In today's "What to Play Today" daily question, who still mentions the name Friend.Tech? Attention is not eternal. Once red-hot crypto products have long since fallen from grace.

In the market, some meme coins' prices will never return.

Likewise, products and businesses may also be gone forever.

In the "What to Play Today" daily question, who still mentions the name Friend.Tech?

However, a year ago, you didn't say this: Friend.Tech is the new trend of SocialFi, the darling of Paradigm's investment, the hot topic written in various research reports, and the god of liberating KOL fan economy…

How did it become a discarded product that no one cares about?

Attention is not eternal. Once red-hot crypto products have long since fallen from grace.

But the crypto market has a memory. Let's take a brief look back at how Friend.Tech played its once good hand so poorly.

The peak of extreme clamor, the terrifying silence after disillusionment

Let's start with a ghost story.

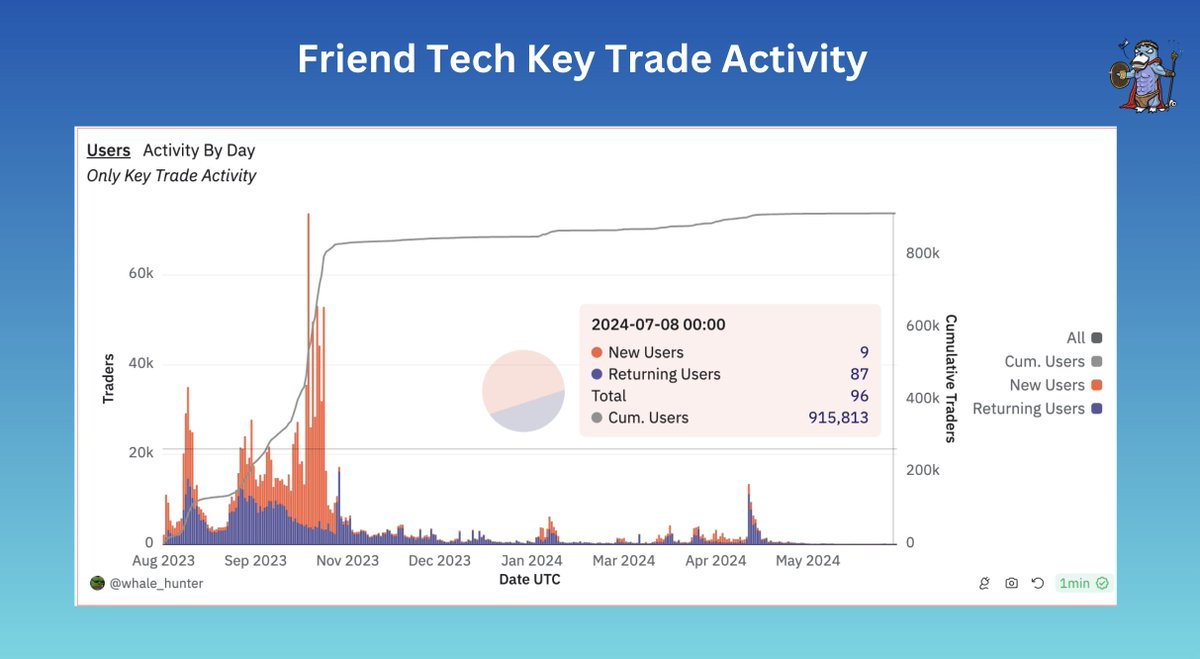

Data shows that Friend.Tech's daily active users today are less than 100.

In the previous frenzy, its daily active users once exceeded 77,000, which means the active users have decreased by 99.9%.

But about a year ago, Friend.Tech rose unexpectedly.

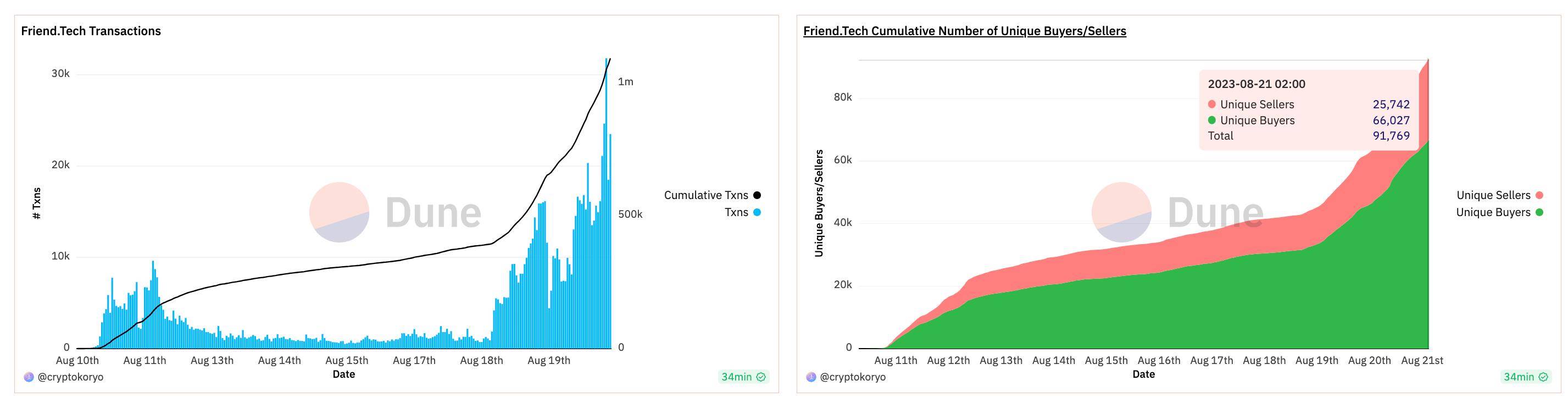

In mid-August last year, friend.tech emerged, with a total trading volume of over 1 million keys, over 66,000 independent buyers, and 25,000 independent sellers, making it another crypto product that almost everyone participated in after StepN.

Within two weeks of the launch of FT's V1 version, the platform attracted over 100,000 users and generated about $25 million in revenue, marking an important achievement in user adoption and financial performance.

At that time, FT's financial performance was still healthy, and it even generated so-called real income sharing, distributing about $6 million in revenue to users.

The mindset of everyone at that time was simple: get in early, buy keys, and make money. Quickly occupying the fan zone of celebrity KOLs became a wealth code, and FT also had a point mechanism, creating expectations of winning airdrops based on activity.

In the previously dull bear market, it did bring a long-awaited liquidity frenzy.

The data in the crypto world is transparent, and this hot trend naturally attracted the attention of institutions in the industry. In the same month, FT also announced that it had received seed funding from top VC Paradigm, adding to the frenzy of airdrop expectations and capital injection.

With a new product model, solid user data, and endorsement from top VCs… back in the previous cycle when there was no debate about high FDV and low liquidity, and VCs were not seen as adversaries, with these elements, Friend.Tech did indeed have a good hand.

But as we all know, the key selling model of FT had some flaws and was monotonous. Once there were no more people entering, the natural flaws would quickly lead to a loss of popularity for the product.

It's clear that the FT team also understood this. So, with a good hand, the top priority was to manage the product, operations, and economic expectations to extend FT's lifecycle and vitality.

But this good hand was played poorly.

Aggressive operations, mediocre product

If we could turn back time, we would find that FT's decline was already evident at different points in time.

In extreme terms, it can be summarized as: aggressive operations, mediocre product.

Don't misunderstand, it's not to say that FT's product has no merits. On the contrary, it has the attracting power of traffic and liquidity that other products didn't have before; it's just that compared to other operational efforts and direction choices, the product itself seems stagnant.

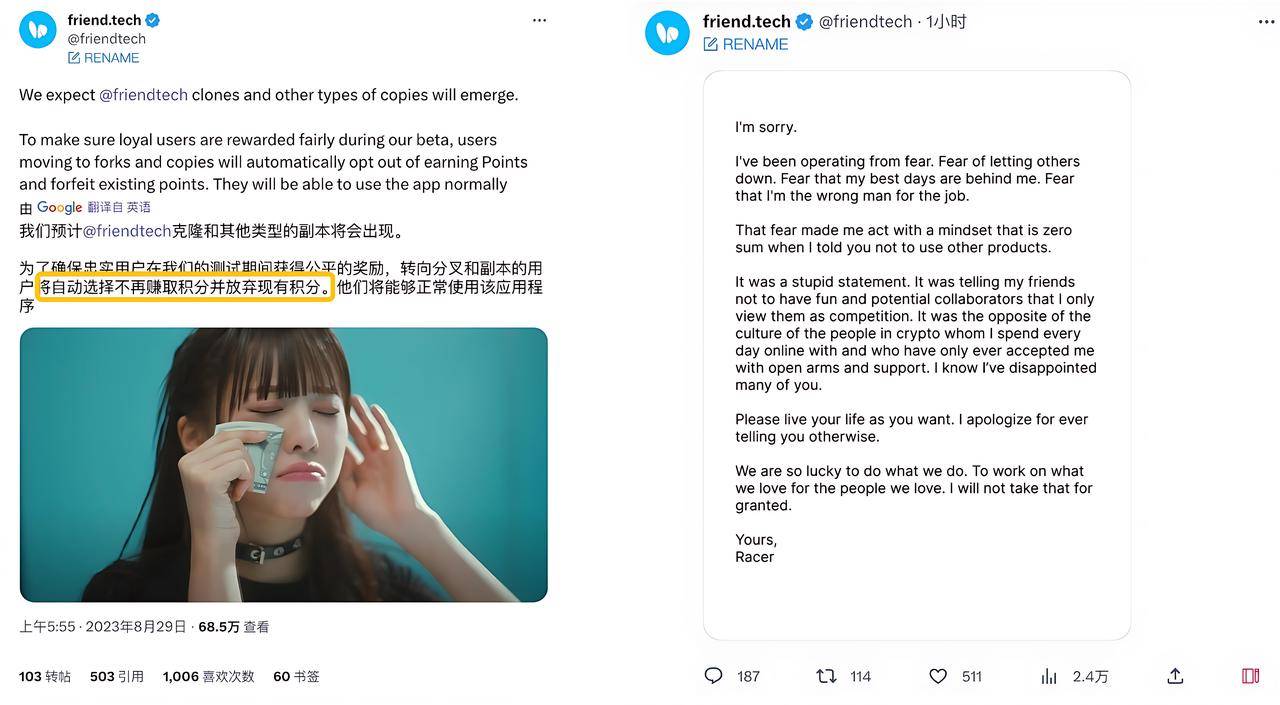

This excessive effort was evident from the beginning, as we mentioned in an article last year titled "Two-level reversal, friend.tech still agreed to be friends with you and the copycat":

FT initially strongly resisted users playing other similar copycats and publicly stated that playing other copycats would not earn FT points. After facing community resistance, the founder immediately issued a public apology, a sudden and unexpected reversal, which can be described as a public relations disaster.

It's very likely that at that time, the FT team itself hadn't figured out how to manage operations and handle relationships with competitors. For a product with a phenomenal impact, being unprepared for a battle seemed a bit amateurish, and it was a sign of deeper issues.

Another aggressive move was the excessive PUA in the V2 version.

By the end of April this year, after a long period of silence, Friend.Tech announced the release of the FRIEND token and a brand new V2 version on the 29th, igniting the community's enthusiasm once again.

However, the release of the token and version was delayed until May 3, a small delay within the range that investors could accept. What was quite off-putting was the rules and experience of receiving the FRIEND airdrop:

In addition to following at least 10 users on FriendTech, users had to join 1 club to receive the airdrop tokens. Obviously, the design of the club was intended to encourage user activity and continuation by providing new things for users to play with.

But the forced binding of joining first and then receiving tokens was already displeasing, and on top of that, many users reported difficulties in receiving the tokens on the day of distribution. With FRIEND's liquidity pool not being enough, it started to plummet in the secondary market, and many people hadn't received their tokens, halving the value of the airdrop.

With my coins plummeting, who has the heart to listen to your PUA again?

Some netizens joked: "8 months later, the only update we got is the 'club,' and everyone is just using it to receive airdrops."

The misalignment of incentives and product features began to erode confidence in FT.

But as if one trouble is not enough, the FT team then publicly expressed their desire to "move the product out of the Base network," and pointed out that the product was being marginalized and isolated within the Base ecosystem.

Drawing a clear line with the public chain they were backed by and publicly complaining, this approach was clearly playing with fire; the market also voted with its feet, and FT once again experienced a double decline in users and price.

What's even more thought-provoking is that in June, FT announced that it would soon launch its proprietary chain, Friendchain, transforming from the application layer to the infrastructure layer.

But will the market pay for this transformation?

Compared to the overly aggressive operational efforts and direction choices, the FT product seems to have changed very little from a year ago. A simple and even crude page, no standalone app, and old-fashioned gaming tactics…

A mediocre product, combined with other internal and external problems, led to the downfall of a phenomenal product, which is not surprising.

In contrast, other social products like Farcaster have created many other meme coins, such as FRAME, FAR, POINTS, with one wave of hype after another. Compared to this, FT seems to have fallen behind.

Is a mediocre product a pass for mediocrity?

Perhaps FT was never meant to sit on a pedestal.

Driven by an improved version of the Pareto model, it can fly higher, but the flaws of the plane itself cannot be ignored.

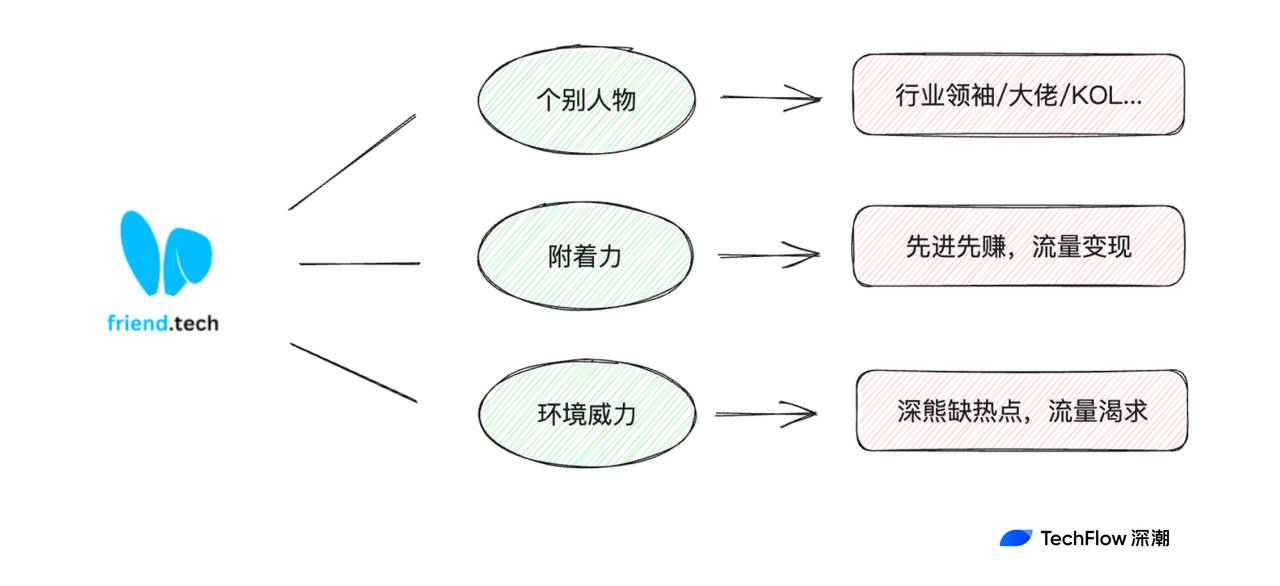

The Pareto model is indeed a pass for mediocrity, but it does not guarantee continuous success. FT exploded onto the market last year due to various factors coming together, with a mix of chance and necessity, but this kind of necessity cannot be fully replicated.

Chasing profit leads to a rush, with no profit leading to a thousand miles away. The principle is simple, but FT's process has been drawn out for a long time.

In the end, socialFi products like FT did not find a true product-market fit and were more like short-term speculative products rather than meeting real needs. Combined with the aggressive operations, the outcome was not surprising.

But if all phenomenal crypto products are just historical phenomena, then the best crypto products are still speculative.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。