作者:Richard Laycock

编译:TechFlow

核心要点

-

2025年价格预测:专家平均预测2025年底以太坊价格为 4,308美元。

-

高峰与低谷预测:2025年余下时间可能波动较大,平均最高价预测为 4,746美元,而最低点预测仅为 1,940美元。

-

长期展望:专家认为以太坊将持续上涨,预计到2030年价格为 10,882美元,到2035年更将达到 22,374美元。

-

是否应购买ETH:多数专家(57%)认为当前是购买以太坊的好时机。

-

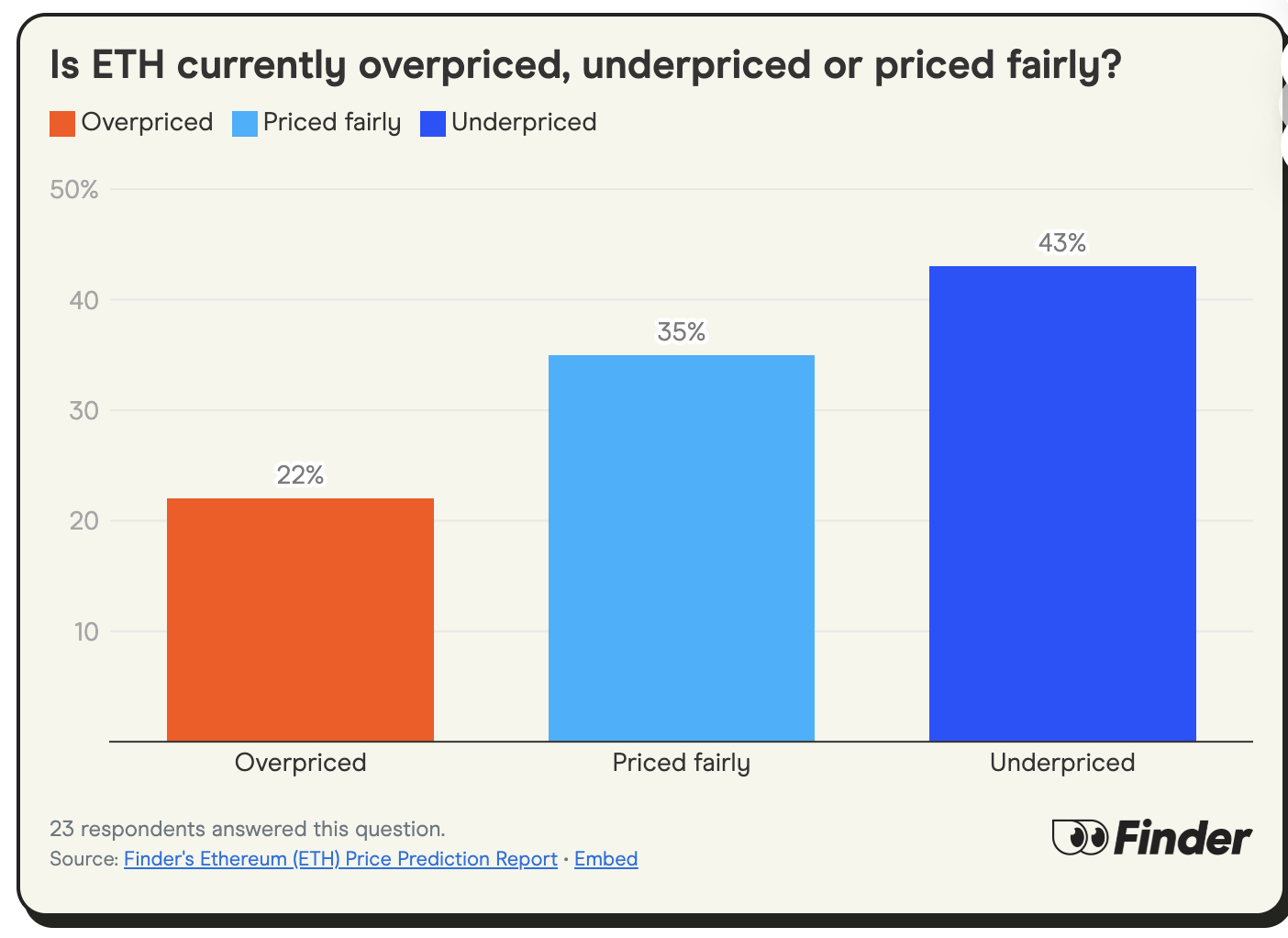

以太坊是否被低估:近半数专家(43%)认为以太坊目前被低估。

免责声明:本文不构成金融建议或数字资产、服务的推荐。数字资产具有高波动性和风险,过去表现不代表未来结果。潜在的监管政策可能影响其可用性及相关服务。投资前请咨询专业金融顾问。Finder及作者可能持有文中提到的加密货币。

Finder 每季度都会分析专家的价格预测。在 2025 年 6 月底,我们对 24 位加密行业专家进行了调查,以了解他们对以太坊(ETH)在未来至 2035 年表现的看法。

本报告中提到的所有价格均以美元计算。

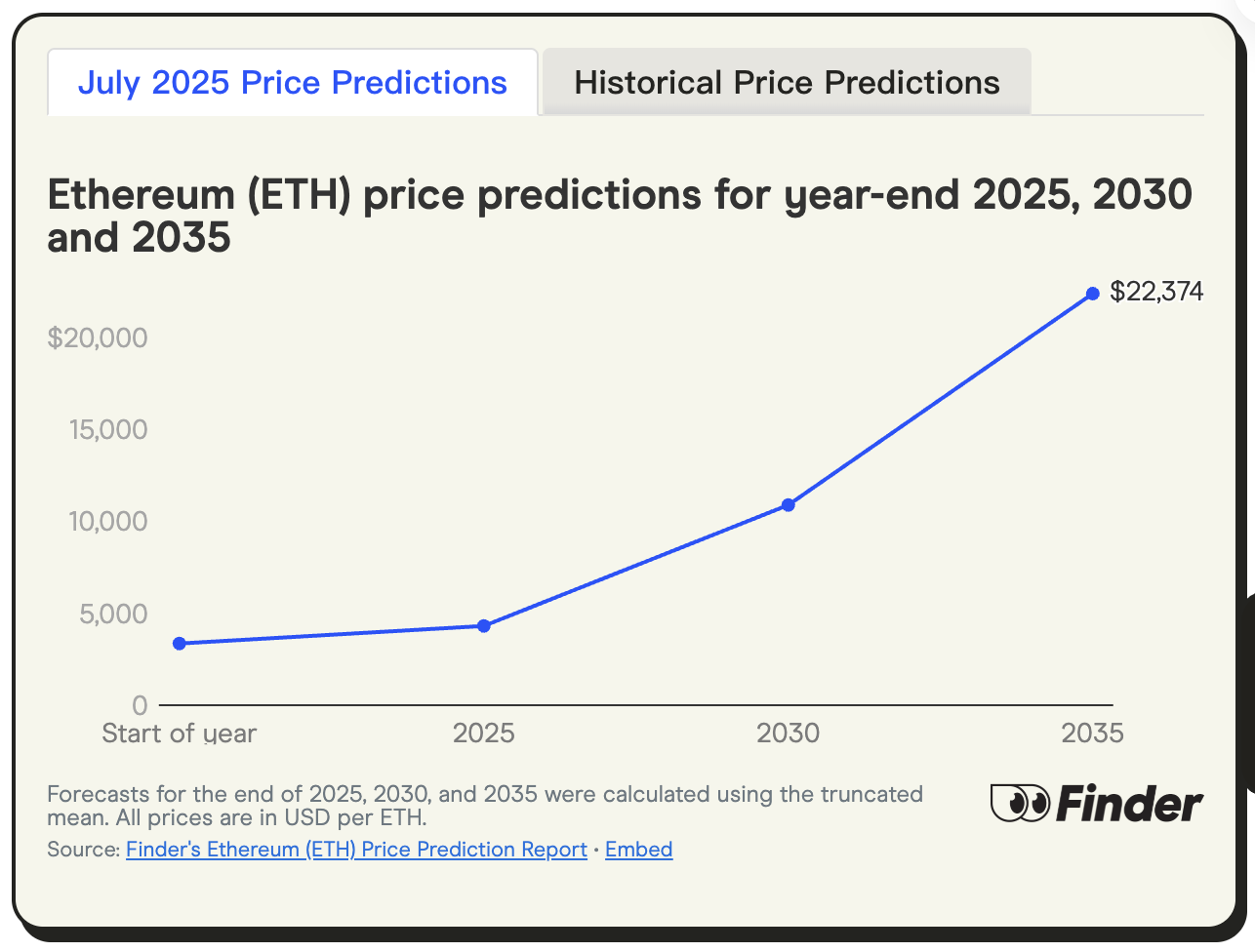

专家小组平均预测,以太坊价格将在 2025 年底达到 4,308 美元,随后在 2030 年底升至 10,882 美元,并在 2035 年进一步攀升至 22,374 美元。

以太坊(ETH)价格预测:2025、2030与2035年展望

根据专家预测,以太坊价格将在2025年底达到 4,308美元,到2030年底上涨至 10,882美元,并在2035年底进一步攀升至 22,374美元,这一预测比2025年4月报告中的 4,153美元 更乐观。

专家预测以太坊(ETH)将在2030年达到 10,882美元,并在2035年升至 22,374美元。与2025年的预测类似,本次专家组的预期略显乐观,高于我们2025年4月调查中的平均预测值——当时预计2030年ETH价格为 9,495美元,2035年为 17,042美元。

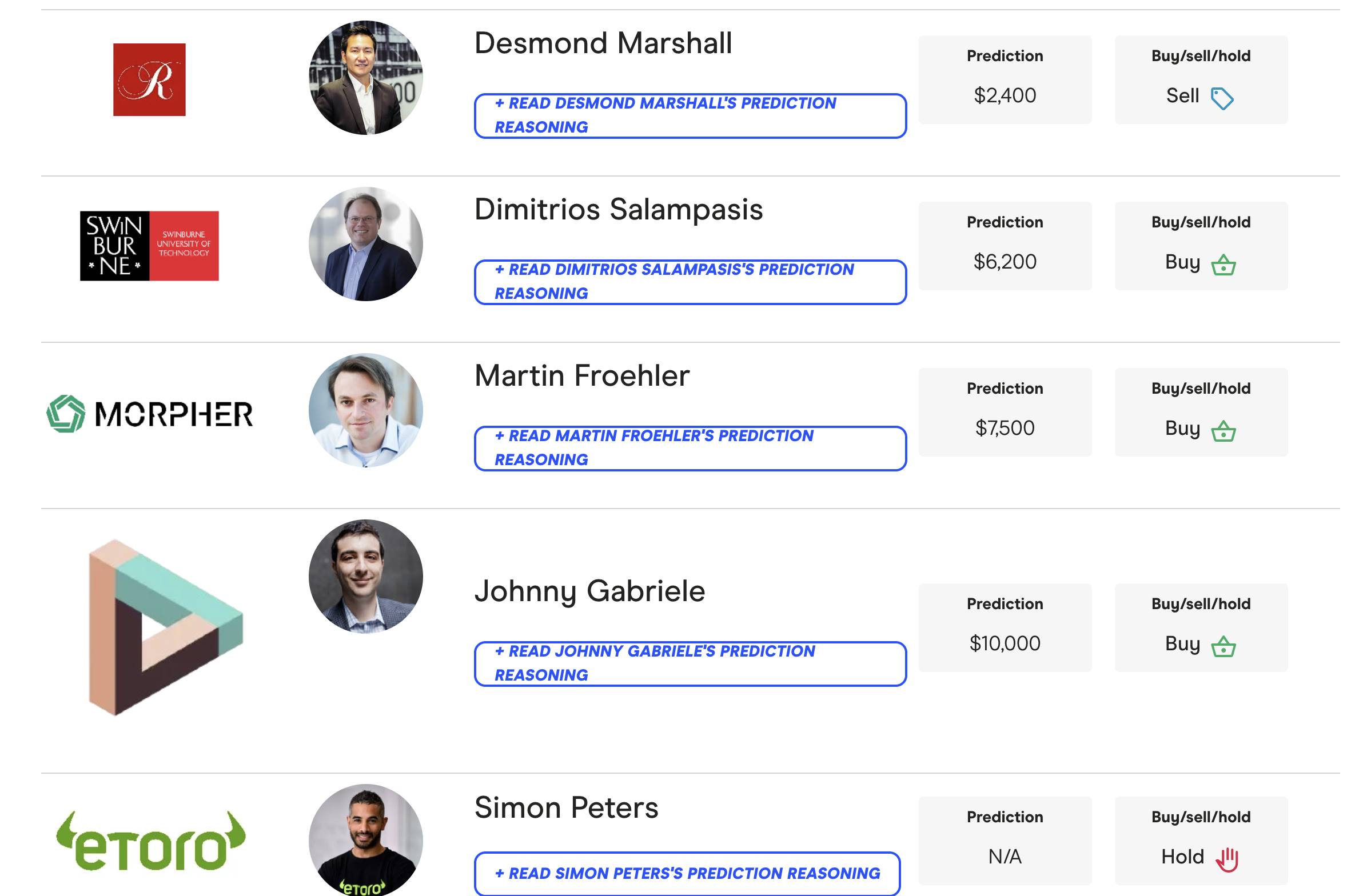

Lifted Initiative 区块链经济与AI集成首席分析师 Johnny Gabriele 预测2025年以太坊价格将达到 10,000美元,并将以太坊与“全球资产如石油”相比较。

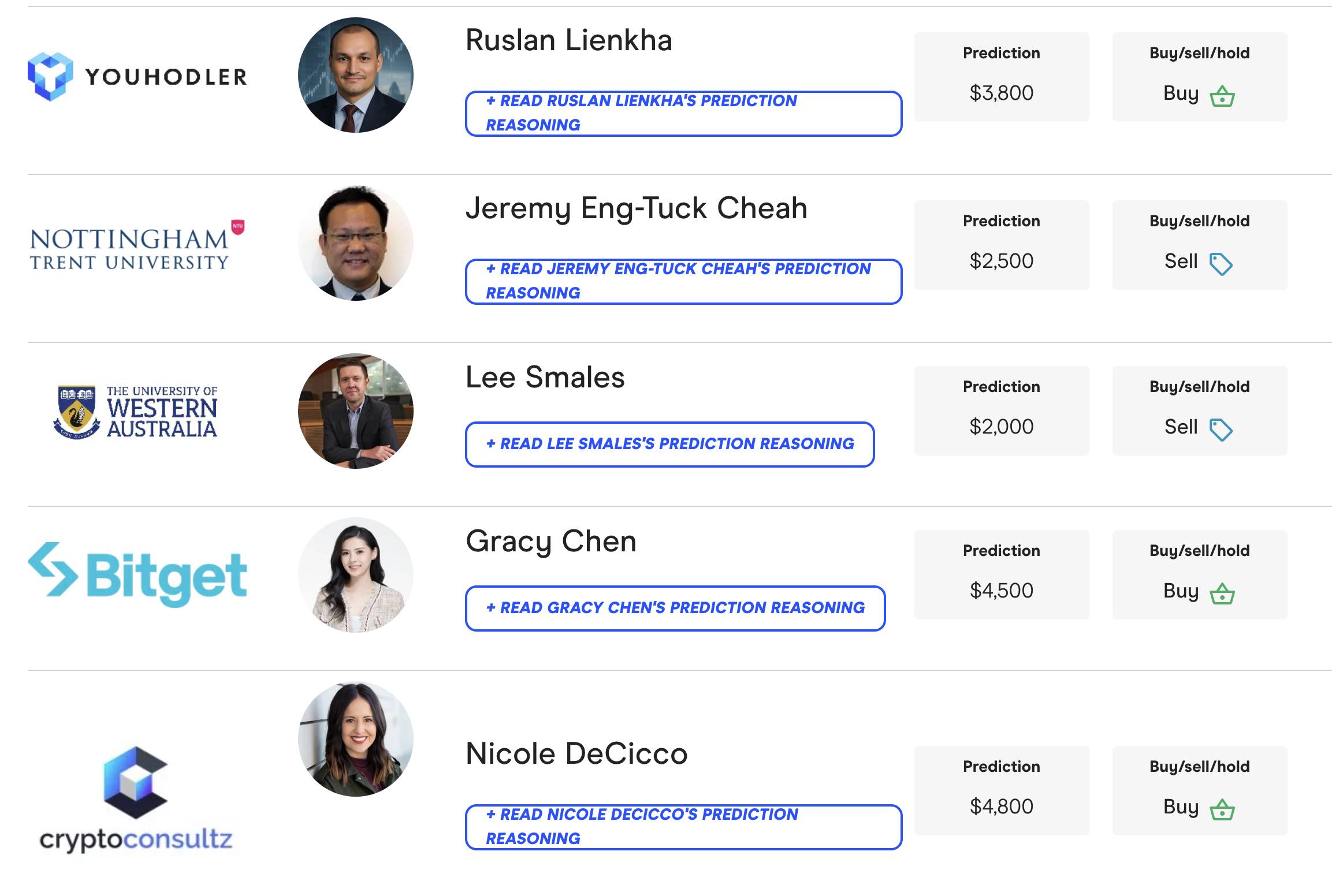

Bitget首席执行官Gracy Chen表示,以太坊是去中心化金融(DeFi)的核心,并因其可扩展的Layer-2解决方案而前景光明。

这些价格预测源于以太坊作为去中心化金融(DeFi)核心支柱的角色,其在现实世界资产(RWA)代币化领域的应用预计到2030年将达到 16万亿美元。此外,Dencun升级后交易速度的提升也促进了以太坊在支付系统中的广泛使用。强劲的机构兴趣以及以太坊可扩展的二层解决方案进一步增强了其未来前景。

Alpha Node Global董事总经理Ben Ritchie预测2025年以太坊价格将达到 6,000美元,并强调机构投资者的兴趣。

我们的观点基于机构兴趣的强劲增长,尤其是通过以太坊现货ETF(交易所交易基金)的推动,以及以太坊在托管现实世界资产(RWA)方面日益扩大的角色。简而言之,RWA需要稳固且可靠的核心基础设施,而以太坊及其虚拟机(EVM)已经在长期实践中证明了其行业领导地位。

Origin Protocol联合创始人Josh Fraser对以太坊(ETH)在2025年的潜力持相当乐观态度,预测其价格将达到 9,000美元,并表示以太坊有可能在长期内超越比特币的市值。

“以太坊是全球的计算机,其应用场景几乎无限。以太坊的需求来自ETF,再加上用于质押的ETH锁仓量,预计2025年将进一步上涨。”

另一方面,堪培拉大学高级讲师 John Hawkins 则持较为保守的观点,预测以太坊价格仅为 1,500美元。

“虽然以太坊在技术上更先进且对环境的影响较小,但其价格与比特币高度相关。”

2025年以太坊价格区间预测

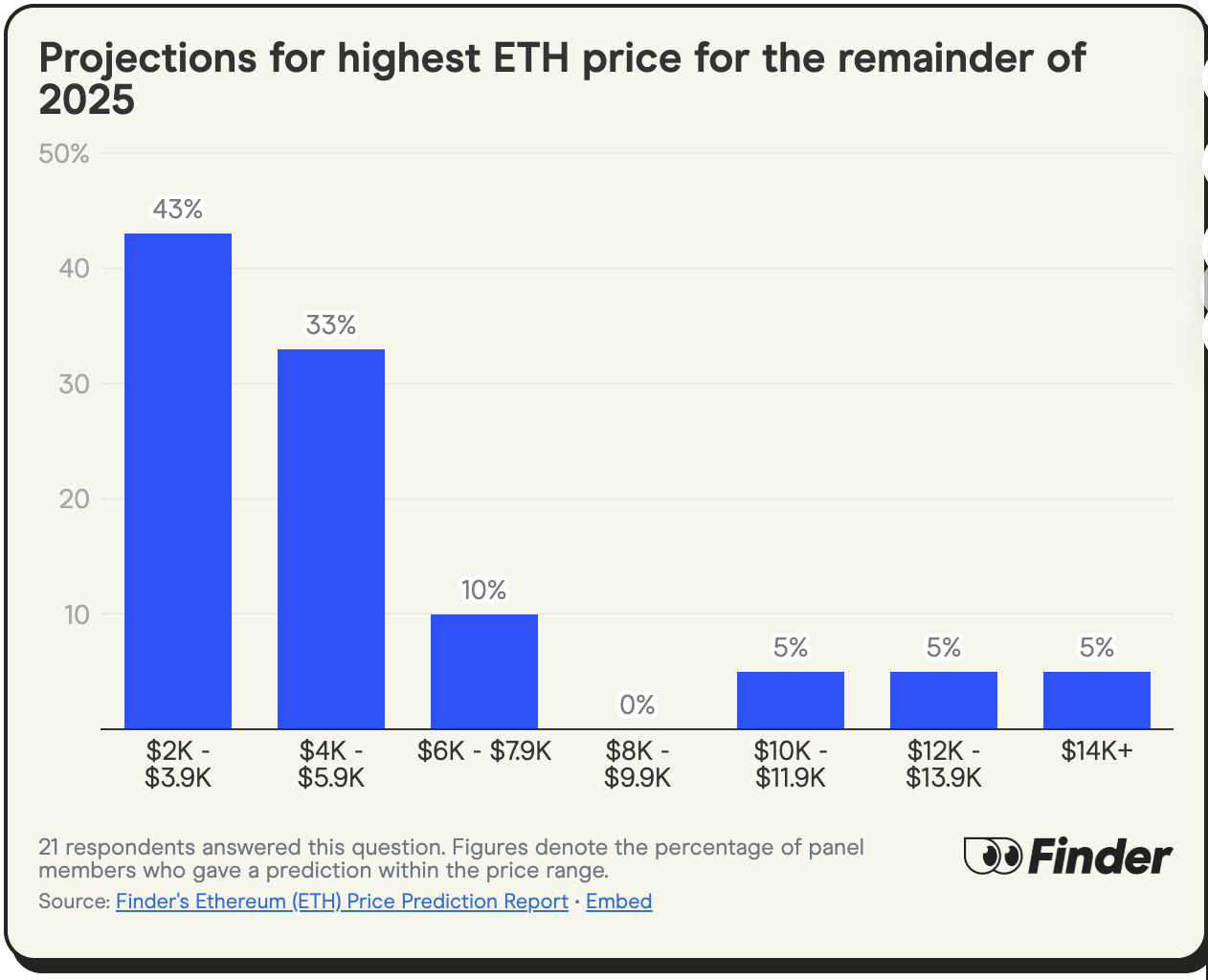

专家组预测,以太坊(ETH)在2025年的平均峰值价格将达到 4,746美元,其中部分预测认为其价格可能高达 14,260美元。

超过五分之二(43%)的专家认为,ETH的价格在2025年底前最高将升至 2,000至3,999美元区间;而三分之一(33%)的专家则预计其价格将在同一时间段内达到 4,000至5,999美元区间。

Morpher首席执行官Martin Froehler对以太坊(ETH)2025年的前景持极度乐观态度,预测其价格将达到 7,500美元,因为以太坊被视为现实世界资产代币化的首选平台。

“以太坊是目前最去中心化的区块链,也是现实世界资产代币化的首选。”

CryptoConsultz首席执行官Nicole DeCicco则给出了最高预测值 5,200美元,并表示基于机构投资者的参与,以太坊将在长期内保持强劲。

“以太坊仍是加密领域最可靠且使用最广泛的平台之一,特别是在现实世界应用方面。最近的Pectra升级带来了交易速度、钱包安全性和验证器性能方面的必要改进。其基础设施被BlackRock(贝莱德)、PayPal等大型玩家使用,这些企业不会押注一个没有长期潜力的平台。结合这种广泛采用和持续的扩容进展,以太坊仍有巨大的增长空间。”

低端预测

-

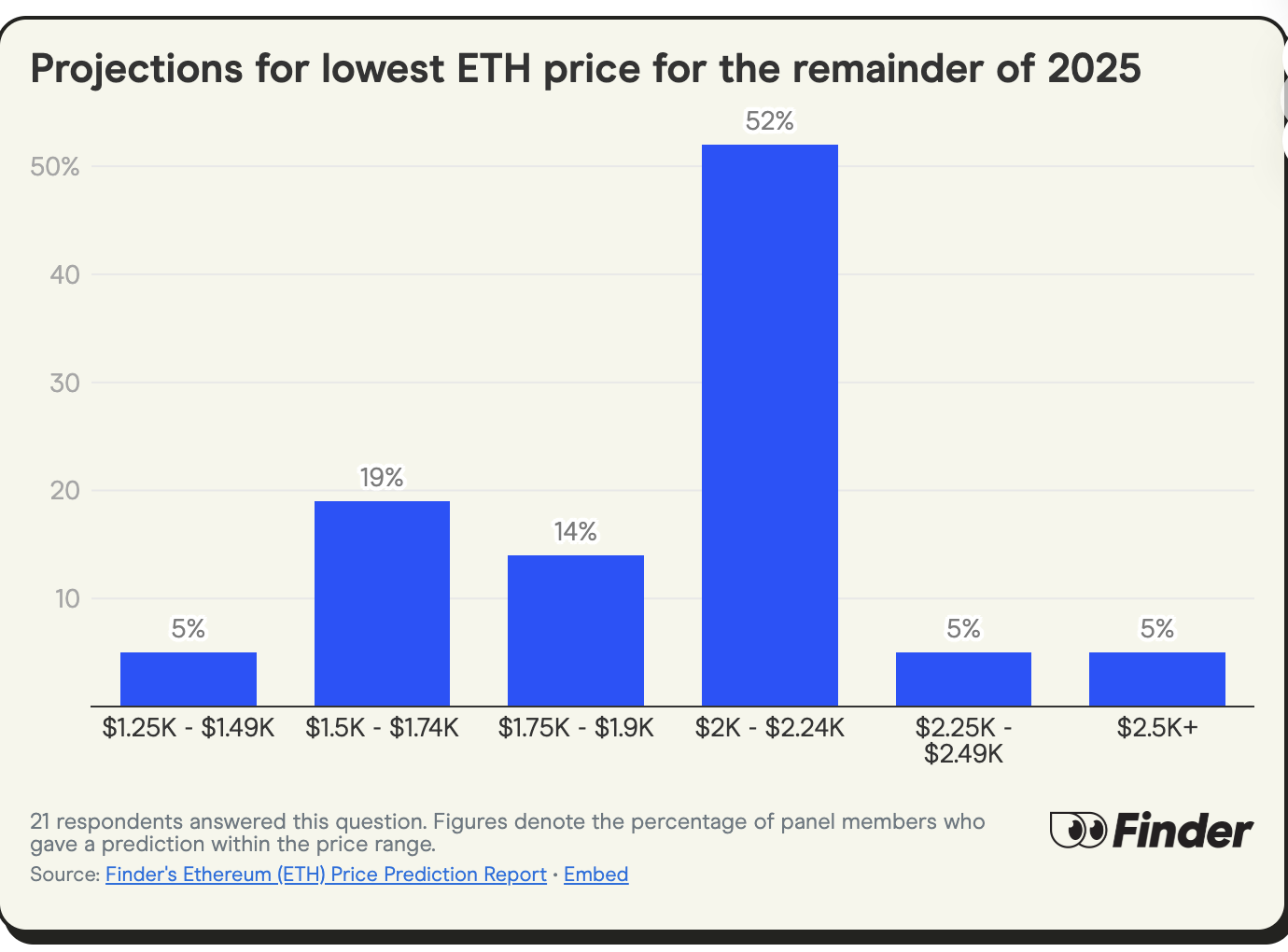

平均最低价:专家小组预测2025年以太坊的平均最低价格为 1,940美元,部分预测甚至低至 1,390美元。

-

底部区间:超过半数专家(52%)认为以太坊2025年余下时间的最低价格将处于 2,000至2,249美元 之间。

Seasonal Tokens创始人Ruadhan O表示,2025年对以太坊(ETH)不利因素较多,预计价格可能在年底前跌至 2,000美元。

以太坊在近期战争爆发时曾跌至 2,200美元,显示其当前价格支撑力度不及比特币(BTC)。自12月选举后的高点以来,以太坊价格已下跌40%。若未来几个月没有意外利好消息,2025年内价格突破 4,000美元 的可能性较低。

InFlux Technologies 首席执行官 Daniel Keller 认为,Gas Fee 的停滞可能对以太坊价格产生负面影响,预测其最低价可能跌至 1,500美元。

目前以太坊(ETH)处于超卖状态,价格仍有上涨空间。然而,不变的Gas费可能会对其产生负面影响,因此我预测到2025年底,价格仅会出现小幅上升。

现在是购买、持有还是出售以太坊(ETH)的最佳时机?

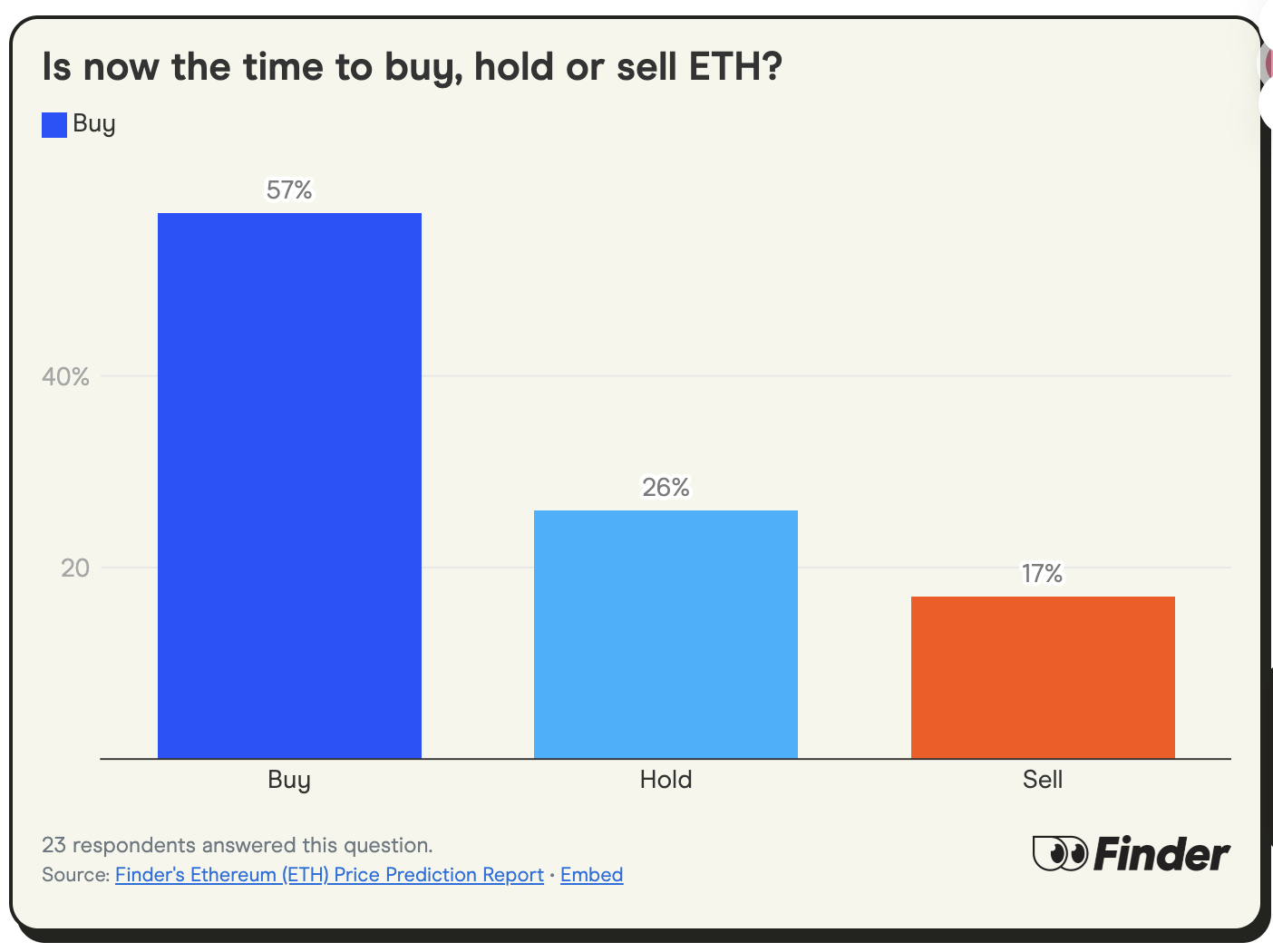

以太坊目前交易价格低于2025年1月的高点,这可能促使57%的专家认为现在是购买以太坊的好时机;26%的专家建议持有,而17%的专家主张出售。

YouHodler 市场主管 Ruslan Lienkha 认为以太坊是值得买入的资产,因为它是稳定币发行的领先区块链。

以太坊依然是稳定币发行和更广泛经济中非金融应用的领先区块链。同时,它仍是市值排名第二的加密货币,并且普遍被认为相比其最接近的竞争对手更加去中心化。

FV Bank首席执行官Miles Paschini表示,以太坊(ETH)应持有,因为它“仍然是主导的去中心化网络,并且在多个领域以及二层(Layer 2)支持方面具有强劲的使用率。”

JT Consulting & Media 的未来学家 Joseph Raczynski 也支持持有的观点,他表示:

稳定币交易量的 70% 都发生在以太坊生态系统中,包括前两大稳定币:Circle 的USDC和Tether的USDT。随着《GENIUS法案》的通过,美国大多数公司将拥有新的渠道来吸引更多用户。这是一个被低估的关键时刻,未来这将对以太坊(ETH)产生重大积极影响。

Rouge International 和 Rouge Ventures 董事总经理 Desmond Marshall 表示,ETH应该被卖掉,对该代币没有任何正面评价。

“ETH一直令人失望。不论市场行情好坏,它的价格始终徘徊在最高2600美元左右。我一直直言不讳地指出ETH被严重操控,它作为一种代币确实有功能……但作为一种金融资产,它毫无价值。”

以太坊(ETH)目前是高估、低估还是估值合理?

专家小组中约43%认为以太坊目前被低估,35%认为价格合理,22%则认为价格过高。

Komodo Platform首席技术官Kadan Stadelmann认为以太坊价格在一定程度上依赖比特币的表现,但机构采用和ETF新闻将推动其价格上涨。他认为目前以太坊价格被低估。

尽管市场在过去几年中取得了显著进展和增长,但以太坊(ETH)仍然是一个主要跟随比特币走势的山寨币。随着我们进入本轮牛市的最后阶段,ETF消息和机构对以太坊的兴趣将继续推动市场活动上升。

B2BROKER首席商务官John Murillo则认为以太坊当前价格是公平的。

以太坊正面临来自更廉价DeFi协议的激烈竞争,如Solana、Stellar、Uniswap以及其他代币。尽管以太坊正在进行多项升级(包括Pectra和Danksharding),但高昂的Gas费用问题仍未解决,这让市场对其未来表现的提升存疑。然而,以太坊作为一项重要的加密货币,依然会随大盘趋势参与市场波动。

Omnia Markets创始人兼首席执行官Mitesh Shah表示,以太坊的价格目前是合理的,主要得益于ETF的推出以及RWA(现实世界资产)市场的增长:

近期现货ETF的推出已吸引了超过 42亿美元 的累计净流入,为这一资产创造了显著且持续的新需求来源。同时,以太坊上的现实世界资产(RWA)代币化市场已增长至超过 240亿美元,巩固了其作为这一数万亿美元机遇的主要结算层的地位。这种日益增长的实用性,加上网络的通缩代币销毁机制以及清晰的技术路线图,为以太坊的长期积极估值提供了强有力的基础。

机构采用的驱动力

以太坊依然是机构玩家的首选区块链,尽管面临诸如Solana等生态系统的竞争。目前已有超过 50家非加密领域企业,包括全球金融巨头如BlackRock(贝莱德)、PayPal和Deutsche Bank(德意志银行)在以太坊及其二层网络上开展业务。

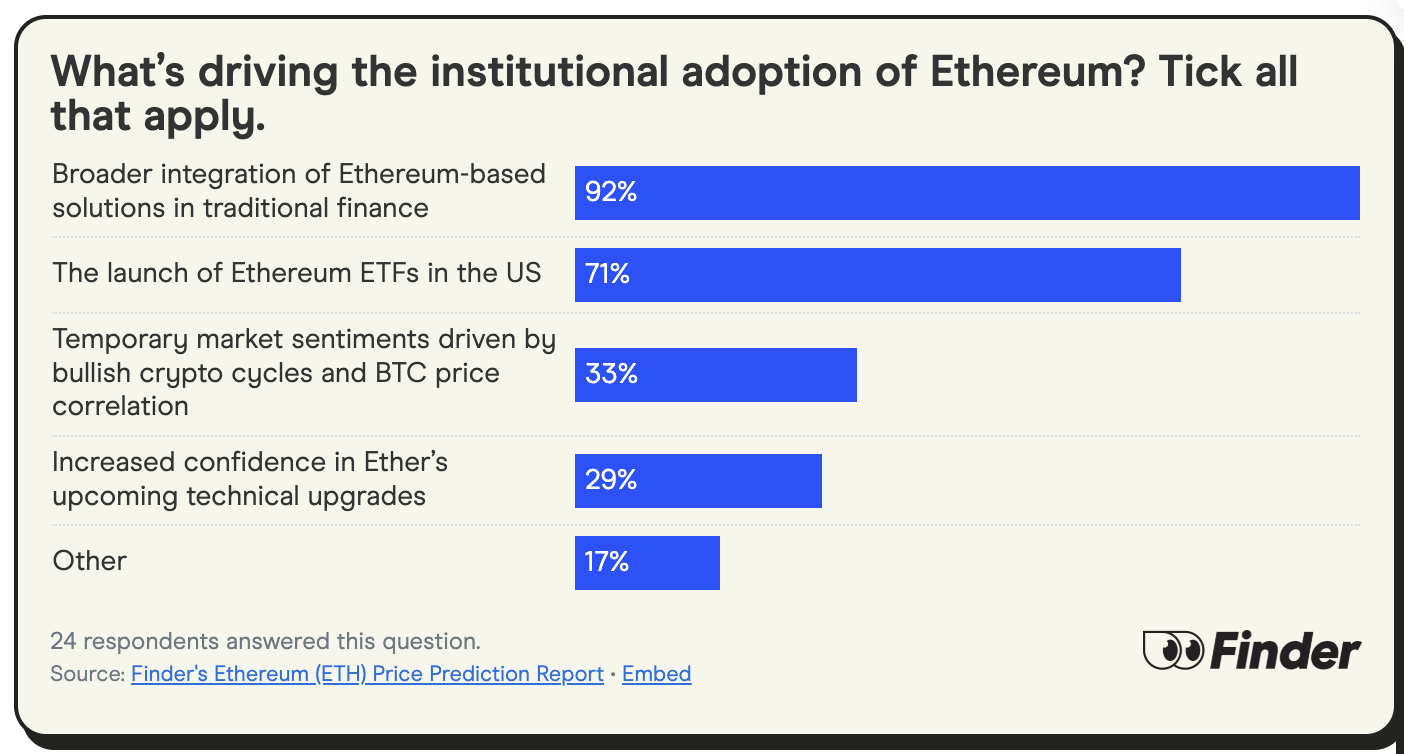

那么,是什么推动了以太坊的机构采用呢?

-

广泛金融整合:92%的专家认为,以太坊解决方案在传统金融领域的应用(如资产代币化、稳定币和现实世界资产)是其被机构广泛采用的主要原因。

-

ETF的推出:71%的专家指出,以太坊ETF的推出是推动机构采用的关键因素。

您如何看待以太坊上去中心化AI的未来?

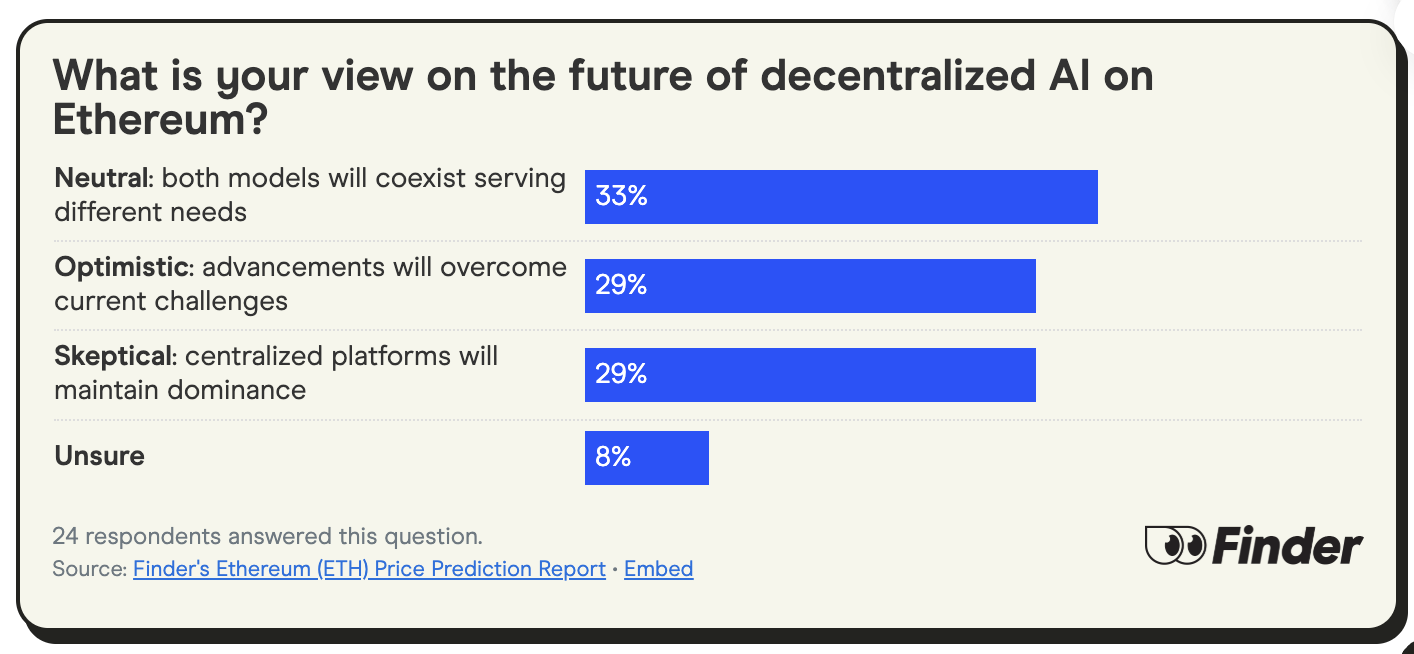

以太坊上的去中心化AI平台开始崭露头角,但据报道在技术和经济挑战面前,难以与中心化服务竞争。专家对这一领域的未来看法不一:

对于以太坊上去中心化AI的未来,专家小组的意见相对均衡。三分之一(33%)持中立态度,认为去中心化和中心化模型将共存,以满足不同需求。

稍少一些(29%)的专家持乐观态度,认为技术进步将克服当前的挑战;与此同时,另有29%的专家则表示怀疑,认为中心化平台仍将保持主导地位。

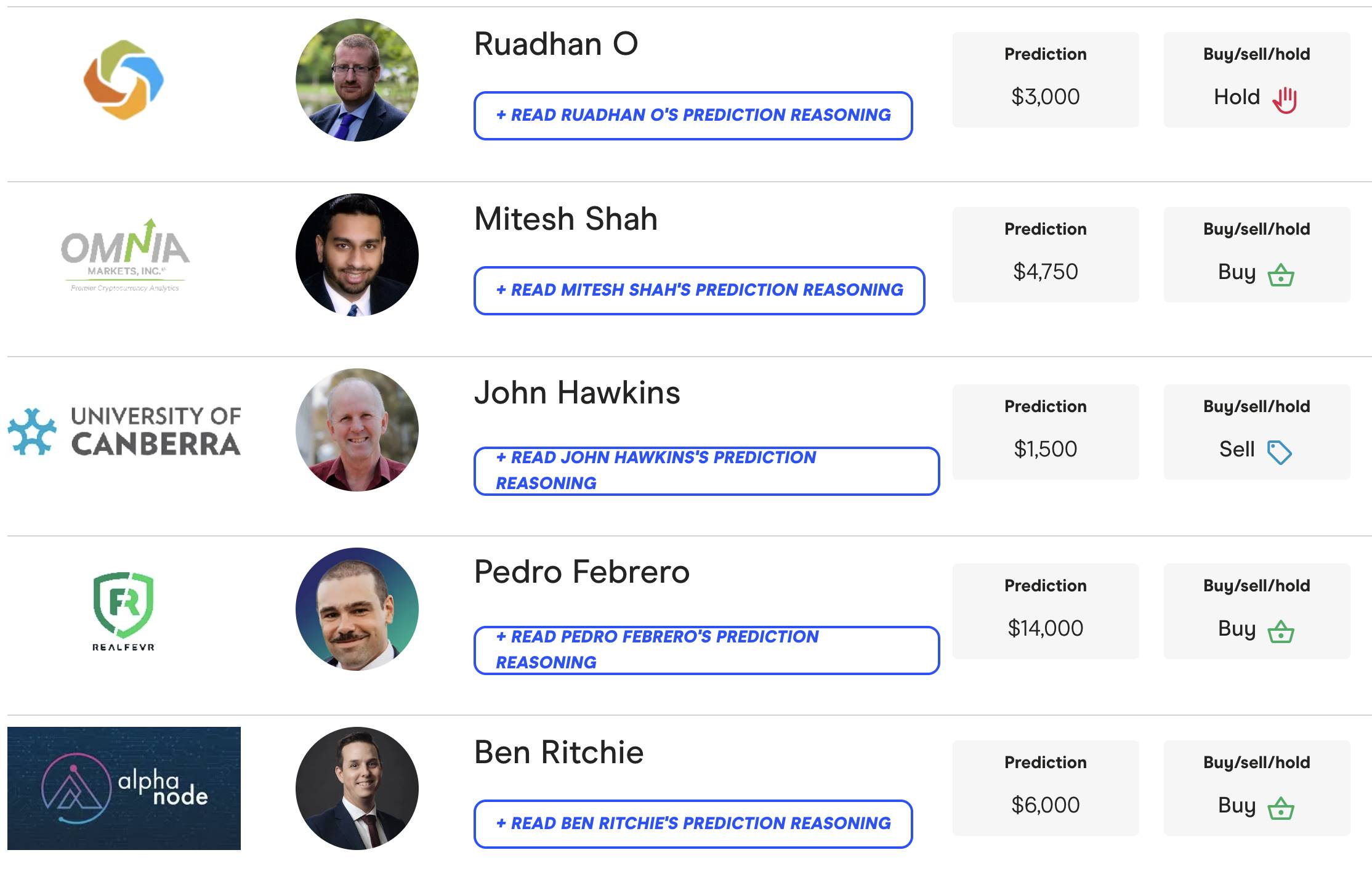

专家团队

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。