Compilation: Carol, Wu mentioned blockchain

Consensys' encrypted assets have been targeted by SEC enforcement actions for being considered as encrypted asset securities. These encrypted assets include but are not limited to the following assets: AMP (AMP token, available through MetaMask Swaps since October 2020), AXS (Axie Infinity Shards, available since November 2020), BNB (native token of the BNB chain ecosystem, available since March 2021), CHZ (see below), COTI (COTI token, available since October 2020), DDX (DerivaDAO token, available since December 2020), FLOW (FLOW token, available since November 2020), HEX (HEX token, available since October 2020), LCX (LCX token, available since October 2020), MANA (see below), MATIC (see below), NEXO (NEXO platform token, available since October 2020), OMG (OMG Network token, available since October 2020), POWR (Powerledger token, available since October 2020), SAND (see below), LUNA (see below), RLY (Rally token, available since October 2020), XYO (XYO token, available since October 2020).

The following is detailed information on some encrypted asset securities that Consensys trades for investor accounts through its MetaMask Swaps platform (not an exhaustive list).

Since their initial issuance or sale, each encrypted asset security has been issued and sold as an investment contract and is therefore considered a security. For each encrypted asset security, the issuer and promoter's statements reasonably lead investors to expect to profit from the efforts of the issuer, promoter, and related third parties. This reasonable expectation exists whether investors acquire these encrypted asset securities through the initial issuance, from previous investors, or through encrypted asset brokerage platforms including MetaMask Swaps.

A. MATIC

"MATIC" is the native token on the Polygon chain. Polygon, originally known as Matic Network and rebranded as Polygon in 2021, is a blockchain platform created in Mumbai, India in 2017 by individuals including Jaynti Kanani, Sandeep Nailwal, and Anurag Arjun. Since its creation, the founders of Polygon have been actively involved in the development of Polygon through an entity they established for "the development and growth of Polygon" called "Polygon Labs" (Polygon).

According to information on Polygon's website, Polygon is an Ethereum scaling solution that claims developers can build low-cost and scalable user-friendly dApps by hosting with Ethereum sidechains, allowing users to process transactions on Polygon's sidechain network and initiate asset transfers and technical development.

Polygon has issued 10 billion fixed-supply MATIC tokens. MATIC holders can earn additional MATIC by staking their MATIC on the Polygon platform and becoming validators, either by delegating their MATIC to other validators in exchange for a portion of the fees collected for validating transactions, or by staking their MATIC with other third parties such as encrypted asset platforms that provide staking services.

According to the initial MATIC whitepaper, "Matic Tokens are expected to provide economic incentives on the Matic network [now Polygon]… Without Matic Tokens, there would be no incentive for users to spend resources participating in activities or providing services to the entire ecosystem on the Matic network."

Around 2018, Polygon raised $165,000 in two early sales at a price of 0.00079 USD per 1 MATIC and $450,000 at a price of 0.00263 USD per 1 MATIC. In April 2019, Polygon sold 19% of its total supply on Binance to the public at a price of 0.00263 USD per 1 MATIC through an Initial Exchange Offering (IEO), raising an additional $5 million to fund network development.

Since its initial issuance, MATIC has been issued and sold as an investment contract and is therefore considered a security.

The price of all MATIC tokens will rise or fall together.

Since July 2021, MATIC has been available for trading through brokerage services provided by MetaMask Swaps.

Information publicly disseminated by Polygon would lead investors (including those who purchased MATIC since October 2020) to view MATIC as an investment. Specifically, MATIC holders would reasonably expect that through the efforts of the Polygon team, the Polygon protocol will experience growth and development, which in turn will increase demand for and value of the MATIC token.

For example, Polygon publicly states in its whitepaper that it will develop and grow its business through investment returns from its private and public fundraising activities.

Additionally, after the IEO, Polygon conducted additional MATIC sales, publicly stating that this was done to raise funds to support the growth of its network. On February 7, 2022, Polygon reported on its blog that it raised approximately $450 million through a private sale to several well-known venture capital firms for its native MATIC token. Polygon reported, "With this funding, the core team can ensure that Polygon is at the forefront of driving mass adoption of Web3 applications, a race we believe will ultimately see Ethereum outperform other blockchains."

Polygon also reported raising funds from other well-known and celebrity investors.

Polygon states that approximately 67% of MATIC will be reserved to support the Polygon ecosystem, foundation, and network operations. Another 20% of MATIC is further reserved to compensate Polygon team members and advisors, aligning their interests with investors' expectations for MATIC.

Additionally, the Polygon blog regularly updates on Polygon's network growth and development, including weekly active wallet and daily transaction statistics up to December 2022, as well as daily revenue and total network revenue and other financial metrics.

Polygon also frequently promotes when encrypted asset trading platforms allow trading of MATIC.

Polygon also explicitly encourages purchasers of MATIC to view MATIC as an investment in other ways. For example, in a tweet on February 5, 2021, Nailwal likened the token to a boxer who returns from failure to become a champion after experiencing the largest price drop in MATIC:

In addition, on November 3, 2022, Nailwal tweeted, "I won't rest until Polygon gets its rightful 'top three' position (tied with BTC and ETH). No other project comes close to this goal." In a "Fireside Chat" posted on YouTube with CNBC on May 24, 2022, Bejelic described "Polygon's uniqueness": "We as a team are very committed, take a very hands-on approach to all projects, work around the clock to promote adoption, which is why we are currently the most popular scaling infrastructure platform." By 2023, Polygon's founders continue to promote the platform through various social media platforms. For example, on February 21, 2023, Nailwal tweeted that Kanani retweeted, "Polygon's growth is exponential. To sustain this amazing growth, we have clearly outlined the strategy for the next 5 years, driving mass adoption of web3 through Ethereum scaling. Our funds are still sufficient, with a balance of over $250 million and over 1.9 billion MATIC tokens."

Since January 2022, Polygon has also promoted its "burning" of accumulated MATIC tokens as fees, indicating a reduction in the total supply of MATIC. For example, in January 2022, Polygon emphasized the protocol upgrade in a blog post titled "Burn, MATIC, Burn!" which made burning possible. In another blog post published on its website during the same period, Polygon explained, "Polygon's MATIC supply is fixed at 10 billion, so any reduction in the available token count will have a deflationary effect." As of March 28, 2023, Polygon has burned approximately 9.6 million MATIC tokens. The marketing of the MATIC burning mechanism in the Polygon network creates a reasonable expectation for investors that purchasing MATIC has potential profits, as there is a built-in mechanism to reduce supply, thereby increasing the price of MATIC.

B. MANA

"MANA" is a digital token minted by Decentraland. Decentraland is a virtual reality platform developed in June 2015, but was not open to the public until February 2020. Decentraland was launched by an entity called Metaverse Holdings through a core development team, including members Ariel Meilich, Esteban Ordano, Manual Araoz, and Yemel Jardi. Decentraland operates on the Ethereum blockchain. According to information on Decentraland's website, Decentraland is a 3D virtual reality platform where users can create, experience, and monetize their content and applications.

MANA is the encrypted asset involved in all exchanges within the Decentraland virtual reality ecosystem. On August 18, 2017, Decentraland held its initial token offering (ICO), during which MANA was exchanged for ETH, raising approximately $24.1 million. Currently, the total supply of MANA tokens is approximately 2.19 billion.

Decentraland offered discounted prices for early contributors to purchase MANA.

Since its initial issuance, MANA has been issued and sold as an investment contract and is therefore considered a security.

The price of all MANA tokens will rise or fall together.

Since October 2020, MANA has been available for trading through brokerage services provided by MetaMask Swaps.

Information publicly disseminated by Decentraland would lead investors (including those who purchased MANA since October 2020) to view MANA as an investment. Specifically, MANA holders would reasonably expect that through the efforts of the Decentraland team, there will be growth and development, which will in turn increase demand for and value of MANA.

Investor funds raised during the MANA ICO were earmarked for marketing, operational expenses, and completion of the Decentraland platform. For example, on July 5, 2017, a few weeks before the MANA ICO, Jardi published a blog post detailing the expected use of token sale proceeds by Decentraland, as shown below:

This blog post further explained that the "primary task" of the revenue was to develop a virtual world, and even after the creation of Decentraland, "development budgets will be focused on continually improving the user experience in the world browser."

In fact, in another blog post, Meilich explained that after the ICO, Decentraland would implement a "continuous token model," where the supply of MANA would increase by 8% in the first year and then grow at a lower rate in the following years to allow Decentraland to "regularly expand to accommodate new users… proceeds from the sale of tokens through the continuous token model will provide long-term funding for Decentraland, keeping it consistent with the network's prosperity."

In April 2020, the Decentraland team announced the establishment of the Decentraland Foundation, which currently holds the intellectual property of products and services offered on the Decentraland platform (including virtual environments and tools). Meilich publicly stated that the initial allocation of MANA tokens issued during the ICO was as follows: 20% to the founding team, advisors, and early contributors; 20% to the foundation; 40% open to the public for purchase; and 20% reserved to "incentivize early users, developers, and partners looking to build within Decentraland."

As Meilich explained in his public blog post, "To incentivize the creation of value within Decentraland, additional tokens will be allocated for development teams, organizations, and reserves to accelerate community and partner participation."

For example, Decentraland publicly released a whitepaper ("Decentraland Whitepaper") describing the architecture to be built in the virtual reality platform and the steps supporting Decentraland's growth. The whitepaper further explicitly states that the platform's development is still in its early stages and lists some "challenges" that need to be addressed during development to ensure the platform's success.

According to Meilich, even after the ICO, Decentraland is preparing a land allocation policy and a method for groups to purchase larger contiguous parcels of land. Since the ICO, Decentraland has developed tools used on its platform (such as "Marketplace" and "Builder"). In a public blog post published on March 19, 2018, the Decentraland team described "Marketplace" as "the first tool in a series."

Furthermore, the Decentraland whitepaper explains how the foundation will "foster network development," stating that it will "host creation competitions for art, games, applications, and experiences, with prizes depending on reaching a series of milestones. Meanwhile, new users will be allocated allowances to enable them to participate in economic activities immediately within the network." The Decentraland whitepaper further claims, "These financial incentive measures will help the network's utility value grow rapidly until it can independently attract users and developers."

The Decentraland whitepaper and website also promote how the protocol will "burn" MANA tokens when used within the Decentraland ecosystem.

The Decentraland whitepaper is still available on the Decentraland website.

C. CHZ

CHZ is a token on the Ethereum blockchain, promoted as the "native digital token of the Chiliz sports and entertainment ecosystem, currently powering Socios," a sports fan engagement platform built on the Chiliz blockchain. The Chiliz blockchain was launched in early 2018 by protocol founder and current CEO Alexandre Dreyfus, operated by a Malta entity named HX Entertainment Ltd. The Chiliz whitepaper describes the Chiliz protocol as a platform where "fans can vote, connect, and help fund new sports and esports entities directly within their favorite sports organizations."

Reportedly, the CHZ token allows "fans to acquire branded fan tokens from any team or organization working with the Socios platform and exercise their voting rights as fan influencers." For example, holders of "Fan Tokens" acquired through purchasing CHZ tokens can participate in voting to influence team decisions, including choosing player warm-up kits and team flag designs.

According to the Chiliz whitepaper from November 2018, it raised approximately $66 million in the second quarter of 2018 through a "Chiliz token generation event," with around 3 billion CHZ tokens "executed through private sales." The CHZ tokens were initially minted in 2018, with a maximum supply of 8,888,888,888 tokens. However, it wasn't until the second quarter of 2019 that Chiliz offered "Fan Tokens" available for purchase using CHZ on the Socios platform.

Since at least December 2020, CHZ has been tradable through the MetaMask Swaps platform.

Information released by the Chiliz team, including statements during the availability of CHZ for trading on MetaMask Swaps, from the initial private sale of CHZ tokens in 2018 to public statements in 2023, would lead CHZ holders to reasonably view CHZ as an investment and expect to profit from the team's efforts to develop, expand, and grow the platform, thereby increasing the demand and value of CHZ.

The Chiliz website introduces the Chiliz team, which "comprises over 350 professionals from 27 different countries and is constantly growing." The Chiliz team operates the Chiliz protocol and Socios.

In fact, the Chiliz whitepaper and other public statements also introduce several members of the Chiliz leadership team, publicly disclosing the resumes of these "leaders" or "advisory" team members and their past successful entrepreneurial experiences. The Chiliz website claims that the Chiliz team is "building web3 infrastructure for sports and entertainment."

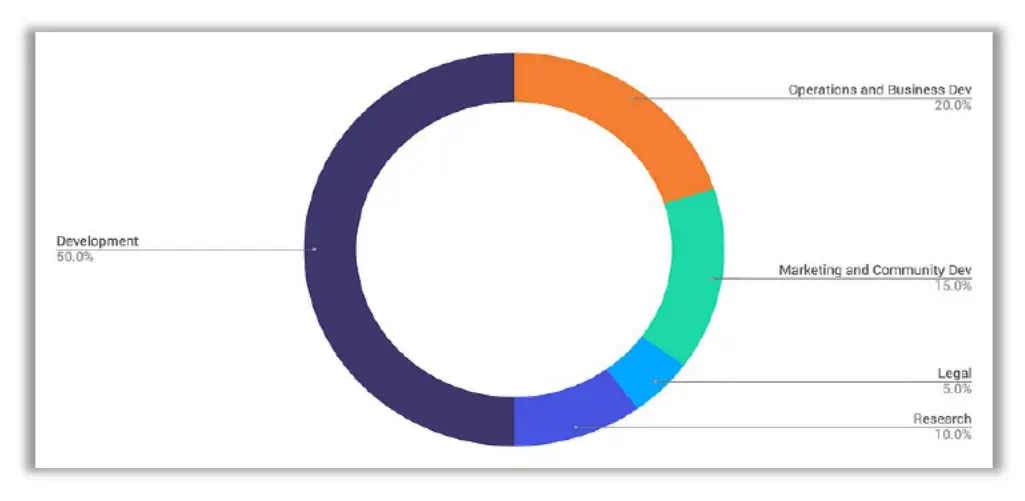

The Chiliz team also publicly states that they will use the proceeds from the sale of CHZ to fund the development, marketing, operational, and growth of the Chiliz protocol, thereby increasing the demand associated with the protocol for CHZ. For example, the whitepaper explains that funds raised through token sales will be allocated as follows: 58% for operational expenses (most of the funds will be passed from the issuer to subsidiaries for developing the Socios platform, ensuring partnerships, and realizing the platform's digital infrastructure); 20% for user acquisition (funds will be used to acquire new users for the Socios platform and increase engagement in its voting functionality); 10% for corporate restructuring; 5% for security and legal; and 7% for ecosystem support.

Additionally, 5% and 3% of the allocated CHZ token supply are distributed to the Chiliz team and advisory committee, respectively, both responsible for the creation and development of the platform, aligning the fate of the management with that of CHZ investors.

The CHZ whitepaper further clarifies the alignment of interests between the founders and investors, warning that "if the value of BTC, ETH, or Chiliz fluctuates, the company may not be able to fund development to the extent necessary, or may not be able to develop or maintain the Socios platform as expected."

The Chiliz team also frequently promotes the growth potential of the sports and esports industry and aims to monetize it through the efforts of the Chiliz team to expand its platform. For example, the whitepaper emphasizes the scale of the gaming industry and the potential revenue of esports, as well as using CHZ to drive and monetize traditional sports fan engagement. Regarding the "token generation event" in June 2018, the whitepaper notes: "We are no longer pursuing fundraising measures, but are focused on leveraging accumulated resources to realize the vision of Chiliz/Socios." The whitepaper continues: "Once the infrastructure is established, Chiliz and its supported Socios platform will benchmark football and expand our tokenized fan voting model to other sports projects to cater to the global market, where different competitive verticals dominate—cricket in the Indian market, baseball in Japan, and more."

The Chiliz team and its executives' public statements indicate that the CHZ token is primarily used to purchase "Fan Tokens" on Socios, and the demand and price of the CHZ token directly depend on the demand for Socios fan tokens and their benefits.

The Chiliz team also made other public statements, emphasizing the economic reality of CHZ's operation within the Chiliz blockchain design— as Chiliz expands its platform through partnerships with more teams, offering attractive opportunities for token holders, the value of the corresponding "Fan Tokens" will increase, thereby increasing the value of CHZ.

For example, the FAQ section on the Chiliz website (publicly available at least from December 2021 to December 2022) states: "As more esports teams, leagues, and game titles join the platform, more fans want voting rights, and the demand for Chiliz tokens continues to grow."

The CEO of Chiliz expressed the same view in other public statements. In February 2020, he stated: "Thousands of regular football fans have already started using cryptocurrency, buying $CHZ to purchase Fan Tokens, and as we continue to add more partners, expand our reach, and enhance our brand, we expect more people to do the same in the future." In March 2021, he tweeted: "Monthly active users (MAU) of the Socios app, powered by $CHZ. You can see the explosive growth in demand for $CHZ (exchanges, Etherscan wallets, etc.). Everything is correlated. We are building a product for mainstream consumers, powered by the Chiliz blockchain." In February 2023, he tweeted: "I'm biased, but I'm very confident that the Chiliz ecosystem will bring a lot of value to fans, sports assets, and innovation."

The Chiliz team also promotes the secondary trading of CHZ by offering tokens on cryptocurrency trading platforms. For example, an early version of the whitepaper emphasized the "ongoing discussions" to offer CHZ on Asian trading platforms, and the Chiliz website has a "listing content and FAQ" document reflecting the proposal to offer CHZ on the Binance platform.

The Chiliz team also informed investors that they plan to support the price of CHZ by "burning" CHZ tokens as a mechanism to reduce its total supply. For example, in 2020, the Chiliz team announced through its "Fan Token" exchange that they would burn 20% of net trading fee revenue, 10% of "Fan Token" sales revenue, and 20% of NFT and collectibles net proceeds. Like other security tokens of cryptocurrencies described in this article, this market-driven CHZ burning would lead investors to reasonably believe that purchasing CHZ has profit potential.

D. SAND

"SAND" is a native token of The Sandbox platform created on the Ethereum blockchain. The Sandbox was initially a virtual gaming platform first released by Pixowl, Inc. ("Pixowl") in 2012, initially as a downloadable game on mobile phones. Pixowl, headquartered in San Francisco, was founded by Arthur Madrid and Sebastien Borget in 2011. In 2018, Hong Kong-based Animoca Brands, Inc. ("Animoca") acquired Pixowl and announced plans to build a new 3D version of The Sandbox using blockchain technology. After acquiring Pixowl, the intellectual property of The Sandbox, along with other assets of Pixowl, was transferred to Animoca's wholly-owned subsidiary TSB Gaming Ltd ("TSB"). Madrid is the CEO of TSB, and Borget is the COO.

According to The Sandbox website, SAND is the token necessary for accessing the Sandbox platform, participating in platform governance, and earning rewards through the platform's staking program.

Before minting SAND in July 2019, around May 23, 2019, Animoca raised approximately $2.5 million in cash and crypto assets through TSB by issuing Simple Agreements for Future Equity ("SAFEs") and SAND tokens to "fund the development of the upcoming blockchain version of The Sandbox." According to a press release from Animoca on May 23, 2019, most investors allocated their investments to the purchase of SAND tokens and future TSB equity obtained through the SAFE agreement (amounting to $2 million), while some investors specifically allocated their investments to SAND tokens ($500,000). The funding round was led by Hashed, with approximately $1 million, and some other crypto venture capitalists also participated.

Around July 2019, TSB minted a total of 3 billion SAND on the Ethereum blockchain and raised $3 million through private sales and an IEO on Binance.

Since October 2020, SAND has been tradable through the MetaMask Swaps platform.

Publicly disseminated information by TSB has led SAND holders (including those who purchased SAND since May 2022) to reasonably view SAND as an investment and expect to profit from TSB's efforts to expand the Sandbox protocol, thereby increasing the demand and value of SAND.

In a blog post announcing the "exchange listing," The Sandbox promoted its "listing" and the liquidity of the SAND token on the secondary market. For example, in a Medium blog post on September 21, 2021, The Sandbox stated that "$SAND has been listed on over 60 cryptocurrency exchanges globally, including those ranked in the top ten by market capitalization."

Additionally, The Sandbox stated that it would pool the proceeds from private token sales and the IEO for platform development and promotion. For example, a press release on May 23, 2019, stated: "The funds raised through this transaction will be used to expand The Sandbox game platform's development team and infrastructure, support marketing efforts through acquiring creators and intellectual property licenses, and provide for security, legal, and compliance expenses, as well as general and administrative expenses." The Sandbox whitepaper similarly describes the same use of the $3 million raised through the IEO.

According to The Sandbox whitepaper, out of the initially minted 3 billion SAND tokens, 19% will be allocated to The Sandbox founders and team, and 25.8% will be allocated to company reserves.

The Sandbox stated in a Medium blog post on July 25, 2019, that "an interesting feature of the SAND token is that, due to its scarcity, its value may increase over time. The supply of SAND will be limited to 3 billion."

TSB publicly stated that it would take measures to manage the SAND market, including controlling the supply of SAND as mentioned in The Sandbox whitepaper, and implementing a "controlled supply mechanism, such as purchasing SAND from multiple exchanges," and that "while the total supply of SAND is fixed, the initially provided amount of SAND will create a scarcity effect, reducing the per capita SAND supply and thereby promoting demand."

On many occasions, Animoca described the success and future development of The Sandbox, promoting the backgrounds of Pixowl, TSB, and core members of The Sandbox (including Madrid and Borget):

After acquiring Pixowl, Animoca's co-founder and director Yat Siu stated in a press release on August 27, 2018, "The experienced developers of Pixowl will significantly enhance our development capabilities. Its founders are respected veterans of the gaming industry, having developed games worth millions of dollars. We believe the blockchain version of 'The Sandbox' has tremendous potential… We look forward to leveraging the many growth opportunities brought by this acquisition."

Madrid also commented in a press release from 2018, "Animoca Brands is a perfect fit for Pixowl, and we are excited to add our brand relationships to its portfolio while accelerating the growth of our key intellectual property 'The Sandbox'…"

A press release from 2018 also promoted "Ed Fries, the founder of Microsoft Game Studios and co-founder of the Xbox project, as a special advisor to Pixowl, the original game developer of 'The Sandbox,' and will continue to serve on the advisory team."

The Sandbox whitepaper further stated, "We have a strong product roadmap and a top-tier team to execute a powerful vision, building a unique virtual world gaming platform where players can create, own, and monetize their gaming experiences, and promoting blockchain as the dominant technology in the gaming industry."

The Sandbox whitepaper described the role of the "Sandbox Foundation" in supporting the Sandbox ecosystem by providing funding to incentivize high-quality content and game production on the platform. It further stated, "The overall valuation of the metaverse grows through the valuation of all games funded by the foundation, creating a virtuous cycle that allows for the funding of larger games." The Sandbox's Gitbook also indicated that the Sandbox Foundation supports competitions and cross-game token earning to encourage wider adoption of SAND; supports marketing activities to promote awareness of NFTs, the metaverse, and SAND adoption, including joint marketing with exchanges and influencers.

E. LUNA

LUNA is the native token of the Terra blockchain, created by Terraform and its founder Do Kwon. The Terra blockchain was launched in April 2019, creating 10 billion LUNA tokens.

Throughout all relevant periods, Terraform and Kwon retained hundreds of millions of LUNA tokens.

There is a "bridge" called "Shuttle" that allows LUNA holders to create a "wrapped" version of LUNA ("wLUNA"). wLUNA tokens are identical to LUNA in all significant aspects, except that they can be traded on the Ethereum blockchain instead of the Terra blockchain.

Since their issuance, until May 2022, LUNA and wLUNA have been offered and sold as investment contracts and are therefore considered securities.

Investors can acquire LUNA and wLUNA by paying fiat currency or crypto assets.

The price of LUNA and wLUNA is the same, and they can be exchanged one-to-one. Any wLUNA holder has the right to convert wLUNA to LUNA at any time.

Therefore, investors in LUNA and wLUNA face the same risks of price appreciation and depreciation, meaning if one investor profits, all investors will profit proportionally to the total amount of LUNA or wLUNA they hold.

LUNA and wLUNA began trading through MetaMask Swaps in January 2021.

Terraform has repeatedly disseminated information about LUNA or wLUNA and the efforts planned by Terraform to make these assets more valuable, leading investors (including those who purchased LUNA or wLUNA since January 7, 2021) to view LUNA and wLUNA as an investment in Terraform's efforts. Specifically, holders of LUNA and wLUNA would reasonably expect to profit from Terraform's efforts to expand the Terra blockchain, as this growth would in turn increase the demand and value of LUNA and wLUNA.

Terraform and Kwon have informed investors that Terraform will use the proceeds from LUNA sales to fund operations and help build and expand the Terra ecosystem. For example, in a token sale agreement in July 2018, Terraform told potential investors that the financing was "to build and operate" the system developed by Terraform.

In a public interview in 2021, Terraform's business development lead stated that LUNA is "our 'equity' in the company."

On April 7, 2021, Kwon posted on X, stating, "Long-term, $Luna value is viable - growing with the ecosystem."

In a video presentation in June 2021, Terraform's special projects director also stated, "Owning LUNA is essentially owning a stake in the network and betting that its value will continue to grow over time."

In marketing materials, Terraform further promotes the expertise of its team, claiming that Terraform is led by "serial entrepreneurs" and is a team with "deep relevant expertise."

Based on these facts and other factors, on December 28, 2023, the Southern District of New York Federal Court ruled that both LUNA and wLUNA are offered and sold as investment contracts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。