Author: Huaxia Fund Hong Kong

Review of Cryptocurrency in the First Half of 2024

- The US spot Bitcoin ETF was approved on January 10, 2024, and the Hong Kong spot Bitcoin and Ethereum ETF was approved on April 29, 2024.

- On April 20, 2024, the Bitcoin halving milestone was reached.

The Bitcoin halving event occurs every time an additional 210,000 blocks are mined, approximately every four years. This year's halving event took place on April 20, 2024. This event will reduce the total issuance of Bitcoin from 900 Bitcoins per day (annual issuance rate of 1.8%) to 450 Bitcoins per day (0.9%). Approximately 13,500 Bitcoins will be added to the total supply each month.

The halving event will continue on the same schedule until 21 million Bitcoins are mined, which is expected to occur around 2140.

Figure 1: Historical Bitcoin Halving Timeline

- Significant progress in the approval process of the US spot Ethereum ETF

On May 23, 2024, the US Securities and Exchange Commission (SEC) approved the 19-b4 filing applications of VanEck, BlackRock, Fidelity, Grayscale, Franklin Templeton, ARK21Shares, InvescoGalaxy, and Bitwise, effectively giving the green light for the issuance and listing of the spot Ethereum ETF.

If the SEC follows a similar schedule to the spot Bitcoin ETF process, according to Bloomberg ETF analysts, the spot Ethereum ETF may be launched as early as early July.

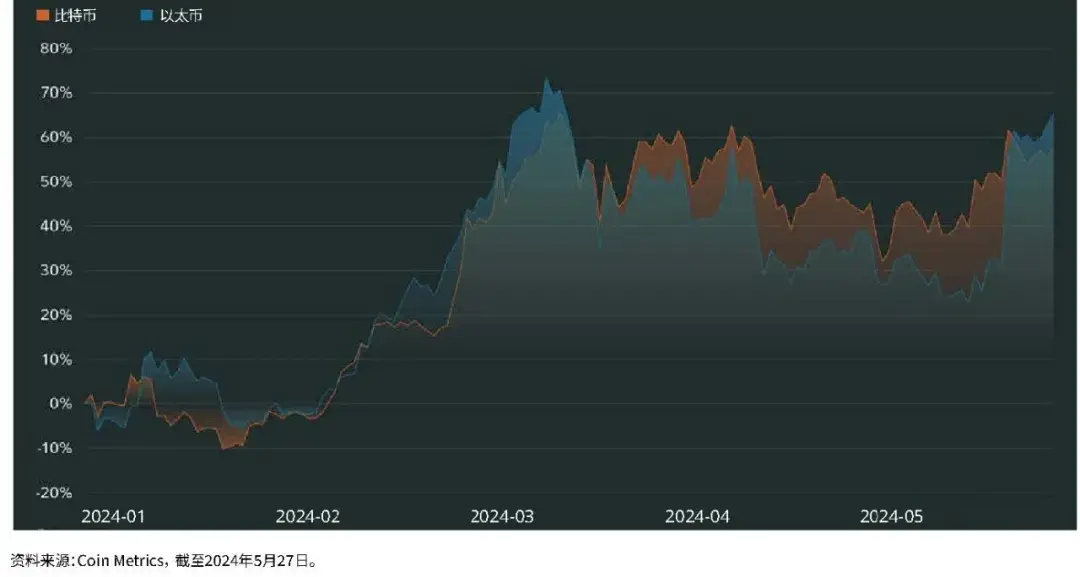

Figure 2: Price Trends of Bitcoin and Ethereum from the Beginning of the Year to Present

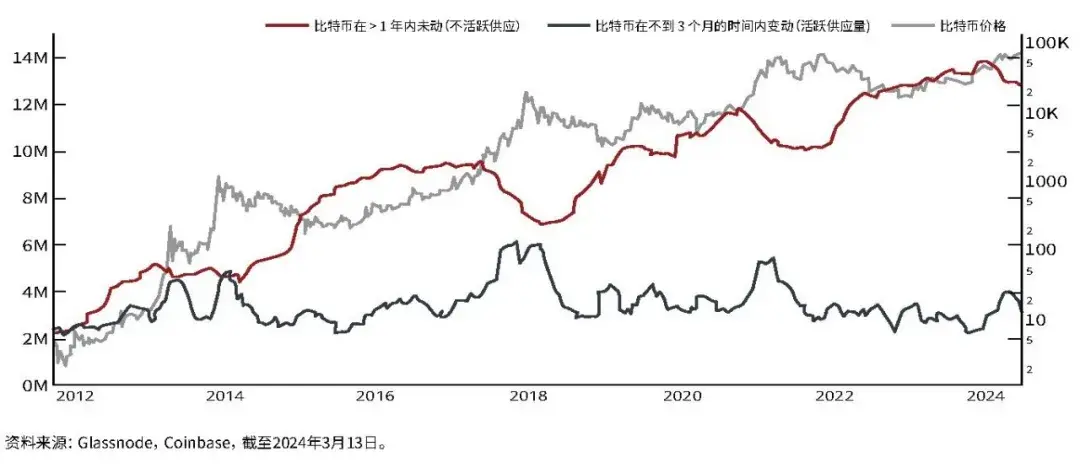

- In the second quarter of 2024, the active Bitcoin supply is declining

Historical data shows that the decline in active Bitcoin supply, which refers to the number of Bitcoins that have been traded in the past three months, usually lags behind local price highs, indicating a slowdown in market trading volume. The active Bitcoin supply dropped from a local high of 4 million Bitcoins in early April to 3.1 million Bitcoins in early June.

However, at the same time, the non-active supply of Bitcoin, which refers to the number of Bitcoins that have not been transferred within a year, has remained stable this year. We believe this indicates a reduction in recent market frenzy, although long-term cyclical investors remain cautious.

Figure 3: Bitcoin Supply vs. Price

- Market focus on long-term holders of Bitcoin

The market value to realized value (MVRV) ratio of long-term holders is close to 3.5, which to some extent reinforces the Bitcoin bull market but has not yet entered the historical "frenzy stage."

In the past two weeks (June 5 to June 19), large long-term holders have sold with a scale of $120 million.

Figure 4: Market Value to Realized Value Ratio of Bitcoin Long-Term Holders

- Active addresses and new address count for Bitcoin are declining.

Current Status of the Bitcoin Market

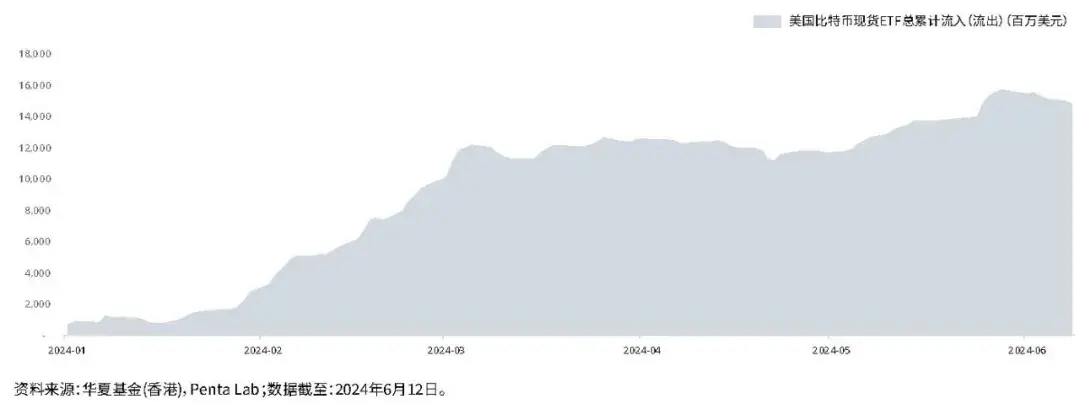

The US spot Bitcoin ETF saw outflows of approximately $64 million, $200 million, and $226 million on June 10, 11, and 13, respectively, leading to a softening of Bitcoin prices.

Figure 5: Total Cumulative Inflows of the US Spot Bitcoin ETF

Outlook for the Bitcoin Market

The 10-year US Treasury bond yield saw a 21 basis point adjustment between 4.43% on June 7 and 4.22% on June 14, which is a favorable factor for all high-risk assets, especially Bitcoin. This indicates an increased demand for risk assets, including Bitcoin.

The Bitcoin miner stock ETF (mining ETF with Bloomberg code WGMI) is one of the leading indicators of Bitcoin prices, and it shows an upward trend. Within this week, the price of the Bitcoin miner stock ETF has risen by 21%. This indicates that smart money continues to actively buy into Bitcoin during price weakness, expressing positive confidence in the future trend of Bitcoin.

The approval progress of the US Securities and Exchange Commission (SEC) for the spot Ethereum ETF has had a positive impact on the market and further boosted the performance of Bitcoin.

The current Bitcoin market bubble has not yet reached its historical peak, indicating the potential for further upward movement in Bitcoin.

In summary, despite occasional softness in Bitcoin prices, a series of positive factors continue to support the Bitcoin market. Investors can continue to closely monitor the impact of these factors on Bitcoin prices and carefully evaluate the risks and returns to formulate corresponding investment strategies.

In addition, we are also closely monitoring the impact of the November US election on digital assets. If Trump is re-elected, it will have a broadly positive potential impact on the crypto market through more supportive crypto regulatory policies.

Outlook for the Ethereum Market

Recently, Eric Balchunas, an ETF analyst at Bloomberg, tweeted that the listing date for the Ethereum spot ETF may be brought forward to July 2, which has sparked widespread attention and discussion in the market.

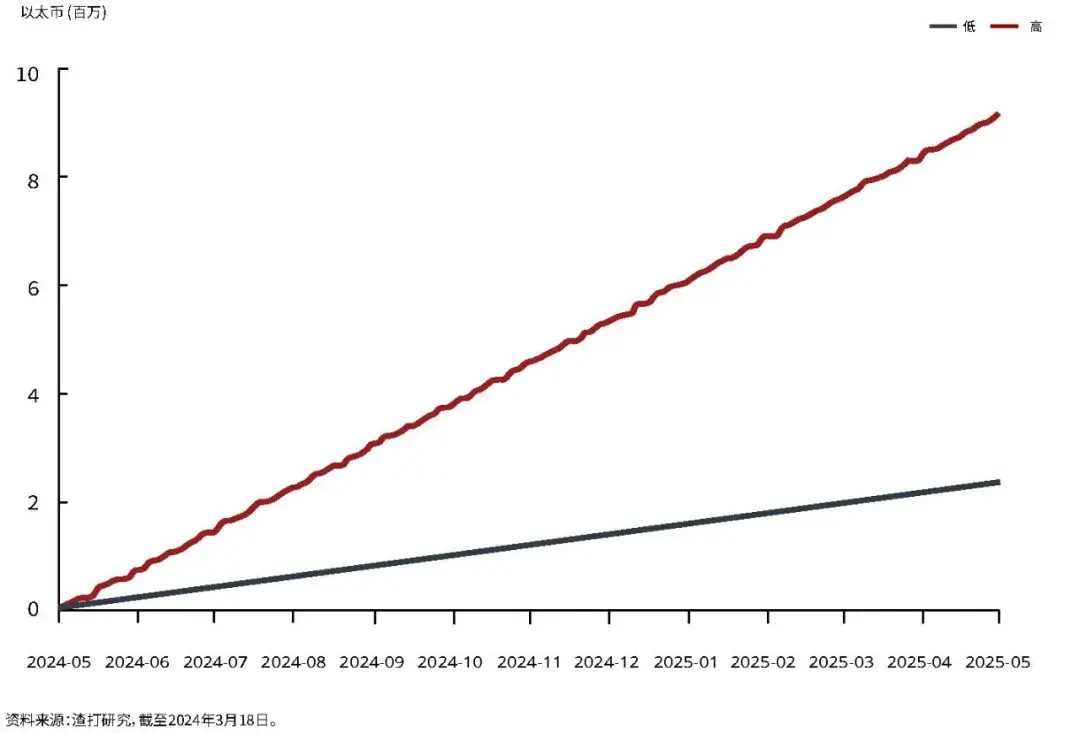

According to a report from Standard Chartered Bank, referencing the situation after the approval of Bitcoin ETFs, Ethereum may experience a large-scale ETF-driven inflow. It is expected that within the first 12 months after approval, the spot Ethereum ETF could bring in approximately $150-450 billion in inflows.

Figure 6: Predicted Inflows for the Spot Ethereum ETF in the Next 12 Months

Recently, the market has been focused on the decline in inflation data and the Fed's hawkish policy stance, which seems to have sent some mixed signals to crypto assets. The US Consumer Price Index (CPI) has declined year-on-year for the second consecutive month. A continued downward trend in inflation data will be favorable for the prices of crypto assets. And Fed officials have adjusted their expectations for future interest rates, expecting two rate cuts in 2024, exceeding the previously widely predicted single rate cut, which will further drive the rise of risk assets.

Although the Fed has been pushing up long-term rates, the upward trend in the 10-year US Treasury bond yield has been broken, indicating that the market is anticipating a looser monetary policy. While low inflation may prompt the Fed to adjust its policy response, it is expected that by the end of 2024, the Fed's stimulus measures may further drive the prices of crypto assets.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。