Solayer, as a re-staking protocol in the Solana ecosystem, leverages the advantages of decentralized cloud infrastructure to provide users with a way to re-stake their assets and earn profits.

By shaofaye123, Foresight News

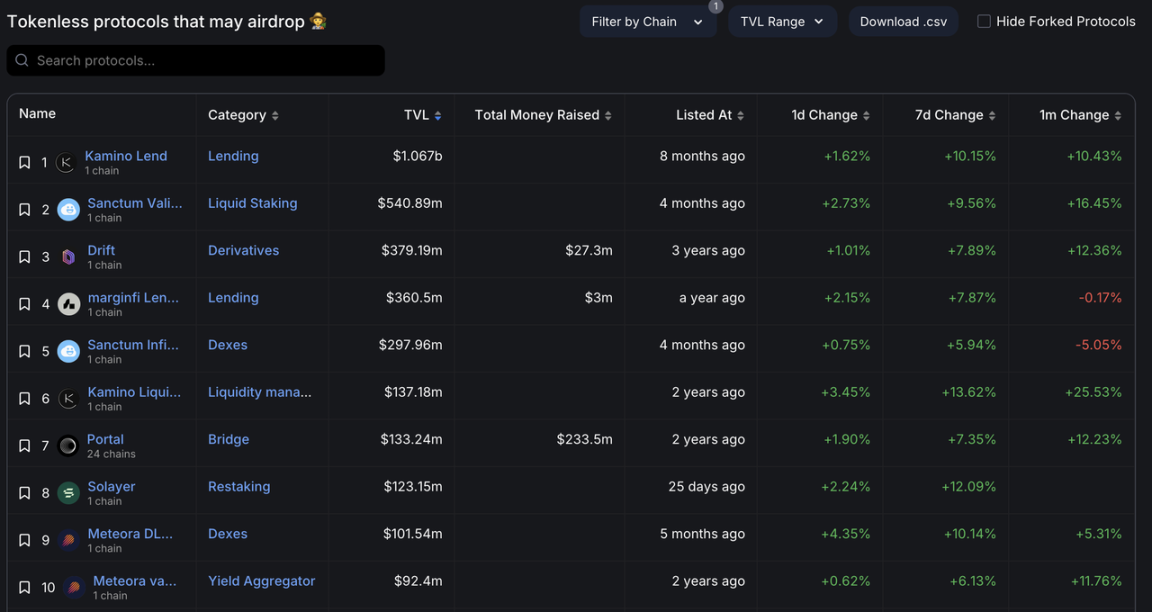

As the market gradually warms up, the sanctum airdrop has landed but the response is not as expected. With a large amount of funds "unlocked," what project in the Solana ecosystem will attract significant capital inflow?

Solayer, as a rising star in Solana re-staking, announced the completion of its builder round financing on July 2, with a strong lineup of investors. As of July 15, the total value locked (TVL) on its platform has exceeded 1.2 billion. With the boost of the airdrop expectation, can Solayer attract more capital inflow, and how to participate in the project? This article will quickly introduce you to this newcomer in the Solana re-staking project.

Source: https://defillama.com/airdrops?chain=Solana

What is Solayer?

Solayer is a re-staking protocol in the Solana ecosystem, leveraging its advantages as a decentralized cloud infrastructure to support SOL holders in staking their assets in other protocols or DApp services within the Solana ecosystem that require security and trust. In addition to POS staking rewards, users can also earn MEV and AVS rewards. Currently, Solayer supports users to deposit native SOL, mSOL, JitoSOL, and other assets.

Solayer utilizes Solana's stakers as validators, providing high decentralization and security, avoiding the trust risks of centralized service providers or proprietary tokens. It provides a simple way for decentralized applications (DApps) to create their own AVS LST. These tokens offer Solana's native staking rewards as the base reward, as well as additional MEV rewards. DApps can also receive a portion of staking commissions and can configure the underlying operators for staking delegation in the future.

Source: https://docs.solayer.org/

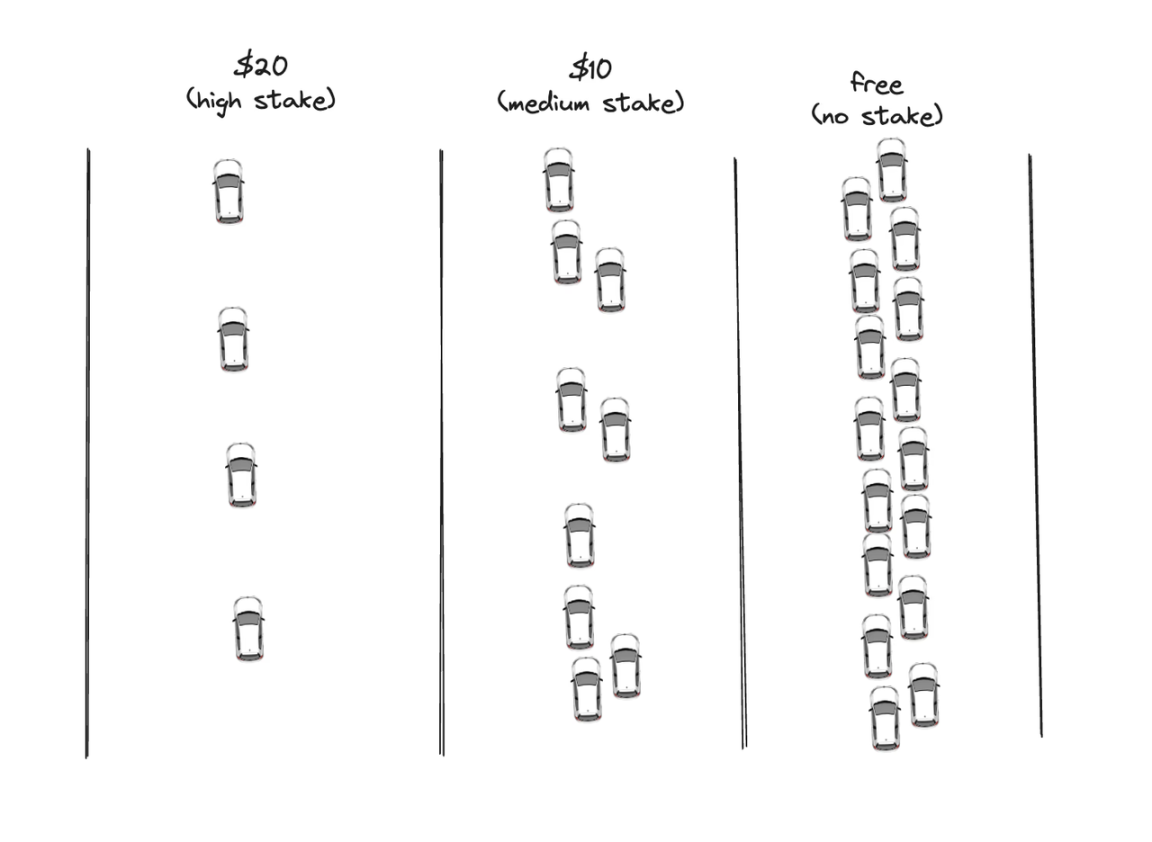

Solayer's role can be summarized in a simpler and more straightforward way. Imagine Solana as a highway, with different lanes having different tolls and congestion levels, and different DApps requiring different speeds and acceptable tolls. Solayer acts as a coordinator for users' fund delegation, playing the roles of coordinating vehicles, highways, toll collectors, and more.

Source: https://docs.solayer.org/

Financing Situation

Solayer currently has no institutional participation, but based on the builder round financing announced on July 2, its investors are quite strong, including Solana Labs co-founder Anatoly Yakovenko, Solend founder Rooter, Tensor co-founder Richard Wu, Polygon co-founder Sandeep Nailwal, and others.

Source: https://x.com/solayer_labs/status/1807797264934678588

EigenLayer on Solana: Exogenous AVS and Endogenous AVS

As Solana's EigenLayer, the main difference in functionality lies in the problems that the re-staking system focuses on solving.

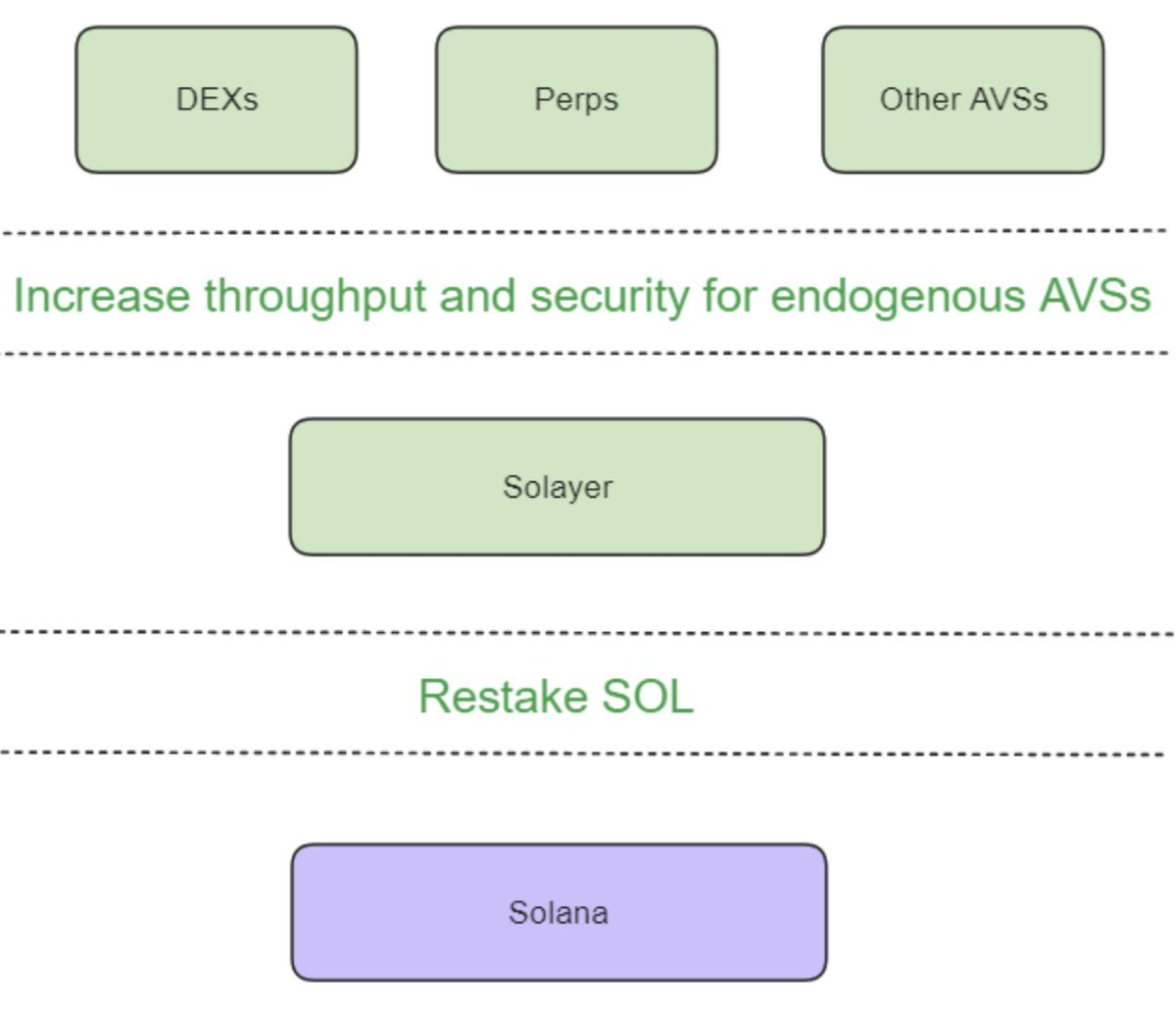

EigenLayer's re-staking is mainly used for Ethereum's scaling solutions, but Solana, as an integrated blockchain, does not rely on Layer 2 like modular Ethereum, and its re-staking system needs to focus more on applications. Solayer is not only used for Exogenous AVS (Actively Validated Services), but also focuses more on Endogenous AVS on the Solana blockchain. The goal is to provide greater block space and priority transaction possibilities for decentralized applications (DApps) on Solana.

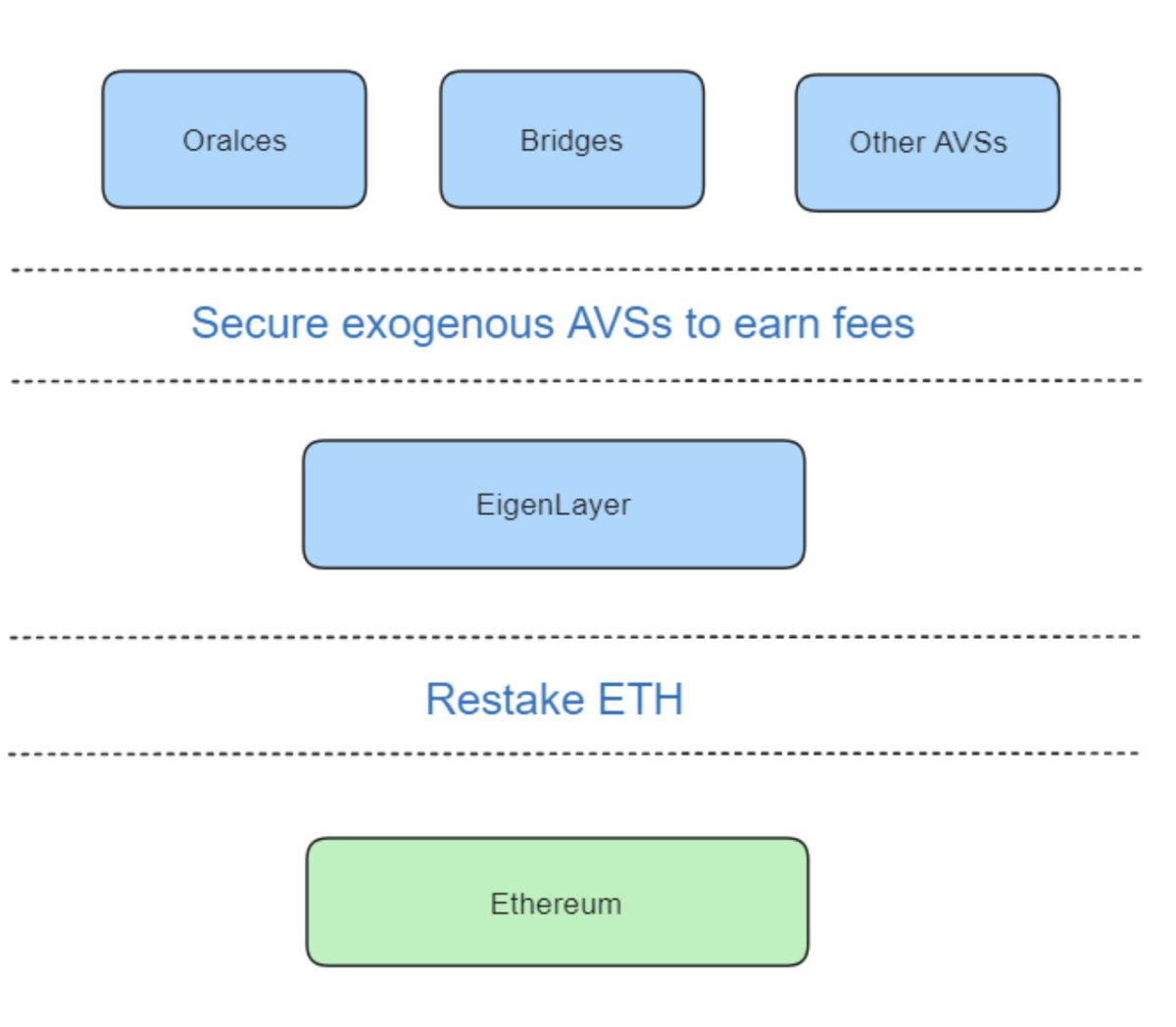

Solayer refers to the reset design of EigenLayer as Exogenous Actively Validated Services (AVS). These systems are located off-chain or outside the Ethereum main chain and can leverage Ethereum's proof-of-stake security.

It defines them as Exogenous AVS: systems off-chain or outside the main network that can share proof-of-stake security.

For example: cross-chain bridges, shared sorters, oracle networks, etc.

Source: https://docs.solayer.org/

Solayer redefines restaking for Solana, addressing the security and performance needs of developers, especially as congestion on the underlying L1 network intensifies. It introduces Endogenous AVS: using SOL PoS to configure application security and throughput on the Solana native program.

It defines them as Endogenous AVS: dedicated to supporting decentralized applications (DApps) on the main network chain. The goal is to provide greater possibilities for block space for DApps on the chain and prioritize transaction inclusion.

Source: https://docs.solayer.org/

In addition, Solayer's AVS unbundling process is managed separately by the delegation manager. To provide greater flexibility, Solayer allows them to design their own unbundling process, with a maximum unbundling time of no more than 2 days. Solayer will also provide an emergency exit mechanism to release bound assets from users when the AVS stops operating.

How to Re-stake on Solayer?

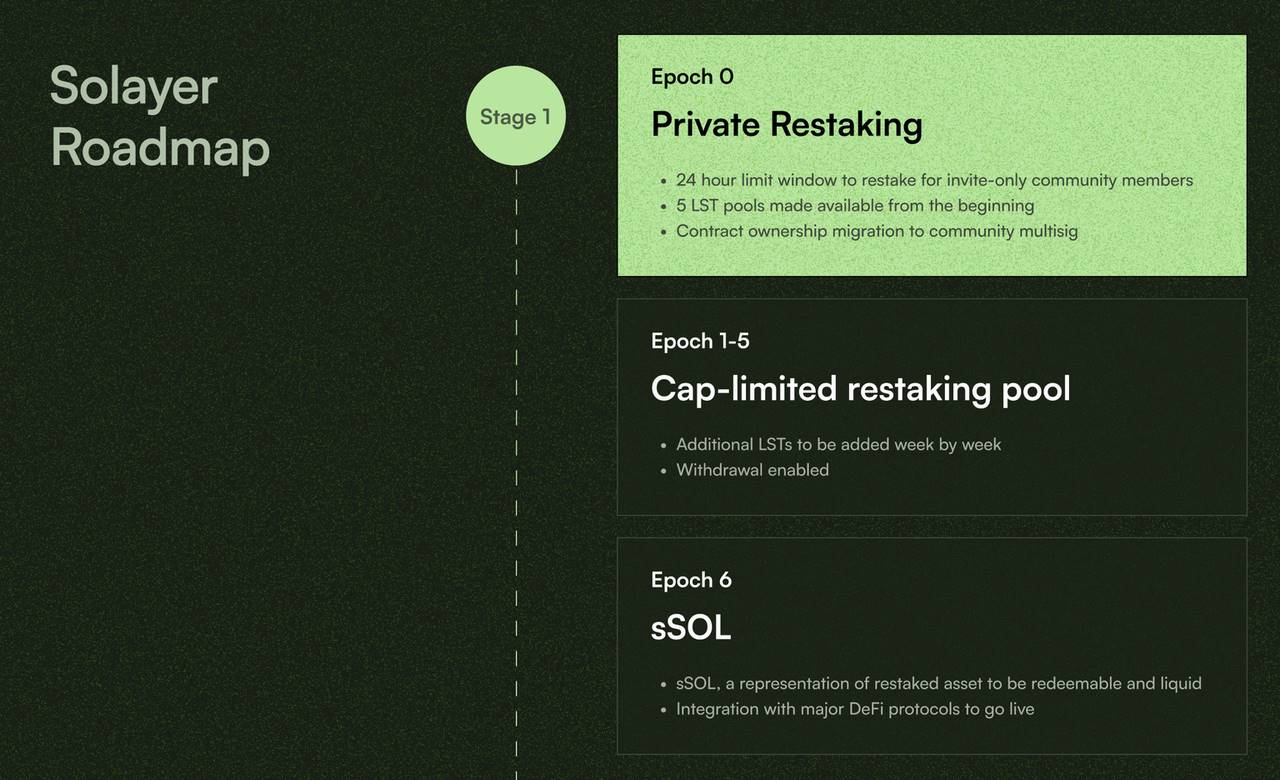

Solayer Labs is developing its own multi-stage scoring plan, which also prioritizes rewarding early participants. The earliest depositors in Solayer (included in the early supporter whitelist) will have 24 hours to deposit any amount, with a higher multiplier effect on the number of points.

In the first stage, starting from May 27, the total locked value (TVL) limit for Cycle 1 was 50 million USD. By June 15, the locked amount reached the limit. During this period, depositing more than 10 SOL can unlock a permanent invitation code, enter the task interface, and complete 3 or more tasks to earn more points. The tasks are similar to those of other projects, such as inviting friends, depositing LST, and depositing for more than two stages.

Currently, entering the third stage, there is no TVL limit, and staking can be done at any time. Compared to other currencies, native SOL deposits can earn more points.

Re-staking Security and the Future

Derived from liquidity staking, re-staking projects can use idle staking assets to earn additional income, expanding the security of the underlying layer for Ethereum. However, for Solana, there are still many doubts about the need for re-staking. Ryan Connor of Blockworks Research believes that Ethereum is a "modular" blockchain that relies on Layer 2 operation, and its large staking asset base makes re-staking more practical. In contrast, Solana, as an "integrated" blockchain, has much less demand compared to Ethereum and other modular systems. In addition, the protocol and nesting risks of re-staking itself have caused many users to worry, lacking trust in the protocol, fear of hacker attacks, and more, like ticking time bombs. However, Solayer, as the re-staking protocol with the highest current lock-up amount on Solana, is still worth paying attention to.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。