Author: Jader

1. Who is Making Money in This Round?

Retail Investors Awaken to "Anti-VC, Embrace Meme"

The narrative of this bull market is mainly macroscopic, with no innovation or breakthroughs overall. Although the price of Bitcoin has surged from $20,000 to $70,000 (currently fluctuating around $50,000 to $60,000), the altcoin season has not arrived, leaving the entire market still in distress.

Retail investors have sparked an "anti-VC" trend, believing that VCs and projects collude to inflate project valuations, and then "peak at token issuance," followed by a waterfall-like decline, with retail investors left to pick up the pieces.

In order to resist "VC coins," many Key Opinion Leaders (KOLs) have started to speak out against VCs and embrace more equitable meme coins (the actual adjustment of positions still needs further investigation).

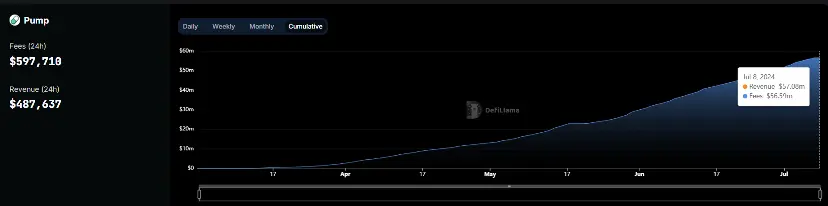

Platforms for issuing meme coins like Pump.fun have already generated revenues exceeding $57 million, surpassing stablecoins like $Pepe in the top 30 by market capitalization. Other non-meme coins like $pizza and $Wif have also experienced significant fluctuations.

VC's High Return on the Surface Forces OTC Token Sales, Leaving Investors Trapped

In reality, VCs are also a vulnerable group. Many projects unlock 2%-20% of their tokens during TGE (Token Generation Event), followed by monthly linear releases over a 2-year period. Many VCs who invested in projects during the pre-listing phase found that after the token issuance, the price could not be sustained, leading to a significant portion of the unlocked tokens becoming worthless. These tokens are then sold at a discount over-the-counter (OTC). While it may seem like a 100x case at the peak of token issuance, it is only useful when VCs report their net asset value. Ultimately, the probability is high that they will only recover their costs or even incur losses. Interestingly, some profitable institutions hedge their losses by having their subsidiaries invest in Bitcoin and Nvidia to make money.

The Market's False Prosperity Requires Calm Reflection

Rather than being "anti-VC," it's more accurate to say that retail investors are "anti-not making money," especially for those who entered the market during the previous bull market's altcoin season. The delayed arrival of the altcoin season in this round has left many people anxious, as they were counting on it to turn their limited cash into wealth.

Quoting a line from a tweet by Chen Jian: "I really think that the current market is a very distorted false prosperity. On one hand, everyone is resisting VC coins, while on the other hand, many VC friends I've encountered are complaining all the time about not making money. Project teams and investors are forced to sell tokens at a discount due to lock-ups (I've even seen them being sold at 90% off) and trying to find someone to take over. In a market without new narratives, this bull market is entirely driven by the regulatory benefits of Bitcoin spot ETFs."

Retail investors and VCs in Web3 should calm down and reflect on their survival strategies.

From the perspective of retail investors, meme coins provide emotional value, allowing users to express their emotions in digital form. However, upon closer examination, meme coins have little to no practical value. They are most likely manipulated by a few KOLs and market makers, leading to a situation where investors end up with nothing. If investment returns are ultimately converted into annualized returns, 5-year returns, or 10-year returns, a case of 100x gains combined with numerous instances of losses and contract liquidations will likely result in a balanced profit and loss, with a high probability of not outperforming Bitcoin or Ethereum.

Some early adopters in the crypto market, such as veteran miners, Ethereum enthusiasts, and DeFi elites, have constructed their portfolios with 70% to 80% consisting of "Bitcoin + Ethereum + blue-chip DeFi + tier 2 public chains like Solana." They have steadfastly invested regardless of bull or bear markets and have earned stable and substantial returns during the transition from the bear to bull market in this round.

From the perspective of VCs and project teams, it is necessary to reconsider the valuation logic.

While token issuance and stock listing mechanisms share many similarities, the stages at which the two projects are situated are different. Traditional company IPOs occur when a company is mature and stable, whereas Web3 projects often issue tokens when there are signs of rapid development or potential, leading to high expectations for the future. This has resulted in overvaluation without substance and ecosystem, which has extended to VCs selling off tokens. The motivation for VCs to sell off tokens conflicts with the growth of project teams. VCs should accompany project teams for long-term growth, and both parties should benefit from the rise in token prices.

VCs and institutions should have their own advanced understanding of the market. When a project team reaches the token issuance stage, both parties should endure the current situation of low valuation and low liquidity, and realize their understanding over time, ensuring that the total value of their tokens remains unchanged while offloading tokens. This maintains the relationship with the project team, just like how a16z is still holding onto Uni, growing together with the project.

Regarding lock-up periods, I have always felt that they are somewhat unreasonable. Lock-up periods are primarily intended to stabilize the market, prevent significant price fluctuations, protect the interests of ordinary investors, and incentivize teams and liquidity providers to participate in the project ecosystem for the long term. After traditional financial IPOs or fund raising, there is typically a lock-up period of one month to six months.

The lock-up period in Web3 is essentially aimed at preventing institutions from selling off tokens. However, even without institutions selling off tokens, there are means such as launch pads, airdrops, ICOs, and IEOs that allow for obtaining tokens in advance. This creates selling pressure in the market at the moment of token issuance. As an investment party, if one is sufficiently bullish about the project team, one should even consider a two-tiered approach, holding onto tokens (passively locked up) while using low prices to absorb chips from the market, rather than rushing to sell off one's tokens like retail investors, as if they were holding a hot potato. Many VCs lack post-investment management and invest solely for financial returns, which is no different from retail investors who have insider information and can obtain chips early. VCs should have a different perspective from retail investors when evaluating projects. It is unreasonable for VCs to run alongside retail investors, and it is unacceptable! Can we prevent retail investors from developing a sense of disgust?

Project teams do not need to rush to spend large amounts of capital on early-stage marketing, market-making, and operations, or to continuously consume capital to cater to the market's preferences without a clear understanding of what they want to do, which is the easiest way to fail. Instead, they should return to the product itself to explore sustainable business models. For example, the DeFi project Compound initially operated as a point-to-pool lending platform, but with its V3 version and future plans, it is evident that it prioritizes absolute security over liquidity. As a result, it has reverted lending from point-to-pool to peer-to-peer, with single-asset collateral and collateral asset isolation.

It is important to remember that the crypto market's pie is limited, and most of the people who make money in the industry are shrewd, cold-blooded, and ruthless. Those who truly make money will not boast about it on the internet.

2. Is DeFi a Panacea or a Poison?

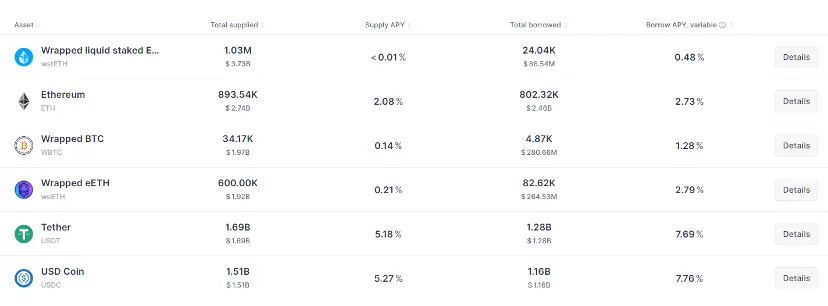

In such a mixed market, what should retail investors do? If retail investors treat Web3 as a financial product rather than an emotional outlet or a casino, then DeFi might be a good choice. As a financial product, it is relatively easy to achieve a 5% APR with little risk, for example, by providing liquidity on Aave, without even considering leveraging. It is also very possible to achieve an APR of 10%-20% with a slightly higher risk. This annualized return may be more stable than retail investors speculating on altcoins for a year or buying VC coins, especially in the current phase where the growth of major cryptocurrencies may not experience significant increases in the short term.

Since its rise in 2019, DeFi has experienced explosive growth, expanding its applications from initial lending and stablecoins to insurance, oracles, and other aspects of traditional finance, marking the quiet arrival of the era of financial empowerment through blockchain technology.

Since the DeFi Summer that began in mid-2020, DeFi, as the most important innovation, has performed mediocrely in this bull market, with little news to speak of. Apart from the major liquidation of Curve's founder, there haven't been many other extraordinary events.

The traditional project Pendle stands out in this round of DeFi bull market, mainly due to its mechanism of leveraging points, catching up with the narrative of points in the Eigenlayer and other LRT tracks. This has been a poison, creating the illusion that DeFi should also become a gold shovel, leading to excessively high expectations. The original intention of Pendle may have been to provide users with financial products similar to fixed income and zero-coupon bonds, but everyone's attention was drawn to the highly tempting leveraged points, and the PT had little demand. Pendle even set up its own Points Market, and the token price soared at that time.

However, with a large number of assets in LRT pools expiring, and points becoming a game for big capital whales, the interaction returns for retail investors were minimal, and Pendle's TVL and token price both plummeted. One can't help but marvel at how Pendle's token price resembles a roller coaster.

According to DeFiLlama's data, the Total Value Locked (TVL) of the yield trading protocol Pendle plummeted by 45% in just one week, dropping from $6.2 billion to $3.5 billion.

This sharp decline occurred in several markets with renewed liquidity, including Ethereum. EtherFi's eETH, Renzo's ezETH, Puffer's pufETH, Kelp's rsETH, and Swell's rswETH all matured on June 27. These markets all reached maturity, and users redeemed their primary investments, leading to a massive capital run. Pendle's CEO, TN Lee, explained that a large number of LRT pools matured on June 27, totaling nearly $4 billion, with one individual redeeming $293 million worth of tokens.

After being continuously enticed by the project team with points, users finally grew tired of it.

3. Innovations in DeFi This Round

Despite the significant drop in TVL after the LRT craze, Pendle actually provided a new design concept, creating a new asset category.

Similar to Derebit, which originally did not have options in the crypto market, Derebit created an options system and platform, occupying about 90% of the market share in the BTC and ETH options market, becoming a giant like mainstream exchanges.

Pendle, on the other hand, incorporated interest rate swaps from the financial derivatives market. PT allows users to obtain stable returns, while YT allows users to reach higher ceilings, allowing users to adjust according to their needs.

Interest Rate Swap in traditional finance is a financial derivative involving two parties exchanging a series of interest payments, usually involving an exchange of floating rate payments with fixed rate payments. Interest rate swaps allow companies and financial institutions to manage and hedge interest rate risks. For example, a company can use an interest rate swap to convert its floating rate loan into a fixed rate loan, avoiding the uncertainty brought about by interest rate fluctuations.

One issue with Pendle is that users have little interest in PT, which is similar to zero-coupon securities and fixed income products. This is not a problem with Pendle, but rather a cultural issue within the entire Web3 community, which does not appreciate stability. However, this does not prevent us from envisioning that in the future, bonus points, meme coins, and other assets could potentially become part of an interest rate trading platform, providing incentives for new projects like Pendle.

Ethena is also a pleasant surprise in this bull market, introducing "options strategies" into DeFi. Ethena is a structured note that holds a long position in stETH (indirectly holding a long position in ETH) and shorts ETH through perpetual contracts on major centralized exchanges to hedge the risk of the long position. This hedging strategy stabilizes the price of Ethena (in USD terms).

For users, this means that they can profit from three aspects when the price of ETH rises: stETH staking rewards, profits from the rise in ETH price, and fee income from shorting perpetual contracts. However, in the event of a decline in the price of ETH, overall profits may decrease, or even become negative. To address this, the Ethena team has purchased insurance to deal with extreme situations. Nevertheless, there is still a risk in the event of a significant decline in ETH—the cost of shorting may sharply increase, or there may not be enough counterparty liquidity, leading to a death spiral.

The interest rate separation + interest rate swap is a very attractive trading market. I am constantly looking for new projects related to interest rate separation or interest rate swaps. In this process, I came across a very interesting innovative project called Doubler.

The airdrop activity for Doubler started a few days ago, and there have been many discussions about interaction methods and strategies. Here, I will mainly discuss the product itself.

Doubler's design concept is somewhat similar to Pendle's. It divides assets into large and small proportions, with the large proportion designed for low-risk, low-return gameplay (similar to Pendle's PT, which is like zero-coupon bonds and fixed income products), and the small proportion designed for high-risk, high-return gameplay (similar to Pendle's YT, which is like natural options contracts). The large proportion's existence helps to share the risk of the small proportion. The ultimate goal is to achieve the effect of "contract returns, spot risks." The core idea is that each pool is a group of people bottom-fishing together, lowering the average asset price, huddling together for warmth, waiting for a rebound, and then finding the appropriate profit-sharing method for each version based on different situations.

Doubler Lite is an asset yield separation protocol that obtains external returns through a generalized Martingale strategy and distributes the protocol's profits and losses based on the tokenization of yield rights. Doubler Lite aims to provide risk hedging and profit optimization for assets through innovative solutions and to provide alternative trading assets based on yield rights for secondary traders.

The Martingale strategy continuously buys low-cost assets when the price falls, which is a measure where users in the pool collectively bear the risk, and when the price rebounds, the pool makes a profit.

For example, User A buys 1 ETH and deposits it into the pool when the price is $3000. When the price of ETH drops to $2000, User B buys 2 ETH and deposits it. At this point, the pool has 3 ETH, with a total value of $7000 and an average cost of $2333. When the price of ETH rises above $2334, the pool starts to make a profit.

Similar to Pendle, in Doubler Lite, the protocol separates the ownership of cost and the ownership of returns for each asset invested in the pool into Cost Tokens and Earning Tokens. The Token representing the ownership of cost is the C Token, denominated in USD, while the Token representing earnings is the 10x Token. This reminds us of Pendle's PT and YT.

The game points for both are also similar, with Pendle's YT and Doubler's E Token + 10x Token. The pool shares profits, and risk-averse users can share profits with risk-loving users in advance at a certain concession to pursue higher returns.

However, unlike Pendle, Doubler's underlying assets allow users to share costs together, binding the operations of users. Different from the starting point of the Martingale strategy, one can feel that Doubler hopes everyone can make money together, stand on a united front, and whether retail or whale, PoS or PoW, risk lover or risk averse, everyone can participate, collectively facing risks and sharing returns, rather than completely handing over the power of returns to the project team. However, the product is still in its early stages, and as long as there are various strategies for arbitrage, it is inevitable that large profits will be distributed to a few, rather than being distributed fairly. I believe there will be more products in the future that will move towards fair distribution and distribution according to labor.

Compared to high-risk and high-volatility futures products, Doubler is more like an options product, which, when used well, can enjoy "spot risks, contract returns."

Currently, issuing Ethereum pools on Arb, in the context of Ethereum spot ETF + US election + multiple rate cuts, I believe it is worth participating for many bullish Ethereum users. Holding E tokens and waiting for a big rise in Ethereum is also a good opportunity to provide a relatively safe leverage for retail investors with smaller capital.

Of course, every DeFi product also has to face risks.

Like Pendle and Ethena, Doubler is a product with strong cyclical characteristics. Everyone bears the bear market together and makes money together in the bull market. If a long-term bull market arrives, the product will become somewhat redundant. Just like Pendle, which benefited from the points craze, after the LRT expiration, both TVL and token prices were halved.

The cyclical nature of the product may be addressed by introducing "neutral assets + long-tail assets" pools in the bull market, and focusing on mainstream assets in the bear market.

Perhaps the best DeFi products still need to adhere to the principle of simplicity. For example, Uni's LP allows users to adjust the range themselves, Compound and Aave involve the interest on cTokens and aTokens, one representing the increase in value and the other representing an increase in quantity, and then Lido and Rocket Pool are even more straightforward. These are all very easy-to-understand products with very simple user operations. Pendle became popular mainly because of the extra income brought by YT. After the LRT staking expired, the TVL plummeted directly, and users didn't care about the value of PT.

As a product divided into 3 parts (C, E, 10x), Doubler is still too complex. If it wants to truly attract users, it either needs to provide stable and high returns, or extremely high returns.

At first glance, it still seems to be a very complex product, which is also a problem with many DeFi derivatives products now. While innovating, they inevitably increase the difficulty of use and gameplay, and each increase in difficulty means a decrease in the number of users who can access it. 1inch, as an aggregator, is a positive example, aggregating and simplifying complex lending and swapping, providing users with a better experience. Ethena, as an embedded protocol, can also develop in the direction of fair profit sharing, allowing users to not have to consider the underlying logic.

4. Summary and Future Prospects

I suddenly thought of Blast, where the returns for interactive users and large staking whales were inverted, and those who only staked without interacting did not have much profit. Although it was heavily criticized by many big players, it is desirable to return to the era where users with different capital levels have their own ways of making money, and where there is a variety of options.

CZ once said, "Decentralization is not a goal; it’s a means to an end. The end goal is more freedom, more choices, more resilience, and more ways to achieve fairness and equality."

It feels like DeFi is one of the few tracks that firmly adhere to the concept of decentralization, bringing more freedom to users, and it is a very worthwhile track to be bullish on. Perhaps the new financial assets generated through DeFi will be the beginning of the next multi-billion-dollar track.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。