Author: Cycle Capital

Review of Market Hot Topics

[Recent Favorable Macroeconomic Background]

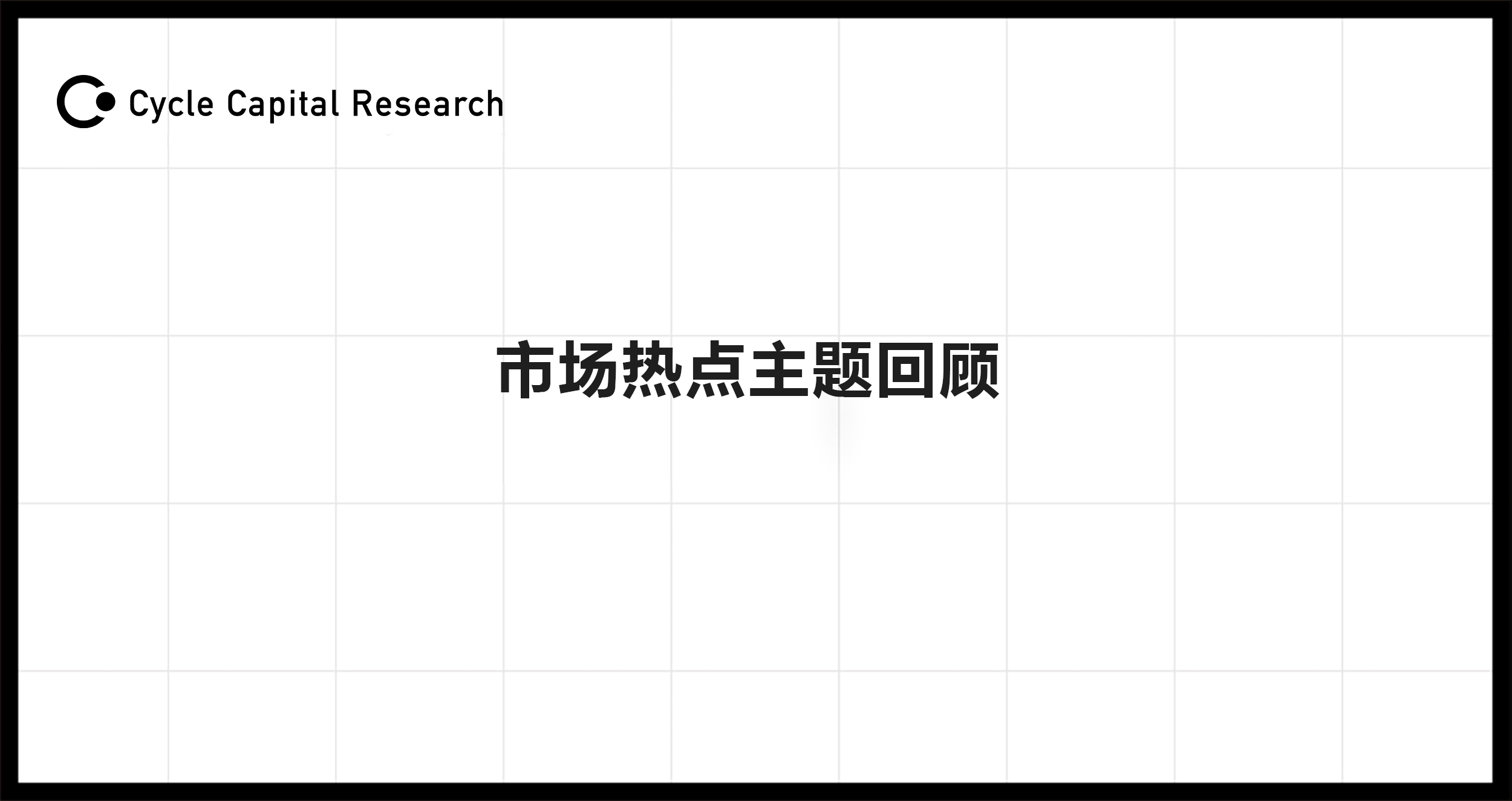

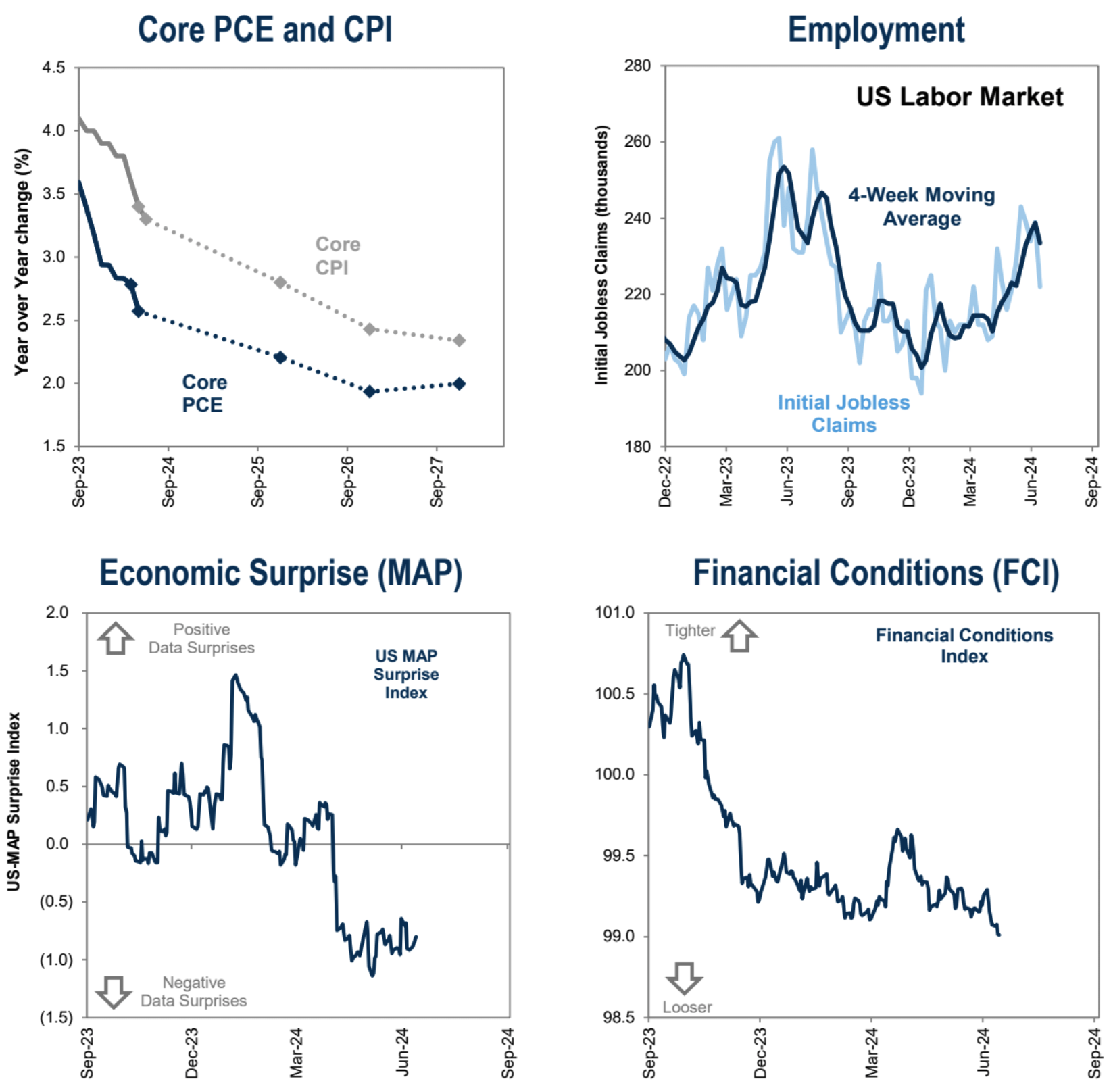

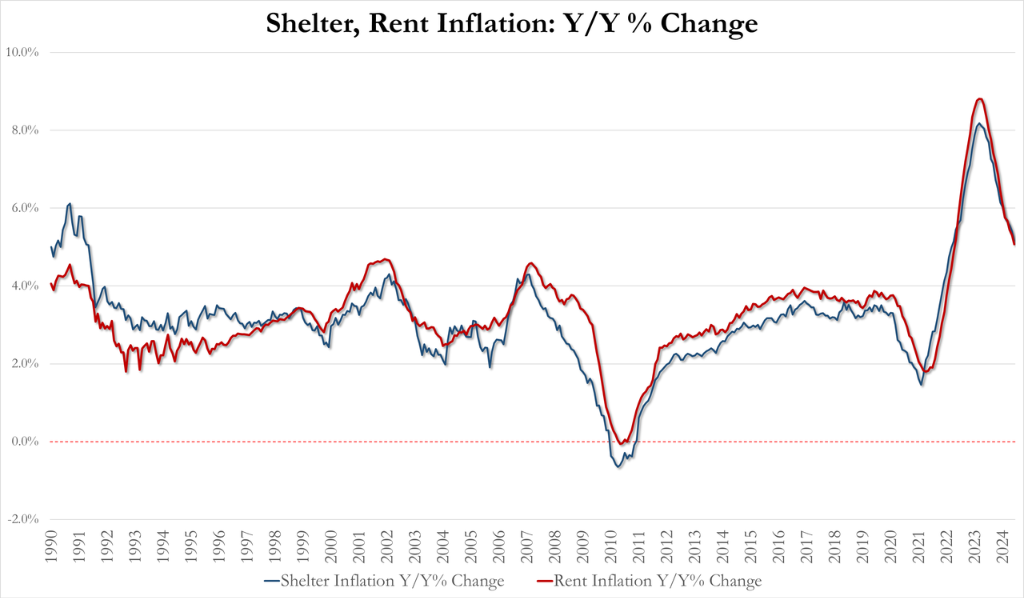

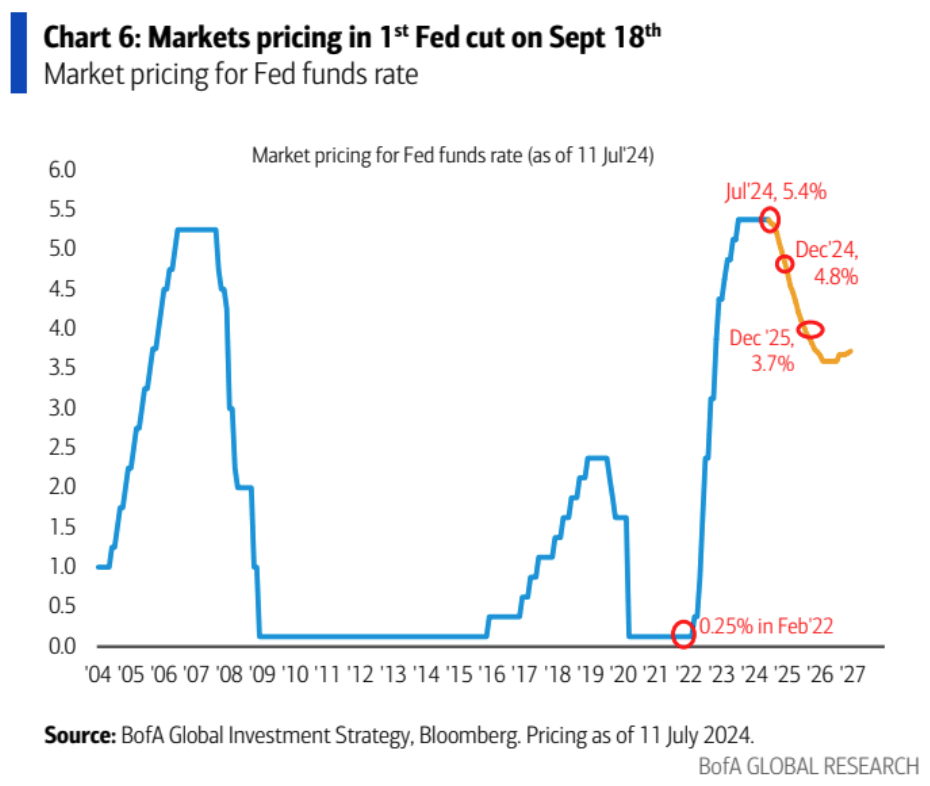

Comprehensive Cooling of Inflation: There has been a clear downward trend in the past two months. The US June CPI turned negative for the first time in four years on a month-on-month basis, and the core year-on-year growth rate hit a new low of over three years. According to GS forecasts, both will be in a downward channel in the next two years. Housing inflation is accelerating its slowdown.

Employment Market: The four-week moving average of initial claims for unemployment benefits has risen by about 10% since April, indicating a slight softening in the job market, but overall it remains relatively balanced and stable.

Economic Surprise Index: At a low point in the past two months, indicating that recent economic data has fallen below expectations.

Financial Conditions Index: Shows a sustained loose trend, the loosest since the end of 2022.

The above background can be said to be favored by the risk asset market, as investors expect the Fed to take action to support economic expansion. As time has passed, the first quarter-end concerns about inflation have been proven to be excessive. Although service sector inflation remains above the central bank's target level, commodity inflation has declined significantly.

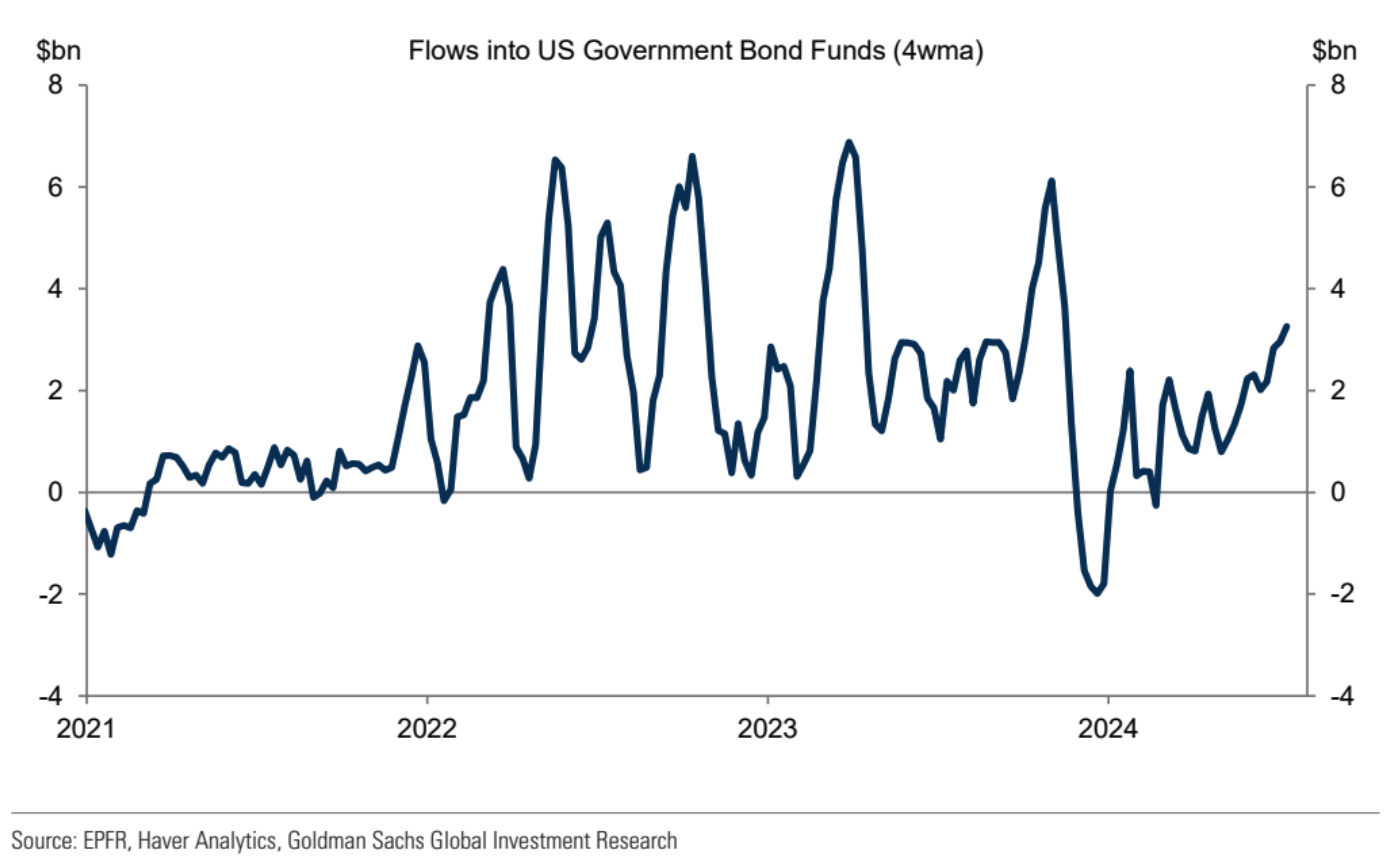

With the weakening of the US dollar and the Fed starting to cut interest rates, emerging markets and cryptocurrencies may benefit in the absence of a recession. If the expected soft landing turns into a hard landing, there may be a rapid shift from stocks and other risk assets to bonds.

[Enormous Pressure in Q2 Earnings Season]

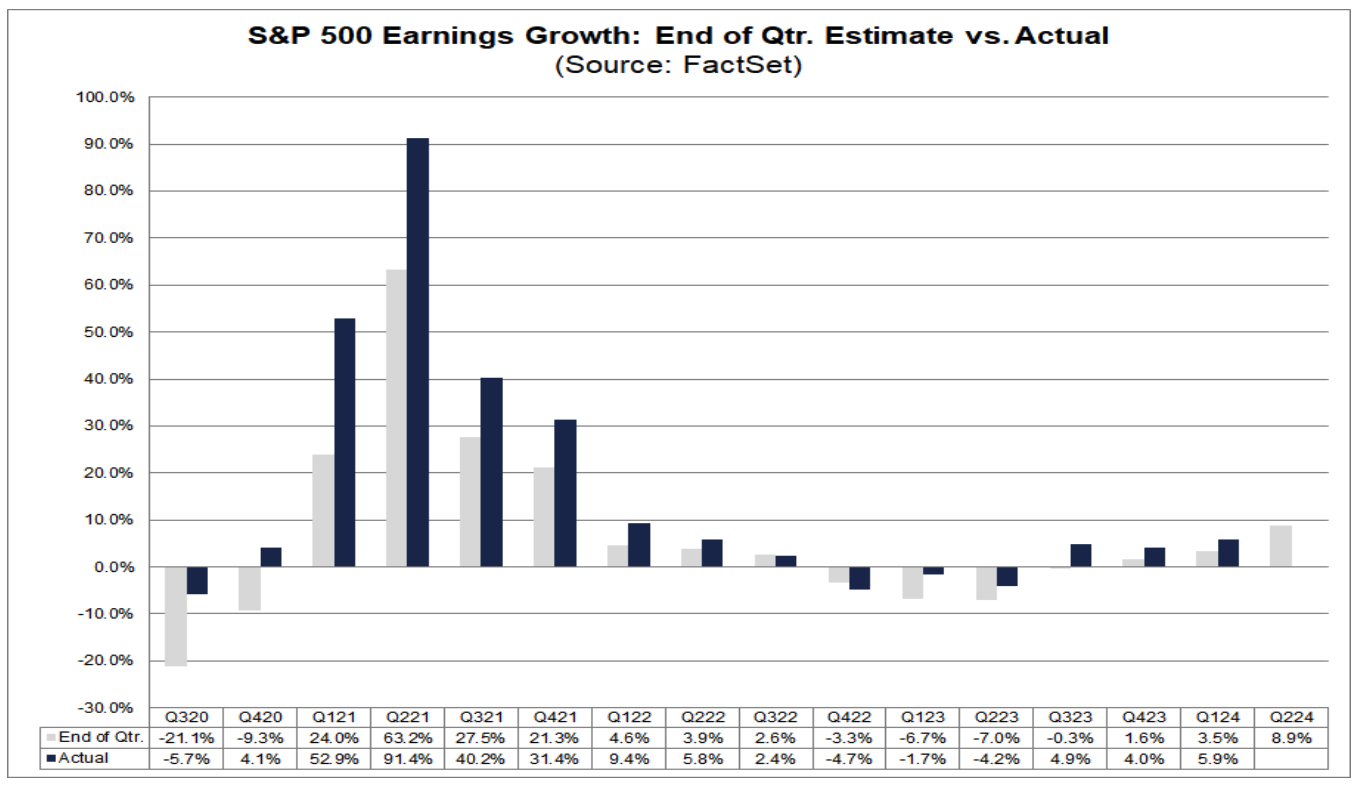

The current market focus is on the ongoing earnings season, with very optimistic market expectations for the quarter. It may be difficult to achieve the surprise level seen in the previous quarter, so it is very likely to see some profit-taking or sector rotation during this quarter's announcements.

Wall Street expects S&P 500 earnings in Q2 to grow by 8.9% year-on-year, significantly higher than the 5.9% in the previous quarter. The last time there was such high earnings growth was back in Q1 2022, when the Fed had just started raising interest rates. At that time, the earnings growth rate was 9.4%. It is worth noting that the 8.8% earnings expectation is a revised result. At the end of March, analysts generally expected an earnings growth rate of 9.1%.

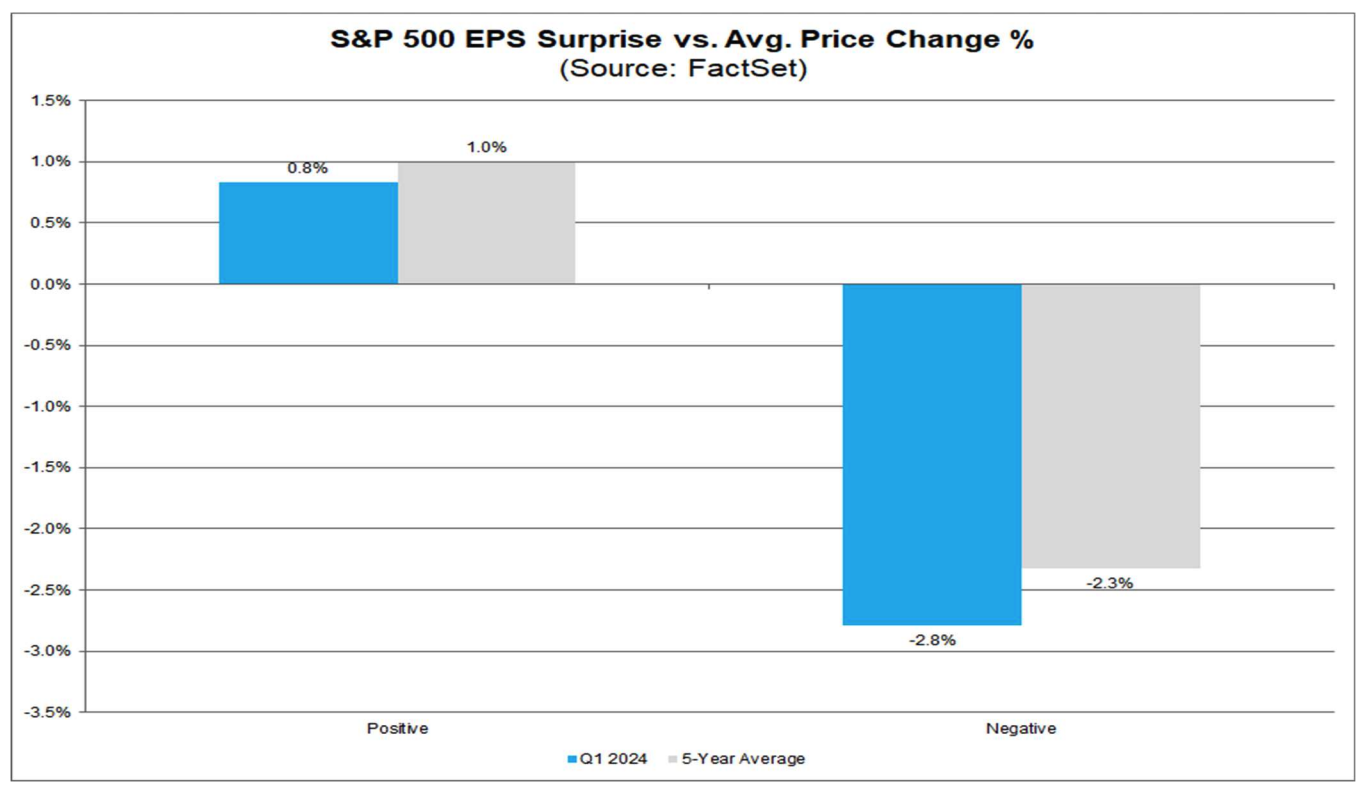

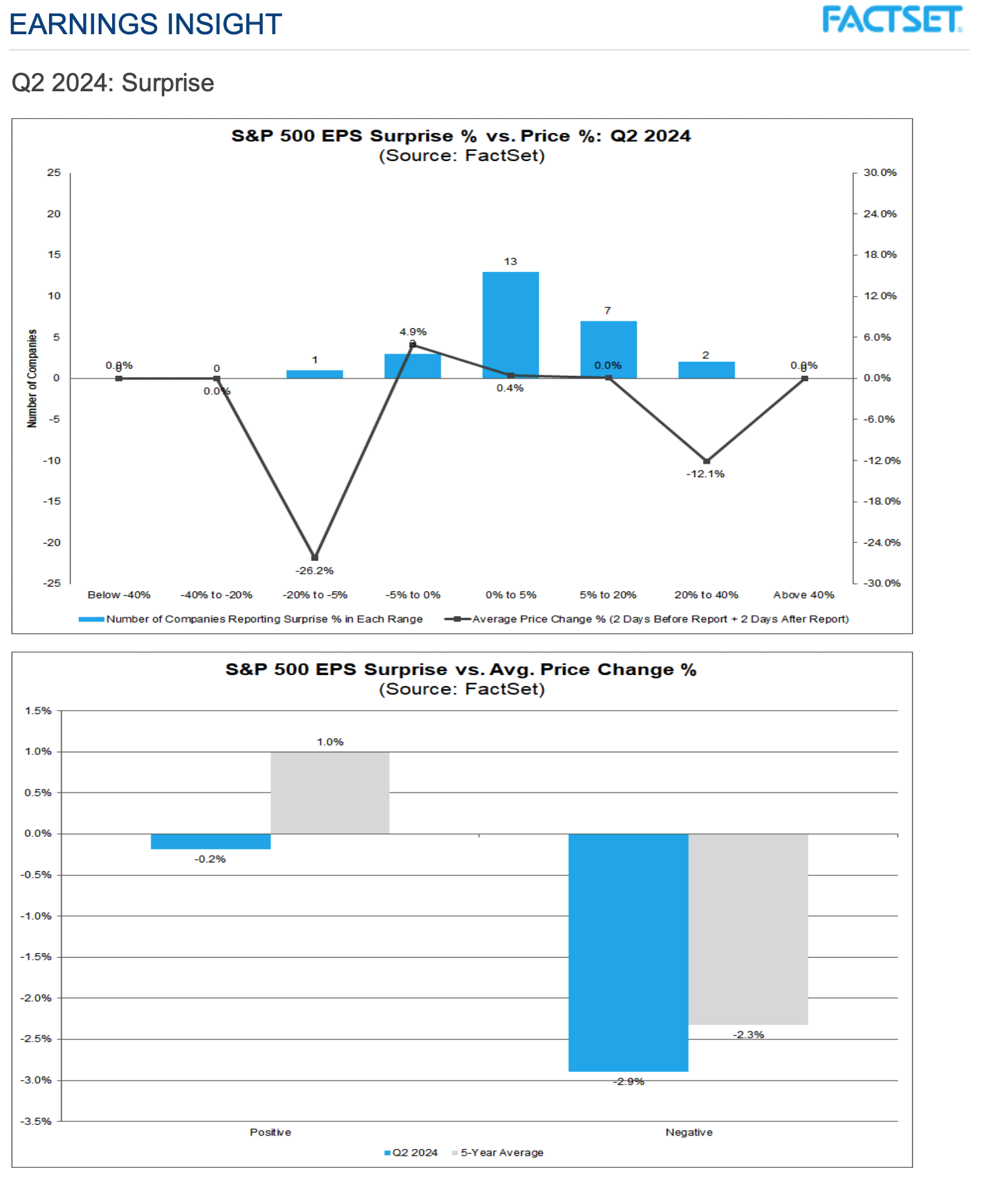

In addition, looking at the short-term market reaction in the first quarter, it is very clear that the magnitude of positive surprises is not as great as the magnitude of negative surprises—companies with positive EPS surprises had an average stock price increase slightly lower than the five-year average. Companies with negative EPS surprises had an average stock price decrease slightly greater than the five-year average.

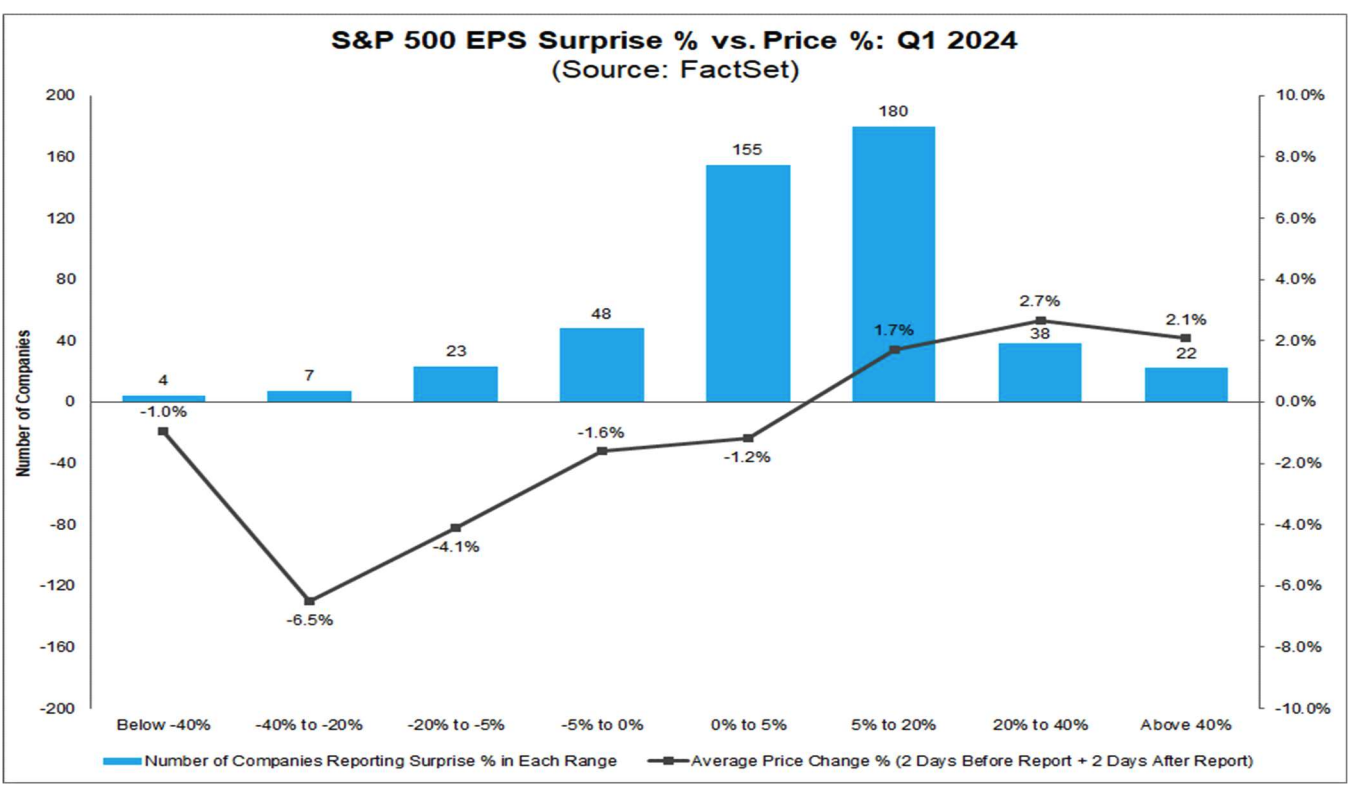

From the performance in the first quarter:

- In the range of EPS surprises "less than -40%", the average stock price change was -6.5%.

- In the range of EPS surprises "0% to 5%", the average stock price change was -1.2%.

- In the range of EPS surprises "5% to 20%", the average stock price change was 1.7%.

- In the range of EPS surprises "20% to 40%", the average stock price change was 2.7%.

Looking at the market reaction of major financial stocks that have already been released in the second quarter, the results are even worse than in the first quarter:

There is increasing discussion in the market about the profit potential of AI, such as a recent report released by Goldman Sachs titled "Generative AI: Spending Too Much, Yielding Little?", in which several experts express deep skepticism about the economic potential of generative AI. This is the most pessimistic report on AI that the author has seen in over a year, and it is worth pondering.

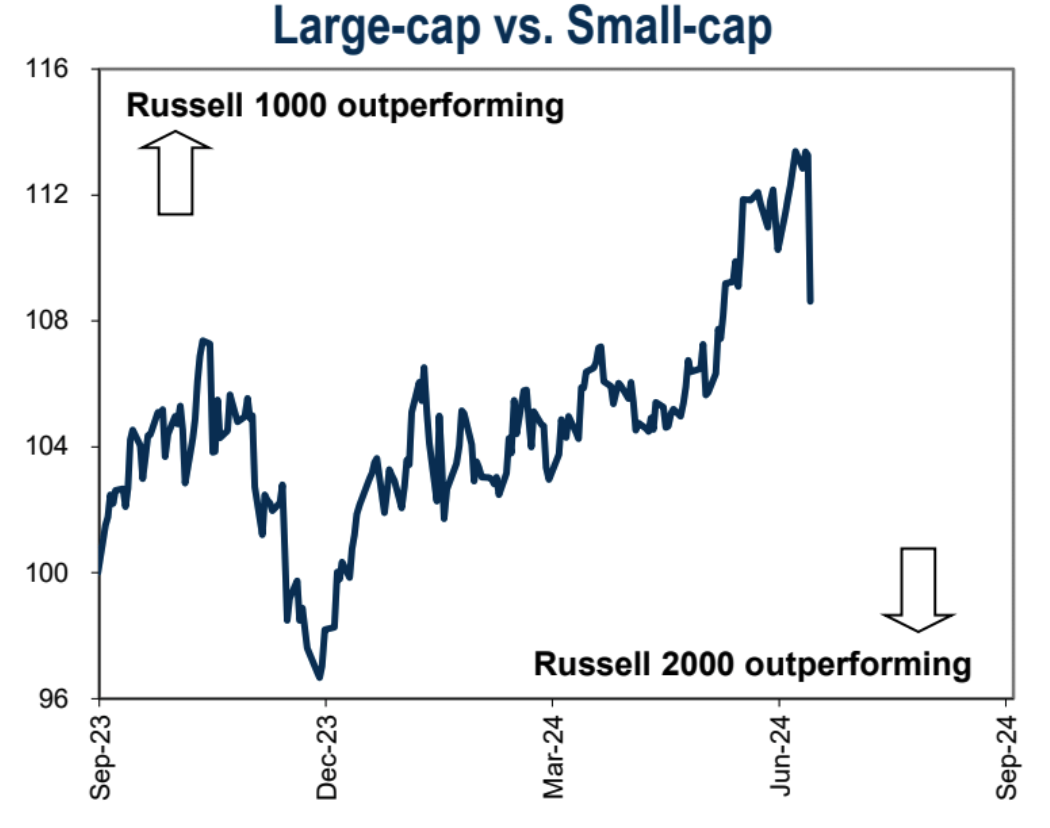

So as big tech stocks emerge from a low point in 2022 performance, the likelihood of hardware companies like Nvidia or Tesla maintaining their strength after earnings reports is decreasing. A better outcome would be a sector rotation from the Mag7 to the 493 (NDX's relative underperformance to R2K last week was 6.3%, one of the worst relative performances in over a decade), or a shift in focus from AI to related tracks, including humanoid robots and autonomous driving.

From the perspective of the consumer market, the market for humanoid robots clearly has huge potential, even higher than AI, because it is difficult to see a visible future in which consumers will pay more for AI, while robots may become a necessary purchase for every household, just waiting for the "iPhone moment" to arrive.

According to Goldman Sachs statistics, the current investor interest in big tech is ranked as follows: NVDA > AMZN > MSFT > AAPL > GOOGL > META.

[Boeing Admits Guilt]

Last week, Boeing agreed to plead guilty in two criminal cases involving the 737 Max. The background of the two cases is that in October 2018 and March 2019, two Boeing 737 MAX 8 aircraft crashed in Indonesia and Ethiopia, resulting in a total of 346 fatalities. Investigations indicated that the cause of the accidents was related to safety design flaws in the new software system inside this aircraft model. Boeing deliberately concealed this risk when applying for FAA certification, and did not strengthen pilot training, leading to the occurrence of the air disasters. According to court documents submitted late on Sunday, Boeing officially admitted to intentionally concealing safety risks during the FAA certification process for the Max model, committing conspiracy to defraud the US government, and the company is willing to accept punishment.

Author: Cycle Capital

Review of Market Hot Topics

[Boeing to Face Up to $487.2 Million Fine]

Boeing is facing a fine of up to $487.2 million, the maximum allowed by law, but the actual amount will be determined by a judge. Due to Boeing's deferred prosecution agreement with the Department of Justice in 2021, the company paid a criminal fine of $243.6 million and compensated the families of the victims with $500 million, so this time it needs to pay a second criminal fine of $244 million. After this incident, the company is also required to invest at least $455 million in compliance and safety improvements over the next three years, and will be under the supervision of an independent compliance monitor for three years. Clearly, such a punishment has left many people dissatisfied, with many saying that $244 million for a company as large as Boeing is only the value of two 737 Max aircraft, and the value of a life is only $700,000. From a strategic perspective, the world's large aircraft manufacturing is basically monopolized by Boeing and Airbus, and it is clear that the United States will not make Boeing too miserable.

However, from an investment perspective, this represents the end of negative news for Boeing, which is a good thing for the recovery of its valuation. This situation is somewhat similar to the Binance fine in November 2023, after which BNB soared from $200 to a high of $720.

[Market Betting on Republican Victory in November]

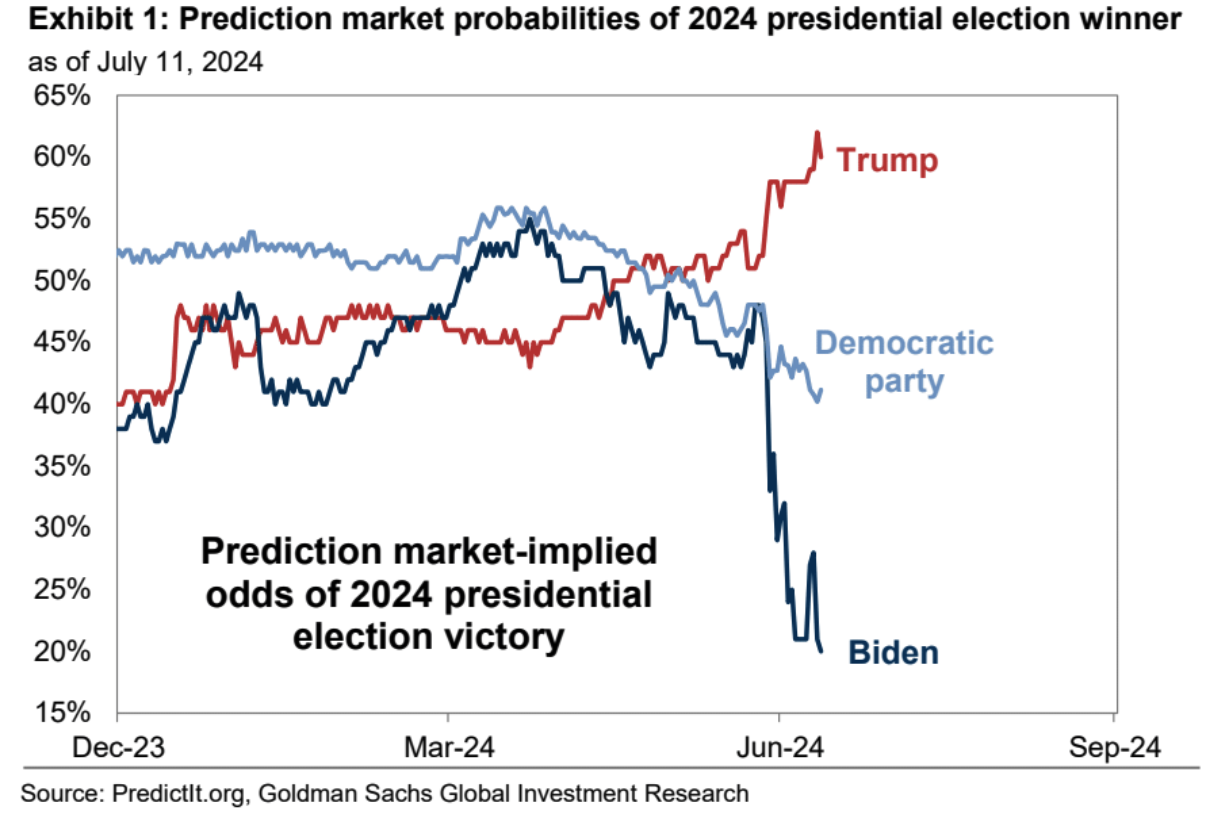

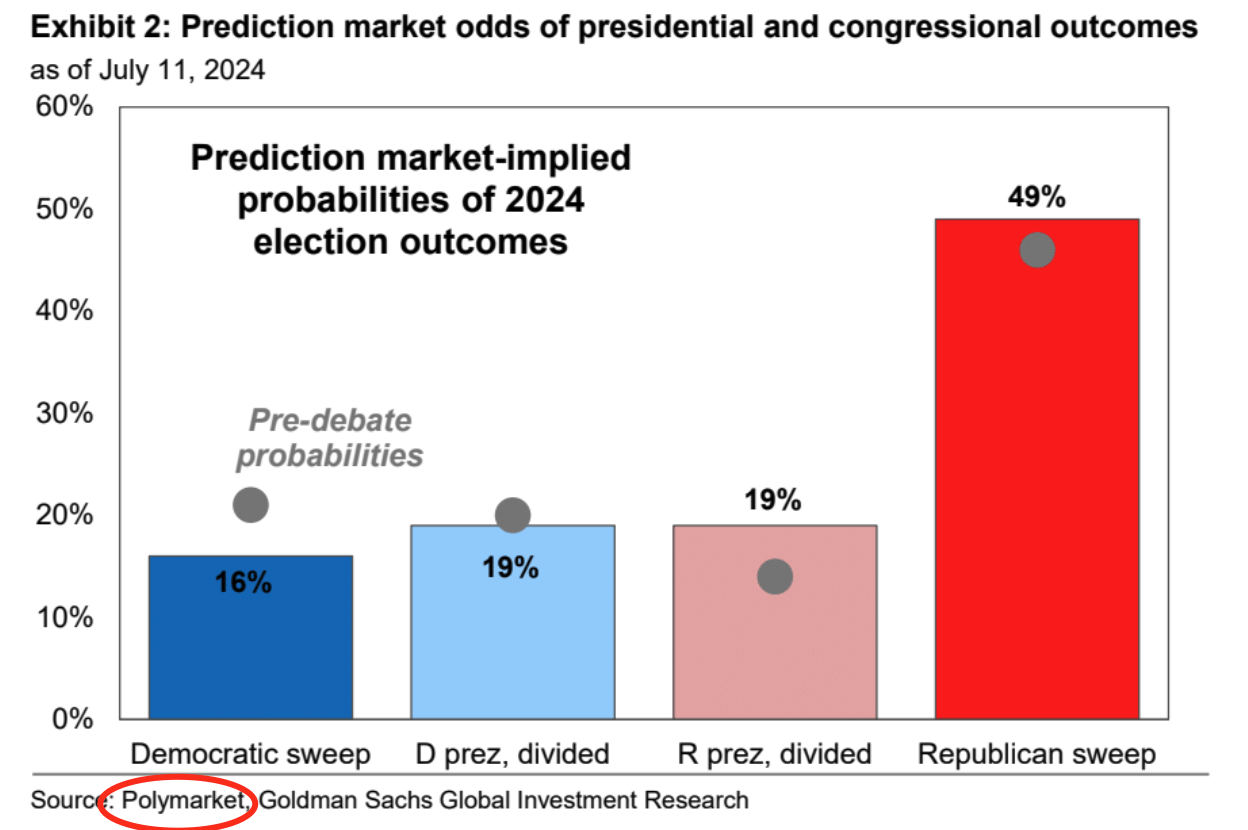

The derivatives market is currently very pessimistic about Biden. After the debate on June 27, the market's probability of Trump winning the election jumped from 40%-50% at the beginning of the year to about 60%. The probability of the Republican Party winning control of both houses of Congress and the presidency (sweep) has also increased, currently at about 50%. The probability of Biden winning has fallen below 20%:

It is worth noting that Goldman Sachs cited data from the cryptocurrency prediction platform Polymarket, which is a side effect of the increasing practicality of cryptocurrency applications.

Key points to follow:

- As expectations for Fed rate cuts stabilize, institutional investors' focus is shifting from growth and monetary policy to politics.

- The key is the potential change in the likelihood of Trump taking office, with investors' questions focused on the tariffs, domestic tax policies, and regulatory changes that the Trump administration may implement.

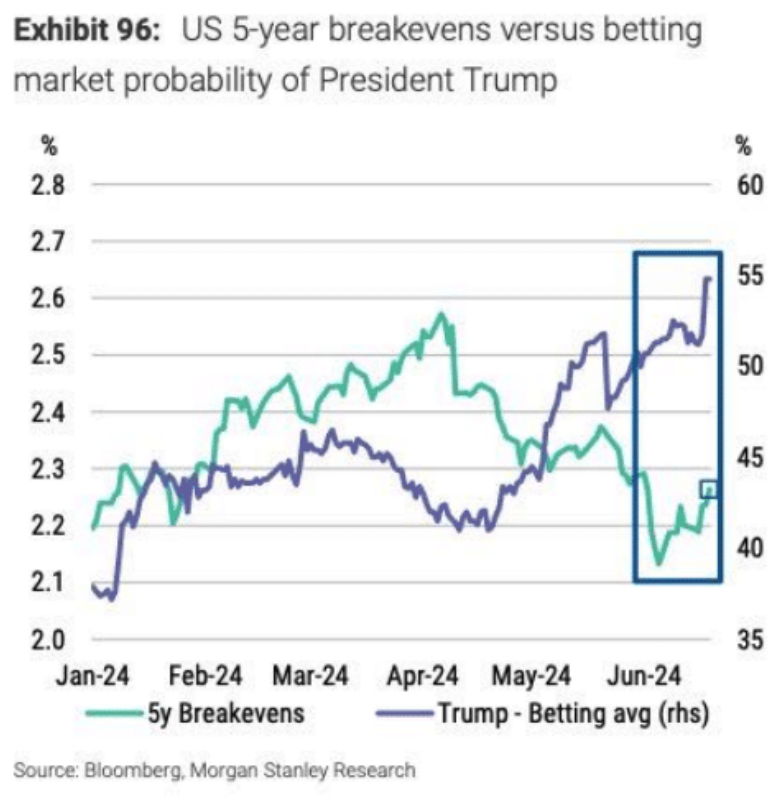

- After Trump takes office, a significant increase in tariffs is expected to benefit companies focused on the domestic market, rather than those with international operations. Tariffs are expected to slightly drag on US GDP growth and may push up inflation in Chinese imports, contrary to what the Fed wants from rate cuts. The chart below shows a recent synchronous upward trend in market inflation expectations and the probability of Trump winning, which may further interact in the future:

- The market has not shown much fluctuation recently with political turmoil, seemingly underestimating the uncertainty of the US election. Although the likelihood of a Republican victory is high, the possibility of changes in Democratic candidates is also rapidly increasing.

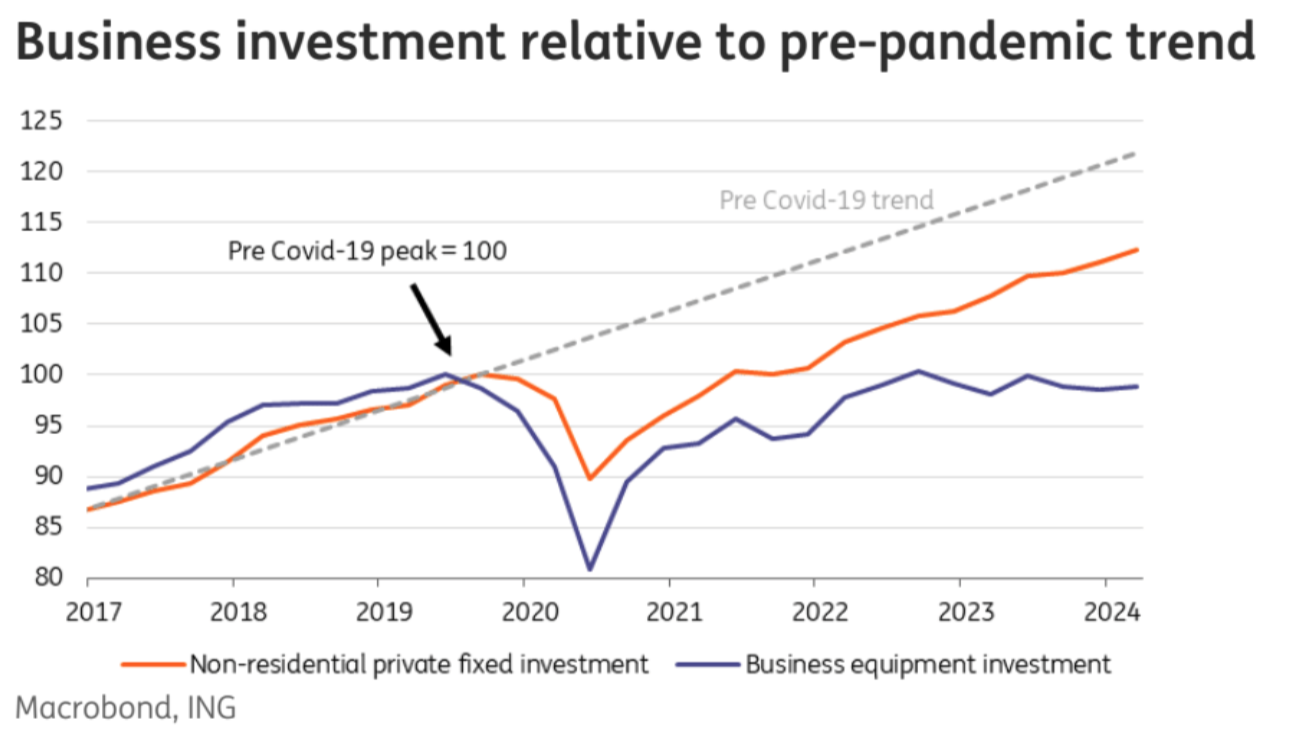

- Business equipment investment has stalled, and companies may delay projects due to concerns about policy changes by the new government, such as permits for oil and gas exploration or approval of foreign battery manufacturing plants. This political uncertainty is making companies more cautious about investment.

(As shown in the above chart, despite strong economic performance, the stock market and corporate profits reaching historic highs, actual business equipment investment is lower than in 2019. Although non-residential fixed investment, including structures and intellectual property, has performed well, it is still 8 percentage points lower than the pre-pandemic trend. The main improvement is attributed to the $1 trillion support provided by the government through the CHIPS Act and the IRA to support semiconductor production and reduce inflation.)

- A Republican sweep could lead to an extension of tax policies and increased fiscal spending, although the specific details are not yet clear, this is the most direct positive for stocks.

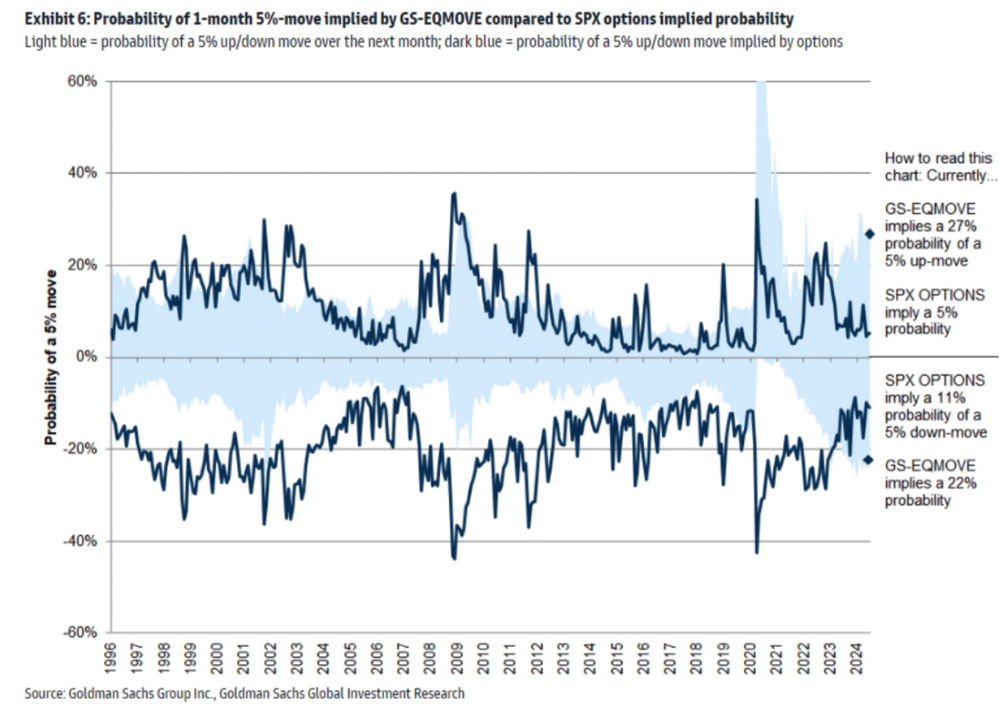

The implied volatility of both upward and downward movements in the SPX options market is very low:

Industries Affected by Policy Changes

- Renewable Energy and Environmental Policies: If Trump is re-elected, there is expected to be some relaxation in environmental policies, which may benefit traditional energy stocks and put pressure on renewable energy stocks.

- Technology and Big Data: The technology industry may face more lenient antitrust reviews under the Trump administration, especially large tech companies, which may benefit from this.

Investment Styles and Market Strategies

- Growth vs. Value: In the current market environment, growth stocks may continue to attract investor attention, especially in the technology and consumer sectors. However, depending on specific policy changes, value stocks in certain industries, such as finance and industry, may also show attractiveness.

- Interest Rate-Sensitive Stocks: Given potential economic policy and interest rate changes, this type of stock may show significant volatility due to its high sensitivity to interest rate changes.

[Wall Street and the Crypto Community Should "Thank" China]

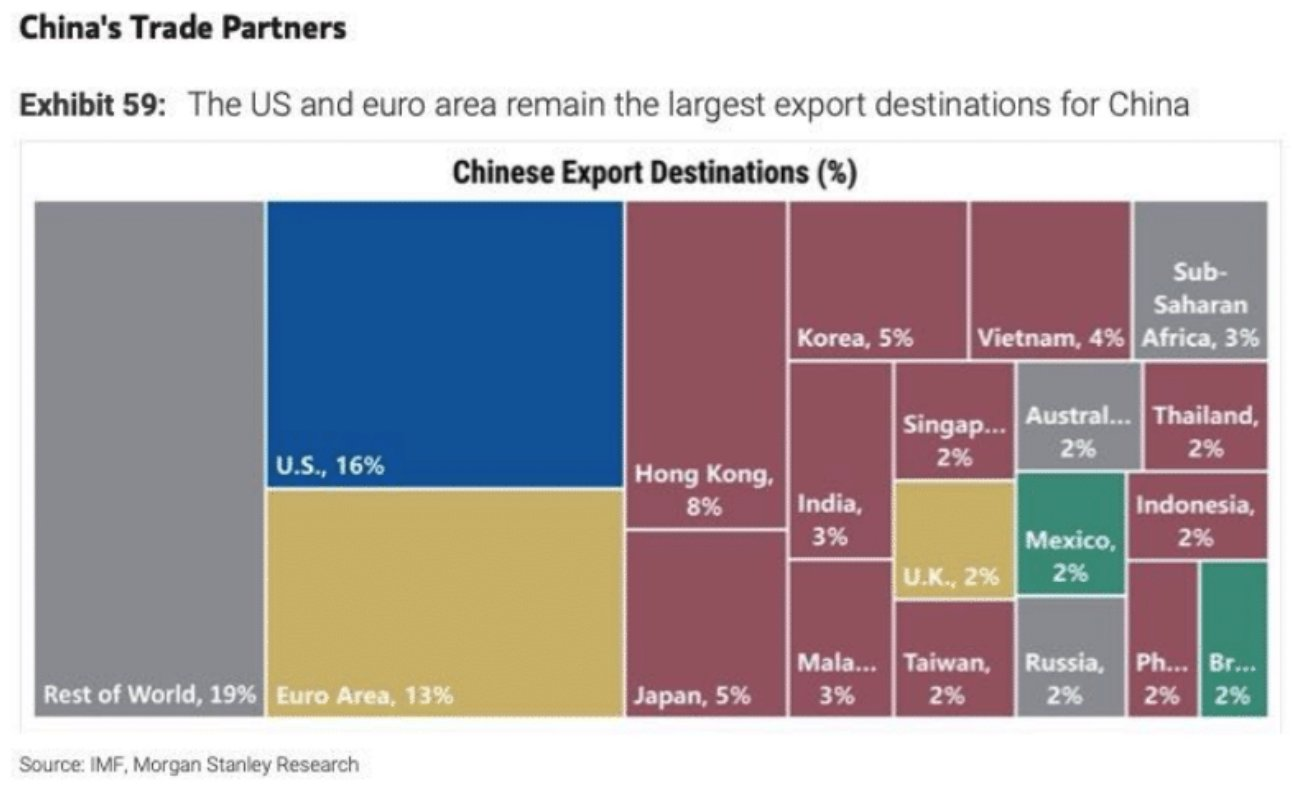

China is experiencing deflation, and policy measures have also increased overcapacity. As the world's largest exporter of commodities, it is exporting deflation. Its spillover effect has contributed to a decrease in core commodity inflation of about 0.5 percentage points, reducing core inflation in Europe and the United States by about 0.1 percentage points. Although the overall effect is moderate, it may give central banks in Europe and the United States more room for interest rate cuts, which is beneficial for stocks and crypto.

The chart above clearly shows that China has a significant market share in several key export products. In addition to still holding an important position in traditional manufacturing sectors such as home appliances (59%), clothing and textiles (38%), and furniture (33%). Furthermore, China's manufacturing capabilities and technological level in the high-tech field have significantly improved, with market shares in lithium-ion batteries and photosensitive semiconductors (cameras, solar energy) reaching 51% and 53%, respectively.

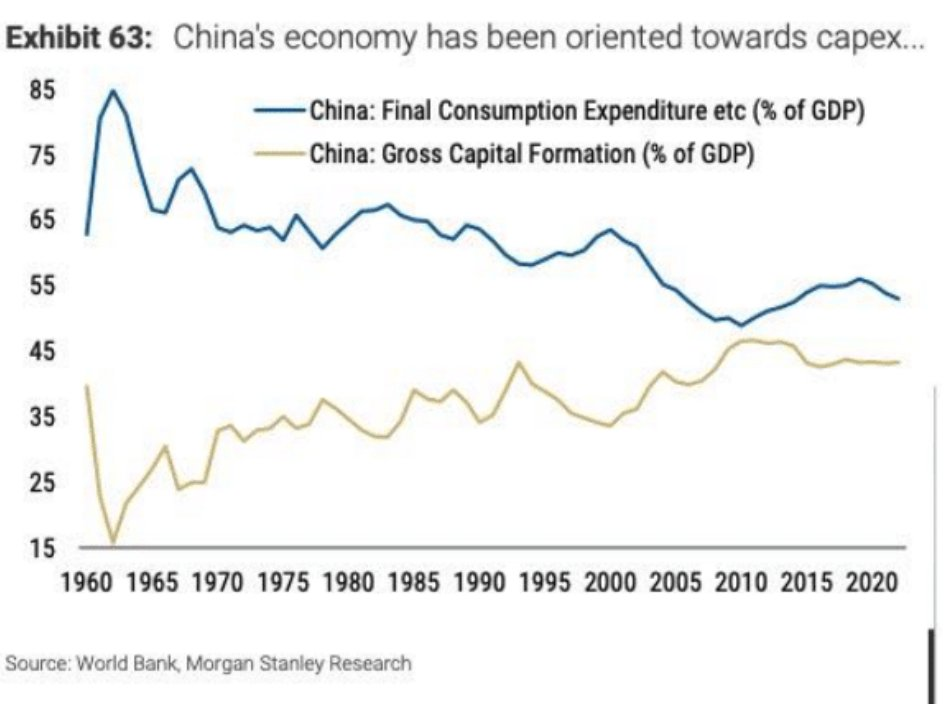

For many years, China has adopted an investment-driven economic growth model, which can rapidly increase production capacity and total economic output in the short term. The chart below shows that China's fixed capital investment as a percentage of GDP is significantly higher than consumer spending. This indicates that a large amount of funds is being invested in building new factories, purchasing equipment, and expanding production lines. This model may exceed the growth rate of market demand.

Despite the rapid increase in China's production capacity, global economic growth has slowed, especially after the global financial crisis, and global demand has not grown in sync. This has led to a situation where a large amount of China's production capacity is not fully utilized, further exacerbating overcapacity.

The capital intensity is particularly high in industries such as steel, coal, chemicals, and real estate. The expansion of these industries is particularly rapid, but they are also the most prone to overcapacity.

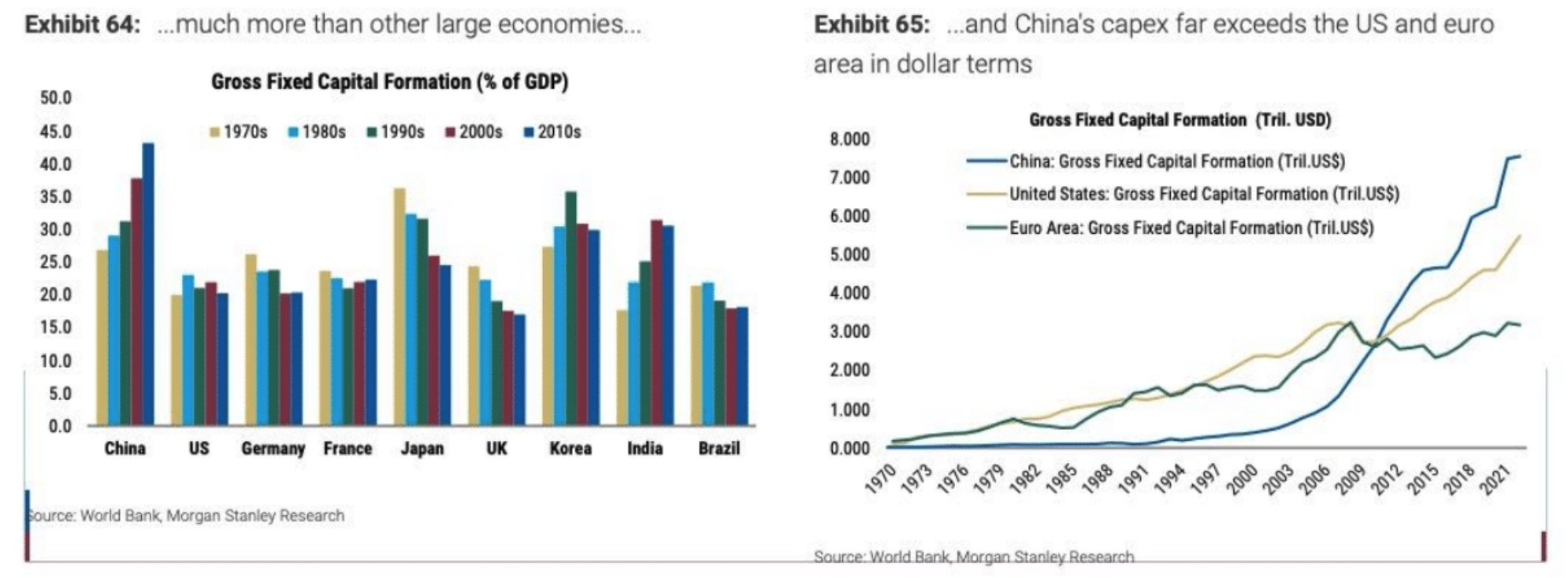

The chart below shows that China's capital expenditure level is nearly 10 percentage points higher than that of other major economies. In US dollars, it is over 85% higher than that of the United States and the Eurozone. Policy-driven overinvestment can lead to inefficient resource allocation, with a large amount of funds and resources being invested in low-efficiency or even ineffective production areas, resources that could have been used in more productive industries or areas. In the long run, this inefficient resource allocation will drag down the overall growth potential of the economy.

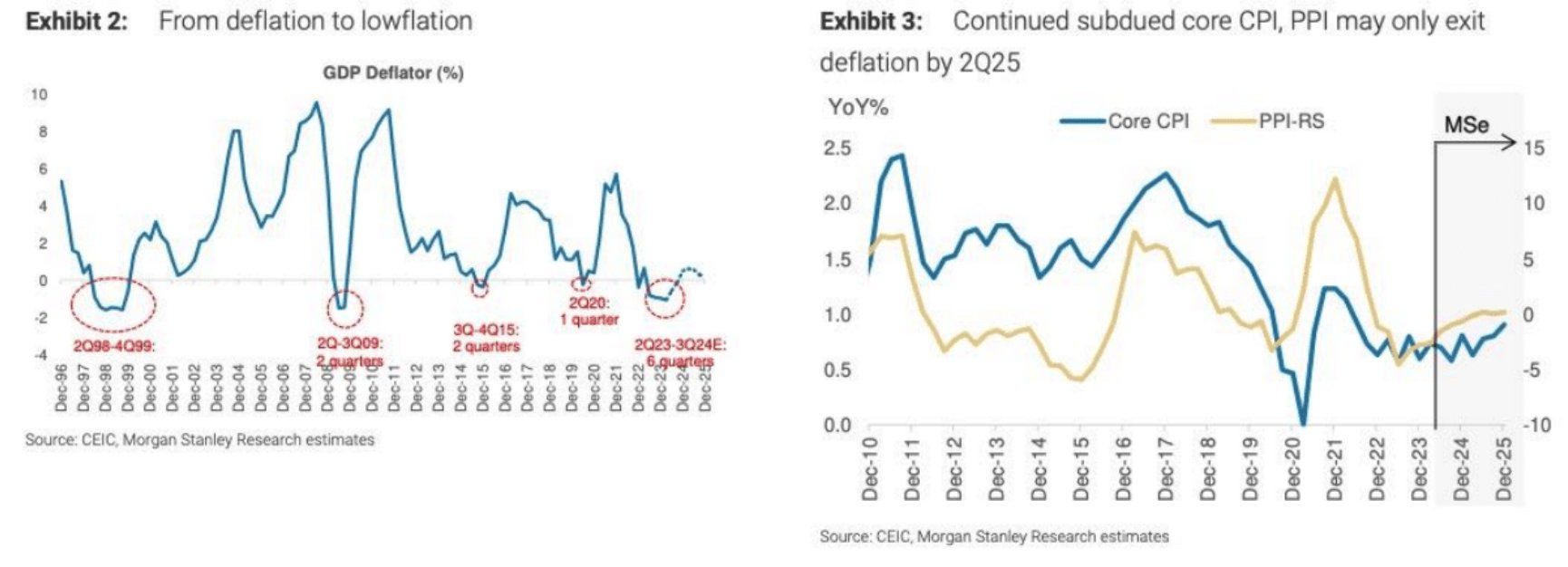

Morgan Stanley China's PPI is expected to end deflation in the second half of 2025.

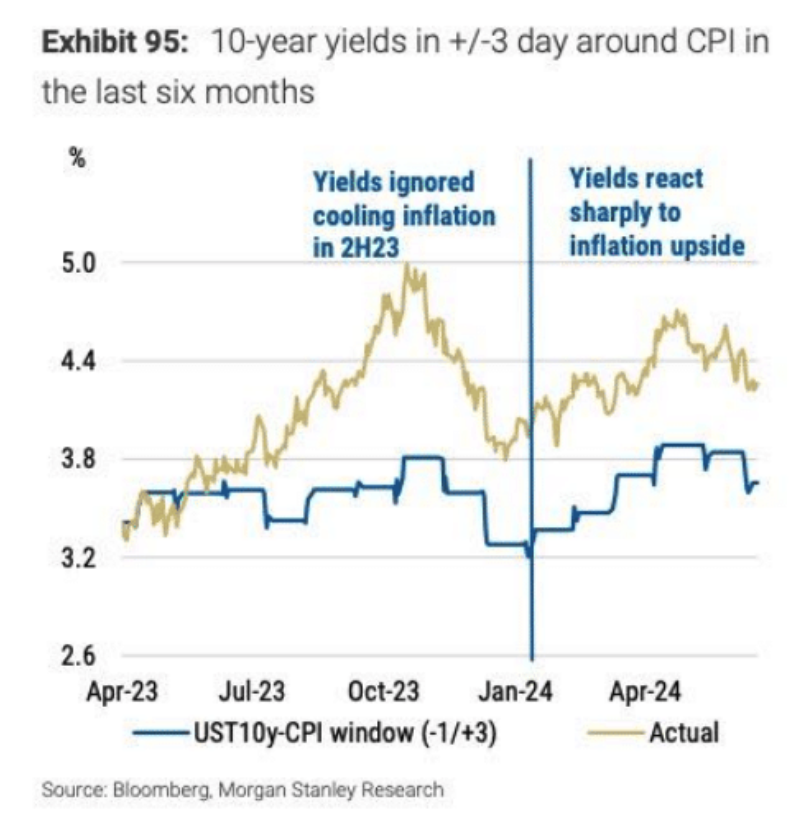

The US interest rate market has shown a high sensitivity to unexpected inflation this year, with the yield on 10-year Treasury bonds fluctuating by 80 basis points in the three days before and after the release of the CPI.

Although the market is confident in the cooling of inflation in the second half of 2023, unexpected inflation has shaken this confidence, leading to a strong market reaction. The chart below shows that after the second half of 2023, the market's expectations for inflation cooling were subdued, but the reaction to unexpected inflation was strong:

The market's strong reaction to the rise in inflation may be due to an excessive focus on short-term data, overlooking seasonal factors, the breadth of inflation, long-term trends, and considerations of actual economic fundamentals. In addition, expectations for central bank policy adjustments may also be exaggerated. Taking all these factors into account, the market's reaction seems somewhat unreasonable, and the impact of deflation from China will exert downward pressure on the core CPI in the United States, a trend expected to continue in the future.

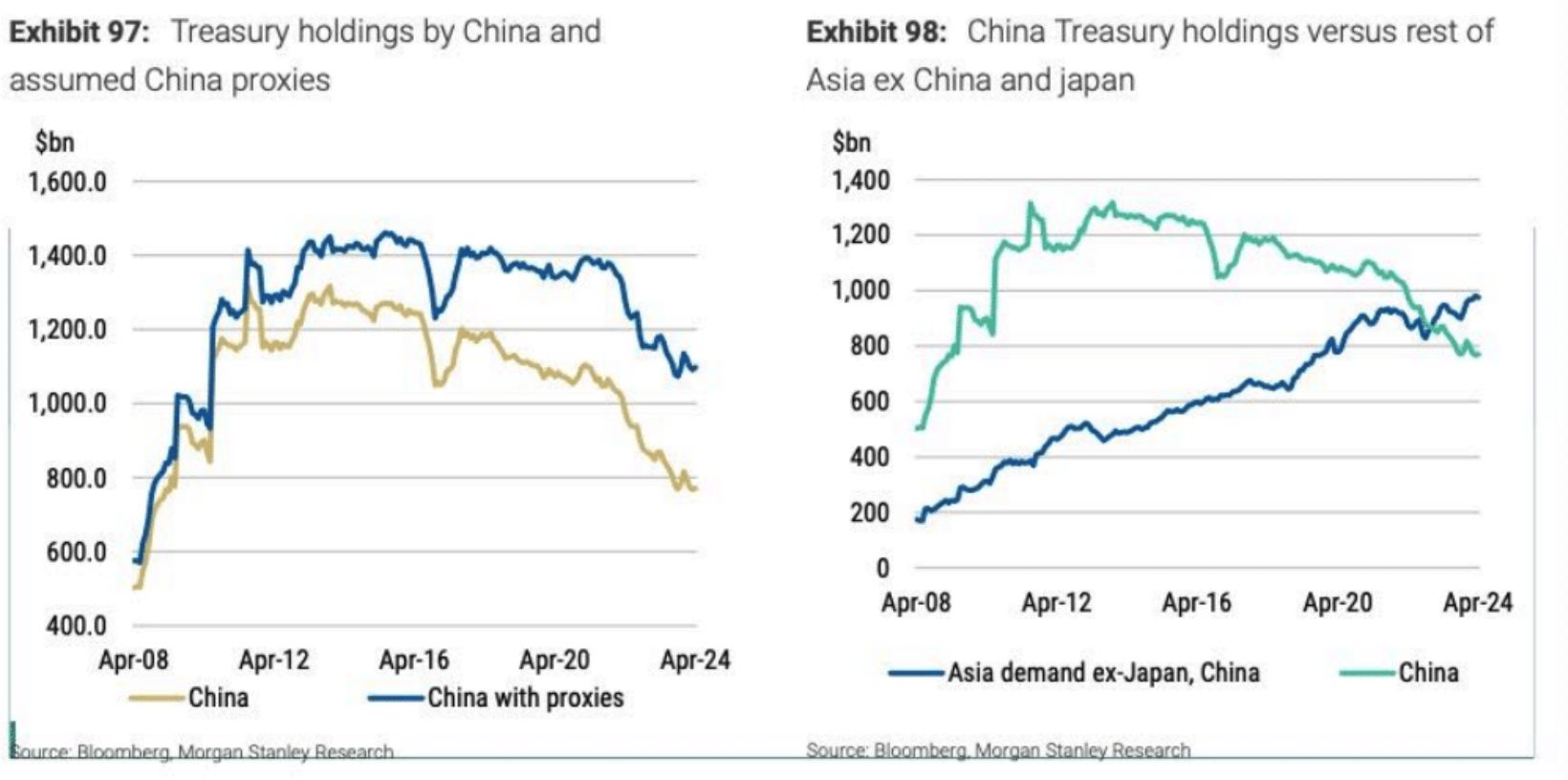

Although China's market share in the US market is declining, the net export value in US dollars is increasing, so the growth in China's exports may increase its demand for US bonds, rather than decrease it.

Figure 97 shows that the amount of US bonds held by China and its proxies has decreased, but not as sharply as expected. Figure 98 shows that demand for US bonds from other Asian countries, excluding China, has been increasing, partially offsetting the decrease in demand from China.

[BTC's Rare Lag]

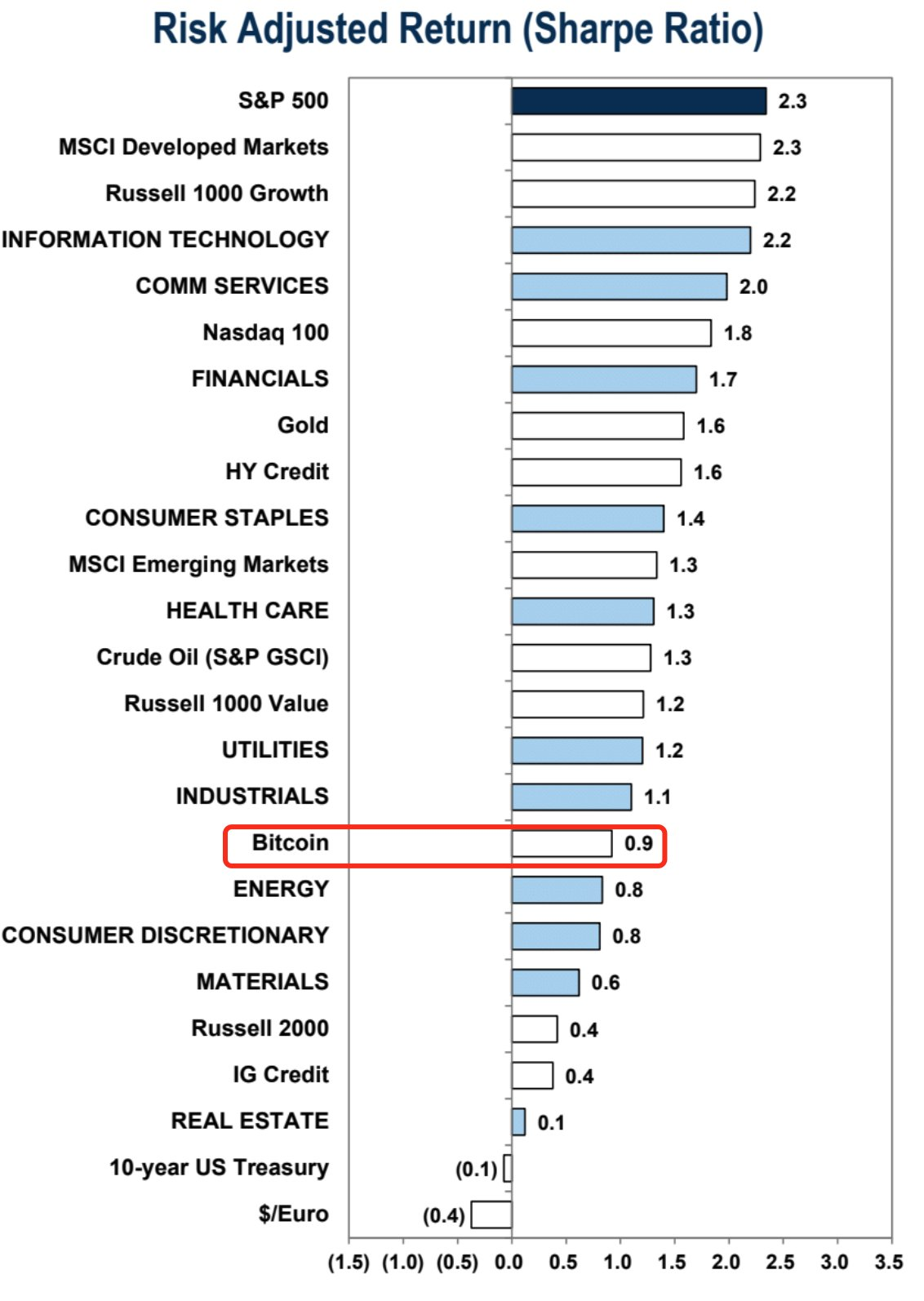

If we take the year-to-date as a sample, the risk-return ratio of BTC is significantly lower than that of US stocks, a situation that is not common in history. This is mainly due to the unexpected sharp drop in the past month. In early June, the YTD Sharpe ratio of BTC was 1.8, higher than the S&P 500's 1.7.

[Signals That May Lead to Misinterpretation…]

Historically, some economic indicators have been considered reliable signals of an impending recession, but in this cycle, these rules seem to have failed. For example:

- Yield curve inversion: The yield curve has been inverted for two years, with the two-year and ten-year Treasury yields, traditionally seen as a precursor to a recession, but the US economy has not fallen into a recession.

- Money supply (M2): M2 sharply declined at the end of 2022, usually a sign of an economic downturn, but the economy remains robust.

- ISM index: Although the ISM index has been negative for 19 out of the past 20 months, the economy has not fallen into a recession.

- Sahm rule: When the unemployment rate rises by 0.5 percentage points from a low point, it usually signals a recession. Although the unemployment rate has risen from 3.4% to 4.1%, the main reason is an increase in labor supply rather than a decrease in demand, and the current unemployment rate remains low.

In the 1990s, the US economy experienced a similar situation, with several traditional recession signals appearing, but the economy did not immediately fall into a recession, instead experiencing a long expansion period. This indicates that similar signals in history do not always mean an immediate economic recession, and the current economic situation may also be similar.

[BlackRock's BUIDL Breaks $5 Billion, MakerDAO Plans to Allocate $1 Billion in Liquidity to US Bond Assets]

Although RWA has not been hyped, the industry has been steadily progressing.

According to Etherscan, BlackRock's BUIDL, launched less than four months ago, currently holds tokens representing $5.028 billion in tokenized national debt.

Cryptocurrency lending platform MakerDAO, the protocol behind the $5 billion stablecoin DAI, released a new plan last week to invest $1 billion of its reserves in tokenized US bond products. Top participants in this field, including BlackRock's BUIDL, Superstate, and Ondo Finance, are lining up to apply for the proposal. The $1 billion investment means a 55% increase in the scale of existing US bond RWA tokens!

From an income perspective, the conversion of $1 billion in interest-bearing (4.5-5%) assets means an additional annual income of $40-50 million for the protocol, accounting for nearly half of the current income, which is a significant positive according to the PE valuation method. However, it is also possible to convert from existing assets, which would not directly benefit the protocol financially, but would reduce the underlying custody risk. However, this could be a key shift for Maker to break out of its own circle and tie itself to traditional large institutions.

[Funds Flow and Sentiment Overview]

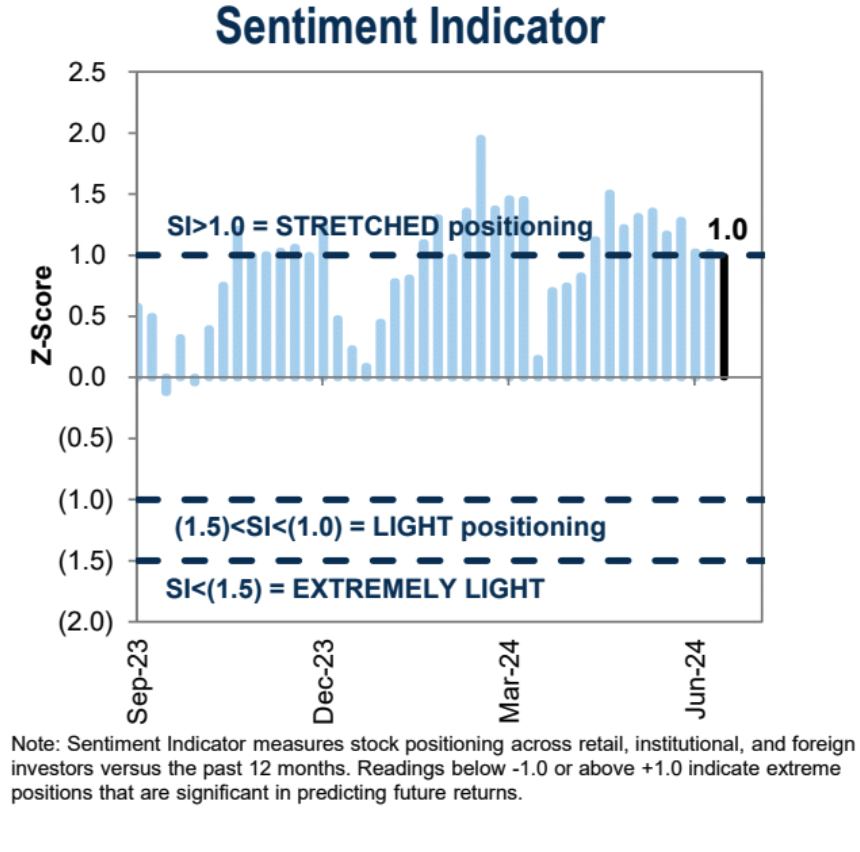

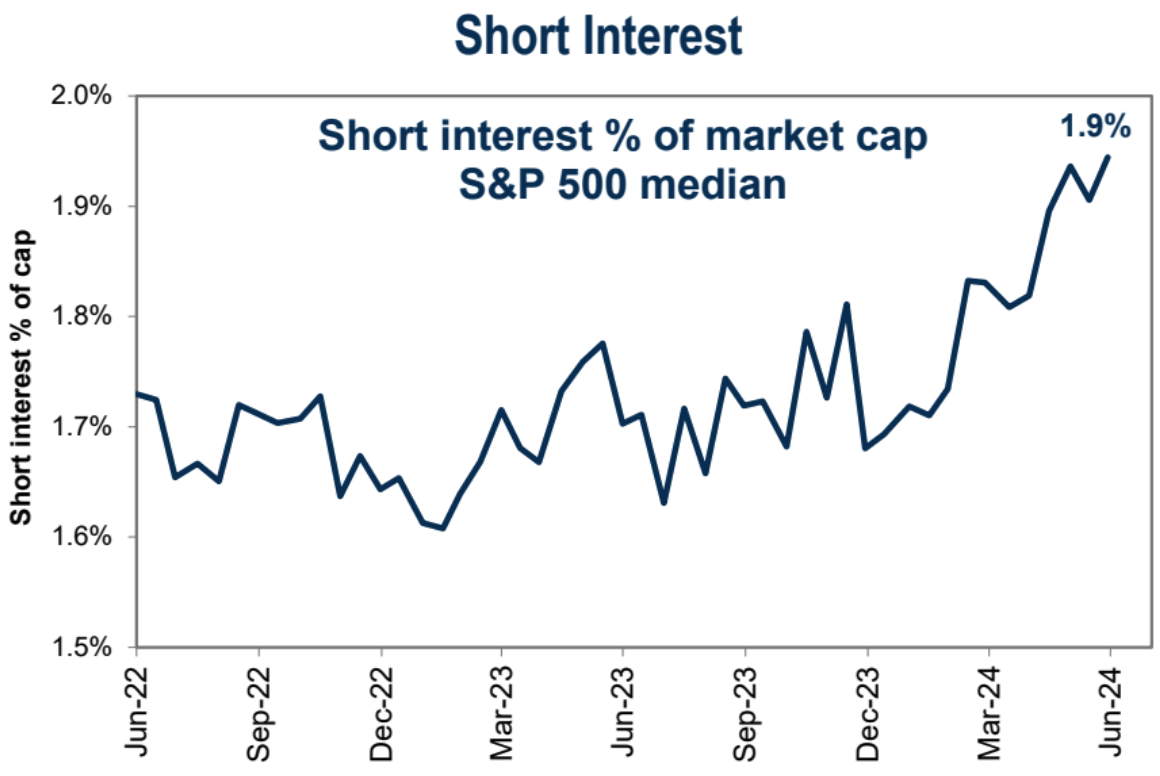

The short position in the US stock market rose slightly in June, approaching the highest level in four years, but the overall level is still not high (it can reach 3-4% at high levels):

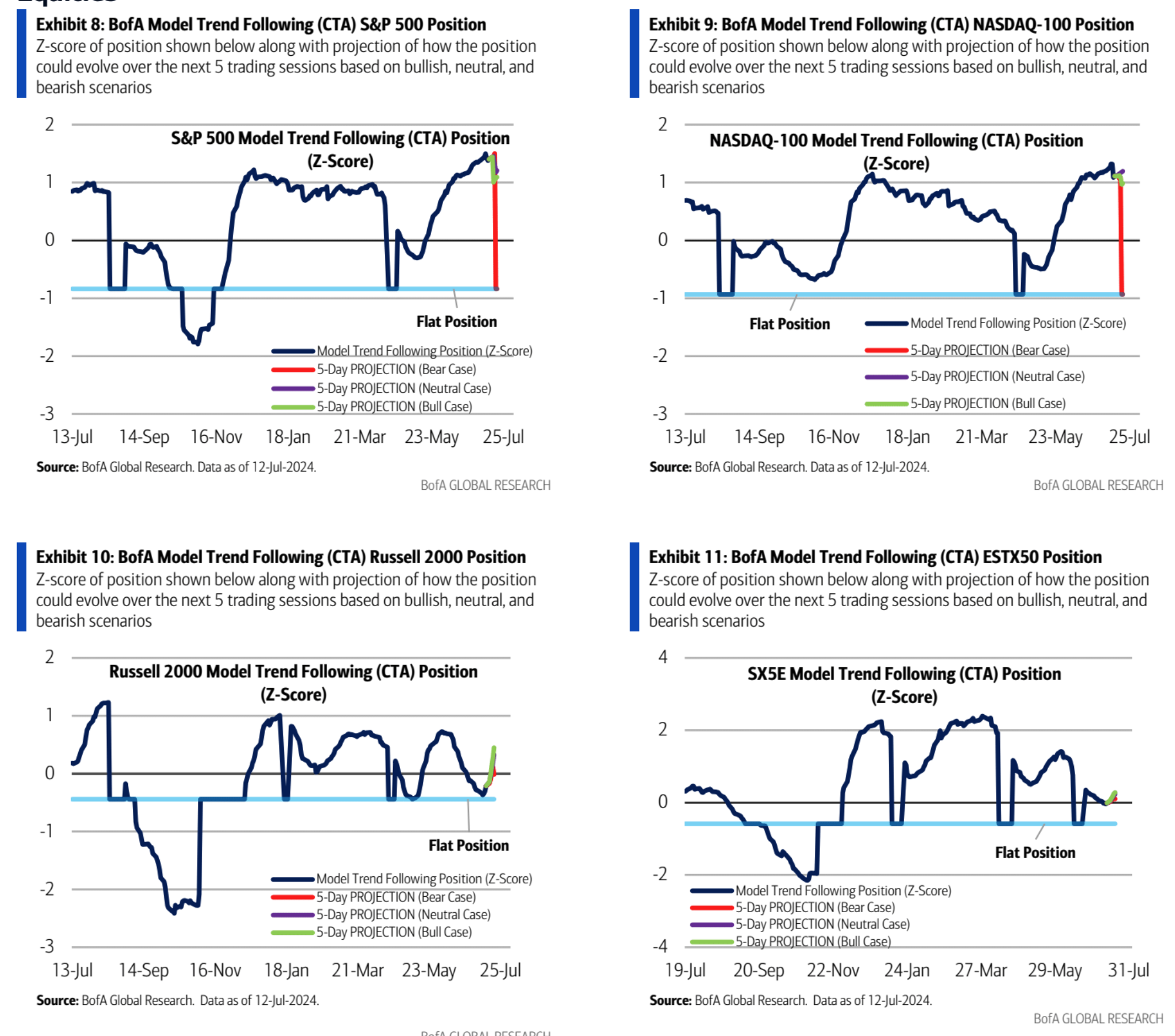

BofA's analysis of CTA positions in different stock indices and the forecast for the next five trading days shows that the S&P 500 position Z-score is close to 2, indicating a high position. The NDX Z-score is close to 1, at a moderately high level, and the Russell 2000 position is more neutral, with a high probability of an increase.

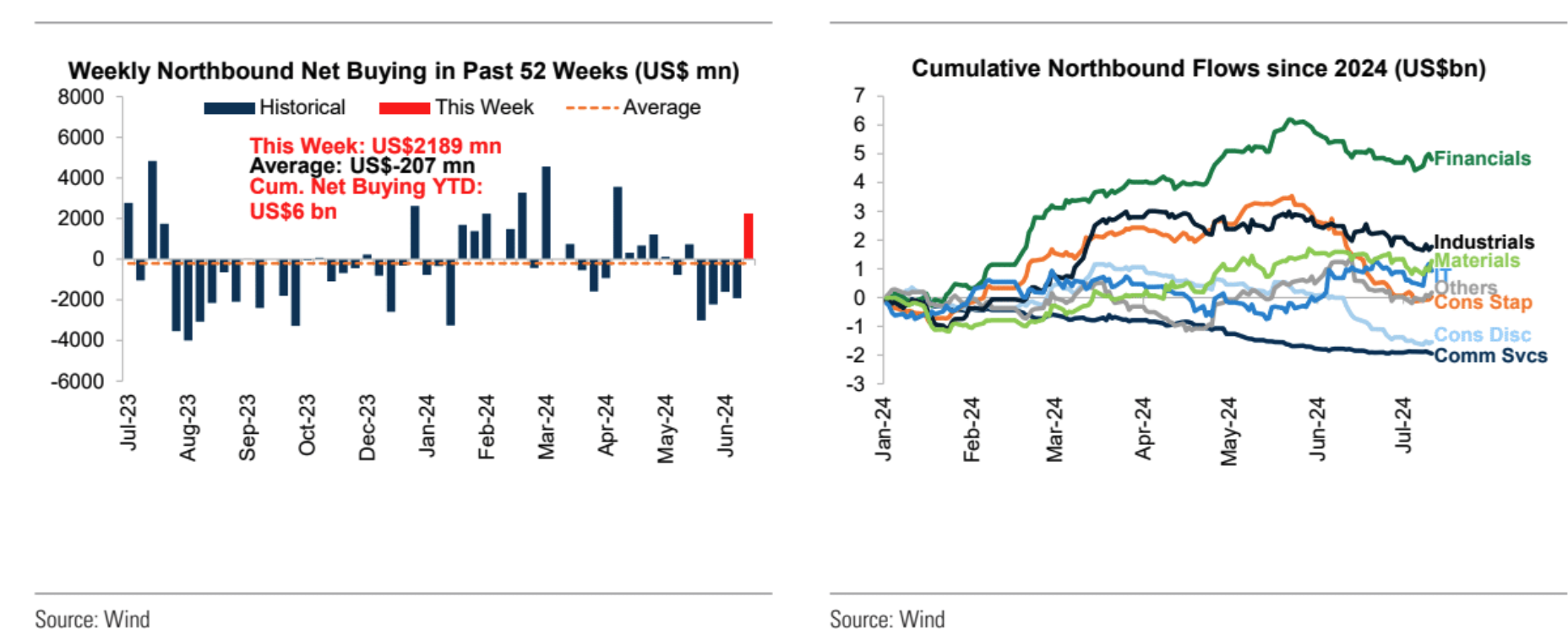

The net inflow of Northbound funds in the A-share market reached 15.9 billion yuan this week, hitting the highest level in 11 weeks and reversing four consecutive weeks of net outflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。