Only a few "ETH beta" altcoins classified as such on Crypto Twitter can outperform ETH itself.

Author: THOR

Translation: DeepTechFlow

Introduction

ETH ETF is about to be launched. While most people are speculating on the short-term and long-term impact of these products, another question is: can the catalyst of ETH be captured by increasing the exposure of ETH beta?

ETH beta refers to the altcoins within the Ethereum ecosystem, which theoretically should serve as a leveraged exposure to ETH. Common examples include LDO or ENS, and traders believe that these altcoins have a greater volatility compared to ETH itself. However, recently the term "ETH beta" is mostly considered a meme, as the overall performance of altcoins is poor. Choosing an altcoin related to ETH as a leveraged exposure is like finding a needle in a haystack, often resulting in traders and investors underperforming ETH over a longer time frame.

So, is this time different? With the listing of ETH ETF, is the best strategy to bet on altcoins with a higher beta relative to ETH? Today's article will explore this issue from a quantitative perspective.

Price Performance

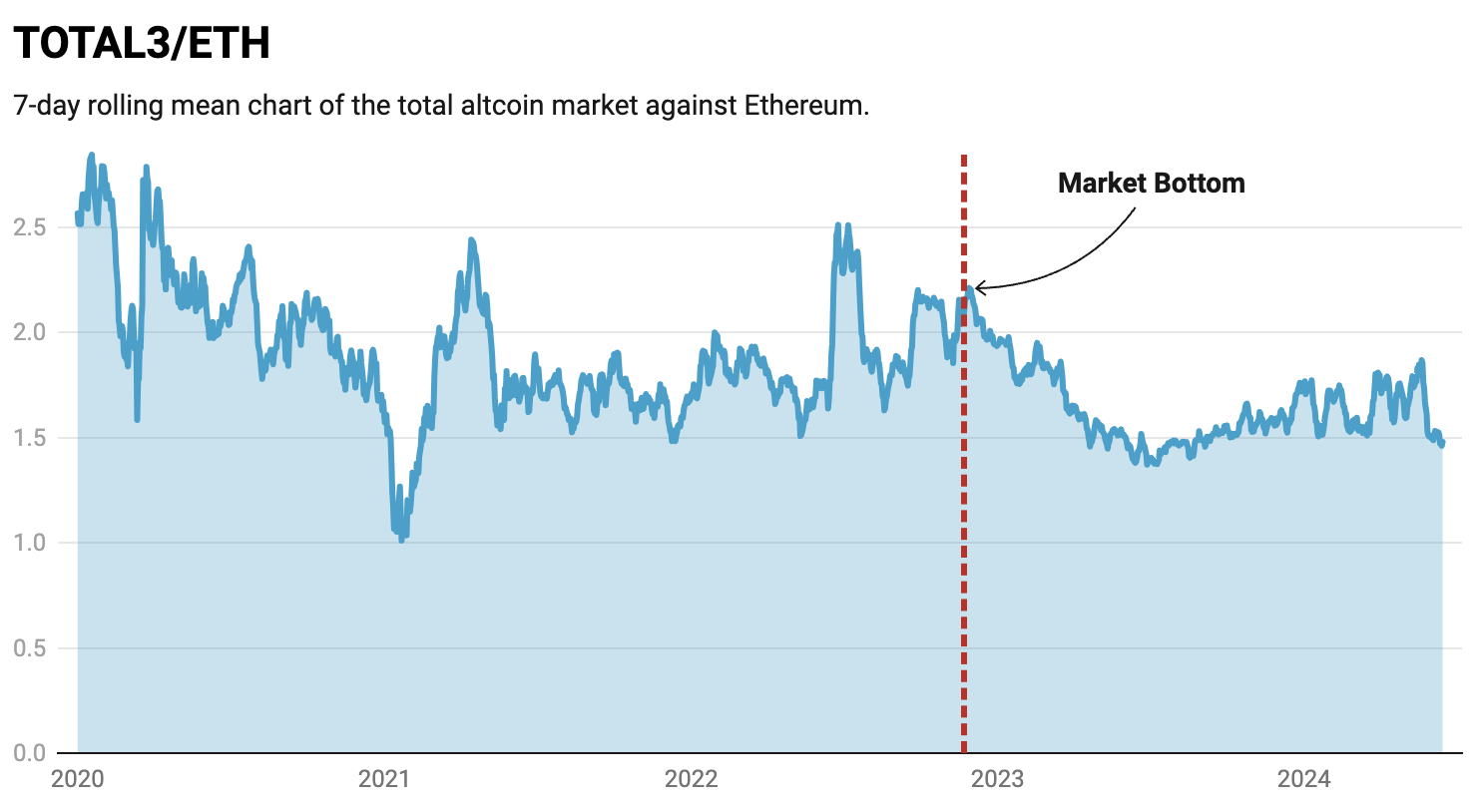

The total market value of altcoins (TOTAL3) is about 1.48 times that of ETH's market value. Since 2020, this ratio has been this low only a few times, indicating that ETH has outperformed most altcoins.

Chart: hyphin; Source: Created using Datawrapper

This chart can be interpreted from several perspectives. First, these altcoins usually bounce back at this level historically. Given the recent highly bearish sentiment towards altcoins, this may be a potential scenario. However, this chart shows a downward trend over the years, indicating that it is difficult to find altcoins that can outperform ETH. In addition, although the market value of altcoins may increase, the price may decline due to the low circulation and large unlocking of many tokens. Therefore, finding a reliable "ETH beta" is even more difficult.

The analysis of tokens as potential ETH beta samples includes the following:

[L2’s]

- OP, ARB, MANTA, MNT, METIS, GNO, CANTO, IMX, STRK

[Alt L1’s]

- SOL, AVAX, BNB, TON

[DeFi]

- MKR, AAVE, SNX, FXS, LDO, PENDLE, ENS, LINK

[Memes]

- PEPE, DOGE, SHIB

Zooming in, the chart below shows the performance of ETH and these four types of tokens this year (over the past 198 days).

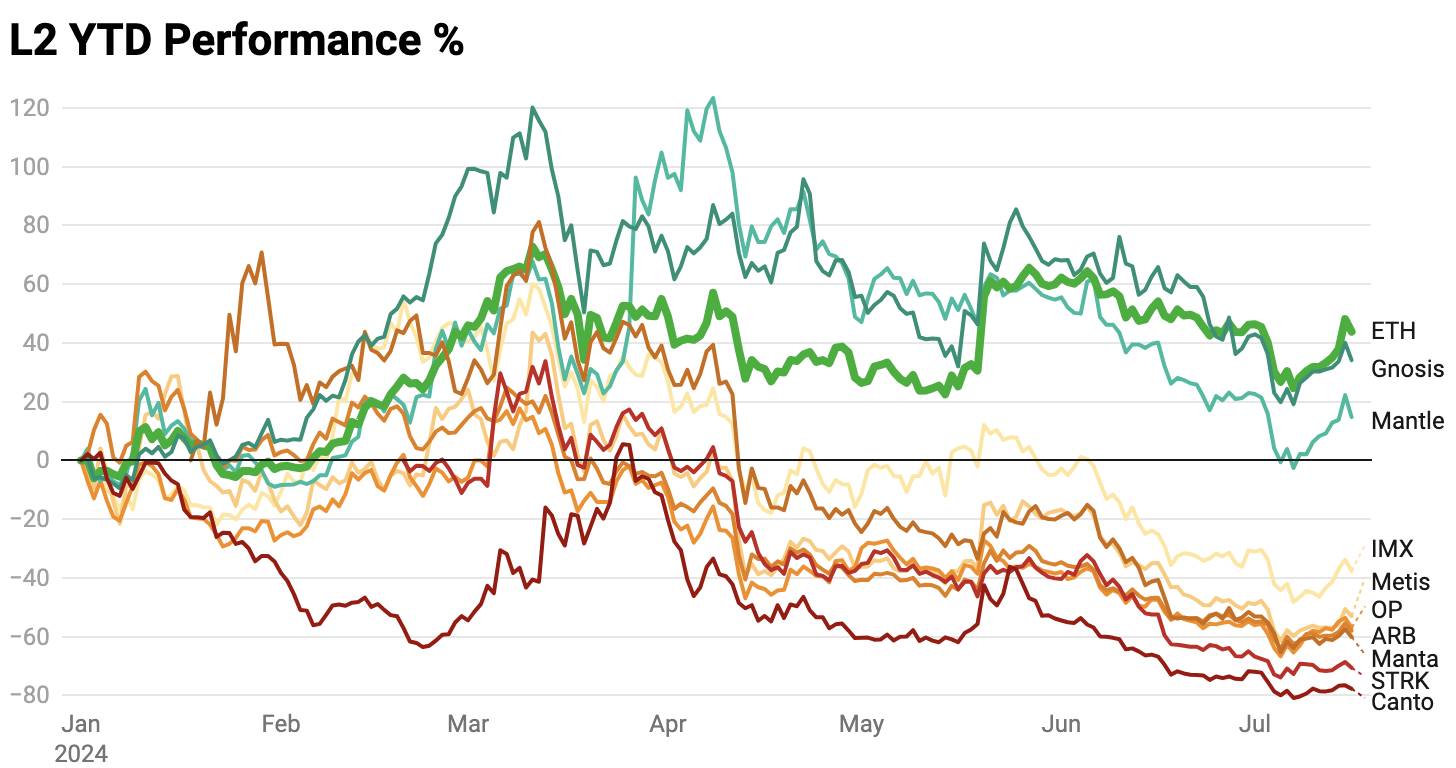

L2 Annual Performance Percentage

Chart: Thor Hartvigsen; Created using Datawrapper

It is worth noting that none of the L2 tokens have outperformed ETH this year, with the best performer GNO rising by 34%, while ETH has risen by 44%. The worst performers include MANTA, STRK, and CANTO, all of which have fallen by over 60% this year.

Top Alt L1 Annual Performance Percentage

Chart: Thor Hartvigsen; Created using Datawrapper

Top Alt L1 tokens have performed much better, with TON and BNB significantly outperforming ETH. AVAX is the only token that has declined this year.

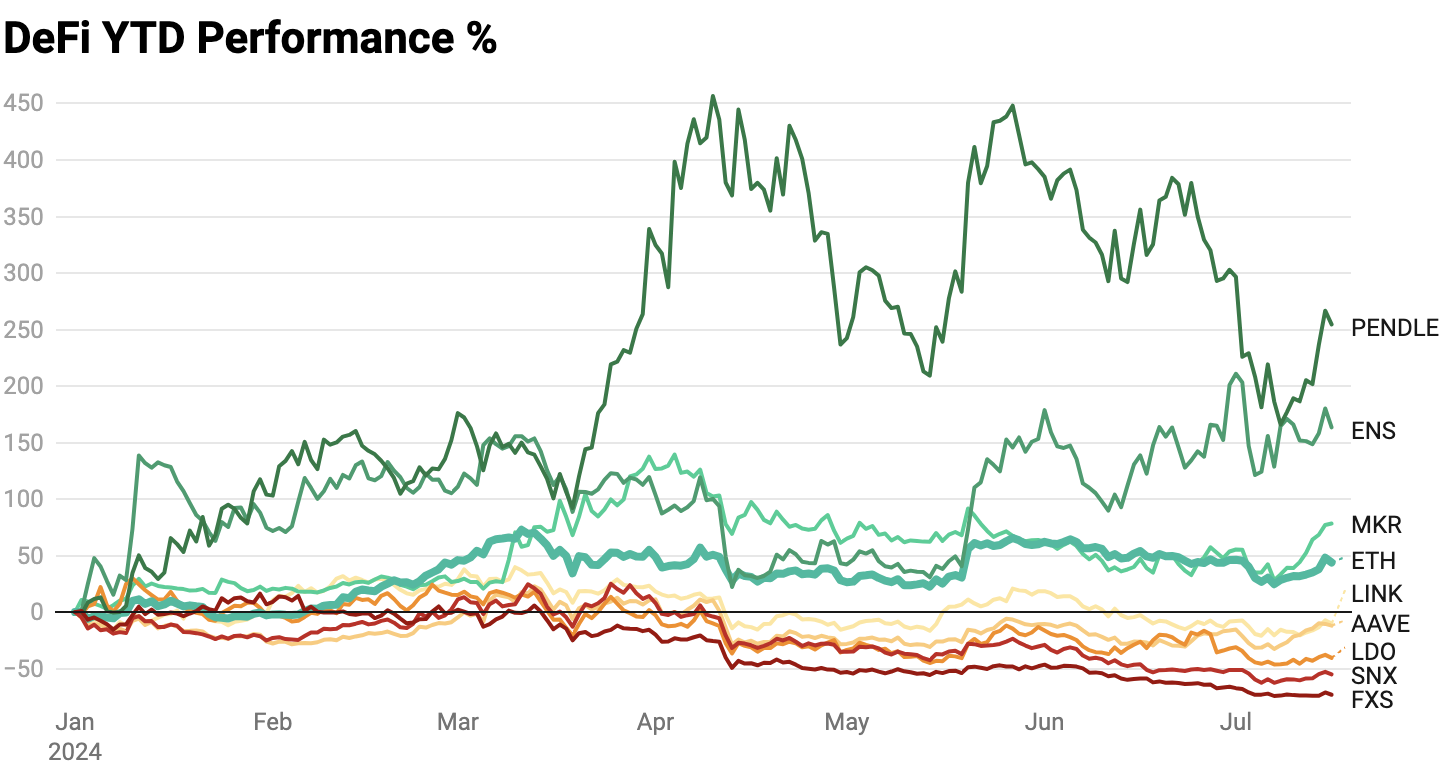

DeFi Annual Performance Percentage

Chart: Thor Hartvigsen; Created using Datawrapper

Among the 8 DeFi tokens in this basket, 3 have outperformed ETH, namely PENDLE (+254%), ENS (+163%), and MKR (+78%). The remaining 5 have all declined this year, with the worst performer being FXS, which has fallen by 73%.

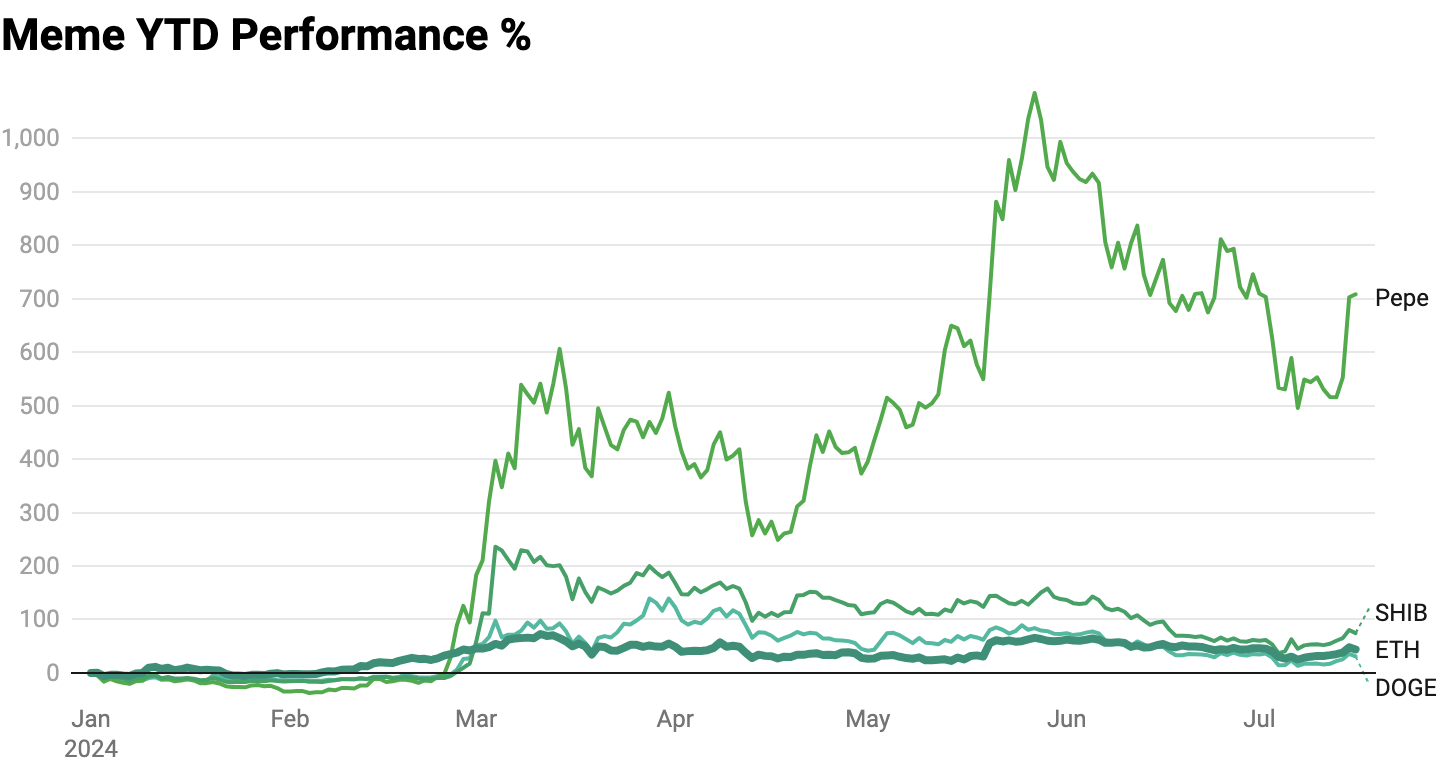

Meme Token Performance Percentage Year-to-Date

Chart: Thor Hartvigsen; Created using Datawrapper

In 2024, meme tokens have performed well, especially among the largest Ethereum-native meme tokens. Pepe has seen the largest increase, rising by 708%; SHIB has risen by 74%; DOGE has risen by 31%.

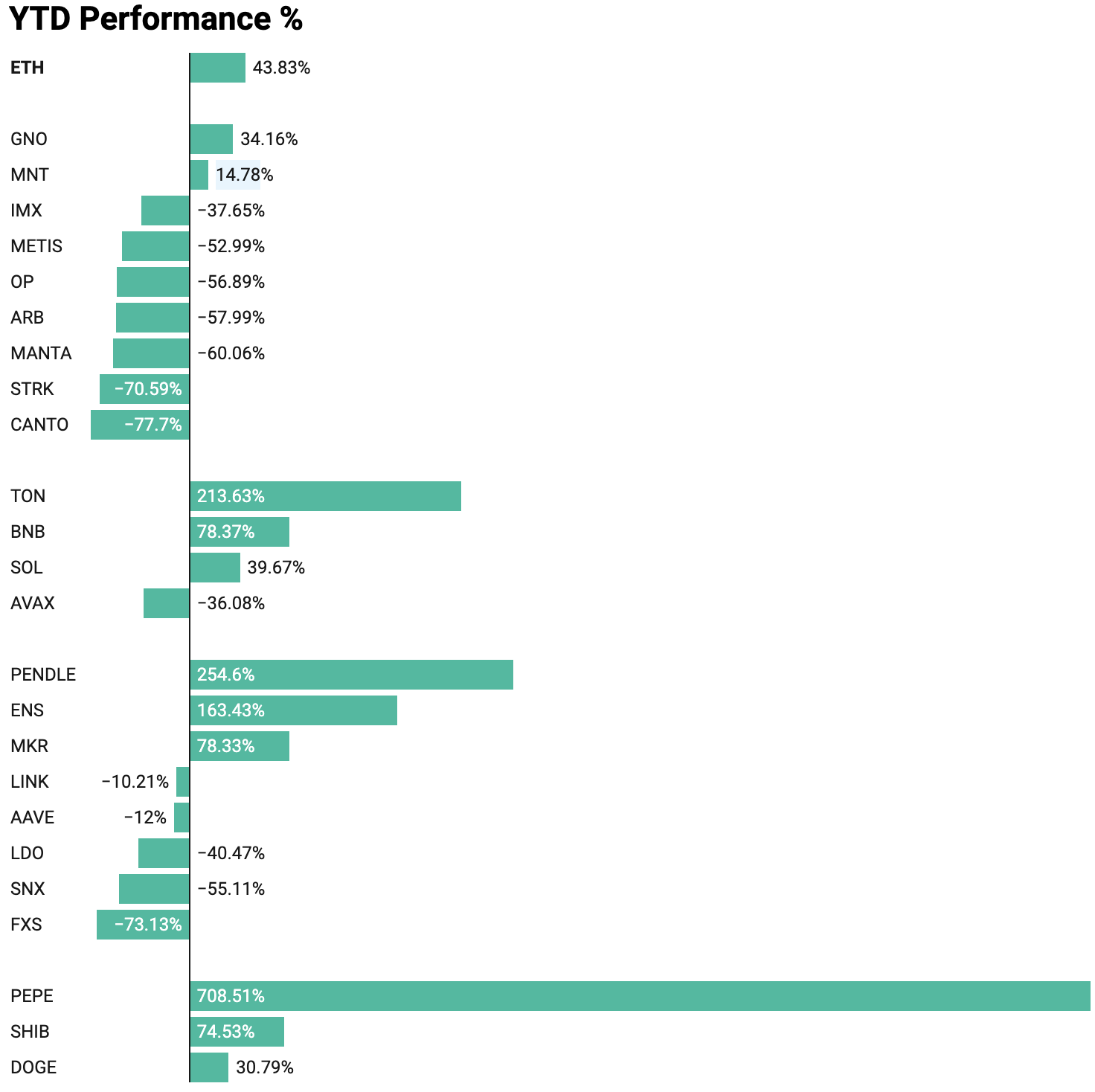

Summary:

Year-to-Date Performance Percentage

Chart: Thor Hartvigsen; Created using Datawrapper

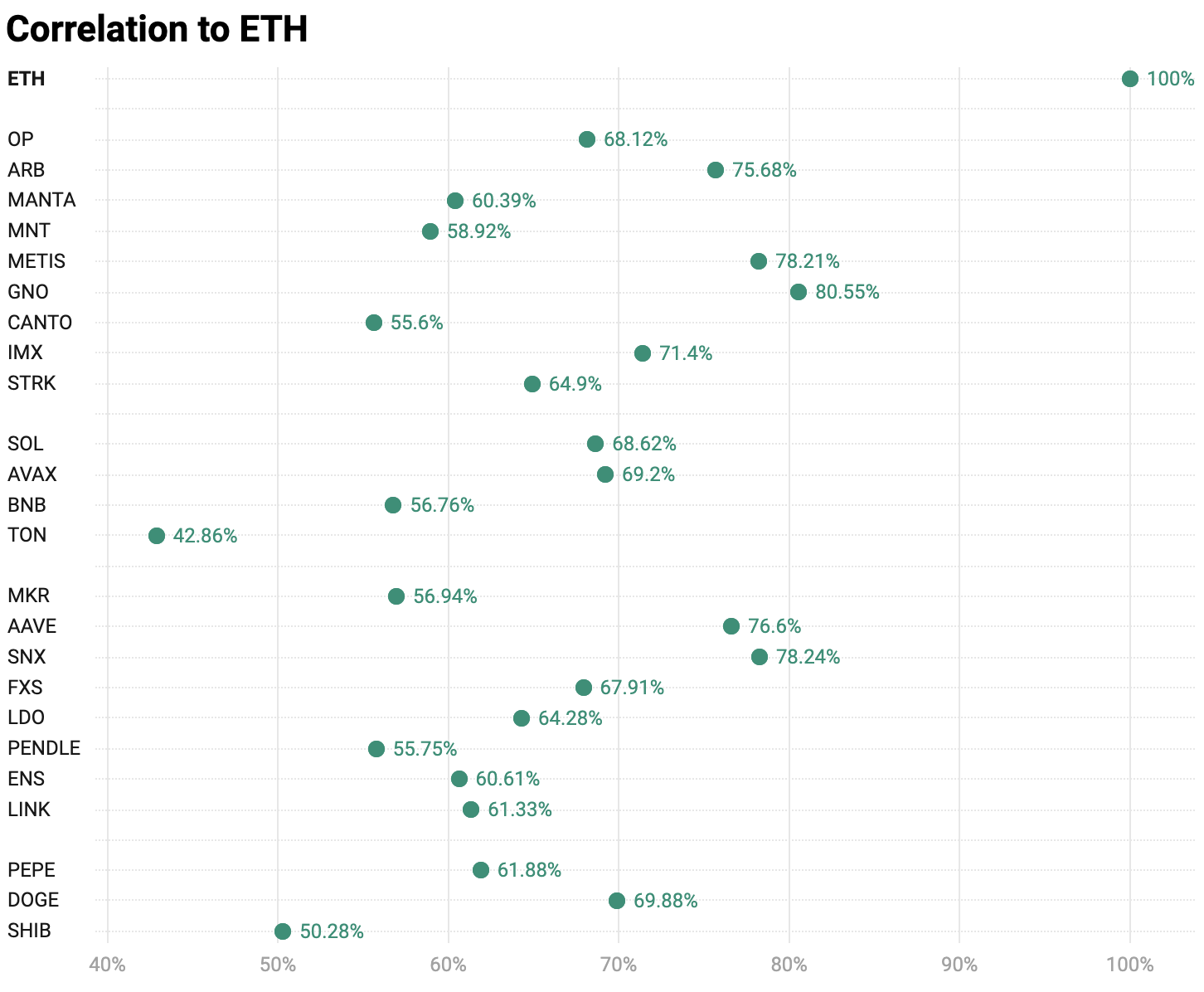

Correlation

The selected samples of altcoins are not random, but are typically considered tokens related to the performance of ETH. For example, random DEX tokens on Solana or Sui have lower correlation with ERC-20 tokens on the Ethereum network compared to ETH.

The individual performances year-to-date mentioned above are valuable references. Although past performance does not guarantee future results, there may be some signals. If we are to analyze whether these tokens truly serve as leveraged beta exposure to ETH, rather than just individual behavior, we need to study more deeply. There is no perfect way to model this, and the crypto market is far from efficient. Therefore, the obtained data must be handled with caution. However, one way to study this behavior is to look at the correlation between these altcoins and ETH.

Correlation measures the strength and direction of the relationship between two assets and can help explain how they move relative to each other. The correlation values range from -1 to 1, where 1 is completely positively correlated and -1 is completely negatively correlated.

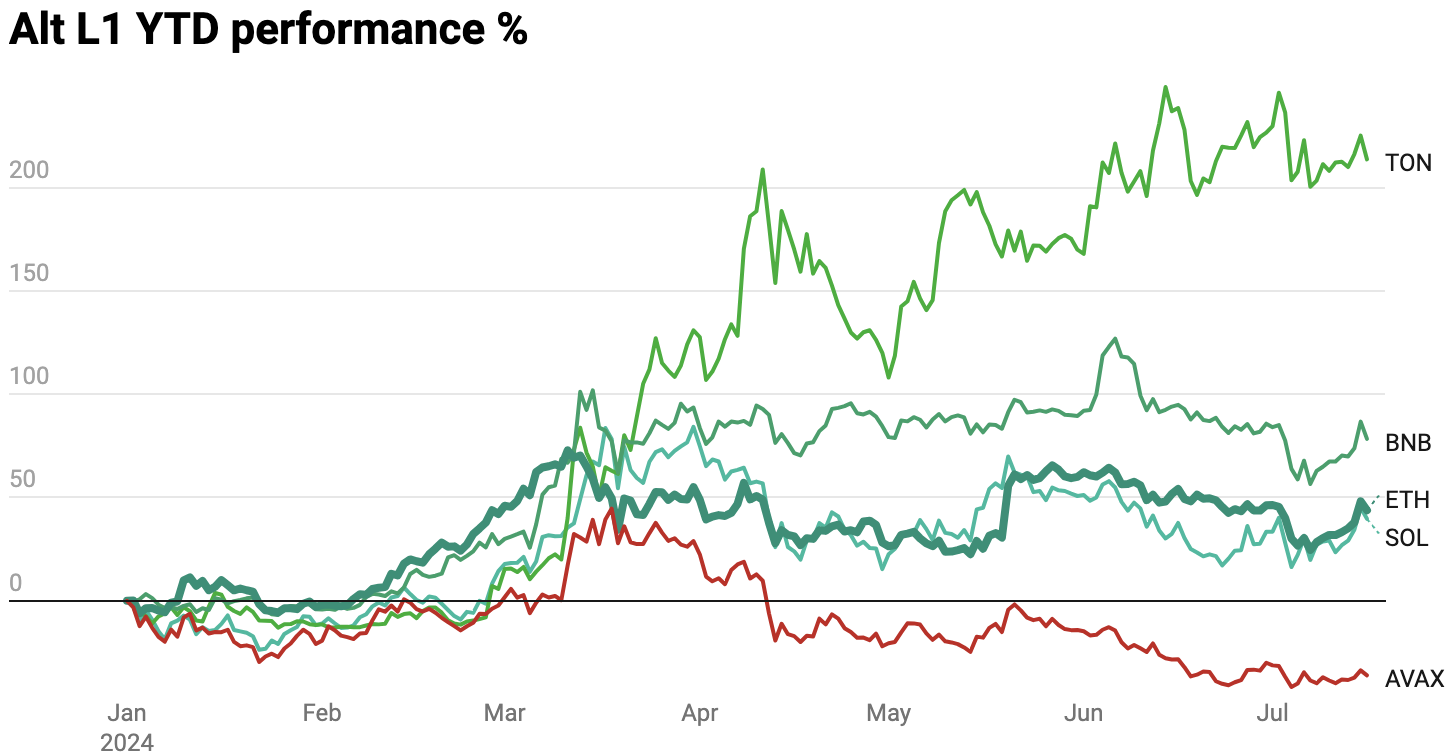

The chart below shows the correlation between various tokens and ETH. The correlation between ETH and ETH is obviously 100%. The altcoins with the highest correlation to ETH are GNO, SNX, METIS, AAVE, and ARB.

Chart created by Thor Hartvigsen using Datawrapper

Chart: Thor Hartvigsen; Created using Datawrapper

Among the best performing tokens year-to-date, PEPE, TON, PENDLE, ENS, and BNB have a correlation with ETH of 60% or lower, indicating that their performance is more influenced by other factors (possibly BTC correlation or individual variables). TON has the lowest correlation with ETH, so purchasing this asset to capture leveraged ETH exposure is not ideal.

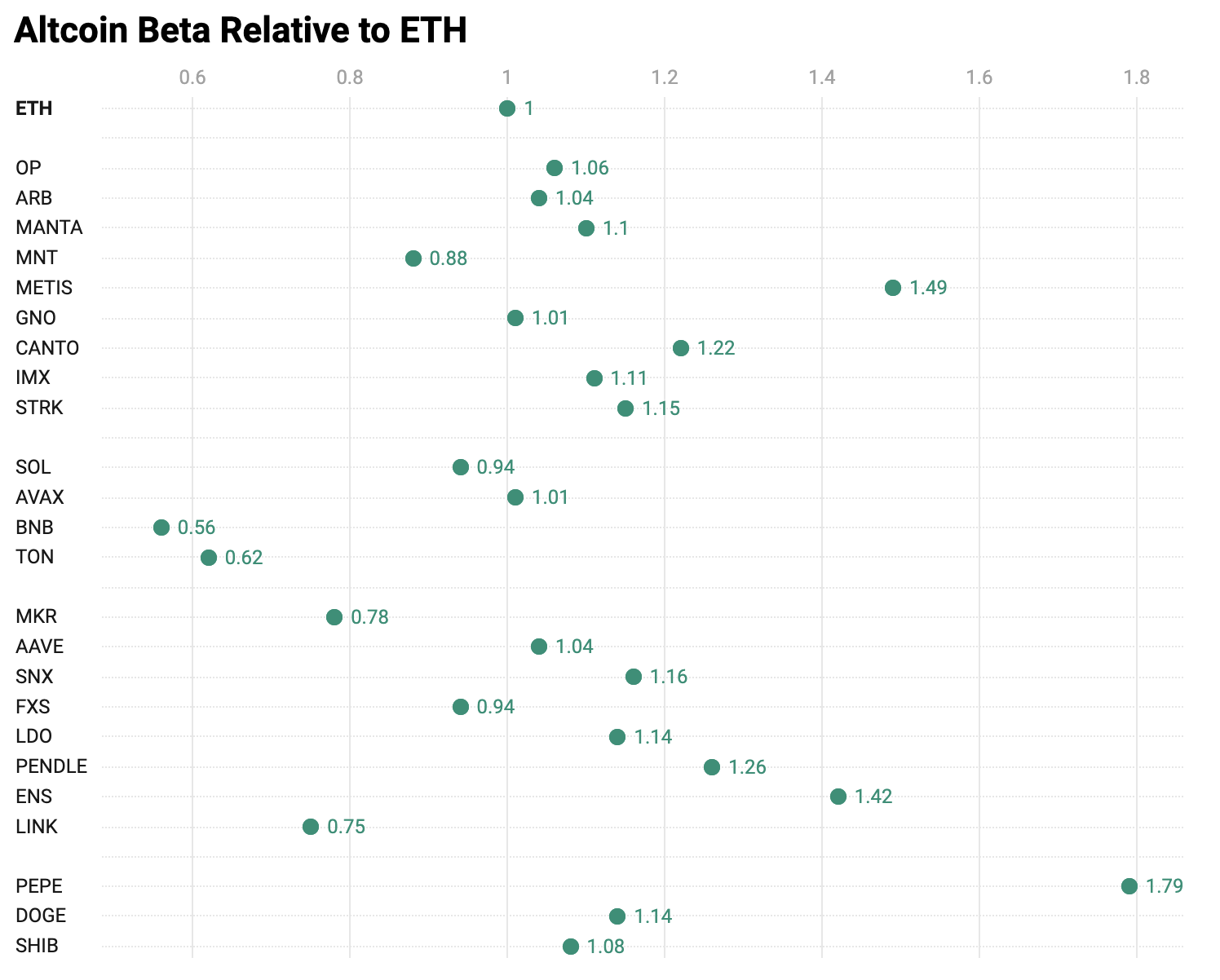

Beta

Furthermore, we can calculate the year-to-date beta coefficients of these altcoins relative to ETH. Beta is used to represent the volatility of an asset relative to the underlying market (in this instance, ETH). The beta value of ETH is 1, with altcoins with higher volatility having beta values greater than 1, and those with lower volatility having beta values less than 1.

Altcoin Beta and Correlation with Ethereum

Chart: Thor Hartvigsen; Created using Datawrapper

From this analysis, only a few altcoins have a high beta coefficient relative to ETH, namely PEPE, METIS, ENS, and PENDLE. Altcoins with a high beta coefficient exhibit greater volatility relative to ETH itself. Combining our correlation and beta analysis results, it can be suggested that PEPE is one of the better ETH beta assets, and may provide good returns if ETH appreciates due to the listing of ETF. However, it is important to remember the limitations of this analysis. There are many external factors that influence the behavior of these assets, which are not included in this analysis, so it should be viewed as a theoretical exercise rather than data directly used for trading.

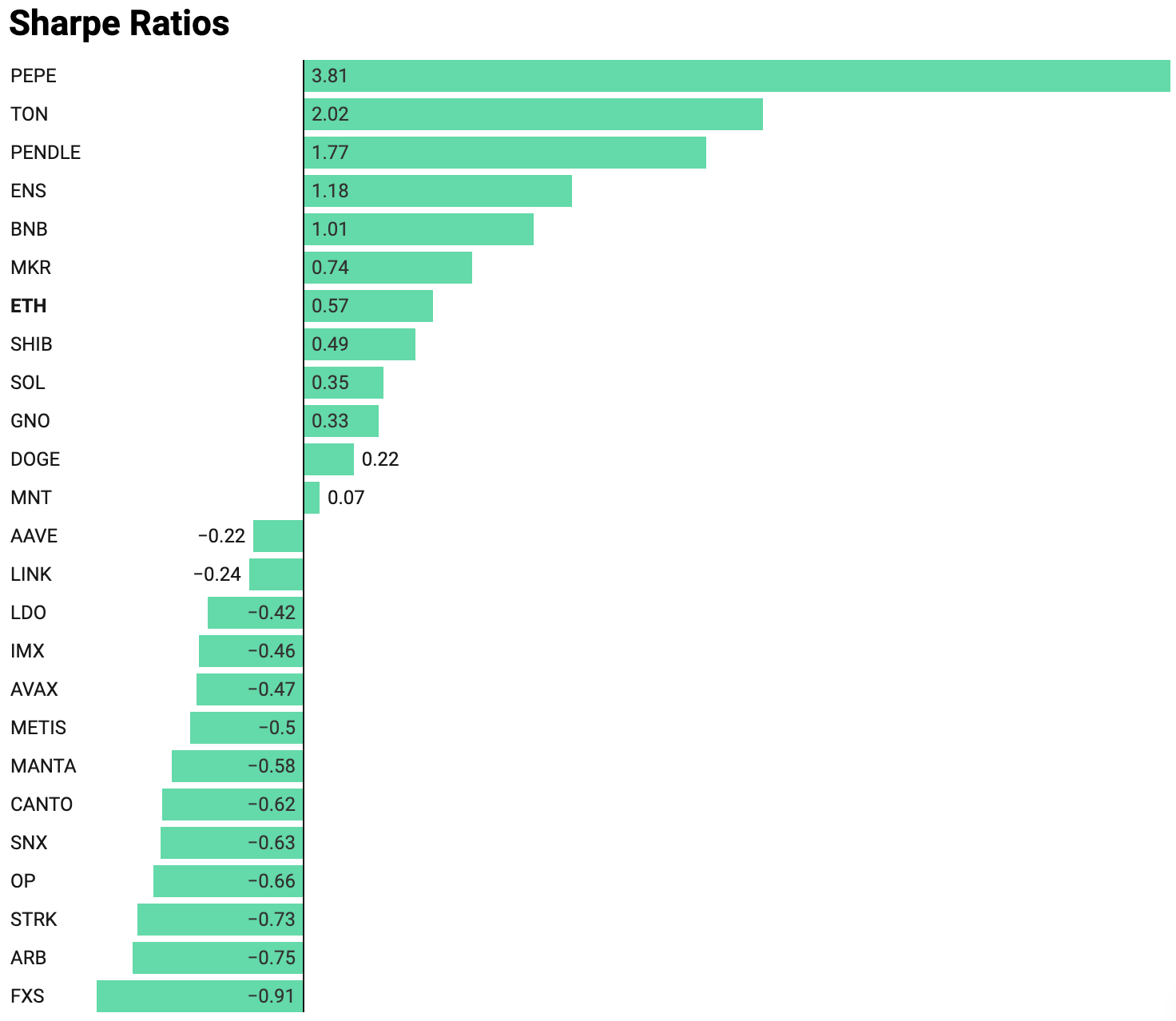

Sharpe Ratio

Finally, we can calculate the year-to-date Sharpe ratio of these assets to measure their recent performance. The Sharpe ratio measures the risk-adjusted return by subtracting the risk-free rate (annual yield of 8% provided by Maker's "DAI Savings Rate") from the return, and then dividing by the volatility (standard deviation). The higher the Sharpe ratio, the better the performance.

Chart: Thor Hartvigsen; Created using Datawrapper

Conclusion

So, what are the main conclusions of this analysis?

Firstly, only a few altcoins classified as "ETH beta" on Crypto Twitter can outperform ETH itself.

Secondly, the performance of altcoins cannot be solely attributed to the correlation or beta of ETH. These tokens are not only correlated with assets other than ETH, but also influenced by individual variables.

It is not wise to purchase these altcoins to gain leveraged ETH exposure, as you may be exposed to many unknown additional risks. If you want to invest in ETH with leverage, it is more reasonable to directly go long 2x ETH on Aave. In this case, you can achieve 100% correlation and a beta value of 2.

Lastly, the expectation of ETH performing well after the listing of ETF is mainly due to potential inflows of new ETH ETF buyers. These altcoins will not be affected by this positive buying pressure (they are not tokens of the upcoming ETF listing), and there will be a large amount of token unlocking in the coming weeks or months. Don't overcomplicate things.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。