On the afternoon of July 25th, AICoin researchers conducted a live graphic and text sharing session titled "Is Bitcoin Becoming the US Reserve? Trump's Big BTC Plan (Free Membership)" in the AICoin PC-end Group Chat Live. Below is a summary of the live content.

I. Trump Considering Bitcoin as US Reserve

Bitcoin has risen by 25% in the past two weeks, reaching $68,000, partly due to speculation that Donald Trump is considering using Bitcoin as a strategic reserve for the United States.

1. Mainstream Media Reports and Market Reactions

CNBC and mainstream media are discussing the possibility of the US government considering Bitcoin as a reserve currency in the event of Trump's potential re-election. However, this is not official news.

Based on current market forecasts, the direction of Bitcoin is generally positive:

Firstly, there is an interesting rumor that the US Department of Justice currently holds about 200,000 Bitcoins, valued at approximately $13 billion at current market prices. This makes the US one of the largest Bitcoin holders in the world. However, while the Department of Justice theoretically can transfer these Bitcoins to the Treasury Department, practical implementation may encounter legal and policy obstacles.

Additionally, if the Department of Justice changes its strategy from frequent selling to long-term holding, this could have a positive impact on the market by reducing the supply and helping to drive up the price of Bitcoin.

Most importantly, Trump's attitude towards Bitcoin is becoming more friendly. It seems that Trump is quite interested in Bitcoin and blockchain, and even recently met with some Bitcoin miners. It is said that he plans to speak at a meeting next week to discuss how to help the cryptocurrency industry through policies, especially by proposing some suggestions to support innovation and reduce mining energy costs, which is good news for the entire industry.

Trump also has a bold idea, hoping that all Bitcoin will be produced in the US in the future. Although this goal sounds unrealistic, if it can encourage more Bitcoin mining in the US, it would at least be beneficial for the domestic market.

Opinions vary, and some Key Opinion Leaders (KOL) have pointed out that the "Trump announces Bitcoin as a national reserve asset" is probably a false news, as there is no precedent for it. The US has never had a national reserve asset announced by the president, and assets like gold and oil are established through legislative procedures.

I personally also think it's false news or a manipulation by large holders.

But we cannot rule out the possibility of false news becoming true news. We also need to closely follow authoritative institutions and mainstream media reports to avoid being misled by false information.

2. Market Strategy Advice: Beware of "Buying Rumors, Selling News"

For investors pursuing short-term operations, caution should be exercised when using the "buy rumors, sell news" market strategy. Remember to set reasonable stop-loss points, as market reactions may not always follow expectations even when buying based on seemingly reliable rumors.

The cautionary advice of "buy rumors, sell news" is mainly due to the following reasons:

1) Separation of speculative expectations and reality: It is common for the market to have excessively high expectations for a certain event, and once the event actually occurs, the impact may have already been fully absorbed, leading to the phenomenon of "selling facts."

2) Unstable expectations for major events: For example, Bitcoin often performs poorly during various "big events," reflecting the market's deviation between expectations and actual effects.

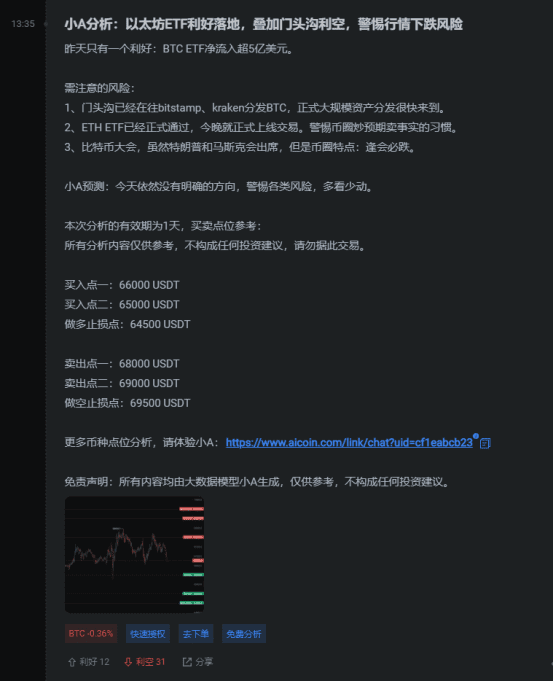

The content analyzed by Xiao A also indicates the cautionary advice of "buy rumors, sell news."

There are also flash news messages available on the PC end for everyone to experience.

It is also important to pay attention to the upcoming 2024 Bitcoin conference. Due to frequent election mishaps, this year's conference will have a strong political color. The market predicts that Trump will provide important guidance on US cryptocurrency policies.

II. Potential Impact Analysis of Trump's Plan on Bitcoin Price

1. Trump's Policy Support and Direct Impact on Energy Costs

(1) Trump's policy support: If Donald Trump can implement policies to promote Bitcoin mining, such as reducing energy costs, this will contribute to the development of the mining industry. Miners being able to obtain energy at lower costs will directly drive up the price of Bitcoin.

(2) Movement of Bitcoin mining locations: Bitcoin mining activities will move between different states based on changes in energy costs, such as Texas, New York, and Wyoming. This indicates that energy costs are an important factor in mining decisions. Therefore, a part of the price also depends on whether these energy agreements can be reached.

(3) Impact on Bitcoin supply: Lowering energy costs allows miners to hold more Bitcoin rather than selling it to cover costs, reducing the amount of Bitcoin available for trading in the market and further driving up its price.

(4) Vision of Americanizing Bitcoin: Although Trump's hope for all Bitcoin to be produced in the US is unrealistic, increasing the production of Bitcoin in the US can enhance the integrity of the domestic industry chain and market control, which is also beneficial for the healthy development of the Bitcoin market in the long run.

2. Bitcoin Price Outlook

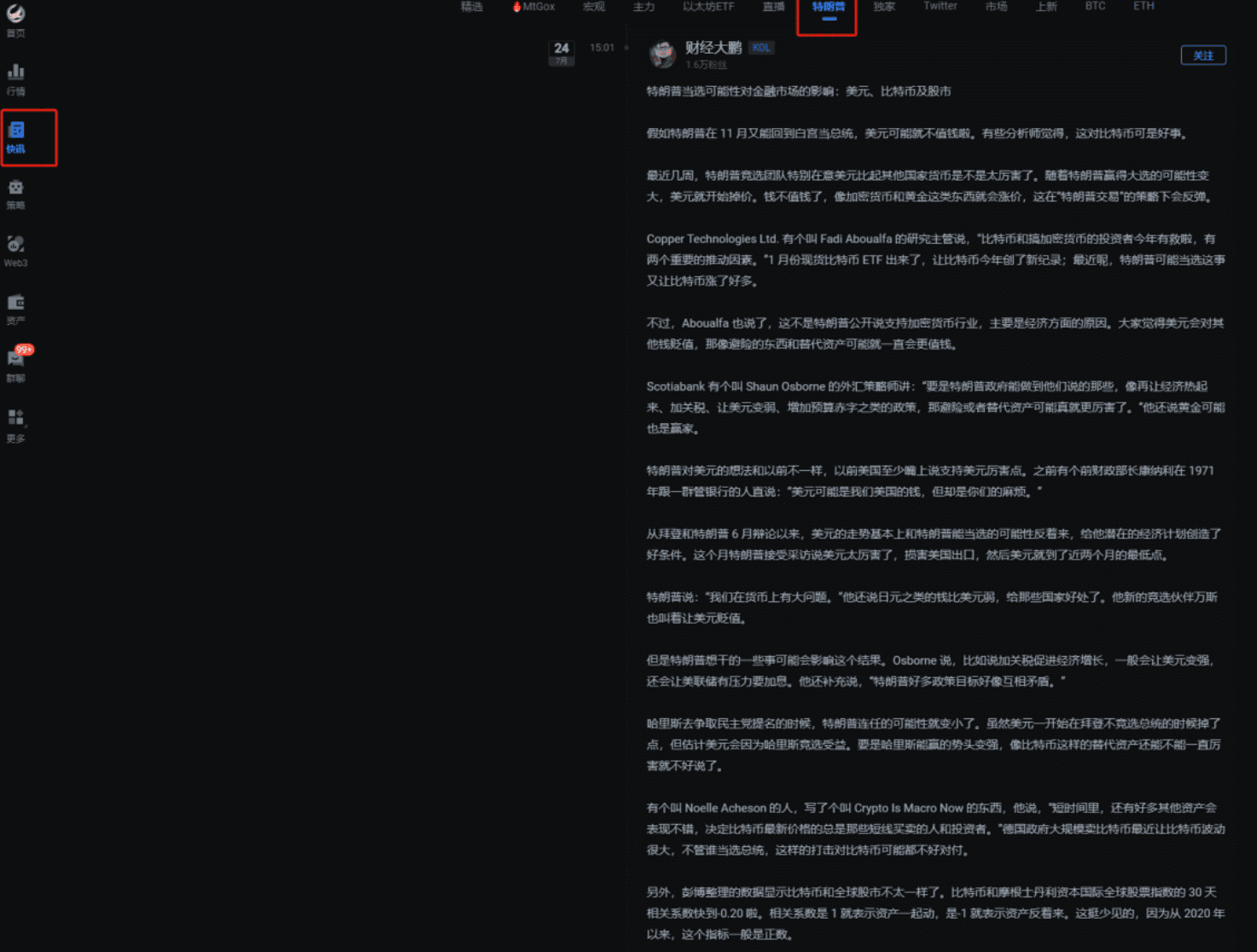

The viewpoints of KOL in the flash news are half bullish and half cautious.

(1) Expectation of USD depreciation: If Trump is elected, the USD may depreciate. This is because his policies may lead to economic instability, such as increasing budget deficits. In this scenario, investors may turn to alternative assets like Bitcoin as a hedge, thereby driving up the price of Bitcoin.

(2) Market reaction: Trump's campaign has already had an impact on the market, with the USD depreciating as the likelihood of his election increases, while Bitcoin rises. This indicates that the market's expectations of Trump's policies have already been reflected to some extent in the price of Bitcoin.

Since the June debate between Biden and Trump, the trend of the USD has basically been inversely related to the likelihood of Trump being elected, creating favorable conditions for his potential economic plans. This month, Trump said in an interview that the USD is too strong, damaging US exports, and then the USD reached its lowest point in nearly two months.

(3) Policy contradictions: Although some of Trump's policies may lead to USD depreciation, other policies such as imposing tariffs and promoting economic growth may strengthen the USD. These policy contradictions may have a complex impact on the price of Bitcoin.

Therefore, under Trump's leadership, the outlook for Bitcoin depends on specific economic policies and market reactions. Currently, it is bullish but cautious.

3. Application of Signal Tools and Indicators

In the complex market situation, there are some signal tools and indicators that can be recommended for signal alerts and custom indicators, providing double verification for the BTC market.

Here, the KDJ Golden Cross and Death Cross Signal Alerts are used, as well as Volume Surge or Plunge Alerts:

KDJ Golden Cross: Emerging from a low point, buy to make a profit;

KDJ Death Cross: Falling below a peak, sell to break even.

Volume Surge: Bullish;

Volume Plunge: Bearish;

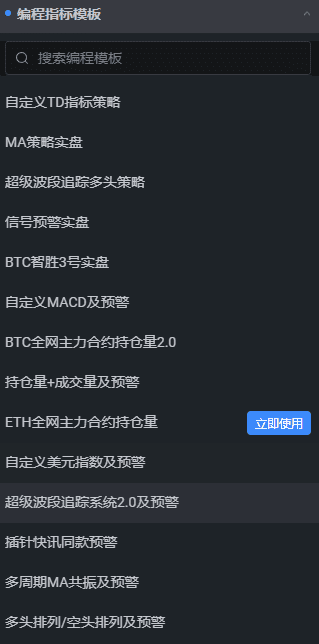

Volume Surge or Plunge Alerts can be edited using custom indicator templates, as shown in the image.

As shown in the image below the candlestick chart, new indicators can be created.

There are more template uses that can be found here: [Link to be provided by the user]

III. Biden Withdraws from the Race, Kamala Becomes the New Focus

1. Impact of Biden's Withdrawal: Recently, Biden withdrew from the race, resulting in a slight decline in the prices of Bitcoin and meme coins related to Biden. This demonstrates the market's sensitivity to political news.

2. Bitcoin Recovery: Despite the initial decline, the price of Bitcoin began to recover shortly after, indicating that the market can quickly self-adjust, despite the current presence of a lot of uncertainty.

3. Opportunity for Kamala Harris: Now, Kamala has become a popular candidate for the 2024 presidential election. If she indicates support for Bitcoin, this could greatly influence the election.

The public's thoughts are straightforward: we need a president who supports cryptocurrency. However, from a more conservative perspective, although Joe Biden and Kamala have not been very friendly towards cryptocurrency in the past, the situation could potentially change.

4. Relationship Between Cryptocurrency and Politics: Whether it's the Democratic Party or the Republican Party, cryptocurrency should not be a divisive issue. The Democratic Party now has the opportunity to attract voters who are interested in cryptocurrency, which is an advantage for them.

5. Potential Policy Changes: If the Democratic Party can make a mark in cryptocurrency policy, this may also compel the Republican Party, including Trump, to improve their strategies.

Therefore, if we open our minds, there are many possibilities for the direction of things and the trends in the cryptocurrency industry. We need to be prepared, even if it currently seems very favorable.

Recommended Reading

For more live content, please follow the AICoin "News/Information - Live Review" section, and feel free to download the AICoin PC end platform.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。