Introduction

Pendle aims to provide a "yield curve" trading market for "income-generating tokens". Pendle introduces the concept of "principal and interest separation" from traditional financial markets into the DeFi field, dividing income-generating tokens into principal tokens and yield tokens, and providing liquidity for these two types of tokens.

Users can maximize asset utilization and achieve multiple returns through Pendle, bringing new possibilities to the DeFi market.

Project Basic Information

Project Team

Core Team

TN Lee: Founder, former member and business lead of the Kyber Network founding team, established Dana Labs in 2019, mainly customizing FPGA semiconductors.

Vu Nguyen: Co-founder, former CTO at Digix DAO, specializing in RWA projects tokenizing real-world assets, co-founded Pendle with TN Lee.

Long Vuong Hoang: Engineering Lead, holds a Bachelor's degree in Computer Science from the National University of Singapore, joined Jump Trading as a software engineering intern in May 2021, joined Pendle as a smart contract engineer in January 2021, and was promoted to Engineering Lead in December 2022.

Ken Chia: Head of Institutional Relations, holds a Bachelor's degree from Monash University, previously interned in investment banking at Malaysia's second-largest bank CIMB, then worked as an asset planning specialist in private banking at J.P. Morgan, entered Web3 in 2018, served as COO at an exchange, joined Pendle as Head of Institutions in April 2023, responsible for institutional markets - proprietary trading firms, cryptocurrency funds, DAO/protocol treasuries, family offices.

Funding Situation:

Seed Round:

In April 2021, led by Mechanism Capital, with participation from HashKey Capital, Crypto.com Capital, CMS Holdings, imToken Ventures, Spartan Group, Alliance DAO, Lemniscap, LedgerPrime, Parataxis Capital, Signum Capital, Harvest Finance, Youbi Capital, Sora Ventures, D1 Ventures, Origin Capital, Bitscale Capital, Fisher8 Capital, Hongbo, Taiyang Zhang, with a total amount of $3.7 million.

Private Round:

In April 2023, Bixin Ventures announced an investment in Pendle, but the amount was not disclosed.

In August 2023, Binance Labs announced an investment in Pendle, but the amount was not disclosed.

From the funding situation of Pendle, top investment firms in the market are very optimistic about its prospects.

Development Strength

Pendle was established in 2020 by founder Yong Ming Lau. The key events in the project's development are as follows:

Time

Key Events

Progress

2020

Pendle project announced

Completed

2021

Mechanism Capital led Pendle's seed round financing

Completed

2021

PENDLE token launched

Completed

2021

Pendle mainnet launched on Ethereum

Completed

2022

Proposed Project Permissionless plan, allowing anyone to create asset pools on it

Completed

2022

Pendle V2 version launched

Completed

2023

PENDLE launched on Binance LaunchPool

Completed

2023

Binance announced investment in Pendle

Completed

From the key development events of Pendle, it can be seen that Pendle has been steadily advancing, with sound project operations.

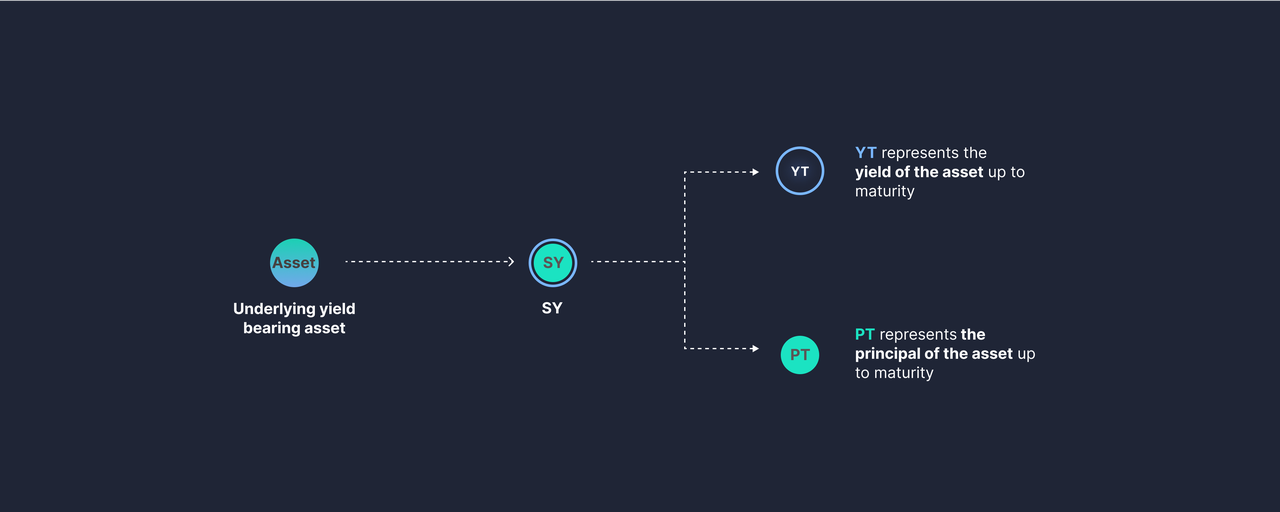

Operating Mode

Pendle packages income-generating tokens into SY (Standardized Yield tokens), which are then divided into principal and yield parts, PT (Principal tokens) and YT (Yield tokens) respectively, and can be traded using a customized V2 AMM. Users can achieve discounted asset purchases, long and short yield rates, and low-risk fixed income on it.

In Pendle, the owners of SY decide to separate income and principal, creating PT and YT. As YT represents the right to future income, the price of PT will be lower than the price of the original bond (ST). The value of PT actually represents the recovery value of the principal at the maturity of the bond, and as the maturity date approaches, the market value of PT will gradually increase, as market participants expect PT holders to be able to cash out PT at a price equal to the value of the underlying asset (i.e., the bond principal) at maturity. If the face value of the bond is $100, then theoretically the price of PT should gradually rise to $100. At maturity, PT holders can use PT to redeem the bond principal of $100. Therefore, even if PT initially trades at a discount (e.g., $95), its value will gradually increase over time and as the maturity date approaches, eventually returning to the full value of the underlying asset, i.e., $100. In the counterparty, people are trading or hedging future yields, selling YT means smoothing the future yield curve in advance and cashing out, or betting against future yields; buying YT means being bullish on future yields. Buying PT means being able to purchase at a discount to a certain extent and believing that the yield rate will decrease during that period.

SY token split diagram

Income Tokenization

YT represents all the income generated by real-time income-generating tokens and can be manually claimed from the Pendle dashboard at any time. If a user owns 1 YT-stETH and the stETH's average annual yield is 3.4%, the user will accumulate 0.034 stETH at maturity. YT can be traded at any time, even before maturity.

Pendle AMM

In the Pendle project, the exchange between SY, PT, and YT requires the use of Pendle's V2 AMM, which is also the core of Pendle Finance. Pendle's V2 AMM is designed specifically for trading yields, and the AMM curve will change to consider the yield generated over time, narrowing the price range of PT as the maturity approaches. By concentrating liquidity into a narrow, meaningful range, the capital efficiency of trading yields will increase as PT approaches the maturity date. In addition, through the AMM, we can facilitate the exchange between PT and YT using a single liquidity pool. PT can be traded directly with SY through the PT/SY pool, and YT can also be traded through flash swaps. Pendle's V2 AMM design ensures that the issue of IL (impermanent loss) can be negligible. Pendle's AMM moves the AMM curve to push the price of PT towards its potential value over time, mitigating time-related IL and releasing the natural price appreciation of PT.

Pendle's AMM curve can be customized to accommodate fluctuations in different yield tokens. Yield rates typically have cyclical fluctuations, usually oscillating between highs and lows.

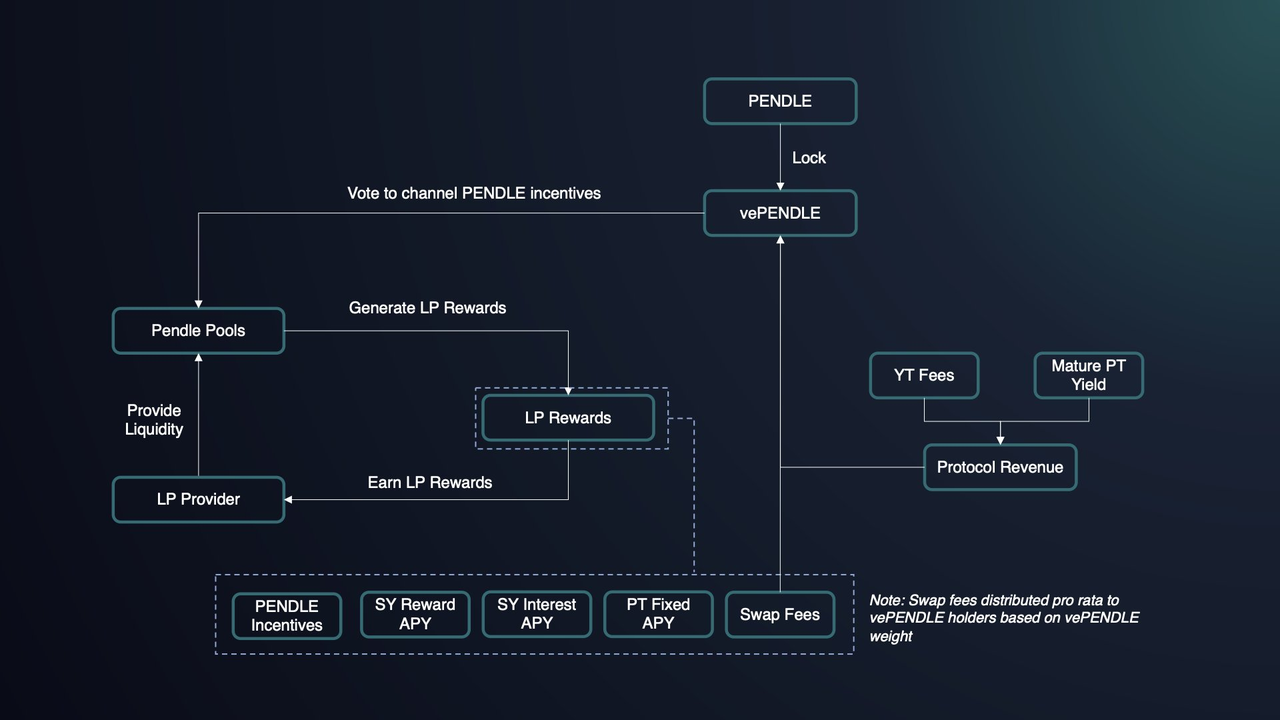

VePendle

VePENDLE is Pendle's governance token, and staking PENDLE will earn VePENDLE, allowing holders to participate in Pendle's governance and voting, while sharing in the income of the Pendle protocol. Income received by VePENDLE holders includes:

The basic APY of VePENDLE is composed of the interest received from YT (approximately 3%) and the rewards from matured PT (excess income generated from unredeemed PT after maturity).

VePENDLE voters also have the right to receive 80% of the swap fees from the voting pool.

Staking VePENDLE in LP pools to provide liquidity will earn rewards in PENDLE from the LP pool, further increasing the returns, up to a maximum of 250%.

VePENDLE obtained after staking PENDLE will be linearly unlocked over a period of time (up to two years).

Acquiring PENDLE: Earn rewards by staking LST or native asset tokens in selected PT LP pools, or stake VePENDLE in LP pools to provide liquidity and earn rewards.

VePENDLE operational principle diagram

Project Advantages:

Principal and Interest Separation Concept

By leveraging Pendle's mechanism of separating principal and interest income, users can flexibly devise various income management strategies based on their own circumstances.

If a user expects the annualized yield to decrease, for example, after the Ethereum Shanghai upgrade, the staking ETH ratio will increase, leading to a decrease in staking yield, the user can choose to sell YT assets, equivalent to cashing in income in advance. At maturity, the user can buy back YT assets, pair them with PT assets, and exchange them for SY assets.

If a user expects the yield to increase, they can buy YT assets because YT assets will appreciate in the future. Since YT assets represent the yield rate, their value will be cheaper than the principal. For example, out of 100 aUSDC, the value of YT assets is $5. This means the user can amplify the yield by 20 times.

If a user expects the yield to remain unchanged, they can provide liquidity pools to offer liquidity for users buying and selling PT and YT assets. While earning the original yield, users can also receive additional trading fees.

Higher Capital Efficiency

Pendle uses an Automated Market Maker (AMM) mechanism, and Pendle's AMM mechanism is specifically designed for the yield market. This means there will be lower slippage during trading, and the AMM curve will change over time to reflect the yield generated over time. As PT (Pendle Token) approaches maturity, the AMM curve will narrow its price range. As PT approaches maturity, the potential price range will narrow, concentrating liquidity within a meaningful range. This design can improve capital efficiency and increase trading yield.

Simplified Operations and Choices

Although Pendle's economic model is complex, involving SY, PT, and YT, and specifically setting up AMM for trading PT and YT, users find it very easy and concise to use Pendle products. After choosing to mint SY, it's simple to select the quantities of PT and YT, and there are 42 LP pools, including a clean interface for staking PENDLE, making it user-friendly. In other projects, the principal and interest are usually combined into one token, such as stETH, which puts users in a dilemma of potentially decreasing staking yield in the future while not wanting to give up holding ETH. With Pendle, this problem is solved, separating the principal and yield, allowing users to devise their own strategies based on their expectations for the future.

Project Model

Business Model

Pendle's economic model consists of two roles: liquidity providers and trading participants.

Liquidity Providers: Liquidity providers are essential participants in Pendle. The AMM mechanism is the core of Pendle's operation, and maintaining sufficient liquidity is crucial for Pendle to function properly. In Pendle, SY acts as an intermediary asset for SWAP pools, so liquidity providers need to provide trading pairs for YT-SY/PT-SY tokens. Liquidity providers can earn pool-generated swap fees, PENDLE token rewards, and protocol incentives from the underlying assets as rewards to incentivize more liquidity providers to provide liquidity.

Trading Participants: Pendle's users are the trading participants, earning income through trading PT and YT to achieve discounted asset purchases, long and short yield rates, and low-risk fixed income.

Pendle's main income sources are:

YT Fees: Pendle charges a 3% fee from all income generated by YT (Yield Token). Additionally, Pendle also charges fees from all unrealized income of PT's SY.

Trading Fees: Pendle charges a 0.1% fee from the trading amount.

Token Model

Token Distribution

The current circulating supply of PENDLE is 155,807,014.67, and the team's tokens have all been unlocked (13.75 million). The supply decreases by 1.1% per week until April 2026, at which point a 2% annual issuance will serve as an incentive.

Token Empowerment

Pendle's token design draws inspiration from Curve's Ve model, providing more empowerment to the token to increase its value.

Governance Function: Users can stake PENDLE to obtain vePENDLE, enabling them to initiate on-chain proposals and participate in voting, directly influencing project decisions.

Incentive Value: After staking PENDLE, users can still receive more economic benefits. Pendle charges a 3% fee from all YT income, with 100% of this fee distributed to vePENDLE holders. VePENDLE voters also have the right to receive 80% of the swap fees from the voting pool.

Token Price Performance

According to Coingecko statistics, PENDLE has increased in price by over 16 times in the past year since July 2023 (from a low of $0.465 to a high of $7.538), with major trading venues including Binance and Bybit.

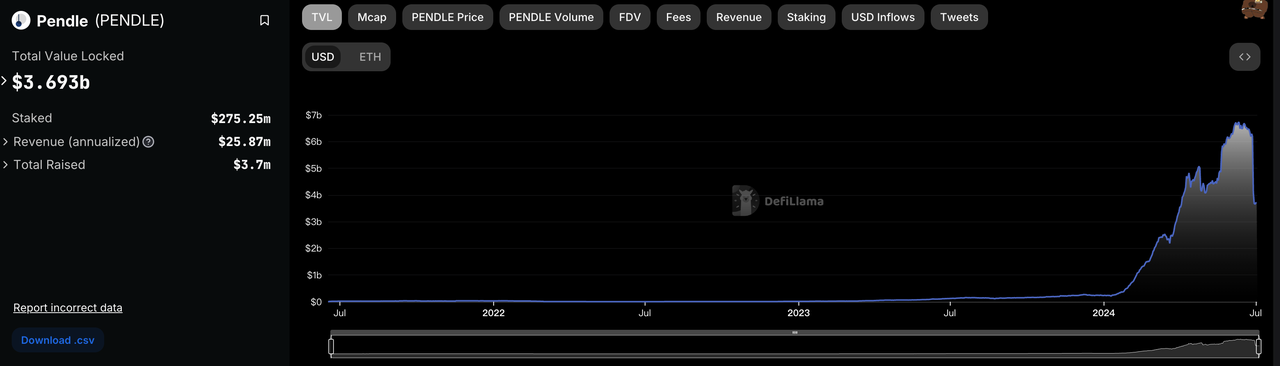

TVL (Total Value Locked)

The current TVL is $3.693 billion.

Pendle protocol TVL statistics

Although Pendle's TVL has experienced a significant decline since June 27, 2024, the total TVL still remains around $3 billion, placing it at the forefront of the DeFi field.

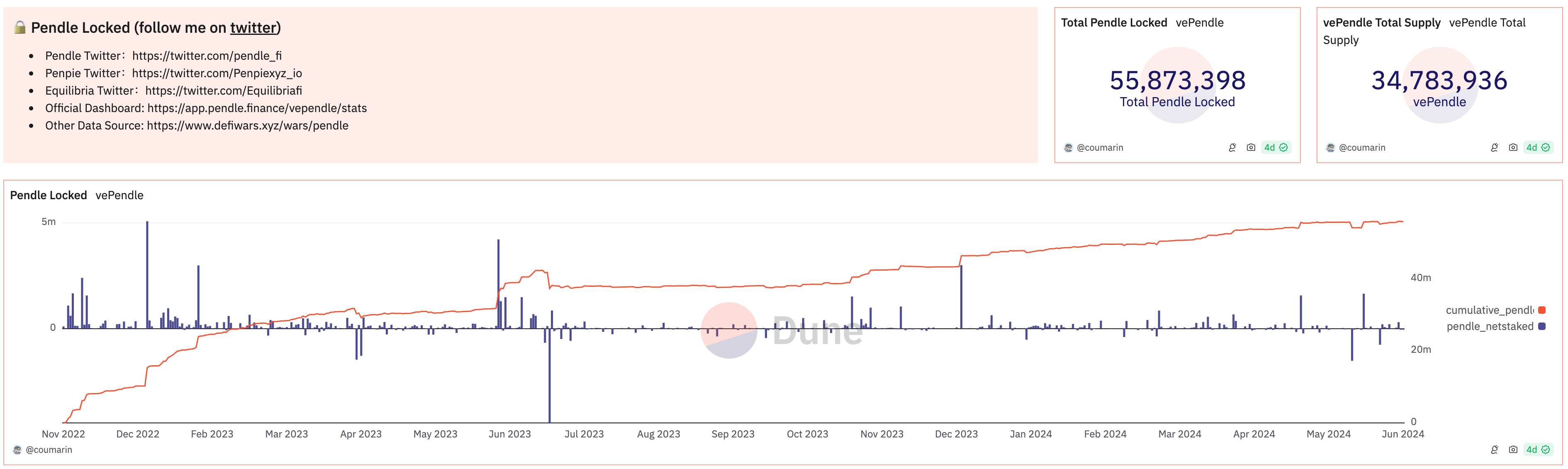

Token Staking Rate

Pendle token staking data statistics

The locked PENDLE amount is 55,873,398, with a staking rate of 36.02%. The staking amount growth rate remains stable, but the current staking growth rate is not sufficient to put Pendle into a deflationary state.

Major Influencing Factors on Token Price

On June 27, 2024, Blast conducted a token airdrop, where the distribution method of the token caused dissatisfaction among whale users, mainly due to Blast announcing that the top 0.1% of users (approximately 1000 wallets) would linearly receive a portion of the airdrop over 6 months. Mainstream exchanges such as Binance and OKEX did not list the Blast token, leading to a decrease in market expectations for its price.

The Blast incident itself is not directly related to Pendle, but it has directly affected market players' confidence in yield farming projects. Users have significantly reduced their expectations for yield farming projects, leading to a lack of motivation to participate in staking and mining as the yield expectations decrease. Most Pendle users are mainly aiming for the "one fish, multiple meals" effect, and pure traders can use the YT method to leverage their positions, while SY providers can hedge their positions. However, with the decrease in yield expectations and market coin prices, the APY of YT has also significantly decreased, causing users to no longer participate in staking and mining. As a result, they have withdrawn collateral assets such as ETH from Pendle, leading to a nearly 50% decrease in Pendle's TVL within 4 days, which has also impacted the price of PENDLE.

Project Risks

As a project in the DEX track, the biggest risk for Pendle is the risk associated with its smart contracts.

Smart Contract Vulnerabilities: There is a possibility of coding vulnerabilities in the smart contracts written in Solidity.

Parameter Configuration Risk: Pendle's contracts have many adjustable parameters, such as fees and reward ratios. Improper parameter settings can lead to a decrease in user experience or security incidents.

Contract Upgrade Risk: With changing demands, the contracts will undergo upgrades. Without sound upgrade testing and version management processes, there is a risk of new contract versions disrupting system stability.

Conclusion

Pendle brings the traditional financial market's concept of separating principal and interest into the crypto world, allowing holders of crypto assets to lock in future yield and receive income in advance, bringing more liquidity and flexibility to the interest rate market. Users can participate in flexible interest rate market trading while also earning points from projects, achieving the "one fish, multiple meals" effect and maximizing their own interests. This innovative mechanism provides a new source of income for cryptocurrency holders and injects more vitality and opportunities into the market.

However, Pendle is currently heavily impacted by the Blast airdrop incident, combined with the overall unfavorable market trends, leading users to abandon the choice of staking and mining, resulting in a significant decrease in Pendle's TVL and token price.

In summary, as a DEX in the interest rate market, Pendle has opened new doors for traders and arbitrage users. Although Pendle is currently experiencing a downturn due to the overall market environment, if there is an upward trend in the future market and the prices of various tokens recover, leading to an increase in YT's APY, Pendle will still experience another period of explosive growth.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。