Hello, I am Paul from Coinmanlabs, and today I would like to talk to you about - Lombard.

Solely for Value Storage

Since its inception, Bitcoin has been defined as "digital gold". Similar to gold, its primary function is to store value. Despite the early concepts of the Bitcoin ecosystem, its development has remained stagnant over the past decade.

Bitcoin serves as a value storage tool mainly due to the following characteristics:

Scarcity: Bitcoin's total supply is set at 21 million, which gives it scarcity. Scarcity is an important feature of traditional value storage tools like gold, as it prevents devaluation caused by excessive currency issuance.

Decentralization: Bitcoin is not controlled by any central authority, meaning it is not influenced by government monetary policies or devalued by economic crises in specific countries. This decentralization gives Bitcoin a certain level of value stability globally.

Security: Bitcoin uses advanced encryption technology to protect transactions and assets. The immutability and transparency of blockchain technology enable the Bitcoin network to resist fraud and double-spending issues.

Global liquidity: Bitcoin can be transferred globally without being restricted by geographical or political boundaries. This high level of liquidity makes Bitcoin an effective cross-border value transfer tool.

Resistance to censorship: Bitcoin's transaction records are on the blockchain, but user identities remain anonymous. This feature makes Bitcoin a tool for evading scrutiny in countries and regions with strict financial transaction regulations.

Long-term appreciation potential: Since its inception, Bitcoin's price has experienced significant growth. Despite its volatility, Bitcoin's value has shown an upward trend in the long term, attracting some investors to use it as a long-term investment and value storage tool.

Q·Is Bitcoin unable to fully realize its potential?

As a decentralized digital currency, Bitcoin has gained recognition and usage globally since its inception in 2009. However, despite its many potential advantages such as decentralization, high security, and transparency, it still faces challenges and limitations in large-scale applications. Initially, Satoshi Nakamoto envisioned Bitcoin as a peer-to-peer electronic cash system, where decentralized digital currency could be used as a medium of exchange.

We all know that the basic function of currency as a medium of exchange is crucial in economic activities. The emergence of currency greatly simplifies the trading process and improves economic efficiency. It is time for Bitcoin to serve as a medium of exchange.

With the approval of Bitcoin's ETF, more traditional and technological companies are using it as a company asset or national treasury asset.

According to statistics, BTC worth over $1 trillion is idle. The reasons for this can be seen in several points:

Lack of native income: Unlike ETH with staking economy, BTC currently lacks low-risk income sources (such as stable staking mining, LST, LRT, etc.).

Lack of cross-chain composability: Any product or asset prioritizes security first, so the current methods of using BTC in DeFi compromise security and decentralization.

Dispersed liquidity: Currently, BTC's liquidity is dispersed, such as various wrapped tokens, but they do not have any usage scenarios.

Insufficient acceptance in DeFi: Currently, more DeFi platforms prefer to accept ETH and USDC as their first choice.

In terms of market value, liquidity, and institutional adoption, Bitcoin is the largest cryptocurrency to date. The infrastructure for Bitcoin is in place, and native DeFi will continue to exist (BRC-20, runes, ordinals, inscriptions, OP_CAT, etc.). The market needs new narratives, just like the DeFi of ETH in early 2020.

Lombard

Project website: Lombard

Twitter: Lombard_Finance

Project introduction: Lombard, established in April 2024, is dedicated to connecting Bitcoin with DeFi to unleash the potential of Bitcoin as a dynamic financial tool. Lombard enables income-generating BTC to move cross-chain without dispersing liquidity, paving the way for the introduction of new capital into DeFi. Its flagship product LBTC is an income-generating cross-chain liquidity Bitcoin, backed by BTC in a 1:1 ratio.

Project Analysis

Q·As a holder of Bitcoin, what concerns you the most?

In the crypto community, there is a saying, "You want interest, but others want your principal." Therefore, security is the most important, even if you don't earn interest, especially when it comes to Bitcoin.

System Architecture

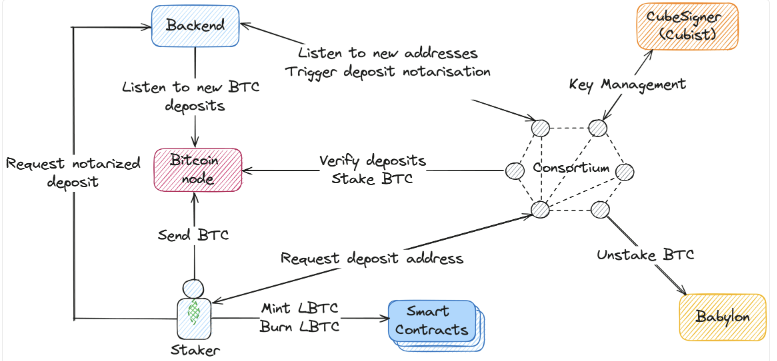

The entire process can be divided into two categories:

- Staking BTC on the Bitcoin blockchain

Staker requests a new or reused BTC address created by the Consortium for the selected blockchain and transfers BTC to that address.

Backend processes the transfer, requests Consortium for notarization once the transfer is confirmed.

Staker receives notarized data (RLP encoded data: uint256 chainId, address, uint64 amount, bytes32 txId, uint32 index; and signature: keccak256 hash value of data signed by Consortium threshold key) and calls the minting transaction to obtain LBTC.

Consortium selects a final provider to stake BTC, establishes an appropriate Babylon consumable staking transaction, and signs it using CubeSigner.

- Unstaking LBTC (not supported yet)

Staker destroys LBTC tokens on the specified blockchain.

Backend processes the destruction transaction (finds it on one of the blockchains with LBTC and waits for the transaction to be confirmed), then requests Consortium for verification.

After verification, the Consortium unstakes the specified amount of LBTC from the selected final provider and sends the BTC transaction to the address for the destruction transaction. For withdrawal transactions, Consortium constructs the correct format of the transaction and signs it using CubeSigner.

CubeSigner checks the security policy. If the daily/weekly withdrawal limit has been reached or the transaction appears suspicious, it requests Consortium members to manually approve the transaction.

There are two important roles here: Consortium and CubeSigner.

Consortium, translated directly as "alliance," is a decentralized state machine used to share ownership and manage assets among its members. In a sense, Consortium also has a certain resistance to censorship, as it can manually confirm transactions, conduct threshold voting signatures, and select service providers for staking that best serve their interests.

CubeSigner is a hardware-supported non-custodial key management solution that primarily addresses the trade-off between the security and availability of current keys.

Coinmanlabs' Thoughts

Currently, there are few narratives in the market. Even though Bitcoin's ETFs have been approved, the market remains tepid. If the glory of DeFi can be revived on Bitcoin, LST is a point worth paying attention to.

Lombard is also invested by major institutions and is worth early attention. Currently, it has formed LRT in cooperation with Babylon (as it appears now), and specific DeFi aspects still need to be observed.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。