The original text is from Howard (Head of Developer Relations, TON Foundation Asia).

Compiled by Odaily Planet Daily Golem (@web3_golem)

Summary:

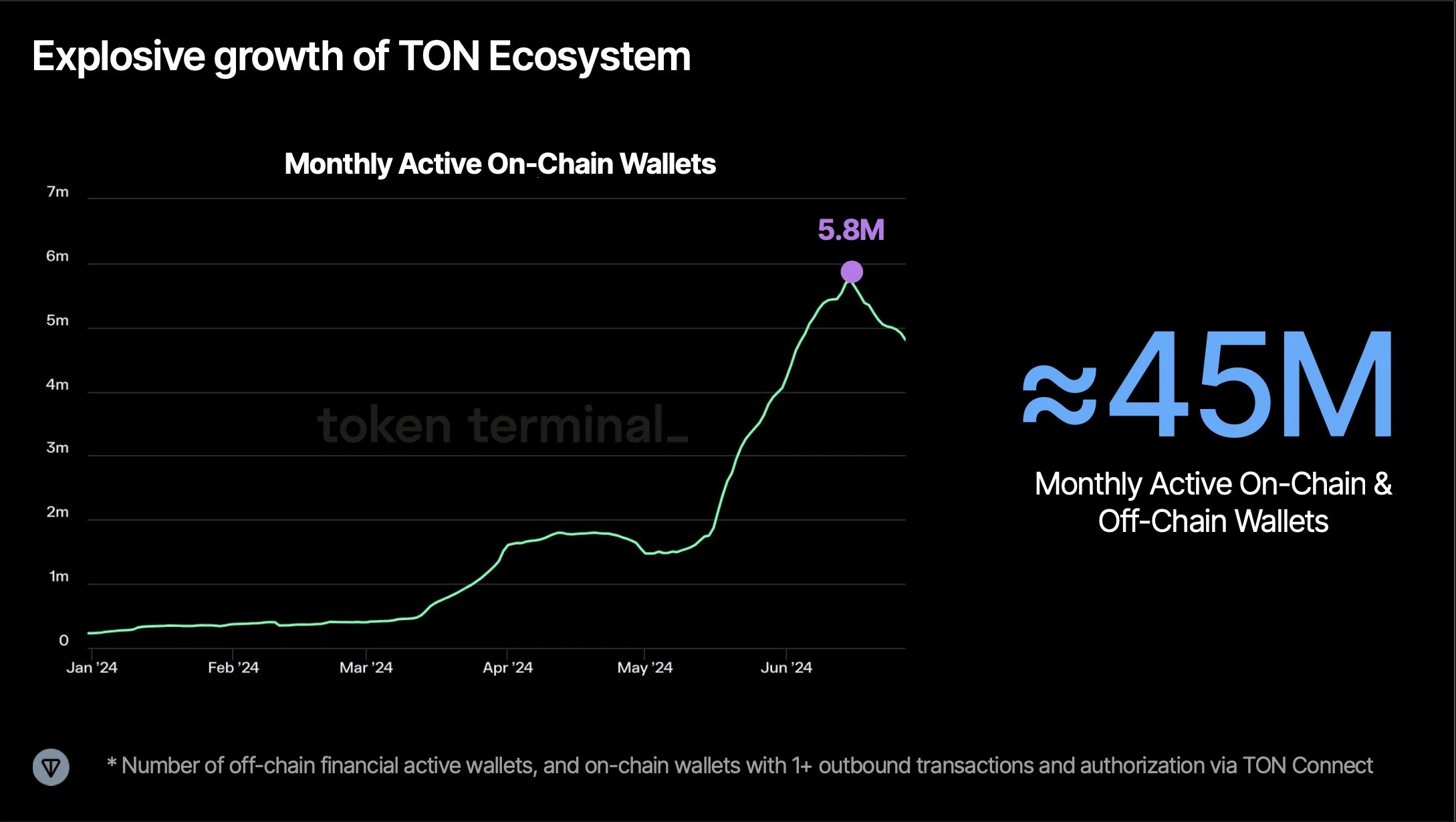

- TON is still in its early stages and has not reached the "real money" stage. However, the flywheel effect has already formed, especially compared to other L1 networks. The moat of the TON blockchain itself has been consolidated, including payments, mini-applications, and an increasing number of network users. TON is experiencing network compound effects.

- Asia is an underestimated region in all aspects (most people agreed on this before the TON boom this year), especially in terms of talent resources for mini-program development. However, in my 9 months at the TON Foundation, I believe there are still few local investors or companies. This also means that VCs have huge opportunities here.

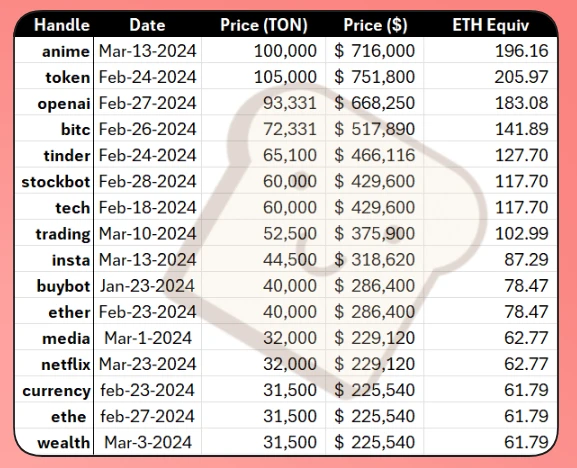

- Due to the huge demand in the Telegram mini-application ecosystem, Telegram usernames will become the most valuable NFT and asset in the history of encryption. Telegram Stars will become the most successful entry point from Web2 to Web3, bringing billions of dollars to the TON network. This will bring about true mass adoption: more users join, and the way of purchasing digital goods becomes more convenient.

- More importantly, 99% of people are focused on mini-applications and click-to-earn or tap-to-earn projects. However, the true potential of TON and Telegram lies in their DeFi and social integration capabilities. In the second half of 2024, TON is likely to achieve growth in DeFi and other on-chain applications, with indicators such as TVL, trading volume, and on-chain user numbers expected to increase.

TON / Telegram Network

Currently, most people only focus on mini-applications on TON. They overlook the bigger picture of the TON blockchain, which includes smart contracts, DNS systems, over 100k TPS, and the most easily convertible user base, all supported by Telegram with 9 billion users.

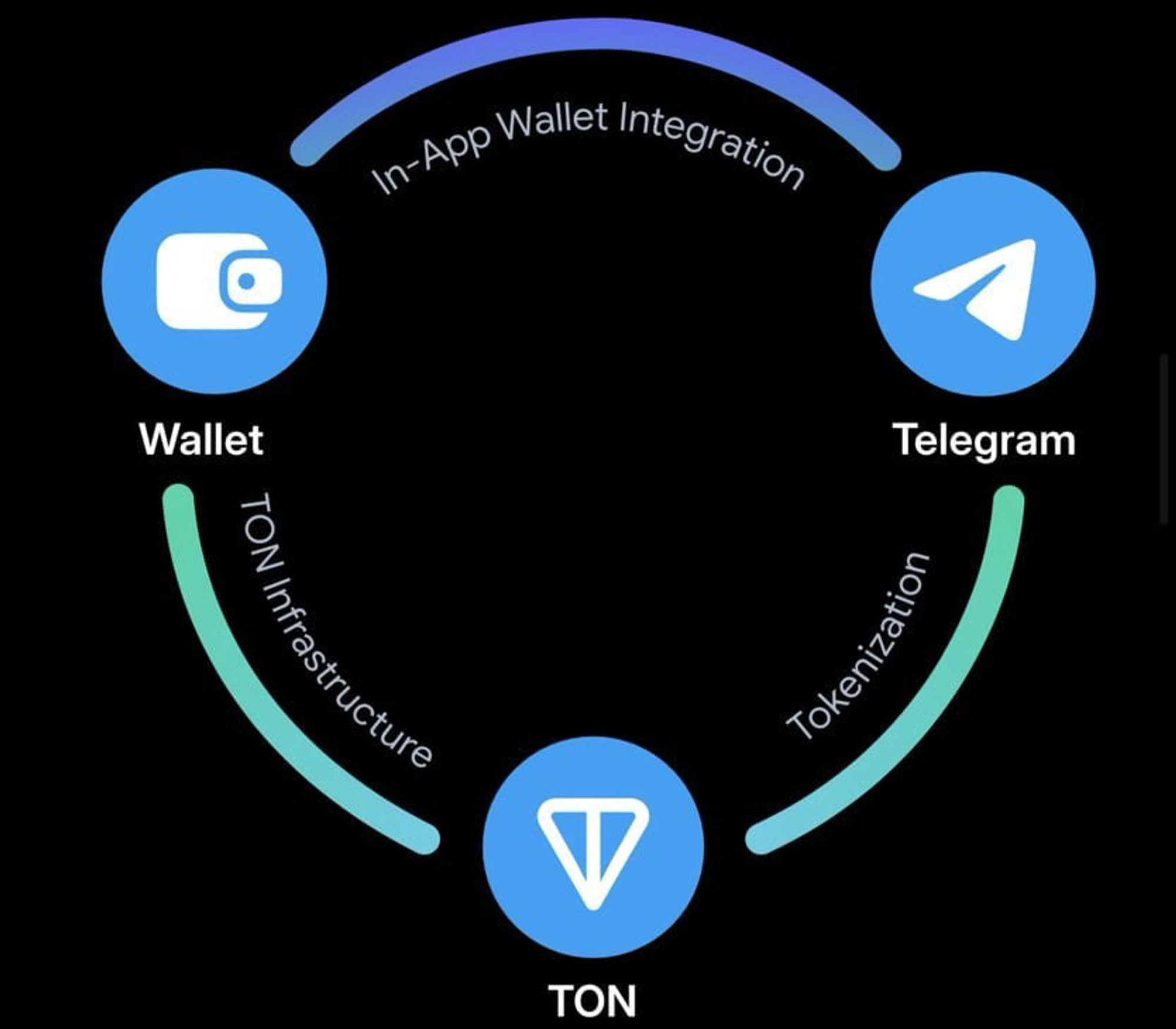

The following structure can help us understand the relationship between Telegram and TON:

- Telegram: the messaging layer that connects everyone, with usernames as unique IDs.

- Wallet: the bridge between messaging and cryptocurrency, connecting users and making it easy for everyone to access cryptocurrency.

- TON blockchain: the asset layer that builds financial systems and other decentralized, permissionless functions and businesses.

Why Hasn't TON Succeeded Yet?

The reasons why TON blockchain still has low transaction richness and no surge in large DApps are as follows:

- Building a small application to acquire users is much easier than investing a lot of time in training smart contract developers, at least in terms of time and financial investment, it is more efficient.

- Due to the scarcity of DApps on the TON blockchain, there are not many open-source projects to refer to or replicate.

- More importantly, the smart contract language itself is too difficult to learn (FunC language), whereas Tact language is simpler and has recently been significantly updated.

To address these issues from top to bottom, we (TON Foundation) and the developer relations team are committed to bridging these gaps. We will create more tutorials and templates and promote more public resources to help projects better develop on TON.

Of course, we know Rome wasn't built in a day.

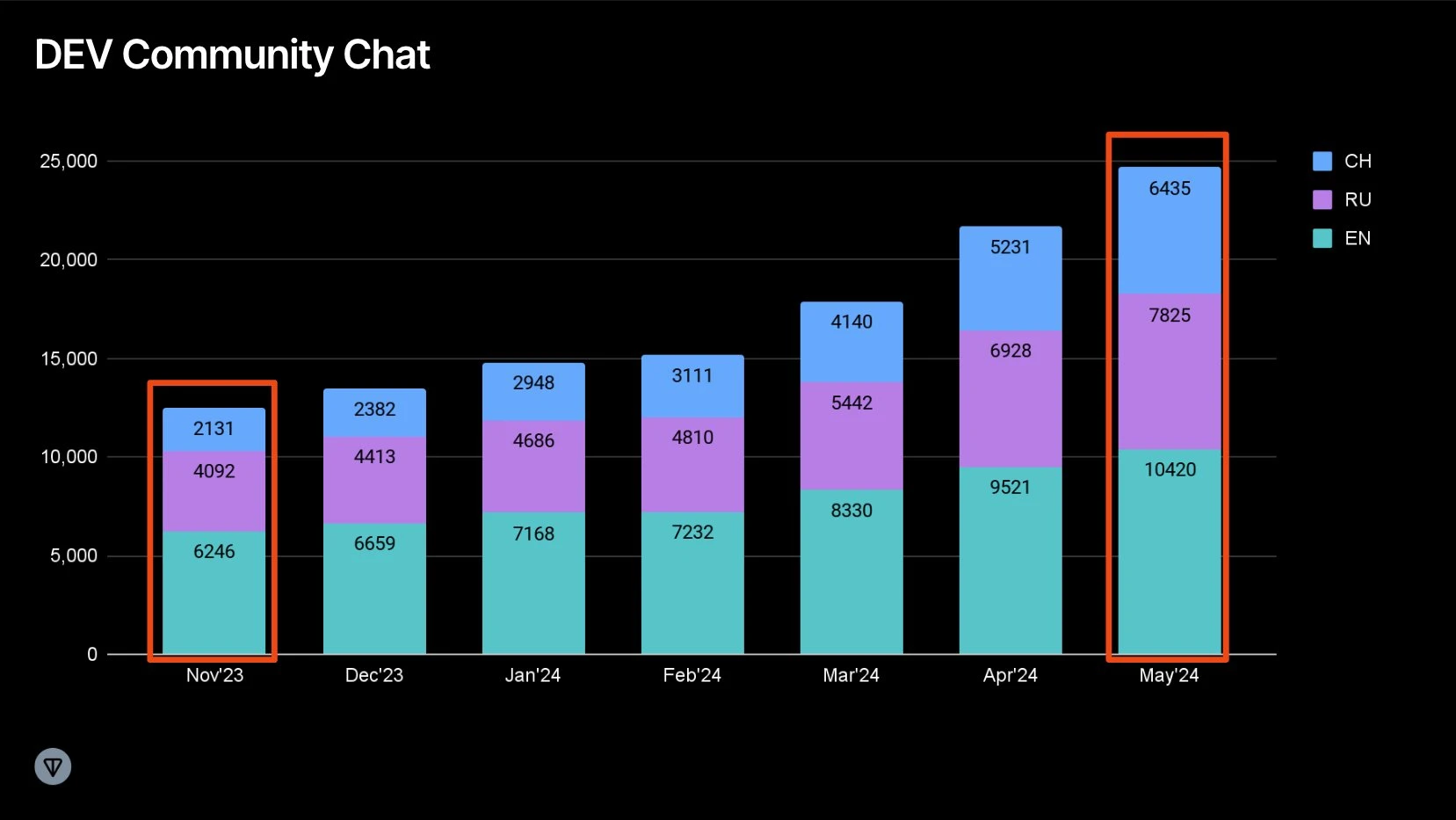

Source: https://t.me/tondev_zh

Fortunately, our developer ecosystem has already seen significant growth. More importantly, the recent success of "Tap-to-Earn" projects and the integration of USDT on TON have greatly accelerated the application of TON.

Developer-related resources:

Howard's developer guide can be found here: https://ton-org.notion.site/Developer-Guideline-by-Howard-024429d0b28c409f992d238057b60f4f

How Does Tap-to-Earn Change the Telegram Ecosystem?

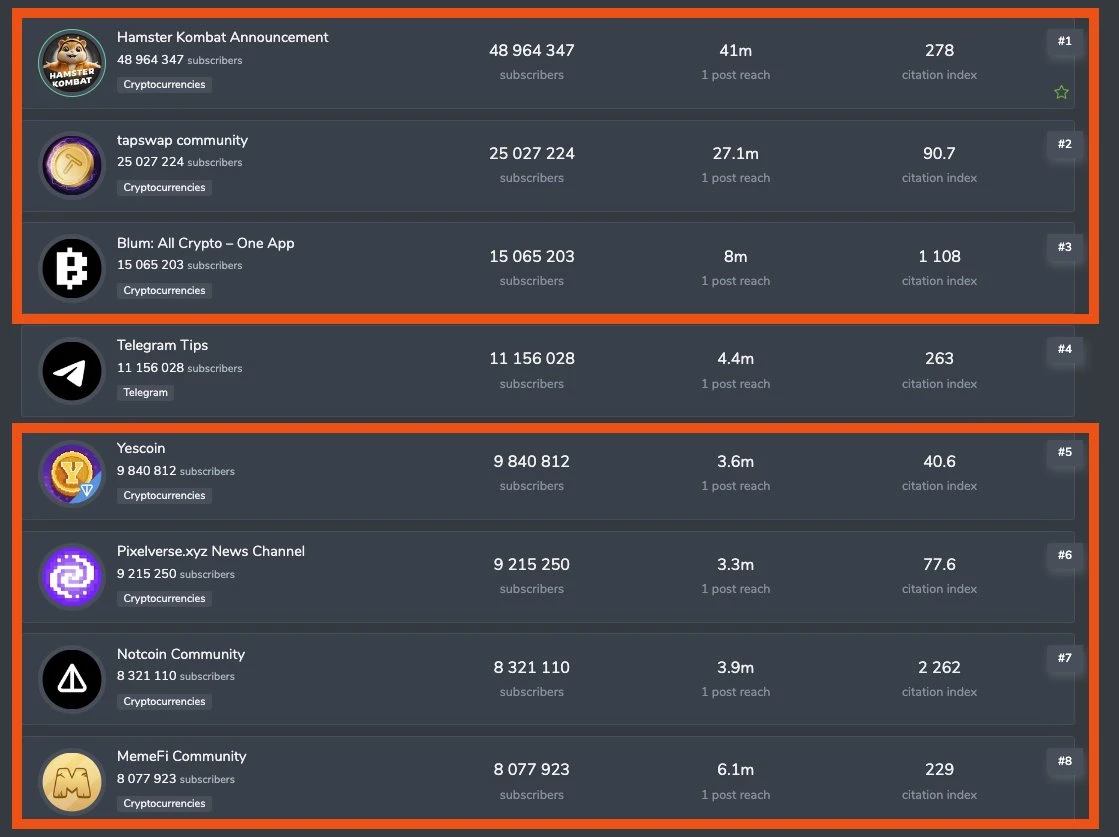

Based on the first point in the previous section on why TON has not yet succeeded, it is obvious that most teams prefer to invest in high-return projects and quickly accumulate users. This makes sense for any internet company. As a result, millions of users are using "Tap-to-Earn" or "click-based products" in the Telegram and TON ecosystems. Here are some data:

Hamster: 48 million subscribers

Tapswap: 25 million subscribers

Blum: 15 million subscribers

Telegram Tips: 11 million subscribers

Yescoin: 9.8 million subscribers

Pixelverse: 9.2 million subscribers

Notcoin: 8.3 million subscribers

MemeFi: 8 million subscribers

Source: https://tgstat.com/ratings/channels

This is an excellent example of how cryptocurrency drives user adoption, not only in terms of subscriber numbers, but also because the top 8 Telegram channels are almost all related to cryptocurrency (except for the 4th, Telegram Tips).

Hamster's subscriber count increased from 1 million on April 15 to 48 million on June 30. This growth rate is faster than any DAU I have seen. It may even be higher than the number of new users Binance.com gained at the end of 2017 by speculating on altcoins. My point is: "In the past, people had no incentive to join public channels. But now they do."

Still think cryptocurrency can't change the world? It has greatly changed the Telegram ecosystem and the way people behave in the Telegram ecosystem.

The reason is simple: the value of crypto is becoming easier to monetize. Since Notcoin was listed on mainstream CEX, it has created more expectations, attracted more users to enter the Telegram ecosystem, and encouraged them to participate more in the ecosystem, such as subscribing to channels and playing click-based games.

This is a great example of how we are gradually transitioning to a Web2.5-Web3 business logic with stronger economic value, network effects, and the best user experience. Furthermore, the barriers created by network effects in the past will in turn benefit the TON blockchain and user experience, promoting the birth of more successful projects and attracting more projects to join.

How Far Can We Go?

Fortunately, I believe we are still in the early stages, with more to explore in the Telegram network and other areas, such as:

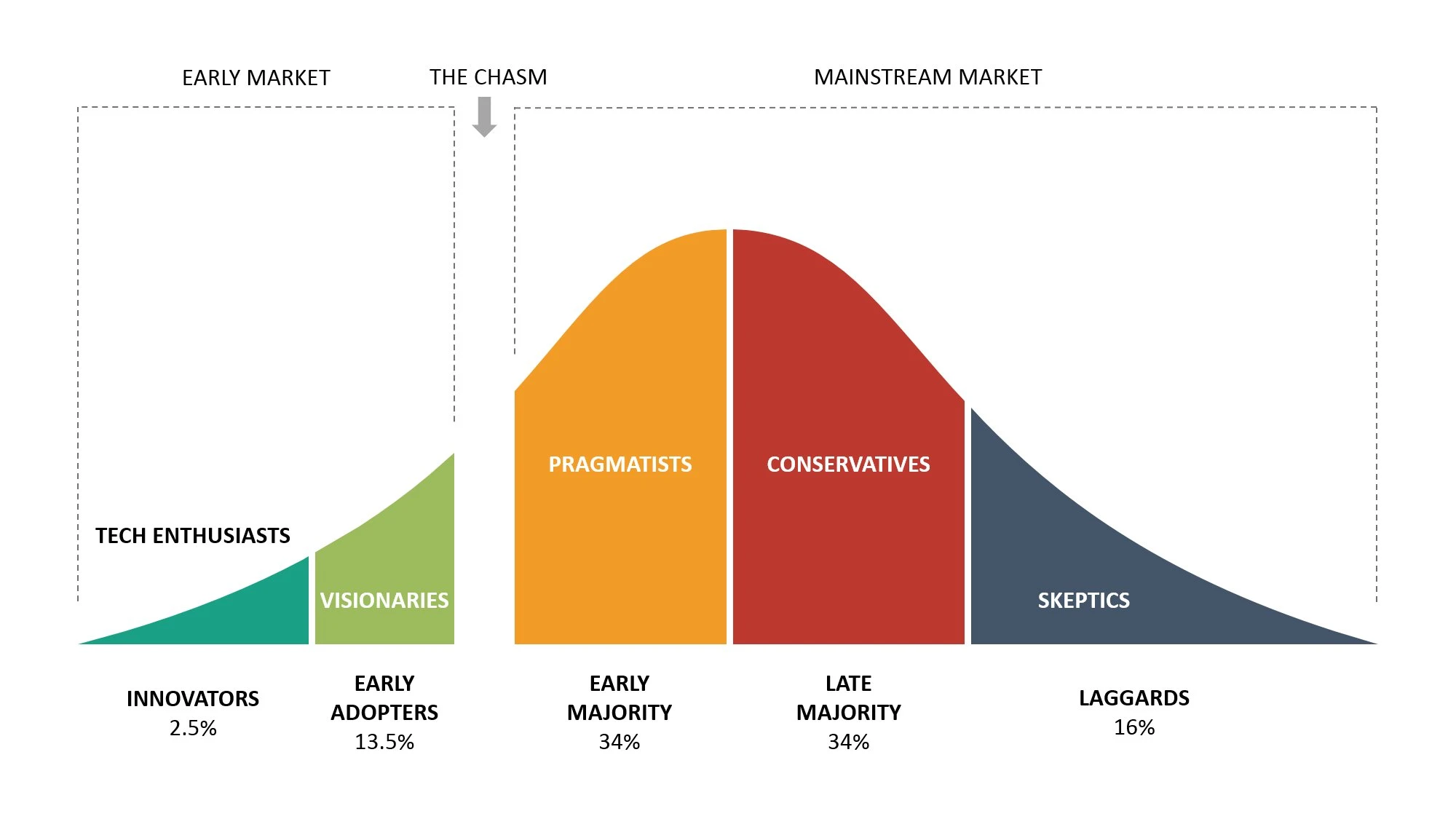

The ratio of Hamster channel subscribers to Telegram's monthly active users (MAU) is 48 million out of 9 billion, accounting for only 5.3%. If compared to mass adoption, we are still in the early stages.

However, this is just basic math. More crucial is the "penetration rate": how many TApps are DeFi-based? How many Telegram users have on-chain wallets? These are the main indicators I am most concerned about.

Again, we are still in a very, very early stage.

Mass-adoption / The Chasm Theory

Network Experiencing Compound Effects

Rapid advancement requires network effects. The large number of users in Telegram channels, combined with the listing of Notcoin and the integration of USDT, has strengthened the overall compound effect.

The flywheel effect is also spreading. While I cannot provide specific numbers on how many projects have submitted proposals to us or how many messages I have received on Telegram, public data shows that the initial momentum has been formed, and further growth and effects could occur at any time.

To ensure this article remains readable and not overly lengthy, here are some potential topics I should expand on in the near future:

- On-chain data: reasons for the increase in TVL on the TON blockchain and the increase in on-chain user numbers.

- USDT supply: what is driving the increase in total USDT supply, and what is the next module we can build on TON?

- Tap-to-Earn projects: how these projects transition into new business models, and what are the business models for these types of "traffic-driven products"?

Overall, I believe our network effects have already formed a starting point on the TON blockchain. Furthermore, the path from 0 to 1 has been completed, and we should now focus on going from 1 to 100+.

Impact on Asia

We have seen many companies succeed based on the "Super App" theory, such as WeChat, Alipay, Zalo, Grab, and Line Messenger.

Super App Theory

Take WeChat for example, it not only has millions of users but also provides a platform for thousands of developers. Here are some key points:

- Asian developers are already familiar with the mobile-driven market. Many case studies can be found in the WeChat mini-program rankings—they know what to build.

- Due to the slowdown of the Chinese economy, more and more teams and studios are seeking overseas opportunities to increase profits and income, such as TikTok, Temu, and Taobao—they want to survive and are eager to find opportunities.

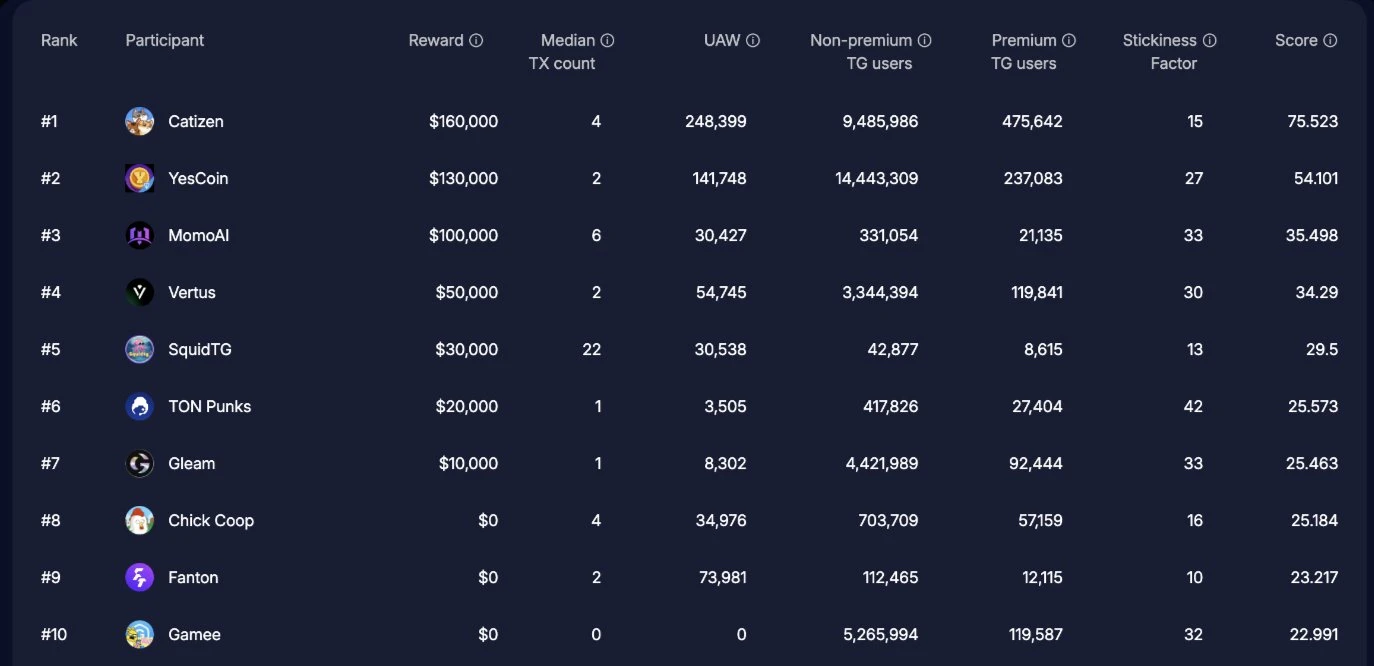

Given the above points, let's focus on the data and check the projects, brands, or companies that can be found through the Open League so far. First, the Open League (@TONOpenLeague) competition uses an SDK to track each visit/opening of Tapps mini-programs. This makes cheating or falsifying numbers very difficult.

The Open League provides liquidity rewards for high-quality projects, which can be roughly divided into NFTs, applications, Meme coins, and more. For more detailed information, click the following link: The Open League Season 4 Results: New Champions Emerge

Again, these are all based on personal opinions and do not represent any entity or foundation's views on projects or issues. These views may be based on my personal perspective, past collaborative experiences, or impressions from the offline events we have held in Asia over the past nine months.

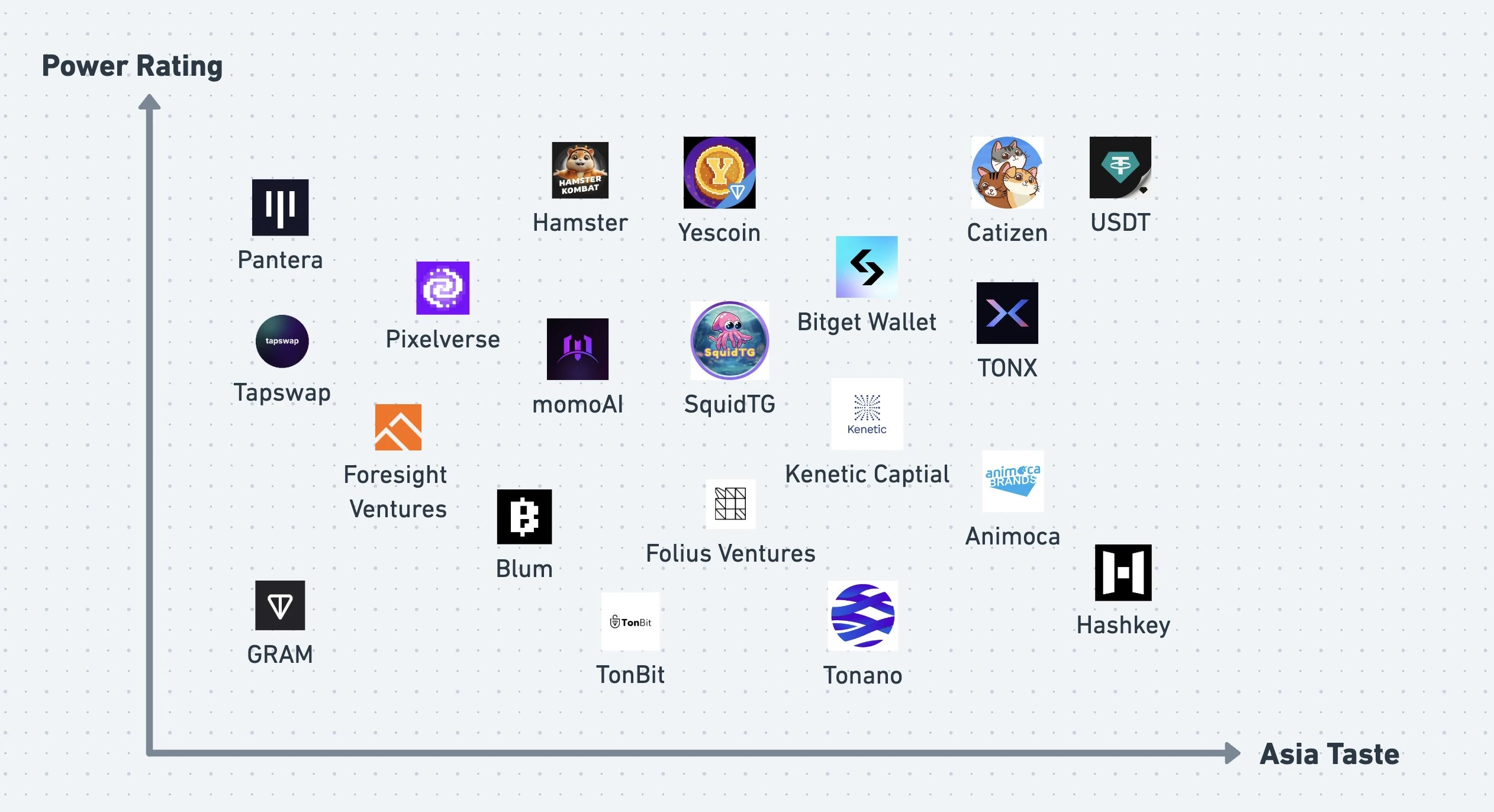

Impact on Asia

From the chart above, we can see that many projects are very good at marketing and attracting user attention. However, most of them face the problem of "cold start" because they are mainly good at operating on platforms like WeChat and Weibo, not X. But with the emergence of more "Tap-to-Earn" projects, project teams can easily enter the market and gain early users (referring to the network effect mentioned earlier), as well as the help of Telegram ads and other tools, making the situation smoother. But we still face some issues:

- How do we define projects purely belonging to Asia? Have they succeeded because they have leveraged unique advantages in Asia? What types of projects are Asian teams particularly good at?

- If I have an idea and build an MVP product, who can I seek support from besides TON Foundation resources (such as Grants or Ton Ventures)?

- Which teams are truly focused on Asia and truly believe in the Super App theory, and are willing to fully invest in TON? How can I help them?

Although we have some clear ideas that indicate we can effectively build an ecosystem in Asia, this ecosystem still lacks outstanding companies to reinvest in it. "Until the price changes in recent months"—this seems to be a long-standing issue, similar to the early Ethereum ecosystem being unwelcome in China: being an early investor and publicly advocating for it is very challenging.

I have seen many successful projects rooted in Asia, such as Catizen, Yescoin, Tonano, 852Web3, SquidTG, Bitget Wallet, okx Wallet, Gate Web3 Wallet, Kenetic, Mechanism Capital, Folius Ventures, and more.

As I prepared this article, the most obvious question that came to mind was, "It seems that not many investors really care about or invest in TON projects in Asia." This may be a fact, or it may be based on my personal experience.

Resources for Asian projects building on TON:

- https://x.com/TONHackerHouse/status/1777422472046092357

- https://x.com/0xHoward_Peng/status/1772895520660369883

TON Open Summit

Fundamentally, there are more issues worth exploring, but due to the limited scope of this article, I will summarize the key points below:

- If you are an Asian developer, you should build on TON because it is the environment you are familiar with.

- If you are stuck in Web2 business and want to try Web3, choose TON. In fact, most successful projects come from teams with a Web2 background.

- If you are an investor who believes in the potential of Asia, then you should come to build and invest.

This is why I am pushing and helping to organize the Open Summit in Taipei, Taiwan from August 6th to 8th. I firmly believe that there are still many projects yet to be noticed, especially considering the tremendous growth of the TON ecosystem.

Source: ton.abs.io

- Summit related information: https://x.com/BuildOnTON/status/1808836768353169814

If you are a VC who has not delved deep into the TON ecosystem or its projects, I strongly recommend joining to discover more opportunities. There is still plenty of room for growth and business opportunities from both the project and VC perspectives.

Brand Building in the Mini-Program Ecosystem

With the emergence of the mini-program ecosystem, a key aspect that all TApps must focus on is brand building.

Here are a few of the most successful brand-building projects on TON:

- wallet: The best centralized TON crypto wallet, also serving TON Space (non-custodial wallet).

- Crypto Bot: The best experience for EVM tokens and other altcoins wallet bot. Users can activate this bot service by entering @send 1 USDT in any chat.

- Whale: The largest crypto gambling bot.

- Telegram Developer Community: A place specifically for Telegram mini-program developers to ask questions.

- Pavel Durov: Pavel Durov's Telegram username.

Source: https://x.com/0xBreadguy/status/1800908705304805659

Telegram Usernames

Due to the upcoming Telegram bot and mini-program services, the huge demand for these usernames will directly drive the demand, whether for purchase or sale. I believe that in the near future, Telegram usernames will be sold on Fragment.com at increasingly higher prices, indicating a growing market demand for unique and short domain names.

Telegram Stars

This is the most exciting update for me since Fragment.com. While it looks like any payment process on any other app, I am very excited about this feature and look forward to seeing the growth in data. Relevant information can be found here:

Combining Telegram usernames, Telegram mini-programs, Telegram ads, and Telegram Stars will make the leverage effect more significant. In addition to providing a better Web3 entry (it can be seen this way), there will be the best user experience to capture the value of these digital projects and highlight them prominently on Telegram pages.

- With the social element, digital content (whether Jetton Token or NFTs) will have more exposure opportunities.

- The shift from peer-to-peer to group interaction will generate more social content and Telegram group-based competition, strengthening the social network.

- This will encourage users to spend more time on Telegram, building the ecosystem layer and the application layer (e.g., "TApps will become the Web3 of the App Store").

However, as the Telegram team may have some potential undisclosed information, I will not invest too much effort in this section, as my main focus is on the TON blockchain and smart contracts.

TON Ecosystem in the Second Half of 2024

There is no doubt that our goal for 2024 is to attract 10 million active on-chain users on the TON blockchain.

According to tonstat.com, we are close to nearly 5.8 million monthly active users (MAU). This is largely attributed to the traffic-driven TApps mentioned earlier, upcoming practical apps, and the influx of new users. Overall, I believe this opens up a lot of potential for expansion, accumulating first-mover advantages, and network effects.

Similarly, I believe that eventually, 80% of the traffic will be contributed by the top 20% of channels and TApps. Therefore, more projects will enter the highly competitive traffic business stage in the future. Currently, maximizing traffic and increasing user numbers as much as possible is crucial, as it can lead to a leading advantage in the second stage.

The question is, what will happen next?

As I mentioned earlier, guiding teams to develop mini-program-based projects to quickly capture the market is crucial based on the measure of return on investment. In the near future, there will be more than just mini-programs or the current business model; there will be more innovation. For example, the combination of Tap-to-Earn with the Launchpad model, or the predicted market that combines social relationships with mobile experiences, there are too many possibilities to explore.

Take the success of Hamster Kombat, for example. It uses airdrop incentives to drive user interaction, encouraging people to click and subscribe to channels. However, I believe this is just an early example of changing user behavior using reward attributes. In the future, due to its natural viral growth, the TON ecosystem will host the most profitable projects, even surpassing FriendTech and Pump.fun. Additionally, it provides a stage for everyone to showcase and promote their NFTs and content.

DeFi Ecosystem May Experience Explosive Growth

More projects will focus on DeFi development, and I believe that in the second half of 2024, the DeFi sector in the TON ecosystem will make significant progress. Here are a few reasons:

- More smart contract developers are joining, and the Tact language is being strengthened and updated more frequently (https://github.com/tact-lang/tact).

- More mini-program teams are providing high-quality TApps, giving them the ability to explore smart contracts.

- The launch of USDT on TON has increased the TVL on the TON blockchain, and more DApps are in development. Additionally, more projects focusing on oracle price are turning to TON, such as RedStone Oracles.

What are the most successful projects currently? Especially in this cycle? GMX, FriendTech, LooksRare, UniBot, and OpenSea.

I firmly believe that as more teams learn to develop mini-programs and a large amount of traffic enters applications related to TON, DeFi protocols built on them will better resonate with the market and amplify network effects. For example, imagine a Polymarket mini-program built on TON and how it will easily achieve expansion and growth.

- Traffic-driven projects will always have a greater impact, whether in dealing with exchanges or in continuing to incubate new projects.

- Investing in TON will become more complex. With more applications and mini-programs increasingly integrated with Telegram, evaluating the "TON network" value becomes increasingly difficult.

Conclusion

In summary, the TON ecosystem has seen significant growth in the first half of 2024. As the Head of Developer Relations for the TON Foundation in Asia, I believe there are many areas worth paying attention to: infrastructure, investor relations, payment solutions, P2P markets, DNS domains, DeFi, NFT markets, derivatives, and more. There are plenty of untapped opportunities in these areas.

On the other hand, it is great to see more projects from Asia joining the ecosystem. However, I must admit that the messages on Twitter and Telegram are overwhelming. I regret that I cannot reply to and handle all projects. Telegram mini-programs and TON will become a way for Asian developers to make an impact and bring value to more people. For those working in development in Asia, this is a familiar pattern.

Personally, it is difficult to describe this feeling, as we have been promoting TON for the past 1.5 years. I previously attempted to build a project on TON, but progress was not smooth due to the lack of infrastructure. In comparison to that time, you can clearly see that since the price increase, everyone is talking about TON and asking questions. Now is definitely the best time to build in our ecosystem and network.

From my personal perspective, although TON is still in its early stages, it is building a strong foundation, with a growing user base and features such as payments and mini-programs, especially in talent-rich Asia. This paves the way for Telegram usernames to become high-value NFTs, and for TON to pave the way for mass adoption in the second half of 2024 through its unique DeFi and social integration potential.

I will not predict or have the ability to predict the price of TON, but I firmly believe that attracting more than 10 times the number of users is my greatest mission. I still maintain the original intention of joining Binance in 2018, which was to help CZ make cryptocurrencies accessible to everyone.

Changing the world is not easy, let's take responsibility and move forward together. I believe that Telegram + TON + Asia will lead us into the next bull market.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。