without borrowing. They mainly do so to earn liquidity rewards and believe that the Aave protocol is secure enough to hold assets for the long term. To attract users to borrow, more medium-term incentives are provided to encourage these users to participate in the Umbrella security module. These incentives are mainly provided in the form of rewards using their respective aTokens, funded by the reserve factors of the relevant assets.

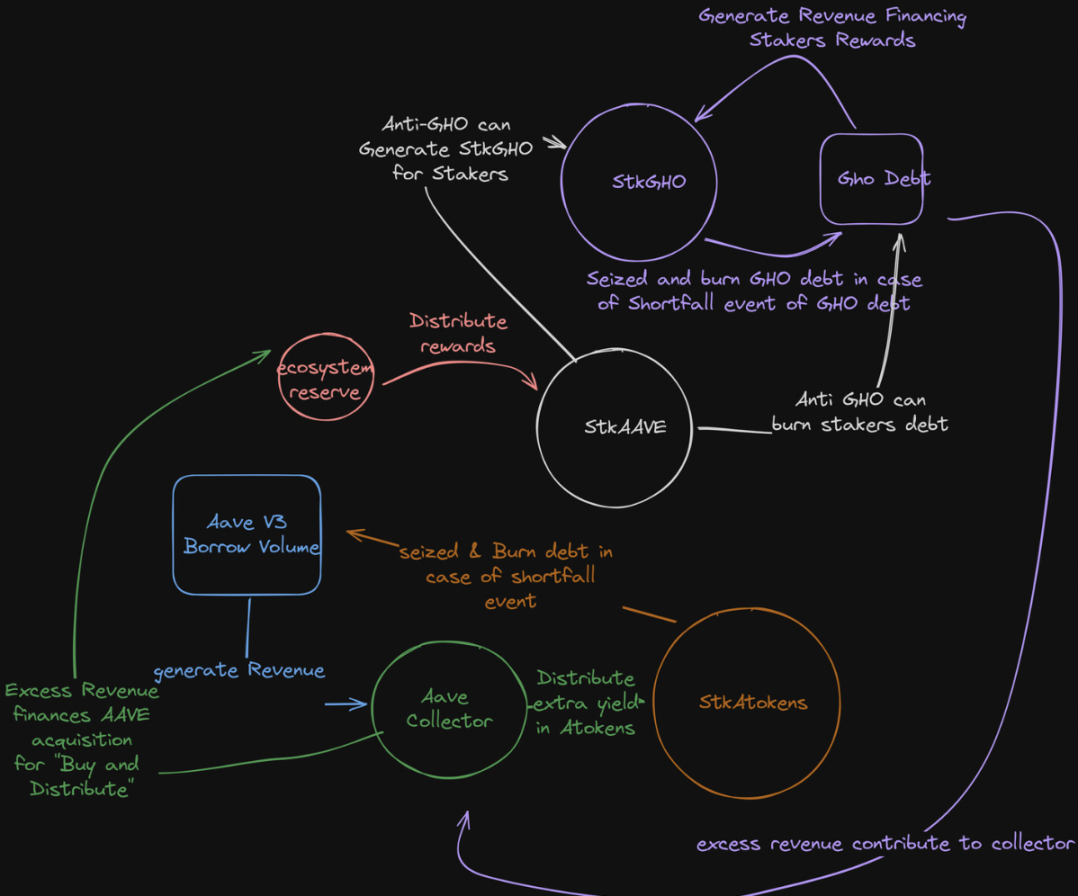

Aave buyback plan operates as follows:

- Income generation: Income generated from Aave V3 lending enters the Aave Collector.

- Income distribution: Part of the income is used to purchase AAVE tokens and distribute them to the ecosystem reserve. Another part of the income is distributed in the form of Atokens to StkAtokens holders.

- Security guarantee: In the event of a fund shortage, the collateralized StkAAVE and StkGHO tokens will be confiscated and destroyed to repay the debt. Anti-GHO provides additional security by generating StkGHO for pledgers and destroying their debt when needed.

- Reward distribution: Pledgers (such as StkAAVE and StkGHO holders) will receive rewards based on their contributions, which come from the income generated by the protocol.

This operating mechanism ensures the stability and security of the Aave protocol while providing continuous rewards to users.

Subsequent Impact

The biggest impact is that the protocol's performance is directly linked to the price of Aave. Whenever lending occurs, the protocol will automatically purchase Aave on the secondary market, undoubtedly injecting a long-term boost into the development of Aave's token price.

For holders, the introduction of the Umbrella Atokens security module and its profit-sharing mechanism can increase the willingness to stake, adding security to the protocol.

The current proposal is still in the early stages, and its substantial impact on the token price is not immediate. Many adjustments and discussions are still needed. However, it can be foreseen that if the proposal is approved, it will make the protocol itself more secure, attracting more funds into the protocol, and the real income generated will also drive the Aave token price.

MakerDAO

Current Situation

Founded in 2014, the first MakerDAO official whitepaper was released in December 2017, introducing the initial Dai (then known as Sai) stablecoin system. At that time, ETH was the only accepted collateral asset in the system, and the generated Dai was called Single Collateral Dai (SCD) or Sai. The whitepaper also included a plan to upgrade the system to support various collateral asset types other than ETH, a wish that was realized in November 2019.

Currently, Dai is the largest decentralized stablecoin and in the last bear market, it also introduced the US Treasury yield, becoming one of the representative projects in the RWA sector. In terms of internal development, it also established Spark Protocol and Summer.fi, both of which are decentralized lending platforms. The former is a subDAO where users can use assets such as ETH, stETH, and sDAI to obtain DAI loans. The latter is a lending yield aggregation platform where users can amplify their existing assets' yields.

In external investments, MakerDAO has invested in Multis and Opolis, with the former being a Web3 enterprise blockchain solution and the latter being a DAO solution.

It can be said that MakerDAO has diverse business tentacles in the crypto industry, actively seeking opportunities both internally and externally.

As the governance token, MKR can vote on projects including adjusting the DAI reserve rate, increasing the collateralizable cryptocurrency fund pool, and adjusting risk parameters.

In addition to the governance token, Maker is also used to pay the stable fee for redeeming assets. When users wish to redeem the originally collateralized assets, they must also pay a fee in Maker. This stable fee payment will be used to repurchase Maker on the market and destroy it to maintain scarcity.

In terms of price, due to factors such as enjoying the RWA track dividend, the price performance of MKR in the past year has not differed much from Ether.

Recent Updates

On May 16th, MakerDAO founder Rune Christensen announced on Twitter that a major upgrade of the DAI stablecoin will be carried out. The reason is that he believes it is not feasible to achieve scalability with the US dollar, maintain pure decentralization, and expand scale at the same time.

However, Rune still hopes for widespread adoption and maintaining decentralization. He expects to launch two stablecoins:

- NewStable: A compliant stablecoin

- PureDai: Completely decentralized stablecoin

NewStable: A compliant stablecoin

Following the development trajectory of Dai, with a focus on practicality and adoption, NewStable is still a decentralized stablecoin, with its governance making it as flexible and transparent as possible, using decentralization as a means to achieve practical goals.

NewStable will take over Dai's RWA and tradfi business and will continue to be attached to Maker, gaining the token economy, growth focus, and governance functions of Endgame.

The addition of a freeze function is to ensure that NewStable can safely achieve global scale. The freeze function will not be implemented at launch, but the token will have upgradeability for later implementation through governance voting. As NewStable is adopted by the mass market, this will lead to higher security, stability, and reliability of using large-scale RWA collateral.

After an initial transition period (currently estimated to be at least 1 year) following the launch of NewStable, the DSR (DAI Savings Rate) will gradually be phased out, with the fee rate gradually decreasing over time. Eventually, yield will only be available on NewStable.

PureDai: Completely decentralized stablecoin

PureDai will only use purely decentralized collateral such as ETH and stETH, without including more centralized assets like USDC.

In addition, PureDai has a freely floating benchmark price (not necessarily pegged to the US dollar) and is accompanied by a highly decentralized oracle system. This mechanism will absolutely not be subject to any organization, including MakerDAO's modifications.

To minimize the legal compliance risk of PureDai, it will be released in its final immutable contract form. Once PureDai is issued, its contract will not and cannot be further upgraded or changed, and will be completely independent of Maker's control. Rune believes that it will take at least a few years to launch the contract.

*NewStable and PureDai can be converted to and from Dai at any time

(2) On July 17th, MakerDAO founder Rune Christensen announced on a community platform that MakerDAO is launching the NewGovToken activation feature.

When the Spark subDAO is launched, NewGovToken holders will be able to activate their NewGovToken to receive SPK rewards. The NewGovToken activator will receive 15% of all SPK token rewards.

NewGovToken can be obtained by exchanging MKR at a ratio of 1:24,000, and will be launched after Endgame. Activating NewGovToken has no lock-up period or additional risk and can be canceled at any time.

(3) On July 13th, MakerDAO announced its plan to invest $1 billion from its reserves in tokenized US Treasury products. Top participants in the field, including BUIDL from BlackRock, Superstate, and Ondo Finance, have expressed their willingness to actively participate in this plan. MakerDAO's plan means that its reserve strategy will undergo a major adjustment, partly supporting its decentralized stablecoins, which are backed by a series of US government bonds and notes held off-chain by a range of partners.

Subsequent Impact

From MakerDAO's recent development direction, it can be seen that there is a strong desire to move towards RWA, compliance, and widespread adoption. With the approval of the Bitcoin spot ETF at the beginning of the year, the crypto market has opened the door to traditional financial markets, and now with the approval of the Ethereum ETF, it also proves that crypto assets are receiving more attention and sparking the interest of traditional institutions.

As the trend of crypto-friendly regulation rises, it can be foreseen that the RWA track will still be a key speculative track in 2024. MakerDAO, with the narrative dividend of RWA and as a long-standing project on Ethereum, is still something we can look forward to in terms of price performance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。