Author: Mary Liu, BitpushNews

On Thursday, the highly anticipated Consumer Price Index (CPI) report in the United States exceeded expectations, with the inflation rate in June dropping to its lowest level in over three years. The CPI rose by 3% year-on-year, better than the expected 3.1%, while the core CPI fell to 3.3% year-on-year, lower than the expected 3.4%.

The CPI data suggests that inflation is continuing to cool, strengthening investors' confidence in the Federal Reserve's potential interest rate cut later this year. CME Fed Watch data shows that a rate cut in September is almost a certainty, with an 84.6% probability of a 25 basis point cut and an 8.1% probability of a cumulative 50 basis point cut.

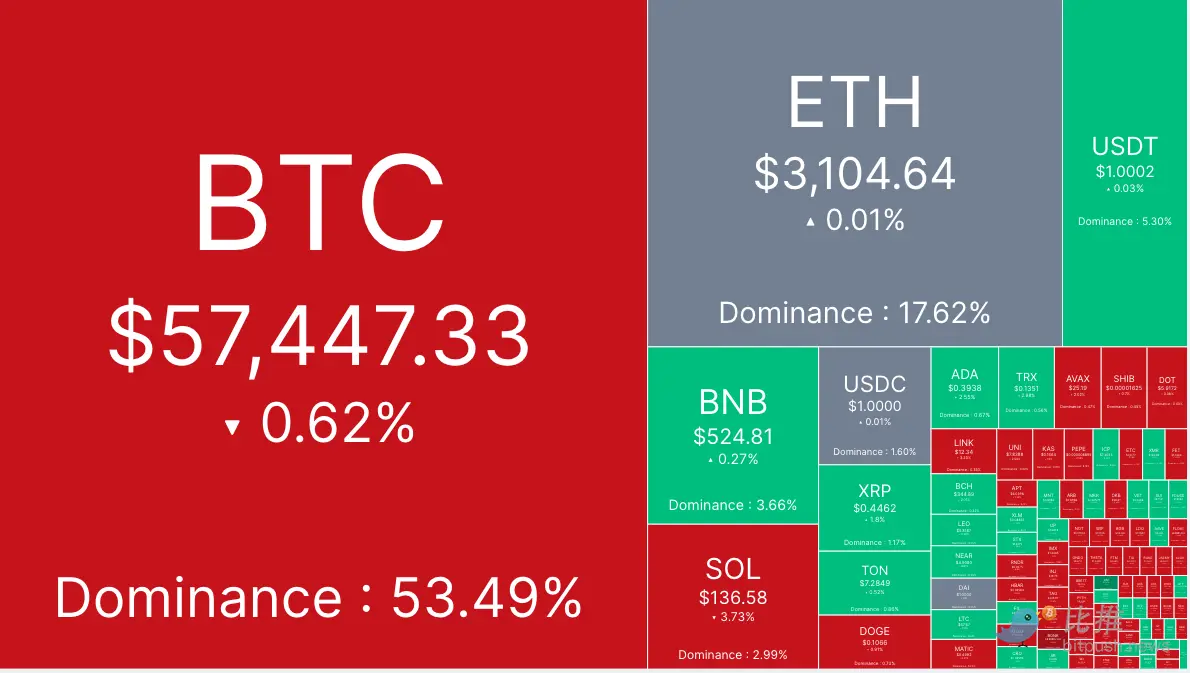

BTC experienced a "roller coaster" market. According to Bitpush data, after the CPI release, Bitcoin reached a high near $59,540, then experienced significant selling pressure, dropping to a low of $57,200 in the afternoon. As of the time of writing, the trading price was $57,447, with a 0.5% decrease in the past 24 hours.

The altcoin market saw mixed performance, with the top 200 altcoins experiencing both gains and losses. MANTRA (OM) performed the best, with a 12.5% increase, followed by Galxe (GAL) with a 9.4% increase, and Stacks (STX) with a 7.4% increase. BinaryX (BNX) experienced the largest decrease, falling by 27.5%, followed by Bonk (BONK) with an 8.2% decrease, and Render (RNDR) with a 6.9% decrease.

The current total market capitalization of cryptocurrencies is $2.13 trillion, with Bitcoin's dominance at 53.49%.

In the US stock market, large tech stocks such as Nvidia (NVDA), Microsoft (MSFT), and Meta (META) all experienced declines, while Tesla (TSLA) ended its 11-day streak of gains with a decrease of over 7.5%. As of the day's close, the S&P 500 and Nasdaq indices fell by 0.88% and 1.95% respectively, while the Dow Jones index rose by 0.08%.

German Government's $3 Billion Bitcoin Sell-off Frenzy Set to End

Blockchain data from Arkham Intelligence shows that Bitcoin wallets associated with the German government transferred a total of 10,567 BTC, worth over $600 million, to cryptocurrency exchanges Bitstamp, Coinbase, Kraken, as well as other service providers such as Flow Traders and Cumberland DRW.

After today's transactions, wallets related to the German authorities hold only 4,925 BTC, valued at $285 million at current prices, accounting for just 9.9% of the Bitcoin originally seized from Movie2k.

This suggests that at the current rate, the German Bitcoin sell-off may come to an end as early as Friday or early next week, as the wallets have sold approximately 35,000 BTC so far this week.

This could help alleviate market concerns, as traders have been closely monitoring on-chain movements of potential large sellers in the market in recent weeks, linking the recent downturn to selling pressure.

JPMorgan: Market Expected to Rebound from August

Despite various factors making it difficult for Bitcoin to gain upward momentum, most analysts, including JPMorgan, believe that a turnaround is on the horizon.

According to a research report released by JPMorgan, the liquidation in the crypto market should start to fade in July, with the market expected to rebound from August.

While market sentiment is expected to improve, the bank has revised its net inflow forecast for cryptocurrencies from $12 billion to $8 billion for the year, expressing doubts about whether the previously estimated $12 billion level can be sustained for the remainder of the year, given Bitcoin's high price relative to its production cost.

Analysts led by Nikolaos Panigirtzoglou stated, "The expected decrease in net inflows is mainly due to the decline in Bitcoin reserves across exchanges over the past month."

The analysts emphasized that the decrease in reserves could be attributed to the liquidation of Bitcoin by Mt. Gox creditors and the Bitcoin sell-off by the German government.

Brian Dixon, CEO of Off the Chain Capital, stated in a report, "In my view, the recent decline in Bitcoin's price is due to the German government selling Bitcoin seized from illegal transactions. Their government has transferred thousands of Bitcoins to exchanges and market makers for sale."

He added, "I believe the German government's sale of Bitcoin is a mistake, as it should be holding Bitcoin in its national treasury reserves, which would provide Germany with a strategic geopolitical advantage as Bitcoin continues to appreciate."

Historically, Bitcoin has shown a positive correlation with the S&P 500 index; however, as the stock market surged and Bitcoin struggled in consolidation and decline from late May, this correlation began to weaken. Market analyst Ali Martinez on X platform stated that this situation may change soon, with Bitcoin potentially catching up rapidly through a quick price increase.

In a subsequent tweet, he pointed out, "The Bitcoin accumulation trend score indicates a change in investor sentiment, with many now choosing to accumulate BTC after a period of selling pressure since April."

According to Arsen, author of Bitcoin Therapy, the recent sideways price movement is a typical characteristic of a Bitcoin bull market cycle. He believes that before the current bull market ends, the price of BTC will reach around $300,000.

In his article, he stated, "When you are feeling fearful, smart money is doubling down, because this kind of decline is nothing new. As you can see, Bitcoin hits a new all-time high every 4 years: 2012: Bitcoin rose from $12 to $1,000 = approximately 9,000% increase; 2016: Bitcoin rose from $650 to $19,000 = approximately 3,000% increase; 2020: Bitcoin rose from $8,000 to $69,000 = approximately 1,200% increase; 2024: ?"

Arsen added, "Please note that in each consecutive cycle, Bitcoin's return rate experiences a decrease of about 60%, which means this cycle's increase could be 450%, with the price of each Bitcoin reaching around $330,000."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。