How did "MetaDEX" Aerodrome rise to prominence on Base and seize the market from Uniswap?

Written by: Blockworks Research

Translated by: Alex Liu, Foresight News

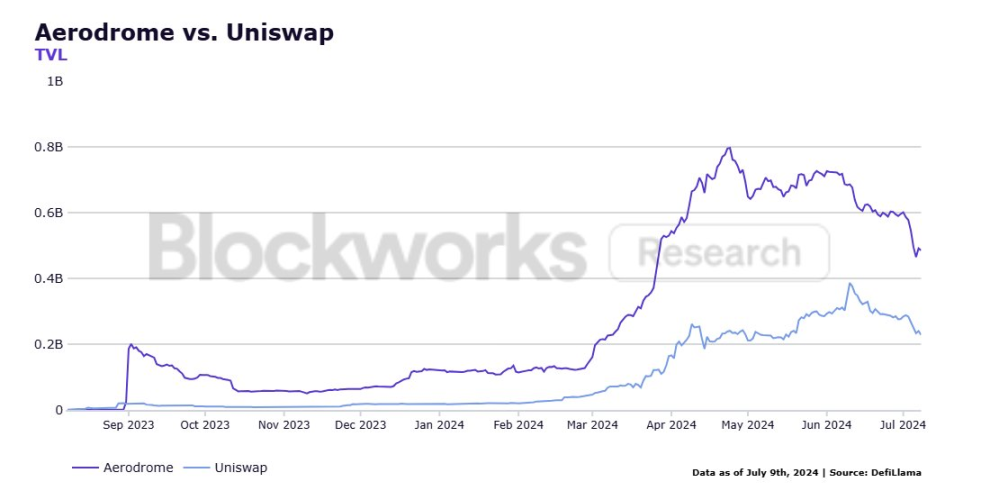

@AerodromeFi is a "MetaDEX" that combines elements from various DEXs such as Uniswap V2 and V3, Curve, Convex, and Votium. Since its launch, it has become the protocol with the largest TVL on Base, with a total locked value exceeding $495 million, twice as much as Uniswap on Base.

Aerodrome and Uniswap TVL growth curve on Base

Architecture

Aerodrome's success can be attributed to its unique architecture, which adjusts the incentive measures among different protocol participants, including traders, LPs, and protocols seeking to bring liquidity to tokens, and achieves this through its Ve governance model.

Participants must lock AERO tokens to collect fees. Locking the tokens as veAERO allows users to direct the protocol's token emissions to specific pools, where they will receive 100% of the fees and emissions.

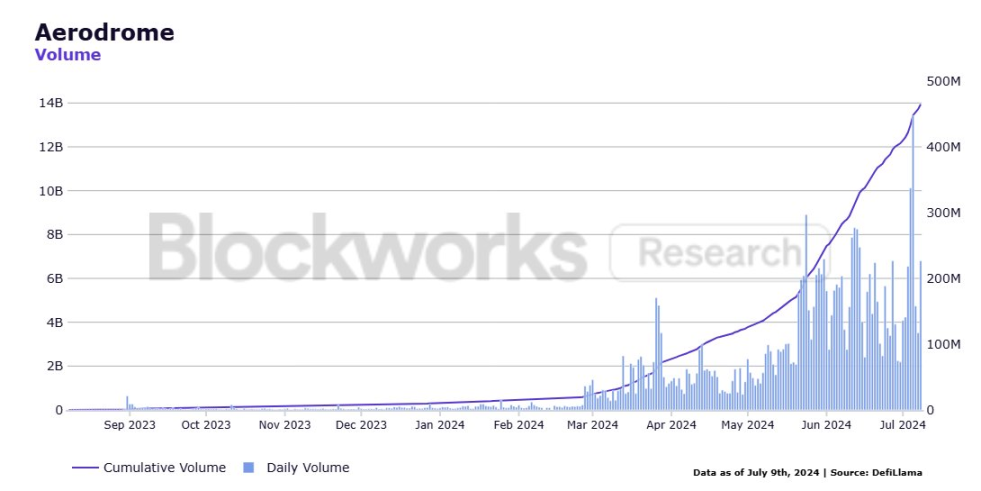

Due to incentives, voters direct token emissions to the pools with the highest trading volume to maximize rewards. This creates a flywheel effect that attracts LPs (liquidity providers), thereby providing traders with a low slippage experience for popular token pairs. This has led to significant growth for the protocol, as evidenced by the surge in trading volume.

Innovation

The latest protocol upgrades include Relay and Slipstream. Relay automates governance for liquidity providers, allowing them to deposit voting tokens into a vault to optimize voting and automatically reinvest rewards for compounding.

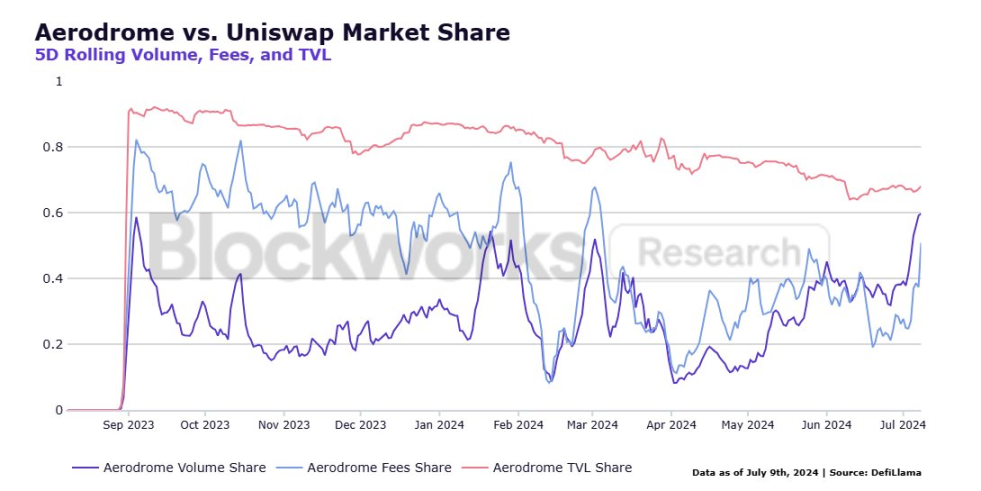

Slipstream has brought centralized liquidity pools to Aerodrome, providing better execution prices for high-volume token pairs. Since the launch of Slipstream on April 22, Aerodrome has achieved a TVL, fee, and trading volume share higher than Uniswap, at 68%, 51%, and 60% respectively.

Ecosystem

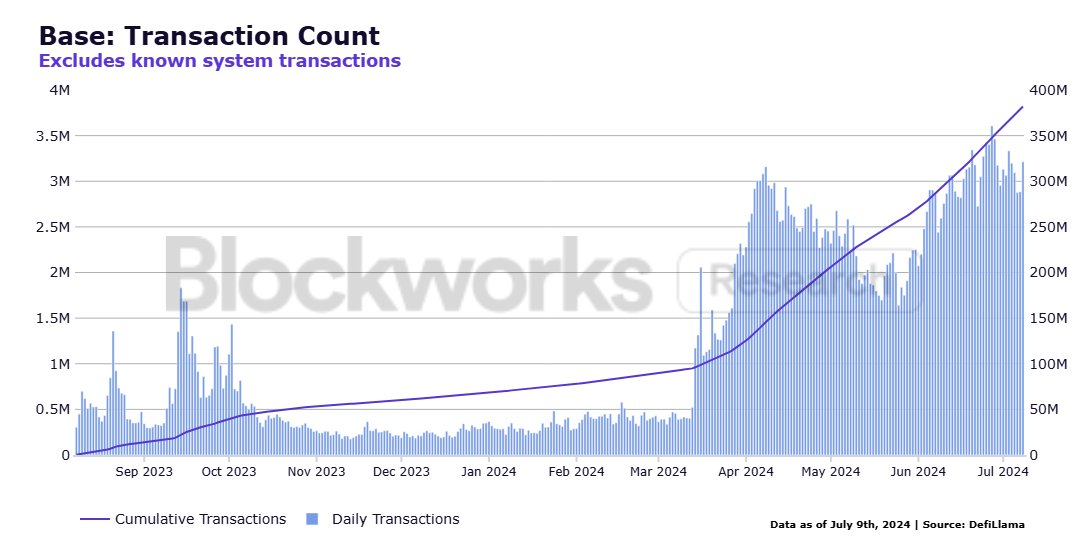

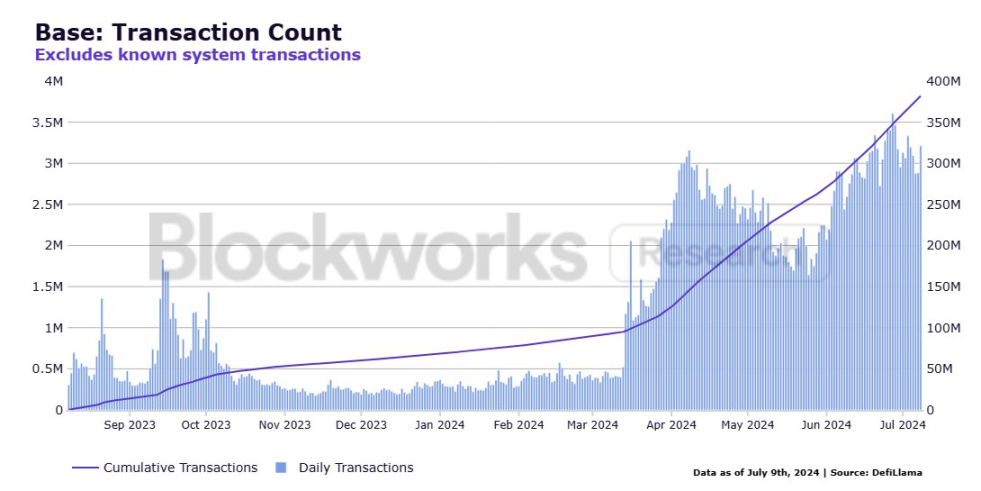

Another key factor in Aerodrome's success is its bet on Base. The Base ecosystem has experienced remarkable growth since its launch, with over 3 million transactions per day (excluding known system transactions).

Coinbase's smart wallet has over 110 million customers and will provide a mechanism to directly onboard millions of users to Base by offering a simple user interface reminiscent of Web 2.0 applications.

The daily trading volume on Base has a total correlation of 0.86 with the AERO token. While it is difficult to prove whether this correlation is statistically significant, it is compelling evidence that AERO will benefit from an increase in Base adoption.

Aerodrome has experienced significant growth, but investors should also be aware of potential risks, including competition from Uniswap. More information can be found in the latest report by @_dshap here.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。