截至 2026 年 1 月 30 日,比特币(BTC)空头动能全面爆发,价格一度击穿 81,000 美元 关口,不仅刷新了 2026 年年度新低,较 2025 年 10 月的历史高点($126,296)跌幅已超 30%。在市场一片哀嚎中,Coinbase 主力的“艺术挂单”再次展示了其恐怖的指向性意义。

数据复盘:Coinbase 主力“艺术挂单”连胜两次

回看近期行情,Coinbase 出现了两次极具代表性的、从成交规模与挂单结构判断的艺术挂单卖出行为,成交后价格均出现明显回落。

什么是「艺术挂单」?

所谓艺术挂单,并非随机抛售,而是指:

- 挂单数量与价格间距呈现高度规律性

- 常见形式为 固定价差(如每 100 美元一档)

- 目的不是“抢成交”,而是向市场持续释放供给压力

这种行为,通常来自体量较大的机构或专业账户,对短期走势具有极强的指示意义。

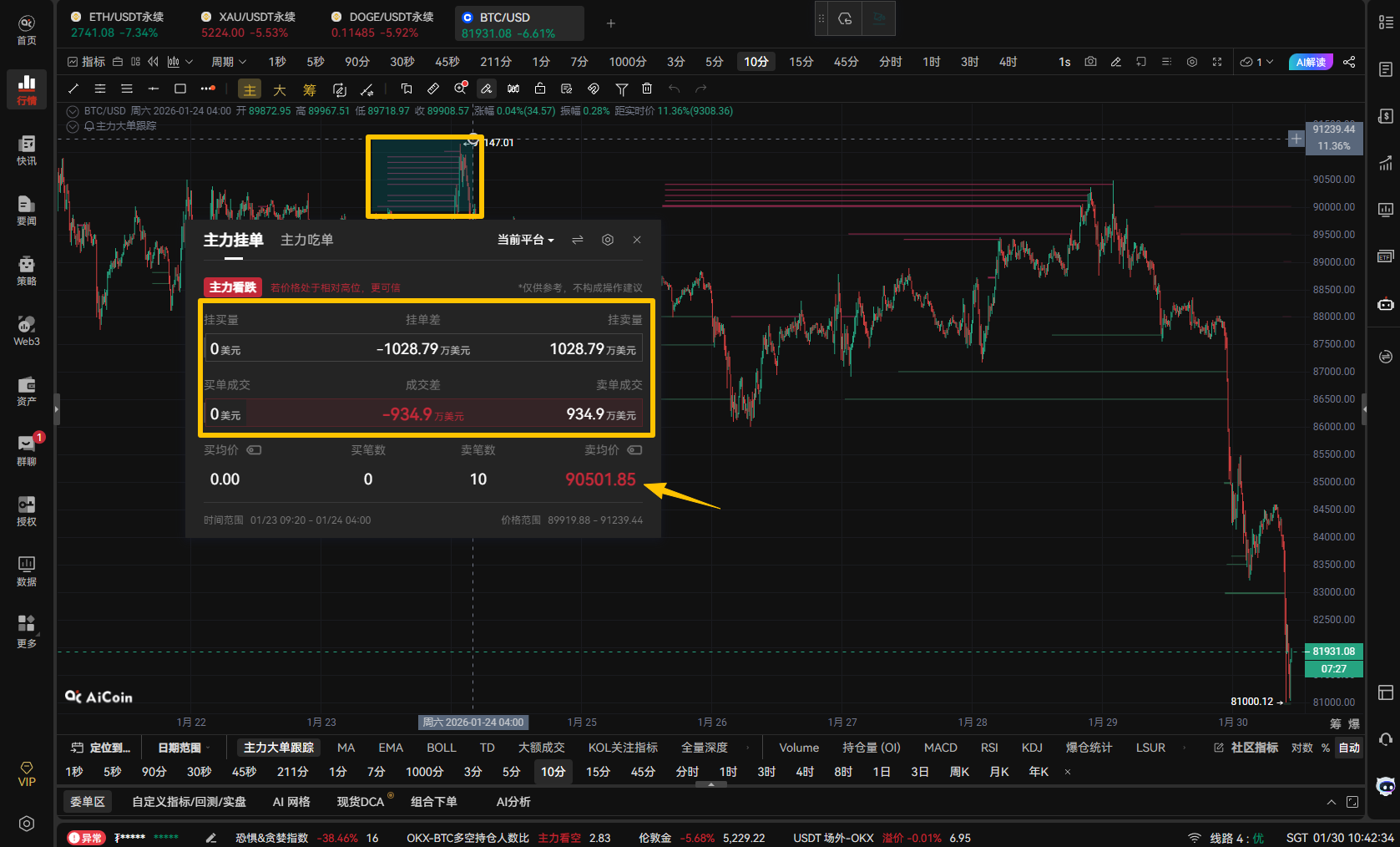

第一次艺术挂单

时间:2026 年 1 月 24 日 凌晨

成交金额:约 934.9 万美元

成交均价:90,501.85 美元

成交完成后,比特币价格一路走弱,最低回落至 86,000.13 美元,跌幅约 5%。

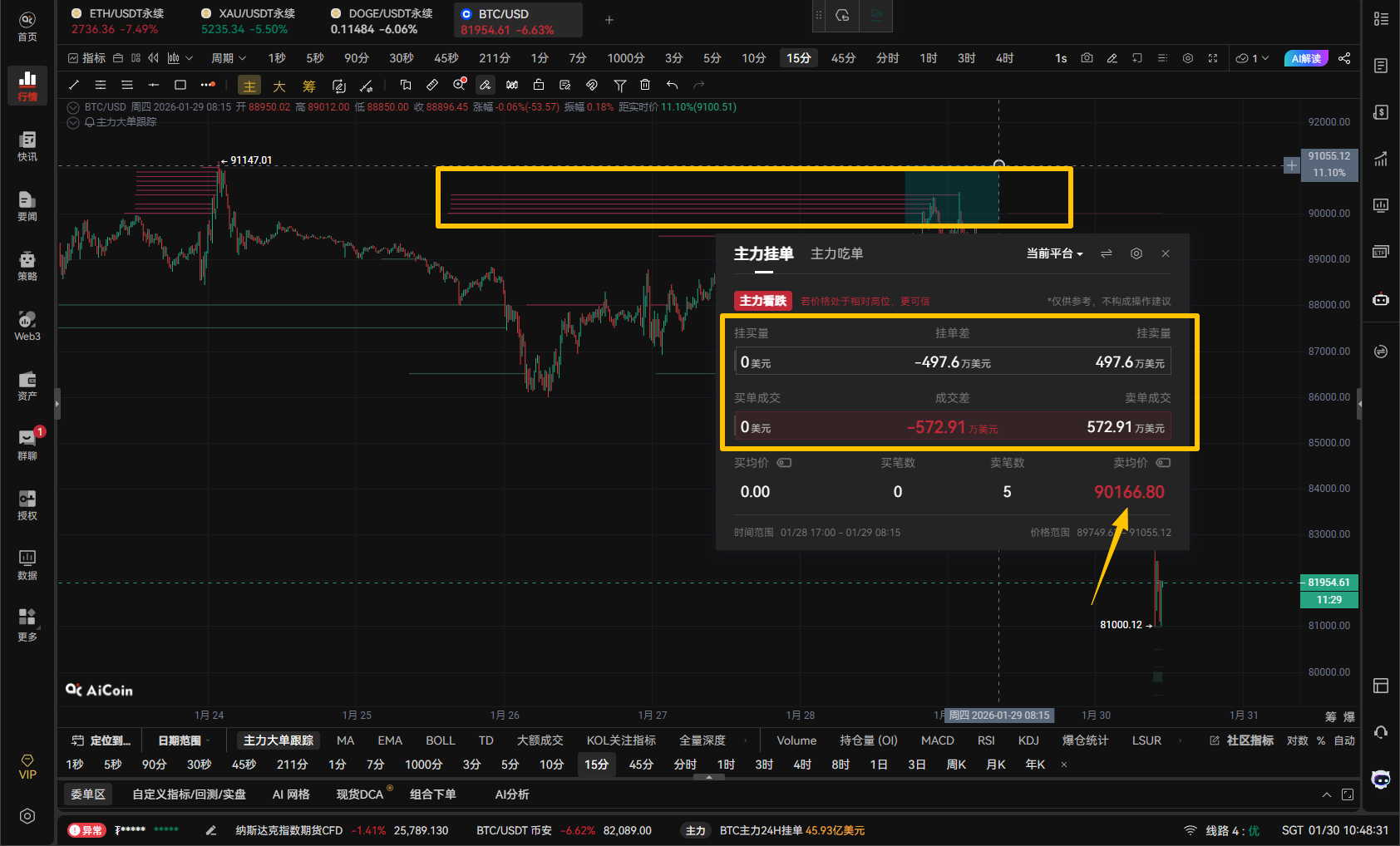

第二次艺术挂单(关键)

时间:2026 年 1 月 30 日 21 点左右

成交金额:约 572.91 万美元

成交均价:90,166.8 美元

随后行情快速走弱,BTC 持续下探,最低触及 81,000.12 美元,跌幅接近 10%。

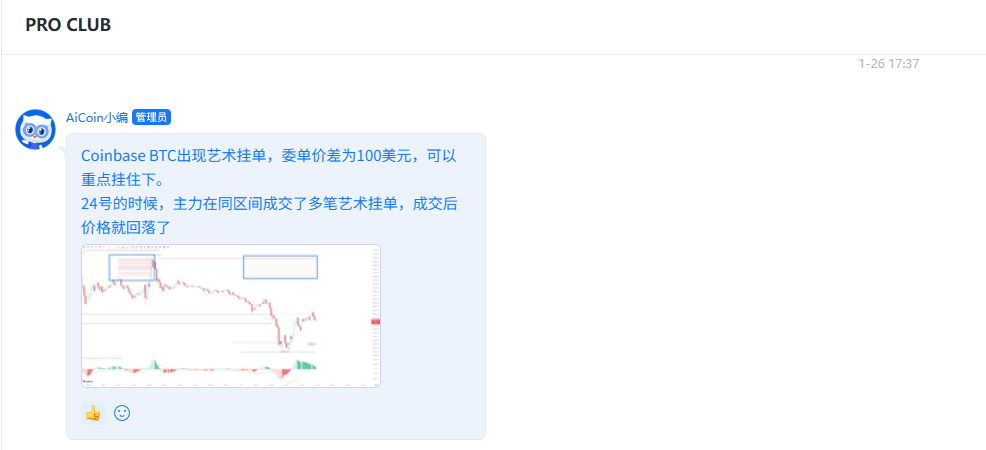

值得注意的是,第二次艺术挂单出现当下,我们已在 PRO CLUB 会员群 内同步提醒:

- Coinbase 主力大单异常

- 建议重点关注成交结果与后续价格反应

- 并可通过【主力成交提醒】第一时间跟踪

对于已开启 主力大单监控 + 成交提醒 的用户而言,主力大单功能的核心价值,就在于:

把“看不见的机构行为”,提前变成可量化、可提醒的信号,在情绪崩塌之前,先看到“筹码在动” 。

本轮下跌的主要驱动因素

除了主力抛售的诱因,本次暴跌是多重利空共振的结果:

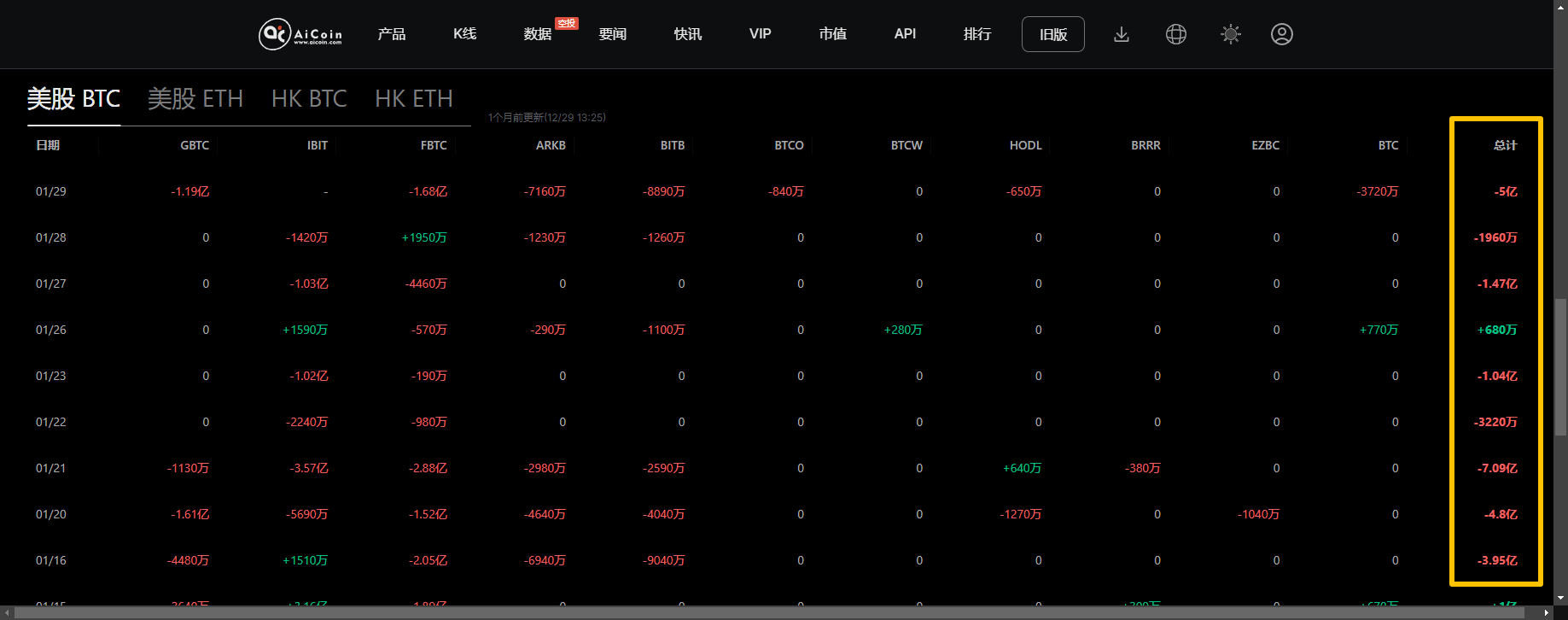

1、现货比特币 ETF 资金持续流出

- 一周内净流出规模超过 11 亿美元

- 为 2025 年初以来最大单周流出之一

- 机构层面明显在 降低比特币敞口

2、风险资产整体承压

加密市场总市值在 24 小时内下滑约 6%

不仅是 BTC,整个加密板块同步去杠杆、降风险

3、宏观不确定性升温

- 加息预期延后

- 美国政府关门风险

- 地缘政治紧张

- 稀土关税等扰动因素

- 资金阶段性流向 黄金、国债等避险资产,高波动资产估值承压。

4、衍生品结构放大跌幅

- 1 月 30 日将有价值近 90 亿美元的比特币期权到期,大量看涨期权处于「价外」

- 期权市场整体偏空

- 订单簿流动性偏薄,稍大的卖压,就容易引发非线性下跌

小结

当下的市场不再是盲目抄底的时机,而是追踪主力数据的博弈场。Coinbase 连续两次精准的“艺术大单”证明了:数据比直觉更诚实。

如果您厌倦了在暴跌中被动挨打,加入 PRO CLUB 会员群,您可以:

- 解锁【主力大单】专属看板: 实时监控主力资金的一举一动。

- 享受“艺术挂单”即时提醒: 在暴跌前收到成交推送,快人一步离场或反向布局。

- 深度研报讨论: 与资深分析师共同研判下个关键支撑位。

👉一键直达:

https://www.aicoin.com/zh-CN/vip

加入我们的社区,一起来讨论,一起变得更强吧!

官方电报(Telegram)社群:http://t.me/aicoincn

AiCoin 中文推特:https://x.com/AiCoinzh

群聊 - 致富群:

https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。