Author: Hedy Bi, OKG Research

Recently, with the opening of the ETF channel, the anticipated "sky-high amount of funds" in the cryptocurrency market did not meet expectations, and the problem of liquidity shortage in the global financial market has spread to the cryptocurrency market. The opening of the new channel also means that the rules of the previous complex and mature market collide with the culture and investment logic of the cryptocurrency market. As a result, the cryptocurrency market has changed from a nearly closed safe haven to a small boat in the vast ocean. The fundamental change in the nature of the market also brings new challenges.

Bitcoin, No Longer Digital Gold?

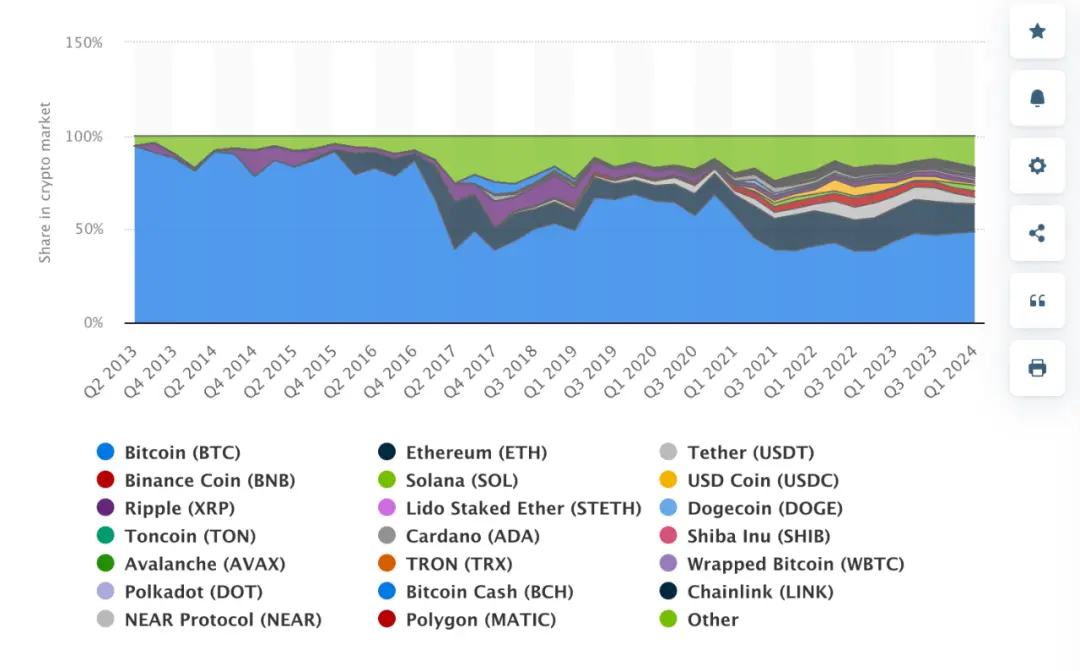

To understand the cryptocurrency market, let's start with Bitcoin, which accounts for half of the market.

Pic: Dominance of Bitcoin and other crypto in the overall market from 2nd quarter of 2013 to 1st quarter of 2024

Pic: Dominance of Bitcoin and other crypto in the overall market from 2nd quarter of 2013 to 1st quarter of 2024

Source: statista

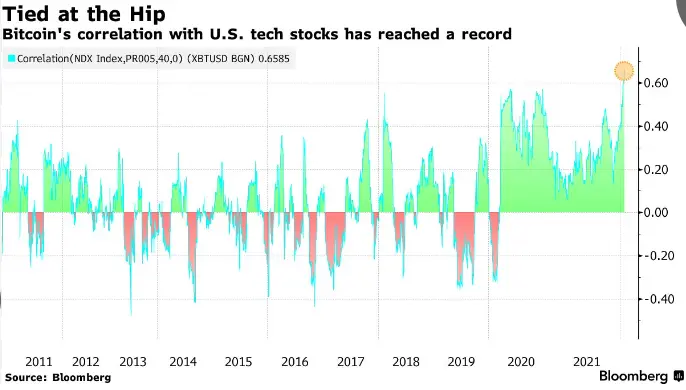

Looking back at this year, we can observe several key events. For example, in April of this year, the tension between Iran and Israel led to retaliatory actions by Iran. Although the reaction in the Asia-Pacific market was not reflected in the financial markets, Bitcoin experienced a significant decline. In addition, U.S. economic data not only affects the U.S. financial market but also affects Bitcoin. For example, several increases in U.S. unemployment numbers in the first half of the year, exceeding expectations, were seen as prompting the central bank to adopt a more accommodative monetary policy, which in turn could drive the rebound of U.S. stocks and also drive the subsequent rise of Bitcoin.

In the past, we regarded Bitcoin as "digital gold," believing that it operated counter-cyclically to the U.S. dollar. However, it now appears that Bitcoin is more like an "amplifier" for the Nasdaq. For these new institutional investors, compared to traditional stocks and bonds, Bitcoin lacks fundamental analysis (financial indicators and cash flow analysis). Its value is mainly determined by market supply and demand and investment trust, so its commodity attributes and emotional indicators have become the quantitative trends relied upon by institutional investors. In addition, with the widespread use of leverage in the cryptocurrency market, Bitcoin's volatility is greater, which is a new market characteristic that we need to adapt to.

In contrast to the 7 rate hikes in 2022, demand in the cryptocurrency market has significantly decreased

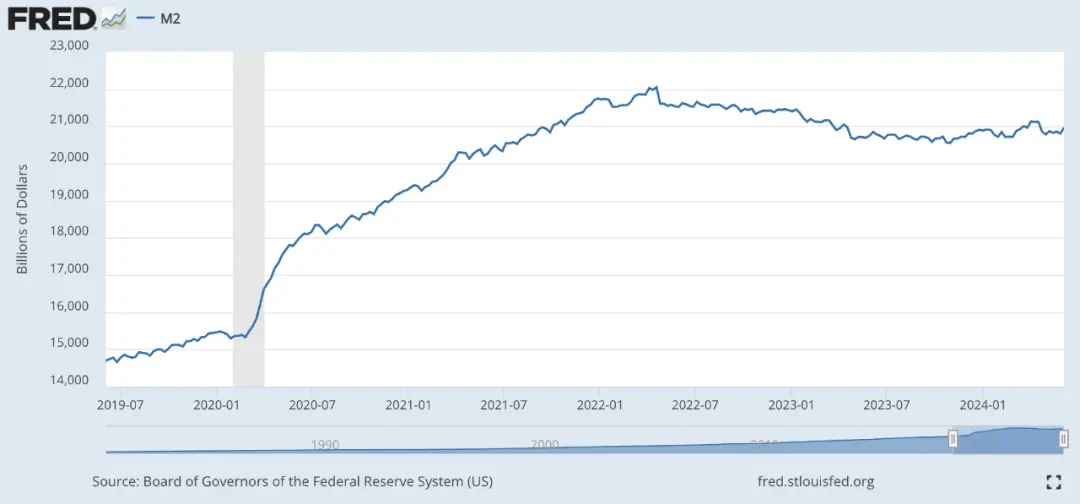

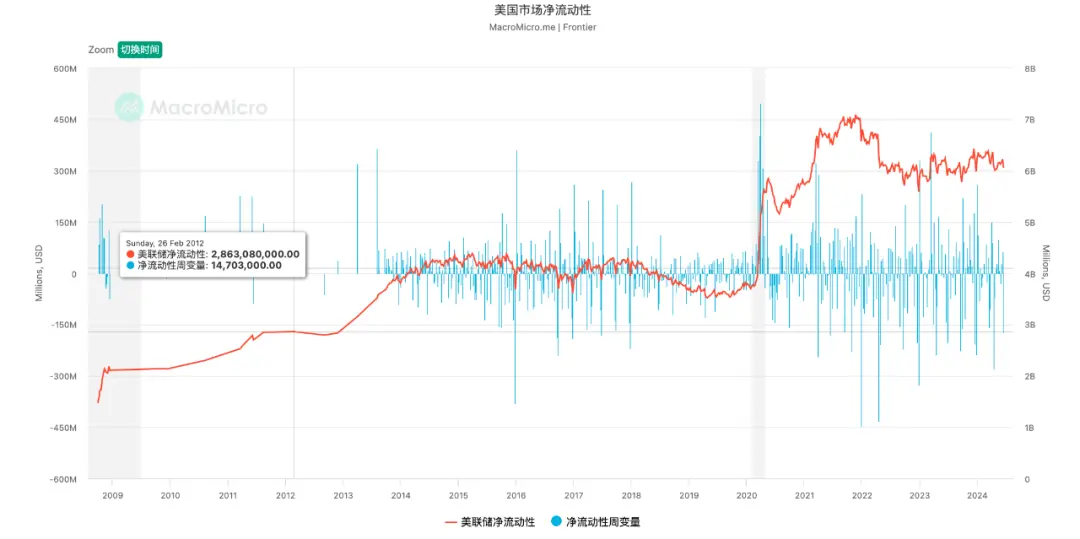

Taking the U.S. market as an example, M2 (broad money supply) has been slowly declining since the first half of 2022. According to Macromicro.me statistics, the 7 rate hikes by the Federal Reserve in 2022 from March to December led to a rapid decline in the U.S. market's net liquidity index, which did not increase thereafter. The Fed's rate hike policy in 2022 had a significant impact on market liquidity, which did not maintain previous growth. Consequently, demand in the cryptocurrency market also significantly decreased.

Source: Fred

Source: Fred

Source: MacroMicro

We can take stablecoins to further examine the demand in the cryptocurrency market. Because the issuance mechanism of stablecoins determines that their issuance can represent the demand for the cryptocurrency market. The overall market value of stablecoins has increased by approximately $30 billion from 2024 to the present (about six months). The growth rate has significantly decreased compared to the second half of 2021 and the first half of 2022. Moreover, this period from 2021 to the first half of 2022 happened to be a time of global financial market liquidity tightening. This means that the cryptocurrency market has changed from being a hedge risk market to being a more sensitive market in the vast ocean.

Pic: Stablecoin Total Market Cap

Pic: Stablecoin Total Market Cap

Source: DeFiLlama

Therefore, we can roughly conclude that the overall style of the cryptocurrency market has changed from a nearly closed market for hedging financial risks to a market with greater sensitivity to the economy, and Bitcoin has also transformed from "digital gold" to an "amplifier" for markets such as the Nasdaq in the U.S. Economic indicators will affect market liquidity and will directly impact the cryptocurrency market.

This OTC is Not That OTC, Injecting Liquidity into the Market

Under the existing macro policies, how do we solve the liquidity problem in the cryptocurrency market? There are two common methods: promoting the participation of institutional investors and improving market infrastructure. Here, we will focus on analyzing the first method.

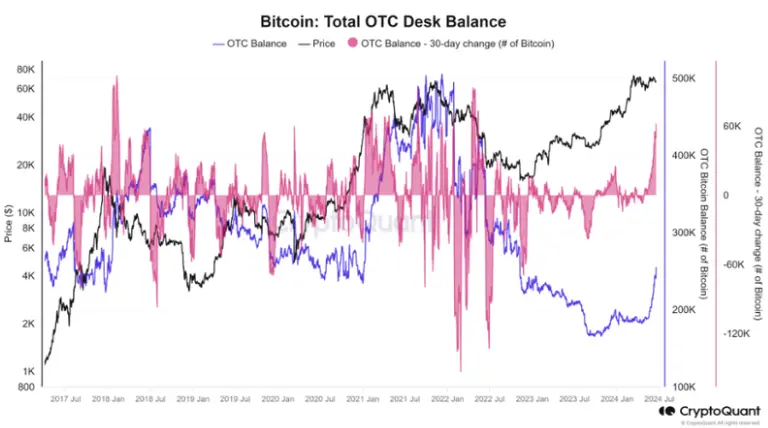

In promoting the participation of institutional investors, over-the-counter (OTC) trading is an indispensable channel that is currently overlooked by the cryptocurrency market. Specifically, taking the global Bitcoin single currency as an example, according to CryptoQuant statistics, the daily balance of OTC trading desks fluctuates between 100,000 and 500,000 BTC (calculated at a Bitcoin price of approximately $65,000, equivalent to approximately $6.5 billion to $32.5 billion). In comparison, the average daily inflow of Bitcoin ETFs is approximately $122 million (Farside Invest data, as of July 5th, UTC+8), which is tens to hundreds of times more than OTC trading.

Source: CryptoQuant

Source: CryptoQuant

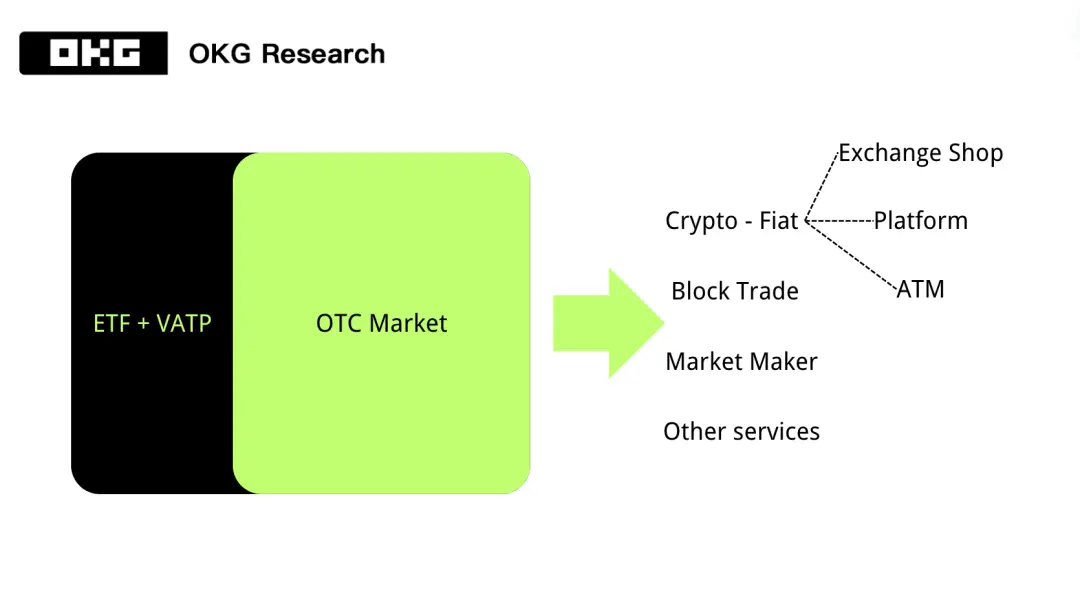

The OTC that is more familiar to everyone in the cryptocurrency market is slightly different. The OTC we are familiar with is more of a bridge between fiat and cryptocurrencies, because before the emergence of compliant channels such as ETFs, the OTC channel was the main channel accessible to the public. However, from the perspective of the financial market, the other two financial market functions of OTC - the main channel for large transactions and providing liquidity and market stability - are yet to be developed.

Source: OKG Research

Source: OKG Research

In terms of institutional investors, RWA is another method that is often mentioned. However, the author believes that improving liquidity through RWA requires the actual use of cryptocurrency assets as the unit of account, and RWA should be issued on public chains, rather than being limited to consortium chains or private chains. Currently, RWA mainly remains in enterprise-level consortium chains or interbank consortium chains, such as the collaboration with Blackrock in April of this year, where Hedera tokenized money market funds (MMF) using a partially decentralized blockchain solution.

As the Web3 market continues to evolve, we can see its inherent changes. The cryptocurrency market is gradually transforming from a niche market for hedging to a market highly sensitive to economic dynamics. Bitcoin has also transformed from "digital gold" to an "amplifier" for markets such as the Nasdaq in the U.S. To address the recent liquidity issues in the cryptocurrency market, we need to take multiple measures to solve them. We not only need to adapt to the fluctuations in the macroeconomic cycle but also need to pay attention to and develop previously neglected business areas, injecting new vitality and improving market stability and maturity.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。