In this rapidly changing field, timely buying and selling decisions are crucial. Seizing opportunities in volatility to achieve sustainable investment returns.

Authors: Ren & Heinrich

Andreessen Horowitz (a16z) is one of the world's most famous venture capital firms. Their portfolio includes approximately 50 cryptocurrencies. In this analysis, I want to see if as a retail investor, if you engage in copy trading, that is, investing in the same coins as a16z and selling them approximately 5 months later, can you make a profit in 2024.

Let's assume some conditions first

• You, as an individual investor, engage in copy trading (investing in the same coins as a16z and selling them approximately 5 months later).

• Invest $100 in each of the top 25 coins in a16z's portfolio by market value (totaling $2500).

• Investment period: from January 1, 2024, to June 6, 2024 (157 days).

In-depth analysis

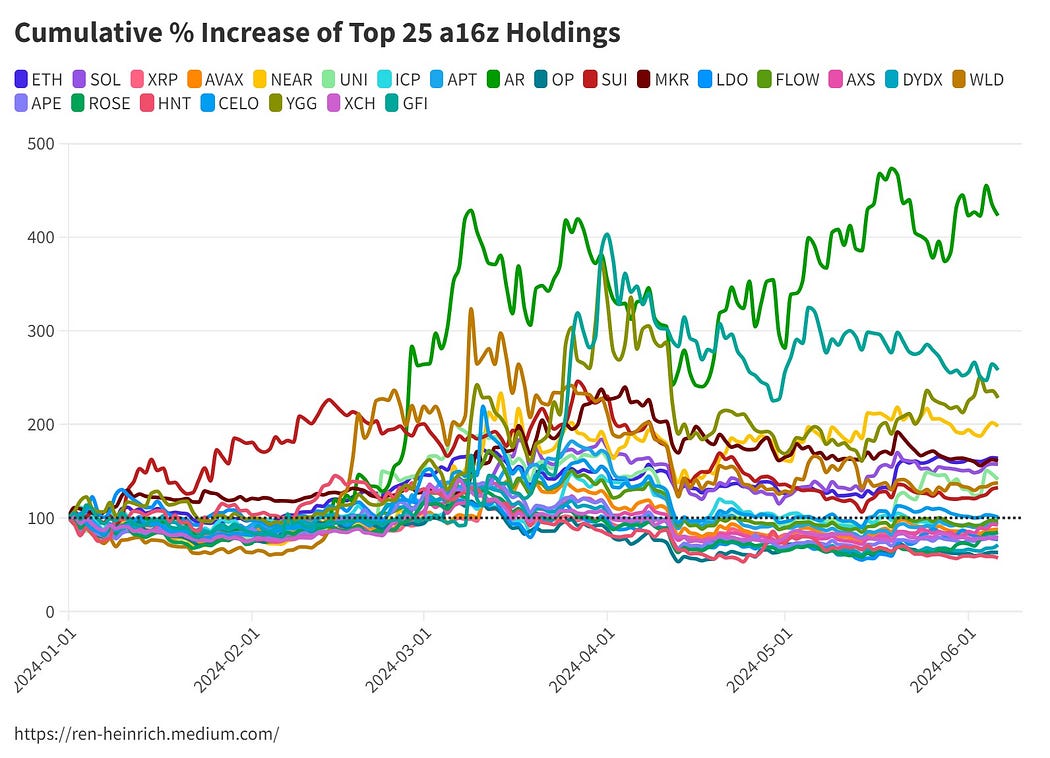

With these conditions, let's see how a16z's portfolio has performed since the beginning of the year.

The X-axis shows the trend over time, and the Y-axis shows the percentage of profit or loss. A value of 200 means that the corresponding cryptocurrency has grown by 100% based on its original value.

As we can see, the situation is complex.

On the one hand, we see that some cryptocurrencies have performed well in price trends over the past few months, such as:

• Arweave (AR): +323%

• Goldfinch (GFI): +157%

• Ethereum (ETH): +63%

On the other hand, many prices have been declining, for example:

• XRP (XRP): -17%

• Optimism (OP): -38%

• ApeCoin (APE): -22%

Overall, 11 of the top 25 cryptocurrencies show a net increase. If we subtract the losses caused by the decline in other coin prices, the total selling price is $3158.82. Therefore, the total profit ($3158.82 - $2500) is $658.82, with a return on investment (ROI) of 26.35%, which is quite good.

In fact, those who only invested in Bitcoin or Ethereum during the same period would have made even greater profits.

Clearly, unconditionally copying Andreessen Horowitz's investment portfolio is not the most ideal choice.

So how can you make more profit?

What other methods are there to increase profits from copying the top 25 coins in a16z's cryptocurrency investment portfolio? Let's take a closer look at the timeline.

When Bitcoin began to rise in early March, the entire cryptocurrency market also experienced a strong upward trend, but not all coins had the same rate of increase.

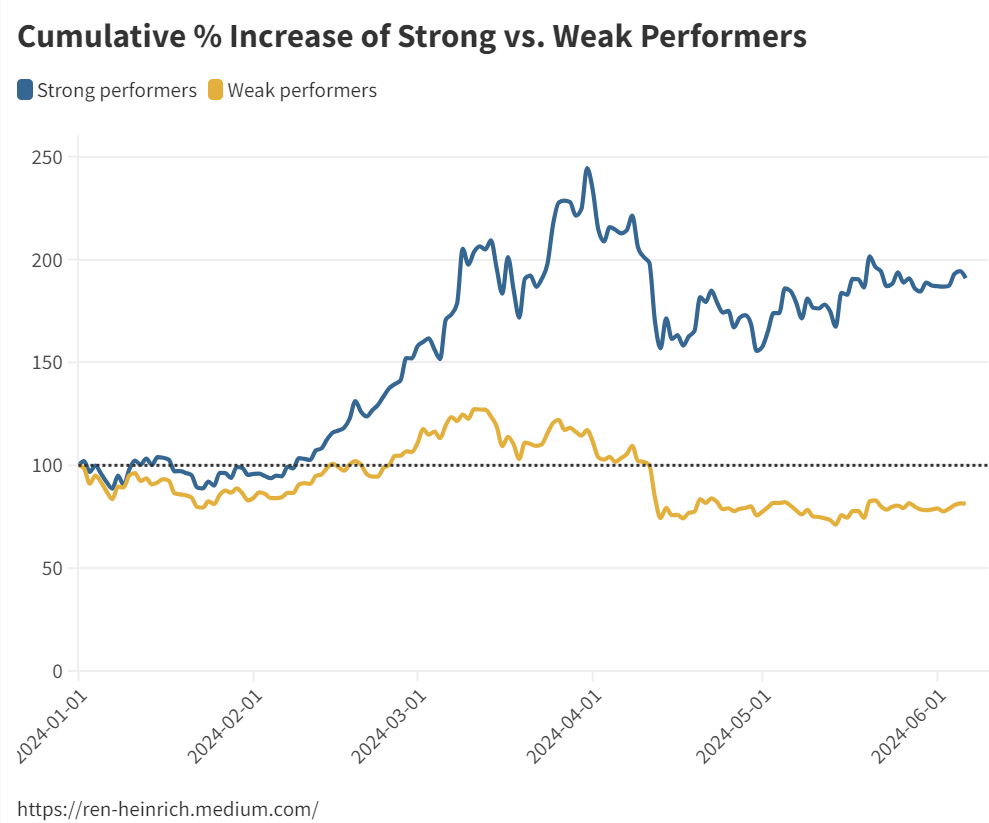

This chart compares the performance of strong and mediocre coins in a16z's investment portfolio (showing the average growth of coins with positive or negative gains in early June).

We can see that the strong-performing coins had a significantly higher average increase on March 13 (average +104%) compared to the mediocre-performing coins (March 13, average +27%), and they were able to maintain this advantage in the long term.

Therefore, the strength of the increase is one of the indicators of whether their performance will be good in the coming months.

Once again, it is important to emphasize that time is crucial in cryptocurrency investment.

Just as Andreessen Horowitz does not hold onto their coins forever, you should always pay attention to trends and seize selling opportunities when copy trading, keeping only the most promising coins in your portfolio.

What does "strong" and "mediocre" performance mean?

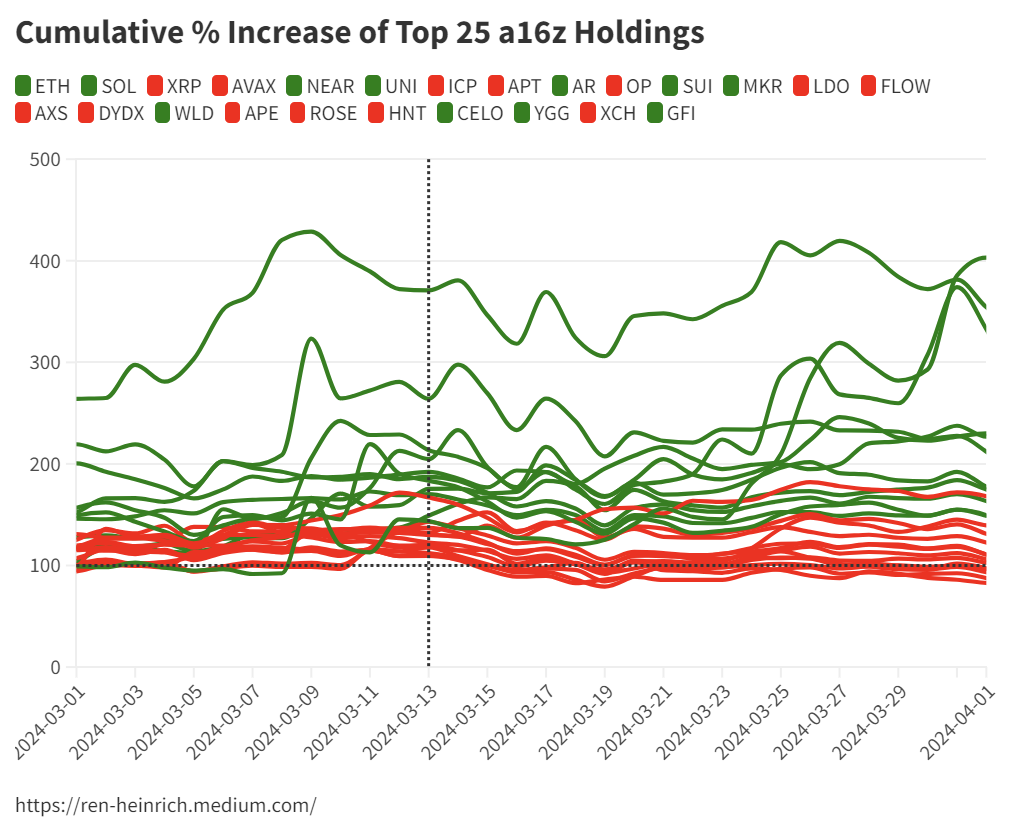

This enlarged chart shows all coins with positive gains by early June in green, while the others are shown in red.

As of March 13, we can see that the strong-performing coins had gains of at least 40%, while the mediocre-performing ones were almost all below this level.

Although no fixed rules can be derived from this, it shows that if you sold half of the underperforming coins in the portfolio around mid-March, you would have made a significant profit in June.

However, this does not rule out the possibility that these mediocre performers may have better performance later.

a16z's cryptocurrency investment portfolio demonstrates market diversity and challenges, and investors should be cautious when replicating their strategy, always paying attention to market trends and the performance of individual coins.

In this rapidly changing field, timely buying and selling decisions are crucial to seize opportunities in volatility and achieve sustainable investment returns.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。