AICoin

In the context of insufficient industry innovation, DeFi is still the main application for Rollup.

Author: YBB Capital Researcher Ac-Core

TL;DR

Due to the different architectures and consensus mechanisms of different blockchains, the lack of unified standards leads to complex and expensive verification processes, limiting asset mobility. Existing third-party bridges face trust and security challenges, and centralized bridges need to maintain liquidity and transfer costs to users. A one-click chain launch is a compromise asset bridging solution to solve the triangular problem.

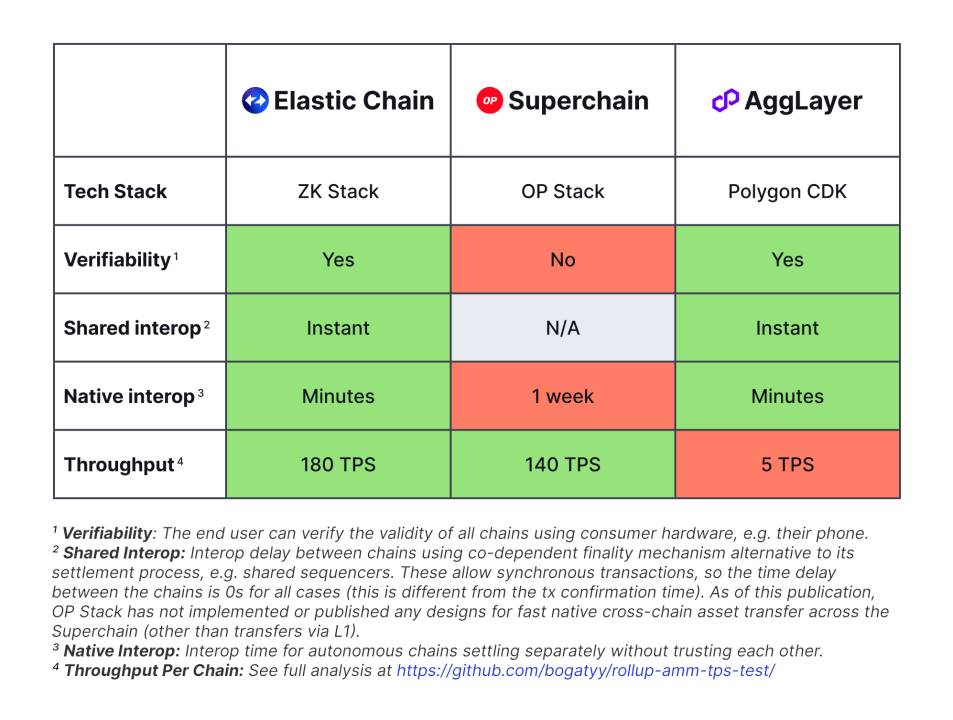

The market maturity of OP Stack and Superchain has taken the lead, with Base being a successful representative. AggLayer, with its native compatibility with Ethereum, is more easily accepted, but it needs to ensure the security and reliability of the aggregation process. Elastic Chain needs to evaluate the development of ZKsSync itself, whether in the market or in technology, short-term focus on OP, long-term focus on ZK.

In the context of insufficient industry innovation, DeFi is still the main application for Rollup. At the current stage, the probability of DePIN, RWA, and large-scale GameFi appearing in Rollup is not high. SocialFi and NFT markets may appear in Rollup, but the market heat is unknown. The overall Matthew effect is suitable for blockchain, and the trend of unlimited issuance of Rollup is a long-term focus on the head, and a short-term focus on the middle and lower reaches.

I. The Isolation of Interconnected Chains: Issues with Bridges

When we transfer assets across chains, different blockchains have unique architectures, consensus mechanisms, state proofs, and state transitions, and the lack of unified standards and interoperability leads to complexity in cross-chain communication and data exchange. These verification processes are often too expensive to be executed on-chain. This limitation has led to a surge in the use of multi-signature committees to prove the status of the other chain. Currently, there is no universal decentralized standard or protocol that can achieve interoperability between all blockchains, which limits the free flow of assets across different blockchains.

To promote cross-chain asset transfer, although a large number of third-party bridges have emerged, these bridges face significant network security challenges related to the "trust issue" in operation. Even if centralized bridges can fully ensure security, they still need to maintain sufficient liquidity on each integrated chain to sustain operations, and their costs will be transferred to users. The current issues include the inability to meet the native decentralized asset bridging and the difficulty in trusting third-party bridges. ZKsync, Polygon, and Optimism have each introduced their own more native Elastic Chain, AggLayer, and Superchain Explainer localized multi-chain expansion solutions.

II. ZKsync 3.0: Elastic Chain

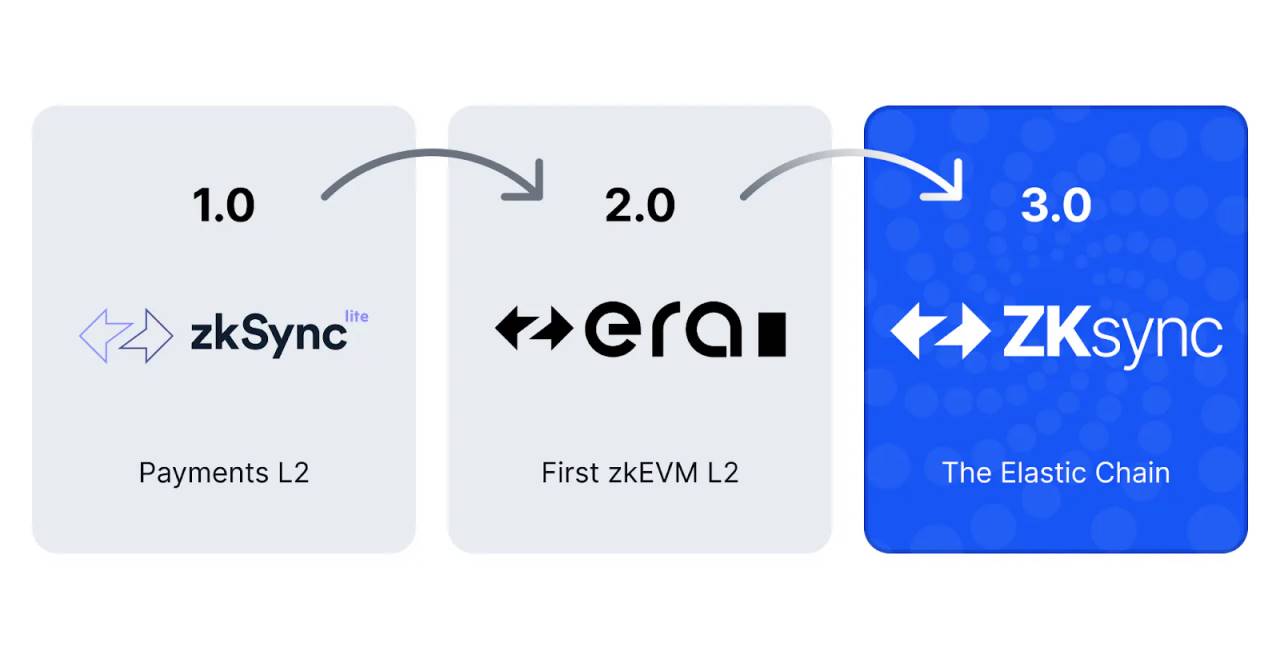

Image source: zksync.mirror

In 2023, Matter Labs, the main development company behind ZKsync, released their ZK Stack, which is a toolkit that allows developers to build their own blockchains based on ZKsync technology. Essentially, these customized chains will be interconnected through Elastic Chain, transforming ZKsync 3.0 from a single Ethereum L2 to The Elastic Chain.

The core upgrade of the ZKsync 3.0 protocol was released on June 7, 2024. It is the most complex upgrade of ZKsync at this stage, reconfiguring the ZKsync L1 bridge into a shared router contract to support an expanding network of interoperable ZK chains within the ZK Rollup framework. The ZK Stack supports local, trustless, and low-cost interoperability between chains.

According to Matter Labs, "Elastic Chain is an infinitely scalable network composed of ZK Chains (rollups, validiums, and volitions), which ensure their security through mathematical verification methods and achieve seamless interoperability under a unified and intuitive user experience, aiming to make interoperability within different ZKsync ecosystems smoother."

2.1 Elastic Chain Architecture

Elastic Chain does not solely rely on ZK technology, nor can it be achieved by adding ZK proofs as "patches" to other non-ZK multi-chain systems. From a high-level perspective, the network is implemented through ZK Router, ZK Gateway, and ZK Chains.

- ZK Router:

Core routing mechanism: The ZK Router is the main routing component of the ZKSync 3.0 architecture, responsible for managing and coordinating communication and data transmission between different chains and nodes in the network.

Cross-chain communication: Through efficient cross-chain communication protocols, the ZK Router ensures that data between different chains can be transmitted quickly and securely, enhancing the overall network interoperability and performance.

- ZK Gateway:

Entry and exit nodes: The ZK Gateway acts as the entry and exit nodes of the ZKSync 3.0 network, handling interactions between external blockchains (such as the Ethereum main chain) and the ZKSync network.

Asset bridging: It is responsible for bridging and transferring assets between external blockchains and the ZKSync network, ensuring the safe and efficient flow of assets between different chains.

Transaction aggregation: It aggregates user transactions into batches, generates zero-knowledge proofs, and submits them to external blockchains for verification, reducing on-chain data load and transaction fees.

Middleware: Overall, it can be understood as middleware deployed between Ethereum and ZK Chains to facilitate comprehensive interoperability between ZK Chains.

- ZK Chains: They ensure the validity and security of transactions by generating and verifying zero-knowledge proofs, submitting the results to the ZK Router for aggregation and coordination. They are interconnected with ZK Gateway and L1 smart contracts, running completely independently and can be customized for autonomous Rollup, Validium, or Volitions using the ZKStack.

According to ZKsync, the Gateway is a key component of the Elastic Chain to achieve seamless settlement to Ethereum for ZK Chains. By submitting proofs and data to Ethereum through the Gateway, it has the following advantages:

- Cross-batch and cross-chain proof synthesis, reducing L1 verification costs;

- State delta compression for forwarding small batch data to L1 in an efficient manner;

- Faster final confirmation by verifying chain proofs and preventing contradictions to achieve low-latency cross-chain bridging, strengthened by the staking of a large number of validators. ZK Chains do not need to trust other chains;

- Activity management: The activity of each ZK Chain is independently managed by its validators, and the Gateway does not affect its activity. Chains can freely leave the Gateway;

- Censorship resistance: Cross-chain forced transactions will be cheaper than regular L1 censorship-resistant transactions, making them more accessible to all users.

ZK Chains do not need to use ZK Gateway and can settle directly to Ethereum, and can choose to leave the ZK Gateway network at any time without affecting the security of their chain. ZK Gateway will be operated by a decentralized, trustless cluster of validators to ensure the elasticity and reliability of the network. Participation in this decentralized verification process requires ERC20 tokens. ZKSync network governance will designate a token for this purpose (which can be the ZK token).

Validators will charge bridge fees and publish state delta data per byte to the ZK Gateway. This provides an incentive for validators to join the ZK Gateway, as their income can grow exponentially as more and more valuable transactions are added to the chain. Additionally, due to the recompression services provided by validators, settling data through the ZK Gateway will be cheaper than settling directly on the Ethereum network, which may be a reason why most ZK Chains may choose to join.

III. Polygon 2.0: Agglayer

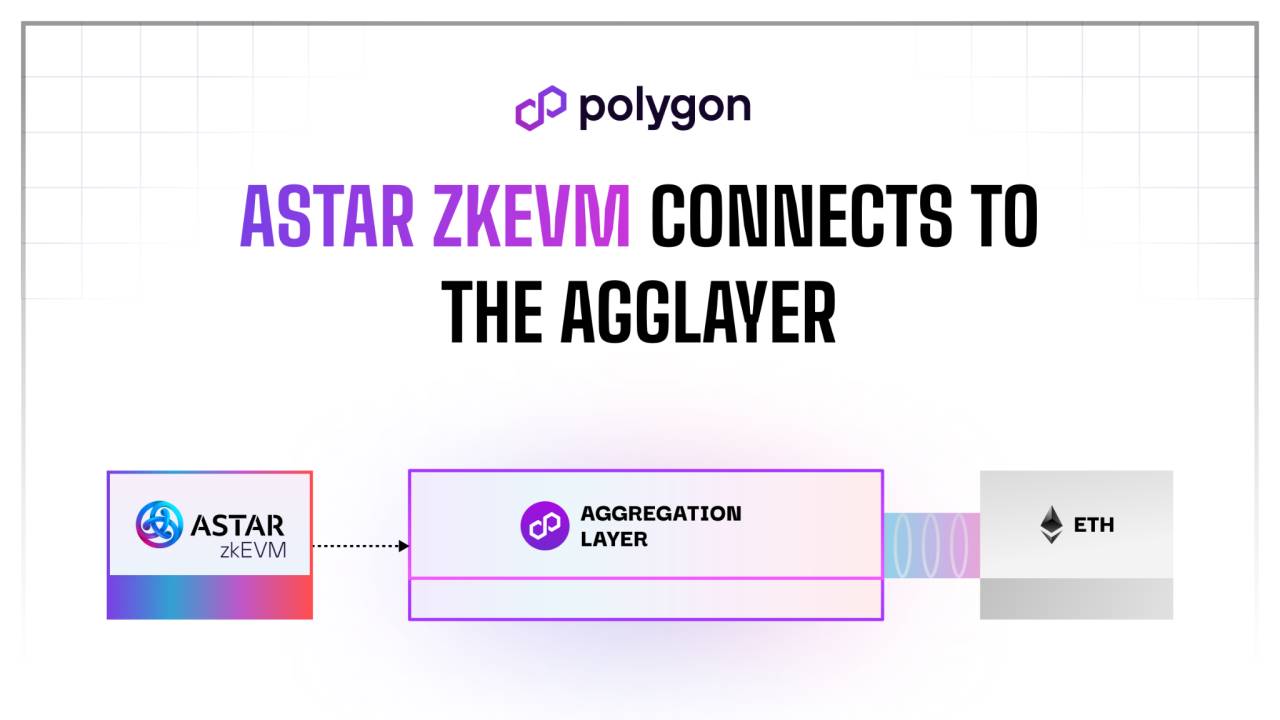

Image source: Polygon Agglayer

3.1 Agglayer Design Origins

Similar to OP Stack and ZK Stack, blockchains created using the Polygon CDK can directly access Agglayer, utilizing its unified bridging and security services to achieve interoperability with other blockchains, forming the core architecture of Polygon 2.0.

The core idea of Agglayer originates from the Shared Validity Sequencing design proposed by Umbra Research, which aims to achieve atomic cross-chain interoperability between multiple Optimistic Rollups. Through shared sequencing, the system can uniformly handle transaction sequencing and state root publication across multiple Rollups, ensuring atomicity and conditional execution.

Implementation Logic: It requires the following three components:

- Shared Sequencer: Receives and processes cross-chain transaction requests.

- Block Construction Algorithm: The shared sequencer is responsible for constructing blocks containing cross-chain operations, ensuring the atomicity of these operations.

- Shared Fraud Proof: Implements a shared fraud proof mechanism between relevant Rollups to enforce cross-chain operations.

Since existing Rollups already have bidirectional message passing between Layer 1 and Layer 2, Umbra only added a MintBurnSystemContract (Burn and Mint) contract to complement the three components.

Workflow:

- Burn operation on Chain A: Any contract or external account can call this operation, and once successful, it is recorded in the burnTree.

- Mint operation on Chain B: After successful execution, it is recorded in the mintTree by the sequencer.

Invariants and Consistency:

Consistency of Merkle roots: The Merkle root of the burnTree on Chain A and the mintTree on Chain B must be equal to ensure the consistency and atomicity of cross-chain operations.

System Operation:

The shared sequencer is responsible for publishing transaction batches and state roots of two Rollups to Ethereum. It can be centralized or decentralized (such as Metis). The sequencer receives transactions and constructs blocks for Rollups A and B. For transactions on A, if the interaction with the MintBurnSystemContract is successful, it attempts to execute the corresponding Mint transaction on B. If the Mint transaction is successful, it includes the Burn transaction on A and the Mint transaction on B; if it fails, it excludes these two transactions.

3.2 Core Components of Agglayer:

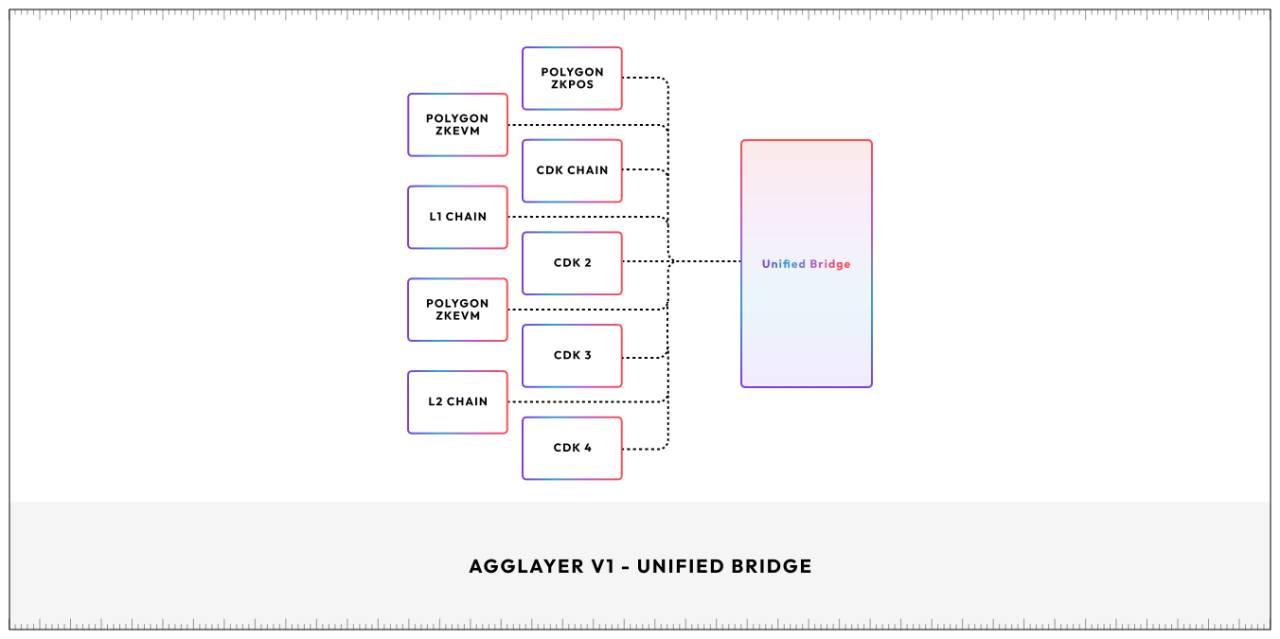

In Polygon 2.0's Agglayer, the Unified Bridge and Pessimistic Proofs are its core components.

1. Unified Bridge

Technical Framework:

- Cross-chain Communication: The core of the Unified Bridge is to achieve seamless communication between different chains. It facilitates data and asset transfer between different Layer 2 solutions and the Ethereum main chain through cross-chain communication protocols.

- Liquidity Aggregation: The bridge aggregates liquidity from different Layer 2 solutions, allowing users to freely move assets between different chains without worrying about liquidity dispersion.

Implementation Logic:

- Message Passing: The Unified Bridge achieves cross-chain communication through a message passing mechanism. Messages contain transaction-related information and are passed between chains through bridge protocols.

- Asset Locking and Release: When a user locks assets on one chain, the Unified Bridge will release equivalent assets on the target chain. This process requires the use of smart contracts to ensure security and transparency.

- Interoperability Protocols: To ensure interoperability between different chains, the Unified Bridge adopts standardized interoperability protocols. These protocols define how to handle cross-chain transactions, how to verify the validity of transactions, and how to handle potential conflicts.

Image source: Aggregated Blockchains: A New Thesis

2. Pessimistic Proofs

Technical Framework:

- Security: Pessimistic proofs are a security measure designed to prevent fraudulent transactions. They ensure all transactions are valid by introducing additional verification steps during transaction validation.

- Delayed Verification: Unlike Optimistic Proofs, Pessimistic Proofs assume transactions may be malicious and conduct comprehensive verification before confirmation.

Implementation Logic:

- Initial Verification: After a transaction is submitted, the system immediately conducts preliminary verification. This includes checking the basic information of the transaction and the validity of the signature.

- Deep Verification: After passing preliminary verification, the transaction enters the deep verification stage. The system calls a series of smart contracts to examine the complexity of the transaction and potential risks.

- Dispute Resolution: If any issues are found during verification, the system triggers a dispute resolution mechanism. This mechanism allows users and validators to submit additional proofs to resolve disputes and ensure the final validity of transactions.

Through the Unified Bridge and Pessimistic Proofs, Agglayer can provide a highly secure, scalable, and interoperable blockchain environment. These components not only enhance the security of the system but also simplify cross-chain transaction operations, allowing users to interact more easily between different chains. For more details, refer to the previous article "Exploring the Core of Polygon 2.0's Agglayer from Modularization to Aggregation" by YBB Capital.

IV. Optimism: Superchain Explainer

In 2023, Optimism took the lead in paving the way for one-click chain launches, with the first task being to establish a unified network standard for OP Stack. OP Stack is the launch platform for The Optimism Superchain, an Ethereum scaling solution, and also serves as the hub for interaction and transactions for all L2s built using OP Stack.

As most of you are already familiar with OP Stack, for brevity, the Optimism Superchain will share a common OP Stack development stack, bridging, communication layer, and security to ensure that each chain can communicate cohesively and act as a single unit. This structure can be divided into five different layers, each with its specific purpose and function:

The Data Availability Layer determines that the original input of chains based on OP Stack is primarily obtained through Ethereum DA.

The Sequencing Layer controls the collection and forwarding of user transactions, usually managed by a single sequencer.

The Derivation Layer processes the original data into inputs for the Execution Layer, primarily using Rollup.

The Execution Layer defines the system's state structure and transformation functions, with the Ethereum Virtual Machine (EVM) as the central module.

The settlement layer allows external blockchains to view the valid state of the OP Stack chain through proof-of-fault proofs.

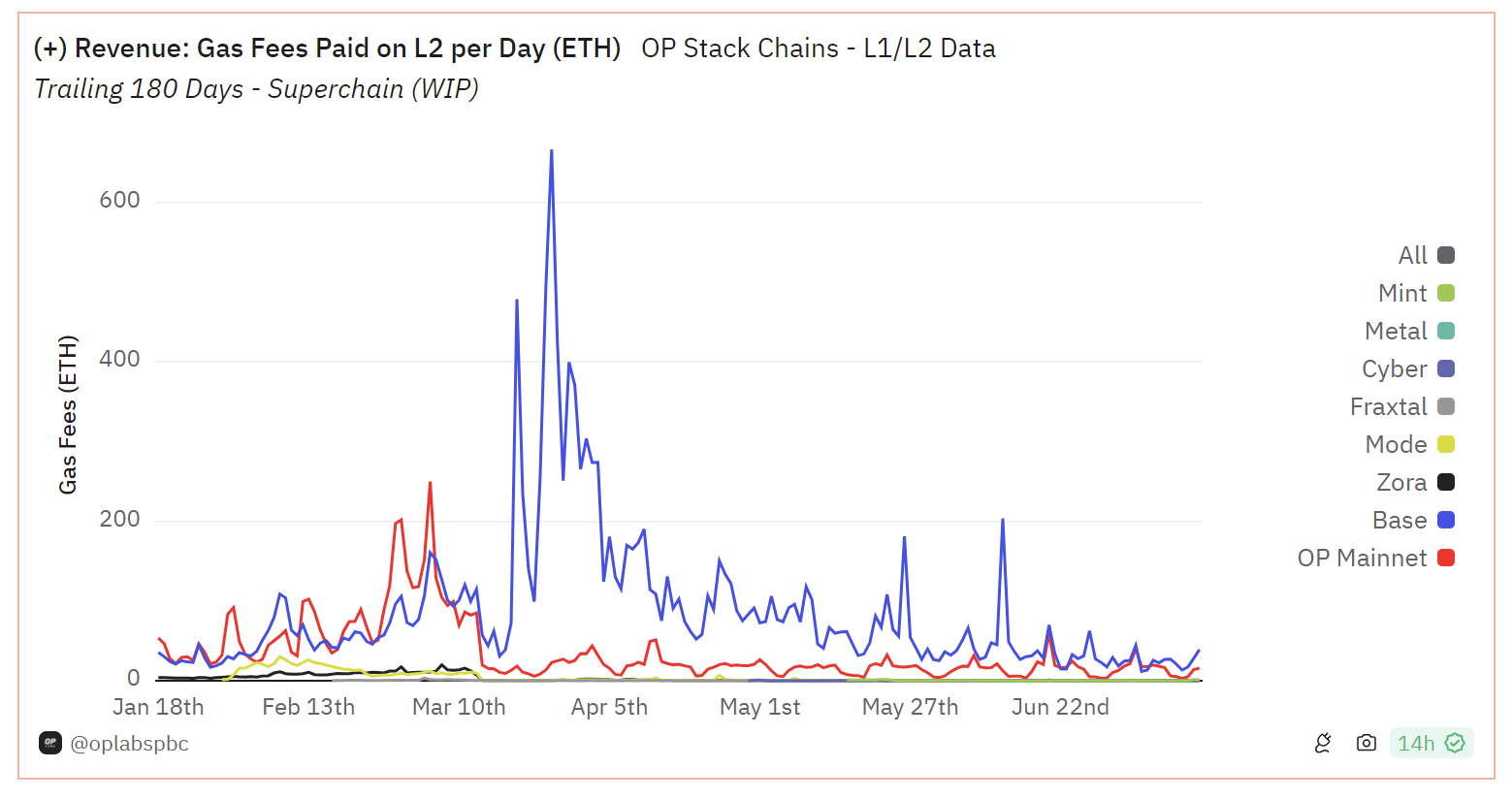

Compared to Elastic Chain and Agglayer, Optimism Superchain was the earliest to enter the market and has taken the lead in Base, occupying the majority of daily gas expenses, reflecting the on-chain activity of Base.

Image source: Dune Optimism - Superchain Onchain Data

V. Subjective Thoughts on One-Click Chain Launch

5.1 Perspective on the Competition Among AggLayer, Superchain, and Elastic Chain

(This section represents the author's personal opinion)

The three expansion solutions are all extensions of their respective Rollup scaling narratives. Based on market maturity, OP Stack and Superchain have taken the lead in the market, with Base being the most successful representative.

AggLayer has the advantage of native compatibility and can run directly on the existing Ethereum network without the need for significant modifications to the underlying protocol. It is more easily accepted by existing Ethereum users and developers. The challenge lies in ensuring the security and reliability of the aggregation process.

The initial judgment of Elastic Chain at this stage depends on the development of the ZKsync ecosystem and community building. If ZKsync itself does not develop, Elastic Chain may face resistance in attracting developers and maintaining community enthusiasm. From both market and technical perspectives, the short-term focus is on OP, while the long-term focus is on ZK.

The above three solutions will bring about native issues with Rollup: a relatively high degree of centralization. With the recent emergence of Based Rollup's scaling solution, it may also be a potential competitor in the future. It directly assigns the sequencer to L1, the Ethereum main chain, eliminating the need for additional sequencers or complex verification steps in L2. This more native scaling, although it may also have some potential MEV issues, is still worth paying attention to for future development.

Image source: ZKsync - Introducing the Elastic Chain

5.2 Future Development Trends and Innovative Applications of Rollup

Overall, with the promotion of "one-click chain launch," the number of Rollups, as the mainstream Ethereum scaling solution, will continue to increase. Even in the event of a major outbreak in the Bitcoin ecosystem in 2023, its non-native extensions have drawn inspiration from many of Ethereum's scaling logics. In the context of insufficient market innovation, the application innovation and impact of Rollup may be limited.

For each VM chain, regardless of market changes, TVL remains the main indicator. Therefore, the first applications to appear are various DeFi protocols. In addition, there may be the emergence of SocialFi protocols and NFT trading markets.

In other tracks, DePIN may have difficulty developing on Rollup and L1, with the leader possibly emerging on Solana. The probability of RWA concept development on L1 is high, but there is insufficient confidence in its development on Rollup. GameFi will also emerge, but large-scale games will only have a chance on Rollups focused on GameFi. Therefore, the most certain applications at this stage are still in the DeFi category.

However, the Matthew effect of blockchain is evident, and with the arrival of the multi-chain era, resources will be concentrated on leading projects, with the strong getting stronger and the weak being eliminated.

Additional links:

(1) Exploring the Core of Polygon 2.0's Agglayer from Modularization to Aggregation

References:

[1] Introducing the Elastic Chain

https://zksync.mirror.xyz/BqdsMuLluf6AlWBgWOKoa587eQcFZq20zTf7dYblxsU

[2] zkSync Protocol Upgrade v24: New precompiles, more blobs, Validiums, and more. #519

https://github.com/zkSync-Community-Hub/zksync-developers/discussions/519

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。