Author: Liam Kelly, DL News

Translator: Felix, PANews

Over the past seven years, Aave Labs has shaped its brand by creating a simple lending platform. With a stable DeFi banking business, Aave survived the 2022 bear market.

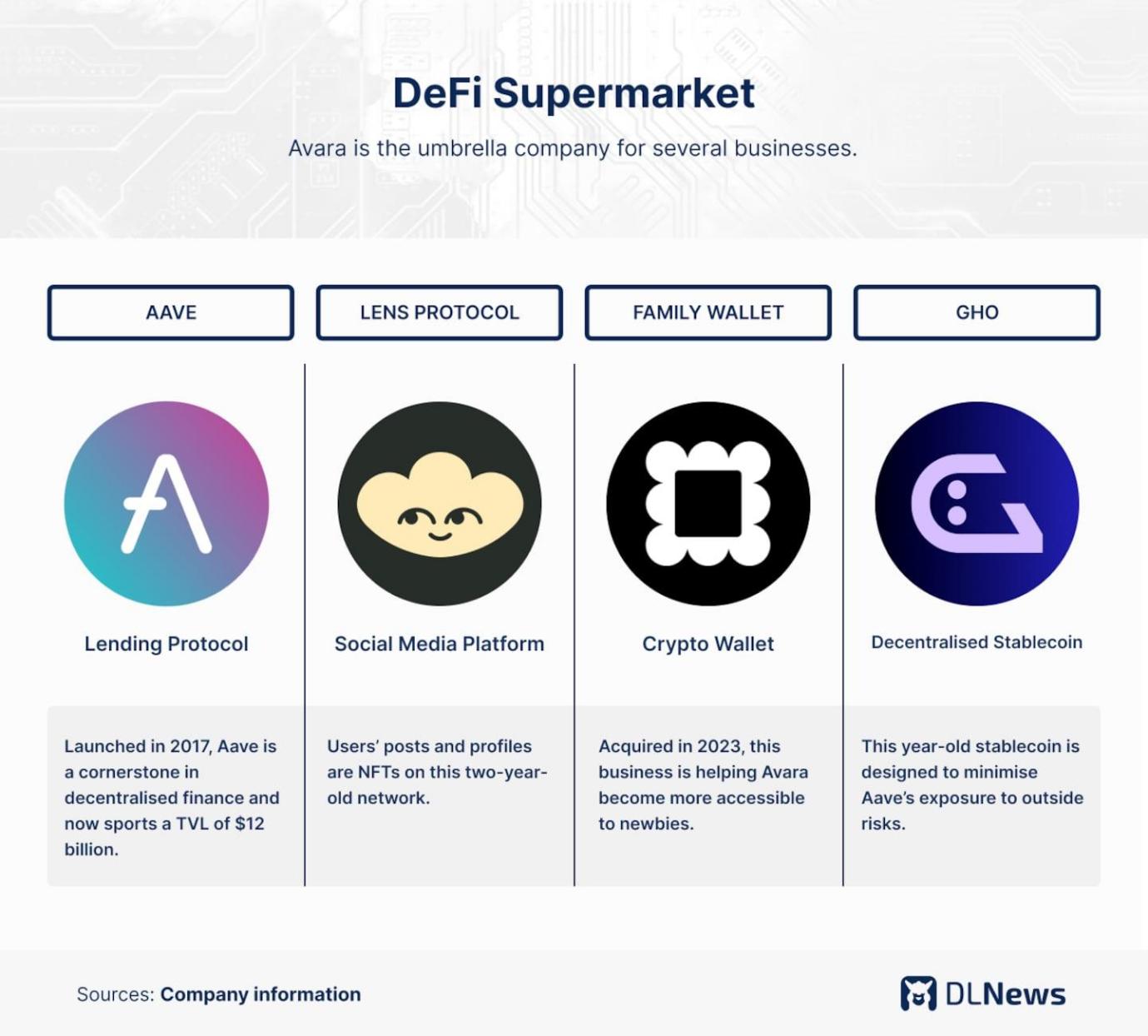

Now, the co-founder of Aave, Stani Kulechov from Finland, is transforming Aave into a DeFi ecosystem. This includes a stablecoin called GHO, a crypto wallet called Family, and a social media network Lens Protocol that is seeking $50 million in funding.

These businesses, along with Aave's lending business, now belong to a new London-based parent company, Avara.

Aave's expansion intensifies competition with several other DeFi institutions.

Kulechov said, "It's clear that the meaning of decentralized systems is always to open the door to competitors."

One of the most notable competitors is MakerDAO, a stablecoin issuer that has been in step with Aave for seven years. Aave has added new businesses, and Maker has done the same.

To expand its business, Kulechov is replacing the simple model with a more complex ecosystem. By building an all-in-one trading platform, Avara will meet the needs of both DeFi newcomers and seasoned crypto users.

Kulechov said, "Every person on Earth, regardless of language, country, or location, has their own social capital. If we can solve the issue of online ownership, then we can fundamentally unlock more value."

So far, Kulechov and the Aave team have proven their ability to unlock value.

According to TokenLogic data, Aave has generated approximately $100 million in revenue over the past 30 days through user borrowing, loan liquidation, and deposit fees.

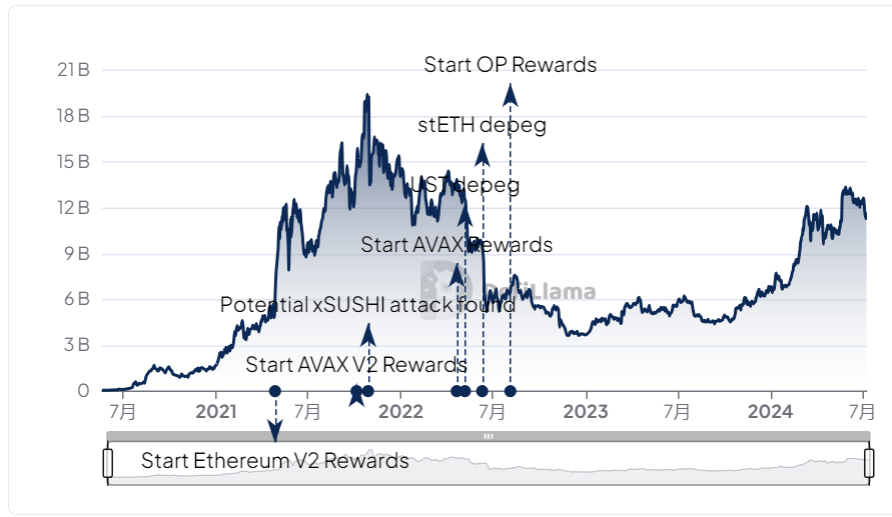

DefiLlama data shows that Aave's total value locked (TVL) has more than doubled in the past 12 months, reaching $11 billion. Aave, active on over a dozen different blockchains, has surpassed MakerDAO this year to become the third most valuable DeFi project.

Aave's TVL over the past three years; Source: DeFi Llama

Drew Osumi, co-founder of venture studio Number Group, said that building a "walled garden" for Aave users may sound counterintuitive but is meaningful.

Drew Osumi said, "If Avara has social, wallet, lending, and stablecoin features, I think it will be an easy entry experience for those who are completely unfamiliar with cryptocurrencies."

"This grand plan feels like building a permissionless, decentralized Meta, allowing users to truly value according to market value."

But why do we need another social media platform?

Kulechov said, "Our main idea may not be to replace Twitter, but to build an open shared network that anyone can build, and there are already users now."

Lens Protocol allows developers to build applications similar to Instagram and inject them with encryption features. Lens meets the needs of NFT collectors by converting profile photos and usernames into non-fungible tokens, and it allows decentralized autonomous organizations (DAOs) to raise critical issues and vote directly on Lens.

DeFi Competitors

Since the ICO era in 2017, Aave and Maker have been cornerstones of DeFi. Both have experienced rapid growth in the cryptocurrency market and market crashes. They compete with each other while also collaborating. This competition has reached its peak in the stablecoin race.

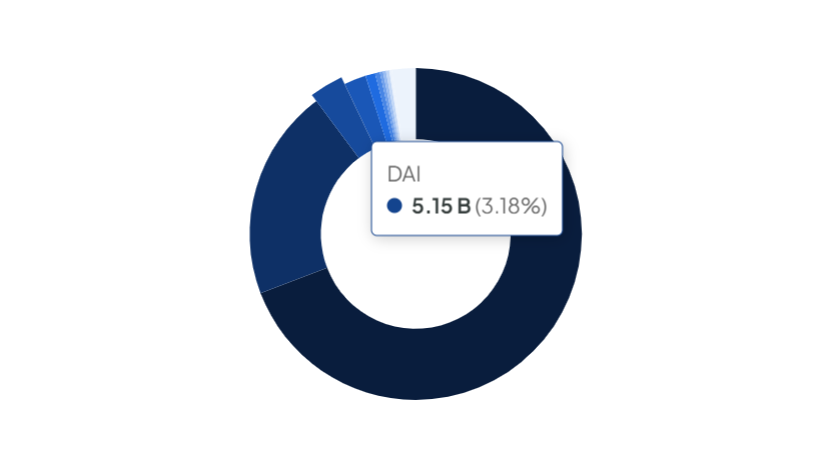

Maker issues DAI, the oldest decentralized stablecoin in DeFi. Aave began issuing its own stablecoin, GHO, in July 2023.

Stablecoins are used throughout DeFi. Source: DeFi Llama

Both stablecoins are pegged to the US dollar and over-collateralized by other cryptocurrencies. For example, minting $1 of stablecoin means putting more than $1 into other cryptocurrencies like Ethereum.

According to analysts at Bernstein, the stablecoin market is expected to grow to $3 trillion in the next five years.

Lito Coen, growth director of cross-chain protocol Socket Protocol, said, "Stablecoins are the biggest market opportunity in the crypto space. If you're entering another market after lending, stablecoins are the most logical choice."

Extreme Volatility

Aave is competing through GHO. This is because Maker launched its own lending protocol, Spark, in 2023.

Lito Coen said, "GHO makes a lot of sense, especially when one of the largest over-collateralized stablecoins competes directly with Spark."

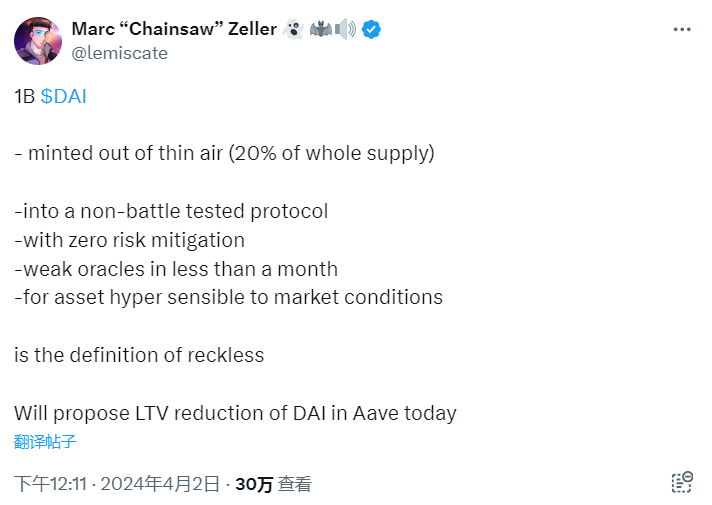

In April this year, when the Maker community proposed a new, untested stablecoin called USDe supported by the Ethereum blockchain platform Ethena to back DAI, the battle lines became clearer.

This asset, called USDe, is backed by dollars and is different from GHO or DAI. It is not over-collateralized but supported by Ethereum and short Ethereum positions pledged by exchanges. If the price of Ethereum falls, these positions make money. This is a novel design mechanism, but it has not been tested in extreme market conditions.

For Aave, the emergence of the Ethena market means huge risks. If USDe depreciates due to a market crash, people will worry that DAI will also lose its peg. Because Aave holds over $130 million worth of DAI, this is a risk the Aave community cannot afford.

In April this year, Marc Zeller, the founder of the DeFi governance project "Aave Chan Initiative," proposed adjusting the loan-to-value (LTV) ratio of DAI to 0% on all Aave deployments and removing sDAI incentives from the Merit program.

Kulechov agreed.

Kulechov wrote on the Aave forum, "If the result is favorable, the off-boarding process should be initiated immediately."

Kulechov attributed this to risk management rather than direct competition. "People's risk perception of DAI has significantly increased. If the risk increases, the best approach is to take the most conservative approach."

Meanwhile, Lens Protocol is facing competition from another encrypted social media protocol, Farcaster. Both offer many of the same features, but Lens stores more activity (likes and follows, etc.) on the blockchain compared to Farcaster. Farcaster focuses more on speed and user experience.

Farcaster is currently far ahead, with nearly 600,000 users, while Lens has only 430,000. Farcaster recently completed a $150 million financing round, valuing it at $1 billion, led by Paradigm, with a16z, USV, and other top venture capitalists participating.

However, the endurance of these two social media projects remains to be seen.

Lito Coen, growth director of cross-chain protocol Socket Protocol, said, "For me, the most uncertain one is Lens. It's a completely different race in the crypto space, and overall, there is much less experience to draw from."

New Financing

In June this year, it was reported that Lens is undergoing a new round of financing, with a valuation of $500 million.

Lito Coen said, "I really appreciate the steps Kulechov is taking. I think few teams have such grand ideals and are able to try to expand their business."

Despite DeFi having all the novel technologies and business models, Kulechov's actions indicate that traditional product development and new markets are key to growth.

Kulechov said, "We like to go from building infrastructure to thinking about what these businesses are and what interfaces can be built."

Related reading: From ETHLend to Aave V4, the Evolutionary Path of Decentralized Lending

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。