In the past 24 hours, the market has seen many new popular coins and topics, which are likely to be the next wealth creation opportunities.

Authored by: Bitget Research Institute

Abstract

Against the backdrop of a stock market crash and waning popularity of risky assets including cryptocurrencies, Bitcoin fell to $64,000 in the early Asian market and rebounded to $67,000. Ethereum continues to experience net outflows, with the following highlights:

Sectors with strong wealth creation effects: Solana Meme sector, BTC Inscription sector;

User hot search tokens & topics: Polymarket, Solana;

Potential airdrop opportunities: Allora Network, RedStone;

Data statistics time: July 26, 2024, 4:00 (UTC+0)

I. Market Environment

Against the backdrop of a stock market crash and waning popularity of risky assets including cryptocurrencies, Bitcoin fell to $64,000 in the early Asian market and rebounded to $67,000. The rise led to the liquidation of some short positions. According to Coinglass data, there were $34.21 million in liquidations across the network in the past 4 hours, with $31.47 million from short positions. The main reason is that the continuous net inflow of Bitcoin ETFs has provided significant buying power to the market, with a total net inflow of $31.40 million into the US spot Bitcoin ETF yesterday.

Ethereum fell by over 8% yesterday, and has since recovered some of the gains, but its performance is worse than the overall cryptocurrency market. Previously, Grayscale's Ethereum Trust ETF (ETHE) saw outflows of $3.462 billion.

II. Wealth Creation Sectors

1) Sector Dynamics: Solana Meme (MUMU, NUB)

Main reasons:

- Solana's on-chain DEX trading volume surpassed Ethereum's mainnet for the first time in the past 30 days, with users flocking to trade meme tokens. Currently, the leading meme token's daily trading volume exceeds $50 million.

Rise situation: MUMU and NUB rose by 107.79% and 29.92% respectively in the past 24 hours;

Factors affecting future market:

Trend of SOL token: In the Solana ecosystem, the trend of the SOL token will affect the prices of the entire ecosystem's tokens, as many tokens are priced in SOL on DEX. Continue to monitor the price trend of SOL. If SOL maintains an upward trend, it is advisable to continue holding SOL ecosystem assets.

Changes in open interest (OI) of futures contracts: The open interest of SOL futures contracts increased yesterday, indicating an influx of hot money. Check the contract data on the tv.coinglass website to understand the movements of major funds. First, observe the increase in net long positions in the contracts; then observe whether there is a net increase in long positions in the contracts, an increase in OI, and an increase in trading volume. If so, it indicates that major players are continuing to buy, and it is advisable to continue holding.

2) Sector Dynamics: BTC Inscription Sector (ORDI, QUARK)

Main reasons:

UniSat has adjusted the service fee for inscription services, not charging a service fee for inscribing up to 20 inscriptions in a single order. However, a service fee will be charged starting from the 21st inscription in a single order;

Lightning Lab announced the release of Taproot Assets on the Lightning network, enabling the Bitcoin network to support multiple assets and bring instant low-cost payments.

Rise situation: ORDI and QUARK rose by 10.89% and 15.94% respectively on the day;

Factors affecting future market:

Dynamic at the news level: Pay attention to the support and dynamics of inscriptions from unisat, KOL, and leading exchanges. If there are related positive releases, consider investing in a timely manner;

Changes in contract data: From the contract data, ORDI has long been in a state where the long/short ratio in the contract accounts was less than 1, indicating that large funds were bullish. Continuously monitor relevant data through coinglass data. If there are signs of a turnaround in the data, consider taking profits in a timely manner.

III. User Hot Search

1) Popular Dapps

Polymarket:

The decentralized prediction market platform Polymarket set a monthly record for trading volume in July, exceeding $275 million to date. The platform's monthly number of traders also reached a record high, surpassing 33,000, an increase of more than eight times from around 4,000 in January. This is mainly due to the popularity of prediction markets related to elections. According to DefiLlama data, Polymarket's TVL exceeded $70 million, currently at $73.52 million, with a 7-day increase of 47.49%. As a blockchain-based decentralized prediction market platform, Polymarket allows users to bet on the future outcomes of various topics using cryptocurrencies.

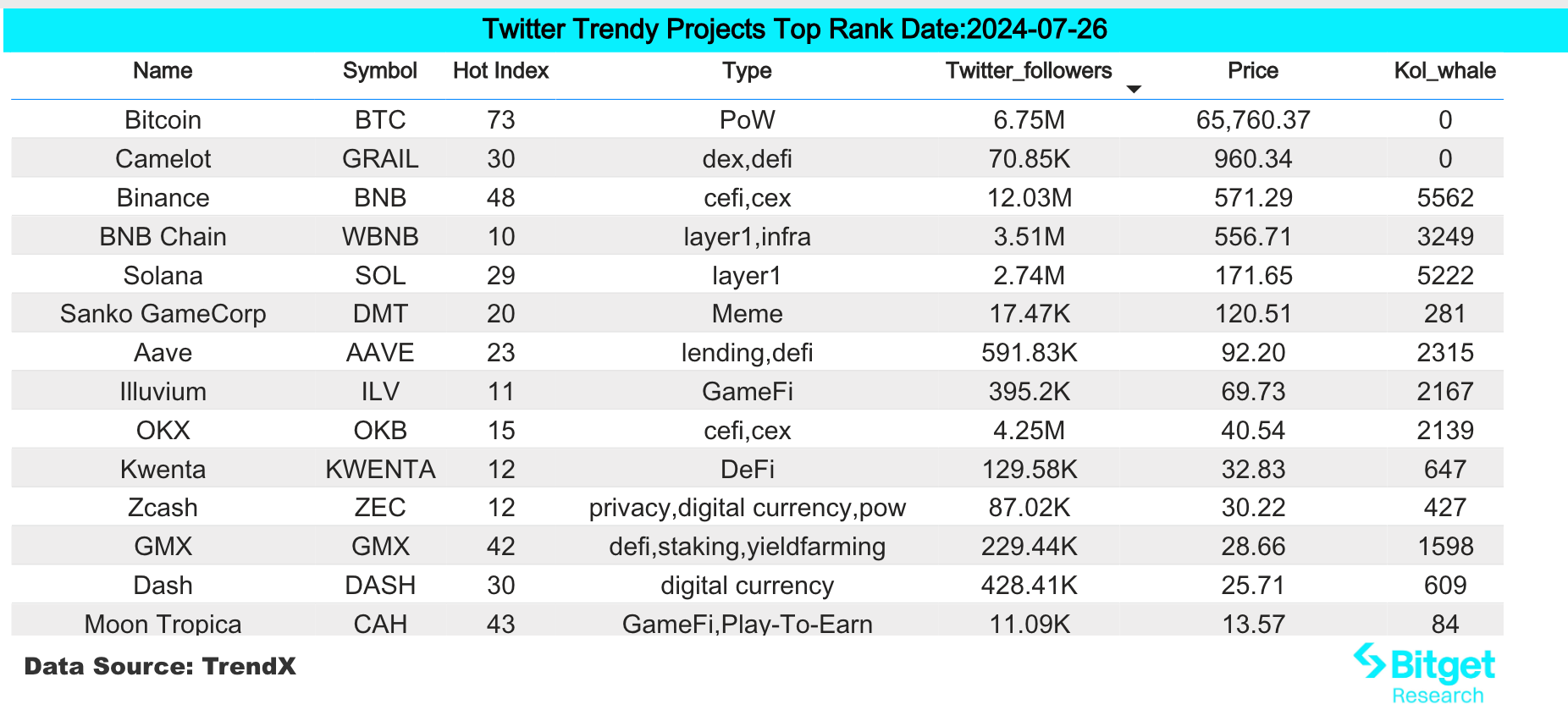

2) Twitter

Solana:

Defillama data shows that Solana's TVL reached $5.15 billion, second only to Ethereum and Tron, with a 7-day increase of 13.7%. In the past 24 hours, Solana's on-chain NFT sales approached $6 million, surpassing Ethereum to rank first, according to CryptoSlam data. The past 24-hour on-chain NFT sales on Solana reached $5,821,706, an increase of 55.7%, while Ethereum's sales were $3,666,892, a decrease of 21.53%; Bitcoin ranked third, with sales of approximately $2.902 million, a decrease of 19.89%. The rise in Solana's on-chain NFT sales is mainly driven by three NFT series: Retardio Cousins, Solana Monkey Business, and Mad Lads, with sales of approximately $1.271 million, $1.081 million, and $871,000, respectively, in the past 24 hours.

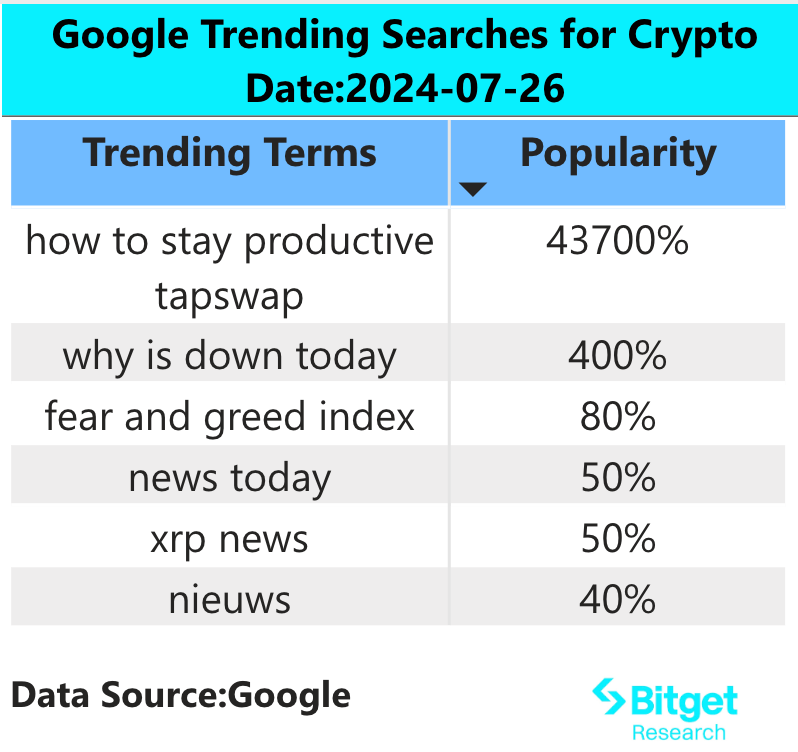

3) Google Search & Regions

Global Perspective:

Why is down today & fear and greed index:

Yesterday, the three major US stock indexes fell sharply, with Tesla falling by 12.33% in a single day, Nasdaq falling by 3.64%, and the fear index (VXX) rising by 13.55%. Market risk aversion increased, and cryptocurrencies followed suit in the decline. The approval of the ETH ETF was accompanied by significant selling pressure from whales based on on-chain data. Yesterday, there was a net outflow of $100 million from the ETH ETF, with Grayscale being the main force behind the outflow. The market needs some time to digest Grayscale's short-term selling pressure.

Regional Hot Searches:

(1) Google Trends hot searches in Asian countries show no obvious characteristics. RWA and SHIBA are the focus of the market, and market websites Coinglass and Coinmarketcap are also on the hot searches list in Asian countries.

(2) Meme coins are more prominent in the CIS region, with terms such as BLUM appearing in hot searches. In European and American countries, the main hot search terms are Monad, crypto ai, and other recent popular projects and tracks.

IV. Potential Airdrop Opportunities

Allora Network

Allora is a decentralized artificial intelligence network dedicated to self-improvement, aiming to provide applications with more intelligent and secure AI services. By combining cutting-edge technologies such as peer prediction, federated learning, and zero-knowledge machine learning, it has opened up a wide range of new application design possibilities at the intersection of cryptocurrency and artificial intelligence.

The decentralized AI network Allora completed a $3 million strategic financing round, with participation from Archetype, Delphi Ventures, CMS Holdings, ID Theory, and DCF God. The financing round began in March and was completed in early June, with an equity financing structure. Currently, Allora's total financing amount is $35 million. This round of financing will be used to recruit 5 to 7 employees. In February of this year, Upshot was renamed Allora, transitioning from an NFT valuation platform to a decentralized AI network. Allora Network is currently in the testnet phase, and Allora Labs is collaborating with the Allora Foundation to launch the mainnet this summer. Currently, the team does not have a clear plan to link points with tokens.

How to participate: After completing any task on Galxe, add the Allora-Testnet test network to the wallet, stake the received water to select a validator, and send any amount through the wallet.

RedStone

RedStone is a cross-chain oracle project, and RedStone is a modular oracle for LST and LRT, providing frequent, reliable, and diverse data sources for dApps and smart contracts on multiple L1 and L2 networks. The market expects the project to launch its coin in the second half of 2024.

In 2022, RedStone completed a $7 million seed financing round, led by Lemniscap, with participation from Coinbase Ventures, Blockchain Capital, Distributed Global, Lattice, Arweave, Bering Waters, Maven11, and SevenX Ventures. In 2023, the project received investments from the founder of Aave, and co-founders of Polygon in the angel round.

How to participate: (1) Obtain RSG points by participating in online activities and Galxe tasks released by RedStone and its various partners. (2) Create content and participate in designated activities on the RedStone Discord server (such as weekly best content or hall of fame) to earn RSG points as a creator.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。