Author: Duncan Matthes, Joseph A.C. Lloyd, Delphi Digital

Translator: Yangz, Techub News

Introduction

In the past few weeks, the most eye-catching aspect of the Web3 gaming field has been the TON ecosystem. From NOT's fair distribution with a FDV of over 10 billion USD without any venture capital support, to Hamster Kombat reaching 142 million registered users within 77 days, the ecosystem has achieved remarkable results almost every week.

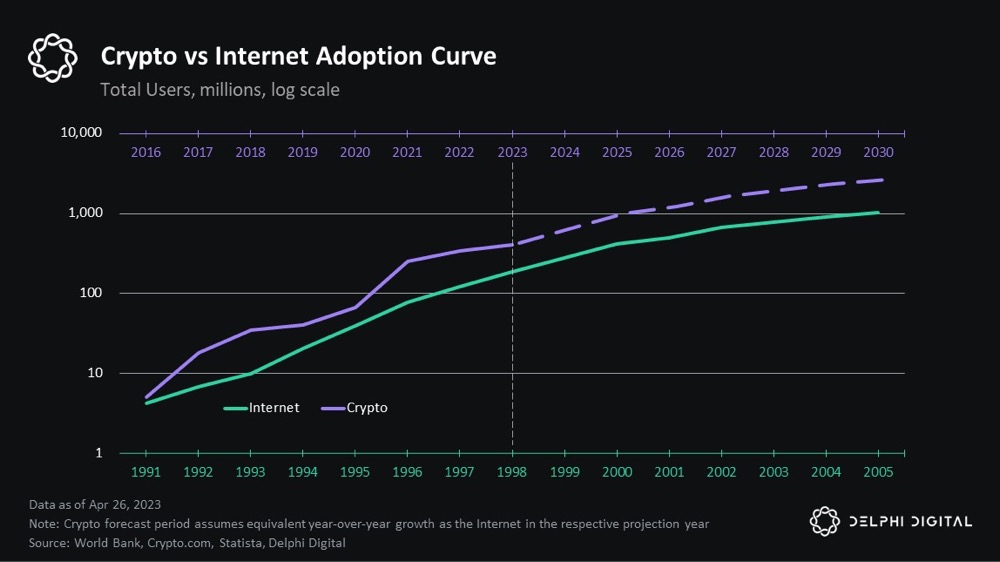

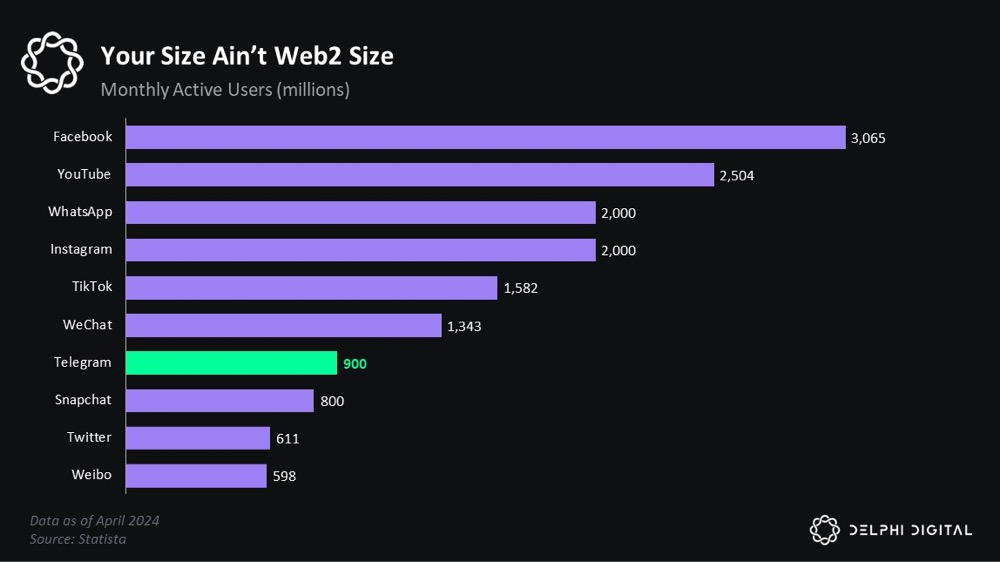

Telegram, with its 900 million monthly active users (MAU), is hailed as the largest Web3 user channel. Additionally, Telegram's more secure and privacy-protecting features, along with its position as the world's fifth largest and second fastest growing chat tool, have made it a mainstream encrypted communication application. Every non-U.S. user who registers on Telegram automatically creates an abstract cryptocurrency wallet, making the TON ecosystem stand out as one of the most powerful "candidates" driving the large-scale adoption of Web3.

In this report, we will delve into social games, closely observe the TON ecosystem, explore the unique aspects of Telegram in acquiring users, focus on five outstanding projects currently developing games on TON, and address the question of whether the current hype around gaming in the TON ecosystem has practical significance.

Social Platforms and Games

In the 2010s, the internet had become a public good, paving the way for the formation of the network's social center. In order to retain users and achieve profitability, these platforms began to expand their business scope to include games, daily services, e-commerce, and more.

Social Games

In the late 2000s, the number of users on social platforms grew exponentially, and they began to explore large-scale entertainment to retain as many users as possible and achieve profitability. Games, which are easy to spread and highly scalable, while providing users with long-term immersive experiences and generating revenue for the platform, naturally became the preferred choice for social platforms. Facebook, Telegram, and WeChat are good examples, as they have invested heavily in establishing gaming departments. The advantages of large platforms are as follows:

Users can access a large amount of content, enriching their core experience on the platform.

Games are often paired with social layers, encouraging competition and social activities.

Games are mostly casual and free, making them easy to get started with, easy to spread, with low development costs and fast iteration speed.

Social platforms have a large user base, with much stronger distribution capabilities compared to most game studios.

Games provide users with ample immersion time, while also offering deep consumption potential, increasing the platform's overall retention rate and lifetime value (LTV).

Facebook's foray into gaming marked the beginning of the era of social games, where even simple games could attract millions of daily active users (DAU) within weeks. The speed and scale of development of these social gaming ecosystems are truly impressive. Farmville, a social farming game launched by Zynga on Facebook, reached 10 million monthly active users just two months after its launch, peaking in 2010 with approximately 80 million monthly active users. Even three years after its launch, the game's revenue still accounted for around 20% of Zynga's total revenue.

It is worth noting that the social nature of these games often leads to player groups concentrating on a few major games. Because players often share their game achievements with friends or compete with them, network effects ultimately lead players to games such as Candy Crush, Farmville, and Zynga Poker, making it difficult for lesser-known games to capture market share.

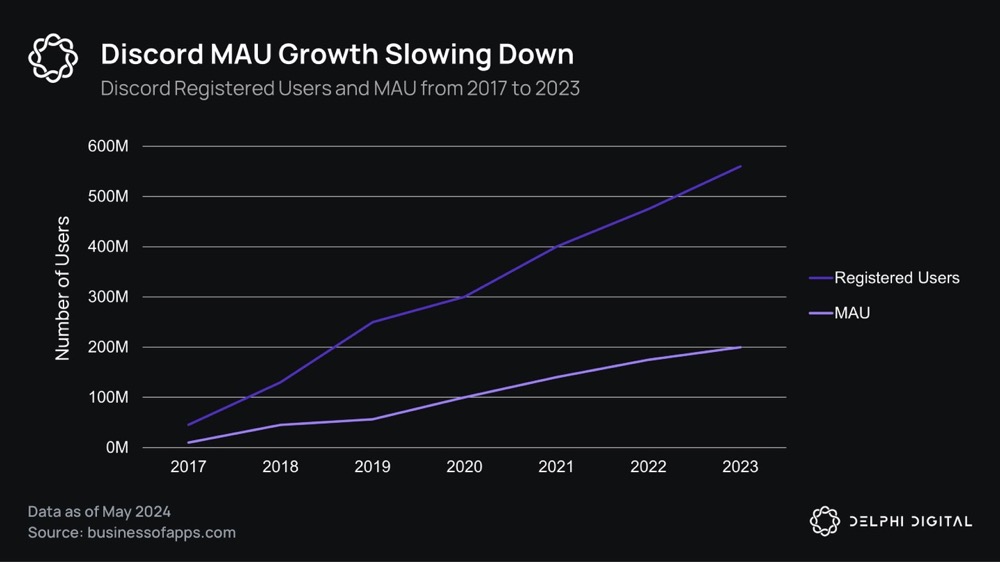

Following Facebook's success in the early 2010s, Discord entered the gaming field in the late 2010s. As a game-centric chat application, Discord's user base is eager for gaming content, with 95% of Discord users often playing games in real time, making it natural to launch native games within the app. However, after launching a game store and game library in 2018, Discord quickly abandoned the plan due to minimal effectiveness, and in 2019 shifted its focus back to Nitro subscriptions. The lack of convenient monetization pathways led to high development risks, limiting potential revenue and innovation.

In the gaming industry, user growth surged on a large scale in 2020 due to the pandemic, leading to a significant increase in Discord users. The company saw this as an opportunity to expand its target audience and planned to expand its user base from gamers to ordinary consumers. However, four years later, Discord shifted its focus back due to its failure to penetrate the broader consumer market, and pledged to return to its roots, customizing the platform according to the needs of gamers once again.

WeChat: More Than Just Communication

Although most communication apps have added social features such as short videos and groups over time, the extent to which other entertainment features, such as games, promote user engagement and monetization is still limited. While game developers in this environment are generally not directly hindered in developing games, such as the early TikTok games, they face challenges and risks due to the lack of proper infrastructure and payment channels. Due to the thin profit margins in the gaming industry, most development teams are reluctant to limit in-app purchases (IAP) to avoid unnecessary user friction.

While Facebook games have gradually faded from view, the growth of WeChat indicates that there is still significant room for development in the intersection of social apps and games. WeChat can be considered a super app, where users can not only chat and make calls, but also pay utility bills, order meals, and book international travel. 80% of Chinese citizens use the app every month, spending an average of 80 minutes per day on WeChat. In comparison, about 37% of U.S. mobile internet users use TikTok at least once a month, spending an average of 58 minutes per day on the app.

In 2017, WeChat launched mini-programs, allowing certain small applications to run natively within WeChat. Shortly thereafter, with the natural fit between games and social platforms, WeChat mini-games (first-party games developed by Tencent) were launched as the initial few WeChat mini-programs. By 2018, third-party developers were allowed to access the platform, and by the end of the same year, over 7,000 registered WeChat mini-games were available.

In the following years, WeChat introduced several updates to support larger-scale mini-games and more complex game mechanisms. However, by 2021, despite the number of mini-game developers exceeding 100,000, the monthly active users (MAU) did not significantly increase from around 20 million in 2017. User acquisition was evidently a challenge for these games, leading mini-game developers to start advertising across the entire Tencent ecosystem.

This was a crucial moment in the development of WeChat mini-games, but the real surge came with the support of Bilibili and Douban, two social platforms that began allowing users to directly jump to WeChat mini-games when clicking on ads. This was followed by a series of viral spread, with the standout being "Sheep Got Sheep", reportedly attracting 60 million daily active users within a month!

By June 2023, WeChat mini-game developers had exceeded 300,000, with monthly active players reaching 400 million, accounting for approximately 31% of WeChat's 1.3 billion users. Additionally, industry insiders estimate the WeChat mini-game market to be valued at $6 billion in 2023, with an expected annual growth rate of 25% to 30% over the next five years.

By the second quarter of 2023, the quarterly revenue of over 100 mini-games reached 10 million RMB (approximately $1.38 million), with several games generating monthly revenue exceeding $15 million. A key factor in the success of WeChat mini-games is that the profit margin is much higher than traditional mobile games (exceeding 30%).

However, it is important to note that games only account for about 10% of the top 500 mini-programs in terms of MAU rankings. WeChat is still primarily a social app, followed by a lifestyle service app, and lastly a gaming app. Nevertheless, WeChat is still a prime case study, demonstrating the results that can be achieved by using games to increase user engagement and introduce new monetization pathways on a highly integrated, frictionless platform.

Having gained an understanding of the aforementioned platforms, let's now turn our attention back to the sudden explosion of Telegram, the TON Foundation, and Telegram mini-games.

Expansion of Telegram

Telegram was the first pure chat app to truly enter the gaming space. After integrating HTML5 compatibility for Telegram bots in 2016, the launch of the TON blockchain in 2017 aimed to provide other key functionalities, further reducing friction for users and developers. Through TON, developers can build payment infrastructure, decentralized storage of in-game assets, or smart contracts for secure and automated game mechanisms, while efficiently distributing content to a community with 9 billion MAU.

TON Ecosystem

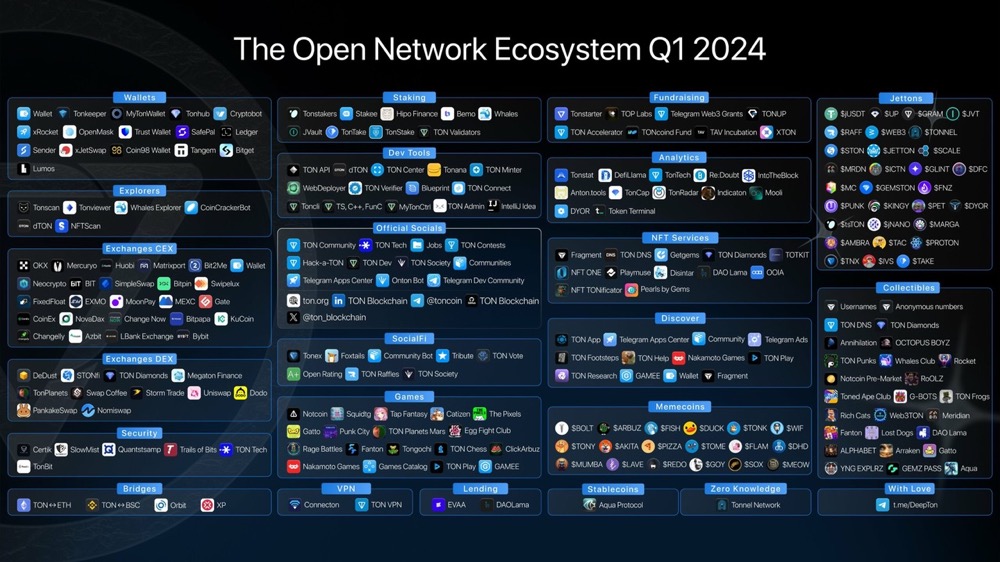

The TON technology stack provides developers with tools to develop various dApps on Telegram. Hundreds of teams are serving the ecosystem with wallets, exchanges, cross-chain bridges, games, and more to meet market demands.

The TON token is at the core of the TON ecosystem. Firstly, TON can be used to pay gas fees, powering all transactions on the blockchain. Secondly, validators need to hold TON to participate in the proof-of-stake validation process, similar to the Ethereum and Solana networks. Additionally, developers need to pay TON to deploy and run smart contracts on TON. The total cost includes base fees, storage fees, and execution fees, ensuring scalable token utility and validator income.

Furthermore, users and developers can exchange value within the ecosystem using TON with minimal friction. Although the TON token supply increases by a fixed 0.6% annually, 50% of network fees are burned, incentivizing people to hold it as an asset. Using the burn rate as of June 2024 as a benchmark, the annual burn amount is approximately 2.89 million TON, less than 10% of the 30.65 million new TON entering the ecosystem due to inflation over the next 12 months.

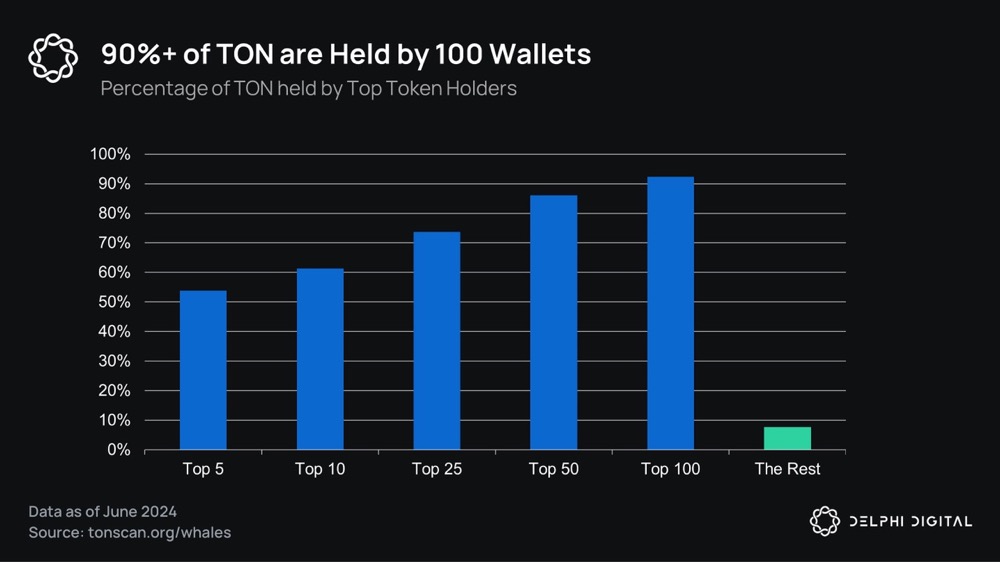

To decentralize decision-making, TON holders can gain governance rights based on their risk exposure ratio. While governance is not the primary use case for TON, it can serve as a complementary utility and theoretically play a significant role in shaping the protocol's future. However, the high level of centralization (the top 100 holders own 92% of the supply) severely limits the impact of decision-making.

In June 2023, after a vote (with 98% in favor), it is possible to destroy 50% of the network fees. The supply of TON is continuously being destroyed. It is worth noting that there is very high consensus on voting for TON. Although only four proposals were voted on, all proposals were passed with an average approval rate of 96%, indicating a high level of community consensus within the TON ecosystem. This overwhelming consensus largely depends on the highly concentrated TON tokens, with over 92% of the voting power coming from 100 wallets.

The Ton Believers Fund is another example of the community's strong conviction. Over 1.3 billion TON tokens are locked in the fund for five years, accounting for approximately 25% of the total supply. In 2023, the fund stopped accepting deposits and initiated a two-year hard lockup period, followed by a three-year linear vesting period for the locked tokens and rewards. While locking a significant amount of supply for five years demonstrates the long-term belief of the TON community, it also further centralizes governance. Additionally, the incentive structure is not clear, and rewards for TON stakers come from "donations" and a proposal that was passed with a 99.4% vote, planning to distribute 1 million TON tokens (0.1% of staked tokens) to stakers.

Attention on TON

The growth of TON can be described as explosive. dApps in the TON ecosystem continue to break user records, with Notcoin reaching 40 million users within six months, and Hamster Kombat surpassing 200 million registered users with over 30 million daily active users (DAU). This rapid growth is in line with the fast-paced growth seen in early social games like Farmville and Sheep Got Sheep, highlighting the power of cryptocurrency growth incentives. Hamster Kombat is expected to launch its token soon, while NOT had an FDV of $1 billion when it launched on Binance last month, peaking at $2.1 billion, and currently retracing to around $1.45 billion.

The hotness of the TON ecosystem can be attributed to a move announced by Telegram at the end of February, where its advertising network will distribute 50% of the generated revenue through TON to channel owners. This opens up a huge potential market for advertisers, allowing them to access Telegram's massive user base. On the day of the announcement, TON surged by 40%, and the market share has not stopped growing since then.

From the first quarter of 2022 to the fourth quarter of 2023, the ecosystem achieved steady growth within its developer community. In the first quarter of 2022, the Telegram developer community for TON had about 2,200 users; by the fourth quarter of 2023, this number had risen to 13,500. As of June 2024, the user count has increased by nearly 100%, reaching 36,500, showing a significant surge compared to previous growth.

Recently, the number of developers in the Mandarin community has significantly increased, growing from over 2,300 to over 7,300, representing a growth of over 300%. In contrast, the Russian community only grew by about 50%. This phenomenon indicates a growing interest from the Chinese cryptocurrency community.

In the second quarter, the daily active wallets and transaction volume of TON showed an upward trend, mainly driven by Notcoin and Hamster Kombat. Similarly, the transaction volume has also seen significant growth over the past three months, breaking the 8 million daily transaction volume mark recently after hovering between 500,000 and 1.3 million transactions in the first quarter (excluding the three-week peak after the advertising network launch).

This trend is reflected in wallet numbers, activated wallets on-chain, NFT minting volume, and overall DAU. Key performance indicators are showing comprehensive exponential growth.

TON Growth Plans

The TON Foundation plays a crucial role in overseeing the ecosystem and driving development. As a non-profit organization, its mission is to incentivize innovation for the benefit of the entire TON ecosystem. With the support of the $90 million ecosystem fund established in 2022 and the newly established 30 million TON community reward program (currently valued at approximately $228 million), the foundation has implemented various investments and grants to promote the development of native dApps within the ecosystem.

Since March, the TON Foundation's accelerator program has seen significant development. Out of 82 proposals approved on Questbook, 17 are related to games or gaming infrastructure, making GameFi one of the most representative areas. Recently, TON also announced a $5 million TONX accelerator program to drive its proactive development strategy.

Additionally, the TON community recently announced an eight-week offline "Open League Hackathon" to be held in 13 IRL locations. Teams from around the world will have the opportunity to win up to $500,000 in prizes and make connections.

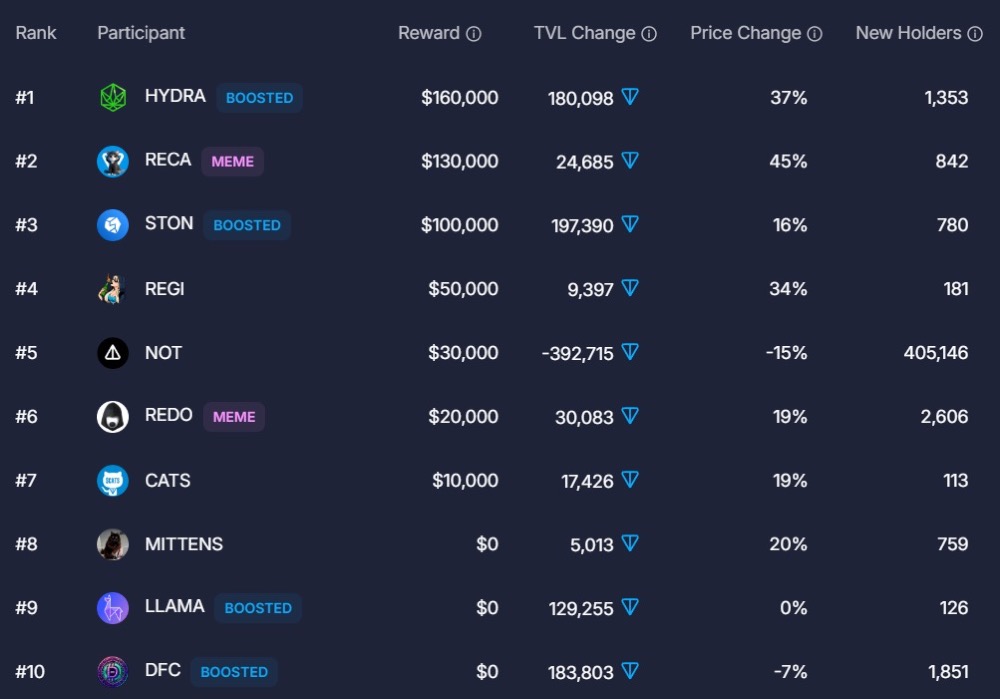

The community rewards are an important part of TON's long-term development strategy. Most activities last 2-4 weeks, and to attract as many participants as possible, the activities are often set to be very simple. As of now, the TON Foundation has distributed rewards worth over 40 million USD, and many more activities are ongoing or planned. In airdrop rewards, LP Boosts, and The Open League Battles, the TON Foundation has distributed a total of 22.4 million USD in rewards, with 17% (3.9 million USD) allocated to gaming projects.

In the above activities, gaming projects in the TON ecosystem have achieved tremendous success, dominating the app battle rankings. TAP Fantasy consistently ranked second in the Beta season and won the first season. The champions of the second and third seasons were both won by Catizen, a game developed by a Chinese team with experience in WeChat mini-games. Citizen is currently expected to defend its championship in the third season, with Yescoin and SquidTG closely following, potentially becoming the top three in the rankings.

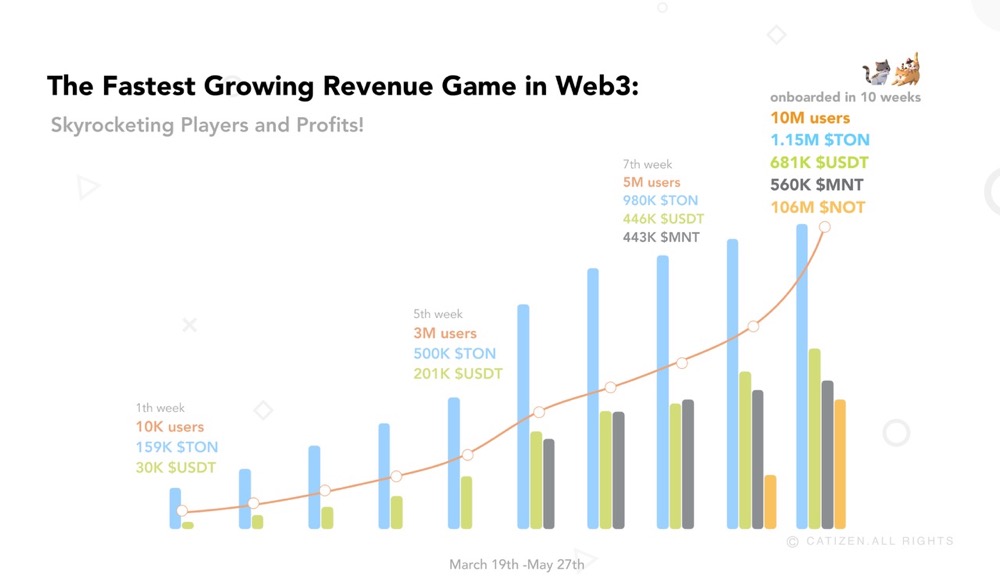

Games have brought valuable and sustainable user attraction to TON. Teams like Catizen have generated over 10 million USD in revenue through in-game purchases in the past three months, indicating that teams with monetization expertise can convert speculative user metrics into valuable revenue.

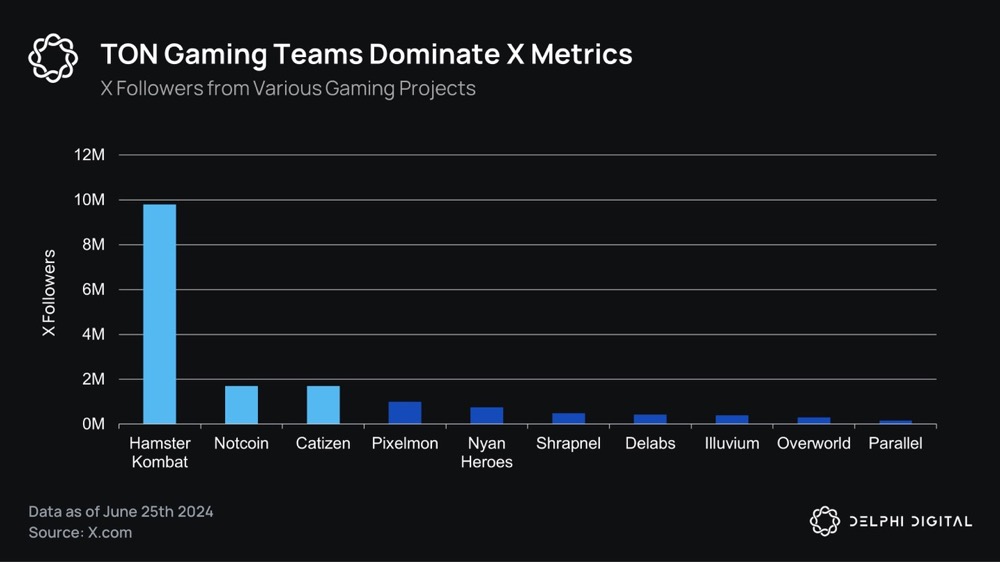

While Catizen steadily builds its empire, Hamster Kombat and Notcoin have also become the focus in recent weeks. Hamster Kombat's Twitter followers surpassed 9.9 million in 77 days, with an average of over 2 million views per tweet, and a user base of 142 million. Meanwhile, Notcoin launched its token through the Binance Launch pool in early May, with an FDV of 14.5 billion USD, 2.44 million on-chain holders, and 40 million active users.

While these data are impressive, project teams building on TON need to demonstrate their ability to operate sustainably and convert free game users into paying users without relying on infinite inflationary token rewards. Acquiring users is crucial, but it also requires regularly providing fresh content to retain users, especially in the attention economy era of Web3.

Additionally, the issue of botting will soon become a problem for project teams. Without effective measures, the prospect of economic rewards will attract a large number of bots, diluting player rewards and causing additional selling pressure.

Games and User Acquisition

User acquisition (UA) is a key metric for any mobile game studio. In this highly competitive and low-profit industry, expanding the user base is crucial for sustained success. According to calculations by CNBC, the operating profit margin for the gaming business is less than 6%, forcing game companies to cut costs across the board.

Currently, there are over 300,000 gaming apps on Google PlayStore and over 225,000 on the Apple AppStore. A large number of games are competing for approximately 2.2 billion mobile game players globally, leading to a sharp increase in UA costs. Back in 2018, the cost per install (CPI) for iOS was about $1.24, and for Android, it was about $0.53. Just 6 years later, these costs have risen to $2 to $5 for iOS and $1.5 to $4 for Android.

According to a report by Sensor Tower, in 2020, the revenue of over 28,000 mobile game publishers was less than $1 million, contributing approximately $834 million (2%) to the AppStore game revenue. In contrast, the revenue of 940 studios that exceeded $1 million contributed $34 billion (98%). This imbalance in the mobile gaming industry puts small studios that cannot afford high UA expenses at a severe disadvantage. Assuming that users spend about 60% of their time in games that are over six years old, it's not surprising that 83% of mobile games fail within three years of launch. For new mobile game studios looking to sustainably penetrate this industry, efficient UA has become essential for survival.

To help developers cope with the increasingly competitive mobile gaming market and further improve the efficiency of transitioning from Web2 to Web3, Telegram recently launched a native IAP currency called stars, which can be easily integrated into bots and mini-games. Now, users can seamlessly purchase their favorite in-game items with this AppStore-compliant currency, bringing deeper player consumption and more stable revenue streams for developers, who will receive a 70% share of the IAP revenue.

By subsidizing teams that pay advertising fees with stars, Telegram not only helps game publishers reduce customer acquisition costs but also makes itself and its Web3-friendly user base an attractive Web3 marketing platform. Additionally, stars can be exchanged for TON, effectively linking them to a wider liquid market. As long as the TON token remains healthy, it ensures developers receive stable and efficient rewards.

Considering the rising user acquisition costs for mobile games and Telegram's large open crypto user base, TON has the potential to become a valuable channel for Web3 games, helping them onboard new Web3 users into their ecosystem. While the technical stack limits the range of games developers can build for Telegram, its large user base, low platform development costs, and low-friction user environment make it a strong pillar of the Web3 gaming ecosystem.

It can be foreseen that mature game projects will undoubtedly leverage TON as a channel in the near future. Telegram's unique positioning makes it an attractive top mobile game UA platform. By building experiences on TON that can be accessed with minimal friction and without requiring too much effort from players, game teams can cast a wide net to attract users. Distributing moderate practical rewards in games can also be an effective lure to bring new potential players into the ecosystem.

Popular Games on TON

In the past few months, the performance of the TON gaming ecosystem has been steadily rising. With various TON growth initiatives, relatively simple HTML5 games, low development costs, and a large potential player base, TON has positioned itself as an attractive choice.

Incentivized referrals are one of the main drivers behind the strong growth of its social metrics. While this strategy has been proven to bring in a large number of new users to the ecosystem, it does not address the inherent lack of deep monetization in casual games like Notcoin and Hamster Kombat. This is also a key issue for game retention and sustainable development.

Clicker games fundamentally lack the conditions for valuable user monetization, while hybrid, casual, and hardcore games combine necessary low-friction onboarding and deep potential revenue streams. Finding the right balance between low-threshold games and providing enough social competition and entertainment value will make users feel the necessity of progression and will ultimately determine the success of these small games.

Notcoin

Recently, few teams have captured the culture and ethos of Web3 like Notcoin. By distributing 95% of the tokens to users, Notcoin has created a unique brand that integrates memes with community spirit. As a simple "tap-to-earn" game, the barrier to entry for players is extremely low. This also achieves the decentralized distribution of NOT, with over 2.44 million on-chain holders.

Notcoin's rapid development, community-centered distribution, and meme-like culture have made it a catalyst for the entire TON ecosystem. Incremental games have existed long before Web3. Cookie Clicker, a clicking game initially released in 2013, is perhaps the most well-known example. The game reached a peak of about 1.5 million players in August 2023 and still has an average of 15,000 concurrent online players. The recent incremental game Banana has been the second most played game on Steam for three consecutive weeks.

NOT has successfully achieved cross-utility throughout the entire TON ecosystem, with various TON games accepting NOT for in-game purchases. Additionally, the Notcoin team has negotiated burn rates for each transaction, for example, 10% of NOT used in Catizen will be burned, reducing the supply and increasing buying pressure. Since the game itself lacks sustainable entertainment value, Notcoin will have to rely on its cultural significance to integrate into as much of the ecosystem as possible to provide ongoing utility.

By conducting the initial token issuance on the Binance Launch Pool, Notcoin has fully capitalized on its recent growth and solidified its position as a leader in the current game token issuance. According to CoinMarketCap (06.24.24) data, NOT is the third-largest game token by market capitalization. Since its release on May 16, the daily average trading volume of Notcoin has ranged from $300 million to $1.5 billion, ranking among the top in-game tokens across all ecosystems.

Catizen

When it comes to popular games on TON, Catizen cannot be overlooked. The game team's previous experience in WeChat game development has translated into an outstanding launch performance for Catizen, with over 20 million registered users in just two months. The core team behind Catizen has developed over 20 mini-games since 2018, with over 300 million downloads on WeChat, Google Play, and Facebook. Catizen is the game on TON with the highest in-game revenue through IAP, with its 2.7 million DAU bringing in over 10 million USD worth of TON income. Additionally, out of 1.25 million on-chain users, approximately 50% are paying users, with an average spend of around $170 per player. Furthermore, the game's conversion rate is 7%, which is 900% higher than the average conversion rate of 0.66% for Telegram games.

Catizen's game design is simple and fun. Set in the Meowverse, players receive a digital cat upon registration and can improve their ranking on the leaderboard through upgrades. By breeding cats, completing tasks, or participating in mini-games, players can earn tokens and NFT rewards, continuously enhancing their strength in the game. The company plans to launch over 200 mini-games in the coming months, establishing an open task platform as a user funnel for other projects and integrating e-commerce, showcasing the breadth of its business scope.

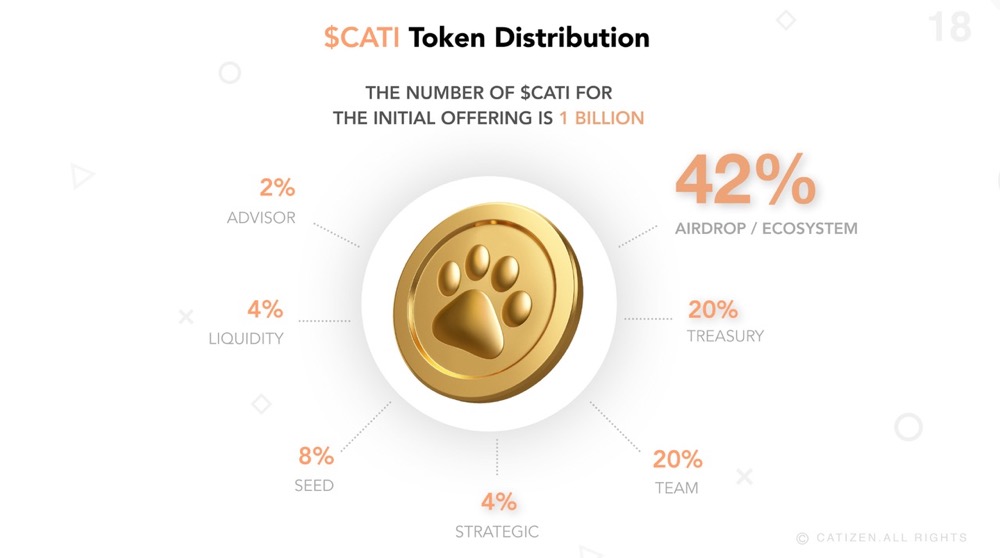

TON games have been very active in community distribution, which is one of the main catalysts for its exponential user growth. In the TGE, most Web3 game teams did not have the ability to airdrop a significant portion of the supply to the community, while Catizen allocated 42% of its supply for community airdrops. Surprisingly, players mostly did not consider the return on investment when spending, as significant token rewards require a high fixed cost.

Hamster Kombat

Catizen and Notcoin have stood out with excellent monetization strategies and clever use of Web3 culture, while Hamster Kombat has shone through its social influence. In the past seven days, the average views of Hamster Kombat's Twitter posts have been 2.2 million, with over 20,000 likes and over 2,000 retweets.

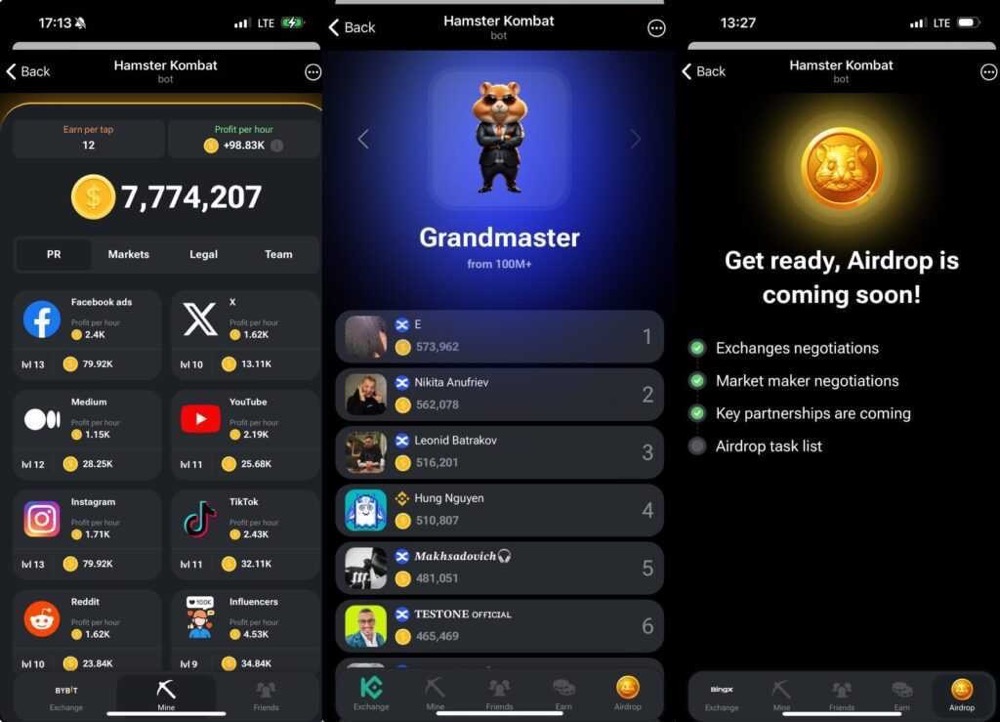

The core gameplay of Hamster Kombat is very similar to Notcoin. Users enter the game, tap the screen, and accumulate points over time. Players take on the role of a fictional hamster, the CEO of a cryptocurrency exchange, with the goal of mining as much HMSTR coin as possible. Players can increase their income by investing in marketing, licenses, talent, and new products in the game, or by referring new players.

This simple game has attracted over 200 million registered users. The prospect of potential returns, coupled with minimal user requirements, has led to exponential user growth. The team has not only focused on Telegram and Twitter but has also invested heavily in gamifying their YouTube channel. The team releases two 2-minute videos daily, one reporting daily cryptocurrency news and the other usually an educational video. The team hides clues in the videos to incentivize continued user engagement.

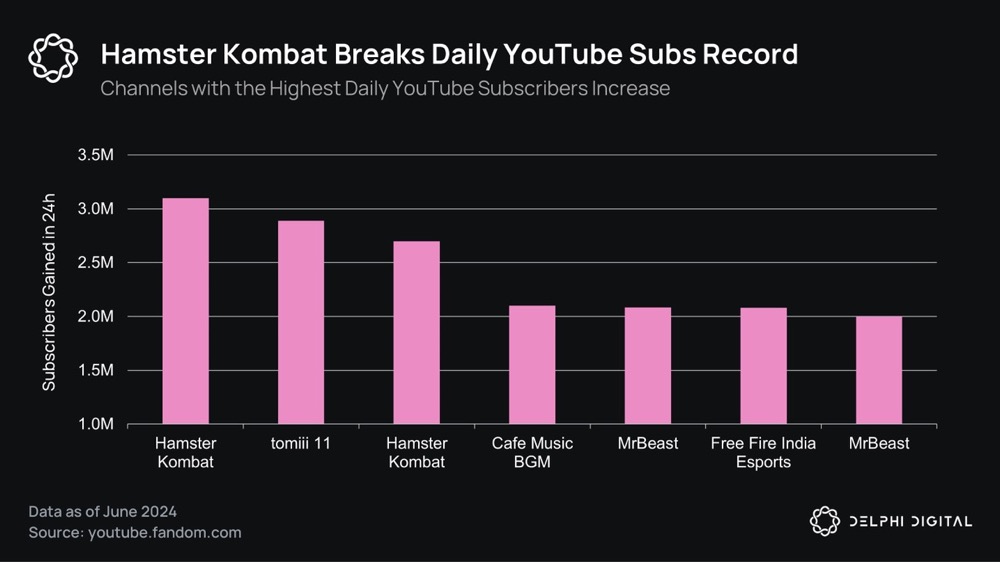

Hamster Kombat's YouTube channel currently has over 28 million subscribers, making it one of the fastest-growing YouTube channels of all time. The 137 videos uploaded have generated a total of over 461 million views. From the perspective of other Web3 games, this number is approximately 100 times that of the Illuvium YouTube channel.

Fanton

Disclosure: Delphi Ventures is an investor in Fanton.

Despite being a football app launched during the European Football Championship, Fanton has attracted much less attention compared to the above three projects. Relatively speaking, the project has been low-key, but it still ranks fifth in the public league's third season, bringing the team a net income of $30,000. The game's lack of social capital may be due to its niche audience and intense competition (mainly from Sorare), as well as its relatively less aggressive token strategy, with no commitment to a large-scale community airdrop in the TGE.

The game follows the typical fantasy football gameplay, where users can pick 5 players to form a team and score based on their real-life performance. Users who pick the best lineup combination on specific match days and achieve the highest score can earn rewards through the leaderboard. The game covers the top five European leagues, the Brazilian league, and the current European Football Championship, which is broadcast in 229 regions, with a cumulative audience of 5.2 billion (1.9 billion independent viewers), with an average live match audience of over 100 million in 2020.

Users can participate in regular tournaments or NFT tournaments, with the latter requiring users to own NFTs to participate. Winners can receive TON and NFT rewards, unlocking access to higher reward tournaments. Despite having 200,000 MAU, typical free tournament player numbers range from 1,000 to 5,000 in the past few weeks, while paid entry tournament player numbers range from 10 to 1,000.

Notably, the first round of the Euro Championship had approximately 37,000 participants with a $100,000 prize pool. The second round saw a significant drop in registrations, with only about 7,000 participants. Additionally, while showcasing the prize pool to attract users, there was an 81% decrease in registered users after the second round, indicating difficulties in user retention. Without adopting a proactive token approach similar to Notcoin or Catizen, the project will struggle to compete with larger projects like Sorare.

Gatto

Gatto is a game that falls between tamagotchi, platform games, and farm simulators. Players can collect NFTs, take care of their pets, and continuously upgrade in the game. On March 26, the TON Accelerator program accepted 11 out of 170 applications, and Gatto was one of them. As a result, it has gained broader ecosystem support, driving game development.

Compared to the aforementioned games, Gatto's community is not as prominent, with only 23.5k followers on its official Twitter account and fewer than 10 posts. Player interactions mainly occur through Telegram, with over 75,000 subscribers in its information channel. Focusing on Telegram has not hindered Gatto's user acquisition, as the game surpassed 1 million registered users over three months ago.

Gatto has committed to launching RPG content, PvE modes, and PVP expansions in the second half of 2024. In early 2025, Gatto hopes to develop a city-building game, adding another layer of progress to its ecosystem. However, despite these ambitious plans, in the past three months, Gatto has been left behind by games like Catizen and Hamster Kombat. The next few months will be an interesting case study to reveal how operational implementation works in Telegram mini-games and whether Gatto can narrow the gap with simpler games like Hamster Kombat.

Bear Market vs. Bull Market Argument

Some readers may naturally compare today's Telegram mini-game ecosystem to early WeChat mini-programs and feel excited about the exponential growth over the next few years. While this assumption has some merit, before outlining our "bull market argument," it is necessary to briefly outline some obvious, insurmountable differences between the two.

Bear Market Argument

Even though it is possible, the likelihood of Telegram becoming a universal app of equal scale to WeChat in the next five to ten years is not high. User behavior on the two platforms will continue to differ. For WeChat, which serves China (the world's second-largest economy), the number of competitors vying for user attention and spending is much lower compared to Telegram and its global audience.

Furthermore, WeChat directly benefits from its highly centralized structure. WeChat not only benefits from Tencent's extensive product and service ecosystem but also benefits from a very favorable regulatory environment, leading to rapid market share growth domestically.

The highly integrated wallet application in WeChat is a good example, but its functionality is not easily replicable. With its undisputed dominant position in the domestic market, WeChat has essentially achieved direct integration with all domestic banks. Therefore, in many cases, the process for WeChat users to play games and purchase in-game items is even simpler than downloading apps from the app store. In contrast, TON users must first purchase a fixed amount of stars or deposit cryptocurrency before participating in in-game currency processes.

Another key point is user acquisition (UA). While Telegram allows for reduced ad spend when using Stars, this does not change the fact that the advertising network performance on the platform is limited. Telegram game developers can at most identify users who have opened certain mini-apps. This is in stark contrast to WeChat, which has a wealth of rich data on all users, including financial, credit, and social scores.

Additionally, while advertising networks will continue to improve over time and introduce more third-party integrations (such as the collaboration between WeChat and Douyin), Telegram's privacy-centric value proposition means that high-granularity data such as demographics and location may still be difficult to obtain.

Bull Market Argument

Nevertheless, Telegram/TON still possesses many unique features, distinct not only from WeChat but also from all other Western social apps. The establishment of TON immediately positioned Telegram as one of the largest gateways for Web2 users to enter Web3, making Telegram's approximately 900 million MAU the largest pool of "Web2.5 users" and a major distribution channel for almost all major cryptocurrency markets.

More importantly, unlike centralized exchanges such as Coinbase and Binance, Telegram is fundamentally a social app, meaning user behavior within the app is vastly different. In other words, because users log into Coinbase for the purpose of trading cryptocurrencies (which is a highly independent and serious activity), any casual entertainment or social features introduced by the app would undoubtedly face stronger resistance or attrition from users. On the other hand, Telegram leans towards the other extreme, making it easier to integrate games and other social-related apps, with a higher product-market fit.

Encouragingly, based on the case studies in this report, Telegram users seem highly receptive to apps that combine social applications with significant financial incentives. Even if over 80% of these "users" are attracted to "finding the next Notcoin," the metrics of these simple games have already surpassed many big-budget games in this and the previous rounds.

Looking back at the development path of WeChat, readers should remember that its situation truly began to heat up with the opening of more cross-platform UA channels and the reduction of customer acquisition costs. We hope that Telegram will leverage this knowledge and prioritize third-party integrations, despite the risk of user attrition.

This, coupled with a deep understanding of native user behavior and market fit, will provide an opportunity for professional real-time operations and monetization of Telegram mini-games to thrive on the platform.

Additionally, many developers may choose to continue utilizing Telegram as a UA channel at the top of the user acquisition funnel. After all, while the ceiling for WeChat mini-games is high, only about 30% of all WeChat mini-games are pure game studios. Most studios operate independent apps alongside operating mini-games to gain cross-platform user experiences, cross-platform gaming (players using multiple platforms tend to spend more), and a larger addressable market.

Conclusion

Over the past few months, TON has gained an impressive share of user mindspace. The mini-game ecosystem led by Catizen, Notcoin, and Hamster Kombat has played a crucial role in the rapid growth of on-chain activities. Hundreds of millions of users are enjoying TON games, injecting millions of dollars into the ecosystem this year.

The grant program has been a key success for TON recently, further highlighting the challenges that Web3 game developers currently face in attracting player liquidity. The newly deployed growth program provides funding, technical support, and marketing assistance to game teams, further accelerating the pace of team entry into the ecosystem.

The introduction of Stars as the native in-app currency on Telegram, flowing seamlessly into the Web3 system, is expected to enable teams to enhance the monetization levels within the games. Games like Catizen, Notcoin, and Hamster Kombat have positioned themselves as serious players. After the success of Notcoin, everyone is waiting for the launch of the next game to assess its development trend. The potential to challenge the top twenty gaming tokens is there, based on their market value at the time of launch.

In the short term, many teams are likely to fully leverage TON's current mindshare, attempting to redirect users from the platform to their own games or protocols. However, if we assume that developer tools and support will become more robust over time, the application of experiences drawn from platforms like WeChat to native games on Telegram will be a research case worth paying attention to in the medium to long term.

The second half of 2024 is crucial for TON games. After the initial user explosion laid a solid foundation for the ecosystem, the current focus will shift to retention and LTV. These two key sustainable development metrics rely more on content than viral spread, compared to user acquisition. These metrics will compel teams to execute meaningful normalized operations for sustainable development.

All information provided on this website is for reference only. The website does not guarantee the accuracy, effectiveness, timeliness, and completeness of the information. Users are solely responsible for any actions relying on the information provided on this website.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。