As the July 30th FOMC meeting of the Federal Reserve approaches, Federal Reserve officials have entered a quiet period. The market, which has already fully priced in the rate cut expectations, has begun to eagerly await the new interest rate decision and the Federal Reserve's policy stance. Taking this opportunity, this article reviews the composition of the current Federal Reserve FOMC voting members and the evolution of the FOMC composition in recent years, as well as the Federal Reserve's policy stance towards the cryptocurrency industry.

Opinions in a nutshell

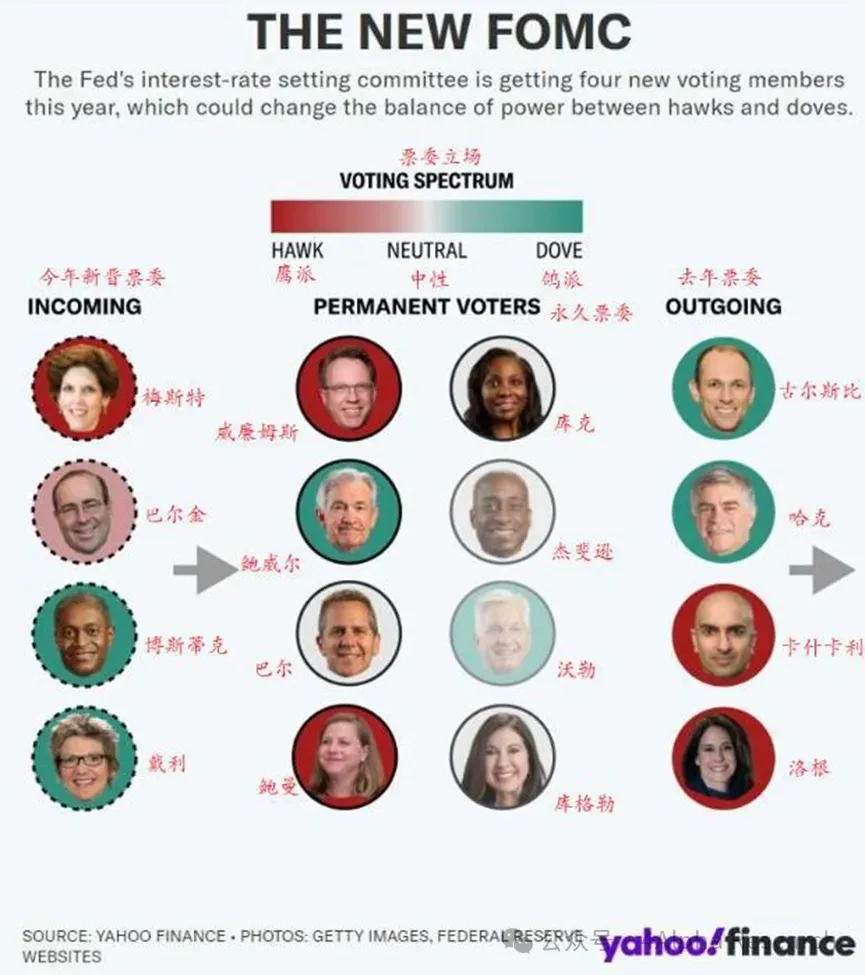

The composition of the FOMC voting members tends to be balanced and neutral. Among the 12 FOMC members, 7 permanent governors have permanent voting rights, while the remaining seats are rotated among regional Federal Reserve Bank presidents. In the current FOMC, most permanent voting members are considered to have a neutral attitude. Among the rotating members, the outgoing members this year include two dovish and two hawkish members, while the new members include two hawkish, one neutral, and one member with a variable stance, overall continuing the trend of neutralizing the FOMC composition.

The neutralization trend of the FOMC has led to the overall balance and neutralization of the Federal Reserve's policy stance, helping the Federal Reserve to independently execute monetary policy and better balance the relationship between inflation and economic growth. The Federal Reserve's neutral and cautious attitude helps to restore its professional, independent, and authoritative image, but the reduction in internal debate may increase the risk of policy mistakes.

In terms of the attitude towards cryptocurrencies, Federal Reserve officials generally hold a negative attitude. Despite the gradual compliance of cryptocurrencies in the U.S. financial market, Federal Reserve officials emphasize that due to the volatile price fluctuations and lack of stability, the basic requirements of cryptocurrencies as a currency have not been met. In addition, the insufficient global acceptance and regulatory maturity of cryptocurrencies make it difficult for them to become a universal means of payment. Federal Reserve officials also point out that the innovation of stablecoins should be conducted within a strict regulatory framework, reflecting the Federal Reserve's cautious attitude towards the cryptocurrency industry, as the Federal Reserve does not want to introduce new exogenous uncertainties in the process of monetary policy decision-making.

I. The composition of the 2024 Federal Reserve FOMC voting members tends to be balanced and neutral

Among the 12 Federal Reserve FOMC voting members, 7 are permanent governors, who have permanent voting rights during their tenure. Currently, these 7 individuals include Federal Reserve Chairman Powell, Vice Chairman Jefferson, Vice Chairman Barr, Governor Waller, Governor Cook, Governor Kugler, Governor Bowman, and New York Federal Reserve Bank President Williams.

Only the President of the New York Federal Reserve Bank is a permanent voting member among the regional Federal Reserve Banks, and the remaining four seats are rotated among other regional Federal Reserve Banks. In this period, the rotating members are President Mester of the Cleveland Federal Reserve Bank, President Barkin of the Richmond Federal Reserve Bank, President Bostic of the Atlanta Federal Reserve Bank, and President Daly of the San Francisco Federal Reserve Bank. President Goolsbee of the Chicago Federal Reserve Bank, President Harker of the Philadelphia Federal Reserve Bank, President Kashkari of the Minneapolis Federal Reserve Bank, and President Logan of the Dallas Federal Reserve Bank are rotating out.

In the current (January 2024) Federal Reserve FOMC permanent voting members, it is generally believed that Bowman is hawkish, while Cook and Kugler are dovish, and the others are neutral. Among the rotating members, this year's outgoing members include two dovish and two hawkish members (Goolsbee and Harker are respectively representatives of dovish and moderate dovish, while Minneapolis Federal Reserve Bank President Kashkari and Dallas Federal Reserve Bank President Logan are two new "hawk kings"), and the new members include 2 hawkish (Mester, Barkin), one neutral (Daly), and one member with a variable stance and long-standing controversial position (Bostic).

Overall, the incoming and outgoing members this year maintain the balance of the Federal Reserve voting members, as shown in the following figure. The slight hawkish tendency also aligns with the Federal Reserve's need to conclude a year-long action against inflation and prevent inflation rebound.

The relatively balanced composition reflects the current monetary policy of the Federal Reserve. In recent years, the Federal Reserve's FOMC interest rate decisions, dot plot, and future outlook have changed from the aggressive stance during the pandemic era (such as the highly unconventional 50bp rate cut by the Federal Reserve on March 3, 2020), presenting a smoother and more cautious trend. In addition, the public statements of Federal Reserve officials have also weakened compared to previous years.

Take Federal Reserve Chairman Powell as an example. Since 2020, he has consistently emphasized that "inflation is transitory," which has been repeatedly contradicted and ridiculed. Currently, his statements rarely include such definitive assertions, leaving ample room for interpretation by media outlets such as "New Federal Reserve News."

The Federal Reserve's trend towards balance and neutralization generally helps the Federal Reserve to be more independent, better act as a monetary policy stabilizer, and better fulfill its function of trading off between inflation and economic growth. The Federal Reserve's previous aggressive monetary policy and asset balance sheet decisions (such as the large-scale QE expansion in 2020) and some overly assertive and unrigorous rhetoric have seriously damaged the professional, independent, and authoritative image of the Federal Reserve. This would seriously weaken the forward guidance effect of the Federal Reserve's statements and decisions, leading to partial ineffectiveness of monetary policy, as monetary policy to some extent is the management of market expectations. Since mid-2023, the Federal Reserve's neutralization and cautious attitude have played a certain restorative role, and the Federal Reserve's neutralization and more balanced process mainly started with personnel balance and de-extremization.

II. The disappearance of dissenting votes among Federal Reserve voting members, is it entirely a good thing?

Since Powell took office, the number of dissenting votes cast by FOMC members has been steadily decreasing. In the nearly six years of Powell's tenure as Federal Reserve Chairman, dissenting votes accounted for only 2.6% of the total votes, marking the lowest level since the Volcker era. Since the start of the pandemic in March 2020, dissenting votes at the FOMC have become even rarer, accounting for only 1.4% of the total votes.

Andrew Levin, an economics professor at Dartmouth College and former Federal Reserve official, stated, "Internal dissent within the FOMC is gradually disappearing, and the FOMC looks more like a corporate board than a public decision-making body." Former St. Louis Federal Reserve Bank President Bullard was one of the officials who cast dissenting votes multiple times during his tenure as an FOMC member. According to Federal Reserve data, Bullard cast dissenting votes in June 2013, September and June 2019, and March 2022.

Some also believe that Powell's affable and smooth character, as well as his skill in maintaining complex interpersonal relationships, may be a factor in the lower dissent rate within the Federal Reserve since he took office. FOMC voting members may also be concerned that in the highly polarized political environment of Washington, the tolerance for internal discord within the Federal Reserve may be very low. FOMC members may have concerns about their personal prospects, but as Bullard said, the internal conformity and excessive external unity within the Federal Reserve may lead to the failure of the FOMC decision-making mechanism and decision-making mistakes. Similar to the consensus reached in the crypto world that "centralization" can damage economic operations, the "centralization" of the FOMC is likely to impair its sensitivity to monetary policy and the timeliness of adjustments, undermining the effectiveness of its voting-based decision-making mechanism. However, the harm of "centralization" is clearly rarely discussed in the traditional financial world.

III. Federal Reserve officials generally hold a negative attitude towards cryptocurrencies

Despite the listing of BTC spot ETFs at the beginning of 2024 and the recent listing of ETH spot ETFs, cryptocurrencies in the U.S. financial market are rapidly transitioning to compliance at an unprecedented speed. However, in recent months, Federal Reserve officials have continued to express a predominantly negative attitude towards cryptocurrencies.

On November 17, 2023, Federal Reserve Vice Chair and permanent voting member Barr stated that due to the cautious approach taken by most banks, the U.S. banking system has not been severely affected by the risks of cryptocurrencies. However, regulatory authorities still need to be very careful with stablecoins. Historically, if regulation is inadequate, private currencies may have explosive influence. Innovation in stablecoins can be allowed, but it must be clearly regulated within a very explicit regulatory framework, which essentially negates one of the most important motivations for web3 decentralized finance.

On February 27, 2024, Federal Reserve Vice Chair and permanent voting member Jefferson further stated that considering cryptocurrencies as currency is a mistake. He emphasized that although cryptocurrencies have shown transaction capabilities in specific scenarios, their volatile prices and lack of stability make it difficult for them to meet the basic requirements of currency, namely as a store of value and unit of account. In addition, he mentioned that the global acceptance and regulatory maturity of cryptocurrencies have not reached the level to make them a universal means of payment, and the tendency of stablecoins to anchor to the U.S. dollar also represents their lack of other solid valuation bases.

Federal Reserve Governor and permanent voting member Bowman has also expressed multiple times that the construction of a U.S. dollar stablecoin must involve the Federal Reserve and various levels of the federal government, and currently, Congress still does not recognize stablecoins. These views reflect the Federal Reserve's cautious attitude towards cryptocurrencies and may affect future policy formulation. Despite the comprehensive compliance of cryptocurrencies in the U.S. financial market, the Federal Reserve has chosen a very conservative stance, possibly due to its need to maintain short-term market stability. As the monetary policy maker, the Federal Reserve is already facing too many uncertain factors (external supply shocks, difficult-to-measure employment elasticity, uncertain interest rate transmission mechanisms, and long-standing debates over the multiplier effect). The voting members of the Federal Reserve have no intersection with the crypto world in their resumes, and in the already very challenging decision-making process, they clearly do not like the new uncertain variables of cryptocurrencies and U.S. dollar stablecoins.

END

The content of this article is for information sharing only and does not endorse or promote any business or investment activities. Readers are strictly required to comply with local laws and regulations and not engage in any illegal financial activities. It does not provide trading access, guidance, issuance channels, or guidance for any virtual currency, digital collectibles, trading, or financing related activities.

4Alpha Research content is prohibited from being reproduced, copied, etc., without permission. Violators will be held legally responsible.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。