On the afternoon of July 18th, AICoin researchers conducted a live graphic and text sharing session titled "Is Bitcoin in a Bull Market or Bear Market (with Membership Giveaway)" in the AICoin PC-end-Group Chat-Live. Here is a summary of the live content.

I. Bitcoin Price Outlook: Market Opportunities and Risks under the Background of Trump's Possible Reelection

- Market Overview and Political Influence

As of July 18, 2024, the price of Bitcoin has reached $64K. Bitcoin may replicate the Trump bull market miracle, which could be one of the hottest topics recently. Looking back at 2016, after Donald Trump won the U.S. presidential election on November 8, 2016, Bitcoin rose by 20%-30%.

In addition, the biggest bullish news this year is that Trump may be reelected in November. Trump has a friendly attitude towards cryptocurrencies, and his presidency may change the U.S. government's attitude towards cryptocurrencies. Although there was an attempt on Trump's life, similar to the assassination attempt on President Reagan in 1981, Trump's reelection seems very stable. This morning's news also indicates an increased probability of Biden losing, which can also be taken into consideration.

- Guidance of Technical Indicators on Important Event Nodes

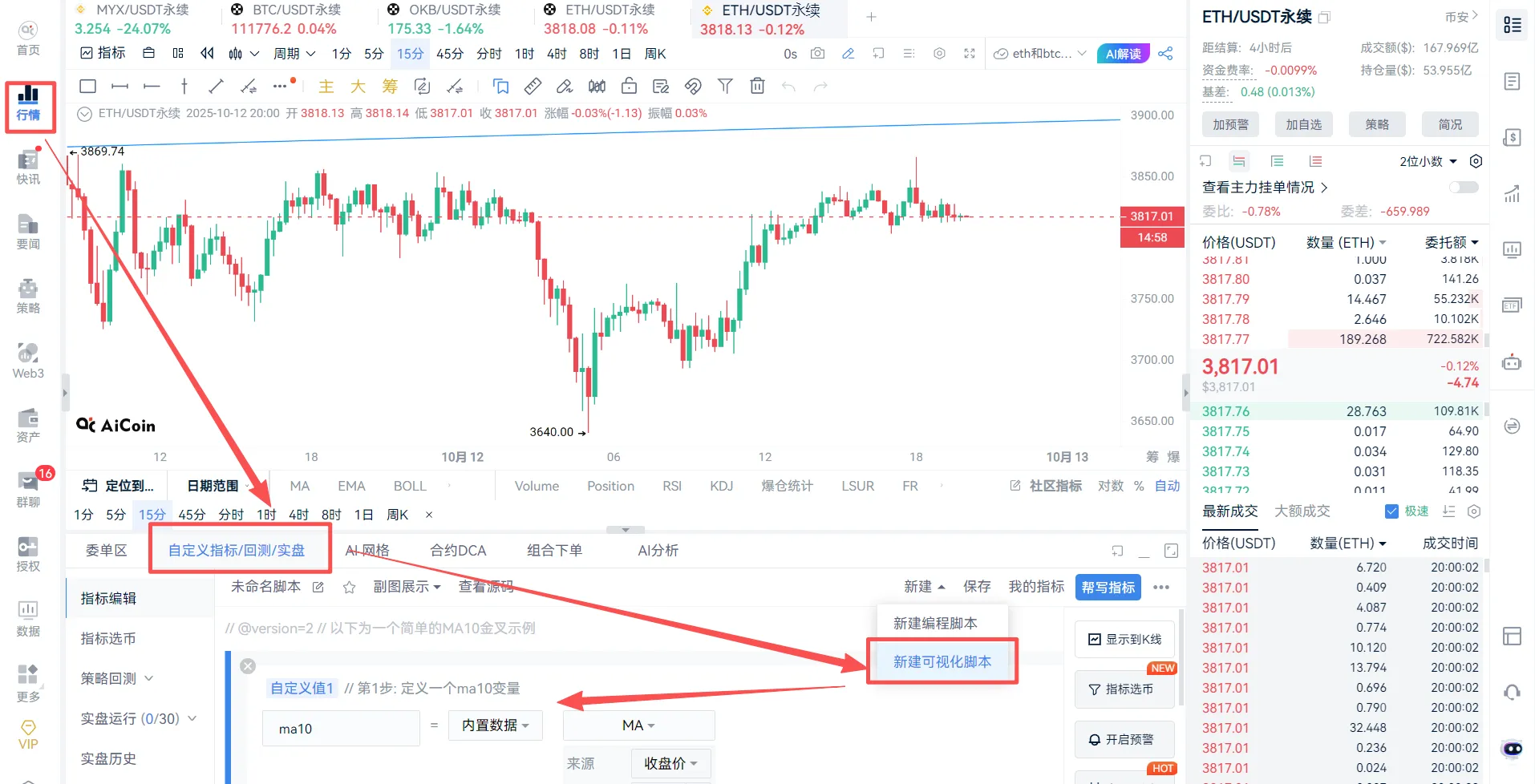

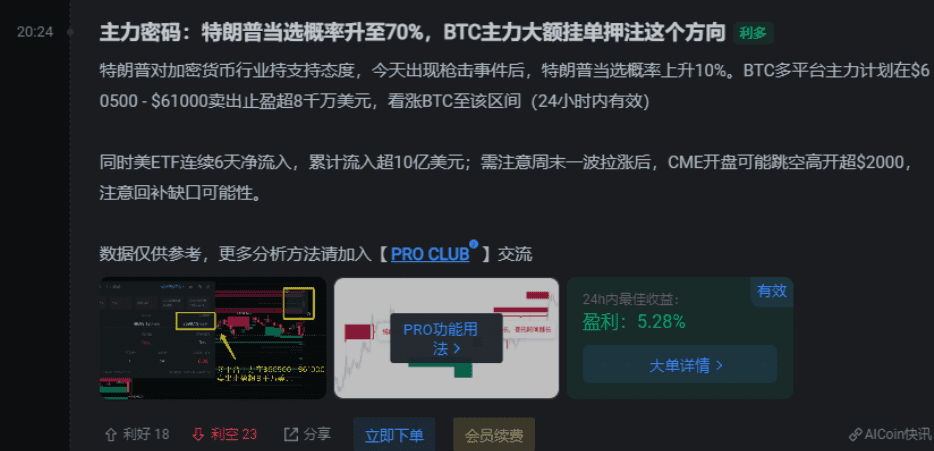

On the 14th, according to the prediction website Polymarket, Trump's election support rate was as high as 70% (now slightly reduced to 65%). At that time, the main news seen was:

On multiple trading platforms, the main plan is to sell for profit in the $60,500-$61,000 range, with an amount exceeding $80 million, indicating the main force's bullish view on BTC in that range.

Based on past data, the success rate of main force data verification within 24 hours is relatively high.

When the news was released, the U.S. ETF market had net inflows for 6 consecutive days, with a cumulative inflow of over $1 billion (now it has been 9 days of net inflows). This kind of fund inflow has a positive impact on market sentiment and may drive up the price of BTC. After a weekend surge, CME's opening may gap up by over $2,000, so attention should be paid to filling the gap. When we analyze our news, we consider macro factors, main market actions, fund flows, and technical analysis, as well as risk situations (such as weekend market fluctuations, CME opening risks, market sentiment risks, and regulatory risks). We need to take all of these into account when forming a comprehensive market understanding.

II. Follow-up Impact of the Mento District Event

- Mento District transferred 140,000 Bitcoins

Two days ago, Mento District transferred Bitcoins worth $9 billion, approximately 140,000 coins. Mento District may have just transferred the Bitcoins to another address for management, as the selling process and repayment process have been clearly disclosed. However, this news still caused short-term impact.

Mt. Gox lost about 940,000 Bitcoins, worth $424 million. So far, they have recovered about 15%, or approximately 141,868 Bitcoins. So far, they have recovered about 15%, or approximately 141,868 Bitcoins.

- How will these Bitcoins be distributed?

Approximately 95,000 Bitcoins will be used to repay claims. Of these, about 20,000 will be given to the claim fund, 10,000 will be allocated to Bitcoinica BK, and the remaining 65,000 will be distributed to ordinary individual creditors. This quantity of 65,000 is significantly less than the previously reported 141,868. This structural distribution can reduce short-term market impact. If 30% of these 65,000 coins are sold, Bitcoin may drop by about 10%. When the German government sold 50,000 Bitcoins at once, it caused a pullback of about 20%, so a 30% sell-off resulting in a 10% pullback is normal.

It can be seen that despite the drastic market sentiment fluctuations, the actual situation may not be as severe as expected.

III. How Does the Inflow of Bitcoin Spot ETFs Affect Bitcoin Prices?

- The recent inflow of Bitcoin spot ETFs is very substantial

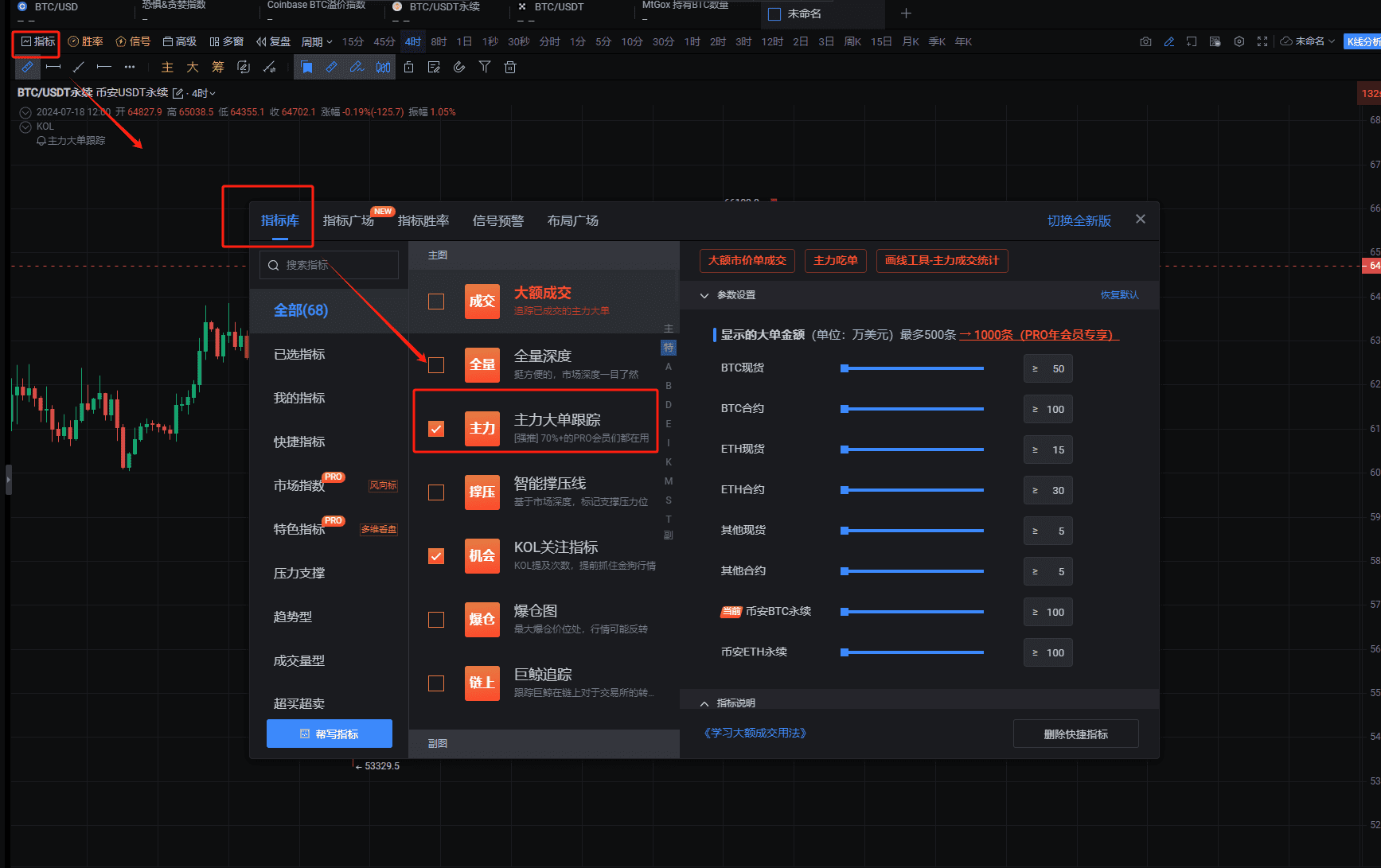

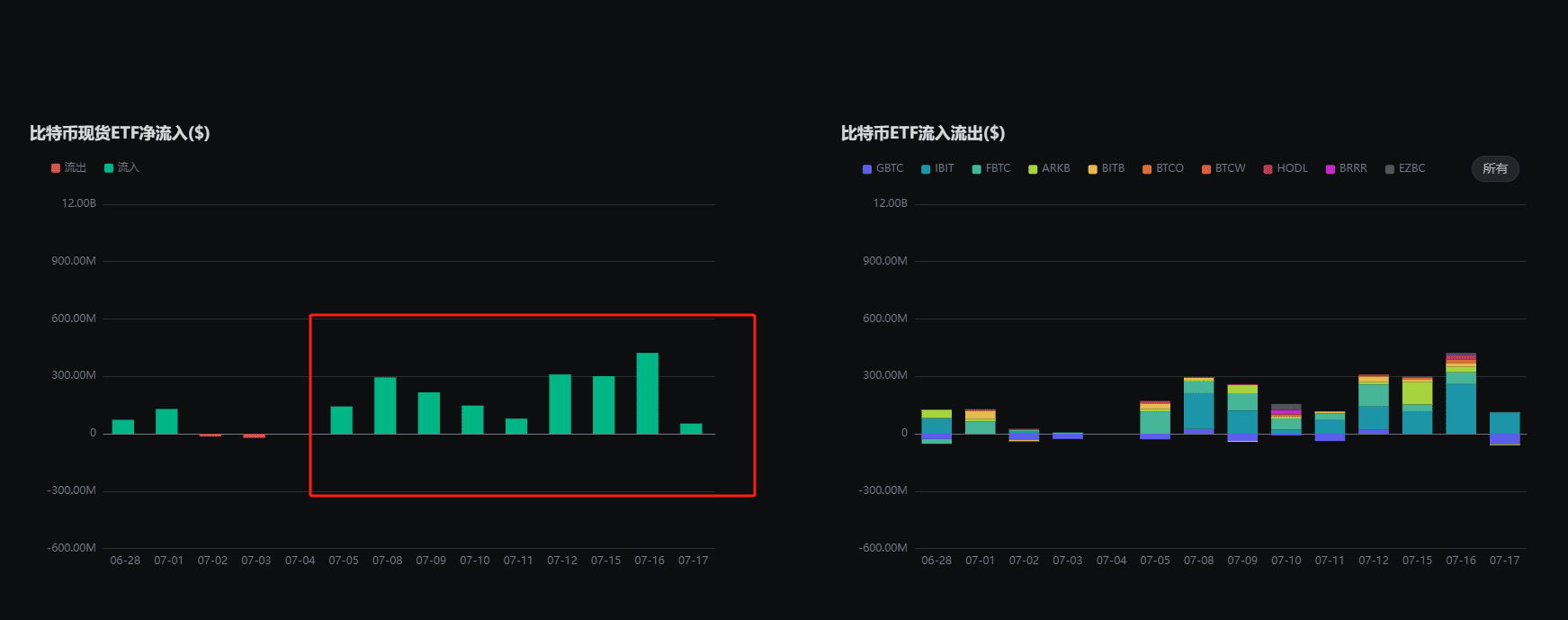

Despite the impact of the Mento District event, the inflow of Bitcoin spot ETFs remains substantial. Over the past few days, there have been three consecutive days of inflows of around $300 million, how does this affect the price of Bitcoin historically?

The recent substantial inflow of spot ETFs, from July 5th to July 18th, saw continuous inflows on each working day. Four days had inflows of around $300 million each, with a single-day purchase of $300 million worth of Bitcoin.

The data can be seen here:

This massive continuous inflow is enough to impact the market. The inflow of Bitcoin spot ETFs reached $300 million for two consecutive days on July 12th and 15th, which is equivalent to half of the peak inflow.

- Data on historical net inflow phases

The inflow of Bitcoin spot ETFs is phased and cyclical.

The first inflow started at the end of January and continued until late March. The inflow during this period was completely consistent with the rise in Bitcoin prices. The second wave of inflow started in early May and ended in early June, lasting for about a month.

Even with the panic caused by the Mento District's transfer of Bitcoins, the inflow of Bitcoin spot ETFs remains substantial. It is very likely that we will see a third wave of inflows starting from now, and the first two waves of inflows were accompanied by the rise in Bitcoin prices.

In addition, the Fed is expected to cut interest rates on September 18th. Inflation in the U.S. has been stable, and the inflation target is only 1% away.

IV. FTX Exchange Expected to Repay Stablecoins, Enhancing Market Buying Power

From the last quarter of this year to the first quarter of next year, the FTX exchange will repay $16 billion in stablecoin liquidity to creditors, and these funds are likely to flow back into the cryptocurrency market, bringing significant buying power. It is expected to be gradually released from the last quarter of this year to the first quarter of next year.

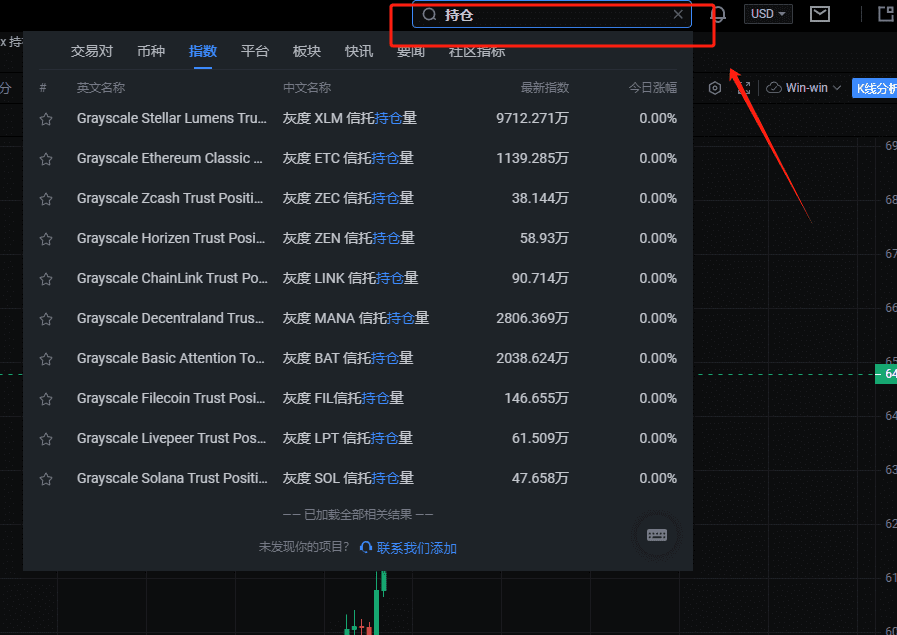

V. "MtGox" Real-time Monitoring is Online

"MtGox" real-time monitoring is now online, allowing everyone to quickly know when Mt. Gox's next transfer activity occurs.

Various indices can be directly searched in the upper right corner search box.

Recommended Reading

- "Profit Signal Strategy for Inserting Needles"

- "Halving Effect? Middle East Situation? - Comprehensive Strategy for Turbulent Markets"

- "How Can Novices Trade Coins Correctly"

For more live content, please follow the AICoin "News/Information-Live Review" section, and feel free to download the AICoin PC-end.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。