Author: 0xFacai, BlockBeats

According to the data from Dune Analytics, RWA has become the only crypto narrative to achieve an increase in the past 3 months, apart from memes. In an environment where the overall market is stagnant, this performance has caught our attention. In fact, the discussion about RWA has been ongoing since June last year, and the narrative was thoroughly ignited after BlackRock launched the BUIDL on-chain fund.

In the face of opportunities, everyone's sense of smell is not bad, but there are not many who can truly "hit the mark." Over the past six months, numerous teams have been transforming into RWA, but only a few projects have successfully seized the opportunity and shown initial results. Whether it's transformation or entry, identifying opportunities is the key for teams to obtain tickets, and among the many competitors, a project called Jiritsu has caught our attention.

The Fragmentation Issue of RWA Liquidity

The greatest benefit of tokenizing real-world assets is to provide faster and more efficient trading and settlement processes for these assets, which is undoubtedly the main reason why institutions are interested in RWA. Although this idea is logically sound, it encounters many difficulties at the technical level when actually implemented, and the fragmentation of liquidity after assets are tokenized is one of them.

When the on-chain and trading of RWA are complex, the fragmented market exacerbates this problem. A report by Digital Asset Research in July last year emphasized that over 60% of the current RWA institutions conduct transactions through their own tokenized asset markets, which means that after the assets have "gone through hardships" to be on-chain, they can only attract a small number of fixed customers.

According to data from The Block, the total financing scale of the RWA track has also reversed its downward trend this year, rising to 300 million US dollars. The current trend of RWA's recovery has led many entrepreneurs to see new "narrative opportunities," and the number of conceptual RWA projects in the market is increasing at a visible speed. However, most funded projects tend to focus on very specific verticals, such as natural resources, specific commodities, and art, while RWA projects in the real estate sector are particularly prominent in this regard.

How specific can these verticals be? Platforms like Balcony and Mnzl provide tokenization processes for regional real estate resources, and the buyers and sellers who trade on-chain assets through on-chain tools are often local institutions or government departments, which can be considered as a semi-closed asset market.

The specialization and regionalization of RWA projects are understandable, as many real-world assets have strong regional characteristics and often require tailored solutions. However, due to different regulatory restrictions in different regions, each RWA project is almost building its on-chain process and trading platform from scratch, and there are also different choices when selecting underlying public chains and smart contract development tools, which poses a huge challenge to the interoperability between different RWAs.

Many entrepreneurs have seen this liquidity fragmentation, so platforms like Midas and Plume, which aggregate RWA assets or launch RWA, have also begun to appear in the market during the same period. However, upon further consideration, you will find that they still face a dilemma: if they want to establish a unified market, they must first have a certain level of compatibility in terms of tokens and contract standards, which hinders the aggregation of RWA assets on a large scale and across multiple categories. And if they aggregate different RWA protocols first, they will be limited to the role of "launch platforms" due to the technical stack differences between protocols, although they bring some liquidity to small projects, the on-chain assets still face the problem of market fragmentation.

Even the tokenized US Treasury market, which has the best liquidity, is no exception. Although it has solved the problem of scale for single-category products under the impetus of institutions such as BlackRock and Franklin Templeton, you will still find that in order to provide more choices for potential investors and cooperative projects in the future, these assets are also scattered across different public chains such as Ethereum, Stellar, and Avalanche.

This has also brought a narrative window for cross-chain interoperability protocols that have been slow to gain traction in terms of volume, such as Axelar, which has been laying out its RWA early. It has cooperated with Centrifuge and Ondo to launch Centrifuge Everywhere and Ondo Bridge last year, optimizing protocols and cross-chain interoperability and liquidity for RWA tokenized products. In the current fragmented market environment, cross-chain interoperability is not without its merits.

Jiritsu ZK - MPC: Trustless and Automated Off-Chain Asset Verification

In fact, it is not difficult to see the bottleneck that RWA faces in breaking through the scale limitation, which is the lack of automated processes or technologies like AMM in the DeFi field. For RWA products, tokenization is often just the beginning, and ensuring continuous asset updates and transparency after the product is on-chain is the key to testing efficiency and cost, usually including the following aspects:

Financial reports: Asset managers need to regularly release financial and performance reports for the assets, such as real estate managers needing to regularly provide details of rental income payment dates and amounts, or details of debts and vacancy situations, to provide investors with a clearer understanding of the cash flow dynamics of the real estate.

Debt management: Products like RWA credit products need to regularly update details such as collateral for loans, repayments, interest rate adjustments, and refinancing activities to let investors understand their health, which is the basis for maintaining investor trust in such products.

Ownership changes: If there are changes in the basic ownership of the underlying assets or the legal entities that own the assets, announcements need to be made in a timely manner.

Market supervision: When there are changes in the market supervision environment where the underlying assets are located, managers also need to make reports and make corresponding adjustments to ensure the compliance of the products.

Of course, in addition to this, there are also various complex details such as asset insurance and risk management strategies, asset valuation and inspection, and the legal entities issuing the assets, all of which require asset managers to invest a lot of effort and attention to various details throughout the investment lifecycle. In summary, in the current "infrastructure redundancy" market environment, on-chain assetization is no longer the most difficult part of RWA development, and off-chain continuous verification and legal supervision are the main reasons for slowing down the growth of asset categories and scale, and eroding the value of on-chain assets. All of this can only be discussed under the premise of setting aside the centralized audit risks of off-chain entities.

The scale and growth of RWA assets depend entirely on the strength of off-chain issuing and management institutions, which is also the important reason why the US Treasury RWA products have grown rapidly after BlackRock's entry, whereas other assets such as real estate and commodities have difficulty achieving economies of scale due to the lack of automation in processes. Of course, the value erosion of on-chain assets also means huge business opportunities, and at present, most of this potential income has flowed into the hands of asset issuers and managers such as Securitize.

Is it possible to build its own automated "asset oracle" system in the RWA field, similar to what ChainLink has done in the DeFi field? We found some answers in the Jiritsu project.

Jiritsu is a specialized Avalanche subnetwork for off-chain asset verification, aiming to achieve automated and trustless off-chain asset registration and verification, while reducing on-chain erosion and costs, and enhancing the economic efficiency and transparency of RWA tokenization. By integrating ZK proofs and MPC multi-party computation, Jiritsu ensures secure and private automated verification of asset details, embedding regulatory compliance and asset integrity into tokenized products. Interestingly, the name "Jiritsu" comes from the Japanese word "じりつ," meaning self-reliance. In the RWA field, which currently heavily relies on centralized manpower in core processes, this is exactly what is needed to enhance its native cryptographic properties and achieve economies of scale.

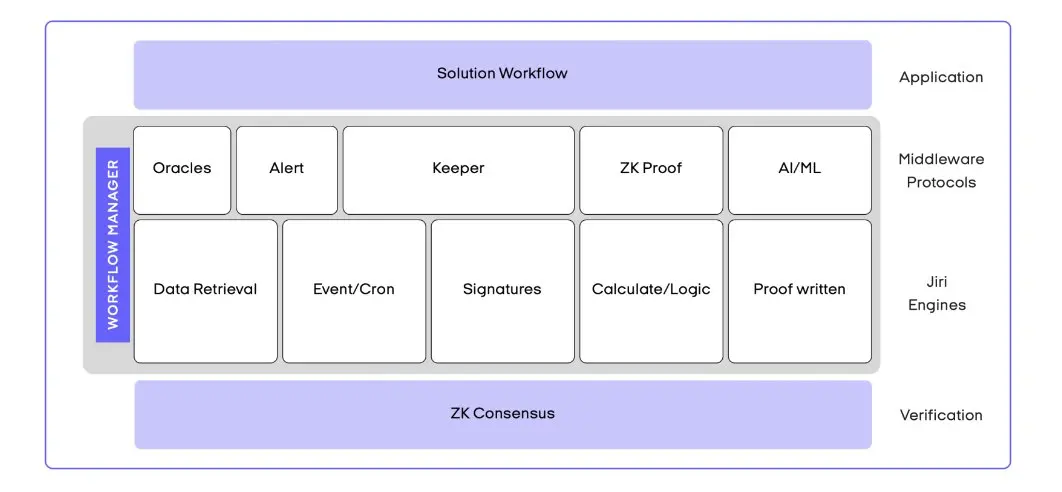

The Jiritsu ZK - MPC oracle aggregates data from multiple sources and verifies related calculations, using a multi-functional data retrieval mechanism to enhance the integration depth of different types of assets. The oracle includes two main mechanisms: "Push" and "Pull." The former allows data providers (such as asset managers) to directly send information to the oracle, while the latter allows the oracle to retrieve data directly from integrated information suppliers' systems, such as supply chain software and banking information, through APIs.

In terms of consensus mechanism, Jiritsu introduces the concept of Proof of Workflow (PoWF), where nodes in the network run an operating system driven by a computational engine and workflow manager, using generated ZK proofs to ensure verifiable computation and smart contract execution, directly integrating the consensus mechanism into its MPC framework. Compared to existing oracles like ChainLink or Pyth, Jiritsu does not require cross-chain bridges for information transmission when aggregating information, and it also adds analysis and verification functions to simple data feedback.

After users or asset managers register assets and their detailed information with Jiritsu, the ZK - MPC validator analyzes this information and confirms the value and compliance status of the assets. The analysis process involves two types of validators: one for reviewing business policies and regulatory compliance, and the other for handling financial data, executing spot price retrieval, and market valuation tasks. After the information is analyzed and verified, ZK - MPC generates ZK proofs and stores them on-chain, allowing users to claim these proofs and embed them into their smart contracts, completing the entire process of tokenizing the assets.

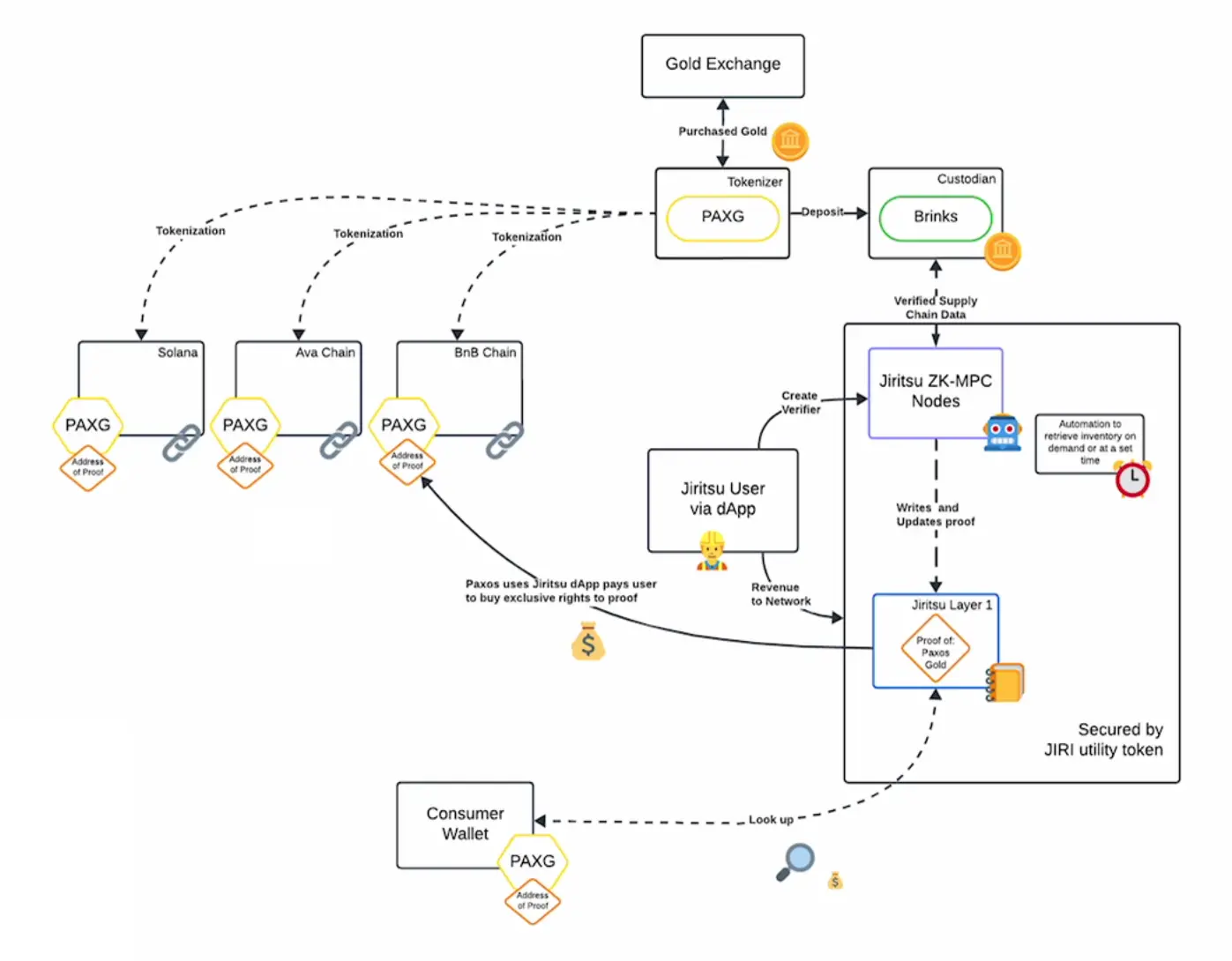

Jiritsu's official example using Paxos' tokenized gold product PAXG demonstrates the complete process of its product usage:

First, Paxos purchases gold from a reliable gold exchange and deposits it with a custodian service. Then, Jiritsu users can use the Jiritsu dApp on supported public chains to create validators on Jiritsu's ZK - MPC nodes. After retrieving information about Paxos' gold custody, the ZK - MPC nodes generate relevant ZK proofs using the validators.

During the verification process, the ZK - MPC nodes are responsible for off-chain verification calculations, and the generated ZK proofs have different levels of access and confidentiality, allowing auditors to have full access to all information, while asset managers can only see specific information relevant to their roles. This verification process can be updated at preset times or on demand, making it more efficient and reliable than Paxos' current manual quarterly inventory verification method.

After the ZK proofs are uploaded to the Jiritsu network, Paxos can proceed with the tokenization of its custodied gold. At this stage, Jiritsu also implements the concept of "chain abstraction," allowing asset issuers like Paxos to mint corresponding tokens on ideal target chains such as Solana, Avalanche, or BNB Chain.

Once the tokens are generated, Paxos pays fees to the nodes and validators through the Jiritsu dApp, with a portion of the fees allocated to the Jiritsu network. The PAXG tokens purchased by investors contain a proof of the underlying gold and can access the gold custody status information on the Jiritsu network, allowing Paxos to shift the cost burden to the investors at this stage.

The dApps on the Jiritsu network are designed to facilitate the writing of specific data, allowing users to create validators for any business logic, data reader, and smart contract integration, ensuring that Jiritsu can provide customized solutions for a wide range of business needs. In addition, its Jiritsu Proof under the ZK - MPC cloud service significantly expands the asset categories for information verification, beyond traditional financial verification such as bank information and corporate credit, to include a range of real-world asset status information, such as equipment, inventory, and transaction and income information for a company's facilities. Jiritsu recently provided inventory proof for an Amazon supply chain company with over 100,000 SKUs and a total value of approximately $20 million.

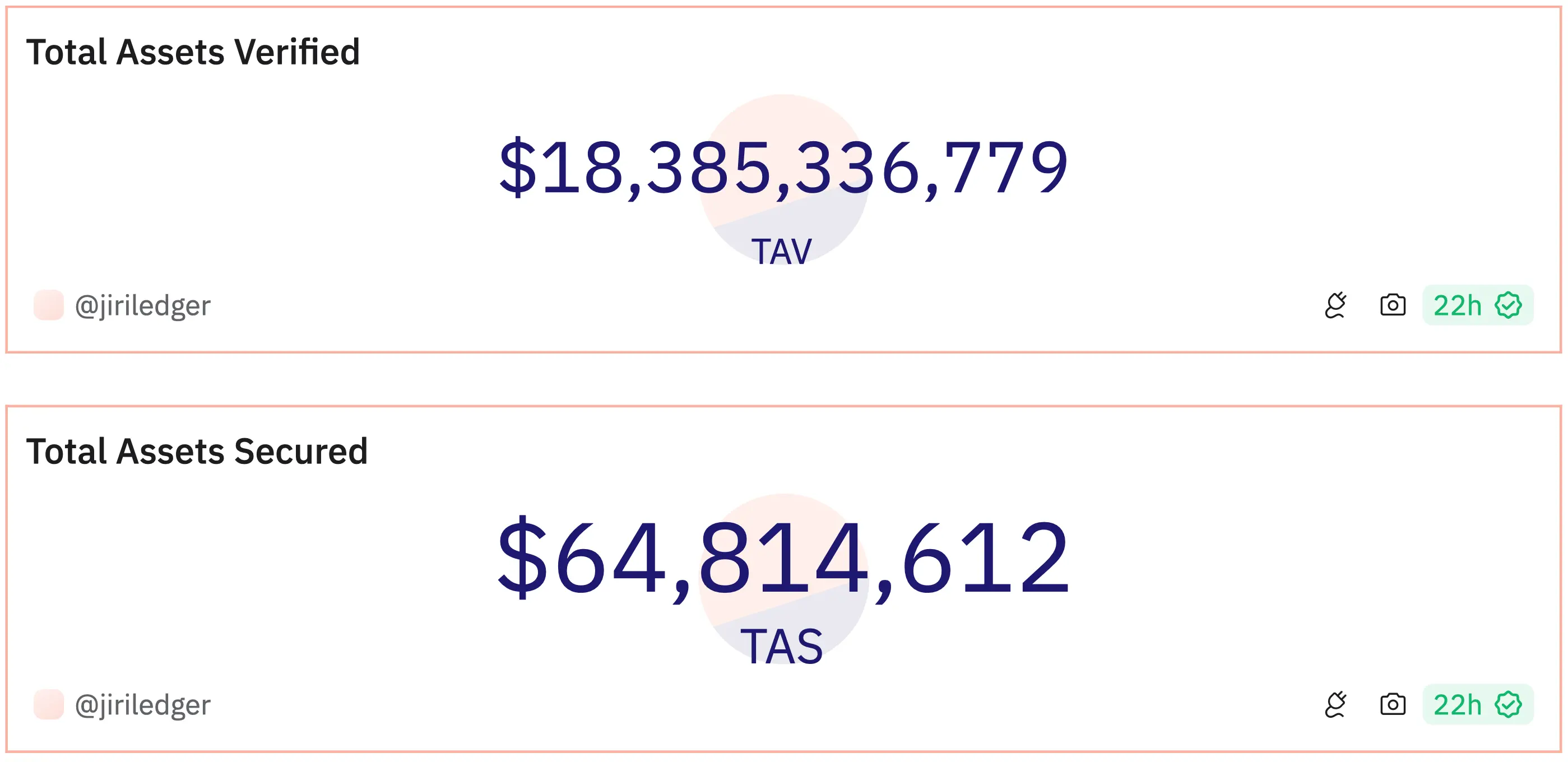

Based on this, Jiritsu also measures its impact on on-chain real-world assets using two data indicators: "Total Asset Verified" and "Total Asset Secured," and uses these data indicators to provide underlying assets Lego with more compatibility and interoperability for DeFi protocols. According to theDune dashboard data provided by the official, Jiritsu has verified over $18 billion in assets to date, with over $60 million in assets waiting for use by various protocols.

Recently, Jiritsu integrated BlackRock's RWA ecosystem, providing automated on-chain proofs for the valuation and verification of reserve assets for its Bitcoin spot ETF and BUIDL fund, as well as compliance and KYC platform information, to facilitate the more convenient and rapid use of these already on-chain assets by other protocols. On the other hand, despite the significant incremental funding brought to the crypto market and RWA by iBIT and BUIDL, their asset verification still relies on self-reporting and only provides annual audits, while Jiritsu provides a more transparent and cost-effective solution for these products.

Jiritsu also integrated with the Republic platform, which is deeply involved in the RWA field, allowing any asset manager to directly implement and use similar solutions, improving compliance and operational efficiency while providing a mature infrastructure for asset managers in tokenization, compliance, marketing, and customer service. Through automated and trustless verification and auditing, Jiritsu moves the work traditionally completed by institutions such as Moody's and KPMG onto the chain, and this part of the traditional market's fee income exceeds $150 billion. Even if calculated at 10%, this is an incredibly imaginative business ceiling.

Team Background

The two co-founders of Jiritsu Network, Jacob Guedalia and David Guedalia, are both highly respected in the academic field. Jacob holds a Bachelor's degree in Physics and Philosophy from New York University and a graduate degree in Applied Physics from the Weizmann Institute of Science in Israel, while David holds a Master's degree in Computational Geography from Bar-Ilan University and a Ph.D. in Neural Computation from the Hebrew University of Jerusalem. In addition, Jacob is a successful serial entrepreneur, having founded and exited four companies, and together with David, they hold over 100 US patents.

Jiritsu has raised a total of $10.2 million in its past two rounds of financing, with gumi Cryptos Capital leading the investment, and Susquehanna Private Equity Investments, LLLP, Republic Capital, and other investors participating, with former BlackRock asset management manager Michael Lustig also joining the Jiritsu team. The company plans to use the new funds to "accelerate the development and adoption of the UVC platform and Tomei RWA." Jiritsu was founded in 2020 and has developed technologies such as Unlimited Verifiable Computation (UVC), aiming to provide a programmable method that can be applied to any workflow and generate workflow proofs.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。