In this article, we will focus on recent airdrops and their structure, the success of Alpha Vault, token economics, key DeFi partnership integrations and listings, the growth of LSTs, and their adoption in Web2.

Author: Greythorn

Opening

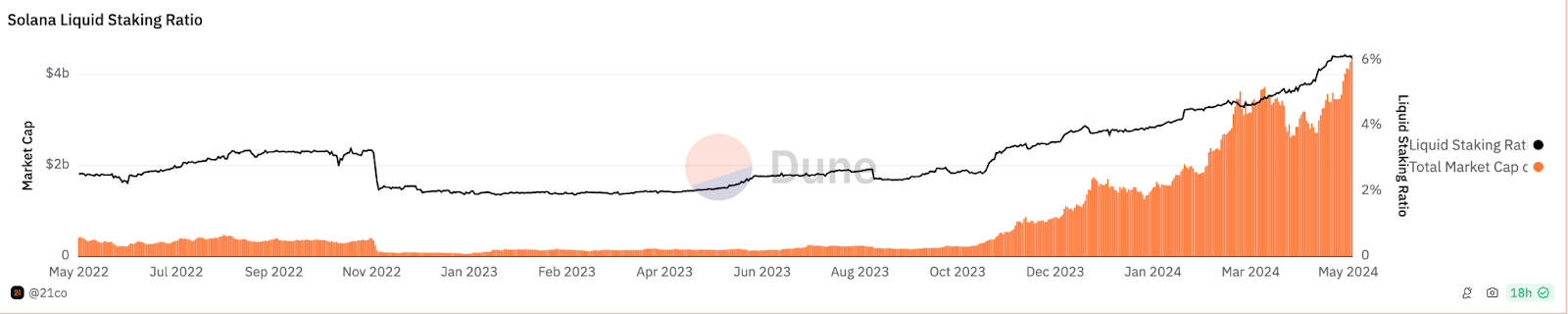

In our "Sanctum Research Part 1," we discussed how liquidity staking is changing asset management in PoS networks. We discussed how liquidity staking technology issues liquidity staking tokens (LSTs) in exchange for staked assets, representing the staked amount and accumulated rewards. We also highlighted the rapid growth of the total staked amount in liquidity staking, pointing out that Solana's staking rate exceeds 70%, far higher than Ethereum's 27%. Nevertheless, LSTs only account for 6% of Solana's staking supply, while Ethereum exceeds 40%, providing a huge market opportunity for Sanctum in the Solana ecosystem.

Source: Dune Analytics

For more detailed information about the Sanctum protocol, its capabilities, technical structure, and comparison with other competitors, please refer to "Part 1." It only takes a few minutes and will demonstrate why Greythorn is closely following this project.

In this article, we will focus on recent airdrops and their structure, the success of Alpha Vault, token economics, key DeFi partnership integrations and listings, the growth of LSTs, and their adoption in Web2.

Token Economics

Since the token economics were not disclosed in our initial research, let's start from here. Sanctum adopts a multi-token system to support and enhance its ecosystem. As the project aims to enable people to launch and trade millions of LSTs in the Solana ecosystem, there must be a way to ensure that these LSTs truly have liquidity. Here, Sanctum introduces the Infinity Pool, a multi-LST liquidity pool that allows exchange among all LSTs in the pool. Users can become liquidity providers by depositing any whitelisted LST and receive $INF tokens, which can accumulate staking rewards, benefit from trading fees in the pool, and be directly used in DeFi protocols.

On the other hand, the Sanctum governance token, $CLOUD, controls the capital and attention within the ecosystem. Partners need to stake $CLOUD to qualify for the Sanctum Verified Partner (SVP) program, and $CLOUD holders vote to decide which partners are accepted.

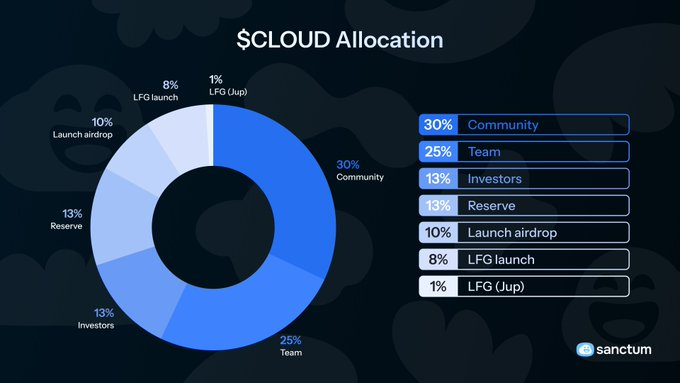

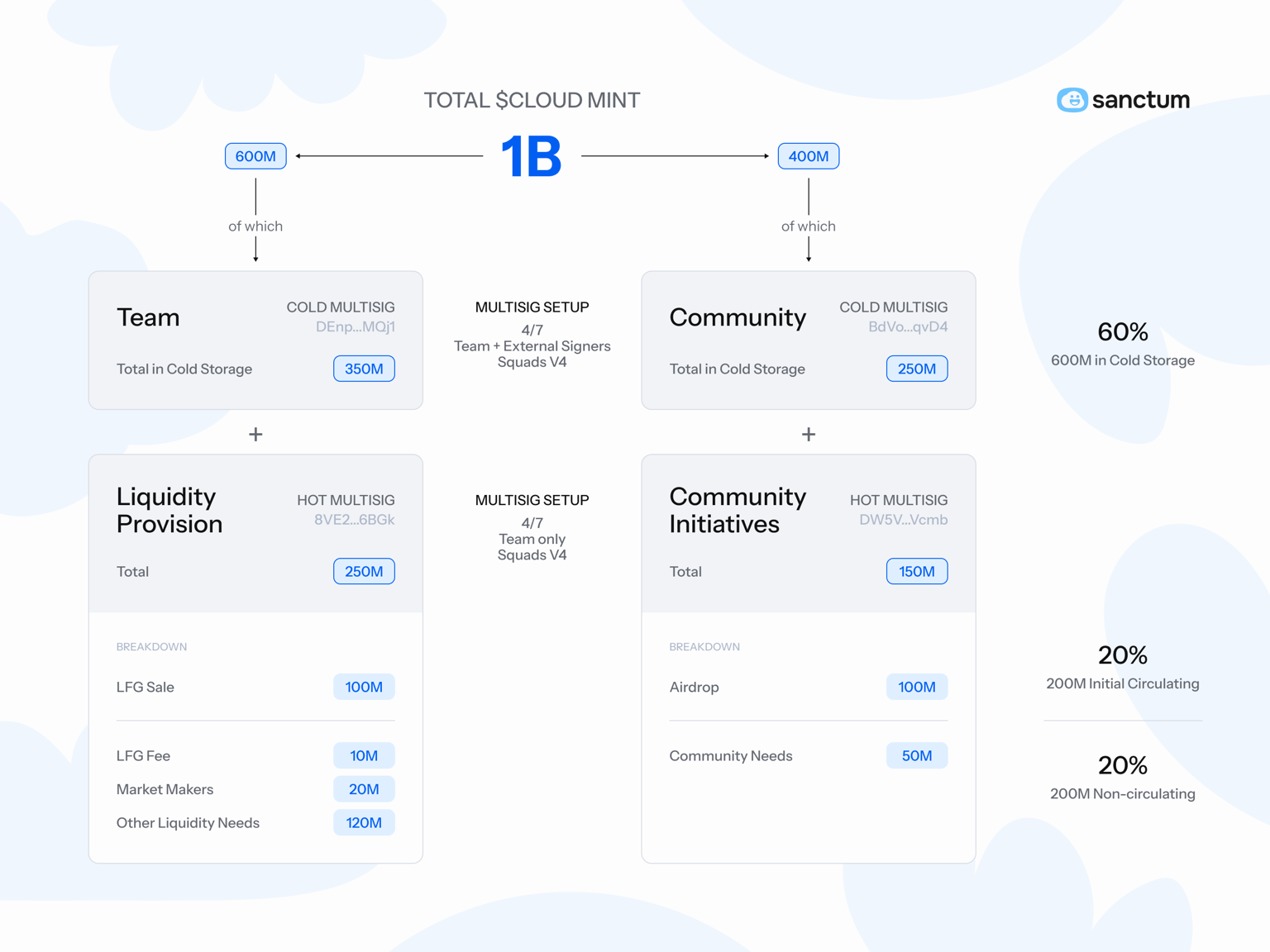

The total supply of $CLOUD tokens is 1 billion (1B), allocated as follows:

Initial liquidity (20%): 10% for the initial airdrop, 10% for initial liquidity.

Community reserve (30%): Managed by the community for growth plans.

Strategic reserve (11%): Used by the team for ecosystem growth and partnerships.

Team (25%): Allocated to founders and core contributors.

Investors (13%): Allocated to investors.

Jupiter LFG (1%): Reserved for Jupiter LFG.

Source: Sanctum

TGE, Airdrop, and Community Feedback

The Sanctum airdrop took place at 11:00 AM Eastern Time on July 18th. This airdrop distributed 10% of the CLOUD tokens, with 5% (50 million CLOUD) allocated to the capital portion and another 5% (50 million CLOUD) to the honest portion. A total of 108,185 accounts were eligible for the airdrop.

Participants had two options for claiming the airdrop. They could choose the "Long-Term-Aligned" option, waiting to receive tokens and earning larger bonuses over time, up to 100%. Alternatively, they could choose the "Sanctum-Curious" option, claiming tokens immediately without any bonus.

To receive the full 100% bonus for the capital portion, participants needed to wait for 14 days. The full 100% bonus for the honest portion was distributed after a 180-day waiting period. Participants could claim tokens at any time, but if claimed early, they would forfeit the remaining bonus.

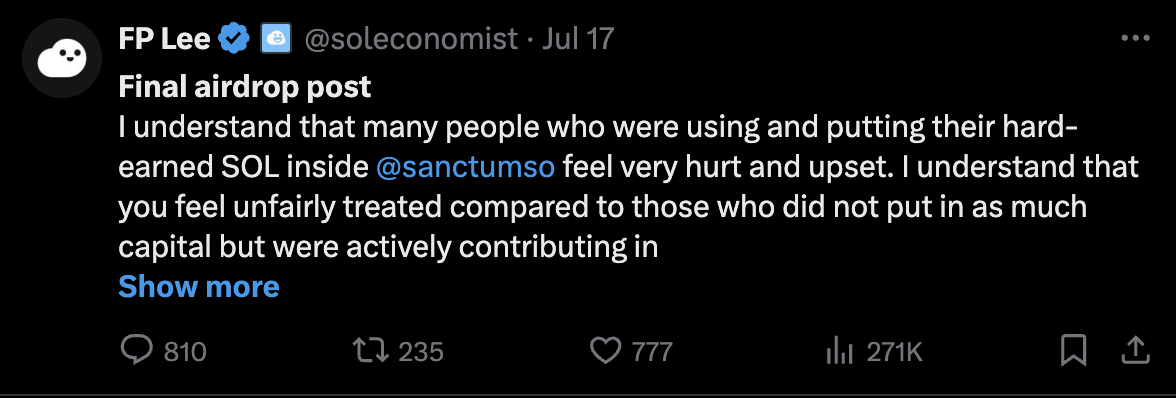

The community's response to the Sanctum airdrop was not as expected, with some users feeling frustrated, especially those who had invested a large amount of $SOL, as they felt unfairly treated compared to non-monetary contributors.

As seen recently, many projects struggle to establish fair standards to reward all deserving participants and balance the distribution between small and large contributors; in other words, it's challenging to satisfy everyone.

The Sanctum team expressed gratitude to all supporters and clarified that the honest distribution aims to build a loyal user base. They acknowledged that they missed out on many deserving users and committed to being more careful in reviewing submitted content in the future.

Source: X

To address these issues, the team held a temporary Twitter Spaces meeting, reiterating their commitment to building top-tier products on Solana and making Sanctum the best destination for SOL holders. This response demonstrates the commitment of the Sanctum team and its community's resilience, as well as the need for better communication and fairer distribution.

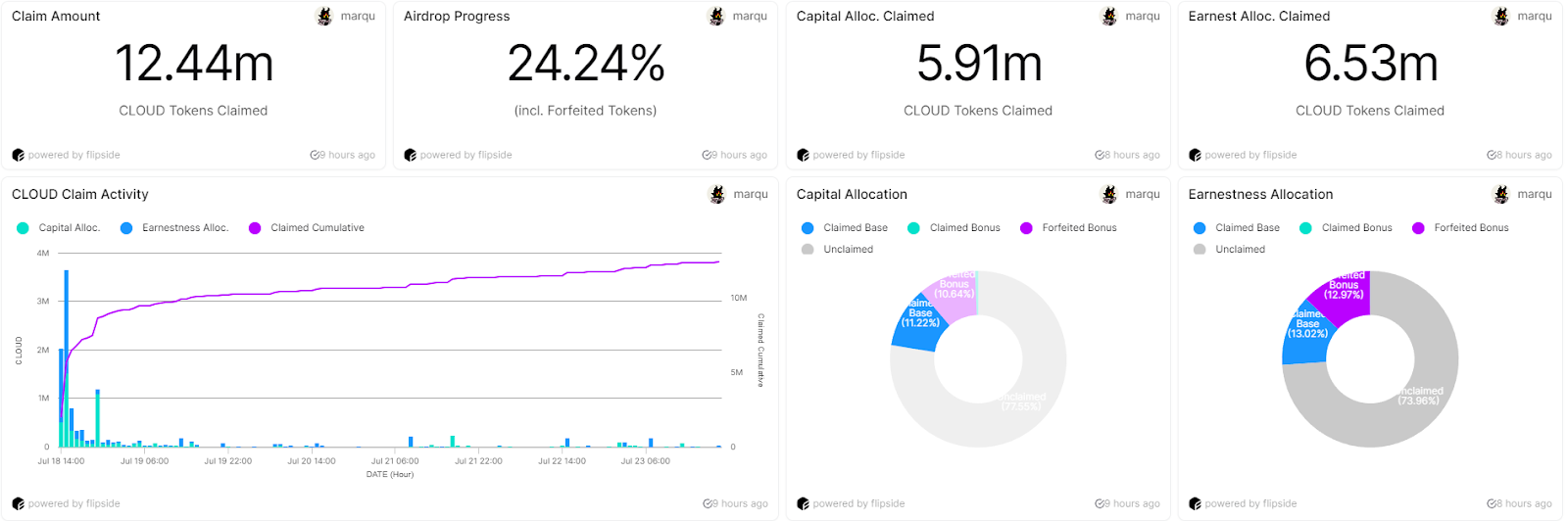

As of today, July 24th, a total of 12.44 million CLOUD tokens have been claimed, accounting for 24.24% of the total allocation (including forfeited tokens). This includes 6.53 million tokens for the honest portion and 5.91 million tokens for the capital portion, based on data from Flipside by Marqu.

Source: Flipside

On the same day, the Sanctum TGE minted 1 billion CLOUD tokens, allocated 60/40 to the team cold wallet and the community cold wallet. From the team cold wallet, 250 million tokens were allocated for liquidity, with 100 million used to bootstrap pools through Meteora DLMM. The remaining tokens will meet liquidity demands within the first year. From the community cold wallet, 150 million tokens were designated for airdrop initiation and community needs. This makes a total of 300 million tokens available within the first year, with a maximum of 125 million tokens initially circulating.

Source: Sanctum

Success of Sanctum Alpha Vault

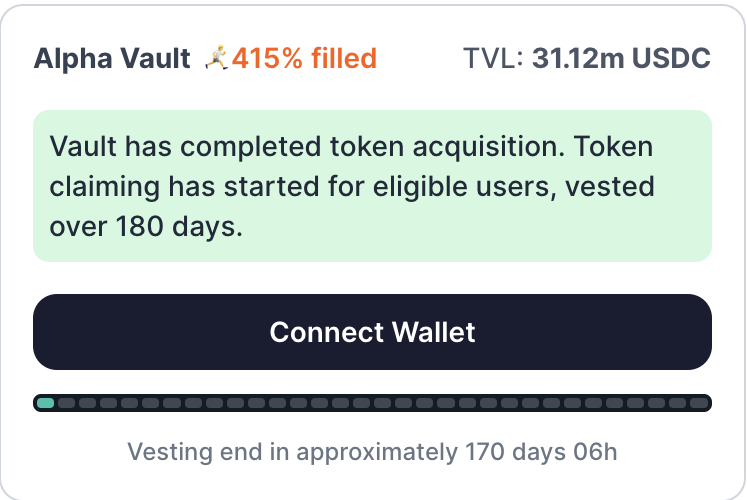

The Alpha Vault is a special feature of Sanctum in collaboration with Meteora, allowing long-term supporters to purchase $CLOUD tokens at a potentially better price. Participants can deposit USDC into the vault, and in return, they receive $CLOUD tokens at a discounted price. However, these tokens have a six-month vesting period to encourage long-term commitment.

The vault has a cap of 50 million CLOUD tokens, with a maximum purchase limit of 7.5 million USDC. The initial price of CLOUD is determined by the amount of USDC in the vault, ranging from $0.001 to a maximum of $0.5 on the LFG curve. If the USDC deposit exceeds the cap, tokens will be proportionally allocated, and the excess USDC will be refunded to contributors.

If the total value locked (TVL) reaches $7.5 million, the maximum price paid by vault buyers is $0.15 per CLOUD. If not, both the spot price and the vault buyer price will be lower.

Participants can deposit into the Alpha Vault at a discounted price with a six-month vesting period, or purchase on the open market for immediate liquidity. The Alpha Vault was open from July 16th, 2024, to July 18th.

The Alpha Vault was highly successful, with over-subscription of 416%, attracting long-term supporters and demonstrating strong interest and confidence in the Sanctum project.

Source: Meteora

Optimistic Future for Sanctum: Outlook

CEX Listings and DeFi Partnership Integrations

From the start, $CLOUD has steadfastly refused to pay any CEX listing fees, but it has successfully increased market presence by strategically listing on major exchanges such as Kraken, Bybit, and Bitget. These moves have improved liquidity, making the token more accessible to traders and investors. Additionally, there are rumors of more listings in the future, which could further enhance the token's visibility and its integration into the DeFi space.

In addition to exchange listings, Sanctum has established valuable partnerships in the DeFi space to expand its ecosystem. Collaborations with platforms like Kamino, Drift, Texture, and Orca have added unique advantages to the Sanctum network. Kamino improves liquidity through its pools, Drift introduces advanced trading options such as perpetual swaps, Texture expands the functionality of $CLOUD through asset synthetics, and Orca simplifies token swaps through its user-friendly interface.

Sanctum Launchpad

Sanctum's founder, fplee, announced plans to create a Launchpad, launching on-chain economies within the Sanctum community. The platform will leverage liquidity staked tokens (LSTs) to support new projects and innovative products of interest to the community. For example, the Pathfinders team is using pathSOL earnings to fund groundbreaking free NFT minting. This initiative is not limited to creative projects but aims to support enterprises looking to adopt crypto-native frameworks. Sanctum is collaborating with Jupiter to develop the infrastructure needed to support these projects, fostering a circular economy where each success paves the way for more, ultimately nurturing a vibrant on-chain ecosystem.

Sanctum Profiles V2

Sanctum announced an upgrade to its profile feature, aiming to redefine identities within the Sanctum universe. These profiles allow users to build and expand their reputation within the community, serving as a digital identity open to everyone. The upcoming Sanctum Profiles V2 aims to change social interactions and loyalty programs on the Solana blockchain by introducing a customizable layer that anyone can tailor as needed.

With Sanctum Profiles V2, users will be able to create their own LSTs, enabling them to monetize their activities in various ways. The platform will go beyond standard communication channels like private Discord or Telegram chats. For example, Greythorn can generate research reports accessible only to their LST holders (greythornSOL) and publish them on Twitter or other websites. This enhancement will allow users to identify and reward their followers through unique content, deepening connections within the community.

Sanctum Pay

Sanctum Pay is also collaborating with BasedApp to develop a Web3.0 financial platform. This innovative project involves creating the first debit card supported by LSTs. By directly converting staking rewards from cardSOL into USDC, Sanctum Pay allows users to make purchases without needing to liquidate their SOL holdings. This integration aims to eliminate the need for traditional cash settlements, enabling users to manage their transactions directly through the debit card, providing a convenient user experience.

Summary

We believe that Sanctum provides a novel and compelling solution to the liquidity issues in traditional staking. By serving as a liquidity backstop, it allows staked SOL to be more flexibly utilized in DeFi, significantly enhancing the utility and accessibility of staked assets. Many other potential future growth opportunities, such as subscription payments, mobile plans, and more, as outlined by James Hanley, may bring positive traffic to Sanctum.

With the TVL healthy, approaching $1 billion (5.54 million SOL), Sanctum has integrated with Jupiter Exchange, Kamino, and several other platforms. These integrations may attract more users and drive adoption and growth.

Source: DeFiLlama

Sanctum plans to establish a DAO for decentralized governance to ensure its development according to community consensus. This approach has garnered trust and participation from the growing Solana community.

Considering these factors, Sanctum's $CLOUD governance token, with a market cap of $53 million and a FDV of less than $300 million, presents an interesting protocol worth watching.

However, the DeFi space on Solana is highly competitive, with multiple projects competing for liquidity and user adoption. Sanctum must continue to innovate and provide higher value to maintain its lead, which will be a challenge.

We hope our Sanctum Research Series has provided valuable insights. Please remember that our content should not be interpreted as financial advice. These are just our thoughts and opinions as we navigate the market. The protocols we research do not necessarily represent our investment portfolio.

For more similar content, please follow our social media and feel free to reach out to us anytime.

Disclaimer

This presentation is prepared by Greythorn Asset Management Pty Ltd (ABN 96 621 995 659) (Greythorn). The information in this presentation should be considered as general information and not as investment advice or financial advice. It is not an advertisement, solicitation, or offer to buy or sell any financial instruments or participate in any specific trading strategy. When preparing this document, Greythorn has not taken into account the investment objectives, financial situation, or specific needs of any recipient. Before making any investment decisions, recipients of this presentation should consider their individual circumstances and seek professional advice from their accountant, lawyer, or other professional advisors. This presentation contains statements, opinions, forecasts, predictions, and other materials (forward-looking statements) based on various assumptions. Greythorn is not obligated to update the information. These assumptions may be correct or incorrect. Greythorn and its officers, employees, agents, advisors, or any other person mentioned in this presentation do not make any representations about the accuracy or likelihood of achievement of any forward-looking statements or their underlying assumptions. To the extent permitted by law, Greythorn and its officers, employees, agents, and advisors are not liable for any loss, claims, damages, expenses, or costs arising from the information in this presentation. This presentation is the property of Greythorn. By receiving this presentation, you agree to keep its contents confidential and agree not to copy, provide, transmit, or disclose any information in its contents without written consent.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。