TRON is the first blockchain with a single stablecoin value exceeding 60 billion US dollars.

Author: OurNetwork

Translation: Deep Tide TechFlow

Stablecoin

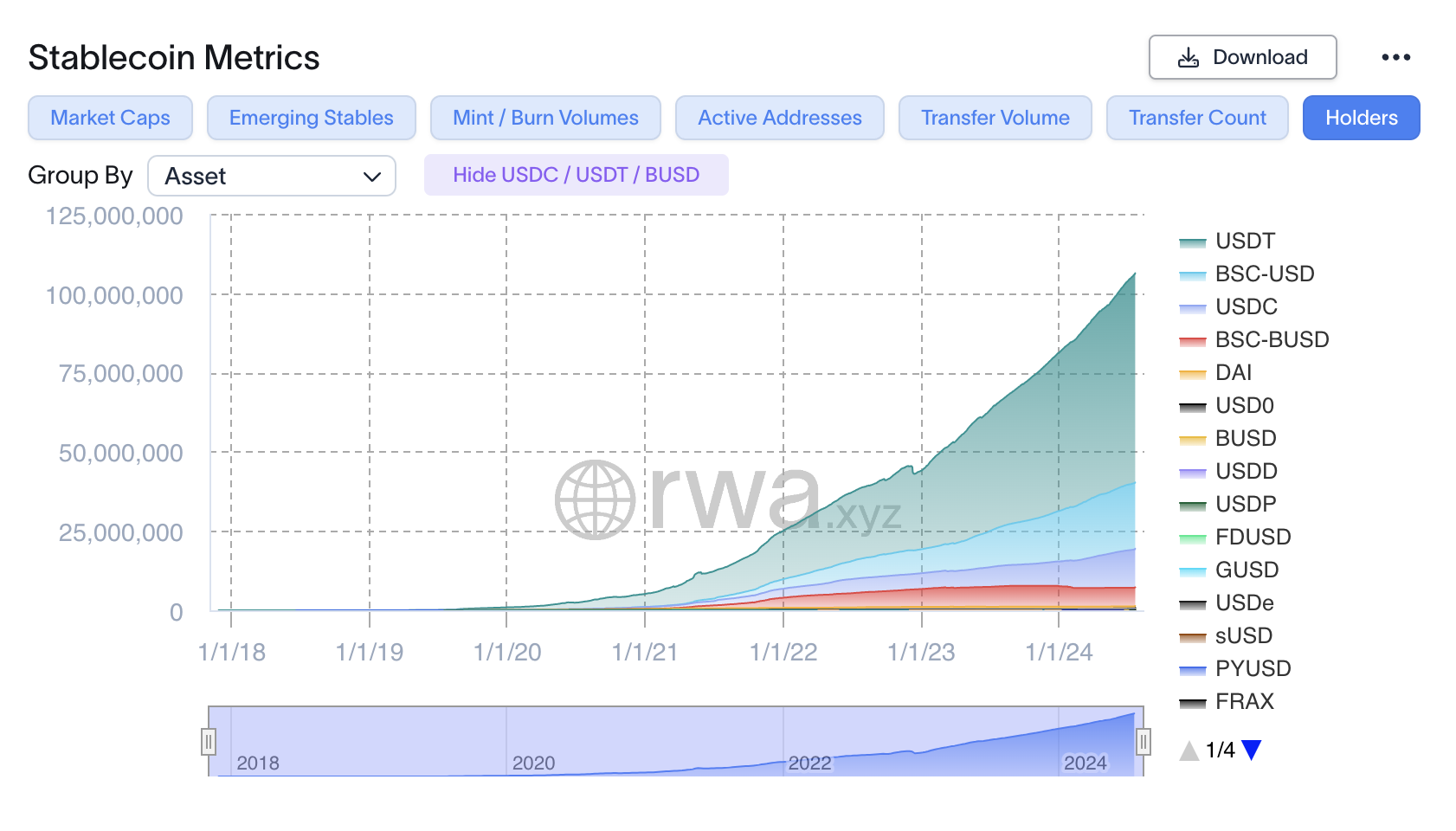

The number of stablecoin holding addresses has exceeded 100 million, and the market value and active addresses remain stable

- Since the last quarter's OurNetwork stablecoin report, the number of addresses holding stablecoins has increased from 95 million to 107 million, a growth of 13%. The total market value of stablecoins has also increased from 162 billion US dollars to 166.3 billion US dollars, an increase of 2.5%. Although the number of active addresses did not reach a new high, it remained stable, with over 21 million active addresses in May.

rwa.xyz

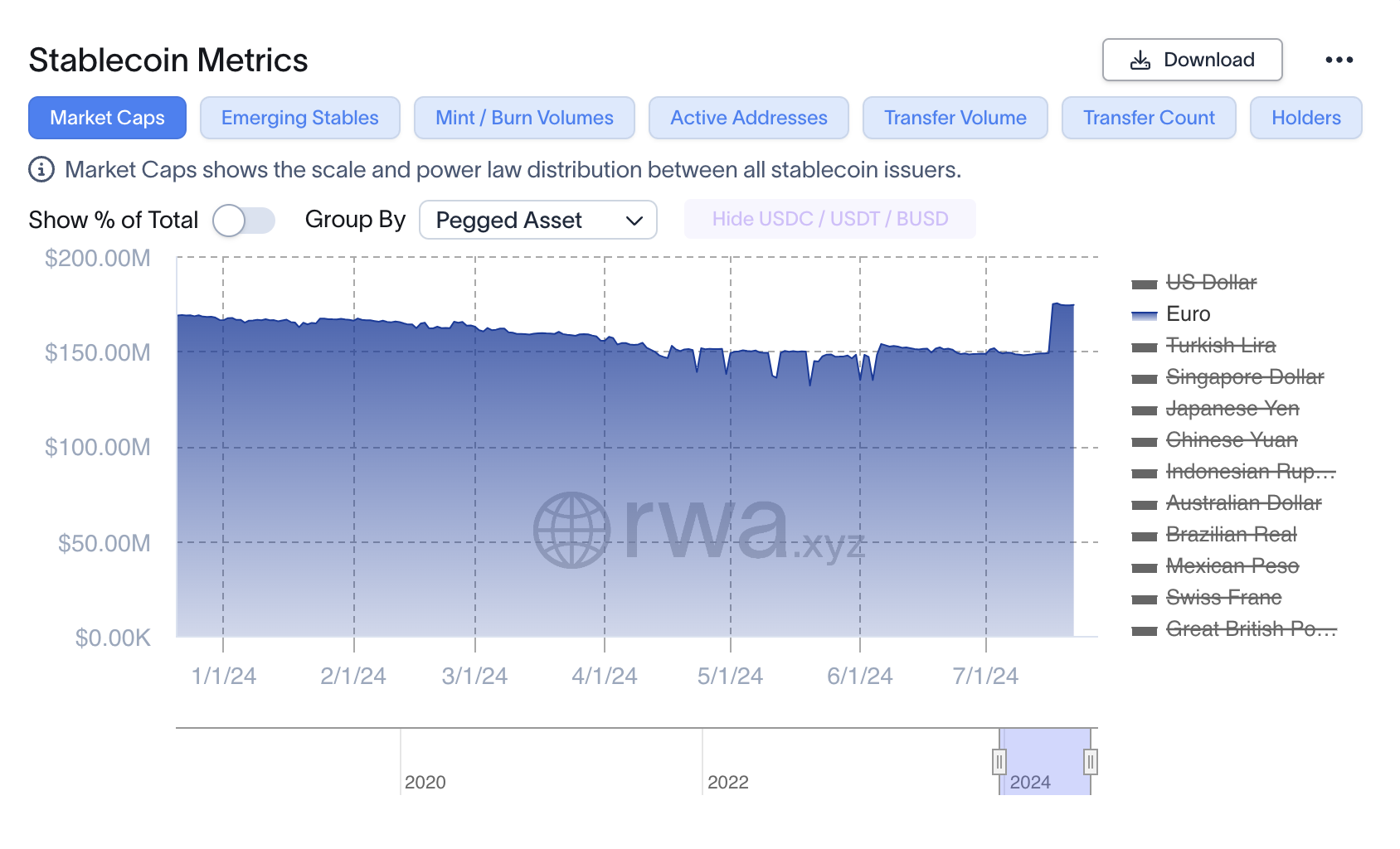

- The MiCA regulatory framework took effect at the end of June, imposing significant restrictions on stablecoin issuers and exchanges, especially leading to the delisting of Tether's USDT from some exchanges. Some speculate that MiCA will benefit stablecoins denominated in euros, as they have fewer restrictions. However, since MiCA took effect, the market value of euro-denominated stablecoins has only slightly increased.

rwa.xyz

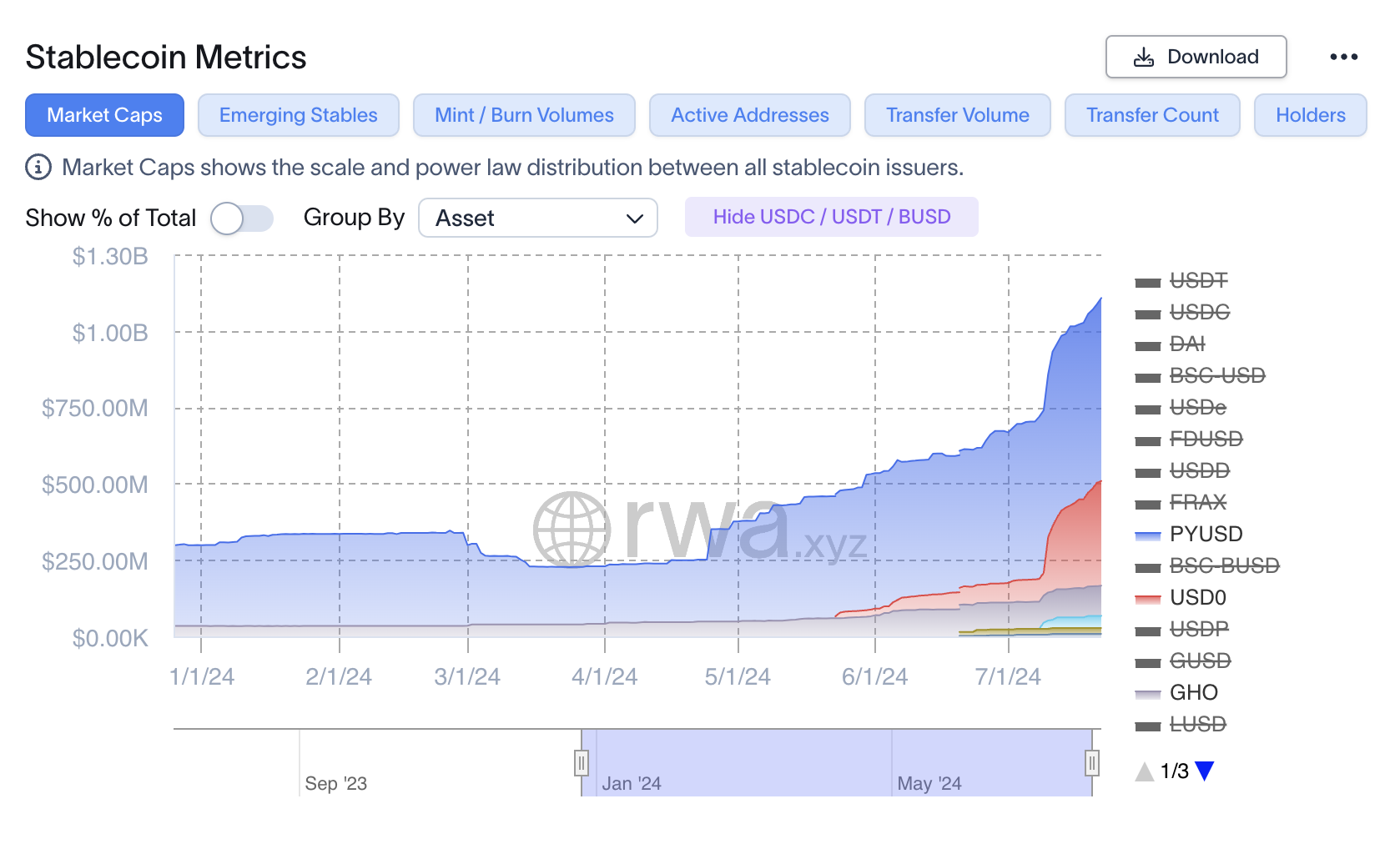

- Despite the overall market value only growing by 2.5%, some stablecoins have performed well. Ethena's USDe market value has increased by over 1 billion US dollars, reaching a total of 3.4 billion US dollars. Other major increases include USD0 growing from 0 to 170 million US dollars, PYUSD nearly tripling in market value to nearly 600 million US dollars, mainly on Solana, and Aave's GHO doubling in market value to nearly 100 million US dollars.

rwa.xyz

- Trading Level Alpha: This is the first large-scale minting of the AUSD stablecoin, which is pegged to the US dollar and backed by cash and cash equivalents managed by VanEck. AUSD is issued by Agora, a startup supported by Dragonfly and Galaxy. They hope to break the monopoly of Tether and Circle by offering a significant share of reserve interest. Agora sees an opportunity in Tether's huge monthly profits exceeding 1 billion US dollars.

① PYUSD

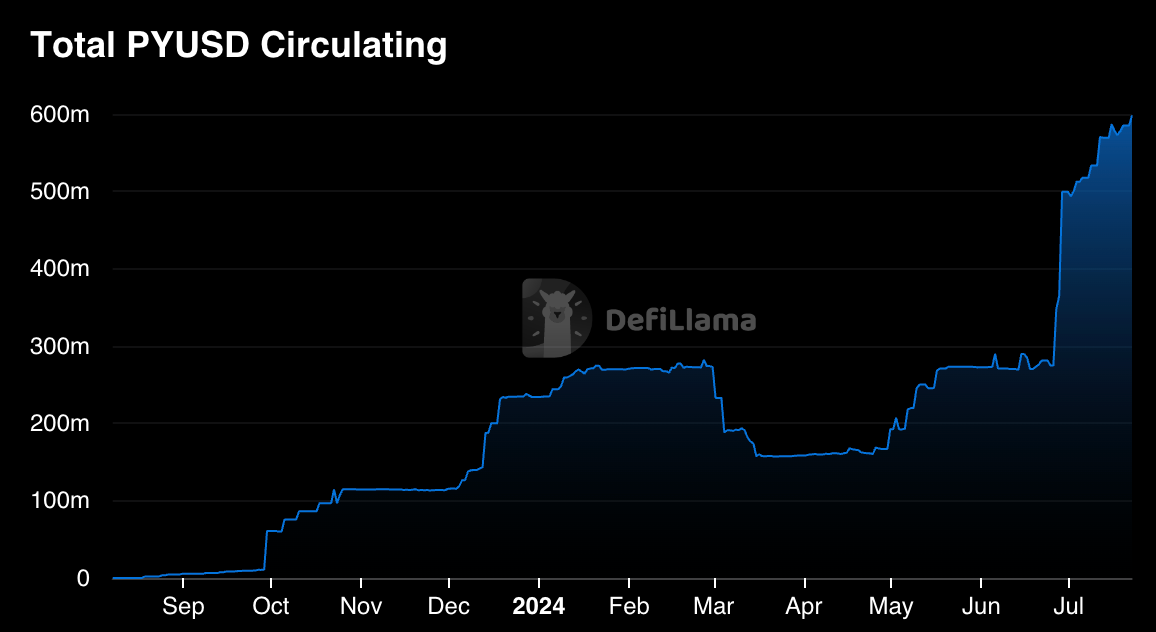

Paypal's stablecoin PYUSD market value exceeds 500 million US dollars

- Paypal launched its stablecoin PYUSD on August 8, 2023, in partnership with Paxos. Since then, the circulating supply has steadily increased. PYUSD was initially launched on Ethereum and then expanded to Solana. The total supply on all chains now exceeds 598 million US dollars. However, PYUSD only accounts for a small portion of all stablecoin trading volume.

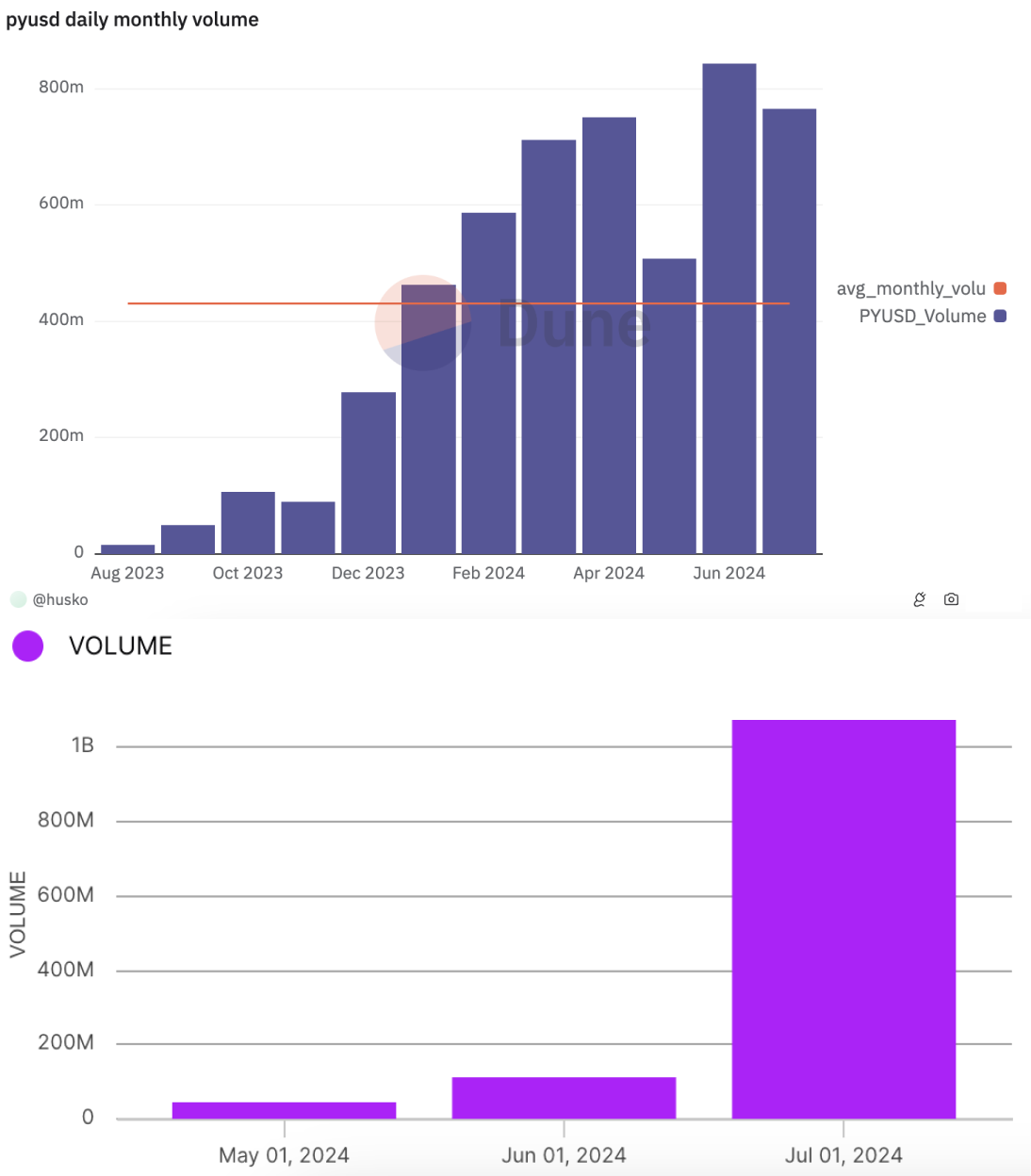

DeFiLlama

- Since its launch on ETH, PYUSD's trading volume has been on the rise. Although July has not ended, the monthly trading volume of PYUSD on Solana has also reached a historical high of 1 billion US dollars. Despite much higher trading volumes from competitors, PYUSD has not fallen behind.

Dune Analytics & Flipside

- Trading Level Alpha: On June 20, a transfer of 30 million PYUSD on the Solana blockchain accounted for 86% of the total daily trading volume. According to a message on Twitter, the address involved in this transaction may be related to market maker Wintermute. The address had previously provided funds for some collateral accounts related to Wintermute. In addition, the address had also been responsible for a one-time transfer of 115,000 SOL. This indicates significant institutional interest in PYUSD.

② USDC

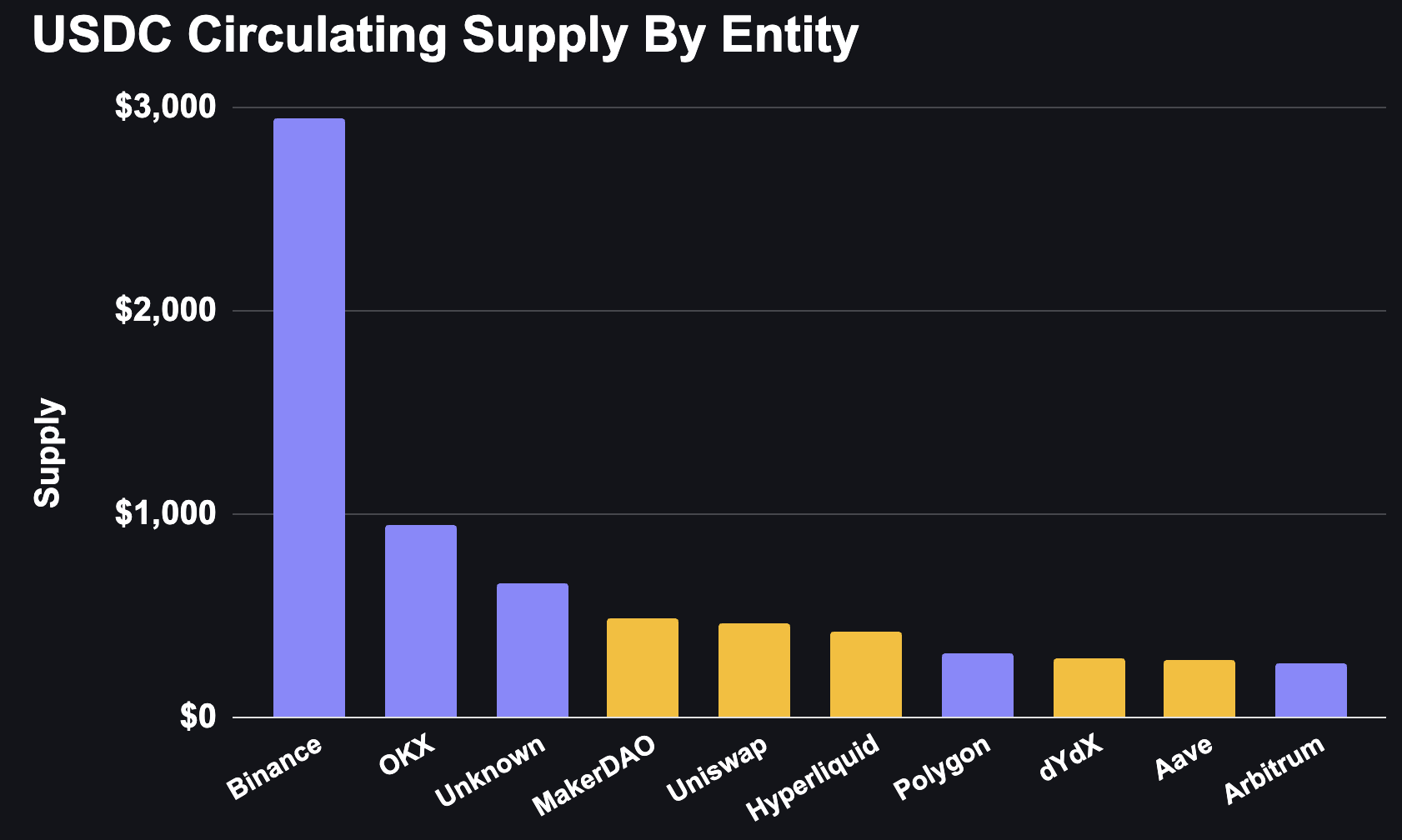

USDC circulation has grown by 35% from the beginning of the year, reaching a supply of 33.6 billion US dollars

- In 2024, USDC has shown strong performance, with a circulating supply exceeding 33.6 billion US dollars, a 35% increase since the beginning of the year. Currently, USDC supports 16 chains, with the circulating supply on 4 chains exceeding 10 billion US dollars. While Ethereum accounts for the majority of the supply (253 billion US dollars), Solana (21.9 billion US dollars) and Base (29.6 billion US dollars) have also seen significant increases in the past year.

Artemis

- USDC plays a crucial role in the DeFi ecosystem, with the top five holders being DeFi applications such as Uniswap, dYdX, and Aave, using USDC extensively as a stable asset.

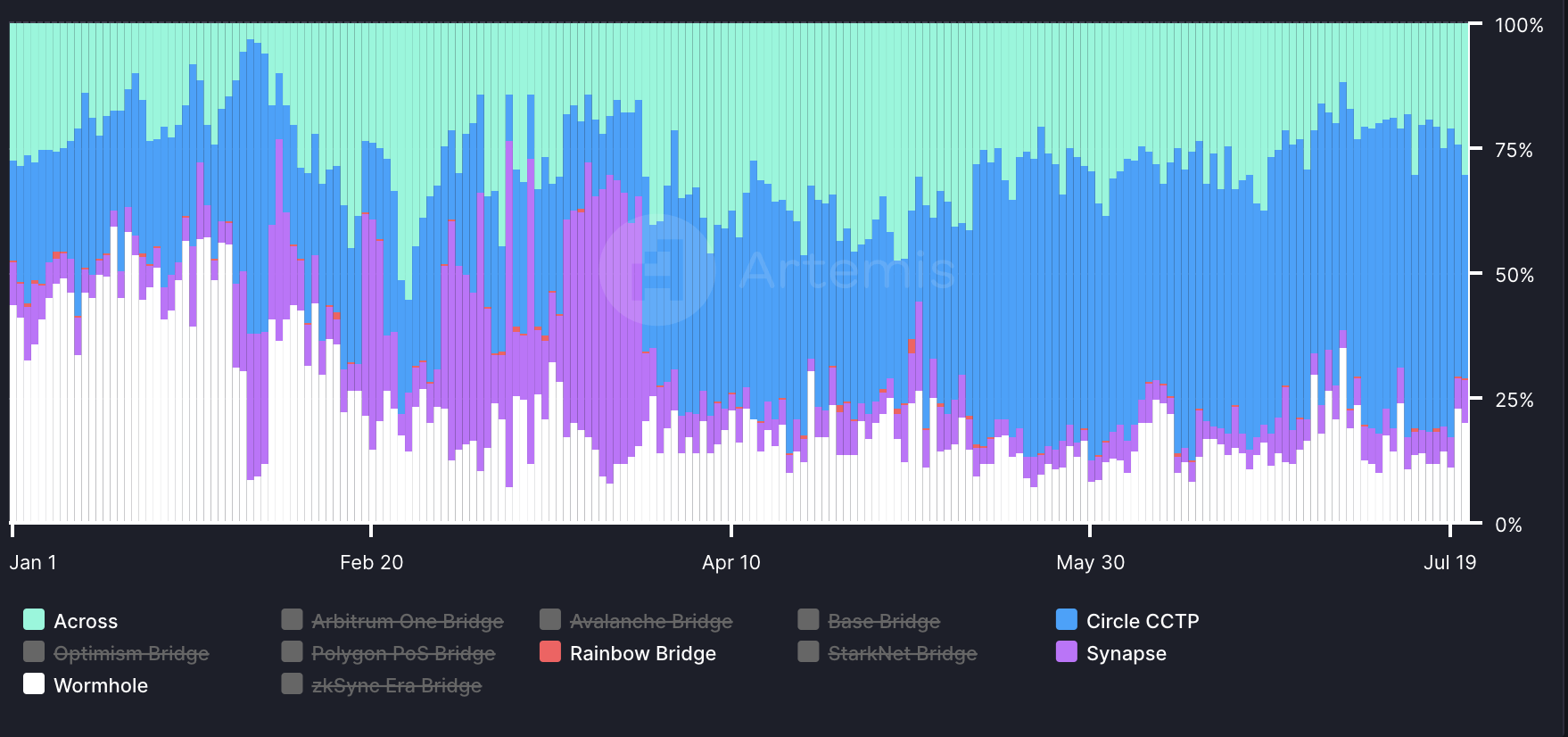

Arkham

- Circle's Cross-Chain Transfer Protocol (CCTP) has seen significant growth since the beginning of the year. CCTP is a permissionless on-chain tool that securely facilitates the transfer of USDC between blockchains through native burning and minting. Since the beginning of the year, CCTP's market share has increased from 19% to over 40%.

Artemis

- Trading Level Alpha: The largest USDC transaction minted on Base this year amounted to 100 million US dollars. The circulating supply of USDC on Base has increased by over 10 times in the past year, indicating a growing global demand for stablecoins as Base's popularity increases.

③ USDT

Henry Child | Website | Dashboard

USDT Dominates on Various Chains, with Over 15 Million Daily Transactions on Tron

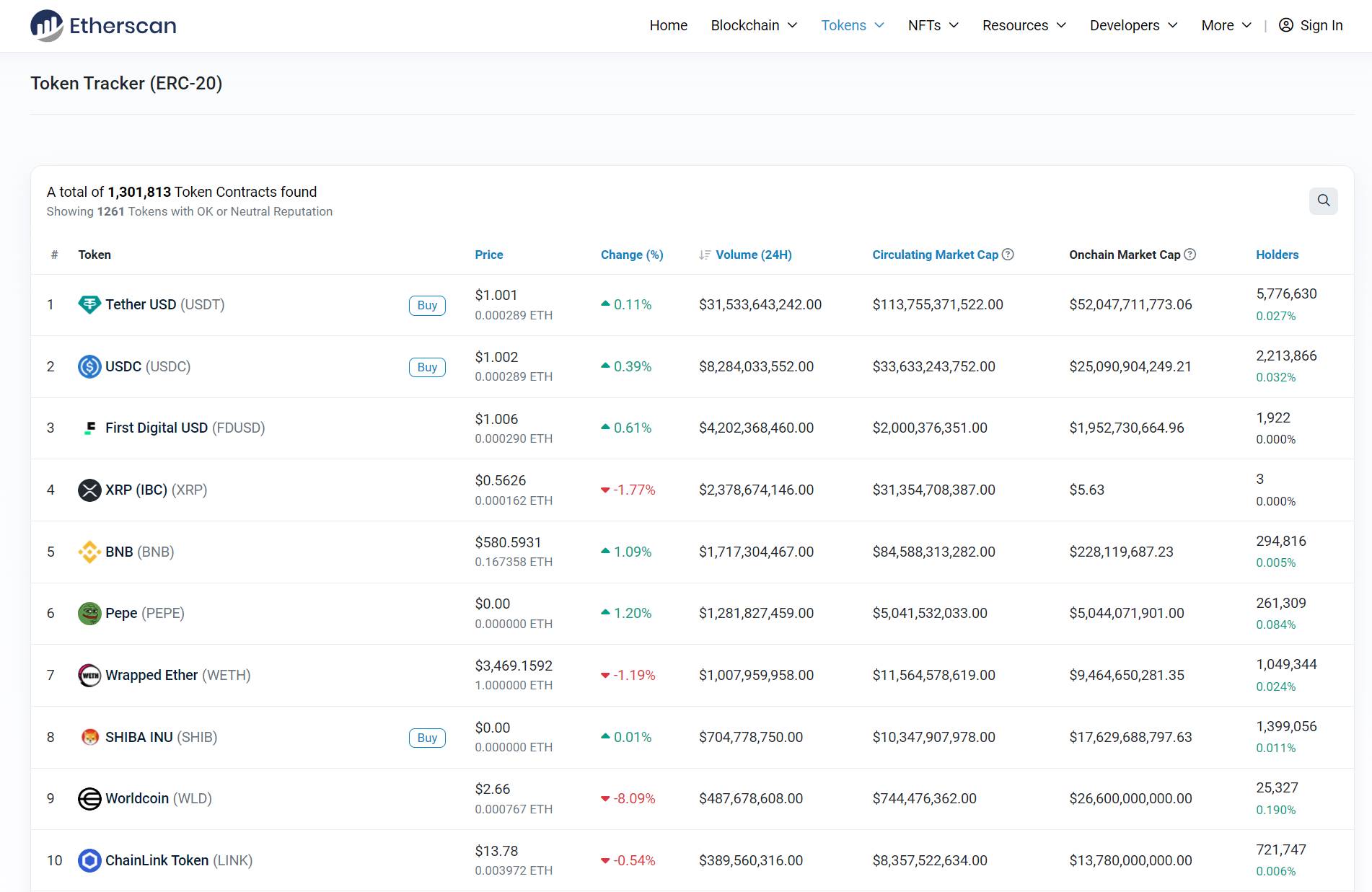

- USDT is the largest ERC20 token by trading volume on Ethereum, with a daily trading volume of 31.5 billion US dollars, surpassing the total of the top 20 ERC tokens.

Etherscan

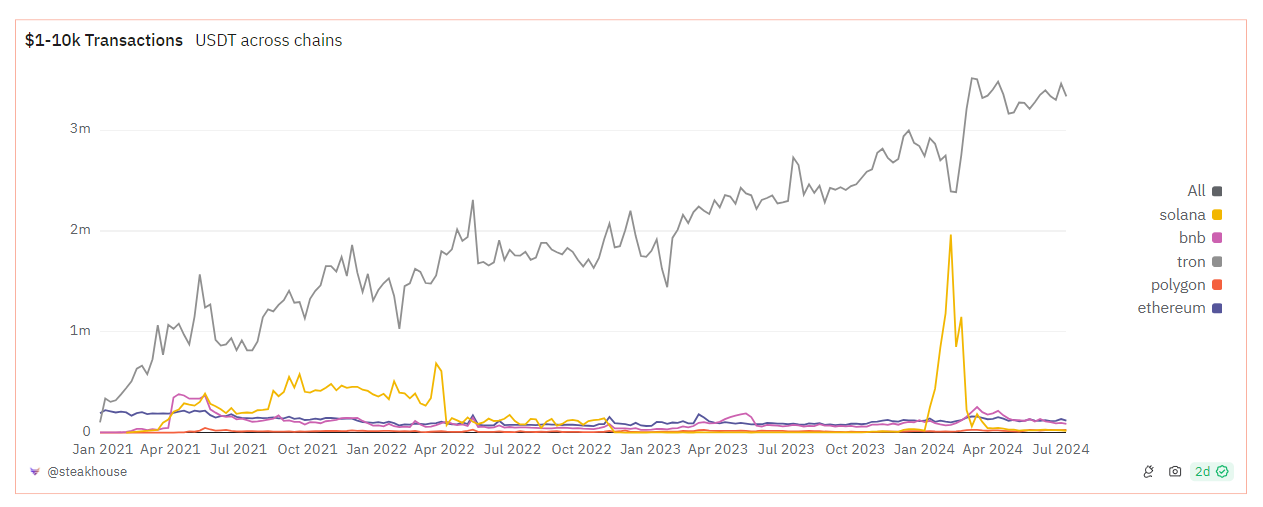

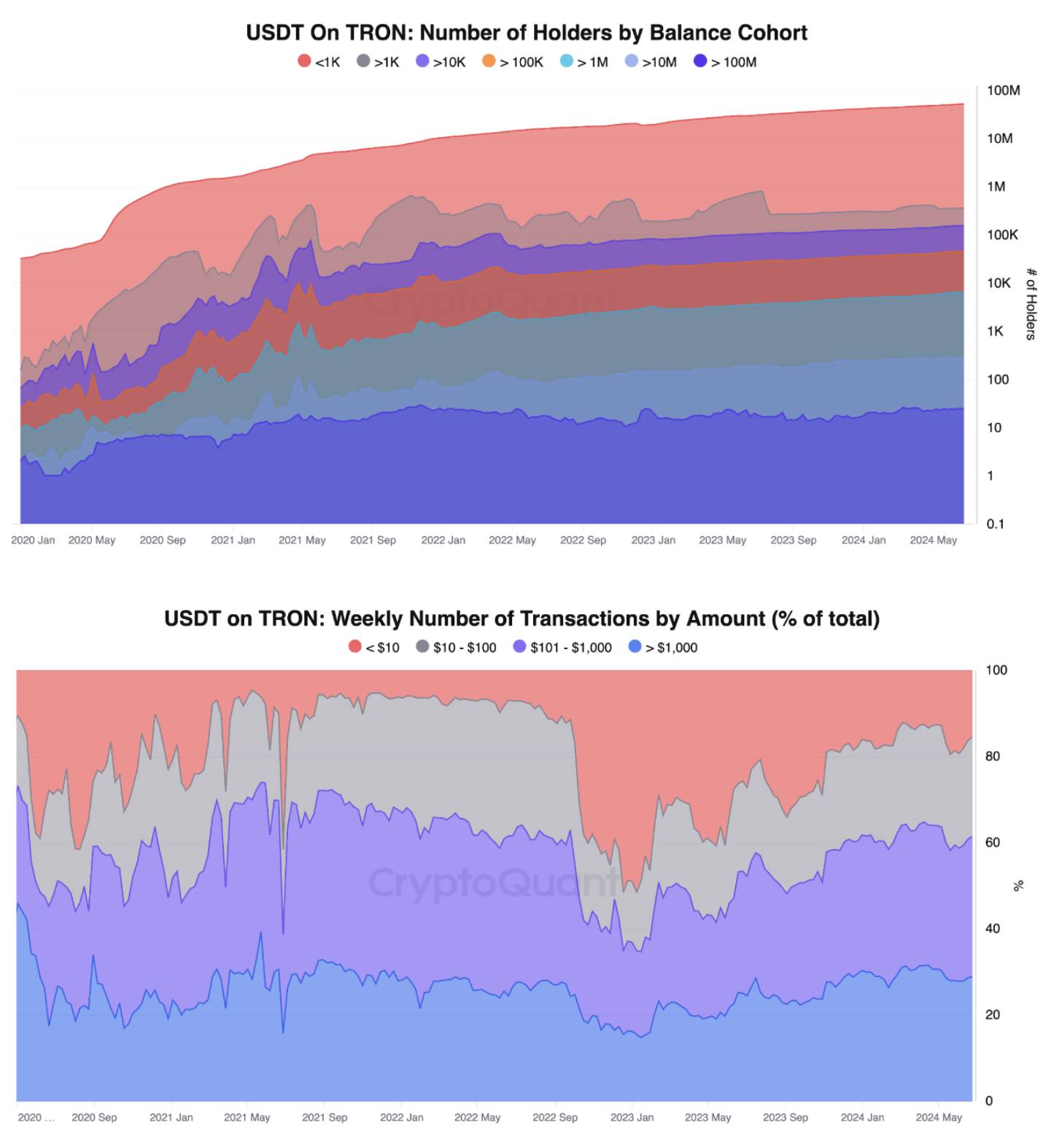

- On TRON, USDT leads in daily transaction volume and unique holder count, with a significant year-over-year increase in the volume of transactions ranging from 1 USD to 10,000 USD, indicating continued real-world adoption for P2P and B2B payments.

Dune Analytics - @steakhouse

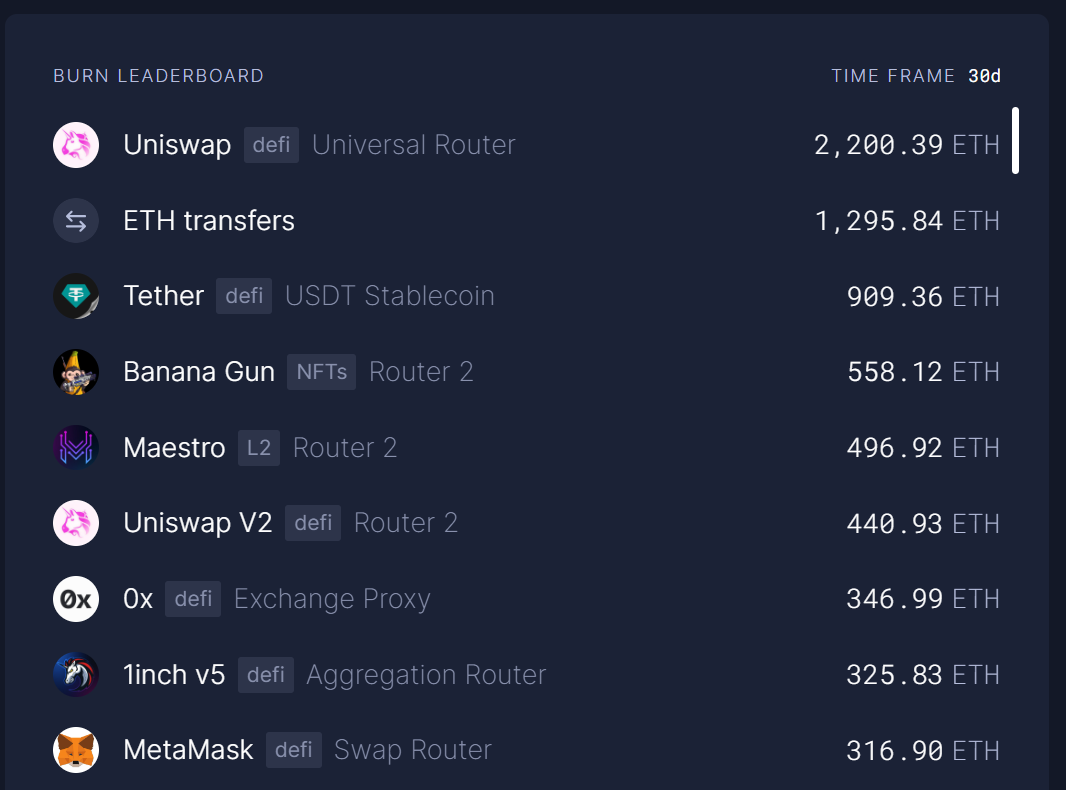

- In the past 30 days, Tether USDT's smart contract on Ethereum has consumed the third most gas, exceeding 909 ETH, worth over 3 million US dollars.

ultrasound.money

- Trading Level Alpha: 58.6% of USDT-Tron holdings are distributed outside the top 500 accounts, indicating widespread distribution of USDT.

④ Tron Stablecoin

Dave Uhryniak | Website | Dashboard

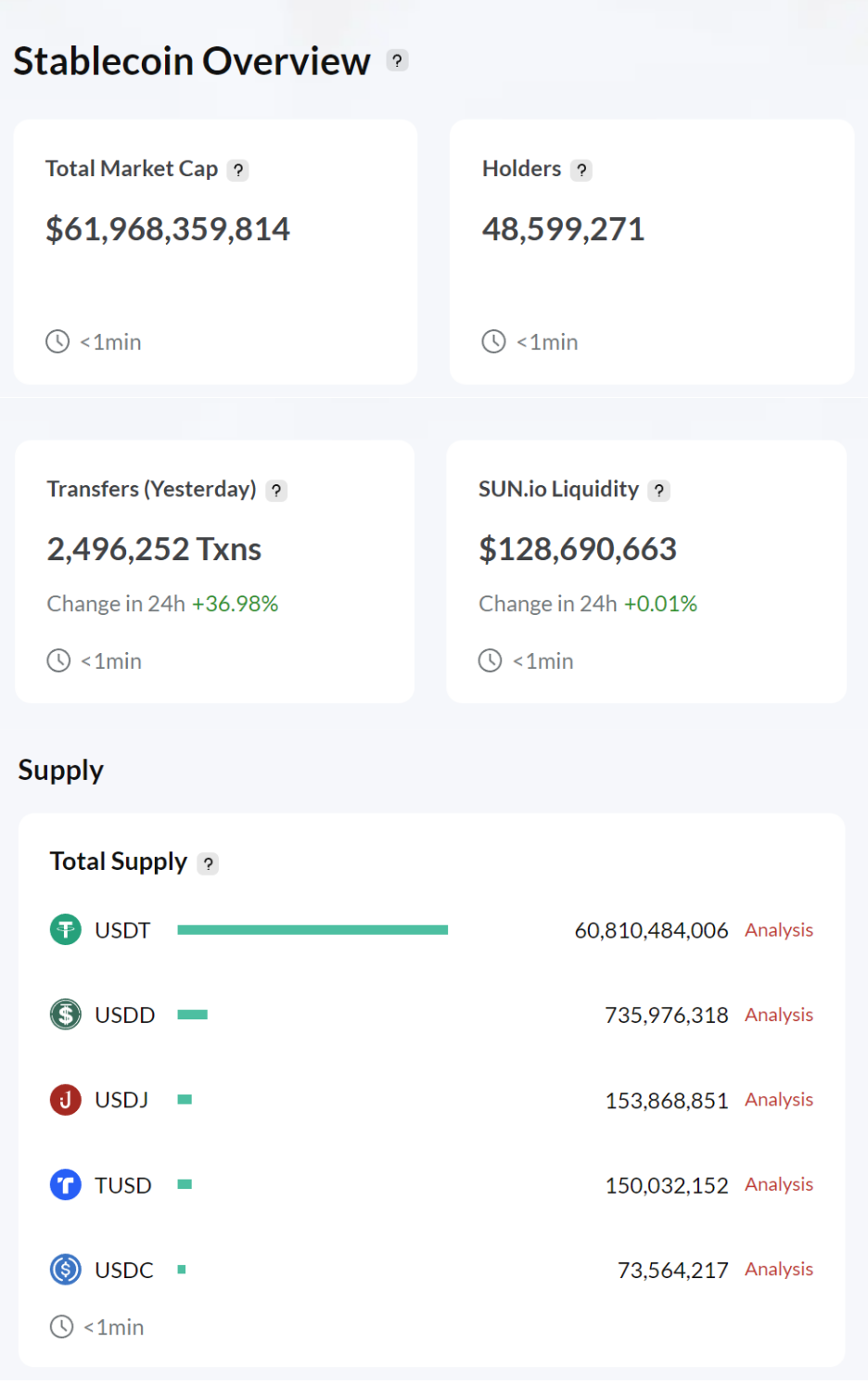

TRON is the first blockchain with a single stablecoin value exceeding 600 billion US dollars

- TRON is a universally accessible and highly useful blockchain. In 2024, the supply of USDT based on TRON increased by 110 billion US dollars, making TRON the first blockchain with a single stablecoin value exceeding 600 billion US dollars. As of July 2024, the total transfer volume on the network has exceeded 13 trillion US dollars, and the total number of accounts has reached 245 million.

TRONSCAN

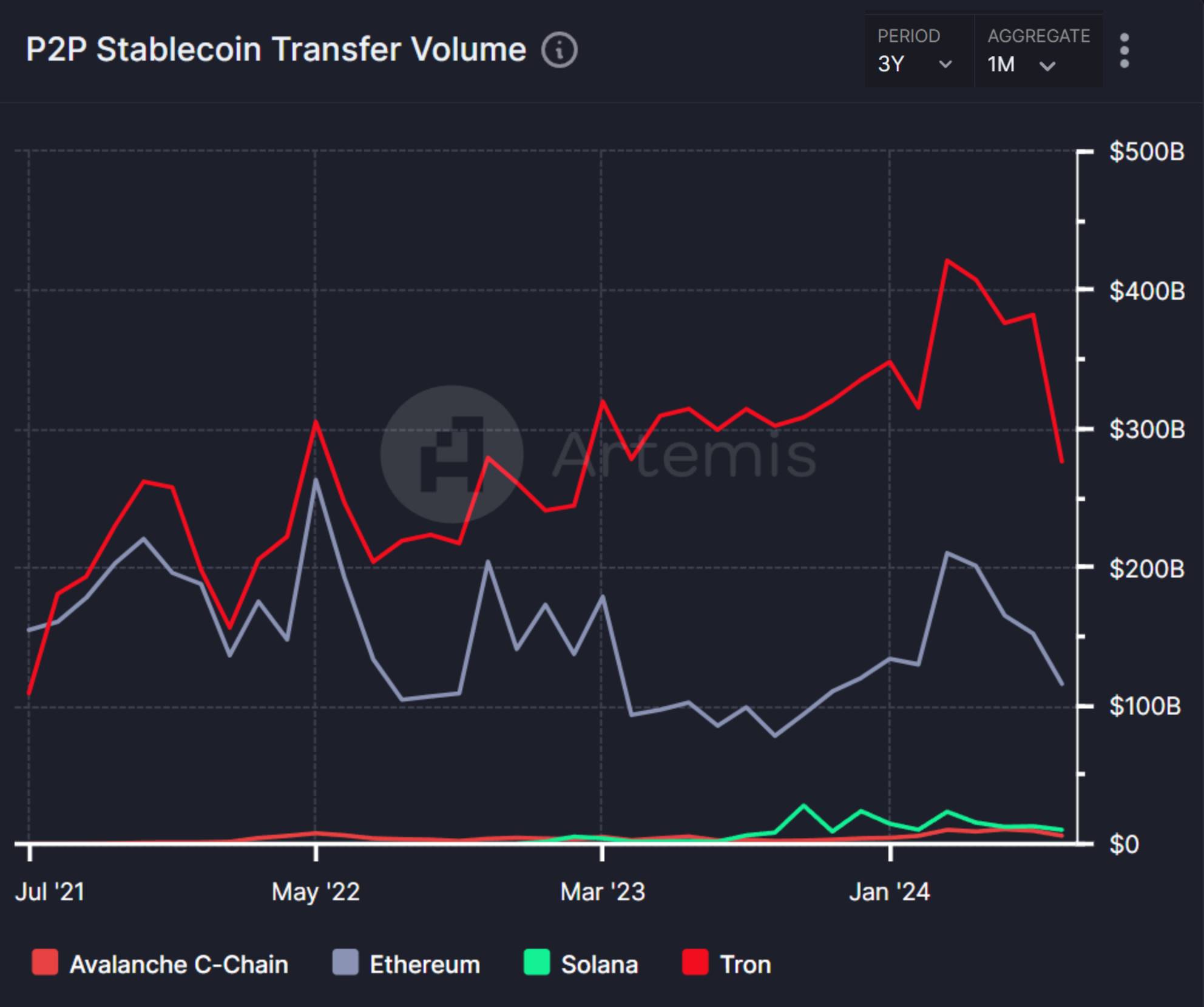

- P2P transactions are the foundation of decentralization, allowing individuals to securely and efficiently exchange value without geographical limitations. TRON continues to lead in this metric, with P2P transfer volume consistently being two to three times that of Ethereum.

Artemis

- Although TRON excels in supporting both large and small transactions, the majority of TRC-20 USDT holders are retail users, with 526,000 people holding balances below 1,000 US dollars. Nearly one-third of USDT transaction amounts are below 100 US dollars, with 15% below 10 US dollars.

CryptoQuant

- Trading Level Alpha: In 2024, the circulating supply of USDT based on TRON increased by 11 billion US dollars, a 23% growth, reflecting the rising demand. Recently, blockchain-based payment provider Orbital emphasized the importance of USDT payments in emerging markets. The company processes millions of transactions annually, with 98% on the TRON blockchain and 99% using Tether's USDT token. A scalable blockchain has the potential to become a global settlement layer for mainstream financial transactions and has made significant progress.

⑤ eUSD & USD3

nagaking | Website | Dashboard

Reserve Protocol TVL exceeds 235 million US dollars, stablecoins reach 60 million US dollars

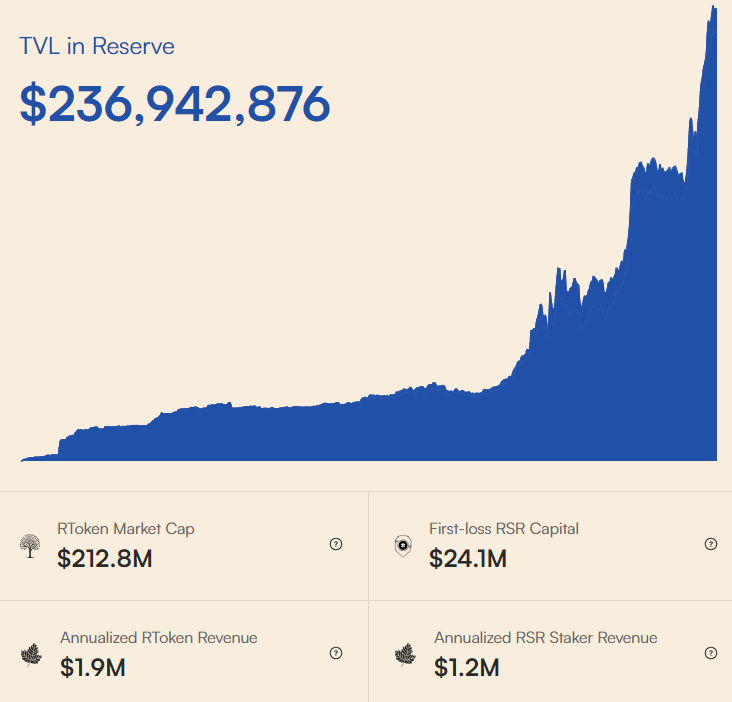

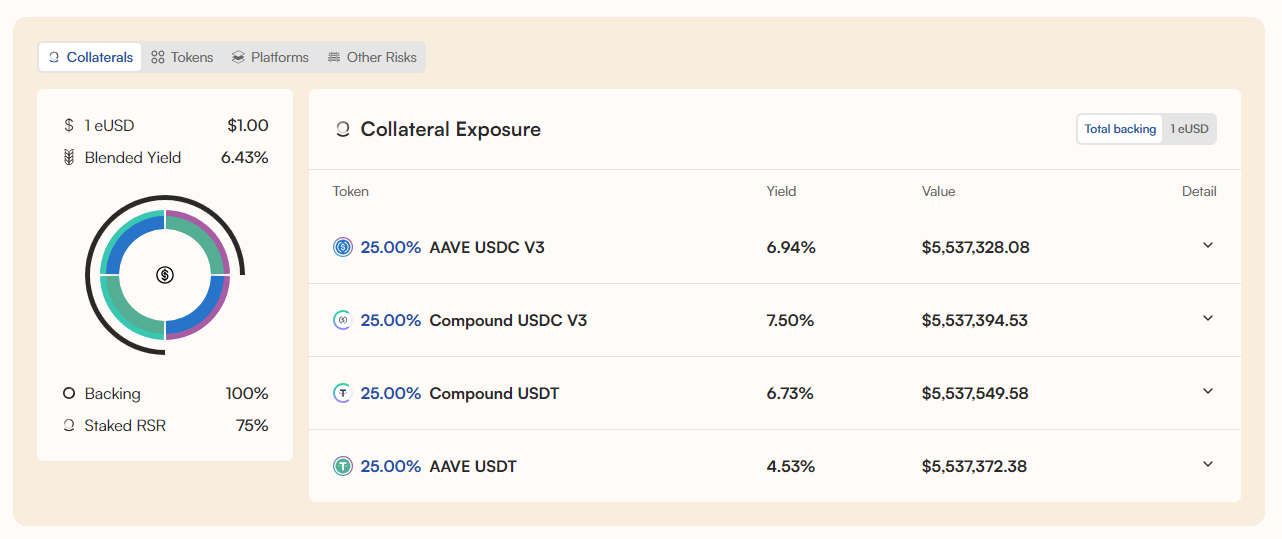

- The Reserve Protocol is a free, permissionless platform for creating, deploying, and managing asset-backed currencies (RTokens). RTokens typically include a basket of yield-generating assets and are over-collateralized with Reserve Rights (RSR) tokens. In 2024, Reserve's TVL increased from around 40 million US dollars to approximately 240 million US dollars (a growth of about 600%), including 212.1 million US dollars in RToken support and 24.1 million US dollars in RSR over-collateralization. Approximately one-fourth of the RToken market value comes from stablecoin RTokens, such as USD3 (32.4 million US dollars) and eUSD (22.3 million US dollars).

Reserve

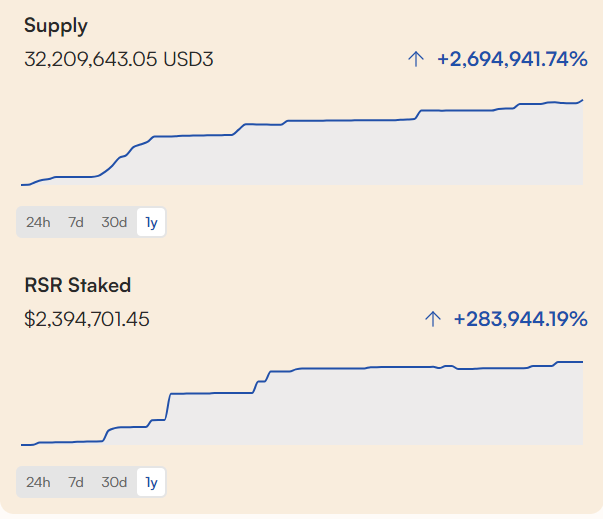

- Different RTokens cater to different risk/reward preferences. Web 3 Dollar (USD3) focuses on holder rewards, distributing 85% of the earnings to RToken holders. In the past year, the supply of USD3 has grown from just over 1,000 US dollars to over 32 million US dollars, while RSR collateral has grown from less than 1,000 US dollars to approximately 2.4 million US dollars.

Reserve

- Electronic Dollar (eUSD) focuses on stability and widespread utility, incentivizing RSR collateral with 94% of the earnings and plans to share earnings with fintech applications integrating it. eUSD supports DeFi earnings and consumer fintech applications in the United States and Latin America.

Reserve

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。