Author: Joyce, BlockBeats

Editor: Jack, BlockBeats

"I have been resigned for several months and have been full-time meme trading," said meme player Lu Qi (pseudonym) to BlockBeats. Four months ago, the meme coin BOME on Solana broke through a market value of 0 to over 1.5 billion USD within three days, attracting many crypto novices to start playing memes. Lu Qi is one of them. "When I was playing memes, I had about 30 to 40 thousand in my wallet. I haven't added any more money in the past few months. I can earn 70 to 80 thousand yuan per month on average."

There are many people in a similar situation to Lu Qi. These people only trade meme coins and almost live on the chain 24 hours a day, waiting for a chance to enter that lasts only 3 minutes, and the holding time for meme coins is usually in minutes.

The vast majority of tokens they trade come from the issuance platform Pump.fun on Solana. For several months, Pump.fun has maintained a daily average income of over 600,000 USD, with over 10,000 new tokens appearing on Pump.fun every day. Many people shuttle between fragmented liquidity, seeking phase certainty income in various ways.

500K Cap, Only Playing Small

Four months ago, if the market value of a meme coin on Ethereum was less than 1 million USD, most people would speculate that the token consensus was loose, and the team was too "grassroots" to dare to take action. But on Solana, the cost and time to condense to a consensus that can make money are much smaller, so the difference between the hunter and the prey is only a few minutes.

3 Minutes, Hunter Becomes Prey

Jiawei (pseudonym), who has not been in the circle for less than a year and has just started intensively playing memes, has already felt that he is "falling behind." "Someone in the group asked what uni was, and my first reaction was Uniswap, but actually everyone was talking about unibot."

Ordinary traders need to copy the token contract to the viewing tool for analysis before deciding whether to buy. For meme players, this process needs to be done in minutes. When a "buy signal" for a token appears, it has been more than ten minutes, and you need to be vigilant about the upcoming "closing time."

Line charts of meme coins IQ (left) and ZESTY (right)

The principle of quick in and out is very simple. Players believe that meme coins with expected price increases must go through a shouting process, so in order to get cheap chips as early as possible, you need to enter before others. If you enter a few minutes late, the buying price can be several times higher. And if it's a small profit, it's okay, but most of the time, entering three minutes late is likely to be "buying at a high."

For example, the meme coin CLOWN showed signs of a rise before 01:20, then it rose more than 4 times in the next ten minutes, and then fell back to its initial position. The token contract that was sent to the group has already gone through the process of the monitoring tool releasing a signal, the single hunter capturing information to enter, and the group members discovering and sharing it again. When the trader sees it, they still need to go through the process of selecting the contract, analyzing it on the viewing tool, and placing an order to buy. The difference in entry time is only a few minutes, and a doubling can turn into a loss.

Left: Second line chart of meme coin CLOWN; Right: Discussion about a meme coin in the community

Finding Tenfold in Small Pots

The quick in and out strategy is based on meme players' conservative estimates of market value, which is the game rule of the meme market. In some telegram communities that share meme coins, the group members range from a few hundred to several thousand. As long as a meme coin's market value can be raised from less than 100K to several hundred K, the early large holders who have been lurking can make a lot of profit.

Traders need to analyze their position in the "pot." If later entrants can enter at 100K-200K, they can also make several times the profit. 500K has reached the closing position that many meme players consider, and a market value of 600K would be considered "a bit high." More certainty signals are needed to "hold on" further.

A trader's trading records on meme coins ABDUL and MUMI, with the highest market values of 247.5K and 483.5K, respectively

Another reason for the generally low market value of meme pots is that the participants' capital is not much. After communicating with several meme players, BlockBeats found that many players have around 3-5 SOL in capital, and they trade in at most two tokens at a time, with transaction amounts ranging from 0.5 SOL to 2 SOL each time. "I feel that when the overall market is not good, the meme market will be relatively hot," said Lu Qi.

Maturing Tools

Tokens with expected price increases often need to be grabbed at the bottom of the market value. For reputation reasons, the market value of meme coins posted by group members in the community is often above 100K, but to really get high multiples, you need to enter when it's only tens of K.

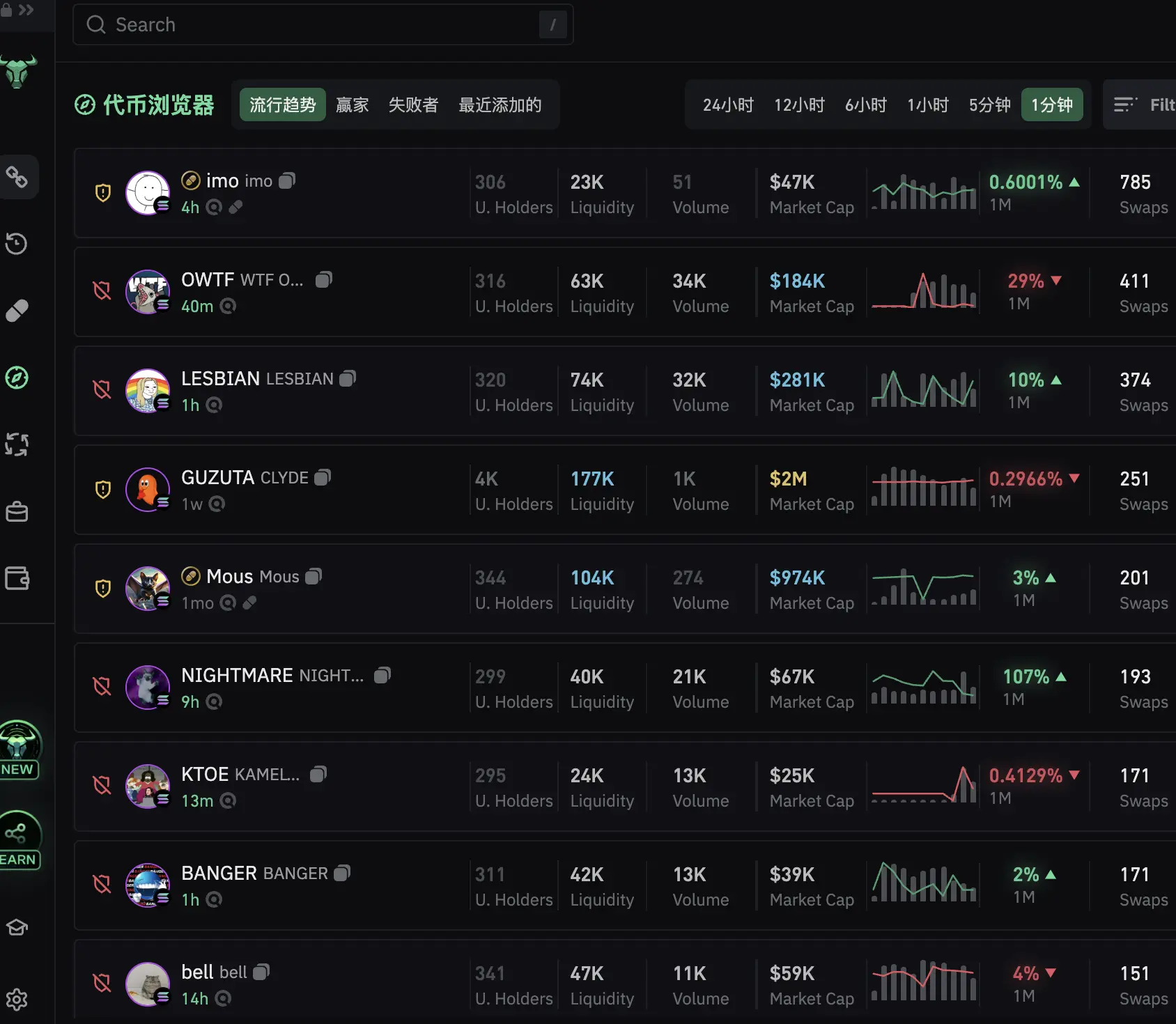

"Waiting for others to output in the group will not make money," for Beibei (pseudonym), group messages only serve as auxiliary references for trading, and active monitoring can ensure autonomy. BlockBeats found that players who often play memes will use two or three tools at the same time, with the most commonly used being GMGN, NFT Sniper (also known as abot), and Bullx.

Viewing token trends is only the most basic function of these tools. The preparation for playing memes can be divided into "finding coins from people" and "finding people from coins." In this regard, some tools are suitable for making boards and analyzing chip distribution, some tools are more sensitive in alerting address movements, and some tools perform better in trading speed.

Knowing how to use them is only the first step; finding the right smart money and sniper tools for oneself is the most important.

GMGN and NFT Sniper have outstanding advantages in viewing the distribution of related stakeholders' chips. GMGN is relatively more user-friendly for novices and can view indicators such as dev, early buyers, large holders, smart money, KOL, etc., and can also create a list of wallets to follow. In the "finding people from coins" process, both GMGN and NFT Sniper provide alerts for on-chain movements. Users can add the on-chain addresses they want to monitor to the watchlist, and when these addresses generate trading activities, users can receive alerts on the web or through the mobile tgbot, getting information in real time.

Left: GMGN; Right: NFT Sniper

Xu Bai (pseudonym) and his friends maintain the same smart money list. Whenever a new signal pops up, Xu Bai will see how many wallets are on board and use GMGN to check the historical transactions of the token's early addresses to decide whether to buy. When signals appear frequently, Jiawei will first look at NFT Sniper. The NFT Sniper interface has fewer icons, making the process of obtaining information more convenient, and it also has more refined automatic trading strategies.

Left: GMGN; Right: NFT Sniper

In addition to equipping suitable tools in these aspects, traders who want to obtain more alpha signals will not only rely on the instructions of smart money but actively seek newer coins, such as meme coins still in the internal market. The internal market refers to the phase before the market value of new coins released on Pump.fun reaches less than 67.8K and the liquidity is transferred to Raydium. Most new coins do not fill the internal market, but there are also a few "signal" players.

In these coins, meme players default to competing with the market makers and use the term "stuff" to refer to buying in. This allows for faster discovery. Beibei prefers to use Bullx, "Monitoring new coins is a good experience, and the trading is fast."

Bullx page

The functions of GMGN, NFT Sniper, and Bullx overlap to some extent, each with its own advantages. In the community, meme players often discuss the use of these tools and compare their response speeds. Mastering the usage of smart money and sniper tools that are suitable for oneself is considered the first step in meme trading.

Dev Must Run, But Still Needs Dev

To win in trading, the most important thing is to understand who your opponents are and try to anticipate their actions as much as possible. In the meme market, the role of the opponent has undergone several transformations, from dev to "CTO team," from "conspiracy group" to smart money.

CTO as a Clear Consensus

During the meme season in the Solana ecosystem at the end of last year, the community discussed the dev rug trap of meme coins. After the token rises, the dev withdrawing liquidity or selling the coins obtained at a very low cost can take away all the liquidity on board, leaving a "beheaded" trend.

At that time, the viewing tool was mainly Birdeye, which could only distinguish traders into three different categories based on trading volume, and the dev team was hidden. However, with the emergence of on-chain tracking tools such as GMGN and NFT Sniper, this situation has been completely changed, as both can clearly display the chip situation of the dev and early traders.

Left: Birdeye; Middle: GMGN; Right: NFT Sniper

It only costs 0.02 SOL to release a coin on Pump.fun, and once the token is transferred to the external market, the dev can earn multiple profits. Now with the clear signal, there is an extra layer of insurance. Many meme players have told BlockBeats that not buying meme coins where "dev is still on board" is one of their trading principles. "The developer is a time bomb. My habit is not to buy when I see the dev still on board, and wait to see the situation after the dev sells," Lu Qi told BlockBeats.

Therefore, most meme coins can only rise after the dev sells. When Jiawei first started using GMGN, he found that many meme coins would have the dev selling at the opening, followed by a complete surge after the dev completely vacated. For example, DLORF and OOO in the image below started to rise 10 minutes and 1 hour, respectively, after the dev sold all the tokens, with both increasing by several tens of times.

The red DS icon in the image represents the operation of the dev selling tokens

However, the dev sell can only be considered as a signal to exclude potential risks, and most meme coins that can rise cannot do without the "CTO" stage.

CTO stands for Community Takeover, which refers to the situation where the original developers abandon the project and it is taken over by the user community. For retail investors, when a crypto project is taken over by CTO, it means the elimination of the developer's front-running risk, and the project is led by the community. For example, Satoshi Nakamoto's disappearance and the rise of Bitcoin can be seen as the most classic CTO model.

In the meme world, CTO manifests as the team buying meme coins that have been rug pulled and continuing to operate the meme coin community on Twitter and Telegram. "For a while, picking up those coins that were taken over by CTO after the dev ran away would have a good certainty of profit," Xu Bai recalled. "At that time, after a token was taken over by CTO, I would enter the telegram group organized by the team to see the community atmosphere, judging the token's upward potential based on whether the team was playing music, whether everyone was excited, and whether they would pay for updating the dex."

But not all meme coins taken over by CTO can be safely boarded. In understanding CTO, Xu Bai's perspective has shifted from feeling the community atmosphere to analyzing chip distribution.

10-Second Entry, Cartel Operation

Now, the CTO process has become a standard part of the meme coin lifecycle, and all meme coins have learned to release this selling point. GMGN has marked the tokens with "CTO takeover," and most meme coins on the hot list have a CTO label, even though the coin has been online for less than an hour.

For example, in the case of MARU in the image below, the dev quickly bought the token after it was launched, but only held it for 27 seconds before completely clearing it, earning a profit of only 0.01 SOL (about 2.08 USD) at a cost of 5 SOL. After the dev sold, MARU started to rise, increasing 20 times within 50 minutes.

The yellow icon in the image means "CTO community takeover"

Are there really so many CTO teams that react quickly and have effective shouting? "Most CTOs are self-directed, which is already common knowledge for meme trading," Xu Bai said. After interviewing several meme players, BlockBeats found that players are well aware of the CTO routine, some are under the guise of a "god-tier team," "I've seen four or five just claiming to be the GME CTO team," Lu Qi recalled. Some are "lightning-speed CTOs," "After the dev buys and sells to make a profit, the original CTO comes in to make another profit."

Using MARU as an example, just under 10 seconds after the dev sold the coins, several addresses quickly bought in and became large holders. After their profit rate reached 20-40 times, they sold in a concentrated manner, causing MARU's price to drop by 52% in 7 minutes. In the community's view, this situation is most likely a case of the dev team creating a front-running opportunity in the form of CTO.

Trading records of MARU's large holders

Meme players have developed coping methods, and the profit situation of large holders is also a must-see indicator for meme players. "If you encounter large holders entering at the beginning, you can try to follow them. If they make too much profit, you should be cautious about boarding," Jiawei said. Xu Bai has already changed his strategy, "Now, if I see a good opportunity and the dev is still on board, I will also follow."

Milady Cabals and "Conspiracy Groups"

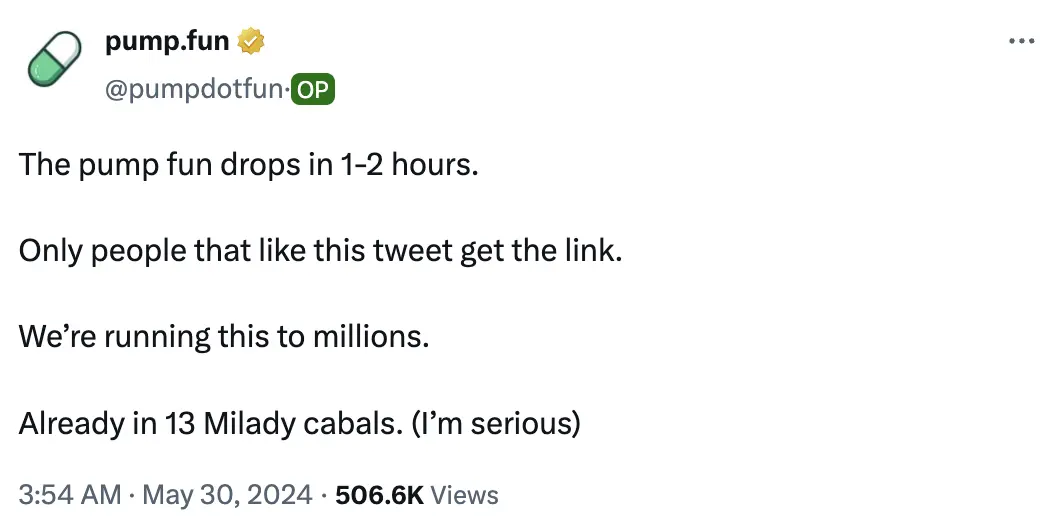

The logic of CTO is no longer "community governance" but has become the process of "changing from individual front-running to group front-running," and the hidden rug point has returned to the consideration of retail investors. However, to experienced meme players, this process presents an opportunity for profit in the game. "Milady cabals" is the first "slang" that Jiawei learned when he first started playing memes.

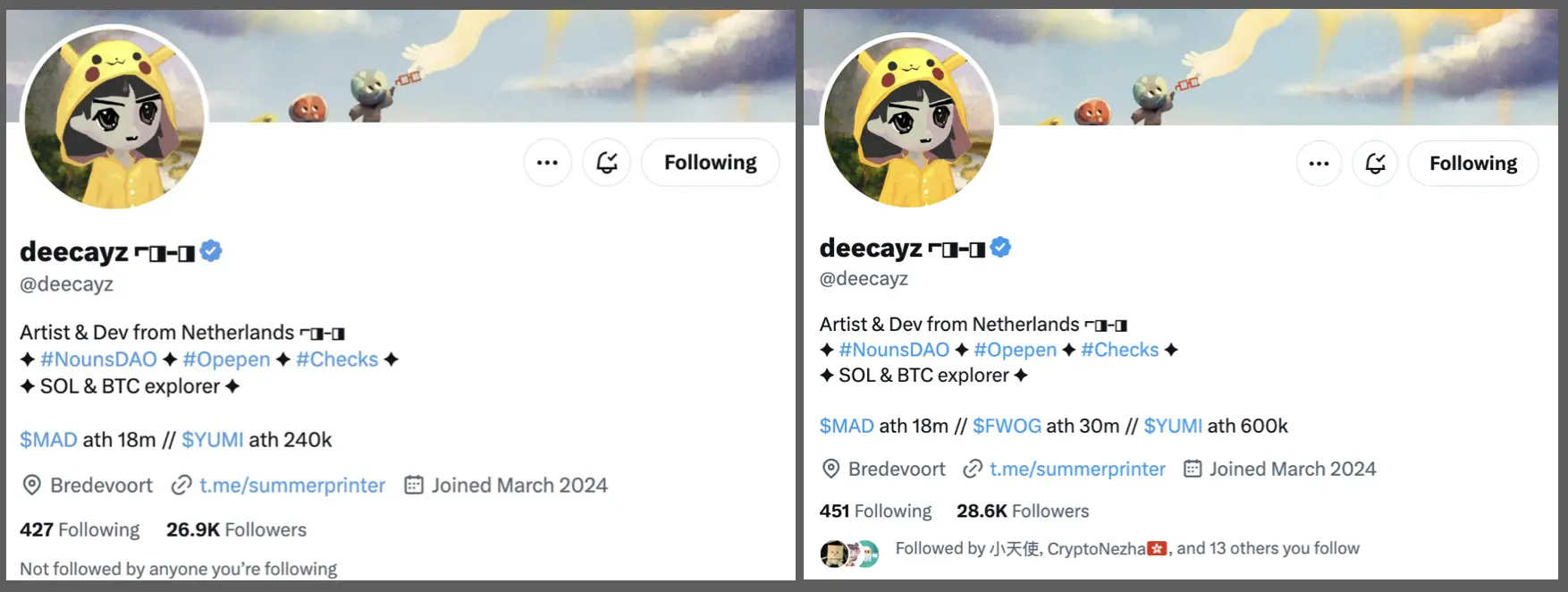

Searching for "Milady cabals" on Twitter will show a lot of discussions. The initial discussions were concentrated at the end of May, as Lu Qi recalled, "For a period of time, KOLs with Milady avatars on Twitter would quickly have several others with the same Milady avatars helping to retweet after they made calls, and the market value of the coins they called for would be very high."

So, opening the Twitter notifications of these people and monitoring their on-chain addresses became an important basis for meme players during that time. This discovery became so popular that even Pump.fun officials once joked, "I am already in 13 Milady cabals, I am serious)."

Yesterday, FWOG, which was originally not favored due to its imitation, achieved a 50x increase in 7 hours and a trading volume of over 60 million USD. The avatar of the CTO team caller @deecayz is exactly Milady, and in his bio, he displayed two successful meme coins that he had CTO'd.

When FWOG reached its peak, the top 3 holders of FWOG cleared their positions to take profits, and on-chain monitor ai_9684xtpa analyzed that this operation caused the token to plummet by 73% in a short period. However, this did not affect deecayz's record, as "FWOG" became his third successful work.

deecayz's Twitter bio

But Milady is not the only criterion for judging "conspiracy groups." In the eyes of meme players, teams that lay a large number of low-priced chips in advance, push up a meme coin through calls, and then raise the price to sell are all considered "conspiracy groups." Meme players need to constantly look for new opponent organizations. "Now I only occasionally check those Milady accounts. I've already cleared my follow list once," Beibei said.

Staying at the Table

Even with multiple successful experiences, Lu Qi still spends up to a dozen hours a day watching the market. "Most of the time it's boring, but the more boring it is, the more you should wait for that seemingly inexplicable opportunity."

Copytrading Might Be Fake Smart Money

Players who can consistently make money in meme trading believe that trading signals are actively squeezed out from numerous information flows and not just waiting for the password to wealth to come to them.

As more and more people learn to track KOL addresses and smart money addresses that have been publicly marked by tools, players need to have stronger information analysis abilities to make money. "It's getting harder to copytrade now," Lu Qi said. True smart money is always in a state of uncertainty.

Many obstacles stand between players and true smart money. Firstly, there is on-chain noise. Many people will look for smart money addresses from those with a high win rate in single coin trading. However, from the perspective of smart money, it is not necessary to make tenfold or even hundredfold profits in every investment. As long as the portfolio is large enough and the capital is sufficient, even a 20% increase in profit can accumulate considerable profits. "Not all purchases at the low point are made by smart money, and those who seek long-term returns do not want to be discovered by the market," Xu Bai said.

Secondly, there is the issue of malfunctioning information asymmetry. If the copytrading volume is small, the price will immediately rise several times after smart money buys in, and blindly copytrading will only make oneself the liquidity for smart money to exit. Crypto KOL 0xSun wrote a post a few days ago from the perspective of being copied, mentioning this issue.

In addition, information asymmetry only applies on a small scale. Retail investors want to track the "insider market," but market makers also squeeze the space for retail investors to grab low-priced chips through wash trading, killing copytraders, and creating matrix addresses, among other methods. A few days ago, KOL "Wang Xiaoer, who made a big profit on meme coins," vowed not to let followers copy his trades on Twitter. He explained that he prefers to pick meme coins with very low market values that have been launched for many days, but "this strategy becomes meaningless after being copied." This can be seen as evidence of the diminishing information asymmetry dividend in the copytrading trend.

Many players that BlockBeats has communicated with have also realized this, "Addresses that are followed by many people are not very valuable. You need to constantly find new wallets to survive," Lu Qi, Beibei, and Xu Bai all spend a lot of effort in maintaining their follow address lists.

Strategies that Fail Periodically

If there is a universal meme trading strategy, it is "to have awe for experience, but experience will quickly fail."

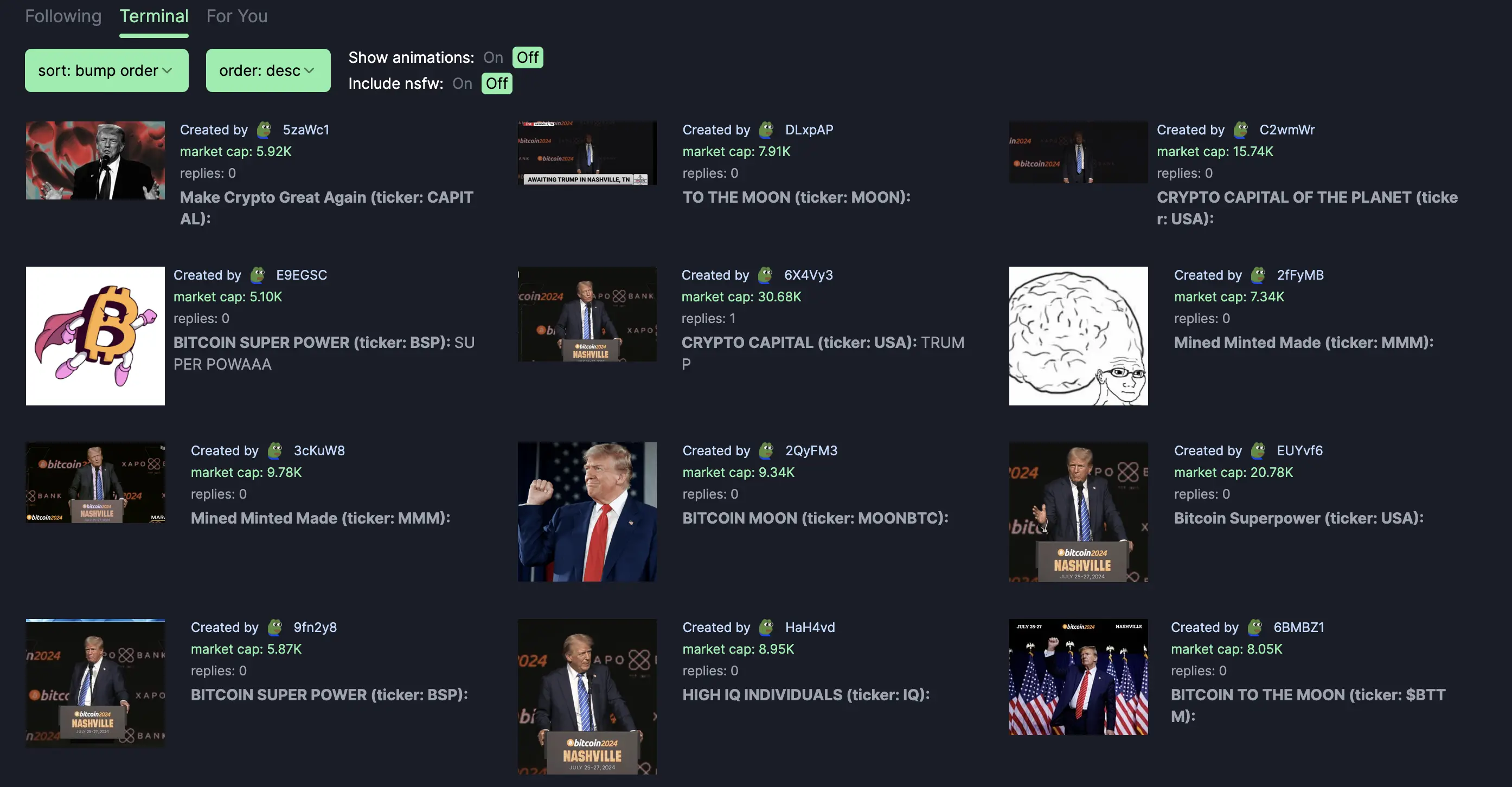

For example, creating memes around Trump news was once a highly successful smart money strategy, but it has now been exhausted.

On the day Trump was assassinated, Lu Qi was serving as a best man at a friend's wedding. "I woke up very early that day, and my first reaction after seeing the news of Trump's assassination was to look for related meme coins. I didn't have time to watch the market, so I scanned many coins at once." Among the coins Lu Qi bought, EAR achieved an 80x increase in 7 hours after going online. "I sold all the way up, but also made a good profit."

"Attention is the most important. Whenever there is news about Trump, there are definitely coins that have surged." This is the judgment Lu Qi has made since then. A few days ago, during the Bitcoin 2024 conference in Nashville, where Trump, as the first former U.S. president, gave a speech, meme players waited throughout the entire speech, from the postponement of the appearance to the completion of the speech, and searched for betting targets among various keyword tokens on Pump.fun. However, among the dozens of related meme coins, none had a market value exceeding 500K.

Pump.fun homepage during Trump's speech

On that day, the owner of the original dog prototype of DOGE, Kabosu, showcased her new pet NEIRO on Twitter. During Trump's speech, meme coin Neiro had already attracted a trading volume of 50 million USD. "I miscalculated, I didn't expect the dog to outperform Trump," meme players who missed out on the opportunity complained in the group.

If the movements of KOL addresses are taken as the leading signal, the battle between meme coins "Neiro" and "NEIRO" on that day would have been completely chaotic. NFT Sniper showed that 31 KOL addresses participated in trading Neiro, and 28 addresses participated in NEIRO. Looking back, many KOLs also "miscalculated."

As mentioned earlier, KOL deecayz, who made a 50x FWOG the day before, CTO'd three meme coins to the community, and one of the meme coins he specifically released, BEIRO, did not exceed a market value of 30K.

Nothing New in Meme

To Zhang Ran (pseudonym), who entered the crypto industry several years ago, "The evolution of the meme market is just like the ICO frenzy a few years ago, nothing new."

After experiencing the crazy bubble of ICOs, the crypto industry spent several years exploring new narratives such as NFTs and DeFi, and from an investment perspective, formed sub-directions such as cross-chain interoperability, L2 scaling, and RWA. But now, mainstream crypto investors are self-deprecatingly saying things like "value investing is a waste, go all in on MEME and live in the palace."

Even with a lot of time spent, the win rate of most meme players is still relatively low. "Small losses and big gains" is the ideal settlement result for meme players. "On the one hand, you need to stay cautious and stay at the table, and on the other hand, you need to seize opportunities and be a hunter."

BlockBeats found that many players in the meme community only started to learn about cryptocurrencies at the end of last year during the Bitcoin inscription frenzy. BOME and SLERF three months ago solidified their choice of the meme market. When asked if they would learn about and participate in other crypto areas outside of memes, "We are not newcomers or novices," Lu Qi replied. "The purpose of building an investment portfolio is to hedge risks. I will try to avoid blind gambling, so I won't participate when my energy is limited," Xu Bai said.

This article acknowledges the interviewees: Lu Qi, Xu Bai, Beibei, Jiawei, and Zhang Ran.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。